Dental Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dental Bundle

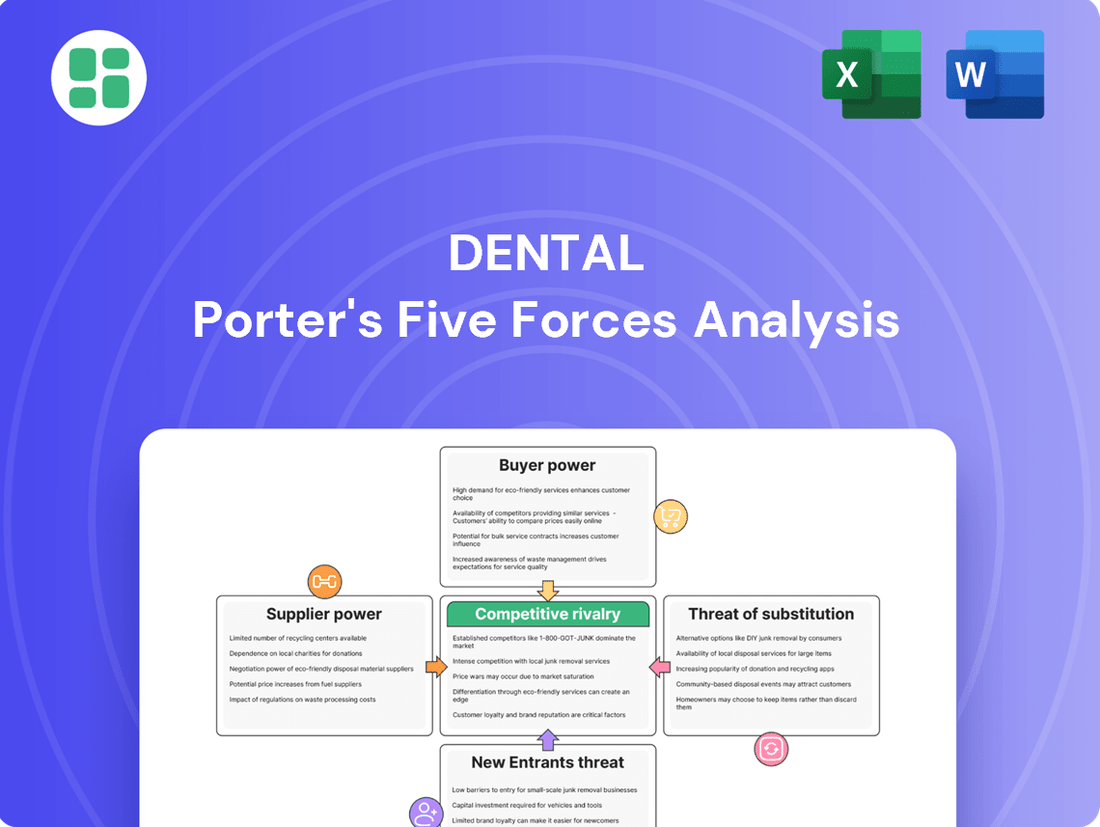

Understanding the competitive landscape is crucial for success in the dental industry. Porter's Five Forces Analysis provides a powerful framework to dissect these pressures, revealing the underlying dynamics that shape market profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dental’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The suppliers of specialized dental equipment, like advanced imaging systems and CAD/CAM technology, wield considerable bargaining power. This is largely due to the high expense and unique nature of these essential tools, with few alternative providers available. For instance, a state-of-the-art cone-beam computed tomography (CBCT) unit can cost upwards of $100,000, making switching suppliers a significant financial undertaking.

Dentalcorp's ability to negotiate pricing for these critical technologies is consequently constrained. The necessity of employing cutting-edge equipment for optimal patient care means that dental practices are often reliant on a limited pool of suppliers. This reliance is further cemented by maintenance agreements and software licenses, which can lead to vendor lock-in and amplify the suppliers' leverage in pricing discussions.

The bargaining power of dental consumables manufacturers and distributors is generally moderate. While a vast number of suppliers exist for common items like gloves and masks, large purchasing groups, such as dentalcorp, can leverage bulk orders to negotiate better terms, potentially reducing supplier leverage.

However, this power dynamic shifts for specialized or branded consumables. If only a few manufacturers produce a specific high-demand item, or if dental professionals exhibit strong brand loyalty, these suppliers gain significant bargaining power. For instance, the global dental consumables market was valued at approximately $45.5 billion in 2023 and is projected to grow, indicating sustained demand that can embolden suppliers of unique products.

Furthermore, supply chain vulnerabilities, as seen with disruptions in 2021 and 2022 affecting various medical supplies, or increases in raw material costs, can amplify supplier bargaining power. When production is constrained or input costs rise, suppliers are better positioned to pass these increases onto buyers, thereby strengthening their position in negotiations.

The market for skilled dental professionals, including dentists, hygienists, and assistants, represents a significant supplier force for dental networks like Dentalcorp. Demand for these specialized roles frequently exceeds availability, especially in niche areas or specific geographic locations, giving these professionals considerable leverage.

This scarcity of talent means skilled dental staff can negotiate favorable terms for compensation, benefits, and work environments. In 2024, for instance, reports indicated that the average salary for a general dentist in the US continued to rise, reflecting this strong demand and the specialized skills required, directly impacting the operational expenses of dental groups.

Pharmaceutical Companies

Suppliers of specialized dental pharmaceuticals, such as anesthetics, antibiotics, and pain relievers, can exert significant bargaining power. This strength often stems from patent protection, stringent regulatory hurdles, and the critical role these drugs play in patient care. For instance, the global pharmaceutical market reached approximately $1.6 trillion in 2023, highlighting the substantial value and potential leverage held by key drug manufacturers.

While large dental service organizations like dentalcorp might negotiate for volume discounts, the indispensable nature and often limited substitutability of these essential medications tend to preserve supplier leverage. The market for dental anesthetics alone is projected to grow, underscoring the continued importance of these specialized suppliers.

- Patent Protection: Exclusive rights granted by patents limit competition, giving pharmaceutical companies considerable pricing power for their patented dental drugs.

- Regulatory Barriers: The extensive and costly regulatory approval processes required for pharmaceuticals create high barriers to entry for new suppliers.

- Essential Nature of Products: Anesthetics, antibiotics, and pain management drugs are vital for dental procedures, making dentists highly reliant on these suppliers.

- Limited Alternatives: For specific patented or highly regulated dental pharmaceuticals, genuine alternatives may be scarce, further strengthening supplier position.

Real Estate & Facility Management Services

Suppliers of commercial real estate and facility management services can exert significant bargaining power, especially in sought-after urban centers or areas with high foot traffic. Dental clinics often require specialized fit-outs, and long-term lease agreements can reduce flexibility for companies like Dentalcorp, influencing their ability to adapt or relocate efficiently. For instance, in 2024, average commercial lease rates in major metropolitan areas saw an increase, with some prime locations experiencing year-over-year hikes exceeding 5%.

The localized nature of real estate markets means this power can fluctuate considerably depending on the geographic area. This variability directly impacts expansion strategies and overall operational expenses for dental practices. In 2023, the average cost to build out a new dental clinic space ranged from $150,000 to $350,000, with real estate acquisition or leasing being a substantial component of this figure.

- Location Premium: High-demand urban and suburban areas command higher rental prices, increasing supplier leverage.

- Specialized Fit-Outs: The unique and often costly modifications required for dental practices lock tenants into specific spaces.

- Geographic Disparity: Real estate market power varies greatly by region, affecting expansion costs and operational flexibility.

- Lease Term Impact: Long-term leases limit a dental practice's ability to respond to changing market conditions or relocate easily.

Suppliers of specialized dental equipment and pharmaceuticals hold significant bargaining power due to high costs, limited alternatives, and essential product nature. This leverage is amplified by patent protection, regulatory barriers, and supply chain vulnerabilities, forcing dental networks to accept less favorable terms. For instance, the global dental consumables market was valued at $45.5 billion in 2023, with specialized items commanding higher prices.

Skilled dental professionals, like dentists and hygienists, also possess strong bargaining power due to talent scarcity. In 2024, rising dentist salaries in the US reflect this demand, impacting operational expenses for dental groups. Real estate suppliers in prime locations also exert power through high lease rates and specialized fit-out requirements, with commercial lease rates in major cities increasing in 2024.

| Supplier Category | Key Factors Influencing Power | Example Data/Impact |

|---|---|---|

| Specialized Equipment | High Cost, Few Alternatives, Vendor Lock-in | CBCT units >$100,000; High switching costs |

| Specialized Pharmaceuticals | Patent Protection, Regulatory Barriers, Essential Nature | Global pharma market ~$1.6 trillion (2023); Limited substitutes for critical drugs |

| Skilled Professionals | Talent Scarcity, Niche Demand | Rising dentist salaries (2024); High demand vs. availability |

| Real Estate (Prime Locations) | Location Premium, Specialized Fit-Outs | Increased lease rates (2024); Clinic build-out costs $150k-$350k (2023) |

What is included in the product

This analysis dissects the competitive landscape for Dental by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Effortlessly identify and address competitive threats with a visual representation of each force, simplifying complex market dynamics.

Customers Bargaining Power

Individual patients generally possess limited bargaining power when it comes to dental services. The necessity of oral health means they often have to accept prevailing prices for treatments. For instance, in 2024, average dental procedure costs, like a root canal, can range significantly, making it difficult for a single patient to negotiate down the price.

However, the collective decisions of many patients can indirectly influence a dental practice. If a significant number of patients choose clinics based on factors such as proximity, perceived quality, or which insurance plans are accepted, it can impact a practice's patient volume and revenue streams. A study in late 2024 indicated that over 60% of patients consider insurance coverage as a primary factor when selecting a dentist.

Maintaining patient satisfaction is therefore paramount. Negative experiences can lead to patients seeking care elsewhere, impacting a practice's long-term viability and reputation. In 2023, patient retention rates in the healthcare sector were a key focus, with clinics actively working to improve patient loyalty through better service and communication.

Dental insurance companies and third-party payers wield considerable influence over dental practices, acting as a key customer segment. Their power stems from their ability to shape patient volume and, crucially, reimbursement rates for services. In 2024, the landscape continues to be defined by these large entities dictating fee schedules and imposing administrative burdens that practices must navigate.

This bargaining power directly impacts the financial health of dental corporations like Dentalcorp's network. By setting reimbursement levels, these payers can significantly affect the profitability of specific dental procedures and, consequently, the overall revenue streams generated by member practices.

For dentalcorp, the dental practices it acquires or partners with are essentially its customers in this context. These practices, especially those that are thriving and have a strong reputation, hold considerable sway when negotiations for acquisition or partnership are underway. They can push for advantageous terms, better valuations, and the freedom to maintain their operational independence, which in turn shapes how dentalcorp grows its network.

In 2024, the market for dental practice acquisitions saw continued interest, with many established practices leveraging their success to negotiate favorable deal structures. For instance, practices with consistent revenue growth, often exceeding 5% annually, were in a stronger position to demand higher multiples on their earnings before interest, taxes, depreciation, and amortization (EBITDA).

The bargaining power of these dental practices is amplified by the competitive landscape for acquiring quality practices. If dentalcorp is perceived as offering less attractive terms compared to other consolidators, these practices can easily seek out alternative partners, forcing dentalcorp to be more competitive in its offers and potentially increasing the cost of acquisitions.

Corporate & Group Clients

While individual patient bargaining power is typically low for dental services, corporate and group clients, such as those participating in employee dental programs, can exert more significant influence. These larger entities can negotiate better rates due to the volume of patients they direct to a practice. For instance, a large corporation with a comprehensive dental benefits package might represent hundreds or even thousands of potential patient visits annually, giving them leverage to seek discounted service fees or bundled packages. Dentalcorp's ability to secure and maintain these group contracts would hinge on its network's capacity to handle increased patient flow and its willingness to offer competitive pricing structures.

The bargaining power of these corporate clients is amplified by the potential for switching providers if terms are not met. In 2024, many large employers are reviewing their benefits packages to optimize costs and employee satisfaction. This review process often includes renegotiating contracts with healthcare providers, including dental networks. A dental group's ability to offer a broad range of services, convenient locations, and transparent billing practices can be key differentiators in securing these lucrative group contracts. The financial implications of losing a major corporate client can be substantial, impacting revenue streams and potentially requiring adjustments to operational costs.

- Increased Leverage: Corporate clients can negotiate favorable rates due to the volume of patients they represent.

- Contract Renegotiation: In 2024, many large employers are actively reviewing and renegotiating their employee benefits contracts.

- Service Differentiation: A wide service offering and convenient network access are crucial for attracting and retaining corporate clients.

- Financial Impact: Losing a major corporate client can significantly affect a dental practice's revenue and operational planning.

Geographic Patient Base

The geographic concentration of patients around a dental clinic significantly impacts customer bargaining power. In areas with a high density of potential patients and numerous dental practices, patients gain leverage. For instance, a 2024 report indicated that metropolitan areas with over 500,000 residents often feature a patient-to-dentist ratio below 1,500:1, providing ample choice and thus increasing customer power.

Conversely, in rural or underserved regions where dental providers are scarce, patient bargaining power diminishes. These patients have fewer alternatives, which can allow clinics in such locations greater flexibility in setting prices and service standards. Data from 2023 showed that some rural counties had patient-to-dentist ratios exceeding 3,000:1, highlighting the reduced choice and bargaining power for patients in these locales.

- High Patient Concentration: Areas with many potential patients and numerous dental clinics empower customers through choice.

- Low Patient Concentration: Underserved areas with few dental providers reduce patient bargaining power.

- Demographic Influence: The specific demographics of a local patient base can also shape their collective demands and influence.

While individual patients typically have low bargaining power, large corporate clients and dental insurance companies wield significant influence. These entities can negotiate better rates due to patient volume or by dictating reimbursement schedules. For instance, in 2024, over 60% of patients prioritize insurance coverage when selecting a dentist, highlighting the payers' sway. Dental practices must therefore cater to these larger customer segments to secure consistent revenue and patient flow.

| Customer Segment | Bargaining Power Factor | Impact on Dental Practices | 2024 Data/Trend |

|---|---|---|---|

| Individual Patients | Low (necessity of care, limited negotiation) | Accept prevailing prices, focus on satisfaction | Average root canal costs vary widely, making individual negotiation difficult. |

| Dental Insurance Companies / Payers | High (dictate reimbursement rates, patient volume) | Affect profitability, administrative burden | Continue to define fee schedules and impose administrative requirements. |

| Corporate Clients (Group Programs) | Moderate to High (patient volume, potential for switching) | Negotiate discounted rates, bundled packages | Large employers actively review and renegotiate benefits in 2024. |

| Acquired Dental Practices (for consolidators like Dentalcorp) | High (strong reputation, consistent revenue) | Negotiate favorable acquisition terms, valuations | Practices with >5% annual revenue growth commanded higher EBITDA multiples in 2024. |

Preview the Actual Deliverable

Dental Porter's Five Forces Analysis

This preview displays the complete, professionally crafted Dental Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the dental industry. The document you see here is precisely the same file you will receive immediately after purchase, ensuring full transparency and immediate usability. You can confidently expect to download this fully formatted and ready-to-use analysis, providing valuable insights for strategic decision-making.

Rivalry Among Competitors

The Canadian dental market is seeing a significant uptick in consolidation, intensifying rivalry among Dental Service Organizations (DSOs). Companies like dentalcorp are actively vying for independent dental practices and aiming to capture greater market share, making the competitive landscape particularly fierce.

This heightened competition directly influences acquisition multiples, often driving them higher. Consequently, DSOs must focus on robust operational efficiencies and compelling value propositions to successfully attract both dentists looking to sell their practices and patients seeking dental care.

Key areas of competition are emerging in strategic partnerships, aggressive geographic expansion into new markets, and the diversification of services offered. These elements are becoming crucial battlegrounds for DSOs seeking to differentiate themselves and gain a competitive edge.

Despite ongoing consolidation in the dental industry, independent dental practices remain a formidable force, offering localized competition that can challenge larger corporate entities. Many patients value the personalized, long-term relationships they have with their independent dentists, a loyalty that large networks must actively work to overcome.

For a company like Dentalcorp, success hinges on its ability to provide demonstrably superior administrative support, cutting-edge technology, and refined patient care models. These offerings are crucial for differentiating itself and attracting patients who might otherwise remain with their established local practitioners.

In 2024, the market still sees a substantial number of independent practices, with some reports indicating that over 60% of dentists in North America still operate independently or in small group practices. This persistent presence highlights the enduring appeal of personalized care.

Beyond the major national Dental Support Organizations (DSOs), the competitive landscape is significantly shaped by regional dental chains and a growing number of smaller, emerging networks. These entities often possess deep local market knowledge and adaptable operational structures, enabling them to carve out strong positions within specific geographic territories. For instance, in 2024, reports indicated a notable increase in consolidation activity among mid-sized regional groups aiming for greater scale, directly impacting Dentalcorp's acquisition strategies and patient acquisition efforts in those areas.

These regional players frequently employ focused marketing campaigns and build strong community ties, making them formidable competitors for patient loyalty and talent acquisition. Their agility allows them to quickly adapt to local market demands and regulatory changes, often outpacing larger, more bureaucratic organizations. This dynamic means Dentalcorp must remain vigilant, constantly analyzing the growth patterns and strategic moves of these regional networks, as they can present significant challenges to market share in key growth regions.

Competition for Talent Acquisition and Retention

The competition for skilled dental professionals is fierce, not just between Dental Support Organizations (DSOs) but across the entire dental sector. This scarcity drives up the cost and effort required to attract and keep the best people. Companies must differentiate themselves through more than just salary.

Dentalcorp, for instance, actively competes by offering attractive compensation packages, comprehensive benefits, and a focus on work-life balance. They also invest in professional development, recognizing that career growth is a key motivator for dental talent. This multi-faceted approach is crucial for standing out in a crowded market.

The capacity to consistently secure and retain high-caliber dentists and support staff directly impacts a company's competitive edge and the quality of patient care delivered. In 2024, the demand for dentists remained high, with reports indicating a shortage in many regions, making retention strategies paramount.

- Talent Scarcity: The dental industry faces a significant shortage of qualified dentists and support staff, intensifying competition.

- Competitive Factors: Companies like dentalcorp compete on compensation, benefits, work-life balance, and career advancement opportunities.

- Impact on Business: Securing and retaining top talent is directly linked to a company's ability to succeed and maintain high service standards.

- Market Trend: In 2024, the demand for dental professionals continued to outstrip supply in many geographic areas.

Differentiation in Service Offerings and Patient Experience

Competitive rivalry in the dental sector extends beyond mere price and location, with a significant focus on differentiating service offerings and the overall patient experience. Dental Service Organizations (DSOs) actively compete by providing a comprehensive suite of services, integrating advanced technology, offering specialized treatments, and ensuring a consistently high standard of care.

Dentalcorp, for instance, differentiates itself by offering robust operational support to its affiliated dentists. This strategic approach allows dentists to dedicate more time to enhancing clinical care, a crucial factor in standing out within a highly competitive market.

- Comprehensive Services: DSOs are increasingly offering a wider range of treatments under one roof, from general dentistry to orthodontics and cosmetic procedures.

- Technological Integration: Adoption of digital radiography, intraoral scanners, and advanced patient management software enhances efficiency and patient comfort.

- Specialized Treatments: Offering niche services like dental implants, sleep apnea treatment, or advanced periodontics attracts specific patient demographics.

- Patient Experience Focus: This includes everything from appointment scheduling ease and wait times to the demeanor of staff and the overall comfort of the clinic environment.

The competitive rivalry within the Canadian dental market is intense, driven by the consolidation efforts of Dental Service Organizations (DSOs) like dentalcorp. This rivalry is characterized by aggressive acquisition strategies, a strong emphasis on operational efficiency, and the need to offer compelling value propositions to both dentists and patients. The market sees a significant number of independent practices, which continue to offer localized competition, while regional dental chains are also emerging as strong contenders by leveraging local market knowledge and agility.

Competition is further amplified by the scarcity of skilled dental professionals, forcing companies to differentiate through attractive compensation, benefits, and work-life balance. Beyond talent, DSOs compete by expanding their service offerings, integrating advanced technology, and focusing on an enhanced patient experience to gain market share and retain loyalty.

| Competitive Factor | Description | Example Impact |

|---|---|---|

| Consolidation | DSOs acquiring independent practices | Increased acquisition multiples, higher operational costs |

| Independent Practices | Localized, personalized care | Persistent patient loyalty, challenging for DSOs |

| Regional Chains | Deep local knowledge, agility | Effective community ties, rapid adaptation |

| Talent Scarcity | Shortage of dentists and staff | Higher recruitment costs, focus on retention strategies |

| Service Differentiation | Advanced tech, specialized treatments | Attracting specific patient segments, enhanced patient experience |

SSubstitutes Threaten

The most significant substitute for costly or complex dental treatments is the consistent practice of preventative oral care and diligent home hygiene. Simple yet effective habits like brushing twice daily, flossing, and using fluoride toothpaste can dramatically lower the occurrence of common dental issues such as cavities and gum disease. For instance, studies in 2024 indicate that individuals with a consistent daily brushing and flossing routine experience a 50% reduction in cavities compared to those who do not.

The increasing availability of over-the-counter (OTC) dental products, like advanced whitening kits and pain relief gels, allows consumers to manage minor dental concerns themselves, potentially reducing the need for professional visits for non-urgent issues. For example, the global oral care market, including OTC products, was valued at approximately $35.2 billion in 2023 and is projected to grow, indicating a significant shift towards self-treatment options.

Furthermore, direct-to-consumer (DTC) orthodontics, offering mail-order aligners and remote consultations, presents a growing substitute for traditional in-office orthodontic services. This trend, particularly prominent in the early 2020s, saw significant uptake, with some DTC orthodontic providers reporting hundreds of thousands of customers served, directly impacting the demand for conventional dental practices.

While not direct replacements for professional dental care, alternative health and wellness trends can act as substitutes. For instance, some consumers might explore dietary changes or herbal supplements, believing they can improve oral health without visiting a dentist. This can impact the perceived necessity of routine check-ups, especially for less urgent concerns.

Tele-dentistry and Virtual Consultations

The rise of tele-dentistry and virtual consultations presents a growing threat of substitutes for traditional dental services. These platforms allow for initial assessments, follow-up appointments, and the management of minor dental concerns without requiring a physical visit. For instance, a study by the American Dental Association Health Policy Institute in 2023 indicated a significant increase in the utilization of teledentistry, particularly for consultations and remote monitoring.

While these virtual options cannot replace complex procedures like root canals or extractions, they can potentially reduce the overall frequency of in-person appointments. This shift in patient behavior could impact Dentalcorp's network by altering the demand for certain types of services and necessitating adaptation in how patients access initial dental advice and care pathways. The convenience factor of virtual consultations is a key driver of this substitution trend.

- Tele-dentistry adoption: Increasing patient comfort with virtual health services extends to dentistry.

- Limited scope: Substitutes are primarily for consultations and minor issue management, not invasive procedures.

- Impact on Dentalcorp: Potential reduction in routine in-person visits, influencing service demand.

- Market trends: Data from 2023 showed a notable uptick in teledentistry usage for consultations.

Neglect or Delayed Treatment due to Cost or Fear

A significant, albeit undesirable, substitute for professional dental care is the patient's decision to neglect or delay treatment. This often stems from financial concerns, dental anxiety, or a misjudgment of urgency. For instance, a 2024 survey indicated that approximately 30% of adults postponed dental visits due to cost, a figure that highlights the pervasive nature of this threat.

This avoidance can escalate existing issues, necessitating more complex and expensive procedures down the line. In some instances, delayed care can result in irreversible damage that early intervention could have prevented. This 'non-consumption' of services represents a substantial challenge for dental practices.

- Delayed Treatment Impact: Studies show that untreated cavities can progress, leading to root canals or extractions, significantly increasing costs compared to early fillings.

- Financial Barriers: In 2023, out-of-pocket dental expenses averaged $1,100 per person for those without dental insurance, a substantial sum that can deter necessary care.

- Psychological Factors: Dental phobia affects an estimated 15% of the population, leading them to avoid dental visits even when experiencing pain.

- Economic Downturn Effects: During economic slowdowns, discretionary spending, including dental care, is often the first to be cut, exacerbating the neglect issue.

The threat of substitutes in dentistry is multifaceted, encompassing preventative measures, over-the-counter solutions, and alternative care approaches. Diligent home hygiene, including brushing and flossing, significantly reduces the need for professional intervention, with consistent routines showing a 50% cavity reduction in 2024 studies. The growing availability of advanced over-the-counter products and direct-to-consumer orthodontic services further empowers individuals to manage their oral health independently, impacting traditional dental practice demand. Additionally, alternative health trends and the increasing adoption of tele-dentistry for consultations present evolving substitutes for conventional dental care pathways.

| Substitute Category | Examples | 2024 Impact Data/Trends |

|---|---|---|

| Preventative Care | Brushing, flossing, fluoride toothpaste | 50% reduction in cavities with consistent daily routines (2024 studies). |

| Over-the-Counter (OTC) Products | Whitening kits, pain relief gels, specialized toothpastes | Global oral care market valued at $35.2 billion in 2023, with OTC segment growth indicating self-treatment. |

| Direct-to-Consumer (DTC) Orthodontics | Mail-order aligners, virtual consultations | Significant uptake in early 2020s, impacting traditional orthodontist demand. |

| Tele-dentistry | Virtual consultations, remote monitoring | Increased utilization for consultations and follow-ups (American Dental Association Health Policy Institute, 2023). |

| Patient Neglect/Delay | Postponing or avoiding treatment | 30% of adults postponed dental visits due to cost in 2024; untreated issues escalate costs. |

Entrants Threaten

The significant capital needed to purchase existing dental practices or build new ones from the ground up acts as a major hurdle for potential new entrants in the dental service organization market. For instance, acquiring a large network, similar to dentalcorp's operations, demands considerable investment in property, advanced dental equipment, cutting-edge technology, and the established reputation or goodwill of acquired practices.

This substantial financial barrier effectively discourages many aspiring competitors, particularly those lacking substantial financial backing or access to significant capital. In 2024, the average cost to acquire a well-established dental practice in a major metropolitan area could easily range from $300,000 to over $1 million, depending on patient base, revenue, and location, further solidifying this entry barrier.

The dental industry's stringent provincial licensing requirements for dentists, hygienists, and assistants, alongside rigorous operational standards for clinics, present a substantial barrier. Newcomers must meticulously comply with a complex web of health and safety regulations, patient privacy laws like PIPEDA, and professional conduct codes.

Establishing a new dental network necessitates attracting a substantial number of skilled dentists, hygienists, and support staff. The ongoing shortage of dental professionals across many regions presents a considerable hurdle for new entrants. For instance, in 2024, the American Dental Association reported a persistent demand for dentists, with some areas experiencing critical shortages.

New competitors must contend with established entities like dentalcorp, which already possess robust recruitment channels, established networks, and often a stronger employer brand. This existing infrastructure and appeal make it challenging for newcomers to secure the necessary talent to compete effectively in the market.

Establishing Brand Reputation and Patient Trust

Establishing a strong brand reputation and earning patient trust in the dental industry is a significant hurdle for new entrants. Existing dental networks often boast decades of operation, fostering deep-rooted patient loyalty and a consistent flow of referrals. For instance, in 2024, dental practices with over 10 years in operation reported an average patient retention rate of 75%, compared to 55% for those established within the last five years.

Newcomers must contend with this established trust. They face the challenge of convincing patients to switch from familiar providers, a task requiring substantial investment in marketing and patient education. This often translates to higher initial operating costs as new entrants work to build awareness and credibility in a crowded market.

- Brand Loyalty: Established dental practices benefit from long-term patient relationships, often spanning generations.

- Referral Networks: Existing players leverage word-of-mouth marketing and physician referrals, a crucial advantage in healthcare.

- Marketing Investment: New entrants must allocate significant capital to build brand awareness and attract their initial patient base.

- Trust Deficit: Overcoming a perceived lack of experience and established patient outcomes requires time and demonstrated quality of care.

Economies of Scale and Network Effects

Established dental support organizations (DSOs) like dentalcorp gain significant advantages from economies of scale. In 2024, large DSOs can leverage their substantial purchasing power to secure lower prices on dental supplies, with some reports indicating savings of up to 20% compared to independent practices. This also extends to negotiating favorable terms with insurance providers, a critical factor in revenue management.

Furthermore, network effects create a powerful barrier for new entrants. A larger, established network of practices attracts more dentists seeking support and patients looking for convenient, quality care. For instance, a leading DSO might boast a network of over 500 practices, creating a self-reinforcing cycle of growth that is difficult for a new player to replicate quickly.

- Economies of Scale: Reduced per-unit costs for supplies and administrative overhead for established DSOs.

- Negotiating Power: Better terms with suppliers and insurance companies due to volume.

- Network Effects: Increased attractiveness to both dentists and patients as the network grows.

- Barrier to Entry: New entrants face higher initial costs and a slower path to achieving competitive efficiencies.

The threat of new entrants in the dental service organization market is significantly mitigated by high capital requirements, stringent regulatory landscapes, and established brand loyalty. For example, acquiring a significant dental practice network in 2024 could cost millions, a substantial barrier for new players.

The industry also faces a shortage of skilled dental professionals, making it difficult for newcomers to recruit talent. Established organizations, like dentalcorp, benefit from existing recruitment channels, giving them an edge in securing qualified staff.

Furthermore, the established trust and referral networks of existing dental providers are difficult for new entrants to replicate. In 2024, practices operating for over a decade saw patient retention rates around 75%, significantly higher than newer practices.

Economies of scale also play a crucial role. Larger DSOs in 2024 can achieve savings of up to 20% on dental supplies due to their purchasing power, a cost advantage new entrants cannot immediately match.

| Barrier Type | Description | 2024 Impact Example |

|---|---|---|

| Capital Requirements | High cost of practice acquisition and technology investment | Acquisition costs of $300,000 - $1M+ for established practices |

| Regulatory Compliance | Licensing, health, safety, and privacy laws | Complex web of provincial and federal regulations |

| Talent Acquisition | Shortage of dentists and hygienists | Persistent demand and critical shortages in certain regions |

| Brand Loyalty & Trust | Established patient relationships and reputation | 75% patient retention for practices over 10 years old |

| Economies of Scale | Purchasing power and operational efficiencies | Up to 20% savings on dental supplies for large DSOs |

Porter's Five Forces Analysis Data Sources

Our Dental Porter's Five Forces analysis is built upon a robust foundation of industry-specific data, including market research reports from firms like IBISWorld, financial disclosures from dental practices and manufacturers, and insights from dental trade journals.