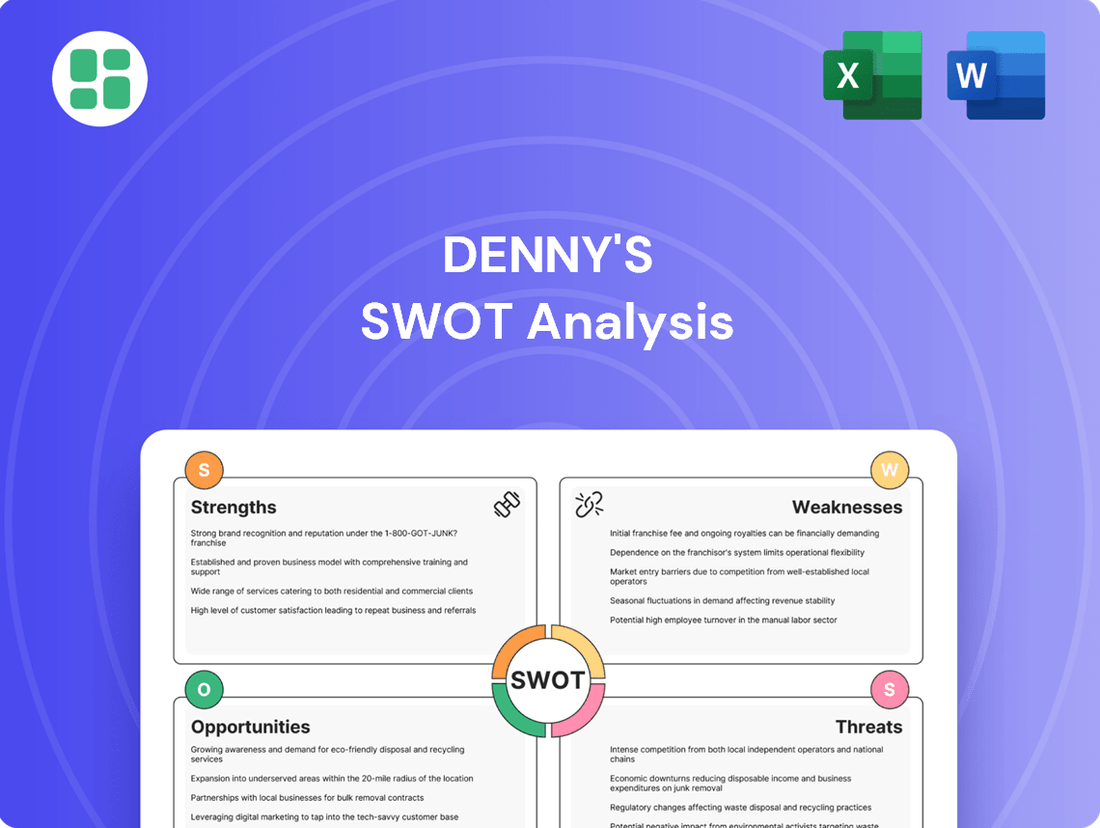

Denny's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denny's Bundle

Denny's, a beloved diner chain, leverages its strong brand recognition and 24/7 accessibility as key strengths, while facing challenges like evolving consumer tastes and intense competition. Understanding these dynamics is crucial for navigating the fast-casual dining landscape.

Want the full story behind Denny's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Denny's boasts over seven decades of operation, solidifying its identity as 'America's Diner.' This extensive history has cultivated robust brand recognition and a widespread presence throughout the United States, giving it a distinct competitive edge.

The company's longevity translates into a powerful, recognizable identity for consumers seeking a dependable and familiar dining experience. This deep-rooted history fosters a loyal customer base, reinforcing Denny's strong market position.

Denny's strategic 24/7 operating model provides a significant advantage, offering customers unparalleled convenience and accessibility at any hour. This round-the-clock service caters to a wide range of dining needs, from breakfast to late-night cravings, setting Denny's apart from many competitors who have more limited hours. In 2024, this continuous operation allows Denny's to capture a broader customer base, including shift workers and travelers, contributing to consistent revenue streams throughout the day and night.

Denny's consistently delivers a strong value proposition, making it a go-to for a wide range of customers seeking affordable dining options. The ongoing success of their value menus, like the '$2,$4,$6,$8' promotions, directly translates into increased customer visits and solidifies their reputation as a budget-friendly choice. This commitment to value is a key factor in retaining customer loyalty, particularly when consumers are more mindful of their spending.

Robust Franchise-Driven Business Model

Denny's operates a highly effective franchise-driven business model, with a significant majority of its locations being franchised. This strategy allows for rapid expansion of its brand presence while minimizing the capital investment and operational burdens for the parent company. For instance, as of the end of fiscal year 2023, Denny's reported approximately 1,500 franchised restaurants out of its total system, highlighting the asset-light nature of its growth.

This franchised structure not only strengthens Denny's balance sheet by reducing debt and capital expenditure requirements but also empowers franchisees to tailor operations to local market demands and reinvest in their businesses. This localized approach fosters a stronger connection with customers and drives operational efficiency across the network. The robust franchisee network is a cornerstone of Denny's brand reach and its ability to adapt and thrive in diverse markets.

- Franchise Dominance: A substantial majority of Denny's restaurants are franchised, facilitating expansion with reduced capital outlay.

- Asset-Light Growth: The model minimizes financial risk and enhances balance sheet health for the corporation.

- Local Adaptation: Franchisees drive market-specific strategies and reinvestment, boosting brand relevance.

- Network Strength: The extensive franchisee base is critical for brand reach and operational effectiveness.

Growing Off-Premise and Virtual Brand Sales

Denny's has seen robust growth in its off-premise sales, encompassing takeout and delivery, which continue to be a significant revenue driver. This channel's strength reflects a successful adaptation to evolving consumer preferences for convenience.

The company's strategic rollout of virtual brands, such as Banda Burrito, has been effective in capturing incremental sales, particularly during off-peak hours like dinner and late-night. These brands efficiently leverage existing kitchen operations, boosting profitability without substantial new capital investment.

- Off-Premise Strength: Off-premise sales, including delivery and takeout, remain a cornerstone of Denny's revenue strategy.

- Virtual Brand Impact: Virtual brands like Banda Burrito are successfully generating additional sales, especially during dinner and late-night periods.

- Operational Efficiency: The use of existing kitchen infrastructure for virtual brands enhances profitability and expands customer reach.

Denny's established brand recognition, built over seven decades as America's Diner, provides a significant competitive advantage. This deep-rooted history cultivates customer loyalty and a dependable image. The company's 24/7 operating model offers unparalleled convenience, catering to diverse customer needs and ensuring consistent revenue streams. Furthermore, Denny's commitment to value, exemplified by promotions like the '$2,$4,$6,$8' menu, attracts a broad customer base seeking affordable dining options, reinforcing its market position.

What is included in the product

Delivers a strategic overview of Denny's’s internal and external business factors, highlighting its brand recognition and value proposition against market shifts and competitive pressures.

A Denny's SWOT analysis can relieve the pain of unclear strategic direction by providing a clear roadmap for addressing weaknesses and capitalizing on opportunities.

Weaknesses

Denny's has faced a persistent challenge with declining domestic system-wide same-restaurant sales. This trend, particularly noticeable in recent quarters of 2024, signals difficulties in attracting and retaining customers at its established locations. The inability to boost traffic or increase spending per visit at existing restaurants directly impacts the company's top-line growth and overall financial health.

Denny's has seen an accelerated rate of restaurant closures in 2024 and 2025, with more locations shutting down than initially planned. This aggressive pruning of underperforming and older sites, while aimed at strengthening the overall business, inevitably shrinks the brand's visibility and market presence.

The significant number of these closures points to persistent challenges in the operational efficiency and profitability of many Denny's units, raising concerns about the long-term viability of a substantial portion of its store base.

Despite a slight uptick in total operating revenue, Denny's has experienced significant declines in net income and operating income during recent financial quarters. For instance, in the first quarter of 2024, Denny's reported a net income of $7.1 million, a notable decrease from $15.6 million in the same period of the previous year. This trend highlights a squeeze on profit margins, likely driven by escalating operational costs and less robust sales performance.

The downward trend in these crucial profitability indicators raises questions about Denny's overall financial stability and the effectiveness of its operational strategies. This contraction in earnings signals potential challenges in managing expenses and maintaining sales momentum in a competitive market environment.

Aging Infrastructure and Remodel Needs

Many of Denny's older restaurants are showing their age, necessitating significant renovations. For example, in fiscal year 2023, Denny's invested $44.1 million in company-owned restaurant remodels and improvements. Some locations are even being closed due to their deteriorating condition, which requires substantial capital to bring them up to modern standards.

The inconsistent appearance across its restaurant portfolio can negatively affect the customer experience. This aging infrastructure presents a considerable financial hurdle and an ongoing operational challenge as the company works to modernize its footprint.

- Capital Intensive Renovations: Significant investment is required to update older, outdated restaurant locations to meet current customer expectations and operational efficiency.

- Customer Perception Impact: An aged and inconsistent look across units can deter potential customers and detract from the overall dining experience, potentially impacting sales.

- Operational Strain: Managing the logistics and costs associated with widespread modernization creates an operational burden, diverting resources from other growth initiatives.

Limited Menu Customization

Denny's recent strategic moves to streamline its menu and reduce customization options, while intended to boost operational efficiency and profitability, could inadvertently alienate customers who prefer a more personalized dining experience. This simplification, though beneficial for back-of-house operations, risks alienating a segment of their clientele. For instance, a move away from extensive 'build-your-own' options may not resonate with current consumer trends that increasingly favor bespoke meal choices.

This reduction in flexibility could impact customer loyalty, especially among younger demographics who often seek tailored dining experiences. While Denny's aims to improve margins, the potential loss of customers who value extensive customization is a notable weakness. For example, in 2024, the fast-casual dining sector saw continued growth in personalized ordering systems, highlighting a market trend that Denny's current strategy might be diverging from.

- Reduced Customer Choice: Simplifying the menu limits options for diners seeking highly personalized meals.

- Potential Alienation of Key Demographics: Younger consumers, in particular, often prioritize customization, which could be a missed opportunity.

- Operational Efficiency vs. Market Trends: The focus on efficiency might overlook the growing consumer demand for bespoke dining experiences.

Denny's faces significant challenges with its aging restaurant infrastructure, requiring substantial capital for renovations. In fiscal year 2023 alone, the company invested $44.1 million in company-owned restaurant remodels. Some older locations are being closed due to their deteriorating condition, which necessitates considerable expense to update to modern standards.

This aging and inconsistent appearance across its locations can negatively impact the customer experience, potentially deterring new patrons and affecting sales. The ongoing need for modernization presents a considerable financial hurdle and an operational challenge, diverting resources from other strategic initiatives.

The company's strategic decision to streamline its menu and reduce customization options, while aimed at improving operational efficiency, risks alienating customers who value personalized dining experiences. This simplification might not align with current consumer trends favoring bespoke meal choices, potentially impacting customer loyalty, particularly among younger demographics. For instance, the fast-casual sector continued to see growth in personalized ordering systems in 2024.

Same Document Delivered

Denny's SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. Our Denny's SWOT analysis provides a comprehensive overview of the brand's strengths, weaknesses, opportunities, and threats. You're viewing the actual analysis document; buy now to access the full, detailed report.

Opportunities

The acquisition and ongoing expansion of Keke's Breakfast Cafe present a compelling growth avenue for Denny's Corporation. Keke's has demonstrated robust performance, with strong positive same-restaurant sales growth and successful expansion into new states, indicating a healthy and scalable concept.

This strategic move allows Denny's to diversify its brand portfolio within the highly competitive breakfast segment, effectively targeting a different set of consumer preferences and occasions. By investing further in Keke's, Denny's is poised to drive overall company growth and capture a larger share of the breakfast market.

Denny's Diner 2.0 remodel program has already shown a positive impact, with renovated locations experiencing higher sales and more customer traffic. This success suggests a strong opportunity to accelerate these upgrades throughout the franchise network.

By offering financial incentives, Denny's can encourage franchisees to adopt the Diner 2.0 format, which is designed to refresh the brand's image and improve the overall guest experience. This strategic revitalization aims to boost average unit volumes and attract a broader customer base.

Denny's has a significant opportunity to boost its appeal by innovating its menu. This involves introducing healthier choices, plant-based alternatives, and exploring new flavor profiles that align with current consumer tastes. For instance, the growing demand for plant-based diets saw the U.S. market reach an estimated $7.4 billion in 2023, presenting a clear avenue for expansion.

Introducing limited-time offers (LTOs) and refreshing core menu items can be a powerful strategy to draw in both new patrons and encourage existing customers to return more frequently. In 2024, restaurants that effectively leverage LTOs often see a noticeable uptick in sales, with some reporting increases of 5-10% during promotional periods.

By adapting its offerings to reflect current dietary trends and evolving palates, Denny's can significantly broaden its customer base. This strategic menu evolution is crucial for staying relevant in a competitive landscape where consumer preferences shift rapidly.

Enhanced Digital Capabilities and Loyalty Programs

Denny's can capitalize on enhanced digital capabilities and loyalty programs to boost customer interaction and sales. Investing in user-friendly online ordering and mobile apps streamlines the customer experience, making it easier for patrons to engage with the brand. This focus on digital convenience is vital, as a 2024 report indicated that restaurants with strong digital platforms saw a 15% increase in order frequency compared to those with limited online presence.

Launching a new, appealing loyalty program offers another significant opportunity. Such programs are proven to foster repeat business and customer retention. For instance, a well-structured loyalty initiative can drive an estimated 10-20% lift in customer lifetime value. Denny's can leverage these digital tools to gather valuable customer data, enabling more targeted and personalized marketing campaigns, which can further enhance engagement and drive repeat visits.

- Digital Investment: Enhanced online ordering and mobile app functionality to improve customer convenience and accessibility.

- Loyalty Program: Introduction of a new loyalty program designed to increase customer retention and encourage repeat business.

- Data Utilization: Leveraging customer data from digital interactions for personalized marketing efforts.

- Market Competitiveness: Strengthening digital presence to remain competitive in the evolving restaurant industry landscape.

Targeting Younger Demographics

Denny's has a significant opportunity to capture younger demographics by focusing on innovative partnerships and marketing. For instance, collaborations with popular gaming platforms or social media influencers could significantly boost brand visibility among Gen Z and Millennials. This is crucial as data from 2024 indicates a growing preference among these age groups for brands that align with their digital lifestyles and values.

Revamping menu offerings to include more plant-based options, globally inspired flavors, and customizable meals can directly appeal to the evolving tastes of younger consumers. A 2025 industry report highlighted that 65% of Gen Z consumers actively seek out restaurants with diverse and health-conscious menu choices. This shift can help Denny's diversify its customer base and mitigate potential declines in traditional diner segments.

Tailoring the in-restaurant and digital experience to resonate with the expectations of Gen Z and Millennials is paramount. This could involve enhancing mobile ordering capabilities, loyalty programs with gamified elements, and creating social media-friendly dining environments. By 2024, brands that successfully integrated digital convenience and personalized experiences saw a 15% increase in repeat customer visits from younger age brackets.

- Partnerships: Exploring collaborations with emerging tech companies or entertainment franchises to reach younger audiences.

- Menu Innovation: Introducing limited-time offers featuring trending ingredients and global cuisines popular with younger consumers.

- Digital Engagement: Enhancing the mobile app with loyalty rewards, personalized offers, and social sharing features.

- Brand Messaging: Crafting marketing campaigns that highlight Denny's value, inclusivity, and community involvement to resonate with younger demographics.

Denny's has a significant opportunity to expand its reach through strategic acquisitions, exemplified by the successful integration and growth of Keke's Breakfast Cafe. This expansion into new markets, with Keke's showing strong same-restaurant sales growth, diversifies Denny's portfolio and captures a larger share of the breakfast market.

Accelerating the Diner 2.0 remodel program presents another key opportunity, as renovated locations have demonstrated increased sales and customer traffic, indicating a strong return on investment for brand revitalization.

Menu innovation, including healthier options and plant-based alternatives, aligns with growing consumer demand, a market segment that reached an estimated $7.4 billion in the U.S. in 2023.

Enhanced digital capabilities, such as user-friendly online ordering and loyalty programs, can significantly boost customer engagement and sales, with data from 2024 showing a 15% increase in order frequency for restaurants with strong digital platforms.

Threats

Persistent inflation and ongoing pressure on household incomes in 2024 are creating significant volatility in consumer sentiment. This economic backdrop directly impacts Denny's, as diners are increasingly prioritizing value and potentially reducing discretionary spending on eating out.

The challenging economic environment, characterized by elevated inflation rates, poses a substantial threat to overall sales and customer traffic for the entire restaurant industry, including Denny's. This necessitates a keen focus on value propositions and operational efficiency to navigate the current headwinds.

Denny's faces a tough battle in the casual dining space, with many other family-style restaurants vying for customer attention. It's not just other sit-down places; fast-casual and even fast-food chains are also strong competitors, often luring diners with different price points or quicker service.

These rivals frequently present unique selling points, whether it's a focus on healthier options, a more modern ambiance, or specialized cuisine that aligns with shifting consumer preferences. For instance, the rise of fast-casual brands offering customizable bowls or gourmet burgers presents a direct challenge to traditional diner menus.

The sheer volume of options available to consumers means Denny's must constantly work to stand out. This crowded marketplace makes it difficult to capture new customers and keep existing ones loyal, impacting the ability to grow market share and achieve consistent revenue increases in the 2024-2025 period.

Denny's faces a significant threat from rising commodity and labor costs. For instance, the cost of eggs, a staple ingredient, saw substantial increases throughout 2023 and into early 2024, impacting food expenses. Simultaneously, labor inflation, driven in part by minimum wage hikes in various states, directly pressures the company's payroll expenses, squeezing operating margins.

Shifting Consumer Preferences Towards Healthier Options

Consumers are increasingly prioritizing healthier food choices, which presents a significant challenge for Denny's. The company's classic diner fare, often perceived as indulgent, may not align with these evolving dietary preferences. For instance, a 2024 survey indicated that over 60% of consumers actively seek out menu items with lower calorie counts or healthier ingredients when dining out.

This shift is compounded by a growing trend towards home-cooked meals, particularly those focused on wellness. Denny's core business model, centered on a broad, sit-down menu, faces pressure from this dual trend. Adapting its menu to incorporate more health-conscious options, such as plant-based alternatives or lighter preparations, is crucial for Denny's to remain competitive and attract a wider customer base in 2024 and beyond.

- Growing Health Consciousness: A substantial portion of consumers, estimated at over 60% in recent surveys, are actively seeking healthier dining options.

- "Eat-at-Home" Trend: The resurgence of home cooking, often driven by health and budget considerations, diverts potential customers from traditional dine-in establishments.

- Perception of Traditional Menus: Denny's menu, while popular, is often associated with comfort food that may not be perceived as aligning with current health trends by a segment of diners.

- Need for Menu Adaptation: To maintain relevance, Denny's must consider integrating more nutritious and diverse offerings that cater to contemporary dietary demands.

Decline in Family Dining Segment Foot Traffic

The family dining sector, Denny's core market, has seen a more pronounced drop in customer visits than other restaurant types since 2020. This trend, observed across the industry, suggests a lasting change in consumer dining habits, directly impacting Denny's established business approach.

Data from Q3 2024 indicates a 4% year-over-year decline in same-store traffic for casual dining restaurants, a segment heavily influenced by family dining trends. This highlights the persistent challenge Denny's faces in attracting customers back to traditional sit-down experiences.

- Industry-wide Decline: The broader family dining segment has experienced a steeper decline in customer traffic since 2020 compared to other restaurant categories.

- Shifting Consumer Habits: This indicates a fundamental shift in how consumers choose to dine out, posing a systemic threat to Denny's business model.

- Strategic Adaptation Needed: Overcoming this segment-specific challenge requires significant strategic adaptation to evolving consumer preferences.

The competitive landscape for Denny's is intensifying, with numerous casual dining, fast-casual, and fast-food chains vying for consumer dollars. This crowded market, coupled with evolving consumer preferences for healthier options and the persistent "eat-at-home" trend, presents a significant challenge to maintaining market share and driving traffic in 2024-2025.

Rising operational costs, particularly for commodities like eggs and labor due to wage increases, are directly impacting Denny's profit margins. Navigating these cost pressures while maintaining competitive pricing and value perception is a critical threat.

The family dining segment, Denny's primary market, has experienced a more pronounced decline in customer visits post-2020, with Q3 2024 data showing a 4% year-over-year drop in same-store traffic for casual dining. This indicates a fundamental shift in dining habits that Denny's must address.

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, encompassing Denny's financial statements, comprehensive market research reports, and expert industry analyses to provide a robust and insightful SWOT assessment.