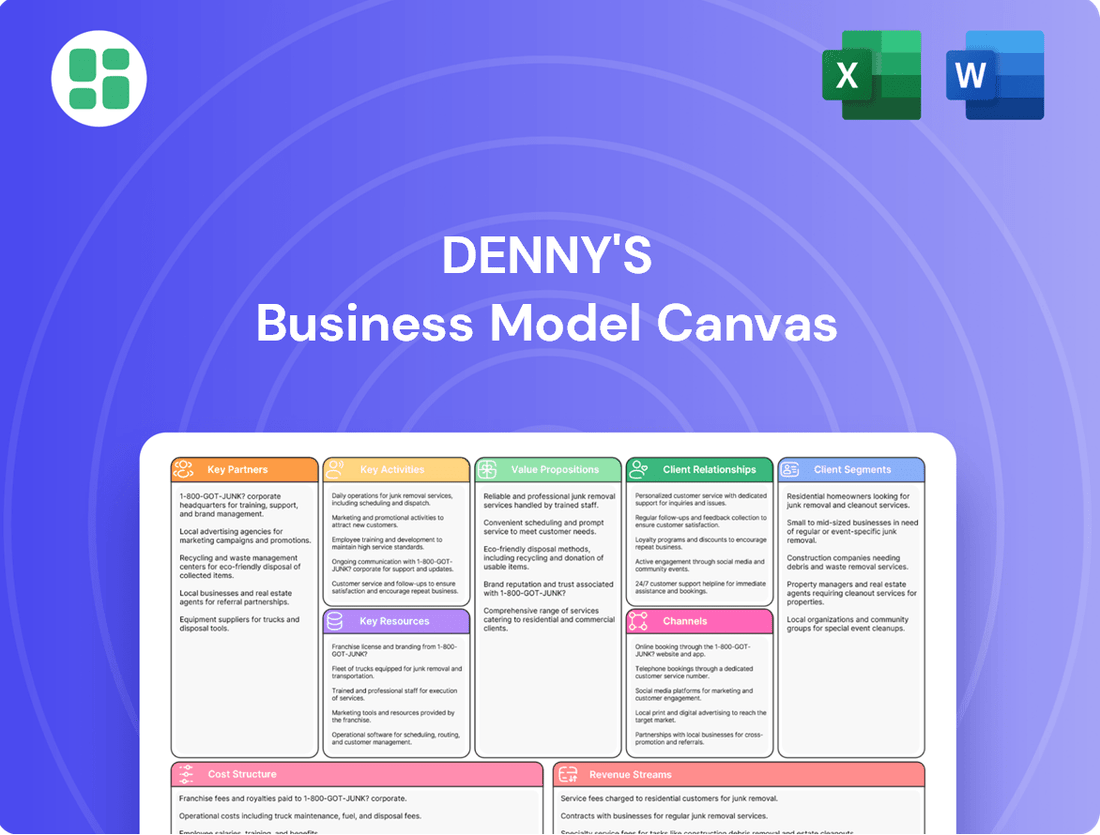

Denny's Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denny's Bundle

Unlock the full strategic blueprint behind Denny's business model. This in-depth Business Model Canvas reveals how the company drives value through its iconic diner experience and broad customer appeal, while effectively managing its cost structure and revenue streams. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a well-established casual dining chain.

Partnerships

Denny's relies heavily on its franchisees, with over 97% of its restaurants operating under this model. These partners are vital, injecting capital and overseeing day-to-day operations. Their commitment to brand standards is essential for Denny's extensive reach.

Denny's maintains crucial relationships with a wide array of food and beverage suppliers to consistently stock its extensive menu. These partnerships are fundamental for securing everything from fresh produce and quality meats to dairy products and a variety of beverages. In 2023, Denny's invested significantly in its supply chain, aiming for greater resilience and cost-efficiency across its vast network of over 1,500 locations.

The company's strategy involves fostering strong, collaborative ties with these suppliers to guarantee the high quality of ingredients and competitive pricing. Efficient and reliable delivery is paramount, ensuring that each restaurant has the necessary components to maintain menu consistency and customer satisfaction. Effective supplier management directly impacts Denny's operational costs and its ability to uphold the integrity of its brand.

Denny's increasingly relies on technology and digital platform providers to modernize its operations. Partnerships with companies like Olo are crucial for streamlining digital ordering and delivery, a segment that saw significant growth. For instance, Olo reported a 22% increase in digital revenue for its restaurant partners in 2023, highlighting the impact of such collaborations.

These collaborations extend to enhancing in-restaurant experiences through advanced point-of-sale (POS) systems and improving supply chain management with platforms like ArrowStream. ArrowStream's data analytics capabilities help optimize inventory and reduce waste, contributing to Denny's overall efficiency. In 2024, Denny's continued to explore these tech integrations to support initiatives like virtual brands, further expanding its digital footprint.

Marketing and Advertising Agencies

Denny's collaborates with marketing and advertising agencies to ensure its brand remains prominent and appeals to a broad customer base. These collaborations are crucial for crafting and implementing nationwide advertising initiatives, digital marketing plans, and promotional activities designed to boost customer visits and revenue.

In 2024, Denny's continued to invest in its marketing efforts, recognizing the importance of reaching consumers across various platforms. For instance, a significant portion of their marketing budget is allocated to digital channels, including social media campaigns and online advertising, which have proven effective in engaging younger demographics.

- Brand Visibility: Agencies help Denny's maintain a strong presence through creative advertising and consistent messaging across all media.

- Customer Acquisition: Targeted campaigns developed with agency partners aim to attract new customers and re-engage existing ones.

- Promotional Execution: Partnerships facilitate the successful rollout of limited-time offers and seasonal promotions that drive immediate sales.

Community and Charitable Organizations

Denny's actively partners with community and charitable organizations, notably its long-standing relationship with No Kid Hungry. This collaboration directly supports social responsibility efforts, aiming to combat childhood hunger. In 2024, Denny's continued its commitment, with specific campaign details often highlighted through their marketing efforts, reinforcing their dedication to giving back.

These strategic alliances significantly bolster Denny's public image, showcasing a commitment that extends beyond its core business operations. By contributing to local communities and aligning with causes like hunger relief, the company reinforces its brand values of inclusivity and service, resonating positively with a broad customer base.

- No Kid Hungry Partnership: Denny's has been a key partner, with past campaigns raising millions to support childhood hunger initiatives.

- Community Impact: Collaborations enhance local community engagement and brand perception.

- Brand Values Alignment: These partnerships reinforce Denny's commitment to service and inclusivity.

Denny's key partnerships extend to technology providers, enhancing digital ordering and operational efficiency. Collaborations with entities like Olo, which saw a 22% increase in digital revenue for its partners in 2023, are crucial for modernizing customer interactions and expanding the digital footprint. These alliances ensure seamless online experiences and support initiatives like virtual brands, vital for growth in the current market landscape.

What is included in the product

This Denny's Business Model Canvas outlines a strategy focused on broad customer appeal through accessible, affordable, and familiar diner-style food, leveraging a vast franchise network for widespread reach and operational efficiency.

Denny's Business Model Canvas acts as a pain point reliver by offering a clear, one-page snapshot of their operations, allowing for quick identification of areas needing improvement or innovation.

Activities

Restaurant Operations Management is the engine that drives Denny's, encompassing the daily execution across all locations, both company-owned and franchised. This core activity ensures that every customer experiences consistent quality and service, from the kitchen to the front of the house.

Key tasks within this domain include meticulous inventory management to minimize waste and ensure fresh ingredients, efficient staffing to meet demand, and upholding rigorous food safety and preparation standards. Denny's also prioritizes exceptional customer service, aiming to create a welcoming atmosphere for its patrons, often around the clock.

In 2024, Denny's continued to refine these operational processes. For instance, the company's focus on optimizing staffing and supply chains contributed to its ability to maintain its signature 24/7 service model in many of its restaurants, a critical differentiator in the casual dining sector.

Denny's actively manages its vast franchise network, a cornerstone of its operations. This involves delivering comprehensive training programs, essential operational guidance, and consistent brand adherence to all franchisees. Providing robust marketing collateral and ensuring strict compliance with franchise agreements are also key activities to maintain brand integrity and foster expansion.

The company's commitment to supporting its franchisees directly impacts system-wide performance and growth. For instance, in 2023, Denny's reported that approximately 90% of its domestic restaurants were franchised, highlighting the critical role of franchisee success. This ongoing support is vital for replicating the Denny's experience across all locations.

Denny's supply chain and procurement activities are crucial for maintaining consistent food quality and managing costs across its vast network of restaurants. This involves meticulous sourcing of ingredients, negotiating favorable terms with a diverse supplier base, and optimizing the logistics of getting those ingredients to each location efficiently.

In 2024, Denny's continued to focus on leveraging technology to enhance these operations. For instance, implementing advanced inventory management systems helps reduce waste and ensures that popular menu items are always available, directly impacting customer satisfaction and sales. This technological integration is key to streamlining procurement processes and maintaining cost-effectiveness.

Menu Innovation and Development

Denny's actively engages in menu innovation and development to stay ahead of changing consumer tastes and introduce exciting new options. This crucial activity involves thorough research and development for new dishes, rigorous testing of novel concepts, and the regular updating of existing menu items. The goal is to ensure the menu remains relevant, appealing to a broad range of customers, and drives traffic to their locations.

In 2024, Denny's continued its strategy of introducing limited-time offers (LTOs) and seasonal promotions. For instance, their "Build Your Own Pancake" options, a recurring favorite, often see updates with new flavor combinations and toppings, directly responding to customer feedback and social media trends. These LTOs are designed to create buzz and encourage repeat visits.

- Menu Innovation: Denny's focuses on creating new dishes and updating existing ones to meet evolving customer preferences.

- Research and Development: This includes testing new food concepts and ingredients to ensure market appeal.

- Customer Relevance: Menu updates aim to attract diverse demographics and maintain a competitive edge.

- Limited-Time Offers: Seasonal promotions and LTOs are key strategies to drive customer engagement and sales.

Marketing and Brand Building

Denny's actively works to maintain and enhance its brand through targeted marketing and advertising. This includes developing promotional campaigns that resonate with its customer base and managing a robust social media presence to foster engagement. In 2023, Denny's continued its focus on digital initiatives, aiming to reinforce its identity as America's Diner.

Key activities in marketing and brand building for Denny's include:

- Promotional Campaigns: Developing and executing compelling offers and limited-time menu items to drive traffic and sales.

- Digital Engagement: Utilizing social media platforms, email marketing, and its website to connect with customers and build loyalty.

- Public Relations: Managing the company's reputation and engaging with media to highlight positive brand attributes and community involvement.

- Brand Reinforcement: Consistently communicating the core values and experience of 'America's Diner' across all marketing channels.

Denny's key activities revolve around managing its extensive restaurant operations, supporting its franchise partners, and ensuring a robust supply chain. The company also prioritizes menu innovation and strategic brand building through marketing and advertising efforts to maintain its competitive edge in the casual dining market.

Full Version Awaits

Business Model Canvas

The Denny's Business Model Canvas preview you're seeing is the actual document you will receive upon purchase. This means you get an unedited, complete view of the strategic framework, allowing you to assess its value firsthand before committing. Rest assured, the file you access after buying will be identical in content and structure to this preview, providing you with a ready-to-use tool for your business analysis.

Resources

Denny's boasts significant brand recognition as America's Diner, a title earned over its 70-year history. This established reputation, coupled with its reputation for a casual, family-friendly atmosphere and 24/7 availability, acts as a powerful draw for customers and potential franchisees alike.

Denny's boasts an extensive franchise network, encompassing over 1,500 restaurants worldwide, a significant portion of which are franchised. This vast reach is a critical asset, allowing for broad market penetration and brand recognition.

The proprietary operational system is another vital resource. This includes valuable intellectual property such as trademarks, unique building designs, established recipes, comprehensive training programs, and rigorous operational standards that all franchisees must adhere to, ensuring consistency across the brand.

As of the first quarter of 2024, Denny's reported 1,540 system-wide locations, with approximately 1,375 of these being franchised. This highlights the significant reliance on their franchise partners for growth and operational execution.

Denny's relies heavily on its physical assets, including specialized kitchen equipment and dining area fixtures, to facilitate daily operations and serve its customers effectively. This foundational infrastructure is key to delivering the consistent dining experience guests expect.

The company recognizes the importance of continuous investment in its restaurant infrastructure. For example, Denny's has been actively updating its kitchen technology and point-of-sale (POS) systems. These upgrades are designed to streamline kitchen workflows, reduce order errors, and enhance the overall guest experience through faster service and more accurate billing.

In 2024, ongoing capital expenditures are allocated towards modernizing restaurants, which includes kitchen equipment upgrades and technology implementations. These investments are vital for maintaining operational efficiency and adapting to evolving customer expectations for speed and convenience in the casual dining sector.

Human Capital (Employees and Franchisees)

Denny's relies heavily on its diverse human capital, encompassing both its restaurant employees and its extensive network of franchisees. This skilled workforce is the backbone of the brand, responsible for delivering the consistent dining experience customers expect.

The operational expertise and dedication of restaurant staff, from cooks to servers, are crucial. Management teams further ensure smooth operations and customer satisfaction. In 2023, Denny's operated over 1,500 franchised and company-owned locations, highlighting the significant reach and reliance on these human resources.

Franchisees bring invaluable experience and local market knowledge, acting as key partners in Denny's growth and brand representation. Their commitment to operational standards and customer service directly impacts brand perception and profitability.

- Skilled Workforce: Restaurant staff, management, and franchisees possess operational and customer service expertise.

- Franchisee Network: Experienced franchisees contribute local market knowledge and operational oversight.

- Brand Delivery: Human capital is fundamental to providing the characteristic Denny's dining experience.

- Scale of Operations: Over 1,500 locations in 2023 underscore the importance of a robust human capital structure.

Technology and Digital Platforms

Denny's leverages significant investments in technology and digital platforms as key resources. These include cloud-based point-of-sale (POS) systems, robust online ordering platforms, and sophisticated supply chain management software. The company also utilizes virtual brand infrastructure to expand its reach and offerings.

These digital tools are crucial for enhancing operational efficiency across all locations and improving customer engagement through seamless digital experiences. For instance, their online ordering and delivery services, integrated with platforms like DoorDash and Grubhub, saw significant growth, with digital orders accounting for a substantial portion of their off-premise sales in recent years.

- Cloud-based POS Systems: Streamline operations and data collection.

- Online Ordering Platforms: Facilitate direct-to-consumer sales and third-party delivery partnerships.

- Supply Chain Management Software: Optimize inventory and reduce waste.

- Virtual Brand Infrastructure: Enable new revenue streams and market penetration without physical expansion.

Denny's key resources include its strong brand equity, an extensive franchise network, proprietary operational systems, physical restaurant assets, and a skilled human capital base. Technology and digital platforms are also critical, supporting online ordering, efficient operations, and virtual brand expansion.

| Resource Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Brand & Network | Brand Recognition, Franchise Network | Over 1,540 system-wide locations (Q1 2024), ~1,375 franchised. |

| Intellectual Property | Trademarks, Recipes, Training Programs, Operational Standards | Ensures brand consistency across all locations. |

| Physical Assets | Kitchen Equipment, Dining Area Fixtures | Ongoing capital expenditures in 2024 for modernization. |

| Human Capital | Restaurant Staff, Management, Franchisees | Over 1,500 locations in 2023 rely on skilled workforce and franchisee expertise. |

| Technology & Digital | POS Systems, Online Ordering, Virtual Brands | Enhances efficiency and customer engagement; virtual brands expand reach. |

Value Propositions

Denny's offers 24/7 dining at many of its locations, a key value proposition that sets it apart. This constant availability means customers can enjoy breakfast, lunch, or dinner whenever hunger strikes, regardless of the hour. This flexibility is crucial for individuals with non-traditional work schedules or those simply seeking a meal outside typical dining times.

This round-the-clock service is a significant differentiator in the casual dining sector. For instance, in 2023, Denny's reported that a substantial portion of its restaurants operated 24/7, highlighting the brand's commitment to this accessibility. This strategy directly addresses the needs of a broad customer base, from late-night travelers to early-morning workers.

Denny's diverse and extensive menu is a cornerstone of its business model, offering a wide array of classic American comfort food. This includes breakfast favorites available all day, alongside lunch and dinner selections, catering to a broad spectrum of tastes and dining occasions.

In 2024, Denny's continued to leverage this broad appeal, with its menu acting as a significant draw for families and individuals seeking familiar and satisfying meals. The all-day breakfast concept, a long-standing success, remains a key differentiator, contributing to consistent customer traffic.

Denny's positions itself as a value leader, consistently offering competitive pricing and attractive promotional deals. Examples like their '$2 $4 $6 $8' menu and 'Slams under $10' directly appeal to budget-conscious consumers. This commitment to affordability ensures accessible dining options for a broad customer base.

Casual and Welcoming Diner Experience

Denny's cultivates a casual and welcoming diner experience, emphasizing a non-judgmental, come-as-you-are atmosphere. This approach aims to make every guest feel comfortable and at ease, fostering a sense of community. In 2024, Denny's continued to highlight this value proposition through its marketing and in-restaurant experience, reinforcing its identity as a go-to spot for relaxed dining.

The brand's commitment to a friendly environment makes it a popular choice for a wide range of customers, from families to individuals seeking a familiar and dependable dining option. This welcoming ambiance is a cornerstone of their strategy to build customer loyalty and encourage repeat visits.

- Casual Atmosphere: Denny's prioritizes a relaxed setting where guests feel no pressure to dress up or conform to strict dining etiquette.

- Welcoming Staff: The company trains its employees to be friendly and attentive, contributing to the overall positive and inclusive vibe.

- Community Hub: This comfortable environment positions Denny's as a gathering place for friends and family, strengthening its connection with local communities.

Off-Premise and Digital Convenience

Denny's is making it easier than ever for customers to get their favorite meals. They've really leaned into online ordering and working with delivery services like DoorDash and Uber Eats. This means you can get your pancakes or burgers delivered right to your door, or swing by for a quick pickup.

Beyond just delivery, Denny's has also launched virtual brands. Think The Burger Den and The Meltdown. These are essentially delivery-only concepts operating out of existing Denny's kitchens. This strategy allows them to reach more customers and cater to different cravings without needing entirely new physical locations. In 2024, off-premise sales continued to be a significant driver for the restaurant industry, with many chains reporting strong growth in digital orders and delivery volume.

- Expanded Reach: Virtual brands and third-party delivery partnerships significantly broaden Denny's customer base beyond traditional dine-in traffic.

- Digital Integration: Online ordering systems streamline the customer experience for both pickup and delivery, enhancing convenience.

- Adaptability: The development of virtual brands demonstrates Denny's ability to adapt to evolving consumer preferences for off-premise dining.

- Revenue Diversification: These digital and off-premise channels provide new revenue streams, complementing the in-restaurant dining experience.

Denny's offers a broad and accessible menu, featuring classic American comfort food with a strong emphasis on all-day breakfast. This extensive selection caters to diverse tastes and dining occasions, making it a reliable choice for families and individuals alike. The brand's commitment to providing familiar and satisfying meals contributes significantly to its consistent customer appeal.

The value proposition of affordability is central to Denny's strategy, with competitive pricing and frequent promotions like the '$2 $4 $6 $8' menu. This focus on value ensures that Denny's remains an accessible dining option for a wide demographic, including budget-conscious consumers. In 2024, this emphasis on value continued to resonate with customers seeking cost-effective meal solutions.

Denny's cultivates a casual and welcoming diner atmosphere, promoting a come-as-you-are ethos that fosters comfort and inclusivity. This relaxed environment, coupled with friendly staff, positions Denny's as a community hub and a dependable choice for relaxed dining experiences. The brand actively reinforces this welcoming ambiance through its marketing and in-restaurant operations.

Denny's has significantly expanded its off-premise dining capabilities through online ordering and partnerships with third-party delivery services. The introduction of virtual brands like The Burger Den and The Meltdown further enhances this reach, allowing the company to cater to evolving consumer preferences for convenience and delivery. This digital integration is a key driver for growth, with off-premise sales showing robust performance in 2024.

Customer Relationships

Denny's cultivates a casual and accessible customer relationship, embodying a come-as-you-are philosophy that makes guests feel at home anytime. This approach prioritizes friendly, uncomplicated service, reinforcing the diner's welcoming atmosphere and encouraging frequent patronage. For example, Denny's reported over 1.1 billion guest visits in 2023, highlighting the success of its accessible service model in drawing a broad customer base.

Denny's actively cultivates customer loyalty through its Denny's Rewards program, offering members exclusive discounts and special deals. For instance, in early 2024, Denny's continued to feature promotions like the "Grand Slam Deal," providing a popular and affordable breakfast option that encourages frequent visits and builds a consistent customer base.

Denny's actively engages customers through its website, social media platforms like Facebook and Instagram, and its mobile ordering app. In 2024, the company continued to leverage these digital touchpoints to foster direct communication and gather valuable customer feedback.

This digital strategy enables Denny's to collect insights on menu preferences, service quality, and promotional effectiveness. For instance, online reviews and social media comments provide real-time data that informs operational adjustments and marketing campaigns, aiming to enhance the overall customer experience.

In-Restaurant Experience and Hospitality

Denny's fosters customer relationships through a consistently positive in-restaurant experience. This involves attentive service, a welcoming atmosphere, and efficient order processing, all crucial for guest satisfaction and repeat business.

In 2024, Denny's continued to emphasize hospitality as a core element of its customer relationship strategy. This focus aims to create memorable dining moments that go beyond mere food service.

- Attentive Staff: Well-trained servers are key to a positive interaction, anticipating needs and resolving issues promptly.

- Cleanliness and Ambiance: Maintaining a clean, comfortable, and inviting dining space enhances the overall guest perception.

- Order Accuracy and Speed: Efficient kitchen operations ensure guests receive their orders correctly and in a timely manner, minimizing frustration.

Community Involvement

Denny's actively cultivates goodwill and strengthens its connection with a wider customer base through strategic alliances with charitable organizations and participation in local community events. This engagement signifies a dedication that extends past mere food service, appealing to consumers who prioritize social responsibility.

- Community Partnerships: Denny's collaborates with various non-profits, such as Feeding America, to combat hunger. In 2024, Denny's continued its support, contributing to initiatives that provided millions of meals to those in need across the United States.

- Local Engagement: Franchisees often spearhead local efforts, supporting school programs, sponsoring youth sports teams, and participating in community festivals. This localized approach fosters a sense of belonging and reinforces Denny's as a neighborhood staple.

- Socially Conscious Appeal: By demonstrating a commitment to community well-being, Denny's resonates with a growing segment of consumers who prefer to patronize businesses that align with their values. This builds a positive brand image and customer loyalty.

Denny's maintains customer relationships through a welcoming, casual atmosphere and a focus on value, exemplified by its ongoing "Grand Slam" promotions. The Denny's Rewards program further incentivizes repeat business with exclusive deals and early access to new menu items.

Digital engagement is a key pillar, with active social media presence and a user-friendly mobile app facilitating direct communication and feedback collection. This allows Denny's to refine its offerings based on customer preferences and market trends observed throughout 2024.

| Customer Relationship Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Atmosphere & Service | Casual, welcoming, and friendly service. | Over 1.1 billion guest visits in 2023. |

| Loyalty Program | Denny's Rewards offers discounts and deals. | Continued promotion of value offerings like the "Grand Slam Deal" in early 2024. |

| Digital Engagement | Website, social media, and mobile app for communication and feedback. | Ongoing use of digital touchpoints to gather customer insights in 2024. |

Channels

Denny's primary channel is its extensive network of physical, dine-in restaurants, offering a classic full-service dining experience. These locations are the heart of the brand, providing direct customer interaction and the familiar, comfortable diner atmosphere that patrons expect. As of the first quarter of 2024, Denny's operated approximately 1,500 franchised and company-owned locations across the United States, with a continued focus on maintaining and optimizing this physical footprint.

Denny's leverages its official website and dedicated mobile app for direct online ordering, a crucial component of its customer engagement strategy. This digital pathway allows patrons to easily select menu items for convenient pickup or delivery, significantly enhancing accessibility to their favorite comfort foods.

In 2024, Denny's continued to invest in its digital infrastructure, recognizing the growing consumer preference for online food ordering. While specific app usage figures for Denny's in 2024 aren't publicly detailed, the broader restaurant industry saw a substantial increase in digital orders. For instance, industry reports indicated that by the end of 2023, over 60% of all restaurant orders were placed digitally, a trend that has undoubtedly continued to climb into 2024.

Denny's actively utilizes third-party delivery platforms like DoorDash, Uber Eats, and Grubhub to broaden its customer base and tap into the expanding food delivery market. This strategic move allows customers to easily order their favorite Denny's meals through familiar apps, significantly enhancing convenience.

In 2023, the U.S. online food delivery market was valued at approximately $30 billion, showcasing the substantial opportunity these platforms represent for restaurants like Denny's. By participating, Denny's aims to capture a larger share of this lucrative segment, driving incremental sales and improving market penetration beyond its traditional dine-in model.

Virtual Brands (Ghost Kitchens)

Denny's utilizes virtual brands, such as The Burger Den and The Meltdown, as a strategic channel. These delivery-only concepts operate from existing Denny's restaurant kitchens, effectively expanding their reach and catering to the growing demand for off-premise dining. This approach allows Denny's to test new menu items and target different customer demographics without the significant investment required for new physical locations.

By leveraging their established infrastructure, Denny's can efficiently manage the production and delivery of these virtual brands. This strategy is particularly effective in urban areas where delivery services are prevalent. In 2023, the US ghost kitchen market was valued at approximately $4 billion, with projections indicating continued growth, underscoring the viability of this channel.

- Channel: Virtual Brands (Ghost Kitchens)

- Description: Delivery-only food concepts operating from existing Denny's kitchens.

- Key Benefit: Expands market reach and revenue streams with minimal capital expenditure.

- Market Context: Leverages the significant growth in the off-premise dining and food delivery sector.

Advertising and Marketing Media

Denny's utilizes a multi-faceted approach to advertising and marketing media, ensuring broad customer reach and engagement. National television campaigns remain a cornerstone, effectively communicating new menu items and value propositions to a wide demographic. In 2024, Denny's continued to invest in these traditional channels to reinforce brand messaging.

Social media advertising and digital ads are increasingly vital for Denny's, allowing for targeted campaigns and direct interaction with customers. These platforms are used to highlight limited-time offers, promote seasonal menus, and build community around the brand. For instance, a 2024 campaign might feature user-generated content to boost engagement.

In-store promotions play a crucial role in driving immediate traffic and encouraging repeat visits. Denny's frequently offers special deals, loyalty program incentives, and event-specific promotions at the restaurant level. These efforts complement broader advertising strategies by converting awareness into action.

- National Television Campaigns: Broad reach for brand messaging and new product introductions.

- Social Media Advertising: Targeted engagement, community building, and real-time promotions.

- Digital Ads: Online visibility through search, display, and video advertising.

- In-Store Promotions: Driving immediate sales and customer loyalty through on-site offers.

Denny's physical locations serve as its primary channel, offering a direct, dine-in experience. As of Q1 2024, the company operated roughly 1,500 restaurants across the U.S., a testament to its enduring brick-and-mortar presence. This extensive network allows for consistent brand interaction and reinforces its core diner concept.

The company's digital channels, including its website and mobile app, facilitate direct online ordering for pickup and delivery. This digital pathway is crucial for customer convenience and accessibility, reflecting a broader industry trend where digital orders continue to surge. By the end of 2023, over 60% of restaurant orders were digital, a figure expected to grow through 2024.

Denny's also leverages third-party delivery platforms like DoorDash and Uber Eats to expand its reach. This strategy taps into the substantial U.S. online food delivery market, valued at approximately $30 billion in 2023, driving incremental sales and market penetration beyond its traditional dine-in model.

Virtual brands, such as The Burger Den, operate from existing Denny's kitchens as delivery-only concepts. This channel capitalizes on the growing off-premise dining market, estimated by the U.S. ghost kitchen market's $4 billion valuation in 2023, allowing for efficient expansion and testing of new offerings.

| Channel Type | Description | Key Data Point (2023/2024) | Strategic Importance |

| Physical Restaurants | Dine-in locations | Approx. 1,500 U.S. locations (Q1 2024) | Core brand experience, direct customer interaction |

| Official Website/App | Direct online ordering | 60%+ of restaurant orders digital (End of 2023) | Customer convenience, accessibility |

| Third-Party Delivery | Partnerships with DoorDash, Uber Eats, etc. | $30 billion U.S. online food delivery market (2023) | Expanded reach, tap into delivery market |

| Virtual Brands | Delivery-only concepts from existing kitchens | $4 billion U.S. ghost kitchen market (2023) | Off-premise growth, minimal capital expenditure |

Customer Segments

Denny's primarily targets families and individuals looking for a relaxed, budget-friendly, and hospitable place to eat. This broad segment appreciates the extensive menu, which offers something for everyone, from picky eaters to those with specific dietary needs, solidifying its role as a go-to spot for family outings.

In 2024, Denny's continued to focus on value, a key driver for families and casual diners. The brand's consistent affordability, often highlighted in their promotional offers and everyday pricing, makes it an attractive option for households managing their budgets, especially when dining out.

Denny's 24/7 operations in many of its over 1,500 locations cater to a distinct customer segment: the late-night and early morning crowd. This includes essential workers on night shifts, travelers needing a reliable meal at odd hours, and individuals simply seeking comfort food beyond typical meal times.

This segment represents a crucial revenue stream, particularly during off-peak hours when other establishments may be closed. For instance, in 2024, Denny's continued to leverage its accessibility, with many franchisees reporting steady business from this demographic, especially in areas with significant industrial or transportation hubs.

Value-conscious consumers represent a significant portion of Denny's customer base. These individuals and families actively seek out dining experiences that offer substantial meals at budget-friendly prices. Denny's consistent focus on value menus and attractive promotional offers, such as their Grand Slam deals, directly caters to this demographic's desire for affordability and generous portions.

Travelers and Commuters

Travelers and commuters represent a significant customer segment for Denny's. Many of its restaurants are strategically located along major highways and near travel hubs, offering a convenient and predictable dining experience for those on the move. This accessibility is crucial for individuals needing a quick, reliable meal during long journeys or daily commutes.

This group often prioritizes consistency and familiarity. They seek out establishments that offer a dependable menu, knowing what to expect regardless of their location. Denny's broad appeal and consistent brand promise resonate well with this need for reliability on the road.

In 2024, the restaurant industry, including casual dining chains like Denny's, continued to see a strong demand from travelers. Factors such as increased leisure travel and a return to pre-pandemic commuting patterns in many areas contributed to this. For instance, U.S. road travel, a key indicator for highway-adjacent businesses, saw robust activity throughout the year.

- Convenient Locations: Denny's restaurants are frequently found along major roadways, making them easily accessible for travelers and commuters.

- Reliable Dining: This segment values the consistent menu and service Denny's provides, offering a predictable meal experience.

- On-the-Go Needs: Many travelers and commuters require quick service and readily available options, which Denny's aims to deliver.

- Brand Familiarity: The well-established brand offers a sense of comfort and trust for customers who may be far from home.

Millennials and Gen Z (Increasingly Diverse)

Denny's is making a concerted effort to capture the attention of younger diners, with Millennials and Gen Z increasingly forming a significant part of its clientele. This demographic is particularly responsive to Denny's value-driven menu options and the convenience of off-premise dining. By 2024, Denny's reported that digital orders, including those through its virtual brands, accounted for a substantial and growing percentage of its total sales, reflecting the preferences of these younger consumers.

These younger generations are drawn to Denny's not just for its affordability but also for its adaptability to modern dining habits. The company's investment in digital platforms and the introduction of virtual brands have been key strategies in engaging these segments. For instance, the success of virtual brands like The Burger Den and The Meltdown by Denny's demonstrates an understanding of how to reach consumers who prioritize convenience and digital ordering experiences.

- Value Proposition: Millennials and Gen Z are attracted to Denny's affordable menu items and promotional deals, which align with their budget-conscious spending habits.

- Off-Premise Dining: The growing demand for takeout and delivery services among younger consumers is met by Denny's expanding off-premise capabilities.

- Digital Engagement: Virtual brands and robust online ordering platforms are crucial for capturing the attention and business of digitally native Millennials and Gen Z.

- Brand Perception: Denny's is working to evolve its brand image to resonate more strongly with younger demographics, emphasizing inclusivity and modern dining experiences.

Denny's customer segments are diverse, encompassing families seeking value and a relaxed atmosphere, and individuals looking for affordable, accessible meals anytime. The brand also actively targets younger demographics like Millennials and Gen Z by enhancing its digital offerings and virtual brands.

Value-conscious consumers remain a core group, attracted by Denny's consistent affordability and generous portions. Travelers and commuters rely on Denny's convenient locations and predictable menu for reliable dining on the go.

In 2024, Denny's continued to leverage its 24/7 accessibility to serve late-night workers and travelers. The company's strategic focus on digital orders and virtual brands like The Burger Den and The Meltdown resonated particularly well with younger, digitally-savvy customers.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Families & Casual Diners | Seek value, relaxed atmosphere, broad menu appeal. | Continued focus on affordability and family-friendly promotions. |

| Late-Night & Early Morning Crowd | Need for 24/7 accessibility, essential workers, travelers. | Many locations maintained round-the-clock operations, serving off-peak demand. |

| Value-Conscious Consumers | Prioritize affordability, large portions, promotional deals. | Grand Slam deals and value menus remained central to attracting this segment. |

| Travelers & Commuters | Need convenience, consistency, familiarity along travel routes. | Strategic highway locations supported consistent demand driven by leisure and business travel. |

| Millennials & Gen Z | Respond to digital convenience, off-premise dining, evolving brand image. | Digital orders and virtual brands saw substantial growth, indicating strong engagement. |

Cost Structure

Food and beverage costs are a substantial component of Denny's operating expenses, directly tied to the ingredients needed for their diverse menu. These costs are variable, meaning they fluctuate with sales volume and ingredient prices.

For the fiscal year 2023, Denny's reported its Cost of Sales, which primarily includes food and beverage costs, at approximately $1.1 billion. This figure highlights the significant investment in sourcing ingredients to prepare their meals, a critical area for cost management.

Effective management of supplier contracts and efficient inventory control are paramount for Denny's to keep these costs within a target range, often between 25% to 35% of total revenue, ensuring profitability.

Labor and payroll expenses are a significant component of Denny's cost structure. These costs encompass wages for hourly staff, salaries for management, and the associated expenses like benefits, payroll taxes, and training programs. For instance, in 2023, Denny's reported that labor costs represented a substantial portion of their operating expenses, a trend that continued into early 2024.

The company's commitment to 24/7 operations means maintaining adequate staffing levels around the clock, which can be challenging and costly, especially with ongoing labor inflation. Denny's has been actively managing these costs through various initiatives, including optimizing staffing models and investing in training to improve efficiency and retention, as noted in their investor reports throughout 2023 and into 2024.

Occupancy costs are a significant drain on Denny's resources, encompassing rent or mortgage payments for their numerous restaurant locations, essential utility bills like electricity and water, and the continuous upkeep of their facilities and equipment. These expenses are not static; they fluctuate based on geographic location and the specific type of property leased or owned.

In 2024, Denny's operates a vast network of restaurants, many of which are franchised, impacting how these costs are directly borne. For company-owned locations, rent and property taxes can represent a substantial fixed cost. Utility expenses, particularly electricity for lighting and kitchen operations, are variable and influenced by energy prices and seasonal demand.

Maintenance and repair costs are ongoing, covering everything from routine equipment servicing to more significant structural repairs. These are crucial for maintaining operational efficiency and customer experience, but they add another layer to the occupancy cost structure. For instance, a 2023 report indicated that restaurant chains often allocate between 2% to 6% of their revenue towards occupancy-related expenses, a figure Denny's likely mirrors.

Franchise-Related Expenses and Royalties

Denny's franchise-related expenses involve significant payments to the franchisor. These costs are crucial for maintaining brand consistency and accessing corporate resources. For franchised locations, this includes initial franchise fees, which can be substantial, and ongoing royalty fees. These royalty fees are typically calculated as a percentage of gross sales, commonly ranging from 4% to 5%.

Beyond royalties, franchisees also contribute to advertising and marketing efforts. An additional fee, usually between 3% and 4% of gross sales, is allocated to advertising funds. These combined fees directly support the corporate infrastructure and contribute to the overall brand building and promotional activities that benefit all Denny's locations.

- Royalty Fees: Typically 4-5% of gross sales paid to the franchisor.

- Advertising Fees: Generally 3-4% of gross sales for brand promotion.

- Initial Franchise Fees: A one-time payment required to join the franchise system.

- Contribution to Corporate Support: These fees fund the franchisor's operational and marketing infrastructure.

Marketing and Advertising Costs

Denny's significant investment in marketing and advertising is a core component of its cost structure. This includes substantial expenditures on national and local marketing campaigns, digital advertising across various platforms, and the creation of promotional materials. These efforts are crucial for driving customer traffic to its restaurants and ensuring the brand remains highly visible in the highly competitive casual dining sector.

These marketing initiatives are not just about attracting new customers but also about retaining existing ones through loyalty programs and special offers. For instance, Denny's frequently runs promotions tied to holidays or specific events, requiring budget allocation for creative development and media placement. In 2024, the company continued to leverage digital channels, including social media and targeted online ads, to reach a broader audience and engage with consumers more directly.

- National Campaigns: Expenditures on broad-reaching advertising to build overall brand awareness.

- Local Marketing: Targeted efforts at the franchise or individual restaurant level to drive local traffic.

- Digital Advertising: Investment in online ads, social media marketing, and search engine optimization.

- Promotional Materials: Costs associated with menus, flyers, and in-store signage for special offers.

Technology and information systems represent a growing segment of Denny's costs. This includes investments in point-of-sale (POS) systems, kitchen display systems (KDS), online ordering platforms, and customer relationship management (CRM) software. These technologies are vital for operational efficiency, data collection, and enhancing the customer experience. For example, in 2023 and continuing into 2024, Denny's has focused on upgrading its digital infrastructure to support its omnichannel strategy.

Ongoing maintenance, software licensing fees, and the potential need for system upgrades contribute to these technology costs. The company also incurs expenses related to cybersecurity measures to protect sensitive customer and operational data. As of early 2024, the industry trend shows increased spending on technology to streamline operations and gather customer insights, a direction Denny's is actively pursuing.

General and administrative (G&A) expenses form another key part of Denny's cost structure. These include costs not directly tied to a specific restaurant operation but necessary for the overall business functioning. This encompasses executive salaries, corporate office expenses, legal fees, accounting services, and insurance. These costs are essential for managing the brand, ensuring compliance, and supporting the franchise network.

In 2023, Denny's reported G&A expenses as a necessary overhead to support its extensive operations. These costs are managed to ensure they remain lean while providing the necessary corporate oversight and support. For instance, the company’s efforts in 2024 to streamline corporate functions aim to optimize these G&A expenditures without compromising essential business support.

| Cost Category | Description | Typical Range/Impact | 2023/2024 Relevance |

|---|---|---|---|

| Food & Beverage | Ingredients for menu items. | 25-35% of revenue. | Approx. $1.1 billion in Cost of Sales (2023). |

| Labor & Payroll | Wages, salaries, benefits, taxes. | Significant portion of operating expenses. | Managed through staffing optimization and training amid inflation. |

| Occupancy | Rent, utilities, maintenance. | 2-6% of revenue (industry average). | Impacted by geographic location and property type; utilities are variable. |

| Franchise Fees | Royalties, advertising contributions. | 4-5% royalties, 3-4% advertising. | Funds corporate infrastructure and brand promotion. |

| Marketing & Advertising | National/local campaigns, digital ads. | Crucial for brand visibility and traffic. | Continued investment in digital channels in 2024. |

| Technology & IT | POS, KDS, online platforms, cybersecurity. | Growing investment for efficiency and CX. | Upgrading digital infrastructure for omnichannel strategy. |

| General & Administrative | Corporate overhead, salaries, legal, accounting. | Essential for business management and support. | Focus on streamlining corporate functions in 2024. |

Revenue Streams

Company restaurant sales are a primary driver of Denny's revenue, stemming directly from the food and beverages purchased at their company-owned locations and Keke's Breakfast Cafe. This segment is distinct from income generated through their franchise operations.

For the fiscal year ending June 30, 2024, Denny's reported that company restaurant sales contributed a significant portion to their overall financial performance, underscoring the importance of direct customer transactions within their own establishments.

Franchise and license revenue, primarily through ongoing royalty fees, represents a significant and consistent income source for Denny's. These fees are typically calculated as a percentage of each franchisee's gross sales, ensuring that as the franchised network grows and performs better, Denny's revenue also increases.

In 2024, Denny's continued to rely on this model, with royalties from its extensive network of franchised locations forming a foundational element of its financial structure. This stream provides stability and predictability, as it's directly tied to the sales performance of over 1,500 franchised units globally.

Denny's generates revenue through initial franchise fees, a one-time payment new franchisees make to secure the right to operate a Denny's restaurant and leverage its established brand and operational system.

These upfront fees are crucial for Denny's as they represent an immediate influx of capital, contributing to the company's growth and expansion efforts by funding new restaurant openings.

While specific figures for 2024 are not publicly detailed, historical data shows franchise fees are a standard component of franchise agreements, contributing to the overall financial health of franchisors.

Advertising and Marketing Contributions

Denny's generates significant revenue from advertising and marketing contributions, primarily from its franchisees. These contributions are typically structured as a percentage of each franchisee's gross sales, creating a pooled fund for system-wide marketing initiatives. This collective approach ensures a robust marketing budget that benefits the entire brand.

In 2023, Denny's reported that its franchisees contributed approximately 4% of their gross sales to the advertising fund. This generated substantial income, allowing Denny's to invest in national campaigns and promotional activities designed to drive customer traffic and enhance brand visibility. For instance, a portion of these funds supported the popular "Grand Slam" promotions, a key driver of sales.

- Franchisee Contributions: Fees paid by franchisees, usually a percentage of their gross sales, fund the advertising and marketing efforts.

- System-Wide Marketing: These contributions create a collective marketing budget for brand-wide campaigns and promotions.

- 2023 Data: Franchisees contributed around 4% of gross sales to the advertising fund, supporting national marketing efforts.

- Brand Enhancement: The pooled funds enable Denny's to execute impactful marketing strategies that benefit the entire franchise network.

Off-Premise Sales (Takeout and Delivery)

Off-premise sales, encompassing both takeout and delivery, represent a significant and growing revenue stream for Denny's. This channel captures revenue from orders placed directly with the restaurant, as well as those facilitated through online ordering platforms and third-party delivery services. In 2024, Denny's continued to see strong performance in this area, adapting to consumer preferences for convenience.

The expansion of virtual brands operating out of existing Denny's kitchens further diversifies off-premise revenue. These brands, often focused on specific cuisines or delivery-only concepts, leverage existing infrastructure to reach a broader customer base. This strategy has proven effective in capturing additional market share and maximizing operational efficiency.

- Takeout Orders: Revenue generated from customers picking up food directly from Denny's locations.

- Delivery Sales: Income derived from orders delivered to customers' homes or workplaces, including those managed through third-party apps.

- Virtual Brands: Revenue streams from delivery-only brands operating from Denny's kitchens, expanding the menu's reach.

- Digital Platform Growth: Continued investment in and reliance on online ordering and delivery platforms to drive sales volume.

Denny's revenue streams are primarily driven by company-owned restaurant sales and franchise-related income. Company restaurant sales directly reflect customer purchases at Denny's and Keke's Breakfast Cafe locations. Franchise and license revenue, generated through royalty fees and initial franchise fees, provides a stable and predictable income base.

In fiscal year 2024, Denny's continued to benefit from these diverse revenue channels. Franchisees contribute to a system-wide advertising fund, typically around 4% of gross sales, which supports brand-wide marketing initiatives and promotions.

Off-premise sales, including takeout and delivery, are a growing segment. The company also leverages virtual brands operating from existing kitchens to capture additional revenue and reach a wider customer base.

| Revenue Stream | Description | Key Driver | 2023/2024 Relevance |

|---|---|---|---|

| Company Restaurant Sales | Revenue from food and beverage sales at company-owned locations. | Customer traffic and average check size. | Primary revenue driver, significant portion of overall financial performance. |

| Franchise Royalties | Ongoing fees paid by franchisees as a percentage of gross sales. | Performance of franchised locations. | Provides stability and predictability, tied to over 1,500 global franchised units. |

| Franchise Fees | One-time payments from new franchisees for brand and operational rights. | New restaurant openings and expansion. | Immediate capital influx for growth and funding new locations. |

| Advertising & Marketing Contributions | Franchisee contributions to a pooled fund for system-wide marketing. | Franchisee sales volume. | In 2023, franchisees contributed ~4% of gross sales to fund national campaigns. |

| Off-Premise Sales (Takeout & Delivery) | Revenue from orders picked up or delivered, including via third-party apps. | Consumer demand for convenience and digital ordering. | Significant and growing segment, adapting to consumer preferences. |

| Virtual Brands | Revenue from delivery-only brands operating out of existing Denny's kitchens. | Leveraging existing infrastructure for broader reach. | Diversifies off-premise revenue and maximizes operational efficiency. |

Business Model Canvas Data Sources

The Denny's Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer dining habits, and competitive analysis of the fast-casual restaurant sector. These diverse data sources ensure a comprehensive and accurate representation of Denny's strategic framework.