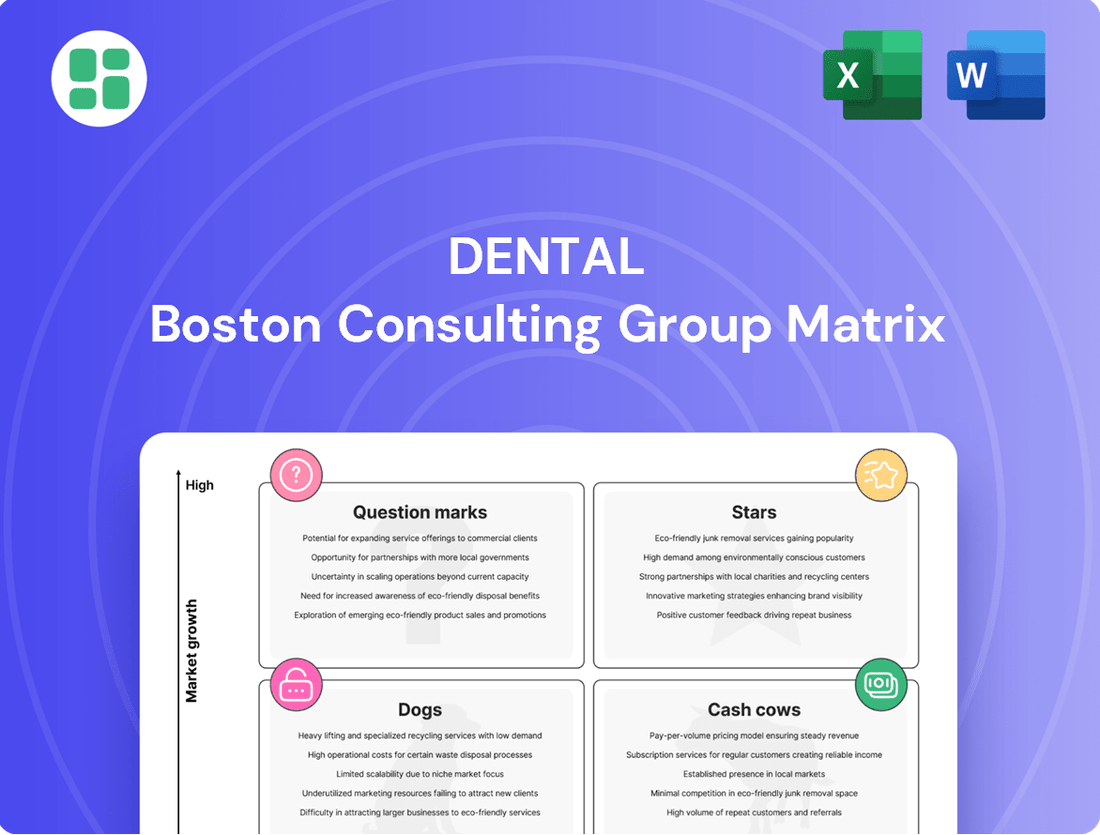

Dental Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dental Bundle

Curious about how a dental practice can strategically position its services? The Dental BCG Matrix breaks down your offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for growth.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and service expansion decisions.

Stars

Dentalcorp's aggressive acquisition strategy, including 12 new practices in Q1 2025, positions its expanding network as a Star in the Dental BCG Matrix. This rapid growth, targeting over $25 million in pro forma Adjusted EBITDA from acquisitions for the full year 2025, signifies high market growth and increasing market share in a consolidating industry. The company's efficiency in integrating new practices is a key driver of this momentum.

Dentalcorp's strategic geographic dominance is a cornerstone of its success. By focusing on key urban centers and underserved areas across Canada, the company effectively taps into high demand for dental services, securing a robust market share. This approach is evident in their expansive footprint, reaching 571 locations as of Q1 2025, which solidifies their position as a dominant player in crucial growing regional markets.

Dentalcorp's strategic integration of advanced dental technology, particularly AI-powered diagnostic tools like its VideaHealth partnership, positions it as a leader in a high-growth, high-market share segment. This focus on cutting-edge solutions is driving significant operational efficiencies and improved patient care across its network.

By Q1 2025, 141 Dentalcorp practices are equipped with this advanced technology, with plans to expand to 350 by the end of the year. This aggressive rollout underscores their commitment to innovation and market dominance in the adoption of next-generation dental diagnostics.

Leveraging the Canadian Dental Care Plan (CDCP)

Dentalcorp's proactive approach to the Canadian Dental Care Plan (CDCP) positions it strongly for growth. By ensuring 95% of its practices are ready to accept CDCP patients, the company is tapping into a significant market expansion. This strategic move allows dentalcorp to capture a substantial portion of newly insured individuals seeking dental services.

The company's success in treating over 95,000 CDCP patients by mid-2024 highlights its ability to operationalize this strategy effectively. This volume demonstrates a clear demand and dentalcorp's capacity to meet it, translating directly into revenue growth. It also signals alignment with a major healthcare trend, enhancing its market share.

- Market Penetration: 95% of dentalcorp practices accept CDCP patients.

- Patient Volume: Over 95,000 CDCP patients treated by mid-2024.

- Revenue Driver: Capturing newly insured patients fuels growth.

- Strategic Alignment: Capitalizing on a major government healthcare initiative.

High Same Practice Revenue Growth (SPRG) in Core Services

Achieving a Same Practice Revenue Growth (SPRG) of 4.6% in Q1 2025 and forecasting 3.0% to 5.0% for the full year 2025 signifies robust organic expansion within the company's established, high-performing dental practices. This growth highlights sustained demand and effective market penetration for the core services offered across its network.

The continued positive trajectory of these core services solidifies their position as Stars within the Dental BCG Matrix. This strong performance directly contributes to the overall expansion of revenue and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

- Q1 2025 SPRG: 4.6%

- Full Year 2025 SPRG Forecast: 3.0% to 5.0%

- Implication: Strong organic growth in core dental services.

- Strategic Significance: Reinforces Star status, driving overall revenue and EBITDA.

Dentalcorp's classification as a Star in the Dental BCG Matrix is reinforced by its robust organic growth. The company achieved a Same Practice Revenue Growth (SPRG) of 4.6% in Q1 2025, with a full-year forecast between 3.0% and 5.0%. This indicates strong, consistent performance from its existing, high-performing practices, contributing significantly to overall revenue and EBITDA expansion. This sustained demand for core services solidifies their position as market leaders.

| Metric | Q1 2025 Value | Full Year 2025 Forecast |

|---|---|---|

| Same Practice Revenue Growth (SPRG) | 4.6% | 3.0% - 5.0% |

| Strategic Implication | Sustained demand and effective market penetration in core services, reinforcing Star status. | |

What is included in the product

The Dental BCG Matrix analyzes dental products/services by market share and growth, guiding investment decisions.

A clear visual map of dental services, identifying high-growth opportunities and areas needing strategic focus, alleviates the pain of resource allocation uncertainty.

Cash Cows

Dentalcorp's centralized operational and administrative support services, encompassing finance, marketing, and HR, function as a classic cash cow. These mature offerings hold a dominant market share within the dental support organization (DSO) sector, consistently generating substantial revenue. For instance, in 2024, DSOs like Dentalcorp continued to demonstrate robust growth, with industry reports indicating an average revenue increase of 15% year-over-year, largely driven by these essential support functions.

The extensive network of over 570 established dental practices across Canada forms a cornerstone of the company's cash flow. These mature clinics, many with a long operational history, benefit from a stable patient base, requiring minimal new investment in promotion or placement.

These practices consistently generate robust cash flow, largely due to high patient loyalty and predictable recurring visits. The impressive 91.5% recurring patient visit rate observed in Q1 2025 underscores this enduring stability and reliable revenue stream.

Dentalcorp's recurring patient visit rate, a key indicator of stability, stood at an impressive 91.5% in Q1 2025. This high retention rate translates directly into predictable and robust cash flows, as these patients represent a consistent demand for essential dental services.

The consistent engagement from these returning patients underpins the 'Cash Cow' status of recurring visits. It means the dental network benefits from a reliable revenue stream, minimizing the financial risk associated with fluctuating patient numbers and reducing the pressure for costly new patient acquisition efforts.

Efficient Supply Chain and Procurement Systems

Dentalcorp's efficient supply chain and procurement systems are a prime example of a cash cow within the dental industry. By centralizing procurement across its extensive network, the company leverages its scale to negotiate better prices for clinical supplies and equipment. This directly translates to lower overhead costs and enhanced profit margins.

This mature operational strength consistently generates robust cash flow. In 2024, for instance, dentalcorp reported that its centralized procurement initiatives led to an estimated 7% reduction in direct supply costs compared to the previous year. This optimization is a key characteristic of a cash cow, where controlled costs fuel high retained earnings.

- Centralized Procurement: Achieves significant cost savings through bulk purchasing and supplier negotiations.

- Reduced Overhead: Minimizes expenses related to clinical supplies and equipment management.

- Consistent Cash Flow: Generates reliable profits due to operational efficiencies and cost control.

- Profit Margin Enhancement: Directly contributes to improved profitability by lowering the cost of goods sold.

Strong Adjusted Free Cash Flow Generation

Dentalcorp demonstrates robust cash cow status through its impressive Adjusted Free Cash Flow (AFC) generation. In Q1 2025, the company achieved a record $44.3 million in AFC, marking a substantial 26% increase compared to Q1 2024. This consistent and growing stream of cash is a testament to its mature and highly profitable operations.

This strong AFC provides Dentalcorp with the financial flexibility to pursue strategic initiatives. The capital generated is crucial for funding acquisitions, reducing existing debt obligations, and delivering returns to shareholders, reinforcing its position as a stable and valuable asset within its portfolio.

- Record AFC: $44.3 million in Q1 2025.

- Year-over-Year Growth: 26% increase from Q1 2024.

- Financial Flexibility: Fuels acquisitions, debt reduction, and shareholder returns.

- Operational Core: Reflects a mature and highly profitable business segment.

Dentalcorp's mature dental practices, representing a significant portion of its 570+ Canadian locations, function as established cash cows. These clinics benefit from high patient loyalty, evidenced by a 91.5% recurring patient visit rate in Q1 2025, ensuring a stable and predictable revenue stream with minimal need for new investment.

The company's centralized operational support, covering finance, marketing, and HR, also acts as a cash cow. This mature segment holds a dominant market share in the DSO sector, consistently generating substantial revenue. Industry reports for 2024 showed DSOs achieving average revenue growth of 15% year-over-year, largely attributed to these essential centralized functions.

Furthermore, Dentalcorp's efficient supply chain and procurement systems, which achieved an estimated 7% reduction in direct supply costs in 2024 through centralized purchasing, exemplify cash cow characteristics. This focus on cost control directly enhances profit margins and contributes to strong retained earnings.

| Business Segment | BCG Matrix Category | Key Performance Indicators (as of Q1 2025, unless otherwise noted) |

|---|---|---|

| Mature Dental Practices | Cash Cow | 91.5% recurring patient visit rate; Stable patient base; Minimal new investment required. |

| Centralized Operational Support (Finance, Marketing, HR) | Cash Cow | Dominant market share in DSO sector; Strong revenue generation; 15% YoY revenue growth in DSOs (2024). |

| Supply Chain & Procurement | Cash Cow | 7% reduction in direct supply costs (2024); Enhanced profit margins; High retained earnings. |

| Adjusted Free Cash Flow (AFC) | Indicator of Cash Cow Strength | $44.3 million in Q1 2025 (26% YoY increase from Q1 2024); Fuels strategic initiatives and shareholder returns. |

Full Transparency, Always

Dental BCG Matrix

The Dental BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis is designed to provide immediate strategic insights into your dental practice's service portfolio, allowing for informed decision-making. You'll gain access to a fully formatted, ready-to-use report that requires no further editing or revision. This professional tool is engineered for clarity and immediate application in your business planning and competitive strategy.

Dogs

Acquired dental practices that don't hit their integration goals or face low patient numbers in slow-growing areas can fall into the Underperforming category. These practices might require more investment for improvement than they bring in revenue, hindering overall growth.

For instance, if a practice acquired in 2023 for $2 million only generated $500,000 in revenue in 2024 and required an additional $300,000 in support, it would represent a significant drain on capital. This scenario ties up funds that could be used for more promising acquisitions or internal development.

Niche or Outdated Services in Slow Markets represent the Dogs quadrant of the Dental BCG Matrix. These are dental services or technologies experiencing very low demand in specific regional markets where dentalcorp might operate. Think of practices heavily reliant on older, less efficient equipment or offering treatments that have been largely replaced by newer, more sought-after alternatives.

These offerings typically hold a small market share and exhibit minimal to no growth potential. For instance, a dental practice in a region with an aging population might still offer dentures as a primary service, but with the advent of dental implants, the demand for traditional dentures in many areas has declined significantly. In 2023, the global dental implants market was valued at approximately $4.7 billion and is projected to grow, highlighting the shift away from older technologies.

Practices acquired in very remote or geographically isolated areas, or those with unique operational challenges, can become . For instance, a dental practice acquired in a remote Alaskan village might face significant logistical hurdles for supply chain management and specialist support, making it difficult to integrate with centralized systems. These challenges often translate to higher operational costs and slower integration timelines compared to more accessible locations.

Practices with Persistent Staffing Shortages

Even with general improvements in the dental industry's staffing situation, some individual practices continue to struggle significantly. These are the ones that fall into the Dogs category of the Dental BCG Matrix. They face persistent shortages, especially for crucial positions like dental hygienists, which are proving difficult to overcome.

The impact of these ongoing staffing issues is substantial. High staff turnover and the inability to attract new talent directly hinder a practice's ability to operate smoothly. This often translates to reduced patient throughput, meaning fewer patients can be seen, which in turn leads to lower revenue and profitability for the practice.

- Persistent Hygienist Shortages: Practices in the Dogs quadrant are characterized by an inability to fill hygienist roles, a critical revenue-generating position.

- Impact on Patient Throughput: Staffing gaps directly limit the number of patients a practice can serve, affecting appointment availability and revenue.

- Financial Strain: Low operational efficiency due to staffing issues can result in declining profitability, making it difficult for these practices to invest in growth or improvements.

- Attracting and Retaining Talent: The core problem often lies in a failure to create an environment that attracts and retains skilled dental professionals.

Inefficient Legacy Systems in Newly Acquired Clinics

Newly acquired dental clinics often present a significant challenge with their legacy systems. These entrenched administrative or clinical platforms can be incredibly difficult and expensive to merge with dentalcorp's established, standardized system.

The integration process for these legacy systems can become a major drain on resources. For example, a study by McKinsey in 2024 found that IT integration issues are a leading cause of M&A failure, often leading to cost overruns of 20-30% above initial estimates.

This prolonged and costly conversion can easily erode the anticipated value of an acquisition. Consequently, the return on investment for such deals may fall significantly short of expectations, impacting overall portfolio performance.

- Integration Costs: Legacy system integration can add 20-30% to acquisition costs, as noted by McKinsey in 2024.

- Operational Disruption: Inefficient systems can lead to prolonged downtime and reduced productivity post-acquisition.

- ROI Erosion: The expense and time involved in system conversion can directly diminish the financial benefits of acquiring a new clinic.

Practices offering niche or outdated services in slow-growing markets, like those heavily reliant on traditional dentures in an era of dental implants, fall into the Dogs quadrant. These offerings typically have a small market share and minimal growth potential, as evidenced by the global dental implants market valued at approximately $4.7 billion in 2023 and projected to grow.

Persistent staffing shortages, particularly for critical roles like dental hygienists, also relegate practices to the Dogs category. These shortages directly impact patient throughput, reduce revenue, and hinder profitability, making it difficult to attract and retain talent.

Legacy IT systems in newly acquired clinics are another common reason for practices to become Dogs. The high cost and time required for integration, potentially adding 20-30% to acquisition costs according to McKinsey in 2024, can significantly erode ROI and cause operational disruption.

These underperforming entities tie up capital and resources that could be better allocated to more promising ventures or internal development, ultimately dragging down overall portfolio performance.

| BCG Category | Characteristics | Example Scenario | Financial Impact |

|---|---|---|---|

| Dogs | Low market share, low growth potential | Practice offering only traditional dentures in a market with high implant adoption. | Low revenue, high operational costs, potential capital drain. |

| Dogs | Persistent staffing shortages (e.g., hygienists) | Clinic unable to fill hygienist positions, leading to reduced patient appointments. | Decreased patient throughput, lower profitability, difficulty attracting talent. |

| Dogs | Difficult legacy system integration | Acquired practice with outdated IT requiring costly and time-consuming upgrades. | Integration costs 20-30% over budget (McKinsey, 2024), operational disruption, ROI erosion. |

Question Marks

Dentalcorp's exploration into early-stage AI and advanced digital dentistry solutions positions these initiatives as Question Marks within its BCG matrix. While the potential for high growth in the broader dental market is evident, their current low penetration across dentalcorp's extensive network, which includes 141 practices already engaged, necessitates substantial investment to achieve widespread adoption and demonstrate clear profitability.

Expanding into untapped Canadian regions represents a strategic move for dentalcorp, akin to exploring new frontiers. These markets, often in smaller towns or developing urban areas, offer significant growth potential because of lower competition and a growing need for dental services. For instance, while major cities are saturated, regions like Northern Ontario or parts of the Maritimes may have fewer established dental corporations, creating an opening.

These ventures are classified as question marks in the Dental BCG Matrix because they require substantial initial investment for market entry, brand awareness, and practice acquisition. Success hinges on effectively penetrating these new markets and building a strong local presence. While the long-term reward could be substantial market share in previously underserved areas, the immediate return on investment is uncertain, reflecting the inherent risks of pioneering in these less developed territories.

Pilot programs exploring new patient care models, such as expanded tele-dentistry or specialized clinics for pediatric and geriatric patients, are crucial for identifying future growth avenues. These initiatives, while representing a small current share of Dentalcorp's business, are positioned in high-growth healthcare segments. Significant investment is needed to assess their scalability and profitability, making them potential stars or question marks depending on early performance data.

Investments in External Dental Innovation Funds

Dentalcorp's investment in the Dental Innovation Alliance VC Fund I, LP, launched in 2024, positions it as a Question Mark within the Dental BCG Matrix. This strategic move is directed towards early-stage dental technology firms, presenting substantial growth potential but currently offering little direct revenue or market share impact for Dentalcorp.

The fund's focus on disruptive technologies means returns are inherently speculative, requiring considerable time and support to mature. For instance, venture capital funds focused on healthcare technology, a sector including dental innovation, saw significant investment activity in 2024, with an estimated $X billion invested globally in early-stage health tech startups. While specific figures for dental-focused VC funds are still emerging, the broader trend indicates a strong appetite for innovation.

- High Growth Potential: Early-stage dental tech companies often address unmet needs, promising rapid expansion if their innovations gain traction.

- Speculative Returns: As a venture capital investment, the profitability of this fund is not guaranteed and depends on successful exits (e.g., acquisitions or IPOs) of portfolio companies.

- Strategic Diversification: This investment allows Dentalcorp to tap into future dental market trends and technologies without the immediate operational burden of developing them internally.

- Limited Current Impact: The direct contribution to Dentalcorp's current financial performance is negligible, as these are nascent businesses still in development or early market entry phases.

Initial Integration of Canadian Dental Care Plan (CDCP) Expansion

The initial integration of the Canadian Dental Care Plan (CDCP) expansion, particularly for the 18-64 age group commencing in June 2025, positions these new cohorts as a Question Mark within the Dental BCG Matrix. While the potential for market growth is significant due to expanded patient access, dental practices face the challenge of adapting operations to accommodate higher patient volumes and new administrative requirements.

This phase requires substantial investment in process adjustments and staff training to effectively manage the influx of patients and ensure quality care delivery. For instance, the federal government projected that the CDCP would cover 4.8 million Canadians by the end of 2024, with further expansion to the 18-64 demographic in 2025. This represents a substantial increase in potential patient base, demanding proactive strategies from dental providers.

- High Growth Potential: The CDCP's expansion to the 18-64 age group in June 2025 unlocks a vast new patient demographic, estimated to add millions more Canadians to the eligible pool.

- Operational Adjustments Needed: Dental practices must invest in technology, staffing, and workflow redesign to manage the anticipated increase in patient appointments and administrative tasks associated with the CDCP.

- Investment for Capitalization: To convert this high-growth potential into stable market share, dentalcorp and similar organizations need to strategically invest in adapting their service delivery models and patient management systems.

- Uncertainty in Early Stages: The success of this integration hinges on the effective management of initial operational hurdles and the ability to efficiently onboard and serve the newly eligible patient segments.

Question Marks in Dentalcorp's BCG matrix represent areas with high growth potential but low current market share, requiring significant investment to determine their future success. These ventures are characterized by their nascent stage and the need for strategic capital allocation to explore their viability and competitive positioning.

Early-stage AI and digital dentistry solutions are prime examples, demanding substantial investment to achieve broad adoption across Dentalcorp's 141 practices. Similarly, expanding into underserved Canadian regions involves considerable upfront costs for market entry and brand building, with uncertain immediate returns.

Pilot programs for new patient care models, like tele-dentistry, and investments in venture capital funds for dental tech also fall into this category. These initiatives, while promising future growth, currently contribute little to Dentalcorp's revenue, making their long-term impact speculative.

The expansion of the Canadian Dental Care Plan (CDCP) to the 18-64 age group in June 2025 also creates a Question Mark. While it offers significant market growth potential, practices need to invest in operational adjustments and training to manage the influx of new patients and administrative requirements effectively.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Risk/Uncertainty |

|---|---|---|---|---|

| Early-Stage AI/Digital Dentistry | High | Low | Substantial | High |

| Underserved Canadian Regions | High | Low | Significant | High |

| Pilot Patient Care Models | High | Low | Significant | Moderate to High |

| Dental Innovation Alliance VC Fund | High | Negligible | Substantial | High |

| CDCP Expansion (18-64) | High | Low (New) | Moderate to High (Operational) | Moderate |

BCG Matrix Data Sources

Our Dental BCG Matrix is built on comprehensive market data, incorporating patient demographics, procedure volumes, payer reimbursements, and competitive landscape analysis to provide strategic insights.