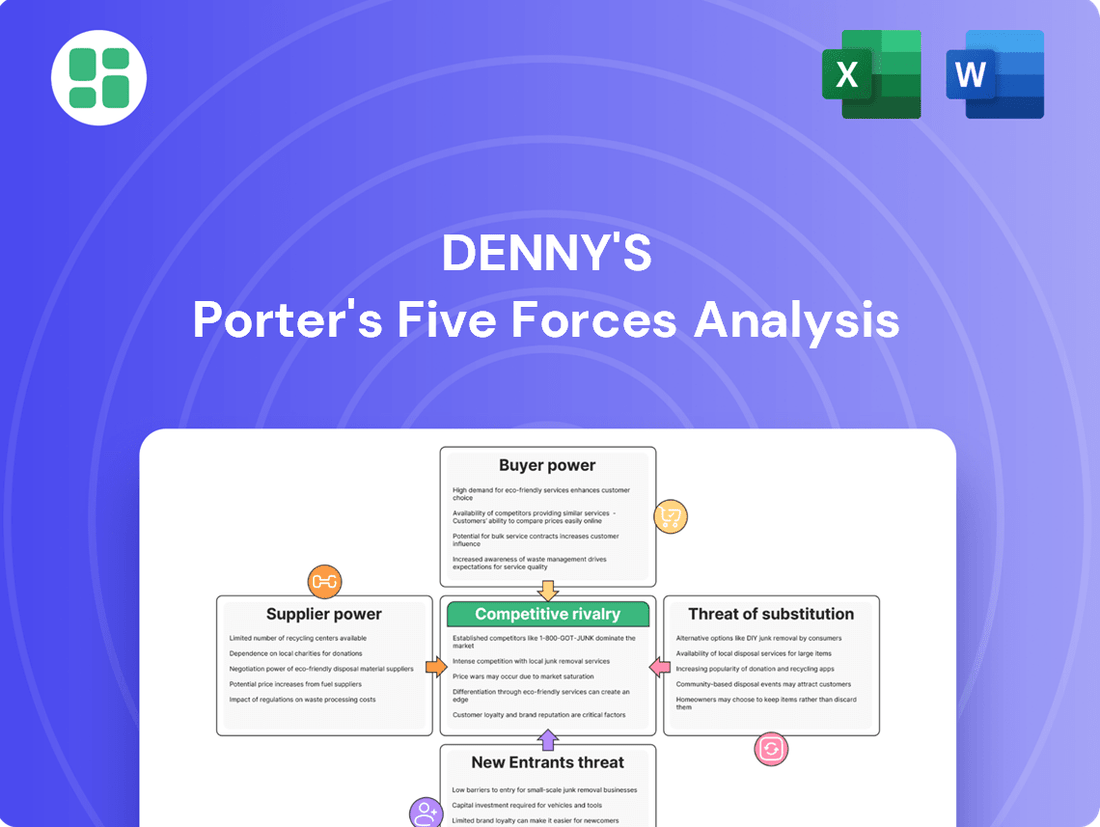

Denny's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denny's Bundle

Denny's operates in a competitive landscape shaped by moderate rivalry among existing competitors and a significant threat from substitutes like fast-casual dining. Buyer power is substantial due to the accessibility of numerous dining options.

The complete report reveals the real forces shaping Denny's’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Denny's, a prominent player in the casual dining sector, faces supplier power influenced by market concentration. Major food distributors like Sysco and US Foods hold substantial sway due to their significant market share, potentially impacting pricing and terms for large chains. In 2024, the food distribution industry continues to be dominated by a few key players, with Sysco, for example, reporting revenues in the tens of billions of dollars annually, underscoring their scale.

The reliance on these large distributors can create considerable switching costs for a company like Denny's, reinforcing supplier leverage. However, Denny's strategy of sourcing from a diverse array of national and regional ingredient suppliers helps to counterbalance the power of any single dominant distributor. This multi-supplier approach allows for greater flexibility and negotiation strength.

Commodity price volatility significantly impacts Denny's, as the cost of key ingredients like wheat and beef can fluctuate dramatically. For instance, the U.S. Department of Agriculture reported that average farm prices for wheat saw a year-over-year decrease of approximately 13% in early 2024, but this followed periods of substantial increases. This inherent market unpredictability grants suppliers more leverage.

While Denny's likely employs strategies such as multi-year supply contracts with price collars or hedging mechanisms to mitigate these swings, these protections are often subject to annual reviews and may not fully shield the company from severe price spikes. The fundamental cost of essential food inputs remains largely beyond Denny's direct control, reinforcing the bargaining power of its suppliers.

Denny's is a significant customer for many food and beverage suppliers, driving substantial order volumes. For instance, in 2024, Denny's continued to operate over 1,500 locations across the United States, each requiring consistent and large-scale deliveries of ingredients and supplies. This consistent demand makes Denny's an attractive partner for suppliers seeking stable revenue streams.

However, the broader food distribution market is highly competitive and fragmented, with numerous players serving a wide array of restaurant chains and independent establishments. This market depth means that most suppliers are not solely dependent on Denny's for their survival. Consequently, suppliers often possess a degree of bargaining power, as they can shift their focus to other clients if Denny's demands become too stringent or unfavorable.

Despite this, Denny's can still leverage its scale and long-standing relationships to negotiate favorable terms. The sheer volume of goods purchased annually by Denny's can translate into bulk discounts and preferential treatment from suppliers eager to maintain such a large account. This dynamic creates a balanced negotiation landscape where both parties have leverage.

Differentiation of Inputs

For standard food ingredients, the low differentiation among suppliers typically grants Denny's considerable leverage. This means if prices rise or terms become less favorable, Denny's can often find alternative sources without significant disruption. For instance, in 2024, the average cost of key commodities like eggs and beef, while subject to market fluctuations, generally saw a stable to slightly increasing trend, allowing Denny's to negotiate based on readily available alternatives.

However, the bargaining power shifts when Denny's requires specialized or proprietary items. Limited alternative suppliers for these niche products can significantly increase their leverage. This could include specific seasoning blends, unique equipment for food preparation, or custom-branded packaging.

Denny's commitment to responsible sourcing and animal welfare standards, a key aspect of their brand identity, can also influence supplier options. Adhering to these ethical guidelines might narrow the pool of available suppliers, potentially giving those who meet these criteria more bargaining power.

- Low Differentiation: Standard ingredients like flour, sugar, and basic produce have many suppliers, reducing individual supplier power.

- High Differentiation: Proprietary sauces, specific cuts of meat, or specialized kitchen equipment may have fewer suppliers, increasing their bargaining power.

- Sourcing Standards: Denny's ethical sourcing policies can limit supplier choices, potentially strengthening the position of compliant suppliers.

Threat of Forward Integration by Suppliers

The threat of food suppliers attempting forward integration, such as opening their own restaurant chains, is generally minimal for a company like Denny's. This is primarily because the operational demands and expertise required for large-scale food production and distribution are vastly different from those of running a direct-to-consumer restaurant business. Suppliers typically excel in logistics and bulk purchasing, not in customer service and brand building inherent in the restaurant industry.

This low likelihood of suppliers entering the restaurant space directly means they are less likely to leverage forward integration as a means to exert greater bargaining power over Denny's. Their core competency remains in providing ingredients and supplies, not in competing for the end consumer's dining dollar. For instance, major food distributors focus on efficiency in their supply chains, not on developing unique menu items or dining experiences.

Consequently, Denny's faces a reduced risk from this specific avenue of supplier power. The barriers to entry for suppliers looking to become restaurant operators are substantial, involving significant capital investment, brand development, marketing expertise, and a completely different operational skillset. This strategic divergence effectively insulates Denny's from a direct competitive threat originating from its supplier base in this manner.

In 2024, the restaurant industry continued to navigate complex supply chains, but the fundamental business model differences between food suppliers and restaurant operators remained a significant deterrent to widespread forward integration. For example, while some suppliers might offer limited catering services, the vast majority do not possess the infrastructure or strategic intent to compete with established national chains like Denny's.

The bargaining power of suppliers for Denny's is moderate, influenced by the concentration of key distributors and commodity price volatility. While large distributors like Sysco hold significant sway due to their scale, Denny's mitigates this by diversifying its supplier base. Commodity price fluctuations, such as those seen in wheat prices in early 2024, grant suppliers leverage, though Denny's employs contracts and hedging to manage these risks.

Denny's substantial order volumes make it an attractive customer, but the competitive nature of the food distribution market means most suppliers are not solely reliant on Denny's. This creates a balanced negotiation dynamic. However, for specialized or proprietary items, supplier power increases due to fewer alternatives.

The threat of suppliers integrating forward into restaurant operations is generally low for Denny's, as the business models are fundamentally different. This reduces a potential avenue for suppliers to exert greater bargaining power.

| Factor | Impact on Denny's Supplier Power | 2024 Context/Example |

|---|---|---|

| Supplier Concentration | Moderate to High | Dominance of distributors like Sysco, with annual revenues in the tens of billions. |

| Switching Costs | Moderate | Establishing new supply chains can be time-consuming and costly. |

| Commodity Price Volatility | High | Wheat prices saw a ~13% year-over-year decrease in early 2024, but followed periods of increases, impacting ingredient costs. |

| Denny's Scale as a Buyer | Lowers Supplier Power | Operating over 1,500 U.S. locations generates significant purchasing volume. |

| Supplier Dependence on Denny's | Low | Fragmented market means suppliers serve many clients, reducing dependence. |

| Product Differentiation | Varies (Low for standard, High for specialized) | Standard produce vs. proprietary sauces; limited suppliers for specialized items increase their power. |

| Forward Integration Threat | Very Low | Suppliers' core competencies differ significantly from restaurant operations. |

What is included in the product

Tailored exclusively for Denny's, this analysis dissects the competitive forces shaping the casual dining industry, revealing insights into buyer power, supplier leverage, and the threat of new entrants.

Instantly identify competitive pressures with a dynamic Porter's Five Forces analysis, allowing Denny's to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Denny's operates in a competitive casual dining space where customers frequently consider price. This is especially true when the economy is uncertain, impacting how much people feel they can spend on dining out. In 2024, many consumers continued to look for affordable meal options, making price a significant factor in their choices.

Denny's has actively addressed this by reintroducing its value-focused $2-$4-$6-$8 menu. This strategy is a clear signal that the company understands its customers’ focus on price and aims to attract more diners by emphasizing its commitment to affordability and value leadership. This approach is crucial for driving foot traffic in a market where switching to a competitor is easy if prices seem too high.

Customers have a wide array of dining choices beyond Denny's, from other family restaurants and fast-casual spots to quick-service chains and even preparing meals at home. This abundance of alternatives means customers can easily shift their spending if they find a better deal or experience elsewhere.

The low cost and effort involved in switching between these dining options significantly amplify customer bargaining power. For instance, a meal at a competitor like IHOP or even a fast-food option can be just as convenient, putting pressure on Denny's pricing and service.

In 2024, the restaurant industry saw continued competition, with consumers prioritizing value and convenience. Denny's, like many in the casual dining sector, faced the challenge of differentiating itself amidst a crowded market where customer loyalty can be fluid.

The cost for a customer to switch from Denny's to another casual dining establishment is remarkably low. There are generally no significant financial penalties or complex procedures involved; it's simply a matter of choosing a different restaurant for their next meal. This ease of transition means customers can readily explore alternatives based on price, menu variety, or perceived quality.

Denny's customers are not typically bound by long-term contracts or substantial loyalty programs that would make switching difficult or costly. This lack of commitment further amplifies their bargaining power. For instance, in 2024, the casual dining sector saw intense competition, with many chains offering aggressive promotions to attract diners, directly benefiting customers with low switching costs.

Consequently, this low switching cost compels Denny's to consistently offer compelling value and a positive dining experience. Customers are empowered to vote with their wallets, seeking out the best deals and most satisfying meals, which puts direct pressure on Denny's to maintain competitive pricing and service standards to retain its customer base.

Customer Information and Transparency

Customers today possess unprecedented access to information about dining options, including menus, pricing, and peer reviews, readily available through online platforms and social media. This increased transparency empowers them to easily compare different restaurants and make well-informed decisions, thereby amplifying their bargaining power when choosing where to eat.

Denny's is actively addressing this by investing in digital initiatives and a new customer relationship management (CRM) loyalty program. These efforts are designed to foster deeper customer engagement and enhance retention, aiming to solidify customer loyalty in a competitive market. For instance, Denny's reported a 1.2% increase in same-store sales for company restaurants in the first quarter of 2024, indicating some success in attracting and retaining customers.

- Enhanced Information Access: Customers can easily find and compare Denny's offerings with competitors online.

- Informed Decision-Making: Transparency in pricing and reviews allows customers to negotiate better value.

- Denny's Digital Strategy: Investments in loyalty programs and digital platforms aim to counter this power by building relationships.

- Customer Retention Focus: By offering value and personalized experiences, Denny's seeks to reduce customer price sensitivity.

Impact of Group Purchasing Decisions

While individual Denny's customers may have minimal sway, groups dining together wield more collective bargaining power. Their combined spending represents a more substantial transaction for the restaurant. Denny's strategy of catering to families and groups means that a negative experience for one member can deter multiple diners, impacting revenue significantly. For instance, in 2024, Denny's reported that family and group dining occasions are crucial for driving traffic and sales, highlighting the importance of satisfying these larger customer units.

The impact of group purchasing decisions on Denny's is multifaceted:

- Increased Revenue Potential: Group meals contribute a larger average check size compared to solo diners.

- Word-of-Mouth Influence: Dissatisfied groups can negatively impact future customer acquisition through negative reviews and recommendations.

- Menu and Service Adaptability: Denny's must remain flexible to accommodate group preferences and ensure efficient service for larger parties to maintain satisfaction and encourage repeat business.

The bargaining power of Denny's customers remains high due to the abundance of dining alternatives and the low cost of switching. In 2024, consumers continued to prioritize value, readily comparing prices and promotions across casual dining, fast-casual, and quick-service options. This environment compels Denny's to maintain competitive pricing and service to retain its customer base.

Denny's strategic response includes its value-focused menus and investments in digital loyalty programs to foster customer engagement and reduce price sensitivity. Despite these efforts, the ease with which customers can choose other establishments, amplified by readily available online information and reviews, ensures that customer power remains a significant force influencing Denny's operational strategies and pricing decisions.

| Factor | Denny's Impact | 2024 Context |

|---|---|---|

| Availability of Substitutes | High | Numerous casual dining, fast-casual, and QSR options |

| Switching Costs | Low | No significant financial or procedural barriers to changing restaurants |

| Information Availability | High | Easy online comparison of menus, prices, and reviews |

| Price Sensitivity | High | Customers actively seek value, especially during economic uncertainty |

| Group Dining Influence | Moderate to High | Larger parties have greater spending impact and word-of-mouth potential |

Same Document Delivered

Denny's Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Denny's competitive landscape through this detailed Porter's Five Forces analysis, covering industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products.

Rivalry Among Competitors

Denny's operates in a highly fragmented casual dining landscape. Direct competitors such as IHOP and Waffle House, along with broader casual dining establishments like Applebee's, present significant rivalry. The sheer volume of independent diners and other chain restaurants further amplifies this competitive intensity.

The overall foodservice industry is expected to see growth, but traditional sit-down restaurants like Denny's might not capture the largest share. Fast-casual and delivery-focused options are often outpacing the growth of full-service dining.

In 2024, Denny's experienced a slight dip in domestic system-wide same-restaurant sales, signaling a market where expansion often means taking business from rivals rather than solely relying on new customers. Projections for 2025 continue to suggest a cautious outlook for this segment.

Denny's, like many in the casual dining sector, faces intense competitive rivalry driven by significant fixed costs. These include substantial investments in real estate, kitchen equipment, and staffing, which remain largely constant whether the restaurant is busy or slow. For instance, in 2024, the restaurant industry continues to grapple with the ongoing impact of inflation on these operational expenses.

Compounding this, the perishable nature of food inventory adds another layer of pressure. To avoid costly waste, Denny's must ensure consistent sales volumes. This necessity often translates into aggressive pricing strategies and frequent promotional offers to attract and retain customers, intensifying the battle for market share among competitors.

Product Differentiation and Brand Loyalty

Denny's strives to stand out with its round-the-clock service, extensive menu, and relaxed dining environment. However, the fundamental nature of casual dining means many of its core product features can be mimicked by competitors, making it difficult to cultivate deep, lasting brand loyalty purely through its menu offerings.

To counter this, Denny's is actively pursuing strategies to deepen customer relationships. Recent initiatives include significant investments in restaurant remodels to improve the overall guest experience and the rollout of a new loyalty program designed to encourage repeat business and foster a stronger connection with its customer base.

- Brand Loyalty Efforts: Denny's is focusing on enhancing the customer experience through remodels and a new loyalty program to build stronger connections.

- Differentiation Challenges: While Denny's offers 24/7 availability and a diverse menu, these aspects are easily replicated in the casual dining sector, posing a challenge for strong brand loyalty.

Exit Barriers

Exit barriers in the restaurant sector, including for Denny's, are often substantial. These include commitments like long-term leases, the need for specialized kitchen equipment that has limited resale value, and the significant costs associated with closing down operations and potentially terminating employee contracts. These factors can make it financially challenging to simply walk away from a struggling location.

Denny's has actively addressed these challenges by accelerating the closure of underperforming units. The company's strategy includes closing between 70 and 90 restaurants in 2025. This proactive approach acknowledges the high costs and difficulties inherent in exiting unprofitable restaurant locations, demonstrating a clear recognition of these exit barriers.

- Lease Commitments: Long-term lease agreements represent a significant financial obligation that continues even if a restaurant is not profitable.

- Specialized Assets: Restaurant-specific equipment, such as grills, fryers, and ventilation systems, is difficult to repurpose or sell at a significant discount.

- Operational Wind-Down Costs: Closing a restaurant involves costs like severance pay, lease termination penalties, and the disposal of inventory and fixtures.

- Denny's 2025 Closures: The planned closure of 70-90 Denny's locations in 2025 underscores the company's efforts to manage and overcome these high exit barriers.

The casual dining sector, where Denny's operates, is characterized by intense competition. Rivals like IHOP and Waffle House, alongside a vast array of other chain and independent restaurants, vie for the same customer base. This crowded market means that growth often comes at the expense of competitors, rather than from an expanding overall market for traditional sit-down dining.

SSubstitutes Threaten

Consumers have a wide array of readily available substitutes for a traditional sit-down dining experience like Denny's. Fast food chains and the rapidly expanding fast-casual sector present compelling alternatives, often at lower price points and with significantly faster service. For instance, the fast-casual market saw robust growth, with many brands reporting strong revenue increases in 2024, indicating a clear consumer preference for quick, affordable, and quality meal options.

Home cooking, amplified by the surge in meal kit popularity, poses a significant threat to dining establishments like Denny's. During economic downturns, consumers increasingly opt for home-prepared meals as a budget-friendly alternative. For instance, the U.S. meal kit delivery market was valued at approximately $4.7 billion in 2023 and is projected to grow, indicating a strong consumer preference for convenient, at-home dining options.

Grocery stores are increasingly becoming a significant threat of substitutes for restaurants like Denny's. The availability of high-quality prepared meals, extensive deli counters, and convenient pre-packaged food options means consumers can easily assemble a satisfying meal at home for a lower cost. For instance, many major grocery chains have invested heavily in their prepared food sections, offering everything from gourmet salads to fully cooked rotisserie chickens, directly competing with the need for a restaurant visit.

Convenience Stores and Grab-and-Go Options

Convenience stores and gas stations are increasingly becoming substitutes for Denny's, particularly for quick hunger solutions outside of traditional meal times. These outlets offer a range of grab-and-go items, from sandwiches and salads to snacks and even hot foods. This trend poses a threat as consumers seeking a fast bite, especially during late nights or early mornings when Denny's 24/7 model is a key draw, might opt for these more accessible, albeit less comprehensive, dining alternatives.

The market for convenience food continues to expand. For instance, in 2023, the U.S. convenience store industry generated over $800 billion in sales, with a significant portion attributed to food and beverage offerings. This indicates a substantial consumer shift towards readily available, quick-service food options that can directly compete with Denny's for certain customer needs.

- Growing Grab-and-Go Market: Convenience stores are enhancing their food selections, moving beyond basic snacks to offer more prepared meals.

- Extended Availability: Many convenience stores operate 24/7, directly challenging Denny's traditional advantage in off-peak hours.

- Price Sensitivity: Grab-and-go options are often perceived as more affordable for a quick meal compared to a sit-down restaurant experience.

- Consumer Behavior Shift: A segment of consumers prioritizes speed and convenience over a full-service dining experience for casual meals.

Alternative Experiences (e.g., Food Trucks, Pop-ups)

Food trucks and pop-up restaurants present a significant threat of substitutes for traditional diners like Denny's. These mobile and temporary eateries often provide unique, localized, and more budget-friendly dining experiences, bypassing the overhead of brick-and-mortar establishments. For instance, the U.S. food truck industry alone was valued at approximately $1.2 billion in 2023 and is projected to grow, indicating a substantial customer base seeking these alternatives.

These substitutes cater to consumers looking for novelty, convenience, and diverse culinary options, directly competing for casual dining dollars. They can offer specialized menus, from gourmet tacos to artisanal burgers, which might appeal to customers seeking something different from a diner's standard fare. This growing segment of the food service market can siphon off potential customers, particularly younger demographics, who are drawn to the flexibility and often lower price points.

- Growing Food Truck Market: The U.S. food truck industry reached an estimated $1.2 billion in 2023.

- Consumer Appeal: Food trucks and pop-ups offer novelty, convenience, and diverse culinary choices.

- Price Competitiveness: These alternatives often provide more affordable options compared to full-service restaurants.

- Target Audience Shift: They attract customers, especially younger ones, seeking experiences beyond traditional diners.

The threat of substitutes for Denny's is substantial, encompassing a wide range of dining options that offer convenience, affordability, and variety. Consumers can easily opt for fast-casual restaurants, home cooking via meal kits, or even prepared meals from grocery stores, all of which can be more cost-effective and quicker than a sit-down diner experience. The expanding market for convenience foods, including those offered by convenience stores, further intensifies this competitive landscape.

| Substitute Category | 2023/2024 Data Point | Implication for Denny's |

|---|---|---|

| Fast-Casual Market | Robust growth reported by many brands in 2024 | Offers quicker, often similarly priced alternatives. |

| Meal Kit Delivery | U.S. market valued at ~$4.7 billion in 2023, projected growth | Appeals to consumers seeking convenience and cost savings at home. |

| Grocery Prepared Foods | Significant investment in prepared sections by major chains | Provides accessible, affordable, and quality meal solutions for home consumption. |

| Convenience Stores | U.S. industry sales >$800 billion in 2023 (incl. food/bev) | Offers immediate, 24/7 access to quick food options, challenging off-peak business. |

| Food Trucks/Pop-ups | U.S. industry valued at ~$1.2 billion in 2023 | Attracts consumers with novelty, diverse menus, and often lower price points. |

Entrants Threaten

The significant capital required to establish a full-service restaurant presents a considerable hurdle for potential new competitors looking to enter the market. Opening a Denny's franchise, for instance, can range from $255,000 to over $3 million, encompassing costs for real estate, building construction, essential kitchen and dining equipment, and initial working capital to cover early operating expenses.

Established brands like Denny's leverage decades of brand recognition and a deeply ingrained customer loyalty, making it a significant barrier for newcomers. For instance, Denny's has been a household name since 1953, cultivating a strong emotional connection with consumers. New entrants face the substantial hurdle of investing heavily in marketing and brand-building initiatives to even begin to chip away at this established loyalty, a costly endeavor in the competitive restaurant landscape.

Newcomers often face significant hurdles in securing reliable and cost-effective distribution channels and supply chains. Established players like Denny's benefit from decades of built-up relationships with major food suppliers and distributors, allowing them to negotiate favorable terms and volume discounts. For instance, in 2024, major restaurant chains continued to leverage their purchasing power, with the top 500 restaurant companies in the U.S. generating over $200 billion in sales, enabling them to command significant supply chain efficiencies that a new entrant would find difficult to match.

Regulatory Hurdles and Licensing

The restaurant sector faces significant regulatory burdens, including stringent health and safety standards. Navigating these complex rules and securing the required licenses and permits can be a substantial hurdle for new players, demanding considerable time and financial investment. For instance, in 2024, the average time to obtain all necessary food service permits across major US cities could range from three to six months, with associated fees often exceeding $1,000.

- Health Code Compliance: New entrants must adhere to detailed health codes, impacting kitchen design, food handling, and staff training.

- Licensing and Permits: Securing liquor licenses, business permits, and health department approvals is a complex and often lengthy process.

- Labor Regulations: Compliance with minimum wage laws, overtime rules, and employee benefits adds to operational costs and complexity for startups.

Economies of Scale and Cost Advantages

Denny's, as a large, established chain, enjoys significant economies of scale. This means they can buy ingredients, supplies, and even marketing services in bulk, leading to lower per-unit costs than a new, smaller restaurant could achieve. For instance, in 2023, Denny's reported total revenues of $1.56 billion, allowing for substantial purchasing power.

These cost advantages create a barrier for new entrants. A startup diner would struggle to match Denny's pricing power with suppliers or spread its advertising expenses across hundreds of locations. This disparity in operational efficiency makes it challenging for newcomers to compete on price or profitability from the outset.

- Economies of Scale: Denny's leverages bulk purchasing for ingredients and supplies, reducing per-unit costs.

- Marketing Efficiency: Advertising costs are spread across a vast network of restaurants, lowering the per-location marketing expense.

- Operational Optimization: Established chains refine operational processes over time, leading to greater efficiency and cost savings.

- Supplier Negotiations: Larger volumes allow Denny's to negotiate more favorable terms and pricing with its vendors.

The threat of new entrants for Denny's is moderate due to substantial capital requirements and established brand loyalty. However, significant regulatory hurdles and the difficulty in replicating Denny's economies of scale and supply chain efficiencies present considerable barriers.

New entrants must overcome high startup costs, with franchise fees alone for a full-service restaurant potentially reaching millions. Furthermore, building brand recognition against a company like Denny's, a fixture since 1953, requires extensive marketing investment.

Supply chain advantages are also a key deterrent; in 2024, top U.S. restaurant chains with over $200 billion in sales commanded superior negotiating power with suppliers, a feat difficult for newcomers to match.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for real estate, equipment, and initial operations. | Significant hurdle, potentially costing millions to establish. |

| Brand Loyalty | Decades of established customer relationships and brand recognition. | Requires substantial marketing investment to overcome. |

| Economies of Scale | Lower per-unit costs due to bulk purchasing and operational efficiency. | Makes it difficult for new entrants to compete on price. |

| Supply Chain Access | Established relationships provide better terms and discounts. | New entrants struggle to secure favorable supplier agreements. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Denny's leverages data from Denny's annual reports and SEC filings, alongside industry reports from firms like IBISWorld and market research from Statista. This blend of company-specific financial data and broader industry insights provides a comprehensive view of the competitive landscape.