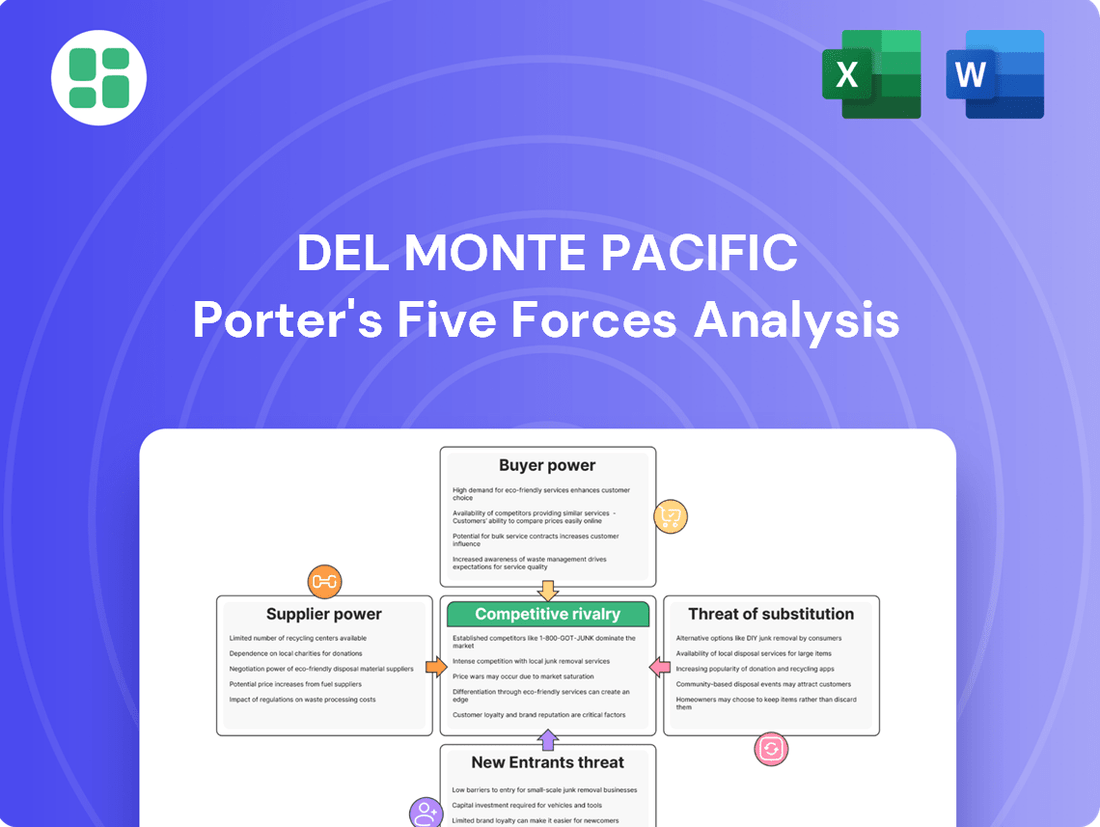

Del Monte Pacific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Del Monte Pacific Bundle

Del Monte Pacific faces moderate buyer power, as consumers have many food choices, but brand loyalty and product differentiation can mitigate this. The threat of new entrants is also a significant factor, requiring continuous innovation and efficient operations to maintain market share.

The complete report reveals the real forces shaping Del Monte Pacific’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability of key raw materials, such as pineapples and other fruits and vegetables, is heavily influenced by agricultural yields and weather patterns. This directly impacts the bargaining power of Del Monte Pacific's suppliers. For instance, climate change or natural disasters can lead to supply fluctuations, thereby strengthening supplier leverage.

Del Monte Pacific has recently faced challenges stemming from reduced pineapple supply in Asia, coupled with increased costs in its U.S. operations. These situations underscore the company's vulnerability to supply-side disruptions and the resulting impact on supplier power.

The concentration of suppliers for key ingredients or packaging materials significantly impacts their leverage. When critical inputs are sourced from a limited number of large providers, these suppliers are better positioned to dictate higher prices. For instance, if only a handful of companies produce specialized aseptic packaging vital for Del Monte's shelf-stable products, their bargaining power is substantial.

Del Monte Pacific's strategic focus on enhancing productivity and minimizing waste for processed pineapple variety C74, as highlighted in their operational reports, demonstrates a proactive approach to managing these supply-side cost pressures. By optimizing internal processes for specific product lines, they aim to reduce their reliance on potentially high-cost inputs or negotiate more favorable terms.

Del Monte Pacific faces moderate supplier power, influenced by the switching costs associated with changing its raw material and packaging providers. High switching costs, perhaps due to specialized sourcing or integrated supply chain technologies, would grant suppliers greater leverage. While Del Monte Pacific's 2024 sustainability initiatives focus on operational efficiencies, these efforts may not immediately translate into significantly lower switching costs for all supplier relationships.

Supplier Power 4

The bargaining power of suppliers for Del Monte Pacific is influenced by the uniqueness and differentiation of the raw materials they provide. When suppliers offer proprietary fruit varieties or specialized processing ingredients, they gain more leverage compared to those supplying common commodity goods. Del Monte Pacific's strategic investment in specific pineapple varieties, such as C74, highlights a reliance on particular inputs that can bolster supplier influence.

This reliance can translate into higher input costs or less favorable terms for Del Monte Pacific. For example, if a key supplier of a specialized ingredient faces production issues, it could significantly disrupt Del Monte's operations and necessitate paying a premium to secure supply. The company's efforts to diversify sourcing and develop in-house capabilities are crucial for mitigating this supplier power.

- Supplier Differentiation: Unique or proprietary inputs, like specific pineapple varieties, increase supplier leverage.

- Input Reliance: Del Monte Pacific's investment in varieties like C74 demonstrates dependence on specialized suppliers.

- Cost Implications: Differentiated inputs can lead to higher raw material costs for Del Monte Pacific.

- Mitigation Strategies: Diversifying sourcing and developing internal capabilities are key to reducing supplier power.

Supplier Power 5

Del Monte Pacific's bargaining power with its suppliers is influenced by its ability to integrate backward and control raw material sources. For instance, its significant pineapple plantations provide a degree of control over a key input.

However, if suppliers possess the capability to forward integrate into food processing, their bargaining power would be amplified, potentially impacting Del Monte's margins. The company's reliance on specific agricultural inputs and the concentration of its suppliers are critical factors in assessing this power dynamic.

- Backward Integration: Del Monte's ownership of extensive pineapple plantations directly mitigates supplier power by securing a significant portion of its raw material needs.

- Supplier Forward Integration Risk: The potential for suppliers to move into processing could shift leverage towards them, increasing costs for Del Monte.

- Scale of Operations: Del Monte's large-scale procurement can provide some leverage, but this is balanced by the specialized nature of agricultural inputs.

- Industry Concentration: The number and size of suppliers for key ingredients like fruits and vegetables play a crucial role in determining supplier bargaining power.

Del Monte Pacific faces moderate supplier power, primarily due to the specialized nature of its key inputs like pineapples and aseptic packaging. While the company's scale offers some leverage, supplier differentiation and the potential for forward integration by suppliers can increase input costs. For example, in 2024, the company noted continued cost pressures on certain agricultural inputs, highlighting the ongoing influence of suppliers.

| Factor | Impact on Del Monte Pacific | 2024 Relevance |

|---|---|---|

| Supplier Differentiation | Higher leverage for suppliers offering unique inputs (e.g., specific pineapple varieties). | Del Monte's investment in C74 variety indicates reliance on specialized inputs. |

| Input Reliance & Concentration | Vulnerability to supply disruptions and price increases from limited suppliers. | Reported reduced pineapple supply in Asia in 2024 impacted operations. |

| Switching Costs | Moderate to high switching costs can empower suppliers. | Sustainability initiatives in 2024 focused on efficiency, not necessarily reducing supplier switching costs. |

| Backward/Forward Integration | Del Monte's plantations mitigate supplier power; supplier forward integration poses a risk. | The company's plantation scale provides some control, but reliance on external suppliers remains. |

What is included in the product

Del Monte Pacific's Porter's Five Forces analysis reveals the intense competitive rivalry, significant buyer power, and moderate threat of substitutes within the global food and beverage industry.

Instantly identify and address competitive threats with a visual breakdown of Del Monte Pacific's Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Large retail chains and supermarkets hold considerable sway over Del Monte Pacific due to their substantial purchasing volumes. These powerful buyers can dictate terms, pushing for lower prices and preferential treatment, which directly affects Del Monte's profitability. For instance, Del Monte's focus on securing holiday merchandising with major customers underscores the importance of appeasing these key distributors.

Del Monte Pacific faces significant buyer power due to the price sensitivity of consumers, especially for staple goods like canned fruits and vegetables. In 2024, the average consumer's disposable income has been a key factor, making them more inclined to seek out value. This sensitivity means customers can easily switch to cheaper brands or private labels if Del Monte's pricing is perceived as too high.

The increasing prevalence of private label brands across the food and beverage sector amplifies this buyer power. Retailers are actively promoting their own brands, often at lower price points, directly challenging established names like Del Monte. This trend was evident in 2024, with private label market share in many grocery categories showing continued growth, putting pressure on manufacturers to justify their premium pricing.

The bargaining power of customers for Del Monte Pacific is significant, driven by the wide availability of alternative products and brands. In 2024, the packaged food and beverage industry, where Del Monte operates, is characterized by intense competition, allowing consumers to readily switch between offerings. This high degree of substitutability means customers can exert considerable pressure on pricing and product features.

Del Monte Pacific faces this challenge across its key segments, including canned fruits, vegetables, juices, and condiments. For instance, in the canned fruit market, consumers have numerous choices from both global brands and local producers, making it easier to substitute Del Monte products if price or quality expectations are not met. This dynamic is a constant consideration in the company's strategic planning.

To mitigate this customer power, Del Monte Pacific is actively focusing on product differentiation and brand building. Initiatives such as introducing innovative product lines, like premium fruit cups or healthier beverage options, and robust marketing campaigns aim to foster brand loyalty and reduce price sensitivity. These efforts are crucial for maintaining market share and profitability in a competitive landscape.

Buyer Power 4

Buyer power is a significant factor for Del Monte Pacific, as informed consumers can exert considerable pressure. Increased customer knowledge about ingredients, health benefits, and sustainability practices directly enhances their ability to negotiate or switch brands. For instance, in 2024, consumer surveys indicated a strong preference for transparency, with over 70% of respondents stating they actively seek information on food sourcing and production methods before purchasing.

The growing demand for healthier, organic, and sustainably produced food options empowers consumers to influence Del Monte Pacific's strategic decisions. This trend is particularly evident in the canned fruit and vegetable market. In 2023, the global market for organic produce reached an estimated $120 billion, signaling a clear consumer shift that companies like Del Monte Pacific must address. Their focus on nutritious, high-quality products and commitment to sustainability, including efforts to reduce plastic packaging, directly aligns with these evolving consumer preferences, thereby shaping their product development and marketing strategies.

Del Monte Pacific's strategic alignment with these consumer demands can mitigate some of the buyer power. By offering products that meet the criteria for health and sustainability, the company can foster brand loyalty and reduce the likelihood of customers switching based solely on price or availability. This proactive approach is crucial in a market where consumer awareness is at an all-time high.

Key aspects influencing buyer power for Del Monte Pacific include:

- Informed Consumers: Access to detailed product information, including nutritional content and sourcing, empowers buyers.

- Health and Sustainability Trends: Growing demand for organic, natural, and ethically produced goods increases consumer leverage.

- Brand Loyalty: Del Monte Pacific's efforts in product quality and sustainability can build loyalty, reducing price sensitivity.

- Market Availability: The presence of numerous alternative brands offering similar products can amplify buyer power if Del Monte Pacific's offerings are not sufficiently differentiated.

Buyer Power 5

The bargaining power of Del Monte Pacific's customers varies significantly based on their size and purchasing volume. Individual consumers, making up a vast but fragmented customer base, possess minimal leverage. However, large distributors and institutional buyers, such as major supermarket chains or foodservice operators, can exert considerable influence due to their substantial order sizes.

Del Monte Pacific's strategic focus on expanding its foodservice channel underscores the increasing importance of these larger, more powerful customer segments. For instance, in the fiscal year 2023, Del Monte Pacific reported that its consumer products segment, which includes retail sales, generated the majority of its revenue, but the foodservice sector is a key area for growth and potential for concentrated buyer power.

- Individual consumers have low bargaining power due to their small purchase volumes.

- Large distributors and institutional buyers (e.g., foodservice) can exert significant pressure due to their scale.

- Del Monte Pacific's growth in the foodservice channel highlights the strategic importance of managing relationships with these major customers.

Del Monte Pacific's customers, particularly large retail chains, wield significant bargaining power. Their ability to demand lower prices and favorable terms is amplified by the sheer volume they purchase. In 2024, the continued growth of private label brands further empowers these buyers, as they can readily offer their own cheaper alternatives, directly challenging Del Monte's market position and profitability.

The price sensitivity of consumers in 2024, influenced by economic conditions, means that Del Monte Pacific must remain competitive. Customers can easily switch to more affordable brands or private labels if Del Monte's pricing is perceived as too high, especially for staple goods. This dynamic necessitates a careful balance between maintaining margins and offering value to the end consumer.

| Customer Segment | Bargaining Power Factor | Impact on Del Monte Pacific |

|---|---|---|

| Large Retail Chains | High volume purchases, private label promotion | Pressure on pricing, demand for favorable terms |

| Institutional Buyers (Foodservice) | Significant order sizes, long-term contracts | Influences product specifications and delivery schedules |

| Individual Consumers | Price sensitivity, availability of substitutes | Requires competitive pricing and product differentiation |

Same Document Delivered

Del Monte Pacific Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Del Monte Pacific's Porter's Five Forces analysis details the intense competition within the global food and beverage industry, highlighting how established brands and private labels exert significant bargaining power over the company. The document also thoroughly examines the threat of new entrants, the availability of substitutes, and the bargaining power of buyers, providing a comprehensive strategic overview.

Rivalry Among Competitors

Del Monte Pacific operates in a highly competitive branded food and beverage sector, especially within packaged fruits, vegetables, beverages, and culinary sauces. This market is crowded with many strong global and regional brands vying for consumer attention and market share.

Key rivals such as Dole Food Company, Nestlé, Kraft Heinz, and General Mills present significant competitive pressure across Del Monte Pacific's diverse product lines and geographic markets. For instance, in the canned fruit segment, Dole is a particularly formidable competitor, often engaging in aggressive pricing and promotional activities to capture market share.

The intensity of this rivalry is further amplified by the relatively low switching costs for consumers in many of these product categories, forcing companies to continually innovate and invest in marketing to maintain brand loyalty and attract new customers. In 2023, the global canned fruit market alone was valued at over $18 billion, highlighting the significant stakes involved.

Competitive rivalry is particularly fierce in segments like canned goods, where global market growth rates are often sluggish or even declining. This slowdown means companies must fight harder for every slice of market share, leading to intense competition on price, product innovation, and marketing efforts.

Del Monte Pacific's own U.S. business has faced headwinds, with declining packaged fruit sales mirroring broader category trends. For instance, in fiscal year 2023, the company reported a net sales decrease in its U.S. business, underscoring the pressure from rivals in a mature market. This environment necessitates constant adaptation to maintain relevance and profitability.

Competitive rivalry within the canned fruit and vegetable sector is intense, with brand loyalty and product differentiation playing key roles. However, the relatively low cost and ease of switching between brands for consumers can significantly amplify this rivalry.

Del Monte Pacific benefits from robust brand recognition, particularly in its home market of the Philippines, where it holds a dominant position. This strong brand equity helps it navigate competitive pressures.

Despite its strengths, Del Monte Pacific encounters significant challenges, especially in segments like ready-to-drink juices. Here, lower-priced competitors have successfully captured market share, indicating a price-sensitive consumer base and the need for continuous innovation and value proposition refinement.

Competitive Rivalry 4

The food industry, including companies like Del Monte Pacific, often grapples with high fixed costs associated with manufacturing and distribution. This economic reality intensifies competitive rivalry, as firms are incentivized to maximize their operational capacity and spread these substantial costs over a larger volume of sales. Consequently, this can trigger aggressive pricing strategies, particularly when the market faces oversupply or a downturn in consumer demand.

Del Monte Pacific's strategic initiatives, such as consolidating its manufacturing footprint and actively working to reduce warehousing expenses, are direct responses to these inherent industry pressures. These moves aim to improve operational efficiency and mitigate the financial strain caused by high fixed costs, thereby strengthening its competitive position.

- High Fixed Costs: Manufacturing and distribution in the food sector demand significant capital investment, creating a barrier to entry but also a pressure to operate at full capacity.

- Price Wars: The drive to utilize capacity can lead to intense price competition, impacting profit margins for all players.

- Capacity Utilization: Companies like Del Monte Pacific must balance production levels with market demand to avoid costly idle capacity.

- Efficiency Drives: Del Monte Pacific's focus on consolidating operations and reducing warehousing costs reflects a broader industry trend towards optimizing supply chains to combat cost pressures.

Competitive Rivalry 5

Del Monte Pacific faces significant competitive rivalry, with players frequently engaging in strategic actions that reshape the market. These actions include launching innovative products, implementing aggressive pricing strategies, pursuing mergers and acquisitions, and executing impactful marketing campaigns. For instance, in the canned fruit and vegetable sector, competitors often introduce new flavors or healthier options to capture consumer attention. In 2023, the global canned food market was valued at approximately $110 billion, indicating a substantial and active competitive landscape.

To counter these pressures and maintain its market leadership, Del Monte Pacific itself is committed to continuous product innovation and dynamic marketing efforts. The company regularly introduces new product lines and refreshes existing ones to align with evolving consumer tastes and health consciousness. This proactive approach is crucial in a market where consumer preferences can shift rapidly, influenced by trends in wellness and convenience.

- Product Launches: Competitors frequently introduce new product variations, such as organic or low-sodium options, directly challenging Del Monte Pacific's market share.

- Pricing Strategies: Aggressive discounting and promotional pricing by rivals can put pressure on Del Monte Pacific's profit margins.

- Marketing Campaigns: Competitors invest heavily in advertising and social media to build brand loyalty and attract new customers, requiring Del Monte Pacific to respond with equally compelling campaigns.

- Market Consolidation: Mergers and acquisitions within the food industry can create larger, more formidable competitors, increasing the intensity of rivalry.

Del Monte Pacific faces intense competition from global giants like Dole, Nestlé, and Kraft Heinz, particularly in mature markets such as canned fruits where growth is slow. This rivalry is fueled by low consumer switching costs and a need for continuous innovation, as seen in the over $18 billion global canned fruit market in 2023.

The company's U.S. business, for example, experienced declining packaged fruit sales in fiscal year 2023, reflecting the pressure from competitors in a saturated environment. High fixed costs in food manufacturing also compel companies to maintain high production volumes, often leading to aggressive pricing and promotional activities.

Del Monte Pacific counters this by leveraging its strong brand recognition, especially in the Philippines, and by focusing on product innovation and marketing to differentiate itself. However, challenges persist, particularly in price-sensitive segments like ready-to-drink juices where lower-priced rivals have gained traction.

The overall canned food market, valued at approximately $110 billion in 2023, is a battleground for market share, characterized by frequent product launches, aggressive pricing, and substantial marketing investments from all players.

SSubstitutes Threaten

Fresh produce presents a considerable threat to Del Monte Pacific's packaged fruit and vegetable offerings. As consumer demand shifts towards fresh, minimally processed, and healthier food options, the appeal of canned and frozen goods diminishes, directly impacting sales volumes for these product categories.

The rising popularity of homemade meals and scratch cooking presents a significant threat to Del Monte Pacific's packaged food and sauce offerings. As more consumers embrace preparing food from basic ingredients, the demand for convenient, ready-to-use alternatives naturally declines. This shift directly impacts sales volumes for products like canned fruits, vegetables, and pre-made sauces, as consumers opt for fresher, often perceived as healthier, home-cooked options.

The threat of substitutes for Del Monte Pacific's packaged beverage products is significant. Consumers increasingly opt for alternative beverage choices like fresh juices, bottled water, and a growing array of other non-carbonated drinks. This trend is fueled by a broader societal shift towards healthier lifestyles and a desire for greater beverage variety, directly impacting the sales of traditional packaged juices.

Threat of Substitutes 4

Private label brands, readily available from major retailers, present a significant threat by offering comparable products at lower price points. These store-brand alternatives directly substitute Del Monte Pacific's offerings across its entire product portfolio, from canned fruits and vegetables to juices and prepared meals.

The appeal of these value-oriented substitutes is particularly strong among consumers prioritizing price. For instance, in 2024, private label penetration in the U.S. grocery market continued to grow, with some categories seeing over 20% market share for store brands. This trend directly impacts branded goods like Del Monte Pacific, as consumers may opt for the more economical private label choice, thereby eroding market share and potentially pressuring pricing strategies.

- Lower Price Points: Retailer-owned brands consistently undercut national brands, making them an attractive option for budget-conscious shoppers.

- Broad Availability: Private labels are ubiquitous in supermarkets, ensuring easy access and convenience for consumers.

- Perceived Value: Many private label products have improved in quality, narrowing the perceived gap with national brands while maintaining a significant price advantage.

- Retailer Support: Retailers often promote their private label brands through prominent shelf placement and in-store marketing, further boosting their visibility and appeal.

Threat of Substitutes 5

The threat of substitutes for Del Monte Pacific is heightened by evolving consumer dietary preferences. The growing popularity of plant-based, vegan, and health-specific diets encourages consumers to seek out specialized ingredients and products that may fall outside Del Monte's core canned fruit and vegetable portfolio. This shift means consumers might opt for fresh produce, frozen alternatives, or entirely new product categories that cater to these niche dietary needs.

Del Monte Pacific is actively addressing this by diversifying its product lines and embracing innovation. For instance, the company has introduced products like Joyba bubble tea, which taps into a popular beverage trend and offers a convenient, ready-to-drink option. This strategic move aims to capture consumer interest in newer, health-conscious, and convenient food and beverage categories, thereby mitigating the impact of traditional substitutes.

The company's focus on healthy offerings is another key strategy. By developing products that align with wellness trends, Del Monte Pacific can attract consumers who might otherwise turn to alternatives perceived as healthier or more aligned with specific lifestyle choices. This proactive approach is crucial in a market where dietary trends can rapidly alter consumer purchasing habits.

- Growing Plant-Based Market: The global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to grow significantly, indicating a strong consumer shift towards alternatives.

- Health and Wellness Focus: Consumers are increasingly prioritizing health, leading to demand for minimally processed foods and beverages, which can challenge traditional canned goods.

- Product Innovation: Del Monte Pacific's introduction of products like Joyba bubble tea demonstrates an effort to compete with newer beverage trends and capture a broader consumer base.

- Dietary Trend Adaptation: The company's strategy to focus on healthy offerings aims to retain market share by aligning with evolving consumer demands for nutritious and convenient food options.

The threat of substitutes for Del Monte Pacific is substantial, encompassing fresh produce, homemade meals, and alternative beverages like bottled water and fresh juices. In 2024, the continued growth of private label brands, which often offer comparable quality at lower prices, directly challenges Del Monte's market share across its product lines. These store brands, achieving over 20% market share in some U.S. grocery categories, represent a significant value-oriented substitute for consumers.

Evolving dietary preferences, such as the rise of plant-based and health-specific diets, further expand the range of substitutes. Consumers seeking minimally processed options may turn to fresh or frozen alternatives, impacting Del Monte's traditional canned goods. The company is responding through product diversification, like the introduction of Joyba bubble tea, to capture demand in newer, convenient, and health-conscious categories.

| Substitute Category | Impact on Del Monte | Key Drivers | 2024 Data/Trend |

|---|---|---|---|

| Fresh Produce | Reduced demand for canned fruits/vegetables | Consumer shift to healthier, minimally processed foods | Continued consumer preference for fresh over processed options. |

| Homemade Meals | Lower demand for pre-made sauces and meal components | Increased interest in scratch cooking and home preparation | Growing popularity of cooking classes and online recipe platforms. |

| Alternative Beverages | Competition for packaged juices and drinks | Demand for healthier options (bottled water, fresh juices) and variety | Significant market share for bottled water brands; growth in niche beverage categories. |

| Private Label Brands | Price-based competition across all product categories | Lower price points, broad availability, perceived value, retailer promotion | Private label penetration exceeding 20% in some U.S. grocery segments in 2024. |

Entrants Threaten

The threat of new entrants for Del Monte Pacific is generally moderate to low, primarily due to substantial barriers in the branded food and beverage sector. Establishing large-scale food manufacturing facilities, building robust distribution networks, and cultivating a strong brand presence require significant capital investment, making it difficult for newcomers to compete effectively. For instance, the global food processing industry, where Del Monte operates, saw investments in new facilities and upgrades in the billions of dollars annually in recent years, a figure that can deter smaller players.

The threat of new entrants for Del Monte Pacific is relatively low, largely due to the significant barriers to entry in the processed food and beverage industry. Del Monte's nearly 140-year history has cultivated strong brand loyalty and high consumer trust, making it a challenge for newcomers to gain traction. For instance, in 2024, the global canned food market, a key segment for Del Monte, was valued at approximately $50 billion, with established brands holding a substantial market share.

Building comparable brand equity necessitates considerable investment in marketing and distribution, which can be prohibitive for new players. Del Monte's extensive distribution network and established relationships with retailers provide a significant competitive advantage. The capital required to establish production facilities, secure raw material supply chains, and meet stringent food safety regulations further deters potential entrants.

The threat of new entrants for Del Monte Pacific is moderate. Securing access to established distribution channels, particularly relationships with major retailers and an efficient supply chain, presents a significant hurdle for newcomers. Del Monte Pacific leverages its extensive distribution networks across the Philippines, the U.S., and the broader Asia-Pacific region, giving it a distinct advantage.

Threat of New Entrants 4

The threat of new entrants in the canned fruit and vegetable market, where Del Monte Pacific operates, is significantly mitigated by substantial regulatory hurdles. Compliance with stringent food safety regulations, such as those from the FDA in the US and equivalent bodies globally, along with complex labeling standards, presents considerable initial costs and operational challenges for any new player. For instance, obtaining necessary certifications and ensuring traceability throughout the supply chain requires significant investment in quality control systems and expertise, which established companies like Del Monte Pacific have already mastered.

These barriers to entry are not trivial. New entrants must invest heavily in meeting these requirements before even launching their products. Del Monte Pacific, having navigated these complex regulatory landscapes for decades, benefits from established processes and a deep understanding of compliance requirements. This existing infrastructure and knowledge base create a significant advantage, making it difficult for newcomers to compete on a level playing field, especially considering the capital required for production facilities, distribution networks, and marketing to gain consumer trust.

Key challenges for new entrants include:

- High Capital Investment: Setting up compliant manufacturing facilities and securing reliable sourcing of raw materials demands substantial upfront capital.

- Stringent Food Safety Standards: Adhering to rigorous safety protocols and obtaining certifications like HACCP or GFSI are costly and time-consuming.

- Complex Labeling and Traceability: Meeting diverse international labeling laws and establishing robust traceability systems adds to operational complexity and expense.

- Brand Recognition and Distribution: Building brand trust and securing shelf space in competitive retail environments requires significant marketing and distribution investment.

Threat of New Entrants 5

The threat of new entrants for Del Monte Pacific is relatively low due to significant barriers to entry. Established players like Del Monte Pacific benefit from substantial economies of scale in purchasing raw materials, manufacturing, and marketing. This allows them to achieve cost efficiencies that are very difficult for newcomers to replicate, making it challenging for new companies to compete on price.

New entrants would face considerable hurdles in matching the operational cost advantages of incumbents. For instance, Del Monte Pacific's global supply chain and extensive distribution networks, built over decades, represent a significant capital investment and operational complexity that new companies would need to overcome. In 2023, Del Monte Pacific reported revenues of approximately $2.4 billion, indicative of the scale required to be a major player in the global food and beverage industry.

Furthermore, brand loyalty and established consumer trust are powerful deterrents. Del Monte's brand recognition, cultivated through consistent marketing and product quality, creates a strong customer base that new entrants would struggle to penetrate. Building such brand equity requires considerable time and investment, often exceeding the resources of nascent companies.

- Economies of Scale: Del Monte Pacific leverages scale in procurement and production, leading to lower per-unit costs that new entrants cannot easily match.

- Capital Requirements: Establishing a similar manufacturing, distribution, and marketing infrastructure demands substantial capital investment, acting as a significant barrier.

- Brand Loyalty: Del Monte's established brand recognition and consumer trust are difficult and costly for new entrants to build.

- Distribution Channels: Access to and establishment of widespread distribution networks is a critical challenge for new players entering the market.

The threat of new entrants for Del Monte Pacific is generally low to moderate. Significant capital investment is required for large-scale food manufacturing, robust distribution, and brand building. For example, the global processed food market, a key sector for Del Monte, involves substantial investments in facilities and supply chains annually, often in the billions of dollars.

New entrants face hurdles in matching Del Monte's established brand loyalty and extensive distribution networks. Building comparable brand equity and securing shelf space in competitive retail environments requires considerable marketing and distribution investment. In 2024, the global canned food market alone was valued at around $50 billion, with established brands like Del Monte holding significant market share.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment needed for manufacturing, distribution, and marketing. | Significant deterrent. |

| Brand Loyalty | Decades of consumer trust and recognition. | Difficult and costly to overcome. |

| Distribution Channels | Established networks across key markets. | Challenging to access and replicate. |

| Economies of Scale | Cost advantages in procurement and production. | Makes price competition difficult for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Del Monte Pacific leverages data from annual reports, investor presentations, and industry-specific market research reports. We also incorporate information from financial news outlets and competitor disclosures to provide a comprehensive understanding of the competitive landscape.