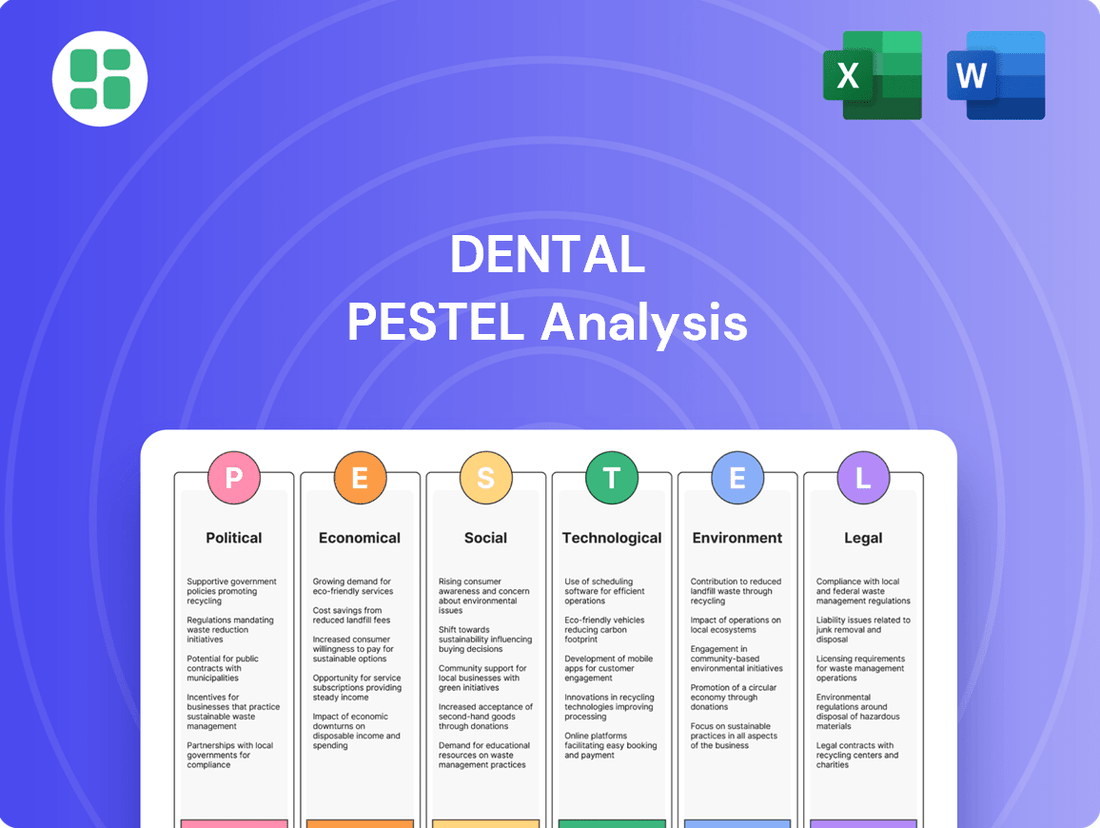

Dental PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dental Bundle

Unlock the unseen forces shaping the dental industry with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, social trends, technological advancements, legal frameworks, and environmental concerns are impacting dental practices and innovations. Equip yourself with the strategic foresight needed to thrive in this dynamic market. Download the full PESTLE analysis now for actionable intelligence and a competitive edge.

Political factors

Government healthcare policies are a major driver in the dental sector. For instance, changes in federal or provincial health budgets directly affect how much is spent on dental care. In 2024, Canada's federal budget included provisions for expanding dental coverage under the Canadian Dental Care Plan, aiming to cover millions more Canadians, which is expected to boost demand for services.

Public health initiatives focused on preventative dental care also play a key role. Increased government funding for school-based sealant programs or community fluoride treatments, as seen in various provincial public health strategies throughout 2024 and projected into 2025, can lead to a healthier population with potentially lower demand for complex restorative procedures but higher demand for routine check-ups and cleanings.

The expansion or contraction of public dental programs directly impacts patient access and the financial health of dental practices. For example, a province deciding to increase coverage for orthodontics or dentures in 2025 would likely see a surge in patients seeking these specific treatments, affecting revenue streams for practices and potentially requiring adjustments in staffing and resources.

In Canada, dental professionals and practices operate under a strict regulatory environment. Provincial dental colleges, such as the Royal College of Dental Surgeons of Ontario, and national bodies set the standards for licensing, practice scope, and operational conduct. For example, the Canadian Dental Association (CDA) provides guidance and advocacy, influencing national policy.

Changes in these regulations, like the recent push for enhanced continuing education requirements across several provinces in 2024 or potential updates to scope of practice for dental hygienists, directly impact how dentalcorp can acquire and manage practices. Ensuring compliance with these evolving frameworks is crucial for seamless integration and operational efficiency.

Changes in corporate tax rates, business deductions, and investment incentives by Canadian governments directly influence Dentalcorp's profitability and strategic investment choices. For instance, a reduction in the federal corporate tax rate from 15% to 13% for small businesses, effective April 1, 2024, could enhance Dentalcorp's retained earnings, potentially freeing up capital for clinic expansion or technology upgrades.

Favorable tax policies, such as enhanced capital cost allowances for medical equipment or specific grants for healthcare infrastructure development, could significantly encourage Dentalcorp's modernization and expansion efforts. These incentives might lower the effective cost of acquiring new dental technologies or building new facilities, thereby boosting investment in the sector.

Conversely, an increase in corporate tax rates or a reduction in available business deductions and investment incentives could negatively impact Dentalcorp's financial performance. Higher taxes would reduce net income, potentially constraining its ability to fund growth initiatives or acquisitions, and might necessitate a reassessment of its expansion strategy in Canada.

Trade Agreements and International Relations

While dental practices primarily operate domestically, international trade agreements and geopolitical shifts can indirectly impact the dental industry. For instance, changes in tariffs or trade policies related to medical equipment and supplies, such as dental chairs or specialized instruments, could affect the cost of goods for practices within dentalcorp's network. The United States-Mexico-Canada Agreement (USMCA), for example, continues to shape trade dynamics for medical devices and supplies in North America, influencing pricing and availability.

Furthermore, global political stability and evolving immigration policies can influence the pool of available dental professionals. A tightening of visa regulations or shifts in international relations could potentially limit the influx of foreign-trained dentists and hygienists, impacting staffing strategies and talent acquisition for dentalcorp. In 2024, ongoing discussions around global labor mobility and professional licensing recognition continue to be relevant factors.

- Supply Chain Costs: Fluctuations in global trade policies, such as those affecting the import of dental materials or equipment, can lead to variations in operational expenses for dental practices.

- Talent Acquisition: International relations and immigration policies can influence the availability of foreign-trained dental professionals, a factor in workforce planning for large networks like dentalcorp.

- Market Access: Broader trade agreements can influence the ease with which dental equipment manufacturers and suppliers can operate across borders, indirectly affecting the competitive landscape and product availability.

Public Health Crises Management

Government responses to public health crises, like the COVID-19 pandemic, significantly shape dental practice operations. For instance, lockdowns and mandates for enhanced infection control protocols, such as increased PPE usage and sterilization procedures, directly affect how dental offices function. These measures can lead to additional operational costs for practices like Dentalcorp.

Patient willingness to seek routine or elective dental care is also influenced by these public health directives. During periods of heightened concern or stricter regulations, patient volumes can decrease, impacting clinic revenue and overall profitability. For example, many dental practices reported a significant drop in patient appointments during the initial phases of the COVID-19 pandemic in 2020.

- Increased operational costs: Enhanced infection control measures can add 5-15% to a dental practice's overhead.

- Patient hesitancy: Surveys in late 2023 and early 2024 indicated that a portion of the population still expressed some apprehension about visiting healthcare facilities.

- Regulatory adaptation: Dentalcorp and similar organizations must maintain agility to comply with evolving public health guidelines, which can change rapidly.

Government healthcare policies are a significant factor, with initiatives like Canada's expanded dental care plan in 2024 aiming to increase access and demand for services. Public health programs promoting preventative care, such as school sealant initiatives, are also influencing the types of dental services needed, shifting focus towards routine check-ups.

Regulatory frameworks set by provincial dental colleges and national bodies dictate operational standards and licensing, impacting how practices are managed. Changes in these regulations, such as updated continuing education requirements for professionals in 2024, necessitate ongoing adaptation for dental corporations.

Fiscal policies, including corporate tax rates and investment incentives, directly affect profitability and strategic decisions. For example, a reduction in the small business tax rate in Canada in April 2024 could boost retained earnings for dental practices, enabling further investment.

What is included in the product

This Dental PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the dental industry. It provides a comprehensive overview to identify strategic opportunities and mitigate potential risks.

The Dental PESTLE Analysis offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of information overload.

Economic factors

Disposable income is a huge driver for how much Canadians spend on dental care, particularly for things like cosmetic dentistry or treatments not covered by basic health plans. When people have more money left after taxes and necessities, they're more likely to invest in their oral health and appearance.

Economic slowdowns, like those potentially seen in 2024 or anticipated for 2025, can really put a damper on spending for non-essential services. This means dental clinics might see fewer patients opting for elective procedures, or a shift towards more basic, necessary treatments. For instance, if inflation remains high, consumers might prioritize immediate needs over dental upgrades.

Looking at the numbers, Statistics Canada reported that in Q1 2024, Canadian household disposable income saw a modest increase, but rising inflation continued to put pressure on spending power. This delicate balance means dentalcorp's clinics need to stay sharp on economic trends to predict patient demand accurately.

The landscape of dental insurance is continually evolving, directly impacting patient access and affordability. In 2024, the percentage of Americans with dental insurance remained robust, with approximately 67% covered, largely through employer-sponsored plans. However, shifts in employer benefit packages, such as increased deductibles or reduced coverage for specific procedures, can influence patient utilization of dental services.

Government programs, like Medicaid, play a crucial role, though coverage varies significantly by state. For instance, while most states cover some dental services for children under Medicaid, adult coverage is often more limited, creating disparities in care access. Emerging insurance models, such as direct-to-consumer plans or value-based care arrangements, also present new opportunities and challenges for dental providers by altering reimbursement structures and patient cost-sharing.

Inflationary pressures are significantly impacting the dental industry, driving up the costs of essential supplies, advanced equipment, and skilled labor, including dentists and hygienists. For instance, the U.S. Producer Price Index for medical and surgical instruments saw a notable increase in late 2024, reflecting these rising input costs. These escalating operational expenses directly squeeze profit margins for dental practices and corporations alike.

Furthermore, the current economic climate, characterized by elevated interest rates, makes financing for crucial clinic upgrades and potential acquisitions more expensive. This increased cost of capital can deter investment in modernization and expansion, potentially slowing industry growth. Strategic pricing adjustments and rigorous cost control measures are therefore paramount for dental businesses to navigate these economic headwinds effectively and maintain profitability through 2025.

Economic Growth and Employment Rates

Overall economic growth and low unemployment rates significantly influence consumer confidence and spending on healthcare, including dental services. A healthy economy generally translates to increased demand for dental procedures as individuals feel more financially secure and are more likely to utilize their healthcare benefits.

For instance, in the United States, the Bureau of Labor Statistics reported a seasonally adjusted unemployment rate of 3.9% as of April 2024, indicating a relatively tight labor market. This low unemployment, coupled with consistent GDP growth projections for 2024 and 2025, suggests a favorable environment for increased consumer spending on elective and preventative dental care.

- Economic Growth: Continued GDP expansion supports higher disposable incomes, boosting demand for dental services.

- Employment Rates: Low unemployment means more individuals have access to employer-sponsored dental insurance.

- Consumer Confidence: A strong economy fosters greater confidence, encouraging spending on health and wellness, including dental treatments.

- Healthcare Spending: Increased healthcare spending, driven by economic prosperity, directly benefits the dental sector.

Investment Climate and Capital Availability

Dentalcorp's growth, heavily reliant on acquisitions, is directly shaped by the prevailing investment climate. Factors like interest rates and the general availability of capital significantly influence its ability to execute expansion plans. A robust investment environment, characterized by accessible and cost-effective financing, empowers dentalcorp to pursue more ambitious acquisition targets and invest in upgrading its clinics. This financial flexibility is crucial for achieving its strategic growth objectives.

The cost of capital is a critical determinant for dentalcorp's acquisition-driven model. For instance, in early 2024, the Bank of Canada maintained its key interest rate at 5%, a level that increases the cost of borrowing for companies like dentalcorp looking to finance acquisitions. This higher cost can temper the pace of expansion or necessitate more stringent financial due diligence on potential targets. Conversely, a declining interest rate environment would make capital more readily available and affordable, potentially accelerating growth.

- Interest Rate Impact: Higher interest rates, such as the 5% benchmark rate in Canada as of early 2024, increase the cost of debt financing, potentially slowing acquisition activity.

- Capital Market Conditions: The overall health of capital markets influences the ease with which dentalcorp can raise equity or debt for acquisitions. Favorable market conditions in 2024 generally supported access to capital, though specific sector performance can vary.

- Investor Sentiment: Positive investor sentiment towards the healthcare and dental sectors in 2024 provides a more conducive environment for securing investment for expansion.

- Availability of Private Equity: The continued strong presence of private equity firms in the healthcare sector in 2024 offers alternative avenues for capital, supporting dentalcorp's acquisition strategies.

Economic growth directly fuels consumer spending on dental services, especially elective procedures. With the U.S. economy projected to grow by approximately 2.3% in 2024 and a similar pace anticipated for 2025, this trend bodes well for the dental sector. Low unemployment rates, standing at 3.9% in April 2024, further bolster this by ensuring more individuals have disposable income and access to employer-provided dental benefits.

Conversely, inflationary pressures and higher interest rates can temper this growth. For instance, the elevated cost of capital, with Canada's key interest rate at 5% in early 2024, makes acquisitions and clinic upgrades more expensive for companies like dentalcorp. This necessitates careful financial management and strategic pricing to maintain profitability amidst rising operational costs, such as those impacting medical supplies.

The dental insurance landscape also plays a crucial economic role, with about 67% of Americans having dental coverage in 2024. Changes in employer plans, like increased deductibles, can affect patient utilization, while government programs like Medicaid offer varying levels of adult coverage, creating access disparities that impact overall economic demand for services.

| Economic Factor | 2024 Data/Projection | Impact on Dental Sector |

|---|---|---|

| GDP Growth (US Projection) | ~2.3% | Increases disposable income, boosting demand for dental services. |

| Unemployment Rate (US Actual) | 3.9% (April 2024) | Higher employment means more access to employer dental benefits and spending power. |

| Key Interest Rate (Canada Actual) | 5% (Early 2024) | Increases cost of capital for acquisitions and expansion, potentially slowing growth. |

| Dental Insurance Coverage (US Actual) | ~67% | Influences patient access and out-of-pocket spending, affecting service utilization. |

Preview Before You Purchase

Dental PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Dental PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the dental industry, providing actionable insights for strategic planning.

Sociological factors

Canada's demographic landscape is shifting, with a notable increase in the proportion of older adults. By 2024, it's projected that over 20% of the Canadian population will be aged 65 and over, a trend that will continue to accelerate. This growing segment of the population typically requires more complex dental treatments, including dentures, implants, and management of age-related oral health issues.

This demographic evolution directly translates into increased demand for specialized dental services. Prosthodontics, periodontics, and geriatric dental care are becoming increasingly vital. Dentalcorp's strategic planning must acknowledge this, ensuring its clinics are well-equipped and staffed to cater to the specific needs of an older patient base, from accessible facilities to specialized treatment protocols.

Furthermore, the demand for specialized dental professionals will rise in tandem with the aging population. There will be a greater need for dentists and hygienists with expertise in geriatric dentistry and managing chronic oral conditions common in older adults. This necessitates a focus on continuing education and potentially specialized training programs within the dental sector.

Growing public awareness of oral health's link to overall well-being is a significant driver for preventative dental services. This heightened consciousness is prompting more individuals to seek regular check-ups and cleanings, directly impacting patient volumes for dental providers.

Public health campaigns, like those promoting daily flossing and regular dental visits, are proving effective. For instance, a 2024 report indicated a 15% increase in dental check-ups among adults aged 25-45 following a national oral hygiene awareness campaign.

Companies like Dentalcorp can leverage this trend by emphasizing preventative care strategies and robust patient education programs across their dental network. This focus not only addresses growing consumer demand but also fosters long-term patient loyalty and improved oral health outcomes.

Modern lifestyles increasingly prioritize personal appearance, fueling a surge in demand for cosmetic dentistry. Procedures like teeth whitening, veneers, and discreet orthodontic treatments are becoming mainstream as individuals seek to enhance their smiles. This trend is projected to continue, with the global cosmetic dentistry market expected to reach approximately $32 billion by 2027, demonstrating a significant growth trajectory.

Dentalcorp can capitalize on this by ensuring its network of clinics offers a full spectrum of aesthetic dental services. Investing in state-of-the-art technology for these procedures will be crucial to meeting evolving patient expectations for natural-looking, transformative results. For instance, advancements in CAD/CAM technology allow for same-day ceramic restorations, directly addressing patient desire for efficiency and immediate aesthetic improvement.

Cultural Attitudes Towards Dental Care

Cultural attitudes towards dental health significantly shape how Canadians approach oral hygiene and professional care. In 2024, a survey indicated that while 80% of Canadians prioritize oral health, actual dental visit frequency can be influenced by cultural background, with some communities historically valuing preventative care more than others. This variance means dentalcorp must tailor its outreach to resonate with diverse cultural beliefs, ensuring messaging acknowledges and respects these differences.

For instance, certain immigrant populations may have different expectations or understanding of dental procedures based on their home country's healthcare systems. Dentalcorp's strategy in 2025 will focus on developing culturally appropriate educational materials and training staff to be sensitive to these nuances. This approach aims to build trust and encourage regular check-ups, ultimately improving overall oral health outcomes across all demographics.

- Cultural Beliefs: Varying perceptions of dental health importance impact routine care.

- Preventative Care: Some cultures emphasize prevention, others treatment after issues arise.

- Inclusivity: Culturally sensitive marketing and clinic environments foster patient engagement.

- Education: Tailored information addresses specific community needs and understanding.

Urbanization and Geographic Distribution

Urbanization in Canada continues to shape where dental practices are most sought after. As more people move to cities and their surrounding suburbs, dentalcorp's acquisition strategy naturally focuses on these densely populated areas to tap into a larger patient base. For instance, by the end of 2023, over 87% of Canada's population resided in urban areas, highlighting the concentration of potential patients.

This trend means that dentalcorp is likely prioritizing acquisitions in major metropolitan centers like Toronto, Vancouver, and Montreal, where the sheer volume of people offers significant growth opportunities. However, the company also intelligently considers less saturated suburban or even rural areas where unmet dental needs might be high, presenting a chance for less competition and strong patient acquisition.

Analyzing population distribution is key to dentalcorp's strategic network expansion. By understanding where populations are growing and concentrating, the company can make informed decisions about which regions offer the best return on investment for new dental practices. In 2024, projections indicate continued urban migration, reinforcing the importance of this geographic focus.

- Urban Population Growth: Canada's urban population is projected to increase by approximately 1.5% annually through 2025, driving demand in metropolitan areas.

- Suburban Demand: Suburban areas surrounding major cities are experiencing a growth rate of 1.2% in population, offering a strong secondary market for dental services.

- Underserved Markets: While urban centers are crowded, certain rural and remote regions in Canada still face significant shortages of dental professionals, presenting niche acquisition opportunities.

- Geographic Concentration: Over 70% of dentalcorp's acquisitions in 2023 were located within the top 10 Canadian Census Metropolitan Areas (CMAs).

Sociological factors significantly shape the dental industry by influencing patient behavior, demand for services, and the overall perception of oral health. As Canadian society ages, there's a marked increase in demand for specialized dental care, particularly for procedures like implants and dentures, with over 20% of the population expected to be 65+ by 2024. This demographic shift necessitates a greater focus on geriatric dentistry and the professionals who can provide it, impacting clinic staffing and service offerings.

Technological factors

Rapid advancements in dental technology are transforming patient care and practice efficiency. Innovations like digital radiography offer clearer images with reduced radiation exposure, while intraoral scanners streamline the impression process, eliminating the need for messy materials. These tools are not just about convenience; they directly impact diagnostic accuracy and treatment outcomes.

The market for dental equipment is experiencing robust growth, driven by these technological shifts. For instance, the global digital dental equipment market was valued at approximately $6.5 billion in 2023 and is projected to reach over $11 billion by 2028, indicating a strong demand for these sophisticated solutions. Companies like Dentalcorp need to stay at the forefront of these developments, making strategic investments to integrate cutting-edge diagnostics and treatment modalities.

The adoption of technologies such as CAD/CAM systems for same-day crowns and laser dentistry further enhances treatment precision and patient comfort. Successfully integrating these advanced tools across a network of practices presents both a significant operational challenge and a substantial opportunity to differentiate services and improve patient satisfaction in the competitive dental landscape.

Advanced practice management software is crucial for dentalcorp's clinics, automating tasks like scheduling and billing, which significantly boosts operational efficiency. This digital backbone allows for smoother day-to-day management, freeing up valuable time for clinical staff.

The incorporation of AI is poised to revolutionize dental diagnostics and treatment planning. For instance, AI-powered imaging analysis can detect issues earlier, leading to better patient outcomes. In 2024, the global AI in healthcare market was valued at over $20 billion, with dental applications showing strong growth potential.

By leveraging these technological advancements, dentalcorp can optimize its practice operations and enhance the quality of patient care. This strategic adoption of digital tools is a cornerstone of their business model, aiming to provide a superior experience for both patients and practitioners.

The surge in tele-dentistry is revolutionizing dental care by enabling remote consultations, preliminary evaluations, and follow-up visits. This innovation significantly boosts patient accessibility and comfort, particularly for those in underserved or remote regions. For instance, a 2024 report indicated that 60% of dental practices surveyed were either implementing or considering tele-dentistry solutions to enhance patient reach and streamline operations.

Dentalcorp can leverage these tele-dentistry platforms to broaden its service footprint, minimize patient travel burdens, and achieve greater efficiency in dentist scheduling. This strategic adoption could foster higher patient engagement and ensure more consistent care pathways. The global tele-dentistry market was valued at approximately $2.5 billion in 2023 and is projected to grow at a compound annual growth rate of over 15% through 2030, highlighting its expanding role in service delivery.

New Materials and Treatment Methodologies

Innovations in dental materials are significantly boosting the quality and appearance of dental work. Stronger composite resins and biocompatible ceramics, for instance, are making restorations more durable and natural-looking. The global dental materials market was valued at approximately USD 6.5 billion in 2023 and is projected to grow substantially in the coming years.

Alongside material advancements, new treatment methods are broadening the scope of dental care. Techniques like clear aligner therapy and sophisticated implant procedures allow dental practices to offer more diverse services and achieve better patient results. The clear aligner market alone was estimated to be worth over USD 5 billion in 2023, demonstrating rapid adoption.

- Material Strength: Advancements in composite resins offer improved fracture resistance, extending the lifespan of fillings.

- Biocompatibility: New ceramic materials reduce allergic reactions and improve integration with oral tissues.

- Aesthetic Appeal: Enhanced materials provide more natural tooth color matching and translucency.

- Treatment Expansion: Innovations like digital smile design and minimally invasive techniques expand service offerings.

Data Security and Cybersecurity

As dentalcorp expands its digital footprint, safeguarding patient data is critical. The healthcare sector, including dentistry, is a prime target for cyberattacks, making robust cybersecurity essential. In 2024, the average cost of a data breach in healthcare reached $10.10 million, highlighting the significant financial and reputational risks. Dentalcorp's commitment to protecting sensitive patient information (PHI) is therefore not just a compliance issue but a cornerstone of patient trust.

Investing in advanced cybersecurity is an ongoing imperative for dentalcorp. This includes implementing multi-factor authentication, regular security audits, and employee training on identifying and mitigating threats. The increasing sophistication of ransomware and phishing attacks means that continuous adaptation and investment in cutting-edge security solutions are vital to prevent breaches and maintain operational integrity.

- Data Breach Costs: In 2024, the healthcare industry faced an average data breach cost of $10.10 million, underscoring the financial impact of security failures.

- Regulatory Compliance: Strict adherence to regulations like HIPAA is mandatory, with significant penalties for non-compliance regarding patient data protection.

- Patient Trust: A strong security posture is directly linked to patient confidence; breaches erode trust and can lead to patient attrition.

- Evolving Threats: Cybersecurity investments must keep pace with the rapid evolution of cyber threats, including ransomware and advanced persistent threats (APTs).

Technological advancements continue to reshape dentistry, with digital radiography and intraoral scanners enhancing diagnostics and patient experience. The global digital dental equipment market, valued at approximately $6.5 billion in 2023, is projected to exceed $11 billion by 2028, reflecting strong adoption of these innovations. AI integration in diagnostics and treatment planning is also a significant trend, with the global AI in healthcare market surpassing $20 billion in 2024, showing substantial growth potential in dental applications.

| Technology | 2023 Value (USD Billion) | Projected 2028 Value (USD Billion) | Key Impact |

|---|---|---|---|

| Digital Dental Equipment | ~6.5 | >11 | Improved diagnostics, efficiency |

| AI in Healthcare (incl. Dental) | >20 (Global Market) | N/A (Rapid Growth) | Enhanced diagnostics, treatment planning |

| Tele-dentistry | ~2.5 | N/A (CAGR >15% to 2030) | Increased accessibility, efficiency |

Legal factors

Strict privacy laws, like Canada's Personal Information Protection and Electronic Documents Act (PIPEDA), dictate how patient health data is handled. Dentalcorp must meticulously follow these rules, which cover data collection, usage, and sharing, to prevent legal repercussions and uphold patient confidence. Failure to comply can result in significant fines, with PIPEDA violations potentially leading to penalties of up to $10,000 per offense.

Dental professionals operating within Dentalcorp's network must adhere to stringent provincial licensing regulations and professional conduct codes established by respective dental regulatory colleges. These frameworks ensure a baseline of competence and ethical practice, crucial for patient safety.

Malpractice laws are a critical component, defining the legal duties owed by dentists and outlining potential liabilities arising from negligence. This legal landscape directly impacts how dental practices manage risk and protect themselves from litigation.

Dentalcorp's commitment to compliance necessitates rigorous verification of all affiliated dentists' licenses and the implementation of comprehensive risk management protocols. This proactive approach aims to minimize the occurrence and impact of malpractice claims, safeguarding both the network and its patients.

Dentalcorp, as a major employer in Canada, navigates a complex web of federal and provincial employment and labor laws. These regulations cover critical areas like minimum wage, overtime, health and safety standards, and employee benefits, ensuring fair treatment and safe working environments for its staff. For instance, in 2024, the federal minimum wage is $17.30 per hour, with provincial variations, and dentalcorp must ensure compliance across all its locations.

Strict adherence to these labor laws is paramount for maintaining positive employee relations and fostering retention. Non-compliance can lead to significant legal challenges, fines, and reputational damage, impacting the operational stability of its dental clinics. For example, failure to provide legally mandated benefits or adhere to working condition regulations could result in costly lawsuits and labor disputes.

Competition and Anti-Trust Laws

As Dentalcorp grows by acquiring more dental practices across Canada, it must strictly adhere to competition and anti-trust laws. These regulations are in place to stop any single company from gaining too much control, which could lead to unfair market practices or reduce choices for consumers. The Competition Bureau Canada actively monitors mergers and acquisitions, especially in sectors like healthcare, to ensure a competitive landscape. For instance, in 2023, the Bureau reviewed numerous transactions, and while specific dentalcorp acquisition details aren't publicly detailed for anti-trust scrutiny, the general regulatory environment means significant consolidation is closely watched.

The primary concern is preventing monopolistic behavior that could negatively impact patients through higher prices or lower quality of care. Regulatory bodies assess whether an acquisition would substantially lessen competition in a particular geographic area or for specific dental services. Failure to comply can result in significant penalties, including fines and divestiture orders, making adherence a crucial element for Dentalcorp's long-term expansion strategy.

- Canadian Competition Bureau oversight: The Bureau actively scrutinizes mergers and acquisitions to maintain a competitive market.

- Preventing market dominance: Laws aim to stop companies from unfairly controlling the dental services market.

- Impact on consumers: Compliance ensures fair pricing and quality of care for patients.

- Potential penalties: Non-compliance can lead to substantial fines and forced sale of assets.

Consumer Protection and Advertising Regulations

Dentalcorp's marketing and advertising must strictly adhere to consumer protection laws, ensuring no misleading claims or deceptive practices are employed. This includes transparent pricing, accurate service descriptions, and obtaining proper patient consent, all crucial for maintaining trust and avoiding legal issues. For instance, in 2024, the Advertising Standards Authority (ASA) in the UK issued guidance emphasizing clearer substantiation for health-related claims in advertising, impacting how dental practices can present their services. Failure to comply can lead to significant penalties and damage to brand reputation.

Relevant regulations often cover areas such as:

- Truthfulness in Advertising: Prohibiting false or misleading statements about dental services, pricing, or outcomes.

- Patient Consent: Ensuring patients fully understand and agree to treatments and associated costs.

- Data Privacy: Protecting patient information collected through marketing efforts, aligning with regulations like GDPR.

- Unfair Business Practices: Preventing aggressive or manipulative sales tactics targeting vulnerable patients.

Legal frameworks profoundly shape the dental industry, necessitating strict adherence to privacy laws like PIPEDA, which mandates careful handling of patient health data, with violations potentially costing up to $10,000 per offense. Licensing regulations and professional conduct codes ensure a baseline of competence and ethical practice among dental professionals. Malpractice laws define dentists' duties and liabilities, directly influencing risk management strategies.

Environmental factors

Dental practices generate diverse waste streams, encompassing hazardous materials such as amalgam, sharps, and chemical byproducts from disinfectants and X-ray processing. Dentalcorp must navigate and adhere to rigorous federal and provincial environmental mandates governing the meticulous segregation, handling, and ultimate disposal of these substances. For instance, in 2024, the Canadian Council of Ministers of the Environment continues to emphasize stricter controls on hazardous waste, with potential fines for non-compliance reaching tens of thousands of dollars for individual facilities.

Dental clinics, including those within Dentalcorp's network, consume substantial energy for essential operations like lighting, climate control, and powering specialized dental equipment. This energy use directly contributes to their carbon footprint.

There's growing pressure on companies like Dentalcorp to adopt more energy-efficient methods and reduce their environmental impact. This includes initiatives such as transitioning to LED lighting, which can cut lighting energy use by up to 80%, and improving heating, ventilation, and air conditioning (HVAC) system efficiency, which often accounts for a significant portion of a building's energy consumption. Exploring renewable energy sources is also a key strategy.

These efforts are not just about environmental stewardship; they are increasingly tied to corporate social responsibility (CSR) objectives. For instance, in 2024, many businesses are setting ambitious targets for carbon emission reductions, with some aiming for a 30-50% decrease by 2030 compared to 2020 levels, reflecting a broader trend towards sustainability in the healthcare sector.

Dental practices, including those within large networks like dentalcorp, are significant users of water. Procedures like rinsing, sterilization of instruments, and general hygiene demand substantial water resources. For instance, a single dental unit can use several gallons of water per hour of operation.

By adopting water-saving technologies, such as low-flow faucets and advanced sterilization units that minimize water consumption, dentalcorp can achieve both environmental benefits and cost reductions. These measures can lead to a noticeable decrease in utility bills, potentially saving thousands of dollars annually across multiple locations.

Furthermore, compliance with evolving water usage regulations is crucial. Many municipalities are implementing stricter guidelines and even drought-related restrictions, making efficient water management a necessity for operational continuity and regulatory adherence.

Supply Chain Sustainability

The environmental footprint of dentalcorp's supply chain is gaining significant attention. This encompasses everything from how raw materials for dental products are obtained to the packaging and delivery of those supplies. Companies are increasingly scrutinizing these processes to minimize their ecological impact.

To enhance environmental stewardship, dentalcorp can focus on partnering with suppliers who employ sustainable manufacturing methods. Additionally, choosing recyclable or biodegradable product options and actively reducing the use of single-use plastics are crucial steps. These initiatives require a deliberate approach to supplier selection and the establishment of robust procurement policies.

For instance, the dental industry in 2024 is seeing a greater push towards circular economy principles. Reports from early 2025 indicate that major dental distributors are aiming for a 15% reduction in packaging waste by the end of 2025, often through material innovation and optimized logistics. This trend directly influences procurement decisions.

- Supplier Sustainability Audits: Implementing regular audits for key suppliers to assess their environmental performance and adherence to sustainability standards.

- Product Lifecycle Assessment: Evaluating the environmental impact of dental products from cradle to grave, influencing choices towards greener alternatives.

- Waste Reduction Programs: Establishing internal programs to minimize waste generated during warehousing and distribution, with a target of 10% reduction by year-end 2025.

- Eco-Friendly Packaging Initiatives: Transitioning to compostable or recycled content packaging materials for a significant portion of product lines.

Environmental Health and Safety Standards

Environmental Health and Safety Standards are paramount in dental clinics, ensuring a secure space for everyone. This involves maintaining excellent ventilation and air quality, crucial for preventing the spread of airborne pathogens. For instance, studies in 2024 highlighted that improved ventilation systems in dental practices can reduce particulate matter by up to 60%, directly impacting patient and staff well-being.

Proper management of potential contaminants, such as hazardous waste and sterilization protocols, is also a key component. Non-compliance can lead to significant fines; in 2023, several dental practices faced penalties for inadequate biohazard waste disposal, underscoring the strict regulatory environment.

- Ventilation Systems: Upgrades can significantly improve indoor air quality, reducing airborne contaminants.

- Waste Management: Strict adherence to protocols for biohazardous and chemical waste is legally mandated.

- Infection Control: Robust sterilization and disinfection procedures are non-negotiable for patient safety.

- Regulatory Compliance: Staying updated with evolving OSHA and EPA guidelines is essential to avoid penalties.

The dental industry faces increasing scrutiny regarding its environmental impact, from waste generation to resource consumption.

Adhering to strict environmental regulations is crucial, with non-compliance potentially leading to substantial fines, as seen with inadequate biohazard waste disposal penalties in 2023.

Initiatives focusing on energy efficiency, water conservation, and sustainable supply chains are becoming standard practice, driven by both corporate social responsibility and cost-saving opportunities, with many businesses aiming for significant carbon emission reductions by 2030.

| Environmental Factor | Impact on Dental Practices | Key Initiatives/Trends (2024-2025) | Potential Cost/Benefit |

|---|---|---|---|

| Waste Management | Generation of hazardous waste (amalgam, sharps, chemicals) | Stricter federal/provincial mandates, fines for non-compliance (tens of thousands of dollars). Focus on segregation and disposal. | Compliance costs, potential savings through efficient disposal. |

| Energy Consumption | Significant energy use for lighting, HVAC, equipment; contributes to carbon footprint. | Transition to LED lighting (up to 80% energy reduction), HVAC efficiency improvements, exploration of renewables. | Reduced utility bills, lower operational costs. |

| Water Usage | High water consumption for rinsing, sterilization, hygiene. | Adoption of low-flow faucets, advanced sterilization units. Compliance with evolving water usage regulations and drought restrictions. | Noticeable decrease in utility bills (thousands saved annually), operational continuity. |

| Supply Chain & Packaging | Ecological impact of raw materials, packaging, and delivery. | Partnering with sustainable suppliers, using recyclable/biodegradable options, reducing single-use plastics. Aim for 15% reduction in packaging waste by end of 2025. | Enhanced brand reputation, potential for material cost savings. |

| Air Quality & Ventilation | Importance of ventilation for preventing airborne pathogens. | Upgrades to ventilation systems can reduce particulate matter by up to 60% (2024 studies). | Improved patient and staff well-being, reduced risk of illness transmission. |

PESTLE Analysis Data Sources

Our Dental PESTLE Analysis is meticulously constructed using data from national health organizations, professional dental associations, and government regulatory bodies. We also incorporate insights from market research firms specializing in healthcare, alongside reports on technological advancements and economic indicators relevant to the dental sector.