Denny's Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denny's Bundle

Denny's masterfully blends its familiar, comfort-food Product offerings with accessible Price points, ensuring broad appeal. Their extensive Place strategy, featuring ubiquitous locations, makes them a convenient choice for a wide demographic.

Dive deeper into how Denny's leverages its extensive menu, value-driven pricing, and widespread accessibility to capture market share. This analysis reveals the intricate interplay of their marketing efforts.

Unlock the full Denny's 4Ps Marketing Mix Analysis and gain a strategic advantage. Discover actionable insights for your own business planning, benchmarking, or academic projects.

Product

Denny's offers a comprehensive menu that spans breakfast, lunch, and dinner, with many locations operating around the clock. This extensive selection caters to diverse dining needs at any hour, featuring beloved diner classics like the Grand Slam. Recent additions and promotions, such as the $2-$4-$6-$8 value menu and seasonal items like Salted Caramel Banana Pancakes, aim to attract a broad customer base.

Denny's has revitalized its value menu, introducing a $10 tier alongside its established $2, $4, $6, and $8 options. This expansion reinforces their commitment to value leadership, a critical strategy in the current economic climate where consumers are highly sensitive to inflation.

This strategic menu development is designed to draw in a broad base of value-seeking customers. By offering well-portioned meals at accessible price points, Denny's addresses the ongoing concerns about rising food costs, aiming to provide affordability without compromising on satisfaction.

Furthermore, the re-engineered offerings on the value menu are intended to boost franchisee profitability. This dual focus on customer attraction and operational efficiency is key to Denny's ongoing success and market positioning, especially as they navigate the 2024-2025 period.

Denny's has strategically expanded its virtual brand portfolio, including concepts like Banda Burrito, Meltdown, and Burger Den. These brands leverage existing Denny's kitchen infrastructure to serve the growing off-premises dining market.

This expansion allows Denny's to tap into new customer demographics and generate incremental revenue, especially during dinner and late-night periods. The virtual brands are designed to complement, rather than cannibalize, the core dine-in business.

In 2024, the virtual brands are projected to contribute significantly to Denny's overall sales growth, with digital orders making up an increasing percentage of total revenue. This initiative aligns with the broader industry trend of ghost kitchens and delivery-optimized menus.

Enhanced Guest Experience Through Remodels

Denny's is actively enhancing its product offering through strategic remodels, focusing on the 'Diner 2.0' initiative. This program aims to modernize the restaurant environment, directly impacting the guest experience. By the end of 2024, 23 locations were updated, reflecting a tangible investment in physical product improvement.

These remodels are designed to boost average unit volumes and customer satisfaction. Early results from test markets are encouraging, showing positive impacts on sales and customer traffic. This demonstrates a clear link between the physical remodel and improved operational performance.

- Diner 2.0 Program: Denny's is revitalizing its restaurant design.

- 2024 Remodels: 23 locations were upgraded in the past year.

- Objective: To modernize dining spaces and elevate the guest experience.

- Impact: Promising sales and traffic increases observed in test markets.

Menu Simplification and Quality Improvements

Denny's focused on menu simplification in 2024, reducing complex customization options and 'Build Your Own' sections to spotlight high-demand, profitable dishes. This strategic move is designed to boost operational efficiency while ensuring guest satisfaction remains high. The company also significantly enhanced ingredient quality, notably investing $8 million to improve its bacon offerings.

This approach to product strategy is directly supported by Denny's financial performance and market positioning.

- Menu Streamlining: Reduced complexity to enhance order accuracy and speed of service.

- Quality Investment: $8 million allocated to improve core ingredients like bacon, aiming for premium taste perception.

- Profitability Focus: Highlighting popular and profitable items to drive higher average checks.

- Operational Efficiency: Minimizing extensive customization to reduce kitchen prep time and waste.

Denny's product strategy in 2024-2025 centers on a revitalized, value-driven menu and enhanced quality. The introduction of a $10 tier to its existing $2-$4-$6-$8 value menu directly addresses inflation-sensitive consumers, aiming to drive traffic and sales. The company also significantly invested in ingredient quality, notably an $8 million upgrade to its bacon, enhancing the perceived value and taste of core offerings. Furthermore, the expansion of virtual brands like Burger Den and Meltdown leverages existing infrastructure to capture off-premises dining opportunities, contributing to incremental revenue and tapping into new customer segments.

| Product Strategy Element | Description | 2024/2025 Focus |

|---|---|---|

| Menu Variety & Value | Extensive breakfast, lunch, dinner options; value menus | Expansion of value menu to include $10 tier; seasonal promotions |

| Quality Enhancement | Focus on core ingredient improvement | $8 million investment in bacon quality |

| Virtual Brands | Leveraging kitchen infrastructure for off-premises dining | Growth of concepts like Burger Den, Meltdown, Banda Burrito |

| Diner 2.0 Initiative | Modernizing restaurant design and guest experience | 23 locations remodeled by end of 2024; focus on sales and traffic increases |

What is included in the product

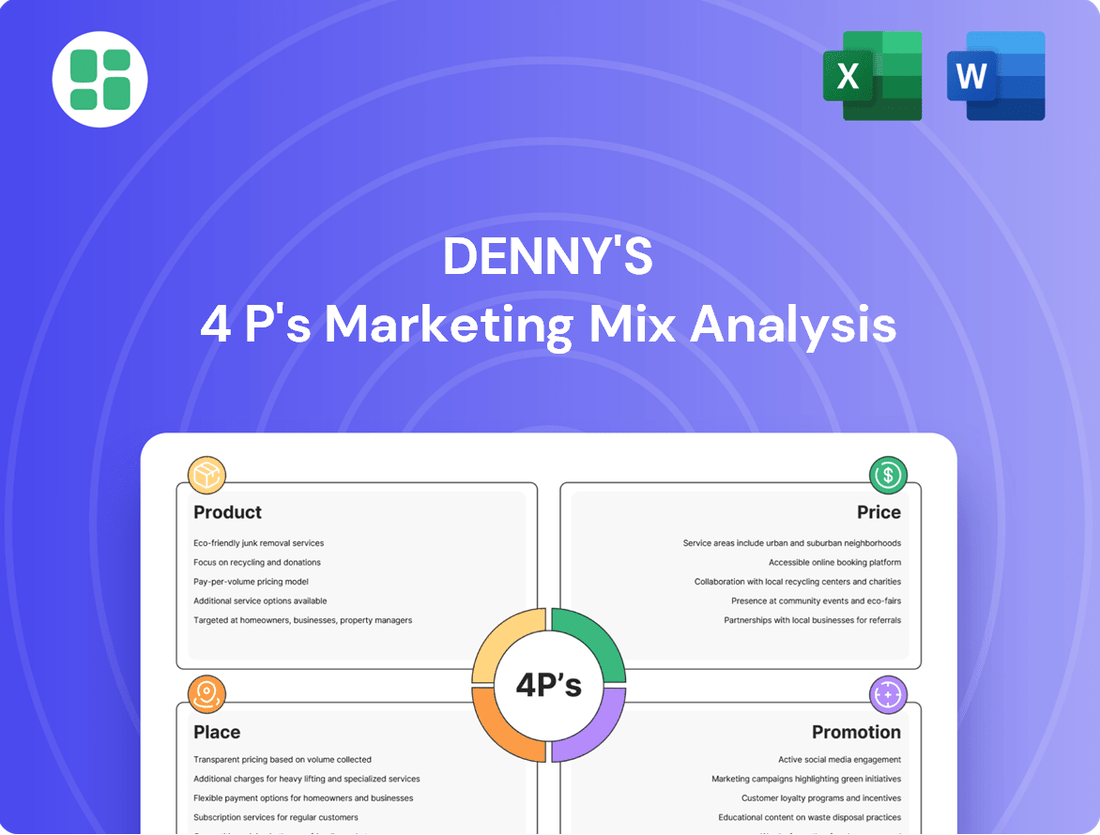

This analysis provides a comprehensive overview of Denny's marketing strategies, examining their Product, Price, Place, and Promotion tactics to understand their market positioning and competitive advantages.

Simplifies complex marketing strategies into actionable insights, alleviating the burden of deciphering Denny's 4Ps for quick decision-making.

Place

Denny's boasts an extensive restaurant network, solidifying its position as a major player in the full-service family dining sector. As of March 26, 2025, the company operated a substantial 1,557 locations, a figure encompassing both franchised and company-owned establishments. This broad footprint, spanning 49 U.S. states and extending into international markets, underscores Denny's commitment to widespread customer accessibility.

Denny's is actively optimizing its store portfolio as part of its place strategy. The company plans to close between 70 and 90 underperforming restaurants in 2025, building on the 88 closures that occurred in 2024. This strategic pruning is designed to bolster the overall health of the franchise system.

These closures are not just about reducing footprint; they are a deliberate move to improve franchisee cash flow. By eliminating less profitable locations, Denny's can redirect resources towards enhancing existing, high-potential units and undertaking modern remodels. This focus on revitalizing profitable locations is key to long-term growth and market presence.

Denny's is strategically prioritizing off-premises dining, a crucial growth engine. This channel, encompassing both takeout and delivery via first- and third-party platforms, consistently contributes around 20-21% of total sales, a figure holding steady through 2024 and into Q2 2025.

This sustained performance highlights Denny's commitment to convenience, driven by robust digital ordering capabilities and the innovative use of virtual brands. This focus on accessible dining solutions sets them apart within the competitive family dining landscape.

Geographic Expansion of Sister Brand

Denny's is strategically expanding its sister brand, Keke's Breakfast Cafe, into new geographic territories to broaden its market reach. This expansion is a key element of their growth strategy, aiming to tap into the lucrative breakfast and brunch segment across the United States.

In 2024, Keke's Breakfast Cafe saw significant growth with the opening of 12 new locations. This expansion initiative has introduced the brand to five new states, including California, Colorado, Nevada, Tennessee, and Texas, diversifying its footprint beyond its initial Florida base.

- 2024 Openings: 12 new Keke's Breakfast Cafe locations launched.

- New States Entered: California, Colorado, Nevada, Tennessee, and Texas.

- Strategic Aim: Capture new market share and cater specifically to the breakfast-focused consumer.

Digital Infrastructure Investments

Denny's is channeling significant capital into its digital infrastructure, aiming to bolster organic digital sales and elevate the customer's online journey. This strategic push includes refining their online ordering systems and enhancing search engine optimization to drive more website traffic. A key initiative is the development of a new, personalized loyalty program slated for release in the latter half of 2025.

These digital enhancements are critical for meeting evolving consumer expectations. For instance, by Q1 2024, digital orders already represented a substantial portion of Denny's revenue, and continued investment is expected to push this figure higher. The upcoming loyalty program, designed with personalized offers, is anticipated to significantly boost customer retention and increase the average check size.

- Digital Sales Growth: Investments focus on platforms that directly contribute to increasing online and app-based orders.

- Enhanced Guest Experience: Optimizing the digital interface and ordering process for seamless customer interaction.

- SEO Improvements: Driving organic traffic to Denny's digital properties through better search engine visibility.

- Personalized Loyalty Program: A new program launching in late 2025 aims to foster deeper customer engagement and repeat business.

Denny's extensive network of 1,557 locations as of March 2025 provides broad accessibility across the US and internationally. The company is strategically refining this footprint by closing 70-90 underperforming restaurants in 2025, following 88 closures in 2024, to enhance franchisee profitability. This focus on optimizing locations supports investments in high-potential units and modern remodels.

Denny's is also leveraging its sister brand, Keke's Breakfast Cafe, to expand into new markets, opening 12 locations in 2024 across five new states like California and Texas. Simultaneously, significant investment in digital infrastructure, including a new loyalty program planned for late 2025, aims to boost organic digital sales and customer retention, with off-premises dining consistently contributing around 20-21% of total sales through Q2 2025.

| Location Metric | 2024 Data | 2025 Projection | 2025 Focus |

|---|---|---|---|

| Total Restaurants (Mar 2025) | 1,557 | N/A | Broad Accessibility |

| Restaurant Closures | 88 | 70-90 | Portfolio Optimization |

| Keke's Openings | 12 | N/A | Market Expansion |

| Off-Premises Sales % | ~20-21% | ~20-21% | Digital Channel Growth |

Same Document Delivered

Denny's 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Denny's 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

Denny's champions value leadership, notably with its revived $2 $4 $6 $8 Value Menu. This initiative, heavily promoted via television commercials and marketing collateral, directly targets budget-conscious diners by highlighting affordable, filling meal choices.

Denny's strategically utilizes partnerships to enhance its marketing mix, most recently with a collaboration tied to the 'Beetlejuice Beetlejuice' film. This partnership involved creating themed menu items, effectively driving customer engagement and raising brand awareness through a unique, timely offering.

These types of collaborations inject novelty and excitement into the dining experience, serving as a powerful draw for both new and existing customers. For instance, the 'Beetlejuice Beetlejuice' promotion likely saw an uptick in traffic from fans of the movie looking for a thematic tie-in, as well as from existing Denny's patrons intrigued by the limited-time offerings.

Denny's is significantly boosting its digital presence, focusing on improving email campaigns and search engine optimization to attract and retain customers. This digital push is a key part of their strategy to enhance the overall guest experience.

A major initiative is the planned launch of a new, personalized, points-based loyalty program, expected in late Q3 or the latter half of 2025. This program is designed to reward frequent diners and encourage repeat business.

By incentivizing engagement through this loyalty program, Denny's aims to increase customer visit frequency and ultimately raise the lifetime value of their digitally connected patrons. This aligns with industry trends where personalized loyalty programs are crucial for sustained growth.

Multi-Channel Advertising Approach

Denny's leverages a robust multi-channel advertising strategy to reach a broad audience. This includes traditional media like television and out-of-home placements, alongside digital avenues such as social media and video-on-demand services. This integrated approach ensures consistent brand messaging across various consumer touchpoints.

Recent data indicates a significant shift in advertising spend, with digital channels increasingly dominating. For instance, in 2024, digital advertising spending in the US quick-service restaurant sector was projected to exceed $30 billion, a trend Denny's actively participates in to drive engagement and promote its diverse menu.

- TV and VOD: Reaching a wide demographic for broad brand awareness.

- Out-of-Home (OOH): Targeting specific geographic areas and high-traffic locations.

- Social Media and Digital: Engaging with consumers directly, driving traffic, and promoting limited-time offers.

- Campaign Integration: Efforts like 'Denny Time, Denny Place' reinforce the brand's accessibility and role in everyday moments.

Brand Revitalization and Modernization Efforts

Denny's brand revitalization is deeply connected to its 'It's Diner Time' campaign and the ongoing Diner 2.0 remodel program. These initiatives are designed to update the brand's image, making it more appealing to a wider range of customers across different generations, while still honoring its heritage as America's Diner.

These modernization efforts are crucial for attracting new customers and retaining existing ones by offering a refreshed dining experience. The goal is to balance nostalgic appeal with contemporary relevance.

- Brand Revitalization: The 'It's Diner Time' initiative and Diner 2.0 remodels are key components.

- Target Demographic: Efforts aim to appeal to a multi-generational guest base.

- Core Identity: The brand aims to retain its identity as America's Diner.

- Financial Impact: While specific figures for this promotion aren't available, Denny's reported a 10.5% increase in same-store sales for company locations in the first quarter of 2024, indicating positive customer reception to their strategic shifts.

Denny's promotion strategy centers on value, partnerships, and digital engagement. The $2 $4 $6 $8 Value Menu, heavily advertised, targets budget-conscious consumers. Collaborations, like the 'Beetlejuice Beetlejuice' film tie-in, create buzz and attract diverse audiences. Digital efforts, including email and SEO, coupled with a forthcoming loyalty program in late 2025, aim to boost customer retention and lifetime value.

| Promotional Tactic | Objective | 2024/2025 Data/Trend |

|---|---|---|

| Value Menu ($2 $4 $6 $8) | Attract budget-conscious diners | Core of affordability messaging. |

| Partnerships (e.g., 'Beetlejuice') | Drive engagement, brand awareness | Leverages cultural moments for novelty. |

| Digital Marketing (Email, SEO) | Customer acquisition & retention | Increasing focus, digital ad spend in QSR sector projected to exceed $30B in 2024. |

| Loyalty Program Launch | Reward frequent diners, increase visit frequency | Planned for late Q3/H2 2025. |

| Brand Revitalization ('It's Diner Time', Diner 2.0) | Modernize image, appeal to multi-generational base | Q1 2024 saw 10.5% increase in same-store sales for company locations. |

Price

Denny's competitive value pricing strategy is a cornerstone of its marketing mix, particularly evident in its relaunched value menus. The $2 $4 $6 $8 Value Menu, now expanded to include a $10 category, directly targets consumers seeking affordability. This approach is crucial in the current economic climate, with inflation impacting household budgets significantly.

This pricing strategy aims to attract a broad customer base by offering clearly defined, accessible price points for a variety of meal options. By providing these value-driven choices, Denny's seeks to increase customer traffic and build loyalty, especially among budget-conscious diners. The inclusion of a $10 option acknowledges the rising cost of ingredients while still positioning Denny's as a provider of affordable dining.

Denny's menu engineering focuses on simplifying offerings to boost profitability. By emphasizing high-demand, high-margin items, they've seen margin improvements. This strategic simplification also helps control food costs and operational complexity, ensuring value remains consistent.

Denny's employs dynamic pricing and promotional offers as a key component of its marketing mix. For instance, deals like 'Buy One, Get One Slam for a Dollar' and 'Four Slams Under $10' are designed to drive customer traffic and boost sales volume.

These flexible pricing strategies enable Denny's to adapt to fluctuating market conditions and evolving consumer demand, a crucial tactic in the competitive casual dining sector. In 2024, Denny's continued to leverage these promotions to maintain customer engagement and attract new diners.

Impact of Inflation on Pricing

Denny's recognizes how persistent inflation affects how consumers feel about spending. To address this, they've leaned into their reputation for offering good value, helping to ease customer worries. This strategy is reflected in a 3% rise in their system guest check average, largely due to pricing adjustments carried over from 2024.

Looking ahead, Denny's is planning for commodity inflation between 3% and 5% in 2025. This forecast directly informs their upcoming pricing strategies, ensuring they can manage rising costs while maintaining their value proposition.

- Consumer Sentiment: Denny's actively manages consumer perception amidst cumulative inflation.

- Value Leadership: The brand leverages its established value proposition to counter inflation concerns.

- Guest Check Average: A 3% increase in the system guest check average was observed, driven by prior year pricing.

- Future Inflation: Anticipated commodity inflation of 3-5% for 2025 will shape pricing decisions.

Franchisee Profitability Considerations

Denny's pricing strategies are carefully crafted to balance customer appeal with robust franchisee profitability. This dual focus ensures that while menu prices attract diners, they also provide a healthy margin for those operating the restaurants.

The company's strategic approach includes optimizing the store portfolio. Closing underperforming locations, such as those with lower sales volumes, directly aims to bolster franchisee cash flow. This financial improvement then empowers franchisees to allocate resources towards crucial growth activities.

These reinvestments can take various forms, including traffic-driving marketing campaigns and essential restaurant remodels. For instance, in 2023, Denny's reported that system-wide comparable sales increased by 6.6%, indicating a positive trend that benefits franchisees.

- Pricing for Profit: Denny's pricing aims to attract customers while ensuring healthy margins for franchisees.

- Store Optimization: Strategic closure of low-volume stores improves overall franchisee cash flow.

- Reinvestment Focus: Enhanced cash flow enables franchisees to invest in marketing and remodels.

- Sales Growth: System-wide comparable sales growth of 6.6% in 2023 signals a positive environment for franchisee profitability.

Denny's pricing strategy is centered on providing value, especially through its relaunched value menus like the $2 $4 $6 $8 Value Menu, now extended to a $10 category. This directly addresses consumer sensitivity to inflation, aiming to maintain customer traffic and loyalty by offering clearly defined, affordable price points. The inclusion of higher price points acknowledges rising ingredient costs while reinforcing Denny's position as an affordable dining option.

Denny's actively uses dynamic pricing and promotions to drive sales, such as their 'Buy One, Get One Slam for a Dollar' offers. These tactics are crucial for adapting to market shifts and consumer demand in the competitive casual dining sector. In 2024, these promotions were key to maintaining customer engagement.

The brand's value proposition is a significant countermeasure against inflation's impact on consumer spending. This is reflected in a 3% increase in their system guest check average, largely due to pricing adjustments made in 2024. Looking ahead to 2025, Denny's anticipates commodity inflation between 3% and 5%, which will guide their future pricing decisions to sustain their value offering.

| Pricing Strategy Element | Description | Impact | 2024/2025 Data/Notes |

|---|---|---|---|

| Value Menus | Relaunched with clear price points ($2-$10) | Attracts budget-conscious diners, increases traffic | Expanded to $10 category to reflect rising costs |

| Promotional Pricing | Dynamic offers like BOGO | Drives immediate sales volume, customer engagement | Continued use in 2024 to maintain competitiveness |

| Inflation Management | Leveraging value perception | Eases consumer spending concerns, supports check average | 3% system guest check average increase (driven by 2024 pricing); 3-5% commodity inflation forecast for 2025 |

4P's Marketing Mix Analysis Data Sources

Our Denny's 4P's Marketing Mix Analysis is grounded in comprehensive data, including official Denny's corporate communications, investor relations reports, and publicly available financial filings. We also leverage industry-specific market research and competitive analysis reports to ensure a robust understanding of their strategic decisions.