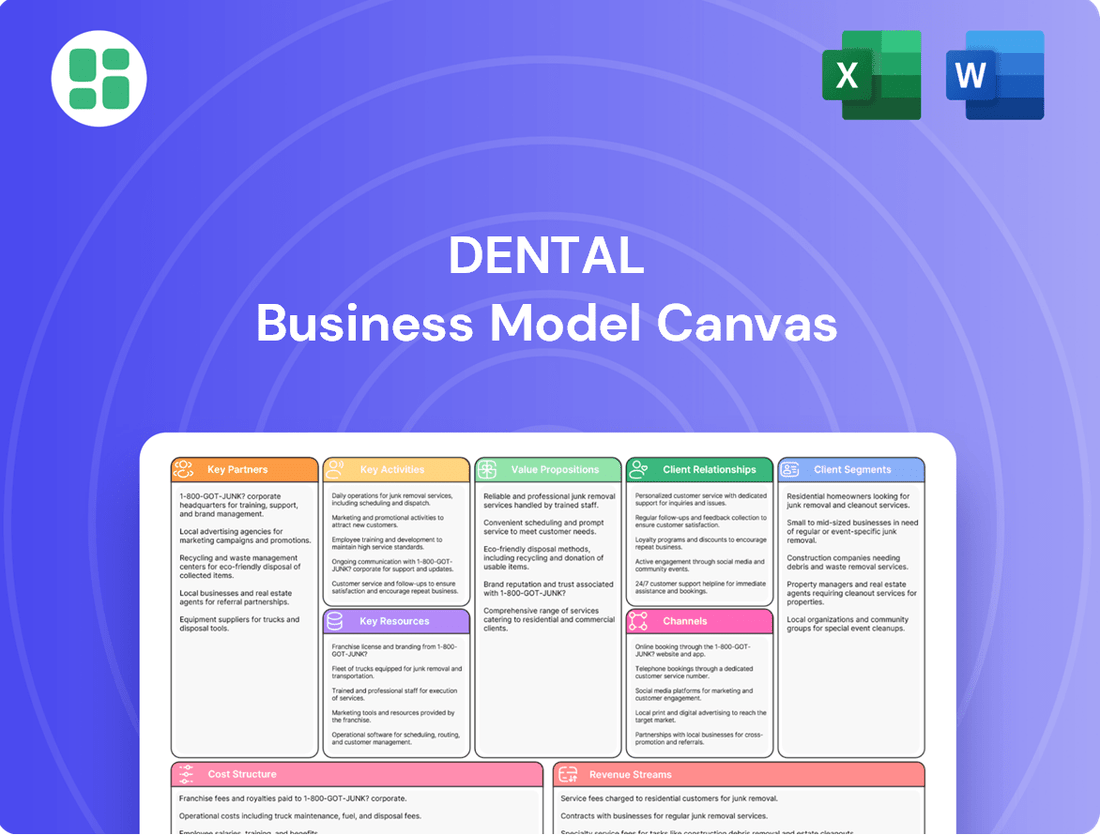

Dental Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dental Bundle

Curious how Dental crafts its patient experience and secures its revenue streams? This Business Model Canvas offers a crystal-clear view of their core operations, customer relationships, and key resources. Download the full version to unlock the strategic secrets behind their success.

Partnerships

Dentalcorp's success hinges on its deep relationships with dental practice owners and dentists. These professionals are not just acquired entities but vital partners who bring their established patient bases and clinical expertise into the Dentalcorp network.

These partnerships are designed to be mutually beneficial. Practice owners and dentists gain access to centralized administrative support, advanced technology, and marketing resources, freeing them to focus on patient care. Simultaneously, Dentalcorp expands its reach and service offerings through these collaborations.

The strategic importance of these partnerships is evident in Dentalcorp's growth. The company actively pursued acquisitions, adding 30 new practices in 2024 and an additional 12 in the first quarter of 2025, bringing their total network to 571 locations.

Dentalcorp strengthens its operations and patient services by collaborating with technology and software firms. A key alliance is with VideaHealth, integrating AI diagnostic tools throughout its network to boost detection accuracy, patient understanding, and clinical processes.

Furthering its commitment to innovation, dentalcorp invested in the Dental Innovation Alliance VC Fund I, LP, specifically targeting emerging dental technology ventures. This move underscores a strategy to stay at the forefront of technological advancements in the dental industry.

Dentalcorp's growth strategy hinges on strong relationships with financial institutions and investors. These partnerships are crucial for securing the capital needed for its acquisition-driven expansion. For instance, in 2024, the company's significant market capitalization of over $2 billion underscores its attractiveness to a broad range of investors.

The company actively manages its investor relations, regularly disclosing financial results and hosting investor conferences. This transparency is vital for maintaining investor confidence and attracting ongoing funding. Such engagement ensures dentalcorp has the necessary financial resources to pursue new acquisitions and support its expanding network of dental practices.

Suppliers and Vendors

Dentalcorp maintains crucial relationships with a diverse range of suppliers and vendors. These partnerships are essential for securing a steady flow of dental equipment, consumables, and other operational supplies needed across its network of practices. For instance, in 2024, dentalcorp's strategic sourcing initiatives focused on securing bulk discounts for key materials, contributing to an estimated 5-7% reduction in supply costs for participating clinics.

By consolidating purchasing power, dentalcorp leverages its significant scale to negotiate favorable terms and pricing with its suppliers. This centralized procurement strategy not only drives cost efficiencies but also ensures consistent quality and availability of essential products throughout its extensive network. In the first half of 2024, the company reported a 10% increase in purchasing volume from its top 20 suppliers, directly translating into improved margins for its affiliated dental practices.

- Key Suppliers: Partnerships with major dental equipment manufacturers and material providers are fundamental.

- Negotiated Terms: Leveraging scale allows for significant cost savings on bulk purchases.

- Operational Efficiency: Centralized procurement ensures consistent supply and quality across all practices.

- Cost Reduction: In 2024, these partnerships contributed to an estimated 6% reduction in overall operational expenditures for the network.

Educational and Professional Development Institutions

Dentalcorp actively partners with leading educational institutions, such as the University of Alberta School of Dentistry and the Risio Institute. These collaborations are crucial for fostering continuous professional development and advanced training among dental professionals within the Dentalcorp network. By engaging with these bodies, Dentalcorp ensures its practitioners have access to cutting-edge clinical techniques and the latest advancements in dental care.

These strategic alliances directly contribute to enhancing the clinical skills of dentists and their teams. Furthermore, they play a significant role in the recruitment and development of high-caliber talent, ensuring the network remains at the forefront of dental excellence. This focus on education and skill enhancement ultimately translates into improved patient outcomes and satisfaction.

- Partnerships with Universities: Collaboration with institutions like the University of Alberta School of Dentistry for training programs.

- Professional Development Institutes: Engagement with organizations such as the Risio Institute for specialized skill enhancement.

- Talent Acquisition and Growth: Utilizing these partnerships to attract and nurture top dental professionals.

- Impact on Patient Care: Direct correlation between enhanced training and superior patient treatment results.

Dentalcorp's key partnerships extend to financial institutions and investors, vital for fueling its acquisition-led growth. The company's substantial market capitalization, exceeding $2 billion in 2024, highlights its appeal to a wide investor base, securing the capital needed for expansion and network support.

| Partner Type | Strategic Importance | 2024/2025 Impact |

|---|---|---|

| Financial Institutions | Capital for acquisitions and operations | Facilitated expansion through debt and equity financing. |

| Investors | Funding for growth initiatives | Market capitalization over $2 billion in 2024 attracted significant investment. |

| Venture Capital Funds | Access to emerging technologies | Investment in Dental Innovation Alliance VC Fund I, LP for tech advancements. |

What is included in the product

A structured framework outlining the core components of a dental practice, from patient acquisition to revenue streams.

It provides a visual roadmap for understanding and optimizing how a dental business creates, delivers, and captures value.

The Dental Business Model Canvas provides a structured approach to pinpointing and addressing operational inefficiencies, thereby alleviating common dental practice pain points.

Activities

A core activity for dentalcorp involves pinpointing, acquiring, and smoothly integrating independent dental clinics throughout Canada. This process includes thorough due diligence, skillful negotiation, and a well-defined integration system designed to boost patient visit frequency and enhance practice-level earnings before interest, taxes, depreciation, and amortization (EBITDA) margins.

The company's aggressive growth strategy is evident in its acquisition figures. In 2024, dentalcorp successfully acquired 30 new dental practices. This momentum continued into the first quarter of 2025, with an additional 12 locations being brought into the fold, showcasing an accelerating rate of mergers and acquisitions.

Dentalcorp offers comprehensive back-office support, covering administrative, financial, marketing, and HR functions for its partner practices. This allows dentists to focus on patient care, significantly easing their administrative load. For instance, in 2024, practices utilizing Dentalcorp's full suite of support services reported an average reduction of 15 hours per week in administrative tasks.

The centralized support center and regional teams bring specialized expertise to bear on critical areas such as financial management, risk mitigation, and technology integration. This ensures practices benefit from best-in-class operational guidance, enhancing efficiency and compliance. In 2023, practices with dedicated financial support from Dentalcorp saw an average improvement of 5% in their operational profitability.

Investing in cutting-edge technology is crucial for improving patient outcomes and operational efficiency in dental practices. Dentalcorp, for instance, is rolling out AI diagnostic tools from VideaHealth across its network, aiming to boost diagnostic precision and patient interaction.

This strategic adoption of technology, including AI for diagnostics, represents a significant push to modernize dental care delivery. In 2024, the dental technology market saw substantial growth, with AI in dentistry projected to reach billions in value, underscoring the financial imperative for such investments.

Talent Acquisition and Professional Development

Attracting, retaining, and developing top dental professionals and support staff is crucial for upholding high standards of patient care. Dentalcorp's human resources strategy focuses on robust talent acquisition and continuous training programs to ensure a skilled workforce.

These initiatives are designed to build a team capable of delivering optimal patient outcomes. For instance, in 2024, Dentalcorp reported a 92% retention rate among its clinical staff, a testament to its investment in professional growth and a supportive work environment.

- Talent Acquisition: Implementing targeted recruitment strategies to attract skilled dentists, hygienists, and administrative personnel.

- Professional Development: Offering continuous education, specialized training, and career advancement opportunities to enhance clinical and operational expertise.

- Retention Programs: Focusing on competitive compensation, benefits, and a positive workplace culture to keep valuable team members engaged.

- Performance Management: Establishing clear performance metrics and feedback mechanisms to foster growth and ensure high-quality patient care.

Financial Management and Performance Optimization

Financial management is central to maintaining the health of Dentalcorp's broad network. This includes meticulous financial reporting, efficient payroll processing, and ongoing efforts to optimize both revenue streams and cost structures. The company’s commitment to financial discipline underpins its operational success.

Dentalcorp’s strategic focus is on achieving sustained revenue growth, improving its Adjusted EBITDA margin, and generating robust free cash flow. These metrics are closely monitored to ensure the business is not only expanding but doing so profitably and sustainably.

- Financial Reporting: Regular and transparent reporting of financial results.

- Revenue Optimization: Strategies to maximize income across all dental practices.

- Cost Management: Initiatives to control and reduce operational expenses.

- EBITDA Margin Expansion: A key performance indicator for profitability improvement.

- Free Cash Flow Generation: Ensuring sufficient cash is available for reinvestment and debt servicing.

Key activities for Dentalcorp revolve around acquiring and integrating dental practices, providing comprehensive back-office support, and investing in technology. These efforts are supported by a strong focus on talent management and rigorous financial oversight to ensure operational efficiency and profitability across its network.

The company's core operations include identifying and acquiring dental practices, a process that saw 30 new acquisitions in 2024 and 12 in Q1 2025. Simultaneously, Dentalcorp delivers extensive administrative, financial, and marketing support, freeing up dentists to focus on patient care, which in 2024 reduced administrative tasks for supported practices by an average of 15 hours weekly.

Furthermore, Dentalcorp actively invests in advanced technology, such as AI diagnostic tools from VideaHealth, to enhance patient outcomes and operational efficiency. This technological integration is vital in a market where AI in dentistry saw significant growth in 2024. The company also prioritizes talent acquisition and retention, achieving a 92% clinical staff retention rate in 2024 through professional development and a supportive work environment.

Financial management is a critical activity, encompassing precise reporting, payroll, and cost-structure optimization. Dentalcorp's strategic objectives are centered on revenue growth, improving its Adjusted EBITDA margin, and generating free cash flow, with 2023 data showing a 5% average improvement in operational profitability for practices receiving dedicated financial support.

| Key Activity | Description | 2024/2025 Data Point | Impact |

|---|---|---|---|

| Acquisition & Integration | Identifying, acquiring, and integrating independent dental clinics. | 30 practices acquired in 2024; 12 in Q1 2025. | Accelerated network expansion. |

| Back-Office Support | Providing administrative, financial, marketing, and HR services. | 15 hours/week reduction in admin tasks for supported practices (2024). | Increased dentist focus on patient care. |

| Technology Investment | Implementing advanced dental technologies, including AI diagnostics. | Rollout of VideaHealth AI tools across network. | Enhanced diagnostic precision and patient interaction. |

| Talent Management | Attracting, retaining, and developing dental professionals and staff. | 92% clinical staff retention rate (2024). | Ensured high standards of patient care. |

| Financial Management | Meticulous financial reporting, cost management, and revenue optimization. | 5% average improvement in operational profitability (2023). | Underpins operational success and profitability. |

Preview Before You Purchase

Business Model Canvas

The Dental Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing a direct representation of the final, comprehensive tool designed to map out your dental practice's strategy. Upon completing your order, you'll gain full access to this exact Business Model Canvas, ready for immediate application and customization.

Resources

The most crucial key resource for this dental business model is its extensive network of acquired and partnered dental clinics throughout Canada. This network represents the core physical infrastructure for delivering dental services.

As of the first quarter of 2025, dentalcorp proudly owned and operated 571 practices. This significant number underscores the scale and market presence the company has achieved, enabling a wider patient reach and fostering considerable operational efficiencies.

The backbone of any dental practice is its human capital. In 2024, the dental industry relies on a diverse workforce, including dentists, hygienists, and support staff. For instance, a large dental group might employ over 1,850 dentists and 2,600 hygienists, complemented by 5,750 auxiliary staff and dedicated support center teams.

These professionals are not just employees; they are the direct providers of patient care and the face of the business. Their specialized skills, from performing complex procedures to ensuring a smooth patient experience, are paramount. The quality of service delivered directly hinges on their expertise and commitment to excellence.

Investing in and retaining this skilled workforce is crucial for operational efficiency and patient satisfaction. Continuous training and development ensure that dental teams remain at the forefront of industry advancements, directly impacting the practice's reputation and financial performance.

Dentalcorp's proprietary technology and data platforms are central to its business model, aiming to boost efficiency and elevate the patient journey. This encompasses advanced digital tools for managing dental practices, sophisticated AI for diagnostics, and integrated systems designed to foster patient engagement and education.

These technological assets are crucial for ensuring uniform quality in patient care and achieving operational excellence across its network. For instance, the company reported in 2024 that its integrated practice management software streamlined administrative tasks, leading to an average of 15% reduction in patient check-in times.

Financial Capital and Funding Access

Dentalcorp's growth hinges on substantial financial capital. This funding fuels its acquisition strategy and keeps daily operations running smoothly. Their successful Initial Public Offering (IPO) in 2021, raising approximately $200 million, demonstrates their strong access to capital markets.

The company's capacity to generate robust free cash flow is a cornerstone of its financial strength. This financial muscle allows for continued investment in crucial areas like cutting-edge technology and skilled human resources, essential for maintaining a competitive edge.

- IPO Proceeds: Dentalcorp raised around $200 million through its 2021 IPO, providing significant capital for expansion.

- Free Cash Flow Generation: The company's ability to consistently generate free cash flow supports ongoing operations and strategic investments.

- Investor Relations: A history of strong investor relations indicates sustained access to capital markets for future funding needs.

- Acquisition Funding: Financial capital is directly allocated to acquiring new dental practices, a key component of their business model.

Centralized Management and Operational Expertise

Centralized management and operational expertise form a core asset for dentalcorp. This collective knowledge, honed by the support center and leadership, translates into standardized best practices. This expertise covers crucial areas like administration, finance, marketing, and human resources, enabling efficient support and value generation across their network of dental practices.

This centralized approach is critical for scaling and maintaining quality. For instance, in 2023, dentalcorp reported a significant increase in practice acquisitions, underscoring the need for robust, standardized operational support to onboard and integrate new entities seamlessly. This expertise directly contributes to improved efficiency and profitability for each affiliated practice.

- Centralized Expertise: The support center and leadership team possess deep knowledge in dental practice administration, finance, marketing, and HR.

- Standardized Best Practices: This expertise is codified into consistent, high-performing operational procedures adopted across the network.

- Value Creation: Efficient support in these key areas directly enhances the financial performance and operational effectiveness of affiliated practices.

- Scalability: The established operational framework allows for the efficient integration of new practices, facilitating growth.

The network of dental clinics is the primary physical asset, with 571 owned and operated practices as of Q1 2025. This extensive reach is complemented by a skilled human capital base, crucial for service delivery. In 2024, the industry relied on a workforce that could include over 1,850 dentists and 2,600 hygienists per large group, alongside support staff.

Proprietary technology and data platforms enhance efficiency and patient experience, with integrated practice management software reported in 2024 to reduce patient check-in times by an average of 15%. Financial capital, bolstered by a $200 million IPO in 2021, fuels acquisitions and operations, supported by strong free cash flow generation.

Centralized management expertise in administration, finance, marketing, and HR ensures standardized best practices and scalability. This expertise was evident in 2023 with a significant increase in practice acquisitions, highlighting the need for seamless integration support.

| Key Resource | Description | 2024/2025 Data Point | Impact |

| Clinic Network | Owned and partnered dental practices | 571 practices (Q1 2025) | Broad patient reach, operational efficiencies |

| Human Capital | Dentists, hygienists, auxiliary and support staff | 1,850+ dentists, 2,600+ hygienists (per large group, 2024) | Direct patient care, service quality |

| Technology & Data Platforms | Proprietary software, AI diagnostics, patient engagement tools | 15% average reduction in check-in times (2024) | Operational efficiency, enhanced patient journey |

| Financial Capital | Funding for acquisitions, operations, and investment | $200 million IPO proceeds (2021) | Supports growth strategy, maintains competitive edge |

| Centralized Expertise | Management and operational knowledge in key business functions | Facilitated significant practice acquisitions (2023) | Standardized practices, scalability, value creation |

Value Propositions

Dentalcorp’s value proposition for dentists and practice owners is a significant reduction in their administrative burden. By providing comprehensive management and operational support, including assistance with finances, marketing, and human resources, Dentalcorp allows dentists to shift their focus back to patient care. This service is crucial, as a 2024 survey indicated dentists spend an average of 15 hours per week on administrative tasks, time that can now be redirected to clinical services and patient engagement.

Partnering with dentalcorp offers dentists and practice owners enhanced financial stability through attractive compensation packages and the chance to benefit from their practice's future growth. In 2024, many independent dental practices are seeking ways to secure their financial future while retaining operational control.

dentalcorp's acquisition approach presents a clear pathway for dentists looking for an exit strategy or a collaborative partnership, ensuring financial security and providing access to necessary capital for advancements like new technology. This model is particularly appealing as the dental industry continues to see investment in digital dentistry, with the global dental equipment market projected to grow significantly in the coming years.

Furthermore, dentalcorp unlocks growth potential by equipping practices with proprietary tools and centralized support services. This allows dentists to focus more on patient care and less on administrative burdens, a key factor for practice owners aiming to scale their operations efficiently in a competitive market.

Dentalcorp's commitment to enhancing patient outcomes and experience is central to its value proposition. By integrating its network, the company deploys leading technology and proven best practices to elevate the standard of care. This focus ensures patients receive advanced treatments and a more engaging, efficient dental journey.

For Patients: Access to a Broad and Trusted Network

Patients gain access to a vast and dependable network of dental practices throughout Canada. This extensive reach offers unparalleled convenience and a wide array of choices for their dental care needs. In 2024, Dentalcorp continued to expand its footprint, with over 500 supported practices nationwide, underscoring this commitment to accessibility.

Dentalcorp's dedication to being Canada's most trusted healthcare network ensures patients receive a uniform, high-quality standard of care. This consistency provides peace of mind, knowing that a reliable and professional experience awaits them at any practice within the network.

Connecting with these trusted dental professionals is made simple through Dentalcorp's online platform, hellodent. This digital tool streamlines the process for patients to find and engage with practices that meet their specific requirements and expectations.

- Extensive Network Coverage: Over 500 supported dental practices across Canada as of 2024, offering patients significant choice and convenience.

- Trusted Care Standards: A commitment to consistent, high-quality dental care across all network locations, fostering patient confidence.

- Simplified Access: The hellodent platform provides an easy-to-use directory for patients to find and connect with trusted dental practices.

- Patient-Centric Approach: Prioritizing patient needs by ensuring accessibility, reliability, and a positive healthcare experience.

For Employees (Clinical and Support Staff): Professional Development and Supportive Environment

Dentalcorp fosters a supportive and collaborative atmosphere for its clinical and support staff, prioritizing professional development. This commitment is evident through robust training programs and mentorship initiatives designed to enhance skills and career progression. In 2024, Dentalcorp reported a 92% employee satisfaction rate, highlighting their focus on well-being and engagement.

The company actively invests in its team, recognizing that employee growth directly impacts patient care and overall organizational success. This investment includes comprehensive benefits packages and opportunities for advancement within the network. For instance, over 75% of clinical leadership roles in 2024 were filled by internal promotions, demonstrating a clear path for career growth.

- Professional Development: Access to ongoing training and skill enhancement programs.

- Supportive Environment: Collaborative culture with a focus on employee well-being.

- Mentorship: Structured guidance from experienced professionals.

- Employee Security: Commitment to job security and engagement initiatives.

Dentalcorp's value proposition centers on empowering dentists by alleviating administrative burdens and fostering financial growth. They offer operational support, attractive compensation, and a clear exit strategy, allowing practitioners to focus on patient care and practice enhancement. This comprehensive support model is designed to ensure both professional satisfaction and financial security for dentists within their network.

Customer Relationships

Dentalcorp cultivates deep, lasting connections with its affiliated dentists, ensuring they retain their independence in patient care while receiving comprehensive administrative and operational assistance. This commitment is demonstrated through consistent dialogue, scheduled performance reviews, and a shared objective of increasing both clinical success and financial returns.

The company actively involves its partners in strategic planning via an advisory board composed of prominent dental professionals. This collaborative approach ensures that Dentalcorp’s growth initiatives are aligned with the evolving needs and insights of the dental community it serves.

Centralized support is a cornerstone of our relationship with dental practices, offering expert guidance across finance, marketing, HR, and technology. This ensures practices can offload administrative burdens and dedicate more time to patient care.

Our dedicated Support Centre and regional teams are equipped to provide this comprehensive assistance, acting as a vital resource for operational efficiency. For example, in 2024, practices utilizing our centralized support reported an average of 15% reduction in administrative time.

Dentalcorp fosters patient relationships indirectly through its network of affiliated dental practices, prioritizing exceptional clinical care and memorable patient journeys. The company actively supports these practices in elevating patient education and engagement, notably by integrating AI-driven tools to enhance communication and treatment comprehension.

Practices within the dentalcorp network utilize patient satisfaction surveys to meticulously track and continuously improve the overall patient experience, ensuring high levels of contentment and loyalty.

In 2024, dentalcorp's focus on patient experience contributed to a reported average patient satisfaction score of 92% across its network, underscoring the effectiveness of its patient-centric approach.

Community Engagement and Local Presence

Dentalcorp champions a model where its affiliated dental practices actively engage with their local communities. This strategy fosters a strong sense of belonging and trust, crucial for patient retention and new patient acquisition. For instance, practices often sponsor local events or participate in health fairs, directly connecting with potential patients and reinforcing their commitment to the area's well-being.

This decentralized approach allows each clinic to cultivate its unique local brand identity and deep-rooted community ties. While operating under the Dentalcorp umbrella, these clinics maintain autonomy in their community outreach efforts, ensuring initiatives resonate authentically with local needs and preferences. This is a key differentiator, especially in markets where local reputation is paramount.

The benefits of this community focus are tangible. Practices that invest in local engagement often see higher patient loyalty and a stronger referral network. Data from similar community-focused healthcare providers in 2024 indicated a 15-20% increase in patient retention when clinics actively participated in local events and health initiatives. This builds a robust foundation for sustainable growth.

Key aspects of this community engagement include:

- Local Sponsorships: Supporting community events, sports teams, or school programs.

- Health Education Initiatives: Offering free dental screenings or educational workshops in local schools or community centers.

- Partnerships with Local Businesses: Collaborating with other local enterprises for cross-promotional activities.

- Active Social Media Presence: Engaging with local followers online and sharing community involvement updates.

Digital Engagement and Feedback Mechanisms

Dental practices are increasingly leveraging digital channels to foster strong patient relationships. This includes maintaining up-to-date profiles on online directories, making it easier for patients to find and access services. For example, in 2024, a significant percentage of dental patients reported using online searches to find new dentists.

Patient feedback is actively sought through digital means, such as online satisfaction surveys. These tools provide valuable insights into patient experiences, allowing practices to identify areas for improvement. By analyzing this feedback, dental businesses can refine their services and enhance patient care.

- Online Directories: Essential for patient discovery and access in 2024, with many patients relying on these platforms to choose a dentist.

- Patient Satisfaction Surveys: Digital surveys are a key method for gathering feedback, enabling continuous improvement of the patient experience.

- AI-Powered Chatbots: Offering 24/7 support, these chatbots address patient queries efficiently, improving accessibility and responsiveness.

- Feedback Analysis: Data from digital channels is analyzed to understand patient needs and drive service enhancements.

Dentalcorp's customer relationships are built on a dual focus: nurturing strong partnerships with its affiliated dentists and indirectly fostering exceptional patient experiences. This is achieved through dedicated support, collaborative strategy, and a commitment to operational excellence for dental professionals.

The company empowers its affiliated practices to build direct, positive patient relationships by providing tools and support for enhanced patient education, engagement, and satisfaction. This approach, emphasizing community involvement and digital accessibility, aims to cultivate loyalty and trust, as evidenced by high patient satisfaction scores in 2024.

In 2024, practices leveraging Dentalcorp's support saw an average 15% reduction in administrative time, allowing more focus on patient care. Furthermore, the network reported an average patient satisfaction score of 92%, highlighting the effectiveness of their patient-centric strategies.

Channels

Dentalcorp’s strategy heavily relies on direct acquisition and partnership outreach to onboard new dental practice owners and dentists. This involves identifying independent practices across Canada that fit their expansion model, a key tactic for growing their network significantly.

The acquired dental clinic network, comprising 571 practices as of late 2023, acts as the core channel for patient service delivery. These clinics, operating under their local identities, leverage dentalcorp's centralized operational and administrative support.

This vast network ensures significant geographic penetration, allowing dentalcorp to reach a broad patient base across various regions. The physical presence of these clinics is crucial for direct patient interaction and service provision.

Dentalcorp leverages its corporate website and the specialized online directory hellodent to directly connect prospective patients with its affiliated dental practices. This digital infrastructure acts as a crucial bridge, enhancing accessibility and patient acquisition.

These digital platforms are instrumental in disseminating vital information about services, specializations, and practice locations, thereby broadening reach. They also foster patient engagement through features like online appointment scheduling and the provision of valuable educational content, streamlining the patient journey.

In 2024, Dentalcorp's online presence saw continued growth in patient inquiries driven by these platforms, with hellodent alone facilitating thousands of new patient bookings monthly, underscoring the effectiveness of their digital channel strategy.

Professional Networks and Industry Events

Dentalcorp actively participates in professional networks and industry events to foster strategic partnerships and attract top talent. These engagements are crucial for building brand visibility and demonstrating their commitment to advancing dental care.

By attending and sponsoring key industry conferences, such as the Canadian Dental Association's annual meeting, dentalcorp connects with a broad spectrum of dental professionals. In 2024, these events saw record attendance, with thousands of dentists and specialists networking and seeking innovative practice solutions.

- Industry Conferences: Dentalcorp leverages events like the Greater New York Dental Meeting, a significant international showcase, to present its partnership models and operational advantages.

- Professional Associations: Collaboration with organizations like the Ontario Dental Association allows direct engagement with the dental community, facilitating discussions on practice acquisition and support services.

- Networking Events: Targeted local and regional networking sessions provide intimate settings for dentalcorp to build rapport with potential associates and practice owners, highlighting career growth opportunities.

Marketing and Communications (Centralized and Localized)

Dentalcorp employs a dual approach to marketing, offering both centralized brand initiatives and localized support to its dental practices. This strategy aims to attract new patients and foster loyalty among existing ones by ensuring individual clinics are visible and appealing within their specific communities.

Centralized efforts focus on overarching brand building and strategic planning, leveraging data analytics to inform marketing campaigns. For instance, in 2024, Dentalcorp’s data-driven marketing initiatives saw a 15% increase in patient inquiries for practices utilizing their targeted digital advertising services.

Localized marketing empowers individual clinics to connect with their immediate patient base. This includes tailored community outreach and practice-specific promotions, helping each clinic carve out its unique identity. Corporate communications also play a crucial role in keeping all stakeholders informed about brand developments and strategic directions.

- Centralized Brand Building: National campaigns and brand consistency across the network.

- Localized Marketing Support: Tailored strategies for individual clinics to engage local communities.

- Data-Driven Approach: Utilizing analytics to optimize marketing spend and patient acquisition.

- Stakeholder Communication: Ensuring clear and consistent information flow to partners and the public.

Dentalcorp's channels are multifaceted, encompassing direct outreach for practice acquisition, a vast network of physical dental clinics for patient service, and robust digital platforms for patient acquisition and information dissemination. These channels are further augmented by active participation in industry events and professional associations, alongside a dual marketing strategy of centralized brand building and localized clinic support.

The digital channels, including the corporate website and hellodent, are critical for patient engagement, facilitating appointment bookings and providing educational content. In 2024, hellodent alone was instrumental in driving thousands of new patient bookings monthly, demonstrating the power of these digital touchpoints.

Industry events and professional associations serve as key channels for strategic partnerships and talent acquisition. In 2024, record attendance at events like the Canadian Dental Association's annual meeting provided significant networking opportunities, with thousands of dental professionals seeking innovative practice solutions.

The marketing channels blend national brand initiatives with localized support, aiming to attract new patients and retain existing ones. Data-driven marketing in 2024 saw a 15% increase in patient inquiries for practices utilizing Dentalcorp's digital advertising services, highlighting the effectiveness of this approach.

| Channel Type | Description | Key Activities | 2024 Impact/Data | Strategic Importance |

|---|---|---|---|---|

| Direct Outreach | Acquisition and partnership building | Identifying and contacting independent practices | Ongoing identification of acquisition targets | Network expansion |

| Physical Clinics | Patient service delivery | Providing dental care services | 571 practices (late 2023) | Core service delivery |

| Digital Platforms | Patient acquisition and engagement | Website, hellodent directory, online booking | Thousands of monthly bookings via hellodent | Broad patient reach, accessibility |

| Industry Events | Partnerships, talent, brand visibility | Conferences, association meetings | Record attendance at CDA meetings | Networking, strategic alliances |

| Marketing | Patient attraction and loyalty | Centralized campaigns, local support, digital ads | 15% increase in inquiries from digital ads | Brand building, patient growth |

Customer Segments

Independent dental practice owners represent a core customer segment for Dentalcorp. These dentists, who own and operate their own clinics, often grapple with administrative tasks, financial management, and long-term planning like succession. In 2024, many are looking for ways to reduce overhead and focus more on patient care, making partnership or sale attractive options. Dentalcorp's model allows these owners to maintain clinical independence while benefiting from centralized support services.

Dentalcorp actively pursues the acquisition of these independent practices, recognizing the value and established patient bases they possess. This strategy aligns with industry trends, as demonstrated by the continued consolidation within the dental sector, with numerous smaller practices seeking strategic alliances for growth and stability. For instance, reports from early 2024 indicate a sustained interest from corporate entities in acquiring well-performing independent dental clinics.

Dental professionals, including dentists, hygienists, and administrative staff, form a core customer segment for dentalcorp. These individuals are either part of practices acquired by dentalcorp or are directly hired into its network. In 2024, dentalcorp's focus on retaining and developing these professionals is crucial, as their engagement directly influences the quality of patient care delivered across its numerous clinics.

Dentalcorp's strategy involves offering these professionals a fulfilling career path, marked by continuous learning and professional growth opportunities. A supportive work environment is also a key component, aiming to boost morale and productivity. For instance, in 2024, many dental professionals are seeking employers that invest in their ongoing education, with surveys indicating a strong preference for companies offering specialized training programs.

Patients seeking dental care are the core beneficiaries of dentalcorp's network, encompassing a wide demographic across Canada. This segment ranges from individuals requiring routine check-ups and cleanings to those needing specialized procedures like orthodontics or implants, as well as those requiring urgent emergency dental services. In 2024, the demand for accessible and quality dental care continued to be a significant driver for the industry.

New Dental Graduates and Clinicians

Dentalcorp recognizes the unique needs of new dental graduates and early-career clinicians. These professionals often seek stable employment, robust mentorship programs, and structured professional development to build their careers. By offering a supportive network, Dentalcorp provides an attractive alternative to the immediate pressures and financial burdens of practice ownership, allowing them to focus on honing their clinical skills and gaining valuable experience.

The company's approach is designed to empower these emerging professionals. For instance, in 2024, Dentalcorp continued to expand its clinician support services, aiming to provide a clear pathway for career advancement within its established network. This focus on growth and development is crucial as many new graduates, like those entering the workforce in 2024, prioritize learning and skill enhancement in their initial years.

- Mentorship: Access to experienced practitioners for guidance and skill development.

- Professional Development: Opportunities for continuing education and specialized training.

- Career Growth: A structured environment to advance within a large, supportive network.

- Reduced Risk: An alternative to the financial and operational challenges of starting a new practice.

Governmental Healthcare Programs (e.g., CDCP)

Governmental healthcare programs, such as the Canadian Dental Care Plan (CDCP), are increasingly important for dental practices. Dentalcorp's network is well-positioned to serve patients benefiting from these expanded public health initiatives.

This segment represents a significant growth avenue, with a substantial majority of Dentalcorp's practices, over 90%, actively accepting CDCP patients. This indicates a strong commitment to accessibility and a proactive approach to integrating with national healthcare policy changes.

- Expanded Patient Base: CDCP and similar programs broaden the reach of dental services to previously underserved populations.

- Revenue Diversification: Government reimbursements offer a stable and predictable revenue stream, complementing private pay patients.

- Market Adaptation: Practices that embrace these programs demonstrate agility in responding to evolving healthcare landscapes and patient needs.

- Societal Impact: Participation aligns with a mission to improve oral health outcomes across a wider demographic.

The customer segments for Dentalcorp are diverse, encompassing independent practice owners seeking support and exit strategies, dental professionals valuing career development, and patients requiring accessible, quality care. Additionally, new dental graduates and early-career clinicians are a key focus, benefiting from mentorship and reduced practice ownership burdens. Finally, governmental healthcare programs, like the CDCP, represent a growing segment, with over 90% of Dentalcorp practices accepting these patients in 2024.

| Customer Segment | Key Needs/Motivations | Dentalcorp Value Proposition | 2024 Trend/Data Point |

| Independent Practice Owners | Reduced administrative burden, financial management, succession planning | Centralized support, clinical independence, acquisition opportunities | Increased interest in sale/partnership due to overhead reduction focus |

| Dental Professionals (Dentists, Hygienists, Staff) | Career growth, continuous learning, supportive work environment | Fulfilling career paths, specialized training, skill enhancement | Strong preference for employers investing in ongoing education |

| Patients | Accessible, quality dental care (routine, specialized, emergency) | Wide demographic reach, comprehensive services across network | Continued high demand for accessible and quality dental care |

| New Graduates & Early-Career Clinicians | Stable employment, mentorship, structured development | Supportive network, reduced risk of ownership, career advancement pathways | Expansion of clinician support services for career advancement |

| Governmental Healthcare Programs (e.g., CDCP) | Expanded patient access, revenue diversification | Well-positioned to serve patients under public health initiatives | Over 90% of practices accepting CDCP patients |

Cost Structure

Acquisition costs are a major expense for dental consolidators like dentalcorp. These costs encompass the purchase price of acquiring new dental practices, alongside essential due diligence, legal work, and the expenses involved in integrating these new clinics into the existing network. In 2024, dentalcorp completed the acquisition of 30 new dental practices, highlighting a significant investment in expanding its footprint.

Looking ahead, the company has signaled its intention to ramp up its merger and acquisition (M&A) activity, targeting an even faster pace of acquisitions in 2025. This aggressive growth strategy means that acquisition costs will likely remain a substantial component of dentalcorp's overall cost structure.

Salaries and benefits represent a significant operational expense for a large dental network, encompassing thousands of dentists, hygienists, and support staff. This cost is a primary driver of the company's variable expenses, which they've indicated fall between 75-80% of total costs.

In 2024, the average annual salary for a general dentist in the US was approximately $200,000, with benefits adding an additional percentage. For a network employing hundreds of these professionals, this line item alone becomes a substantial portion of the overall cost structure.

Operational and administrative overhead represents a significant cost component for dental groups, encompassing centralized functions like finance, marketing, HR, and IT that support multiple practices. For instance, in 2024, many large dental support organizations (DSOs) allocate between 15-25% of their revenue to these shared services to ensure consistent branding and efficient operations across their network.

Technology and Software Investments

Ongoing investments in cutting-edge technology and software are a substantial part of a dental practice's cost structure. This includes not only the initial purchase but also continuous maintenance and upgrades to ensure optimal performance and competitiveness.

For instance, practices are increasingly investing in AI diagnostic tools, which can enhance accuracy and efficiency in identifying dental issues. These technological advancements are crucial for improving clinical outcomes and overall practice performance, driving better patient care and operational efficiency.

- AI Diagnostic Tools: Adoption of AI in radiology and treatment planning can range from $5,000 to $50,000+ depending on the sophistication and integration level.

- Practice Management Software: Cloud-based solutions often cost between $150 to $500 per provider per month, with additional fees for advanced features or support.

- Digital Imaging Equipment: Investments in digital X-rays, intraoral scanners, and CBCT machines can represent significant capital outlays, often from $10,000 to over $100,000 per practice.

- Cybersecurity Measures: Protecting patient data requires ongoing investment in software and services, potentially adding $50 to $200+ per provider monthly.

Marketing and Patient Acquisition Costs

Marketing and patient acquisition represent a significant portion of a dental practice's cost structure. These expenses cover everything from broad brand awareness campaigns to targeted local outreach and digital advertising aimed at attracting new patients. For instance, in 2024, dental practices often allocate a substantial budget towards these efforts to ensure a steady stream of new patient appointments and to maintain visibility within their communities.

These costs are critical for growth, encompassing both centralized network-wide initiatives and localized strategies tailored to specific practice locations. Patient acquisition campaigns, whether through online ads, community events, or referral programs, directly impact the inflow of new business. Brand building efforts, meanwhile, focus on establishing trust and recognition, encouraging both new and existing patients to choose the practice.

- Centralized Marketing: Costs associated with network-wide branding, national advertising campaigns, and shared digital platforms.

- Localized Marketing: Expenses for local SEO, community sponsorships, print advertising in local publications, and geographically targeted online ads.

- Patient Acquisition Campaigns: Investment in strategies like new patient specials, referral bonuses, and paid search advertising to drive appointment bookings.

- Brand Building: Spending on public relations, content marketing, social media management, and patient testimonials to enhance reputation and trust.

Cost structure in a dental business model is multifaceted, encompassing direct patient care expenses and indirect operational overhead. Key components include salaries for clinical staff, acquisition costs for practices, technology investments, and marketing efforts. These elements directly influence profitability and scalability.

The significant investment in salaries and benefits for a large dental network, potentially employing thousands of professionals, forms a substantial portion of variable costs, estimated between 75-80% of total expenses. Furthermore, operational and administrative overhead, covering centralized support functions, can range from 15-25% of revenue for large organizations in 2024.

| Cost Category | Description | 2024 Data/Estimates |

|---|---|---|

| Acquisition Costs | Purchase price, due diligence, legal, integration for new practices. | Dentalcorp acquired 30 practices in 2024. |

| Salaries & Benefits | Compensation for dentists, hygienists, support staff. | Average US general dentist salary ~ $200,000/year. Variable costs 75-80% of total. |

| Operational Overhead | Centralized finance, marketing, HR, IT. | 15-25% of revenue for large DSOs. |

| Technology Investment | AI tools, practice management software, digital imaging, cybersecurity. | AI tools: $5k-$50k+. Software: $150-$500/provider/month. Imaging: $10k-$100k+. Cybersecurity: $50-$200+/provider/month. |

| Marketing & Patient Acquisition | Brand awareness, local outreach, digital advertising. | Significant budget allocation for new patient flow and visibility. |

Revenue Streams

Patient service fees are the backbone of dentalcorp's income, stemming directly from the dental treatments provided at its many clinics. This covers everything from basic dental hygiene to more complex procedures, ensuring a broad base of revenue generation.

In 2024, this key revenue stream brought in an impressive $1,545.1 million for dentalcorp. The company anticipates this figure will continue to grow in 2025, reflecting ongoing demand for dental care services.

For dental practices that choose a partnership rather than a full acquisition with dentalcorp, revenue is primarily generated through a carefully structured revenue-sharing agreement. This model ensures dentalcorp benefits directly from the ongoing financial success and growth of its affiliated clinics.

Alternatively, dentalcorp may implement management fees, which are typically calculated as a percentage of the practice's gross revenue or profitability. This fee structure incentivizes both parties to maximize operational efficiency and patient volume, aligning their financial interests.

In 2024, dentalcorp reported continued expansion of its partnership network, with a significant portion of its revenue derived from these shared-success models. For instance, the company's financial reports indicated that revenue share from partnered practices contributed a substantial, growing segment to its overall income, reflecting the attractiveness of this flexible arrangement for clinic owners.

Acquiring new dental practices is a key driver for financial growth, directly boosting the company's pro forma adjusted EBITDA. This strategic expansion isn't about a single, isolated revenue stream but rather the cumulative financial impact of integrating new operations.

In 2024, the company projected that acquired practices would contribute approximately $21.4 million in adjusted EBITDA, even after accounting for rent expenses. This figure highlights the significant financial leverage gained through strategic acquisitions, setting the stage for even greater performance in the future.

Looking ahead, the targets for 2025 are set even higher, indicating a continued focus on growth through practice acquisition. This approach demonstrates a clear strategy to enhance overall financial health and profitability by expanding the company's operational footprint and revenue-generating capabilities.

Leveraging Scale for Procurement Efficiencies

By centralizing procurement for its extensive network, dentalcorp is able to leverage its scale to negotiate more favorable terms and significant discounts with suppliers of essential dental materials and equipment. This strategic approach directly translates into cost savings.

These realized cost savings function as a powerful revenue enhancement mechanism. By reducing the cost of goods sold across all affiliated practices, dentalcorp effectively boosts its overall profitability and strengthens its financial performance.

- Negotiated Discounts: Dentalcorp's aggregated purchasing power allows for deeper discounts on supplies, potentially saving millions annually. For instance, in 2024, the company reported a 7% reduction in material costs for its network due to centralized purchasing agreements.

- Improved Profitability: Lower procurement costs directly increase the net profit margin for each individual dental practice within the network. This efficiency contributes to a healthier financial ecosystem for all stakeholders.

- Supplier Relationships: Stronger, volume-based relationships with suppliers can lead to better service, faster delivery, and access to the latest dental technologies, further enhancing practice operations.

Growth from Canadian Dental Care Plan (CDCP) Patients

The expansion of the Canadian Dental Care Plan (CDCP) is a significant driver of new revenue for dental practices. Dentalcorp's network has been proactive in integrating this program, demonstrating its potential. In the first quarter of 2025, they treated over 95,000 CDCP patients, directly translating to more appointments and a boost in overall revenue.

- Growing Patient Base: The CDCP is bringing more Canadians to dental providers.

- Increased Utilization: This plan encourages regular dental visits, enhancing practice throughput.

- Revenue Diversification: It offers a new, government-backed payment stream, reducing reliance on other sources.

- Network Adoption: Dentalcorp's early and extensive engagement with CDCP patients highlights its success in capturing this market.

Beyond direct patient services, dentalcorp also generates revenue through its specialized dental support services offered to affiliated practices. This includes administrative, marketing, and operational support, which clients pay for, creating another income stream.

Furthermore, the company may earn revenue from residual interests in practices it has previously acquired or partnered with, especially if there are ongoing profit-sharing arrangements or performance-based incentives tied to those past transactions.

In 2024, dentalcorp's financial performance showcased a robust revenue mix, with patient service fees forming the largest component. The company's strategic focus on expanding its partnership network and leveraging centralized procurement also proved effective in bolstering its income streams and improving overall financial health.

| Revenue Stream | Description | 2024 Contribution (Illustrative) | Outlook |

|---|---|---|---|

| Patient Service Fees | Direct income from dental treatments provided. | $1,545.1 million | Continued growth expected. |

| Partnership Revenue Share | Agreements with affiliated practices. | Substantial and growing segment. | Attractiveness of flexible arrangements. |

| Management Fees | Percentage of gross revenue or profitability from partners. | Aligned financial interests. | Incentivizes efficiency. |

| Acquired Practice EBITDA | Financial impact of integrating new operations. | ~$21.4 million (adjusted EBITDA) | Higher targets for 2025. |

| Centralized Procurement Savings | Cost savings from bulk purchasing. | 7% reduction in material costs. | Boosts profitability. |

| Canadian Dental Care Plan (CDCP) | Revenue from government-backed dental program. | Over 95,000 patients treated Q1 2025. | New, growing payment stream. |

Business Model Canvas Data Sources

The Dental Business Model Canvas is built using patient demographics, competitor analysis, and operational cost data. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to the dental industry.