Del Monte Pacific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Del Monte Pacific Bundle

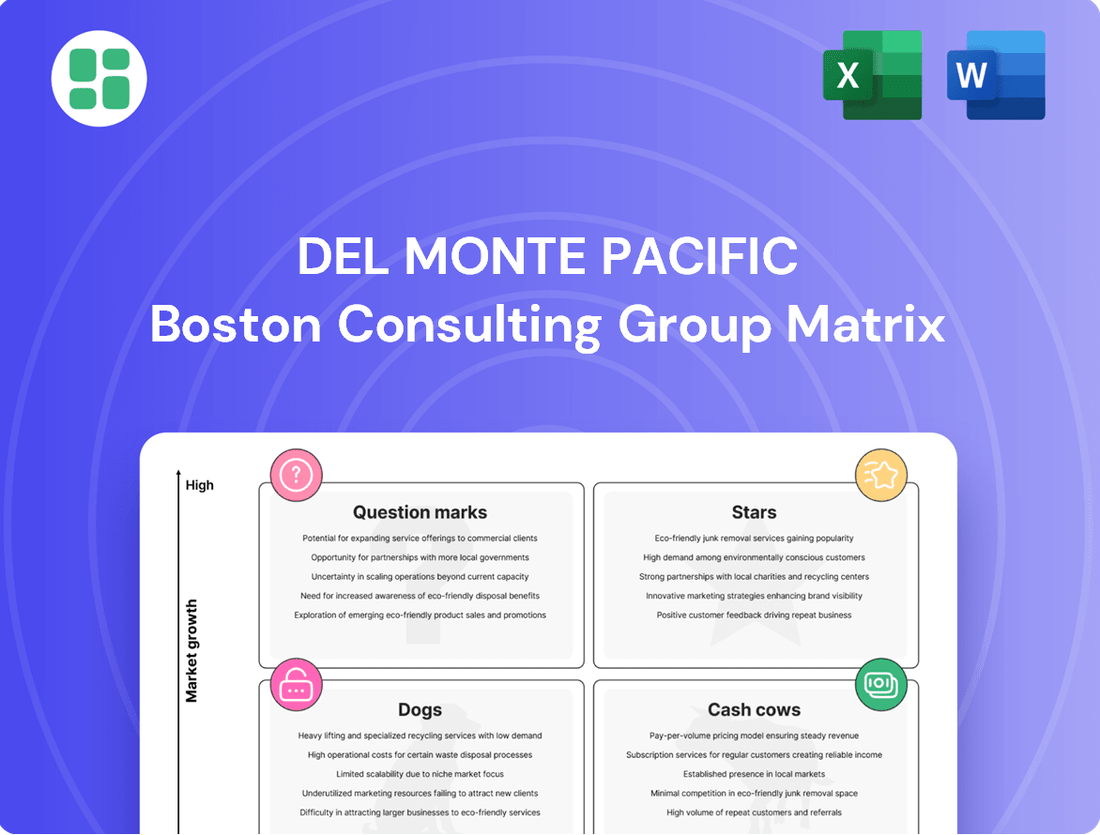

Del Monte Pacific's product portfolio is a fascinating study in market dynamics, with some brands likely shining as Stars and others potentially being Cash Cows. Understanding where each product sits on the BCG Matrix is crucial for strategic resource allocation and future growth.

This preview offers a glimpse into the potential positioning of Del Monte Pacific's offerings. To unlock a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and to gain actionable insights for optimizing their portfolio, purchase the full BCG Matrix report.

Stars

S&W Fresh Pineapple, particularly the S&W Deluxe variety, is a shining star within Del Monte Pacific's portfolio. This segment is experiencing robust growth and commands a dominant market share across North Asia. Key markets like China, South Korea, and Japan are showing particularly strong demand.

The success of S&W Fresh Pineapple is fueled by strong export sales and a growing preference for its premium S&W Deluxe offering. This premium positioning helps drive higher volumes and contributes significantly to the segment's stellar financial performance. For example, in fiscal year 2024, Del Monte Pacific reported a notable increase in sales for its canned pineapple products, with fresh pineapple being a key driver.

Del Monte Pacific's strategic focus on its 'Fresh and Beyond' initiative is directly benefiting the S&W Fresh Pineapple segment. This strategy emphasizes innovation and market penetration, ensuring the brand maintains its leadership position. The company is investing in expanding its distribution network and marketing efforts to capitalize on this high-growth opportunity.

Joyba Bubble Tea is a burgeoning star in the U.S. beverage landscape, showcasing impressive momentum. With distribution now exceeding 35,000 stores nationwide, its reach is substantial.

The brand is projected to surpass US$55 million in sales for fiscal year 2025, a testament to its rapid market penetration and consumer appeal. This performance outpaces the general bubble tea category, signaling robust growth potential and a strengthening market position for Del Monte Pacific.

Kitchen Basics Broth & Stock in the US is a standout performer for Del Monte Pacific. In fiscal year 2024, this brand saw growth of around 300%, significantly outpacing the broader broth and stock market which grew at a much slower pace. This impressive expansion indicates Kitchen Basics is effectively gaining ground and capturing a larger slice of a market that is itself expanding.

Del Monte 100% Pineapple Juice (Philippines)

Del Monte 100% Pineapple Juice in the Philippines is a strong performer, a true star in the company's beverage portfolio. It's not just holding its own; it's actively growing within the competitive ready-to-drink juice market, capturing a larger slice of consumer preference. This growth is fueled by effective marketing that highlights its health advantages, like the introduction of Fiber Enriched options, which consumers are actively seeking out.

The brand's success is evident in its market leadership. For instance, in 2023, the Philippine beverage market saw continued demand for healthy options, with juices playing a significant role. Del Monte's 100% Pineapple Juice has been a primary beneficiary of this trend, solidifying its position as a star product. Its robust sales and market penetration make it a critical component of Del Monte Philippines' overall growth strategy.

- Market Leadership: Del Monte 100% Pineapple Juice is a dominant player in the Philippine RTD juice category.

- Growth Driver: The product is a significant contributor to Del Monte Philippines' revenue growth.

- Consumer Resonance: Campaigns emphasizing functional benefits, such as fiber enrichment, are highly effective.

- Category Performance: In 2023, the juice category continued to show strength, with Del Monte's pineapple offering leading the charge.

Del Monte Fruity Zing (Philippines)

Del Monte Fruity Zing in the Philippines is positioned as a new and exciting, affordable refreshment. It’s generating incremental gains for Del Monte's beverage offerings, especially in areas like Mindanao. The product is specifically targeted at the Gen Z demographic to boost consumption frequency.

Fruity Zing's swift entry into the ready-to-drink (RTD) market, with the introduction of new flavors, highlights its potential. This rapid expansion suggests it's a high-growth, low-current-share product, fitting the profile of a Star in the BCG Matrix.

- Market Penetration: Fruity Zing is actively being promoted to capture the Gen Z market in the Philippines.

- Sales Contribution: The product is contributing incremental gains to Del Monte's beverage portfolio, particularly in regions like Mindanao.

- Product Development: Its rapid expansion into the RTD segment with new offerings indicates strong growth potential.

- BCG Classification: Fruity Zing is classified as a potential Star due to its high growth prospects and currently low market share.

S&W Fresh Pineapple is a key Star, demonstrating robust growth and a dominant market share, especially in North Asia. Del Monte 100% Pineapple Juice in the Philippines also shines as a Star, leading the RTD juice market with effective health-focused marketing. Joyba Bubble Tea is emerging as a Star in the U.S., with rapid expansion and strong projected sales growth. Kitchen Basics Broth & Stock in the US is another Star, achieving exceptional growth of around 300% in fiscal year 2024.

| Product Category | Market Growth | Market Share | Fiscal Year 2024/2025 Data |

|---|---|---|---|

| S&W Fresh Pineapple | High | High | Strong export sales, premium S&W Deluxe driving volume. |

| Del Monte 100% Pineapple Juice (PH) | High | High | Market leader, benefiting from demand for healthy options. |

| Joyba Bubble Tea (US) | High | Low to Medium | Projected US$55 million sales for FY2025, >35,000 store distribution. |

| Kitchen Basics Broth & Stock (US) | High | Low to Medium | ~300% growth in FY2024, outperforming market. |

What is included in the product

This BCG Matrix analysis categorizes Del Monte Pacific's product lines, identifying Stars for growth, Cash Cows for stable income, Question Marks for potential, and Dogs for divestment.

Del Monte Pacific's BCG Matrix offers a clear, one-page overview of each business unit's strategic position, relieving the pain of complex portfolio analysis.

Cash Cows

Del Monte Canned Vegetables in the U.S. operate as a classic Cash Cow within the Del Monte Pacific portfolio. The brand commands a leading market share, even as the overall canned vegetable market experiences some contraction.

Remarkably, Del Monte achieved a record market share of 23.7% in November 2024, underscoring its enduring strength and consumer loyalty in this segment.

Despite modest market growth, this dominant position allows Del Monte to generate significant and consistent cash flow, which can then be reinvested into other business units or used for strategic initiatives.

Del Monte Packaged Pineapple in the Philippines is a classic Cash Cow for Del Monte Pacific. It commands a massive market share, often cited at over 95% in the region, demonstrating its entrenched dominance. This strong position translates into consistent and reliable cash flow generation for the company, even with minor recent fluctuations in its market share.

The brand's enduring consumer loyalty and the product's versatility in culinary applications solidify its status as a stable revenue generator. Investments in this segment are primarily focused on maintaining its leadership and exploring new avenues for its already popular product, ensuring its continued contribution to the company's financial health.

Del Monte Mixed Fruits in the Philippines stands as a prime example of a Cash Cow within Del Monte Pacific's portfolio. The brand dominates the market, holding an impressive 76.8% share in April 2024, indicating strong customer loyalty and brand recognition.

This segment benefits from a growing canned mixed fruits category, further solidifying its position as a consistent revenue generator. The performance of its complementary brand, Today's Mixed Fruits, also contributes significantly, reinforcing Del Monte's leadership and ensuring a steady cash flow for its Philippine operations.

Del Monte Tomato Sauce (Philippines)

Del Monte Tomato Sauce in the Philippines stands as a prime example of a Cash Cow within Del Monte Pacific's portfolio. Its enduring market leadership, evidenced by an impressive 84.9% market share as of early 2024, underscores its consistent revenue generation.

Recent marketing efforts, including targeted campaigns and attractive value bundles, have not only solidified this dominance but also driven further market share gains. This product's status as a household staple ensures a predictable and substantial cash flow for the company.

- Market Share: 84.9% (early 2024)

- Performance: Consistently strong, driven by staple status and effective marketing.

- Cash Flow: Robust and predictable due to high demand and market leadership.

- Strategic Role: Generates significant funds to support other business units.

Del Monte Spaghetti Sauce (Philippines)

Del Monte Spaghetti Sauce in the Philippines stands as a prime example of a Cash Cow within Del Monte Pacific's portfolio. Its leadership position in the market is undeniable, evidenced by a sustained increase in market share, especially during key consumption periods such as birthdays and festive seasons.

The brand's robust market standing is further solidified by its dual-brand strategy, encompassing both Del Monte and Today's brands. This approach effectively captures a broader consumer base, ensuring a consistent and reliable revenue stream for the company.

Key strategies contributing to its cash-generating prowess include a strong emphasis on value packs, which appeal to price-sensitive consumers, and an extensive distribution network that ensures product availability across the archipelago. For instance, in 2024, Del Monte Foods Philippines reported strong performance in its sauces and condiments category, with spaghetti sauce being a significant contributor to overall sales growth, reaching PHP 5.8 billion in revenue.

- Market Dominance: Del Monte Spaghetti Sauce holds a leading position in the Philippine market.

- Revenue Generation: Its strong market share, bolstered by brands like Today's, provides a steady income.

- Strategic Focus: Value packs and widespread distribution enhance its cash-generating capabilities.

- Financial Performance: The category contributed significantly to Del Monte Foods Philippines' 2024 revenue of PHP 5.8 billion.

Del Monte Canned Vegetables in the U.S. and Del Monte Packaged Pineapple in the Philippines exemplify Cash Cows for Del Monte Pacific. These products boast high market share, with Del Monte canned vegetables achieving a record 23.7% in November 2024, and Philippine pineapple holding over 95% market share.

Their mature markets generate substantial and consistent cash flow, enabling reinvestment into other business areas. The strong consumer loyalty and product demand ensure their stable revenue generation capabilities.

| Product Category | Region | Market Share (Approx.) | Key Characteristic |

|---|---|---|---|

| Canned Vegetables | U.S. | 23.7% (Nov 2024) | High market share in a mature market, consistent cash flow. |

| Packaged Pineapple | Philippines | >95% | Dominant market leadership, stable revenue generator. |

| Mixed Fruits | Philippines | 76.8% (Apr 2024) | Strong brand loyalty in a growing category, consistent revenue. |

| Tomato Sauce | Philippines | 84.9% (Early 2024) | Household staple, predictable cash flow driven by market leadership. |

| Spaghetti Sauce | Philippines | Leading position | Significant contributor to 2024 revenue (PHP 5.8 billion for sauces/condiments), strong cash generation. |

Delivered as Shown

Del Monte Pacific BCG Matrix

The Del Monte Pacific BCG Matrix preview you are viewing is the identical, fully rendered report you will receive upon purchase. This means you'll get the complete strategic analysis, free from any watermarks or sample indicators, ready for immediate integration into your business planning. The document is professionally formatted and designed to offer clear insights into Del Monte Pacific's product portfolio, allowing for decisive strategic decision-making. Once acquired, this comprehensive BCG Matrix will be yours to edit, present, or utilize as a foundational tool for competitive strategy and market positioning.

Dogs

Del Monte Foods, Inc. (DMFI) has strategically moved away from lower-margin co-pack products, which are manufactured for external companies. This decision reflects a focus on optimizing resource allocation and enhancing overall profitability.

These co-pack arrangements were consuming valuable resources without delivering commensurate returns or capturing substantial market share. The divestment is a key component of DMFI's strategy to streamline operations and boost its bottom line.

Del Monte Pacific's underperforming US manufacturing plants, like the vegetable facilities in Wisconsin and Washington that have seen closures, represent the Dogs in their BCG Matrix. These operations were likely characterized by low market share and low growth, leading to significant inefficiencies and financial drains. For instance, the company has been working to optimize its US operations, which have faced challenges in a competitive landscape.

The closure of these plants is a strategic move to cut losses and streamline operations, directly addressing the negative cash flow often associated with Dog products or business units. In 2024, the company continued to focus on improving profitability within its US segment, which historically has been a more challenging market compared to its strong performance in Asia.

Del Monte's specific legacy canned fruit varieties in the US, while part of a category where the company holds a leading market share, are facing headwinds. The overall U.S. canned fruit market has seen declining trends, with some packaged fruit experiencing lower sales. This indicates that certain older, specific product lines within Del Monte's vast range are likely underperforming.

These legacy SKUs could be considered cash traps. They might be consuming capital and resources without generating substantial returns, especially as the demand for some traditional canned fruit options diminishes. For instance, while the total U.S. canned fruit market might be stable or slightly declining, specific niche varieties could be experiencing steeper drops in consumer preference.

Fiesta Fruit Cocktail (Philippines)

Fiesta Fruit Cocktail in the Philippines, despite the mixed fruits category seeing growth, has faced challenges in expanding its own sales. This suggests it's a product with a slower growth trajectory than the broader market, potentially indicating a decline in its market share within the segment.

This situation places Fiesta Fruit Cocktail in a position that warrants careful strategic consideration. The product might be a candidate for revitalization efforts to boost its performance, or if these efforts prove unsuccessful, a potential divestment could be on the table.

- Market Position: Fiesta Fruit Cocktail is experiencing low growth, lagging behind the overall Philippine mixed fruits market.

- Strategic Implication: The product may be losing market share, necessitating a review of its competitive standing.

- Potential Actions: Options include investing in marketing and product innovation to reignite growth or considering an exit strategy if underperformance persists.

Older, Declining Canned Juice Variants (Philippines)

While the ready-to-drink (RTD) juice market in the Philippines is experiencing growth, certain older canned juice variants are facing declines. This shift suggests these legacy products are in a low-growth segment and potentially losing market share within Del Monte Pacific's portfolio.

- Market Share Erosion: Older canned juice formats are witnessing a decline in demand, with growth in the overall juice category being captured by newer PET bottle offerings and more budget-friendly competitors.

- Strategic Challenge: These declining canned variants represent a challenge for Del Monte Pacific, as they are likely positioned as 'Dogs' in the BCG matrix, requiring careful consideration for resource allocation.

- Category Dynamics: The preference is shifting towards more convenient and potentially perceived as healthier packaging like PET bottles, impacting the relevance of traditional canned juices.

- Competitive Landscape: Lower-priced competitors are also contributing to the pressure on these older variants, making it harder for them to maintain their market position.

Del Monte Pacific's "Dogs" are essentially its underperforming business units or product lines. These are typically characterized by low market share in a low-growth market. Think of them as the parts of the business that aren't contributing much to profits and are draining resources. For instance, Del Monte Pacific has been working to optimize its U.S. operations, which have faced challenges in a competitive landscape, with some manufacturing facilities seeing closures. These closures often signal that those operations were not meeting performance expectations.

Specific legacy canned fruit varieties in the U.S. are also likely candidates for the Dog category. While Del Monte is strong in canned fruit overall, certain older product lines might be experiencing declining consumer preference, leading to lower sales and making them less profitable. The shift in consumer habits and the rise of alternative fruit options contribute to this challenge.

Similarly, older canned juice variants in the Philippines are facing declines. The market is moving towards newer packaging like PET bottles and more budget-friendly options, pushing these traditional canned juices into a low-growth, potentially shrinking market segment. This means they are likely losing ground to more popular alternatives.

These "Dog" segments require careful management. The company might invest in revitalizing them, or if that's not feasible, consider divesting them to free up resources for more promising areas of the business. The focus is on improving the overall profitability and efficiency of the Del Monte Pacific portfolio.

Question Marks

The S&W Salted Egg Cookies, launched in January 2025 in Hong Kong and Macau, mark Del Monte Pacific's strategic diversification into the snack market. This new product is positioned as a potential star within the BCG matrix, given its entry into a new, high-growth potential category.

As a novel offering, its current market share is naturally low, but its high growth prospects are a key indicator of its star potential. Del Monte Pacific anticipates significant investment will be necessary to build brand awareness and secure robust distribution channels for this innovative product.

Del Monte Halo-Halo Mix in the Philippines is positioned as a potential star or question mark within Del Monte Pacific's BCG Matrix. Its recent launch capitalizes on cultural resonance and the growing trend of at-home dessert preparation, a significant opportunity in a market that values convenience and tradition. The Philippine dessert mix market is experiencing robust growth, with projections indicating continued expansion driven by busy lifestyles and a desire for easy-to-prepare, authentic flavors.

Del Monte Fruit Refreshers, recognized with a 2024 Product of the Year Award in the healthy snack category, exemplifies the company's strategic push into the health-conscious market. This innovation positions them to tap into the growing demand for convenient, nutritious options.

While the award highlights significant potential, Fruit Refreshers are still building their market presence within a crowded and expanding healthy snack landscape. Capturing a more substantial market share will necessitate ongoing investment to solidify its position and potentially elevate it to a Star product in the BCG matrix.

Take Root Organics (US)

Take Root Organics, a brand within Del Monte Pacific's portfolio, is positioned as a Question Mark in the BCG Matrix. This classification stems from its current standing in a high-growth market with a relatively low market share.

The brand is actively increasing its presence in the meal ingredient category. Notably, Take Root Organics secured a 2024 Product of the Year Award, underscoring its innovation and consumer appeal. This recognition highlights the brand's momentum and potential within its segment.

As an organic product, Take Root Organics taps into a significant and expanding consumer trend towards clean labels and healthier food choices. The organic food market in the US experienced substantial growth, with projections indicating continued expansion through 2025 and beyond, driven by consumer demand for transparency and natural ingredients.

Given its focus on the burgeoning organic sector and its recent award, Take Root Organics exhibits high growth potential. However, its current market share is likely modest, necessitating strategic investment to capitalize on the market's upward trajectory and transition from a Question Mark to a Star.

- Market Position: Question Mark

- Growth Rate: High (organic and natural food market)

- Market Share: Low (currently)

- Key Achievement: 2024 Product of the Year Award

Del Monte Dairy Business (Philippines)

Del Monte Pacific is strategically investing in its Philippine dairy business, a move that positions it within a growing market. This expansion signifies a deliberate effort to diversify and tap into new revenue streams.

As a relatively new entrant into the Philippine dairy sector, Del Monte Pacific's business unit likely holds a low market share. However, the overall dairy market in the Philippines is experiencing robust growth, with projections indicating continued expansion in the coming years.

- Market Growth: The Philippine dairy market is anticipated to grow at a compound annual growth rate (CAGR) of approximately 7-8% through 2028, driven by increasing disposable incomes and a growing preference for dairy products.

- Strategic Investment: Del Monte Pacific's commitment to this segment reflects a long-term vision to establish a significant presence and potentially achieve market leadership.

- New Venture Dynamics: New ventures typically begin with a smaller market share but aim to leverage innovation and market penetration strategies to gain traction.

Take Root Organics, a brand within Del Monte Pacific's portfolio, is currently classified as a Question Mark in the BCG Matrix. This is due to its presence in the high-growth organic and natural food market, where it holds a relatively low market share.

The brand's focus on organic products aligns with a significant and expanding consumer trend towards clean labels and healthier food choices. The US organic food market, for instance, saw substantial growth, with continued expansion projected through 2025 and beyond. Take Root Organics' recent achievement of a 2024 Product of the Year Award further underscores its innovation and consumer appeal within this dynamic segment.

Despite its potential, Take Root Organics requires strategic investment to capitalize on the market's upward trajectory and increase its market share. This investment is crucial for transitioning the brand from a Question Mark to a potential Star product.

| Product/Brand | BCG Position | Market Growth Rate | Market Share | Key Achievement |

|---|---|---|---|---|

| Take Root Organics | Question Mark | High (Organic & Natural Food Market) | Low (Currently) | 2024 Product of the Year Award |

BCG Matrix Data Sources

Our Del Monte Pacific BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on consumer trends, and official company disclosures to ensure reliable, high-impact insights.