Del Monte Pacific SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Del Monte Pacific Bundle

Del Monte Pacific is a powerhouse in the global food industry, but understanding its unique market position requires a deeper dive. Our SWOT analysis reveals key strengths like its strong brand recognition and extensive distribution network, alongside potential threats from intense competition and changing consumer preferences.

Want the full story behind Del Monte Pacific's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Del Monte Pacific Limited leverages a rich heritage and exceptionally strong brand recognition, with flagship brands like Del Monte, S&W, Contadina, and College Inn boasting over a century of history. This deep-rooted brand equity translates into significant consumer trust and loyalty, particularly in its core markets of the Philippines, the United States, and the broader Asia-Pacific region. For instance, in the fiscal year ending March 2024, Del Monte Pacific reported robust sales performance, underscoring the enduring appeal of its established brands.

Del Monte Pacific boasts a robust and diversified product portfolio, spanning packaged fruits and vegetables, culinary sauces, condiments, and beverages. This broad offering, including fresh pineapples, acts as a crucial risk mitigator, preventing over-reliance on any single market segment. For instance, the company's strong presence in canned fruits and vegetables, a category that saw steady demand in 2024, provides a stable revenue base.

Del Monte Philippines, Inc. (DMPI) has been a powerhouse, delivering impressive double-digit sales growth for fiscal year 2025. This robust performance is largely fueled by strong demand for its fresh and packaged pineapple products across key international markets like North Asia, Europe, and the Americas.

DMPI's profitability has also seen a significant uptick, with net profit climbing substantially. This financial strength in its core Asian operations provides a crucial stabilizing force for Del Monte Pacific's broader business, even as other segments navigate different market conditions.

Commitment to Sustainability and Operational Efficiency

Del Monte Pacific's commitment to sustainability is a significant strength, evidenced by ambitious goals such as achieving net-zero emissions by 2050. This focus extends to practical initiatives like upcycling food waste, demonstrating a dedication to resourcefulness. These efforts not only resonate with environmentally conscious consumers but also drive operational efficiencies.

The company's investment in operational improvements directly supports its sustainability agenda. For instance, optimizing supply chains and reducing fuel consumption contribute to both environmental responsibility and cost savings. These integrated strategies enhance long-term financial management and bolster the company's competitive position in an increasingly eco-aware market.

- Net-Zero Emissions Target: Del Monte Pacific aims for net-zero emissions by 2050, aligning with global climate goals.

- Food Waste Upcycling: Initiatives to upcycle food waste showcase a commitment to circular economy principles.

- Operational Efficiency Gains: Investments in supply chain optimization and reduced fuel consumption lead to cost savings and improved resource utilization.

Extensive Global Presence and Distribution Network

Del Monte Pacific boasts an extensive global presence, with its primary operations rooted in the Philippines, the United States, and the broader Asia-Pacific region. This strategic geographic footprint is supported by robust manufacturing and distribution capabilities across these key markets. The company’s dual listing on the Singapore and Philippine stock exchanges underscores its international operational scope and accessibility to diverse investor bases.

This widespread network is a significant strength, enabling Del Monte Pacific to effectively penetrate various consumer markets and capitalize on established distribution channels. For instance, as of the fiscal year ending March 2024, the company reported strong sales growth in its US business, driven by its canned fruit and vegetable segments, demonstrating the efficacy of its distribution in a major market. Its presence in the Philippines, a market where it holds a dominant share, further solidifies its distribution advantage.

- Geographic Reach: Operations concentrated in the Philippines, USA, and Asia-Pacific.

- Distribution Powerhouse: Significant manufacturing and distribution infrastructure in key regions.

- Market Access: Ability to tap into diverse consumer bases through established channels.

- Financial Indicator: Dual listing on Singapore and Philippine stock exchanges signifies global financial integration.

Del Monte Pacific's brand equity is a cornerstone of its strength, with iconic brands like Del Monte and S&W commanding significant consumer trust and loyalty across its key markets. This deep-rooted recognition, built over a century, translates into sustained demand and pricing power, as evidenced by consistent sales performance in fiscal year 2024. The company's flagship brands are deeply embedded in consumer purchasing habits, particularly in the Philippines and the United States.

The company benefits from a diverse product portfolio, encompassing packaged foods, beverages, and fresh produce, which mitigates risks associated with over-reliance on any single category. This broad offering ensures resilience, with categories like canned fruits and vegetables showing steady demand in 2024. For example, Del Monte Philippines, Inc. (DMPI) has demonstrated exceptional growth, posting double-digit sales increases for fiscal year 2025, largely driven by its pineapple products in international markets.

DMPI's financial performance is a significant asset, with substantial increases in net profit contributing to the group's overall stability. This strong profitability in its core Asian operations provides a solid financial foundation, enabling continued investment and growth. The company's commitment to sustainability, including a net-zero emissions target by 2050 and food waste upcycling initiatives, enhances its brand reputation and operational efficiency.

Del Monte Pacific's extensive global presence, particularly in the Philippines and the United States, is bolstered by robust manufacturing and distribution networks. This widespread operational footprint allows for effective market penetration and access to diverse consumer bases, as seen in the strong sales growth reported in the US market for fiscal year 2024. The company's dual listing on the Singapore and Philippine stock exchanges further highlights its international reach and financial integration.

What is included in the product

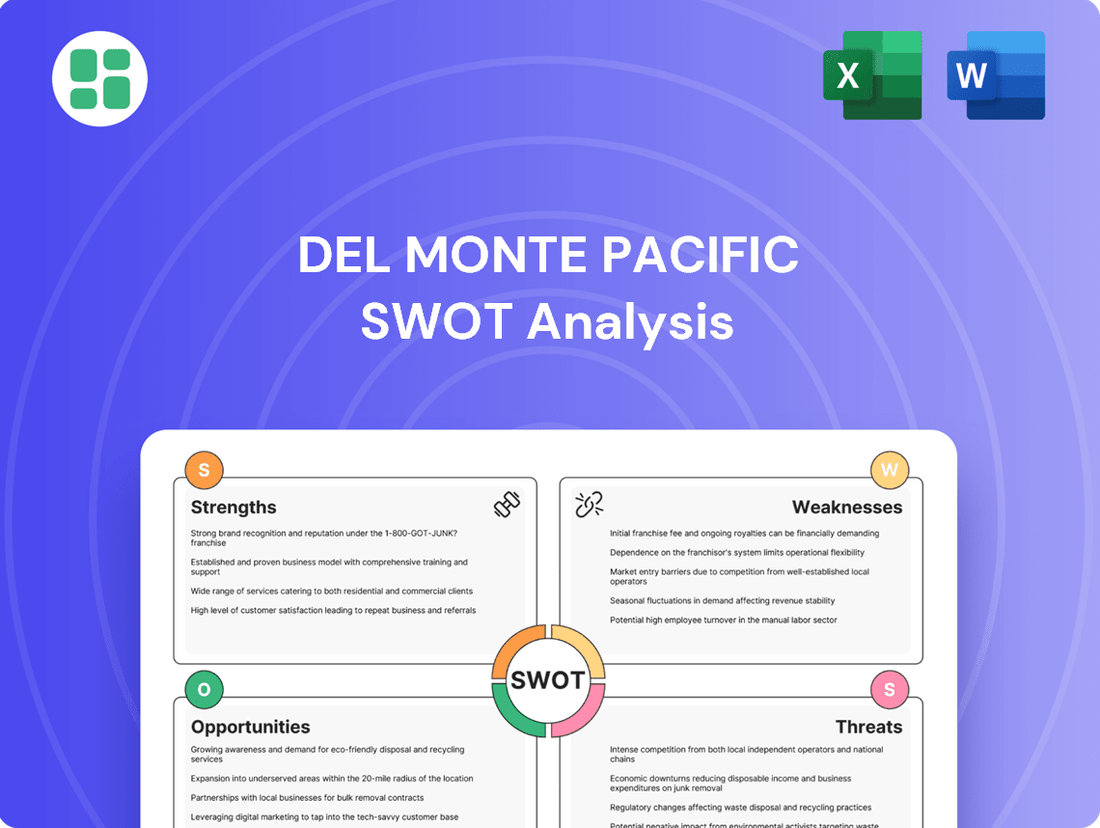

Del Monte Pacific's SWOT analysis provides a comprehensive view of its internal strengths and weaknesses alongside external market opportunities and threats. This assessment helps understand the company's competitive standing and strategic direction.

Del Monte Pacific's SWOT analysis reveals key opportunities for market expansion and brand strengthening, alleviating concerns about competitive pressures.

Weaknesses

Del Monte Pacific has been grappling with significant financial setbacks in its United States operations. The company's US subsidiary, Del Monte Foods, Inc. (DMFI), has been the primary driver of substantial net losses.

For fiscal year 2024, Del Monte Pacific reported a net loss of $127.3 million. This marks a stark contrast to the previous year's profitability and is largely attributed to a decline in gross profit and inventory-related expenses within the US market.

The underperformance of the US segment has consistently weighed down the group's overall financial performance, highlighting a persistent challenge for the company.

Del Monte Pacific's US operations are grappling with a persistent weakness: substantial inventory levels and the resulting wastage costs. This has directly impacted gross profit, with reports indicating a significant decline stemming from these issues.

Despite strategic moves like reduced production and manufacturing consolidation, the problem of high inventory and wastage persists. This ongoing challenge hinders profitability and contributes to the company's net losses in the US market, highlighting difficulties in accurately predicting demand and managing the supply chain effectively.

Del Monte Pacific is grappling with escalating interest expenses, a direct consequence of both elevated interest rates and a growing debt burden. This financial pressure has been a significant factor in the company's reported net losses.

As of April 2025, the company's financial health shows current liabilities outstripping current assets, largely attributed to substantial revolving loans held by its Philippine subsidiary. This challenging liquidity position underscores the urgent need for Del Monte Pacific to explore new avenues for funding and to implement more robust cash flow management strategies.

Declining Sales in Certain US Product Categories

Del Monte Foods, Inc. (DMFI) has experienced a downturn in specific US product categories. This is partly due to a deliberate move away from co-pack arrangements that offered lower profit margins, alongside challenging trends in established packaged fruit segments. For instance, the broader US canned fruit market saw a volume decline in recent years, impacting sales for traditional offerings.

While innovative products such as Joyba bubble tea have shown positive reception, the overall sluggishness in core canned goods and the competitive landscape for healthy snacks in the United States continue to present headwinds for revenue expansion. This segment's performance is a key area for strategic focus to counteract broader market pressures.

- Co-pack Strategy Impact: A strategic pivot away from lower-margin co-packing arrangements has directly affected sales figures in certain DMFI segments.

- Packaged Fruit Decline: Traditional packaged fruit categories in the US have faced declining demand, contributing to softer sales performance.

- Healthy Snacking Competition: The highly competitive US market for healthy snacks presents ongoing challenges for revenue growth in this area.

- Joyba Promise: Newer ventures like Joyba bubble tea offer a positive counterpoint, demonstrating potential in emerging product lines.

Vulnerability to Commodity Price Volatility and Supply Disruptions

Del Monte Pacific's profitability is significantly exposed to the unpredictable swings in commodity prices, especially for its core product, pineapples. This inherent vulnerability means that even minor price shifts can have a substantial impact on the company's bottom line.

Supply chain disruptions, often stemming from agricultural risks like adverse weather conditions in key growing regions, pose another considerable weakness. For instance, reduced pineapple supply in Asia has directly affected Del Monte Pacific's gross profit and overall production capacity, underscoring the challenges of relying on agricultural output.

- Susceptibility to Pineapple Price Fluctuations: Del Monte Pacific's earnings are directly tied to the market price of pineapples, a critical input.

- Impact of Weather on Production: Extreme weather events in major pineapple-producing areas can severely limit supply and drive up costs.

- Agricultural Supply Chain Risks: Disruptions in the agricultural supply chain, such as those experienced in Asia, can lead to lower gross profit margins.

- Operational Challenges from Supply Shortages: Reduced availability of key commodities directly hinders overall production levels and operational efficiency.

Del Monte Pacific's financial performance is significantly hampered by substantial losses originating from its US subsidiary, Del Monte Foods, Inc. (DMFI). These losses, amounting to $127.3 million in fiscal year 2024, are largely driven by declining gross profits and inventory-related expenses within the US market.

The company faces persistent challenges with high inventory levels and associated wastage costs in the US, which continue to erode profitability despite efforts like production consolidation. This points to ongoing difficulties in demand forecasting and supply chain management.

Escalating interest expenses, fueled by rising interest rates and an increased debt burden, further strain the company's financial health. As of April 2025, Del Monte Pacific's liquidity position is weak, with current liabilities exceeding current assets, primarily due to significant revolving loans held by its Philippine subsidiary.

DMFI has also seen a downturn in specific US product categories, partly due to a strategic shift away from lower-margin co-pack arrangements and a general decline in demand for traditional packaged fruit. The competitive landscape for healthy snacks in the US also presents ongoing revenue growth challenges.

| Weakness | Description | Impact |

| US Operations Losses | Significant net losses from Del Monte Foods, Inc. (DMFI) | $127.3 million net loss in FY2024; drags down group performance |

| Inventory & Wastage | High inventory levels and wastage costs in US | Reduced gross profit, contributes to net losses |

| Interest Expenses & Debt | Rising interest expenses due to higher rates and debt | Financial pressure, contributes to net losses |

| Category Performance | Downturn in certain US product categories, competition in snacks | Softer sales, challenges for revenue expansion |

What You See Is What You Get

Del Monte Pacific SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear snapshot of Del Monte Pacific's strategic landscape, highlighting key internal strengths and weaknesses, alongside external opportunities and threats. Access the complete, in-depth analysis upon purchase.

Opportunities

Del Monte Pacific is strategically expanding its product portfolio, notably with the introduction of Joyba bubble tea in the United States. This move taps into the growing demand for convenient and trendy beverage options, diversifying revenue beyond its core canned fruit and vegetable offerings.

Furthermore, the company is bolstering its dairy business in the Philippines, a key market where it holds a strong brand presence. This expansion into dairy products aligns with evolving consumer preferences for healthier and more diverse food choices, presenting a significant opportunity for revenue growth and market penetration.

Del Monte Pacific is strategically divesting non-core assets within the United States. This move is designed to streamline operations and bolster its financial standing. The company is also actively seeking equity injections through strategic alliances, which will provide crucial capital for growth initiatives.

These asset sales and partnerships are key to improving financial ratios and reducing leverage. For instance, as of the first quarter of fiscal year 2025, Del Monte Pacific reported a net debt to equity ratio that the company aims to improve through these financial maneuvers. This deleveraging is vital as the US business navigates a period of restructuring.

Furthermore, a potential initial public offering (IPO) for its highly profitable Philippine subsidiary is under consideration. This subsidiary has demonstrated robust growth, contributing significantly to the group's overall performance. A successful listing would unlock further capital and enhance shareholder value.

Consumers are increasingly prioritizing fresh, healthy, and sustainably sourced food. This shift presents a significant opportunity for Del Monte Pacific, particularly with its S&W brand's fresh pineapple offerings. The company's commitment to sustainability, including upcycling initiatives and ambitious net-zero targets, directly addresses this growing consumer preference, potentially leading to enhanced brand loyalty and the ability to command premium pricing for its environmentally responsible products.

Leveraging E-commerce and Foodservice Channels

Del Monte Pacific's foodservice channel and e-commerce operations have demonstrated significant growth, especially in the United States. This expansion into digital and institutional sales presents a key opportunity to broaden distribution and reach a larger customer segment. Adapting to evolving consumer habits, particularly the increasing preference for online grocery shopping and ready-to-eat meals, is crucial for capitalizing on these channels.

The company’s e-commerce sales saw a notable increase, contributing to its overall revenue. For instance, in the fiscal year ending April 2024, Del Monte Pacific’s e-commerce segment in the US experienced robust growth, reflecting a broader market trend. This digital push allows for direct consumer engagement and offers a more convenient purchasing experience.

- E-commerce Growth: Del Monte Pacific's US e-commerce sales have shown a strong upward trajectory, aligning with the broader shift to online retail.

- Foodservice Expansion: The foodservice channel provides a stable revenue stream and access to institutional buyers, further diversifying sales.

- Adaptability: By strengthening these channels, Del Monte Pacific can effectively cater to changing consumer preferences for convenience and digital accessibility.

- Market Reach: Expanding digital and institutional sales directly increases market penetration and brand visibility across various consumer touchpoints.

Operational Efficiency and Cost Reduction Initiatives

Del Monte Pacific is actively pursuing operational efficiency through a multi-pronged cost-reduction strategy. Key initiatives include streamlining inventory management, minimizing production waste, and consolidating manufacturing facilities. These actions are designed to create a leaner, more agile operational structure.

The company anticipates significant improvements in gross margins, particularly in its US operations, as these cost-saving measures take hold. Projections indicate enhanced profitability in fiscal years 2026 and 2027, stemming from these efficiency gains and a more robust business model.

Digitization plays a crucial role in these efforts, improving planning and execution across the supply chain. This focus on operational excellence is expected to bolster Del Monte Pacific's financial performance and market competitiveness.

- Inventory Reduction: Efforts to lower stock levels and optimize carrying costs.

- Waste Minimization: Implementing processes to reduce material and production waste.

- Manufacturing Consolidation: Streamlining production sites to improve efficiency and reduce overhead.

- Digital Planning Enhancement: Leveraging technology for better demand forecasting and operational coordination.

The company is expanding its product range by introducing new items like Joyba bubble tea in the US, catering to evolving consumer tastes for trendy beverages. Del Monte Pacific is also strengthening its dairy business in the Philippines, a market where it has a strong brand presence, to meet growing demand for healthier options.

Strategic divestments of non-core US assets and the pursuit of equity injections via alliances are aimed at improving financial health and funding growth. For instance, as of Q1 FY2025, the company is focused on reducing its net debt to equity ratio.

The growing consumer preference for fresh, healthy, and sustainable food presents a significant opportunity, particularly for the S&W brand's fresh pineapple offerings, as Del Monte Pacific emphasizes its sustainability initiatives.

Expansion in foodservice and e-commerce channels, especially in the US, offers a chance to broaden distribution and reach more customers, adapting to the trend of online grocery shopping and convenience.

Threats

The branded food and beverage sector is a crowded marketplace, with both global giants and nimble local companies constantly battling for consumer attention and shelf space. Del Monte Pacific operates within this dynamic environment, facing pressure from established brands with deep pockets and loyal customer bases, as well as the growing threat of private label offerings that often compete on price.

In key growth areas like healthy snacks and convenient packaged fruits, where consumer tastes shift rapidly, Del Monte Pacific must contend with a constant influx of new products and innovative startups. For instance, the global healthy snacks market was valued at approximately USD 113.5 billion in 2023 and is projected to grow significantly, presenting both opportunities and intense competition for established players like Del Monte Pacific.

Consumers are increasingly favoring fresh produce and minimally processed foods over traditional canned items. This shift, driven by health consciousness and a desire for natural ingredients, directly impacts Del Monte's core product lines. For instance, the global market for fresh fruits and vegetables is projected to grow significantly, with some estimates suggesting a compound annual growth rate of over 5% in the coming years, a trend that could divert consumer spending from canned goods.

Furthermore, economic uncertainties are fueling a rise in demand for private label products. Consumers looking to save money are more likely to opt for store brands, which often offer lower price points than established national brands like Del Monte. This trend puts pressure on Del Monte's pricing strategies and market share, as retailers increasingly promote their own brands.

To counter these threats, Del Monte must prioritize continuous innovation in its product development. This includes exploring new product formats, expanding into healthier and more convenient options, and potentially reformulating existing products to align with current dietary trends. Adapting its portfolio to meet evolving consumer preferences is crucial for maintaining relevance and competitiveness in the dynamic food industry.

Economic uncertainties and persistent high inflationary pressures, especially noted in the United States, pose a significant threat to Del Monte Pacific. These conditions directly translate to increased operational costs, particularly concerning fuel and labor, which can compress gross margins. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2024, impacting input costs across various sectors.

Furthermore, these macroeconomic headwinds can dampen consumer purchasing power, leading to reduced demand for branded food products. As consumers become more price-sensitive, they may opt for cheaper alternatives, directly affecting Del Monte Pacific's sales volumes and overall profitability.

Supply Chain Disruptions and Agricultural Risks

Del Monte Pacific's heavy reliance on agricultural inputs, particularly pineapples, exposes it to significant threats from climate change. Unpredictable weather events, such as droughts or unseasonal rains, coupled with the potential for crop diseases, can severely impact yields and drive up the cost of raw materials. For instance, in 2023, several key pineapple-producing regions experienced adverse weather, leading to an estimated 15% increase in raw material procurement costs for some agricultural firms.

Furthermore, the company faces ongoing risks from logistical challenges and supply chain bottlenecks. These disruptions can impede the efficient production and timely distribution of its products, affecting inventory management and customer satisfaction. In late 2024, global shipping disruptions led to an average increase of 20% in freight costs for food products, highlighting the persistent nature of these threats.

- Climate Change Vulnerability: Exposure to extreme weather and crop diseases impacting pineapple yields.

- Rising Input Costs: Potential for increased raw material prices due to agricultural risks.

- Logistical Bottlenecks: Ongoing threats from shipping delays and supply chain inefficiencies.

- Distribution Challenges: Risks to production and distribution efficiency affecting market availability.

Financial Risks Associated with US Subsidiary's Bankruptcy and Debt

The recent bankruptcy filing of Del Monte Foods Holdings Ltd. (DMFHL) in the US represents a substantial financial threat to Del Monte Pacific. This event triggered a significant write-down of assets, directly impacting the group's financial health and creating a capital deficit. For instance, as of the fiscal year ending March 2024, Del Monte Pacific reported a net loss of $13.8 million, a stark contrast to the previous year's profit, largely attributable to these US-related issues.

The group is now burdened with high liabilities, necessitating immediate action to shore up its financial standing. This includes a critical need to improve key financial ratios and actively seek new funding avenues to stabilize operations. The situation underscores the inherent risks associated with Del Monte Pacific's substantial investment in its US subsidiary.

- Asset Write-Down: The bankruptcy of DMFHL led to a significant impairment of assets, impacting Del Monte Pacific's balance sheet.

- Capital Deficit and Liabilities: The group faces a capital deficit and increased liabilities, requiring strategic financial management.

- Need for Funding: Urgent efforts are underway to secure new capital and improve financial ratios to mitigate the ongoing risks.

- US Investment Risk: The US subsidiary's financial distress highlights the volatility and potential downsides of large-scale international investments.

Del Monte Pacific faces intense competition from established brands and private labels, particularly in fast-growing segments like healthy snacks. The company must navigate evolving consumer preferences towards fresh, minimally processed foods, a trend evidenced by the significant projected growth in the fresh produce market.

Economic headwinds, including inflation and reduced consumer purchasing power, also pose a threat, potentially shifting demand towards lower-priced alternatives. For instance, the US CPI saw a notable increase in 2024, impacting input costs and consumer spending.

The company's reliance on agricultural inputs makes it vulnerable to climate change and associated price volatility, with adverse weather events in 2023 reportedly increasing raw material costs by up to 15% for some agricultural firms. Furthermore, ongoing logistical challenges, such as increased freight costs by an average of 20% in late 2024, can disrupt supply chains.

The bankruptcy of Del Monte Foods Holdings Ltd. in the US has resulted in asset write-downs and a capital deficit for Del Monte Pacific, leading to a net loss of $13.8 million for the fiscal year ending March 2024, underscoring significant financial risks from its US investments.

SWOT Analysis Data Sources

This SWOT analysis for Del Monte Pacific is built upon a robust foundation of data, including the company's official financial reports, comprehensive market research from leading industry analysts, and insights from expert commentary within the food and beverage sector.