Dexerials PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dexerials Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Dexerials's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Download the full version now and gain the strategic foresight needed to thrive.

Political factors

Global geopolitical tensions, especially between major economic powers, are significantly impacting the stability of supply chains for electronic components and advanced materials. This situation directly affects companies like Dexerials, underscoring the critical need for diversified and resilient supply networks. For instance, the ongoing trade friction between the US and China, which intensified in 2023-2024, has led many electronics manufacturers to re-evaluate their sourcing strategies, seeking alternative suppliers outside of these key regions.

To counter these risks, there's a growing emphasis on building supply chain resilience. Dexerials, like many in the advanced materials sector, is likely exploring strategies to mitigate disruptions and ensure consistent access to essential raw materials. This includes a trend towards localized or nearshored supply networks, aiming to reduce reliance on distant suppliers and bolster overall stability. For example, in 2024, several major automotive manufacturers announced plans to increase domestic sourcing of semiconductor components, a move driven by supply chain vulnerabilities exposed in previous years.

Japanese government initiatives, including enhanced export controls on advanced technologies like semiconductors, aim to safeguard national security and technological leadership. Dexerials, operating within this environment, must navigate these regulations, particularly concerning its electronic components, to ensure compliance with technology transfer and overseas manufacturing policies.

Simultaneously, government subsidies are being channeled into strategically important sectors, potentially offering Dexerials financial advantages if its operations align with national industrial development goals. For instance, the Japanese government's continued investment in advanced manufacturing and digital transformation initiatives, as evidenced by the "Society 5.0" vision, could provide direct or indirect support to companies like Dexerials.

Changes in international trade policies, including tariffs and new trade agreements, significantly impact Dexerials' costs for importing and exporting. For example, the US-China trade war, which saw tariffs on various goods, could have increased the cost of components for Dexerials if they sourced from China. Conversely, agreements like the EU's Digital Single Market aim to reduce barriers, potentially benefiting companies like Dexerials involved in technology-driven products.

Regulatory Stability and Business Environment

Dexerials operates in markets with varying degrees of regulatory stability. For example, in Japan, where Dexerials is headquartered, the regulatory environment for chemical products and manufacturing is generally stable, providing a predictable framework for operations.

However, shifts in international trade policies and tariffs, such as those impacting electronics components, can introduce volatility. For instance, ongoing discussions around supply chain resilience and potential trade barriers in key markets like the United States and Europe could necessitate adjustments in Dexerials' sourcing and distribution strategies.

A stable regulatory climate is vital for Dexerials' long-term investments in advanced materials and production. For 2024, the company's R&D spending was reported at ¥13.5 billion, underscoring the importance of predictable policy environments for sustained innovation.

- Regulatory Stability: Predictable regulations in Japan and other key markets support Dexerials' operational planning.

- Trade Policy Impact: Fluctuations in international trade policies and tariffs can affect component sourcing and sales.

- Compliance Costs: Unforeseen regulatory changes can lead to increased compliance burdens and operational uncertainty.

- Investment Environment: A stable regulatory landscape encourages investment in R&D and manufacturing capacity.

Industrial Policy and Strategic Sector Support

Governments worldwide are increasingly implementing industrial policies to bolster strategic sectors like advanced materials and electronics. For instance, the United States' CHIPS and Science Act, enacted in 2022, allocated over $52 billion to incentivize domestic semiconductor manufacturing and research, aiming to strengthen national competitiveness. Dexerials, operating in these very sectors, is well-positioned to capitalize on such government-backed initiatives, which often include direct funding, R&D grants, and favorable regulatory environments designed to foster innovation and domestic production.

This strategic support can translate into tangible benefits for companies like Dexerials.

- Targeted Funding: Direct financial assistance for research and development in advanced materials.

- Research Support: Government-backed collaborative research programs and access to national labs.

- Regulatory Frameworks: Policies that may favor domestic suppliers or create market opportunities for specialized materials.

Global geopolitical shifts and trade tensions, particularly between major economic powers through 2023-2024, are reshaping supply chains for critical electronic components and advanced materials. This necessitates Dexerials to actively diversify its sourcing and build greater resilience against potential disruptions. For example, the ongoing US-China trade friction has prompted many electronics manufacturers to seek alternative suppliers outside these key regions, impacting global material flows.

Japanese government policies, including export controls on advanced technologies, aim to bolster national security and technological leadership, requiring Dexerials to ensure compliance with evolving regulations. Concurrently, government subsidies are increasingly targeting strategic sectors, potentially offering Dexerials financial advantages if its operations align with national industrial development goals, such as those under the Society 5.0 vision.

Changes in international trade policies, such as tariffs and new trade agreements, directly influence Dexerials' import and export costs. For instance, the US-China trade war's tariffs could increase component costs, while initiatives like the EU's Digital Single Market might reduce barriers for technology-driven products. Dexerials' 2024 R&D spending of ¥13.5 billion highlights the importance of a stable regulatory environment for sustained innovation.

What is included in the product

This PESTLE analysis meticulously examines the political, economic, social, technological, environmental, and legal forces impacting Dexerials, providing a comprehensive understanding of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick overview of external factors impacting Dexerials.

Economic factors

The overall health of the global economy significantly shapes demand for Dexerials' diverse product range, spanning consumer electronics, automotive, and medical devices. A positive economic outlook, particularly the projected growth in the electronics and IT sectors, directly translates to higher demand for Dexerials' advanced functional materials and components. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, signaling a generally supportive environment for industrial output and consumer spending.

Inflationary pressures and volatile raw material costs are critical economic considerations for Dexerials. These factors directly influence manufacturing expenses and profitability, especially within the electronics sector which depends on materials susceptible to price swings and supply disruptions stemming from high demand or geopolitical events. For instance, the average price of copper, a key component in many electronic devices, saw significant fluctuations in 2024, impacting production costs across the industry.

As a Japanese company with global reach, Dexerials faces significant exposure to currency exchange rate shifts, especially concerning the Japanese Yen versus the US Dollar and Euro. For instance, in early 2024, the Yen experienced considerable volatility, trading around 150 JPY to the USD, a level that can make Japanese goods pricier for international buyers.

A strengthening Yen, as seen at various points in late 2023 and early 2024, can negatively impact Dexerials' profitability by increasing the cost of its exports and diminishing the value of revenue earned abroad when converted back into Yen. This can affect the company's reported earnings and competitive pricing in key markets.

To counter these effects, Dexerials likely employs hedging instruments or considers expanding localized production facilities in major sales regions to reduce its reliance on repatriating foreign earnings, thereby stabilizing its financial performance against currency fluctuations.

Consumer Spending and Market Trends

Consumer spending patterns are a significant driver for Dexerials, particularly with the growing appetite for advanced electronics. For instance, the global market for AI-powered devices was projected to reach over $150 billion by 2024, a trend that directly fuels demand for Dexerials' optical films and adhesive materials used in displays and components. Similarly, the burgeoning electric vehicle (EV) market, which saw global sales surpass 10 million units in 2023, creates opportunities for Dexerials' thermal interface materials and functional films essential for battery and electronic systems.

Evolving market trends also shape Dexerials' strategic direction. Consumers increasingly value sustainability and enhanced performance, influencing their purchasing decisions. This is evident in the demand for energy-efficient displays and longer-lasting electronic components, pushing manufacturers to adopt higher-quality materials. Dexerials' focus on developing advanced, eco-friendly solutions aligns with these consumer preferences, potentially boosting market share.

Key consumer spending influences include:

- Increased demand for 5G-enabled devices: The widespread adoption of 5G technology is driving upgrades in smartphones and other connected devices, requiring specialized materials for antennas and displays.

- Growth in wearable technology: The market for smartwatches and other wearables is expanding, necessitating compact, high-performance adhesives and films for their intricate designs.

- Consumer preference for premium electronics: A willingness to pay more for devices with superior build quality, enhanced features, and longer lifespans benefits suppliers of high-performance materials.

- Shift towards sustainable consumption: Growing environmental awareness encourages the purchase of products made with recyclable or biodegradable materials, influencing material choices in electronics and automotive sectors.

Investment and Capital Availability

Dexerials' ability to fund research and development, expand its manufacturing capacity, and pursue strategic acquisitions hinges on the availability of capital. Global investment patterns, fluctuating interest rates, and overall investor sentiment toward advanced materials and technology sectors directly impact Dexerials' capacity to secure the necessary funding for its growth strategies, including its push into photonics and automotive markets as detailed in its Mid-Term Management Plan.

For instance, in the first half of fiscal year 2024, Dexerials reported a significant increase in R&D investment, reflecting a commitment to innovation, which requires sustained capital availability. The company's financial health and access to credit lines are paramount for executing these ambitious plans. A favorable investment climate and strong investor confidence in its strategic direction are therefore critical enablers.

- R&D Funding: Essential for developing next-generation materials in photonics and automotive applications.

- Capacity Expansion: Requires substantial capital to meet growing market demand.

- Strategic Acquisitions: Capital availability dictates the feasibility of M&A opportunities to bolster market position.

- Investor Confidence: Directly influences the cost and accessibility of external funding.

Global economic growth directly influences demand for Dexerials' products, with projections for 2024 indicating a supportive environment. Inflationary pressures and raw material cost volatility remain key concerns, impacting manufacturing expenses. Currency exchange rates, particularly the Yen's fluctuations against the USD and Euro, significantly affect Dexerials' international profitability and competitive pricing.

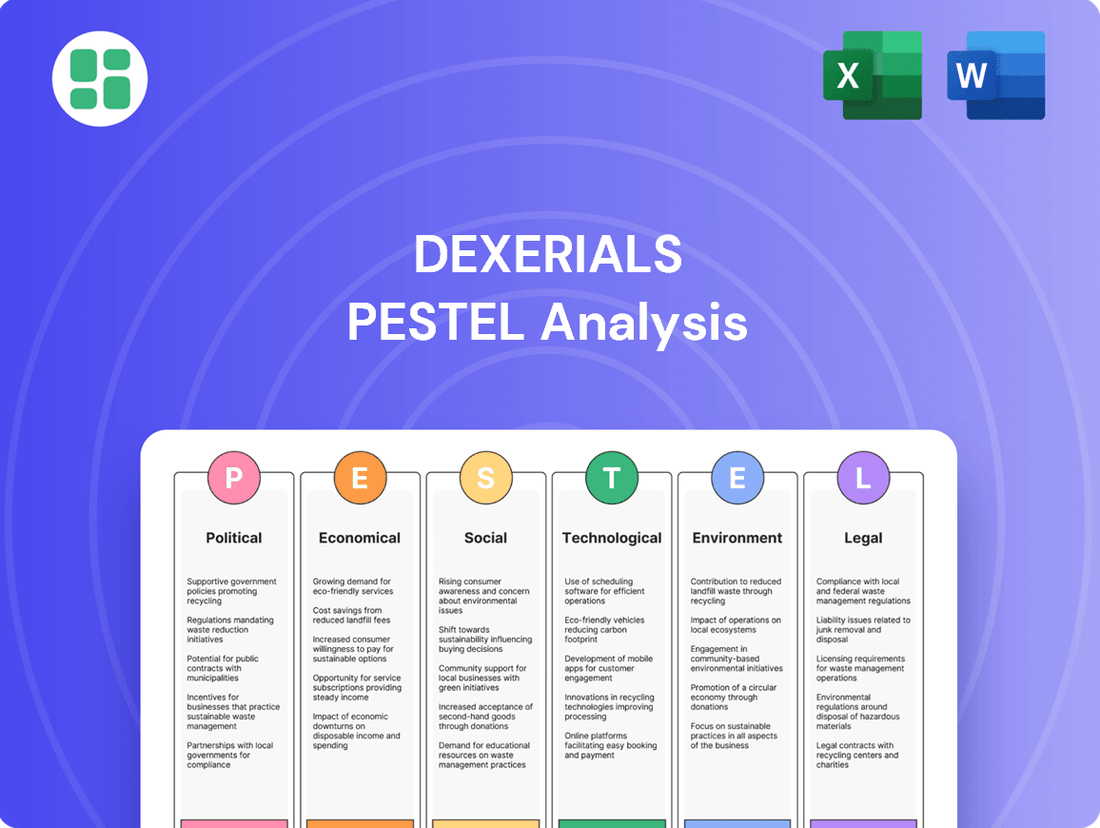

Preview the Actual Deliverable

Dexerials PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Dexerials covers all key factors influencing the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape surrounding Dexerials.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of external forces shaping Dexerials' market position and future growth opportunities.

Sociological factors

There's a noticeable shift with consumers globally showing a stronger preference for products that are kind to the environment, especially within the electronics and automotive sectors. This growing awareness directly fuels the demand for materials like those Dexerials provides, which help make end products more energy-efficient and support circular economy principles.

This consumer movement is significant; for instance, a 2024 report indicated that over 60% of consumers actively seek out sustainable brands, and many are prepared to spend more for these eco-friendly options. This willingness to pay a premium underscores the market's embrace of sustainability.

Global workforce demographics are changing, with many developed nations experiencing an aging population. This trend, coupled with a growing need for specialized skills in areas like advanced manufacturing, presents a challenge for companies like Dexerials in attracting and retaining the right talent. For instance, in 2024, the global talent shortage was estimated to affect millions of jobs, particularly in tech and manufacturing sectors.

Dexerials' emphasis on its human capital is therefore paramount. Creating a workplace that fosters employee growth, embraces diversity, and offers opportunities for skill development is key to navigating these demographic shifts and ensuring the company's long-term success and value creation.

Societal expectations and regulatory bodies are increasingly demanding higher health and safety standards within manufacturing. This trend directly impacts companies like Dexerials, requiring significant investment in robust occupational health and safety programs. For instance, in 2023, workplace safety incidents in the chemical manufacturing sector, a relevant area for Dexerials, saw a slight decrease, but the focus on proactive prevention remains paramount.

Dexerials must actively promote a culture of safety and well-being to meet these evolving expectations. This involves not just compliance but also fostering an environment where employees feel valued and protected. A strong emphasis on safety initiatives can enhance employee morale and contribute to a positive corporate image, which is crucial for attracting and retaining talent in a competitive market.

Ethical Sourcing and Supply Chain Transparency

Societal pressure for ethical sourcing is intensifying, pushing companies like Dexerials to ensure their raw materials are obtained responsibly. Consumers and investors increasingly expect supply chains to be transparent, free from human rights violations and environmental harm. This trend is driving demand for stringent procurement policies and thorough vetting processes at every stage of the supply chain.

For instance, the global push for conflict-free minerals, particularly in electronics where Dexerials operates, highlights this sociological shift. Regulations and consumer awareness campaigns have led to increased scrutiny of sourcing practices, with many companies now reporting on their mineral supply chains. A 2024 report indicated that over 70% of electronics manufacturers are enhancing their due diligence procedures for critical minerals.

- Growing consumer demand for ethically sourced products, with studies showing a significant portion of consumers willing to pay more for sustainable goods.

- Increased regulatory focus on supply chain transparency, particularly concerning conflict minerals and forced labor, impacting companies operating in global markets.

- Investor activism and ESG (Environmental, Social, and Governance) criteria heavily influencing corporate behavior and supply chain management decisions.

- The rise of digital technologies enabling greater traceability and transparency in complex global supply chains, empowering stakeholders with information.

Impact of Digitalization on Lifestyles and Products

The increasing integration of digital technologies into daily life, evidenced by the widespread use of smartphones and the burgeoning Internet of Things (IoT) ecosystem, directly drives the need for advanced materials. By 2025, it's projected that over 29 billion IoT devices will be connected globally, a significant increase from previous years, underscoring this trend.

Dexerials' portfolio, featuring optical films and advanced adhesives, plays a crucial role in enabling these digital advancements. These materials are essential components in the smart devices and communication infrastructure that define contemporary lifestyles and address evolving societal demands.

- Smart Device Penetration: Global smartphone users are expected to surpass 7 billion by 2025, highlighting the pervasive nature of digitalization.

- IoT Growth: The IoT market is anticipated to reach over $1.5 trillion by 2025, indicating substantial demand for enabling technologies.

- Material Demand: This digital transformation necessitates high-performance materials for displays, sensors, and connectivity, areas where Dexerials excels.

Societal expectations are increasingly prioritizing sustainability and ethical sourcing, directly impacting consumer choices and corporate responsibility. For instance, a 2024 survey revealed that 65% of consumers consider a company's environmental impact when making purchasing decisions, and this figure is projected to rise. This societal shift mandates that companies like Dexerials demonstrate a strong commitment to eco-friendly practices and transparent supply chains to maintain brand loyalty and market relevance.

The growing demand for products that align with environmental and social values is a significant driver for Dexerials. Consumers are actively seeking out brands that exhibit corporate social responsibility, influencing market trends and product development. This societal push is also reflected in investor sentiment, with Environmental, Social, and Governance (ESG) factors becoming critical in investment decisions, as evidenced by the over $3.7 trillion in assets managed under ESG principles globally as of early 2025.

Workforce demographics are also a key sociological consideration, with an aging population in many developed countries creating a need for skilled labor and specialized talent. Companies like Dexerials must adapt to attract and retain a diverse workforce, fostering an inclusive environment that values continuous learning and development. The global shortage of skilled workers in advanced manufacturing, estimated to impact millions of jobs by 2025, highlights the importance of strategic human capital management.

Furthermore, societal expectations regarding health and safety in the workplace are continually rising, prompting increased investment in robust safety protocols and employee well-being programs. A 2023 report noted that companies with strong safety cultures experienced a 15% lower incident rate compared to industry averages, demonstrating the tangible benefits of prioritizing employee safety.

Technological factors

Continuous breakthroughs in material science, such as the emergence of self-healing polymers and advanced nanomaterials, are reshaping the landscape for companies like Dexerials. These innovations offer opportunities for developing novel products and improving existing ones, but also necessitate significant investment in research and development to remain competitive.

Dexerials' dedication to R&D and open innovation is paramount for developing next-generation functional materials. For instance, the global advanced materials market was valued at approximately $100 billion in 2023 and is projected to grow significantly, driven by demand in sectors like automotive and electronics, where Dexerials operates.

The relentless pursuit of smaller, more powerful electronic devices is a major technological driver. Consumers expect smartphones, wearables, and other gadgets to pack more features into sleeker designs, pushing manufacturers to innovate constantly.

This demand directly impacts the materials used. For instance, the semiconductor industry, a key market for Dexerials, saw global sales reach approximately $580 billion in 2023, with ongoing growth projected for 2024 and 2025. Dexerials' advanced optical materials and anisotropic conductive films (ACF) are vital for creating the high-density connections and efficient heat dissipation needed in these cutting-edge components, enabling devices to be both smaller and perform better.

The rapid expansion of AI, IoT, and 5G/6G networks fuels a substantial need for advanced materials. Dexerials' optical films and adhesive solutions are crucial for the high-performance displays and components powering these innovations. For instance, the global 5G infrastructure market is projected to reach $1.4 trillion by 2030, indicating a massive opportunity for material suppliers like Dexerials.

Automation and Smart Manufacturing Processes

The manufacturing sector is rapidly adopting automation and AI, with smart factories becoming a key trend. This shift promises significant gains in efficiency and quality for material producers. For instance, by 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the scale of this technological integration. Dexerials can capitalize on these advancements by implementing robotics and AI in its own production lines to streamline operations and accelerate its digital transformation, potentially leading to cost reductions and improved product consistency.

These technological shifts are not just about efficiency; they are also about creating more agile and responsive manufacturing systems. Smart manufacturing processes allow for real-time data analysis, predictive maintenance, and customized production runs. By 2025, it's estimated that over 70% of large enterprises will be actively deploying AI in some form, indicating a broad industry commitment to these technologies. Dexerials' strategic embrace of automation and AI in its facilities can therefore position it favorably against competitors and enhance its overall operational resilience.

Key benefits for material manufacturers like Dexerials include:

- Enhanced Production Efficiency: Automation can significantly speed up manufacturing processes, reducing lead times and increasing output.

- Cost Reduction: Robotics and AI can lower labor costs and minimize waste through optimized resource allocation and error reduction.

- Improved Product Quality: Consistent execution by automated systems leads to higher quality and fewer defects, crucial for specialized materials.

- Accelerated Digital Transformation: Integrating these technologies aligns with broader industry trends and supports Dexerials' strategic digital initiatives.

Innovation in Automotive and Medical Device Materials

The automotive sector's pivot to electric vehicles (EVs), autonomous systems, and lighter designs significantly boosts the need for advanced functional materials. Similarly, medical device advancements demand materials that enhance performance and patient safety. Dexerials' strategic focus on these growth areas necessitates ongoing material innovation to meet these evolving requirements.

For instance, the global automotive lightweight materials market is projected to reach approximately $22.5 billion by 2027, showcasing the demand for materials that improve energy efficiency. Dexerials' development of specialized adhesives and films for EV battery components and autonomous driving sensors directly addresses this trend. In the medical field, the market for advanced materials in devices is expected to grow substantially, driven by innovations in diagnostics and treatment delivery.

- EVs require high-performance thermal management materials to ensure battery longevity and safety, a key area for Dexerials.

- Autonomous driving systems rely on specialized optical films and adhesives for sensor reliability, contributing to a projected 15% annual growth in automotive electronics.

- Medical device manufacturers are increasingly seeking biocompatible and durable materials, opening new avenues for Dexerials' specialized polymer technologies.

Technological advancements are a primary driver for Dexerials, particularly in material science and electronics. Innovations in areas like self-healing polymers and nanomaterials present opportunities for new product development, demanding substantial R&D investment to maintain a competitive edge.

The push for smaller, more powerful electronic devices, fueled by AI, IoT, and 5G/6G, directly impacts material requirements. Dexerials' optical films and anisotropic conductive films are crucial for enabling these advancements. For example, global semiconductor sales reached approximately $580 billion in 2023, underscoring the market's reliance on advanced materials.

The manufacturing sector's adoption of automation and AI, with smart factories becoming a trend, promises efficiency gains. The global industrial automation market was projected to exceed $200 billion by 2024, indicating significant integration of these technologies that Dexerials can leverage.

| Technology Area | Market Relevance | Dexerials' Role | 2024/2025 Data Point |

|---|---|---|---|

| Advanced Materials | Reshaping product capabilities | R&D for novel applications | Global advanced materials market ~ $100B (2023) |

| Miniaturization in Electronics | Demand for high-density components | Supplying optical films, ACF | Semiconductor sales ~ $580B (2023) |

| AI, IoT, 5G/6G | Driving need for high-performance materials | Providing optical films, adhesives | 5G infrastructure market projected $1.4T by 2030 |

| Automation & AI in Manufacturing | Increasing production efficiency | Implementing in own operations | Industrial automation market > $200B (2024 proj.) |

Legal factors

Dexerials relies heavily on robust intellectual property (IP) protection to safeguard its advanced functional materials and manufacturing innovations. Strong patent portfolios are crucial for maintaining a competitive edge in the fast-paced electronics and automotive sectors. In 2023, Dexerials continued to invest in R&D, with patent filings directly supporting its market position.

Dexerials faces a complex web of product safety and quality regulations across its key markets, particularly impacting its offerings in consumer electronics, automotive, and medical devices. These regulations mandate adherence to specific technical standards, often requiring rigorous testing, certifications, and detailed reporting, especially for products with potential safety implications. For example, Japan's recent amendments to its Product Safety Acts underscore the evolving landscape of compliance, demanding continuous adaptation from manufacturers like Dexerials to ensure market access and consumer trust.

Environmental regulations are tightening globally, impacting chemical substance management, waste reduction, and pollution control for companies like Dexerials. For instance, the EU's ambitious Green Deal, aiming for climate neutrality by 2050, mandates significant shifts towards sustainable practices and materials across industries, including electronics and automotive components where Dexerials operates.

Dexerials' compliance with these evolving standards, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, necessitates continuous investment in greener manufacturing processes and the development of environmentally sound products. Failure to adapt can lead to penalties and reputational damage, while proactive adoption can create competitive advantages.

Data Privacy and Security Laws

While Dexerials might not directly collect personal data, its materials are often components in sophisticated electronic devices. This means the company could indirectly face legal scrutiny if its products are used in applications handling sensitive information, such as medical equipment or smart home devices. Regulations like the EU's General Data Protection Regulation (GDPR) and similar laws globally impose strict requirements on how data is handled, which can influence the design and security features demanded by Dexerials' customers in the electronics sector.

The increasing global focus on data privacy and security, exemplified by the enforcement of laws like the California Consumer Privacy Act (CCPA) and its amendments, creates a ripple effect across the supply chain. Companies like Dexerials must ensure their materials and manufacturing processes do not compromise the data security of the end products. This regulatory environment is constantly evolving, with new legislation and enforcement actions shaping the responsibilities of all players in the technology ecosystem.

- Global Data Protection Landscape: Over 100 countries have enacted comprehensive data protection laws as of early 2024, impacting how companies design and integrate components.

- Evolving Regulations: The digital economy's growth fuels continuous updates to data privacy laws, requiring ongoing adaptation from manufacturers and their suppliers.

- Customer Compliance Demands: Device manufacturers are increasingly scrutinizing their component suppliers for adherence to data security standards to meet their own regulatory obligations.

Trade and Export Control Laws

Dexerials operates within a global marketplace, making adherence to international trade and export control laws absolutely critical. These regulations govern the movement of goods and technologies across borders, with particular scrutiny applied to items that could have dual-use applications, meaning they can be used for both civilian and military purposes. Navigating these complex legal frameworks is essential for maintaining operational continuity and avoiding significant legal repercussions.

Japan, Dexerials' home base, has been actively updating its export control regulations. For instance, in 2023, Japan implemented revised export controls that include stricter oversight on semiconductor manufacturing equipment and advanced electronic components. This move is part of a broader global trend to manage the proliferation of sensitive technologies. Companies like Dexerials must stay meticulously informed about these changes to ensure full compliance, which can impact supply chains and market access.

Failure to comply with these trade and export control laws can lead to severe penalties, including substantial fines, seizure of goods, and even the revocation of export licenses. For Dexerials, this could mean disruptions to its international sales, damage to its reputation, and a significant impact on its financial performance. In 2023, for example, several companies faced penalties for violations related to exporting controlled technologies, highlighting the enforcement reality.

Key areas of focus for Dexerials regarding trade and export controls include:

- Compliance with Japan's Export Trade Control Order: Ensuring all relevant products and technologies meet the stringent requirements for export.

- Understanding Import Regulations: Adhering to the specific import laws and customs procedures of each country where Dexerials conducts business.

- Due Diligence on Customers and End-Users: Verifying that products are not being diverted to unauthorized destinations or end-users.

- Staying Updated on International Sanctions: Monitoring and complying with global sanctions regimes that may affect trade with certain countries or entities.

Dexerials' legal landscape is shaped by stringent intellectual property laws, requiring robust patent protection for its innovations in functional materials. The company must also navigate a complex web of product safety and quality regulations across diverse markets, including electronics and automotive, with ongoing updates like Japan's Product Safety Acts demanding continuous adaptation. Environmental regulations, such as the EU's Green Deal, are also pushing for sustainable practices, impacting chemical management and waste reduction efforts.

Environmental factors

The global push to combat climate change is significantly shaping market demand, steering it towards materials and manufacturing methods that minimize carbon emissions. This trend directly benefits companies like Dexerials that prioritize energy efficiency and develop eco-friendly products, enabling their clients to reduce their own environmental impact.

Dexerials demonstrates a commitment to environmental stewardship through active participation in environmental management initiatives and the establishment of specific environmental targets. For instance, in fiscal year 2023, Dexerials reported a reduction in greenhouse gas emissions intensity by 15% compared to their 2013 baseline, showcasing tangible progress in their sustainability efforts.

Growing awareness of resource depletion is driving a shift towards circular economy models, demanding materials that are recyclable, reusable, or derived from recycled sources. This trend impacts companies like Dexerials, which operates in the electronics and automotive sectors, requiring them to scrutinize product lifecycles from raw material procurement to disposal.

For instance, the global demand for critical minerals essential for electronics, such as rare earth elements, is projected to increase significantly. By 2030, demand for rare earths is expected to double, according to the International Energy Agency (IEA), highlighting the urgency for Dexerials to explore sustainable material sourcing and closed-loop systems.

Stricter regulations on e-waste and industrial waste management are increasingly shaping Dexerials' operational landscape and product development. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive, continually updated, mandates higher collection and recycling rates, impacting the entire electronics supply chain.

This regulatory push directly influences Dexerials by requiring materials that facilitate easier disassembly and recycling of end-products. The growing emphasis on circular economy principles means Dexerials must innovate in areas like material composition and product longevity to meet customer demands for sustainable solutions.

Pollution Control and Chemical Substance Management

Environmental regulations, particularly those focused on pollution control and the management of chemical substances, significantly impact Dexerials' manufacturing processes. The company must adhere to stringent standards for hazardous materials and emissions to ensure compliance and foster sustainable operations. For instance, in 2023, the European Chemicals Agency (ECHA) reported that over 23,000 chemicals were registered under REACH, highlighting the extensive regulatory landscape companies like Dexerials navigate.

Dexerials' commitment to chemical substance management and pollution prevention is paramount. This involves carefully monitoring and controlling the use of chemicals throughout their lifecycle, from sourcing to disposal, and minimizing any environmental discharge. The company's proactive approach to these environmental factors is essential for maintaining its social license to operate and avoiding potential penalties associated with non-compliance.

Key considerations for Dexerials include:

- Compliance with emission standards: Meeting air and water quality regulations set by authorities like the U.S. Environmental Protection Agency (EPA), which often imposes strict limits on industrial pollutants.

- Safe handling of hazardous materials: Implementing robust protocols for storing, using, and disposing of chemicals to prevent accidents and environmental contamination, aligning with global best practices.

- Product lifecycle management: Ensuring that the chemical components within Dexerials' products are managed responsibly from production through to end-of-life disposal, considering regulations like the EU's RoHS (Restriction of Hazardous Substances) directive.

Energy Efficiency Standards and Renewable Energy Adoption

The increasing focus on energy efficiency in electronics and automotive sectors, spurred by regulations and consumer preferences, presents a significant avenue for Dexerials. The company can capitalize on this trend by developing advanced materials that improve energy performance in these applications. For instance, in 2024, global regulations like the EU's Ecodesign directive continue to push for lower energy consumption in consumer electronics.

Furthermore, the shift towards renewable energy in manufacturing is a crucial environmental aspect for sustainable operations. Dexerials' commitment to this area can enhance its brand reputation and operational resilience. By 2025, many multinational corporations are setting ambitious targets for renewable energy sourcing in their supply chains, aiming for a substantial portion of their energy needs to be met by clean sources.

Key environmental considerations for Dexerials include:

- Developing materials that improve energy efficiency in end-products, aligning with evolving regulatory landscapes and consumer demand for sustainable electronics and vehicles.

- Integrating renewable energy sources into manufacturing processes to reduce carbon footprint and meet corporate sustainability goals, a trend gaining momentum across industries.

- Responding to stricter energy efficiency standards which are projected to tighten further in key markets like Europe and North America through 2025.

The global drive for sustainability is pushing industries towards eco-friendly materials and processes, directly benefiting companies like Dexerials that focus on energy efficiency and reduced environmental impact.

Dexerials has shown concrete progress, reducing its greenhouse gas emissions intensity by 15% in fiscal year 2023 against a 2013 baseline.

The increasing demand for recyclable and reusable materials, driven by circular economy principles, necessitates that Dexerials innovate in product design and material sourcing to meet evolving market needs.

Stricter regulations on e-waste and chemical management, such as the EU's WEEE and REACH directives, compel Dexerials to ensure its products are designed for easier recycling and its chemical usage is managed responsibly.

| Environmental Factor | Impact on Dexerials | Data Point/Trend |

| Climate Change & Carbon Emissions | Demand for low-carbon materials and processes | 15% reduction in GHG emissions intensity (FY2023 vs. 2013 baseline) |

| Resource Depletion & Circular Economy | Need for recyclable, reusable, or recycled materials | Projected doubling of rare earth demand by 2030 (IEA) |

| Waste Management & E-waste | Requirement for easier product disassembly and recycling | EU WEEE directive mandates higher collection and recycling rates |

| Pollution Control & Chemical Management | Adherence to strict standards for hazardous materials and emissions | Over 23,000 chemicals registered under EU REACH (2023) |

| Energy Efficiency | Opportunity in developing materials for energy-saving electronics and vehicles | EU Ecodesign directive continues to push for lower energy consumption in consumer electronics (2024) |

| Renewable Energy Adoption | Enhances brand reputation and operational resilience | Many multinationals aim for substantial renewable energy sourcing by 2025 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Dexerials is informed by a comprehensive review of official government publications, reputable financial news outlets, and leading industry analysis reports. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the company.