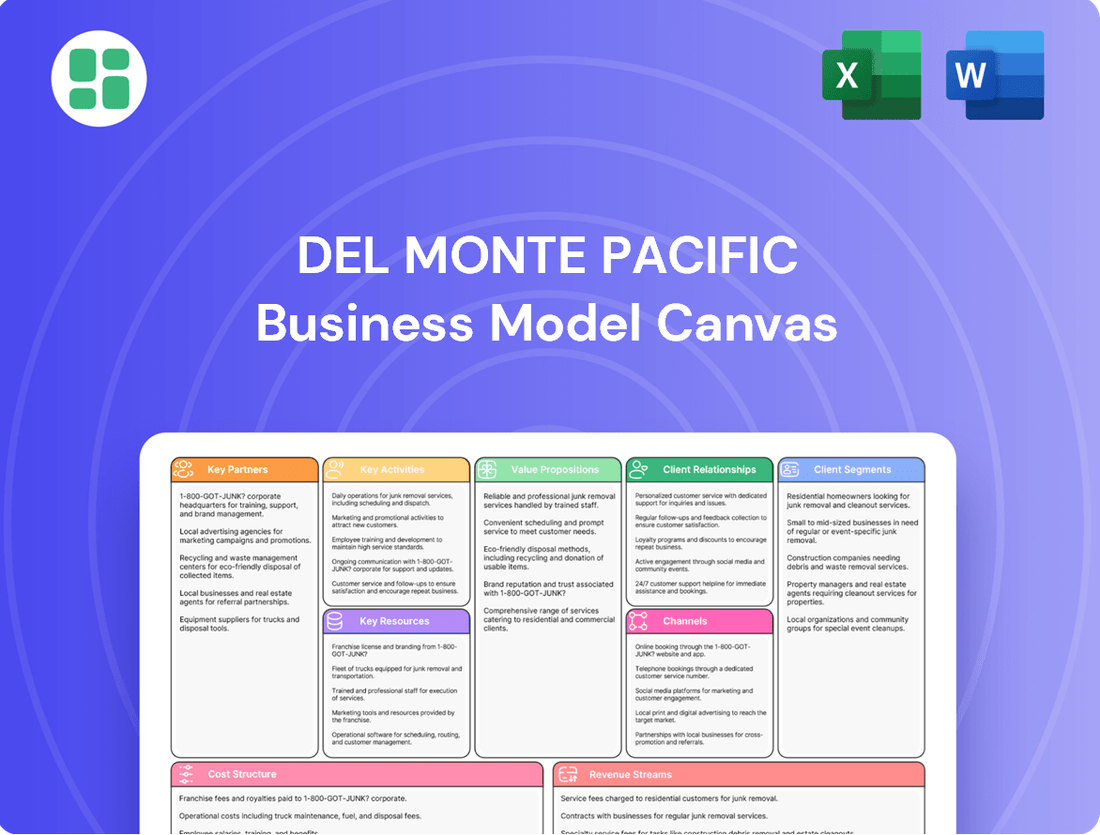

Del Monte Pacific Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Del Monte Pacific Bundle

Discover the strategic core of Del Monte Pacific with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Ready to dissect a winning strategy?

Unlock the full strategic blueprint behind Del Monte Pacific's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Del Monte Pacific is strategically pursuing equity investments from key partners to bolster its financial standing. This move is particularly significant following the deconsolidation of its US operations, signaling a focus on strengthening its capital structure.

The company aims to attract investors who can contribute to its growth trajectory and enhance its financial health, with a clear objective of improving key financial ratios. These partnerships are viewed as essential for raising capital and managing debt effectively in the upcoming fiscal periods.

For instance, in fiscal year 2023, Del Monte Pacific reported a net debt to equity ratio that underscores the importance of such strategic equity injections. Securing these partnerships will be vital for deleveraging and supporting future expansion initiatives.

Del Monte Pacific Limited maintains crucial ties with a robust network of farmers and agricultural suppliers, forming the backbone of its operations. These partnerships are vital for securing a consistent flow of high-quality fresh pineapples, fruits, and vegetables, which are the fundamental ingredients for their extensive range of packaged food and beverage items.

In 2024, Del Monte Pacific continued to emphasize these relationships, understanding that supplier reliability directly impacts product quality and availability. The company actively manages its pineapple plantations and other agricultural input sourcing to ensure production efficiency across its worldwide facilities, underscoring the strategic importance of these upstream collaborations.

Del Monte Pacific's extensive network of distribution and retail partners is crucial for its market reach. Collaborations with major supermarket chains, hypermarkets, and convenience stores across the Philippines, the United States, and the broader Asia-Pacific region ensure widespread product availability. In 2024, these partnerships are instrumental in placing Del Monte Pacific's diverse product portfolio, from canned fruits to juices and prepared meals, directly into consumers' hands.

The company also leverages relationships with food service providers, expanding its presence beyond traditional retail channels. These strategic alliances are foundational for achieving significant market penetration and driving sales volume. For instance, by securing prominent shelf space and ensuring efficient logistics, Del Monte Pacific can capitalize on consumer demand in key markets, reinforcing its position as a leading food and beverage provider.

Logistics and Warehousing Providers

Del Monte Pacific relies heavily on a network of logistics and warehousing providers to navigate its global supply chain. These partners are crucial for managing the transportation, storage, and inventory of its diverse product portfolio, ensuring timely delivery and product quality across various markets.

The company has actively sought to optimize these relationships, with a strategic focus on reducing warehousing and distribution costs. For instance, in fiscal year 2024, Del Monte Pacific continued its efforts to streamline operations, aiming for greater efficiency in its logistics network.

- Global Reach: Partnerships with international logistics firms enable Del Monte Pacific to serve consumers across North America, Asia, and other regions.

- Supply Chain Efficiency: Collaborations ensure timely and cost-effective movement of goods from manufacturing facilities to retail points.

- Cost Optimization: Strategic initiatives in 2024 targeted reductions in warehousing and distribution expenses, enhancing profitability.

- Product Integrity: Specialized warehousing and transportation services maintain the quality and freshness of perishable and shelf-stable goods.

Technology and Innovation Collaborators

Del Monte Pacific actively partners with technology providers and academic institutions to fuel its innovation pipeline and streamline operations. A prime example is their adoption of 'Nice Fruit' technology, specifically designed to enhance the quality and appeal of their frozen fruit products.

These strategic alliances are crucial for developing novel product lines and optimizing manufacturing processes. For instance, by integrating digital solutions, Del Monte Pacific can improve demand forecasting and supply chain management, leading to greater efficiency.

- Technology Collaborations: Del Monte Pacific partners with tech firms for advanced processing and digital integration.

- Research Partnerships: Collaborations with research bodies drive R&D for new product development.

- Operational Efficiency: Innovations like 'Nice Fruit' technology improve production and product quality.

- Market Responsiveness: Digitization efforts enhance planning to meet changing consumer tastes and market trends.

Del Monte Pacific's key partnerships are foundational for its operational success and market penetration. These include strong relationships with a vast network of farmers and agricultural suppliers, ensuring a consistent supply of high-quality raw materials like pineapples and other fruits. The company also relies on extensive distribution and retail networks, encompassing major supermarkets and hypermarkets across its key markets, to make its products accessible to consumers.

Furthermore, strategic alliances with logistics and warehousing providers are critical for efficient global supply chain management, ensuring product integrity and timely delivery. In 2024, Del Monte Pacific continued to focus on optimizing these logistical collaborations to reduce costs and enhance operational efficiency. The company also actively engages with technology providers and academic institutions to drive innovation, as seen in its adoption of technologies aimed at improving product quality and manufacturing processes.

| Partner Type | Key Role | Strategic Importance | 2024 Focus |

| Farmers & Suppliers | Raw Material Sourcing | Ensures quality and consistency of produce | Strengthening reliability and yield |

| Distributors & Retailers | Market Access & Sales | Widespread product availability and consumer reach | Expanding shelf presence and promotional activities |

| Logistics & Warehousing | Supply Chain Management | Efficient transportation, storage, and delivery | Cost optimization and network streamlining |

| Technology & Academia | Innovation & Efficiency | Product development and process improvement | Adoption of advanced processing and digital solutions |

What is included in the product

A comprehensive, pre-written business model tailored to Del Monte Pacific's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

Del Monte Pacific's Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their complex global operations, enabling swift identification of inefficiencies and opportunities for streamlining their supply chain and product diversification.

Activities

Del Monte Pacific's key activities in global sourcing and agricultural management are centered around its vast pineapple plantations, such as the significant 28,000-hectare operation in Bukidnon, Philippines. This extensive landholding is crucial for their core pineapple production, ensuring a consistent supply of high-quality raw material.

Beyond its own farms, the company actively sources a variety of other fruits and vegetables from international suppliers. This global network is vital for diversifying their product offerings and meeting consumer demand for a wider range of processed foods.

The management of these agricultural operations involves meticulous crop management, efficient harvesting techniques, and stringent quality control measures. In 2024, Del Monte Pacific continued to emphasize sustainable farming practices, aiming to reduce environmental impact while ensuring the long-term viability of its supply chain and maintaining input cost stability.

Del Monte Pacific's manufacturing and processing activities are central to transforming raw agricultural goods into their diverse branded food and beverage offerings. This includes operating specialized facilities for packaged fruits, vegetables, culinary sauces, and beverages across their primary markets.

The company is actively focused on optimizing its manufacturing footprint and streamlining operations. For instance, in 2024, Del Monte Pacific continued its efforts to consolidate its US operations to drive cost efficiencies and enhance productivity.

Del Monte Pacific actively engages in developing and executing marketing campaigns to highlight its established brands, including Del Monte, S&W, Contadina, and College Inn. This focus on heritage brands aims to maintain strong consumer recognition and loyalty.

Continuous product innovation is another key activity, with the company introducing new flavors, healthier options, and convenient snacking formats like Joyba bubble tea. For instance, in fiscal year 2024, Del Monte Pacific continued to expand its ready-to-drink beverage portfolio, a segment driven by innovation and consumer demand for convenience.

These marketing and innovation efforts are crucial for enhancing brand relevance and effectively capturing evolving consumer preferences in a dynamic market. The company's investment in these areas directly supports its strategy to drive growth and maintain a competitive edge.

Sales and Distribution Management

Del Monte Pacific actively manages its diverse sales channels, encompassing retail, foodservice, and export markets. This involves strategically expanding its reach within general trade and foodservice outlets to ensure products are readily available to consumers. Optimizing product placement across these channels is key to driving sales and maximizing market penetration.

In 2024, Del Monte Pacific continued to focus on strengthening its distribution network. The company reported that its sales and distribution management efforts were crucial in achieving its revenue targets. For instance, the expansion into new general trade outlets in key emerging markets contributed to a notable increase in sales volume for its canned fruit and vegetable segments.

- Channel Management: Overseeing and optimizing sales across traditional retail, modern trade, foodservice, and export channels.

- Distribution Network Expansion: Broadening the reach of products by increasing coverage in general trade and foodservice outlets.

- Product Placement Strategy: Ensuring optimal visibility and availability of Del Monte products on store shelves and within foodservice operations.

- Market Penetration: Driving sales volume and revenue through effective execution of sales and distribution strategies.

Supply Chain Optimization and Cost Reduction

Del Monte Pacific's key activities heavily revolve around optimizing its supply chain to drive down costs. This includes diligently managing inventory levels to minimize waste and write-offs, a constant effort that directly impacts profitability. For instance, in fiscal year 2023, the company reported a reduction in inventory days, reflecting progress in this area.

A significant focus is placed on reducing warehousing and distribution expenses across its global operations. By streamlining logistics and improving efficiency, Del Monte Pacific aims to enhance its gross margins. The company's strategic initiatives, particularly within its US business, are geared towards achieving these operational efficiencies. These efforts are crucial for bolstering overall financial performance.

- Inventory Management: Actively working to reduce excess stock and minimize spoilage, which directly impacts cost of goods sold.

- Logistics Efficiency: Streamlining transportation and warehousing to cut down on distribution expenses.

- Waste Reduction: Implementing processes to minimize product loss throughout the supply chain, improving gross margins.

- Operational Streamlining: Focusing on efficiency gains, especially in the US market, to boost profitability.

Del Monte Pacific's key activities in product development and marketing are focused on leveraging its strong brand portfolio, which includes Del Monte, S&W, and Contadina. The company actively pursues product innovation, introducing new items like Joyba bubble tea and expanding its ready-to-drink beverage offerings to meet evolving consumer tastes. In fiscal year 2024, a significant portion of their strategy involved enhancing brand relevance through targeted marketing campaigns and product diversification.

Operational efficiency is a core activity, with a strong emphasis on supply chain optimization and cost reduction. This includes meticulous inventory management to minimize waste and warehousing and distribution expense reduction. For example, Del Monte Pacific reported progress in reducing inventory days in fiscal year 2023, contributing to improved gross margins. These efforts are critical for maintaining competitive pricing and profitability.

The company's sales and distribution activities are geared towards maximizing market penetration across various channels, including retail, foodservice, and export. In 2024, a key focus was on expanding their presence in general trade and foodservice outlets. This strategic channel management and distribution network expansion were instrumental in achieving revenue targets and driving sales volume, particularly in emerging markets.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Product Innovation & Marketing | Developing new products and promoting established brands. | Expansion of ready-to-drink beverage portfolio; continued focus on Joyba bubble tea. |

| Supply Chain & Cost Optimization | Managing inventory, reducing logistics costs, and minimizing waste. | Efforts to reduce warehousing and distribution expenses; focus on operational efficiencies in the US. |

| Sales Channel Management | Expanding reach across retail, foodservice, and export markets. | Increased coverage in general trade and foodservice outlets; expansion into new markets contributed to sales volume growth. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Del Monte Pacific you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis you will gain access to. Once your order is complete, you will download this exact file, providing you with a fully editable and ready-to-use resource for understanding Del Monte Pacific's strategic framework.

Resources

Del Monte Pacific's strength lies in its robust brand portfolio, featuring heritage names like Del Monte, S&W, Contadina, and College Inn. These brands are deeply ingrained in consumer consciousness, fostering trust and recognition built over many years.

These established brands are significant intangible assets, complemented by valuable trademarks and unique, proprietary recipes. This strong brand equity enables Del Monte Pacific to secure premium pricing and solidify its market-leading positions across diverse product categories.

Del Monte Pacific leverages its extensive agricultural plantations, most notably its fully-integrated pineapple operation. This includes a massive 28,000-hectare plantation situated in Bukidnon, Philippines. This vast landholding is a cornerstone of their business model, providing a consistent and directly managed supply of a critical raw material.

This direct ownership and operation of plantations offer significant advantages. It ensures a stable and controlled source of key agricultural inputs, which is vital for maintaining product quality and consistency across their diverse product lines. In 2024, this integrated approach is expected to continue to buffer against supply chain volatility and price fluctuations in the agricultural commodity markets.

Del Monte Pacific leverages a network of manufacturing and processing facilities across the Philippines, the United States, and Mexico. These plants are crucial for transforming raw agricultural products into a wide array of packaged foods and beverages, supporting the company's large-scale operations and commitment to food safety and quality.

In 2024, Del Monte Pacific continued its strategic initiative to optimize its manufacturing footprint. This consolidation aims to drive operational efficiencies and cost savings, ensuring that its production capabilities remain competitive in the global food and beverage market.

Human Capital and Expertise

Del Monte Pacific's human capital and expertise are foundational to its success. A highly skilled workforce, encompassing agricultural scientists, food technologists, marketing specialists, and logistics experts, is indispensable. Their collective knowledge fuels product development, upholds stringent quality standards, and optimizes the complex supply chain. The company's commitment to nurturing and retaining this diverse talent pool is critical for achieving its long-term strategic objectives.

In 2024, Del Monte Pacific continued to invest in its people, recognizing that human capital is a key differentiator. The company's focus on specialized training programs for its agricultural teams, for instance, directly impacts crop yields and quality, which are vital for its fresh produce segment. Similarly, the expertise of its food scientists is paramount in developing new, innovative products that meet evolving consumer preferences, particularly in the health and wellness space.

- Skilled Workforce: Expertise spans agriculture, food science, marketing, and supply chain management, crucial for innovation and quality.

- Talent Retention: The ability to keep diverse talent is essential for executing strategic plans and maintaining operational excellence.

- Innovation Driver: The collective knowledge of employees fuels new product development and process improvements.

- Operational Efficiency: Specialists in areas like logistics and supply chain ensure the smooth flow of goods from farm to table.

Financial Capital and Access to Funding

Del Monte Pacific Limited's ability to operate and grow hinges on its financial capital. This includes readily available cash, established credit lines, and the capacity to tap into capital markets for larger funding needs. These resources are critical for day-to-day operations, funding new projects, and executing strategic plans.

The company's financial health is a key consideration for its business model. As of the first half of fiscal year 2024, Del Monte Pacific reported a net debt of $765.5 million. This highlights the ongoing importance of managing its debt levels effectively and exploring avenues for capital restructuring, potentially including equity raises, to ensure financial stability and support future growth initiatives.

- Financial Resources: Del Monte Pacific relies on cash reserves, credit facilities, and access to capital markets to fund its operations and strategic investments.

- Debt Management: The company's net debt stood at $765.5 million in the first half of FY2024, emphasizing the need for careful debt management.

- Capital Restructuring: Exploring options for capital restructuring, including potential equity raises, is a focus to strengthen its financial position.

- Operational Funding: Robust financial health is essential for sustaining operations, pursuing new investments, and achieving strategic objectives.

Del Monte Pacific's key resources include its strong brand portfolio, extensive agricultural plantations, efficient manufacturing facilities, and a skilled workforce. These tangible and intangible assets, supported by robust financial capital, are fundamental to its operational success and market competitiveness.

The company's financial health is crucial, with a net debt of $765.5 million reported in the first half of fiscal year 2024. This underscores the importance of strategic financial management and potential capital restructuring to support ongoing operations and future growth.

Del Monte Pacific's integrated operations, from plantations to manufacturing, provide a stable supply chain and quality control. This operational strength, combined with its brand equity and human capital, positions it well in the global food and beverage market.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Brand Portfolio | Del Monte, S&W, Contadina, College Inn | Drives premium pricing and market leadership. |

| Agricultural Plantations | 28,000-hectare pineapple plantation in the Philippines | Ensures stable, controlled raw material supply, buffering against market volatility. |

| Manufacturing Facilities | Operations in the Philippines, US, Mexico | Optimized footprint for operational efficiencies and cost savings. |

| Human Capital | Skilled workforce in agriculture, food science, marketing, logistics | Drives innovation, quality, and operational excellence; investment in training continues. |

| Financial Capital | Cash, credit lines, access to capital markets | Supports operations, investments, and strategic plans; net debt was $765.5M (H1 FY24). |

Value Propositions

Del Monte Pacific is dedicated to delivering nutritious, high-quality food products globally, building on a legacy of excellence. For instance, their 100% Pineapple Juice Fiber Enriched and Heart Smart options directly address the growing demand for healthier choices, reflecting a commitment to wholesome ingredients and careful preparation.

Del Monte Pacific's product portfolio, featuring items like canned fruits, ready-to-eat oatmeal, and convenient culinary sauces, directly addresses the needs of today's fast-paced lifestyles. These offerings provide quick and easy meal solutions, simplifying preparation for busy individuals and families. In 2024, the demand for convenient food options continued to grow, with the global ready-to-eat meal market projected to reach over $11 billion by 2027, highlighting the relevance of Del Monte's strategy.

The versatility of Del Monte products extends beyond simple meal solutions, offering adaptable ingredients for diverse culinary applications and snacking occasions. This allows consumers to effortlessly incorporate healthy eating into their routines, regardless of time constraints or location. The company's commitment to innovation in this space is crucial, as consumer surveys from late 2023 indicated that over 60% of shoppers prioritize convenience when making food purchasing decisions.

Del Monte Pacific's business model is significantly strengthened by its portfolio of trusted heritage brands, including Del Monte and S&W. These brands boast over a century of history, cultivating a deep-seated reputation for quality and reliability that resonates with consumers worldwide.

This enduring legacy translates directly into strong consumer loyalty, as people have come to depend on these brands for consistent taste, safety, and overall product excellence. For instance, Del Monte's U.S. retail sales in fiscal year 2024 continued to show resilience, a testament to this ingrained trust.

Innovative and Trend-Responsive Offerings

Del Monte Pacific actively innovates by launching new products and flavors that align with changing consumer preferences and health consciousness. For instance, the introduction of Joyba bubble tea and a range of global-inspired culinary items demonstrates this responsiveness. This dedication to innovation ensures the brand remains current and broadens its market reach.

The company effectively adapts to evolving dining habits and the growing demand for healthier product options. This strategic focus on innovation and trend responsiveness is crucial for maintaining market relevance and driving growth in a dynamic consumer landscape.

- Product Diversification: Introduction of Joyba bubble tea and global culinary products caters to diverse tastes.

- Health Trend Alignment: Focus on healthier options resonates with modern consumer demands.

- Market Responsiveness: Continuous innovation keeps Del Monte Pacific competitive and appealing.

Sustainable and Responsibly Produced Products

Del Monte Pacific is deeply committed to sustainability, weaving it into every step of its operations. This means focusing on ethical farming methods, minimizing waste, and adopting eco-friendly packaging solutions. Their dedication to responsible sourcing and environmental care is clearly outlined in their sustainability reports.

This focus resonates strongly with a growing segment of consumers who actively seek out products that are produced ethically and with a reduced environmental impact. For instance, in 2024, Del Monte Pacific reported a 15% reduction in water usage across its key agricultural operations compared to 2020 benchmarks, demonstrating tangible progress in their environmental stewardship.

- Ethical Sourcing: Ensuring fair labor practices and responsible land management from farm to fork.

- Waste Reduction: Implementing strategies to minimize food waste and packaging materials throughout the value chain.

- Environmental Stewardship: Actively working to conserve natural resources and reduce the company's carbon footprint.

- Consumer Appeal: Attracting and retaining customers who prioritize sustainability in their purchasing decisions.

Del Monte Pacific's value proposition centers on delivering high-quality, nutritious food products that cater to modern lifestyles and health consciousness. Their diverse portfolio, including convenient meal solutions and healthier options like fiber-enriched juices, directly addresses consumer demand for both ease of preparation and well-being. For example, in fiscal year 2024, Del Monte Pacific continued to see strong performance in its U.S. retail segment, underscoring the enduring appeal of its product offerings.

Leveraging a century of heritage with trusted brands like Del Monte and S&W, the company builds significant consumer loyalty through consistent quality and safety. This deep-rooted trust is a cornerstone of their value, ensuring repeat purchases. The company's commitment to innovation, evidenced by new product launches such as Joyba bubble tea and global culinary items, further enhances this value by staying relevant to evolving consumer tastes and preferences.

Furthermore, Del Monte Pacific integrates sustainability into its operations, appealing to a growing consumer base that prioritizes ethical sourcing and environmental responsibility. Their tangible efforts, like a 15% reduction in water usage across key agricultural operations by 2024 compared to 2020, demonstrate a commitment that translates into a strong ethical value proposition.

| Value Proposition Pillar | Key Offerings | Consumer Benefit | Supporting Data/Examples |

|---|---|---|---|

| Nutrition & Health | 100% Pineapple Juice Fiber Enriched, Heart Smart options | Supports healthy lifestyles and dietary needs. | Consumer surveys in late 2023 showed over 60% prioritize convenience, often linked to health. |

| Convenience & Lifestyle | Canned fruits, ready-to-eat oatmeal, culinary sauces | Simplifies meal preparation for busy individuals and families. | Global ready-to-eat meal market projected to exceed $11 billion by 2027. |

| Brand Trust & Heritage | Del Monte, S&W brands | Ensures consistent quality, safety, and reliability. | Resilient U.S. retail sales in fiscal year 2024. |

| Innovation & Adaptability | Joyba bubble tea, global culinary items | Caters to diverse tastes and evolving consumer preferences. | Continuous product launches aligning with market trends. |

| Sustainability & Ethics | Ethical farming, waste reduction, eco-friendly packaging | Appeals to environmentally and socially conscious consumers. | 15% reduction in water usage by 2024 (vs. 2020 benchmarks). |

Customer Relationships

Del Monte Pacific cultivates brand loyalty by consistently providing high-quality, trusted products. This unwavering commitment to excellence ensures consumers can rely on Del Monte for their needs, fostering repeat purchases and a strong sense of confidence in the brand.

The enduring heritage of Del Monte brands plays a crucial role in building and sustaining customer loyalty across generations. This long-standing presence and consistent delivery of quality create a deep-seated trust that translates into enduring relationships with consumers.

Del Monte Pacific Limited prioritizes responsive customer service through various channels, including direct contact, online portals, and social media, ensuring inquiries and concerns are promptly addressed. This direct engagement is crucial for understanding evolving customer needs and enhancing overall satisfaction.

In 2024, Del Monte Pacific continued to leverage digital platforms to gather customer feedback, aiming to identify and resolve any discrepancies in customer experiences. This proactive approach helps in minimizing trade support issues and strengthens customer loyalty.

Del Monte Pacific actively cultivates customer relationships through robust digital engagement. Platforms like Del Monte Kitchenomics in the Philippines serve as hubs for recipe content and community building, extending brand interaction beyond mere transactions.

Social media campaigns and online recipe sharing foster a sense of community, offering consumers value through inspiration and practical tips. For instance, the 'Iba ang Sarap ng Paskong Del Monte' campaign in 2024 aimed to deepen this connection during the holiday season, showcasing the brand's relevance in cultural celebrations.

Promotional Activities and Value Bundles

Del Monte Pacific frequently engages in promotional activities, including special offers and value bundles, to draw in new customers and show appreciation for their loyal base. These initiatives are key drivers for boosting sales and encouraging consumers to try new Del Monte products. For instance, in the fiscal year ending March 31, 2024, Del Monte Pacific reported robust sales growth, partly attributed to successful promotional campaigns.

These strategic campaigns are often amplified through various channels. Television advertisements are a cornerstone, reaching a broad audience, while eye-catching in-store displays are crucial for capturing shopper attention at the point of purchase. This integrated approach ensures that promotional messages are consistent and impactful across different touchpoints.

- Promotional Focus: Del Monte Pacific utilizes regular promotions, special offers, and value bundles to attract and retain customers.

- Sales and Trial Drivers: These activities are designed to directly stimulate sales and encourage the trial of new product introductions.

- Marketing Support: Campaigns are typically backed by a combination of television advertising and in-store marketing efforts.

- Impact on Performance: Such initiatives contribute to overall sales figures and market penetration, as seen in their fiscal year 2024 performance.

Partnerships with Retailers for Consumer Programs

Del Monte Pacific actively cultivates customer loyalty through strategic partnerships with retailers, focusing on joint consumer programs. These collaborations often involve co-branded loyalty initiatives and in-store promotional activities designed to embed Del Monte products within the broader retail shopping experience. This integration allows for shared access to valuable customer data and a more unified marketing approach, ultimately strengthening the connection with end consumers.

These retail partnerships are crucial for enhancing sales processes and providing comprehensive customer business reviews, often involving executive-level engagement. For instance, in 2024, Del Monte Pacific's efforts to deepen these relationships contributed to a notable increase in repeat purchases across key product categories. Such programs leverage the retailer's existing customer base, creating a synergistic effect that benefits both parties.

- Loyalty Program Integration: Seamlessly incorporating Del Monte products into retailer loyalty schemes to reward repeat purchases.

- In-Store Promotions: Jointly executed campaigns and discounts that drive immediate consumer engagement at the point of sale.

- Shared Customer Insights: Utilizing aggregated data from these programs to better understand consumer preferences and tailor future offerings.

- Enhanced Sales Performance: Direct correlation observed between participation in these co-branded programs and uplift in sales volume for Del Monte products in 2024.

Del Monte Pacific fosters strong customer relationships by consistently delivering quality products and engaging consumers through digital platforms like Del Monte Kitchenomics, building community and brand loyalty. They also leverage strategic retail partnerships and promotional activities, including television advertising and in-store displays, to drive sales and encourage product trial, as evidenced by their fiscal year 2024 performance.

| Customer Relationship Strategy | Key Activities | Impact/Data (FY24) |

|---|---|---|

| Brand Heritage & Quality | Consistent product excellence | Fosters repeat purchases and trust |

| Digital Engagement | Recipe content, social media campaigns (e.g., 'Iba ang Sarap ng Paskong Del Monte') | Community building, enhanced brand interaction |

| Promotional Activities | Special offers, value bundles, TV ads, in-store displays | Drives sales, encourages trial, contributes to robust sales growth |

| Retail Partnerships | Joint consumer programs, co-branded loyalty initiatives | Increases repeat purchases, leverages retailer customer base |

Channels

Supermarkets and hypermarkets are the bedrock of Del Monte Pacific's distribution, serving as the primary avenues for their extensive range of packaged fruits, vegetables, juices, and culinary items. These vast retail environments offer unparalleled reach, ensuring Del Monte products are readily available to a mass consumer base.

Del Monte Pacific actively works to secure leading market shares within these channels, understanding that prominent shelf placement is key to capturing consumer attention. For instance, in the Philippines, Del Monte is a household name, with its products consistently featuring in major supermarket chains like SM Supermarket and Robinsons Supermarket, contributing significantly to their overall sales volume.

Del Monte Pacific leverages convenience stores and smaller retail outlets to broaden its reach, making its products accessible for immediate consumption. This strategy is crucial for driving sales of single-serve items and impulse purchases, a key focus for the company.

In markets like Japan, convenience stores such as 7-Eleven are vital for distributing products like Del Monte's Pineapple Stick, catering to consumers seeking quick and convenient snacks. The company actively works to expand its presence in these channels.

Del Monte Pacific's objective is to enhance its distribution network within these smaller retail formats, aiming for increased store coverage and the introduction of smaller, more affordable product sizes. This approach aligns with consumer demand for convenient, on-the-go options.

Del Monte Pacific leverages online retail and e-commerce platforms to directly engage consumers, offering a convenient shopping experience and broadening market access, particularly for specialized product lines. This digital channel has shown sustained growth, remaining a critical area for strategic development following the pandemic.

The global e-commerce market size was valued at approximately $5.7 trillion in 2023 and is projected to reach over $8.1 trillion by 2027, highlighting the significant opportunity for brands like Del Monte Pacific to expand their digital footprint and sales.

Foodservice and Institutional Sales

Del Monte Pacific's foodservice and institutional sales channel is a crucial B2B segment, supplying a wide range of products to establishments like restaurants, hotels, and educational institutions. This channel is vital for driving significant volume through bulk orders and catering to specific client needs with specialized packaging and product formats.

The company is actively focusing on strengthening its presence in this market by re-engaging with existing key accounts to recover market share and simultaneously pursuing new business opportunities within the B2B sector. For instance, in fiscal year 2024, Del Monte Pacific reported that its foodservice segment contributed substantially to overall revenue, demonstrating the channel's importance.

- Key Clients: Restaurants, hotels, catering companies, schools, hospitals, and other large institutions.

- Product Focus: Bulk-sized canned fruits and vegetables, juices, and other processed food items tailored for commercial use.

- Strategic Initiatives: Rebuilding relationships with major accounts and expanding the customer base in the institutional sector.

- Market Significance: This channel represents a significant portion of Del Monte's sales, particularly for consistent, high-volume demand.

Direct Export and International Distribution

Del Monte Pacific leverages direct export channels to distribute its fresh pineapples and a range of packaged goods across key international territories. These include significant markets in North Asia, such as China, South Korea, and Japan, alongside European countries. This direct approach allows for greater control over product quality and market penetration.

The company's international distribution strategy relies on establishing direct relationships with overseas distributors and forging strategic partnerships. These collaborations are crucial for expanding its global footprint and ensuring efficient delivery of its products to consumers worldwide. The robust performance of fresh pineapple exports has been a notable engine of growth for the company in these international markets.

- Direct Exports: Focus on North Asia (China, South Korea, Japan) and Europe.

- Distribution Model: Direct sales to international distributors and strategic partnerships.

- Product Focus: Fresh pineapples are a key export driver.

- Growth Driver: International markets, particularly for fresh produce, contribute significantly to revenue.

Del Monte Pacific utilizes a multi-pronged channel strategy, encompassing traditional retail, convenience stores, and a growing e-commerce presence to reach a broad consumer base. This diversified approach ensures product availability across various purchasing habits and preferences.

The company's commitment to securing prime shelf space in supermarkets and hypermarkets remains a cornerstone of its distribution, driving significant sales volume. Simultaneously, leveraging convenience stores and smaller outlets caters to impulse buys and on-the-go consumption needs.

Direct export channels, particularly for fresh pineapples, are critical for international market penetration, supported by strategic distributor partnerships. The foodservice and institutional sector provides a vital B2B avenue for high-volume, consistent demand, with active efforts to rebuild key accounts and secure new business.

| Channel | Key Markets/Focus | Strategic Importance | 2024 Data/Insights |

|---|---|---|---|

| Supermarkets & Hypermarkets | Global mass market | Broad reach, primary sales volume | Dominant presence in key regions like the Philippines. |

| Convenience Stores & Smaller Retail | Urban areas, impulse purchases | Accessibility for immediate consumption | Expansion focus for smaller product sizes and increased store coverage. |

| E-commerce & Online Retail | Global digital consumers | Direct engagement, market access | Continued growth driver post-pandemic; global market valued at ~$5.7 trillion in 2023. |

| Foodservice & Institutional | Restaurants, hotels, institutions | High-volume B2B sales, consistent demand | Substantial revenue contributor; focus on re-engaging key accounts. |

| Direct Export | North Asia, Europe | International market penetration, quality control | Fresh pineapple exports are a significant growth engine. |

Customer Segments

Health-conscious families are a key customer segment for Del Monte Pacific. These households actively seek out nutritious food options, often looking for products with benefits like added fiber or lower sugar and salt content. Del Monte Pacific caters to this demand with its extensive offerings of healthy juices, fruits, and vegetables, designed to support a healthy lifestyle.

Busy individuals and professionals often prioritize convenience, seeking food options that minimize preparation time. Del Monte's range of fruit cups and ready-to-eat meals directly addresses this need, offering quick and easy solutions for those with demanding schedules.

In 2024, the demand for convenient food products continues to surge, with consumers increasingly willing to pay a premium for time-saving options. This segment values efficiency, making products that require minimal effort to prepare or consume highly attractive.

Institutional buyers in the foodservice sector, including restaurants, hotels, and catering companies, represent a crucial customer segment for Del Monte Pacific. These businesses procure products in large volumes to meet the demands of their operations. Del Monte Pacific offers a specialized product line designed to cater to the specific needs of these commercial food establishments.

The company's strategic focus in 2024 centers on strengthening its presence within this business-to-business market. This involves actively working to retain existing key accounts while simultaneously pursuing new partnerships. For instance, by the end of fiscal year 2024, Del Monte Pacific aimed to secure significant new contracts within the foodservice industry, contributing to its overall revenue growth.

International Consumers in Key Markets

Del Monte Pacific targets international consumers across several key markets, recognizing their diverse tastes and purchasing habits. This includes a strong focus on the Philippines, a foundational market, alongside the United States where operations continue with specific brand and product lines. The company also strategically targets high-growth Asian markets such as China, South Korea, and Japan, adapting its offerings to local preferences.

These distinct consumer bases require tailored approaches. For instance, in the Philippines, Del Monte is a household name, often associated with a wide range of canned fruits, vegetables, and juices. In contrast, the US market might see a focus on specific premium or niche product categories. The burgeoning markets in China, South Korea, and Japan present opportunities for introducing and expanding product lines that align with evolving consumer trends in health and convenience.

Del Monte Pacific's strategy in 2024 and looking ahead to 2025 involves leveraging its brand equity while innovating to meet specific regional demands. The company's performance in these segments is crucial, with Asia being a significant contributor to its overall revenue. For example, in fiscal year 2023, the Philippines segment alone demonstrated robust growth, highlighting the importance of these established consumer bases.

- Philippines: A mature market where Del Monte Pacific holds significant brand loyalty and market share across various food and beverage categories.

- United States: Focus on specific brands and product lines, catering to established consumer preferences and potentially exploring niche segments.

- China: A high-growth market with increasing demand for packaged foods, requiring localized product development and marketing strategies.

- South Korea & Japan: Emerging markets with a growing interest in convenient, healthy food options, presenting opportunities for product innovation and market penetration.

Budget-Conscious Consumers

Budget-conscious consumers are a significant customer segment for Del Monte Pacific, particularly in emerging markets. These individuals prioritize affordability without wanting to sacrifice the quality and reliability they associate with established brands. Del Monte Pacific addresses this by offering a range of product sizes and value-oriented bundles, making their products more accessible to a wider economic spectrum. In the Philippines, for instance, the company has strategically introduced items at lower price points to capture this price-sensitive demographic.

This strategy is crucial for market penetration and sustained growth. For example, in fiscal year 2024, Del Monte Pacific reported that its sales in the Philippines remained robust, partly driven by its ability to cater to diverse consumer needs, including those seeking value. The company’s approach often involves leveraging its strong brand equity to offer dependable products at competitive price points.

- Affordability Focus: Consumers in this segment actively seek out products that offer good value for money.

- Quality Assurance: Despite budget constraints, there's an expectation that the product will still meet a certain standard of quality and taste.

- Strategic Pricing and Packaging: Del Monte Pacific utilizes various pack sizes and promotional offers to appeal to price-sensitive buyers.

- Market Penetration: Lower price point introductions, especially in regions like the Philippines, are key to expanding market share among budget-conscious shoppers.

Del Monte Pacific serves a broad customer base, from health-conscious families seeking nutritious options to busy individuals prioritizing convenience. Institutional buyers in the foodservice sector are also a key segment, requiring bulk products for their operations. The company also targets budget-conscious consumers, especially in emerging markets, by offering value-oriented products without compromising quality.

Cost Structure

Raw material procurement costs represent a significant portion of Del Monte Pacific's expenses, encompassing the acquisition of fresh produce like fruits and vegetables, alongside essential packaging materials. These costs are inherently volatile, directly influenced by global commodity price swings and the unpredictable nature of agricultural yields.

For instance, Del Monte Pacific's financial reports for the fiscal year ending April 2024 highlighted substantial impacts from these raw material costs. Reduced pineapple supply in key Asian markets and ongoing inventory adjustments in the United States contributed to a notable pressure on the company's gross profit margins, underscoring the critical role of efficient procurement and supply chain management.

Manufacturing and processing expenses are a significant component of Del Monte Pacific's cost structure, encompassing the day-to-day operations of its production facilities. This includes essential costs like wages for factory workers, the energy required to power machinery and maintain optimal conditions, and the ongoing maintenance of specialized equipment to ensure efficient production. Factory overheads, such as rent, insurance, and administrative costs associated with the manufacturing sites, also contribute to this category.

Del Monte Pacific actively works to manage and reduce these manufacturing costs. A key strategy involves consolidating its production operations, aiming to achieve economies of scale and streamline processes. By improving productivity, the company seeks to lower the per-unit cost of its goods. For instance, in fiscal year 2023, the company continued its efforts to optimize its manufacturing footprint, which can lead to more efficient resource utilization and cost savings in the long run.

This category also accounts for certain non-recurring expenses. These might include one-off costs associated with strategic decisions, such as severance pay for employees affected by plant closures or restructuring initiatives. These expenses, while not part of regular operational costs, are crucial to acknowledge when analyzing the overall financial health and strategic direction of the company's manufacturing segment.

Del Monte Pacific incurs significant expenses in logistics, warehousing, and distribution, covering product storage, inventory management, and the transportation of goods to various points of sale. These costs are crucial for ensuring products reach consumers efficiently but can also represent a substantial portion of operational expenditure.

In 2024, the company continued to focus on optimizing its supply chain to mitigate these costs. High warehousing and distribution expenses, particularly within the competitive US market, have been a persistent challenge. Initiatives aimed at streamlining operations and improving efficiency are ongoing to address this.

A key strategy to reduce these logistical outlays involves aggressive inventory reduction. By managing inventory levels more effectively, Del Monte Pacific aims to decrease the capital tied up in stock and lower the associated costs of storage, handling, and potential obsolescence, thereby improving overall profitability.

Marketing, Sales, and Administrative (SG&A) Expenses

Del Monte Pacific's Marketing, Sales, and Administrative (SG&A) expenses are a significant component of its cost structure, encompassing everything from advertising campaigns and promotional activities to sales force compensation and general overhead. These costs are vital for building brand awareness and capturing market share, especially in the competitive food and beverage industry.

The company actively seeks to optimize these SG&A expenditures to boost its overall profitability. For instance, in the fiscal year ending April 30, 2024, Del Monte Pacific reported SG&A expenses of approximately $339.5 million. This figure highlights the substantial investment in reaching consumers and managing the business effectively, but also the ongoing focus on cost efficiency.

- Advertising and Promotions: Costs associated with campaigns to drive consumer demand for Del Monte products.

- Sales Force Costs: Salaries, commissions, and other expenses related to the sales team.

- General and Administrative: Overhead costs including management salaries, office expenses, and other support functions.

- Efficiency Focus: Ongoing efforts to streamline SG&A to improve the company's bottom line.

Research and Development (R&D) and Innovation Costs

Del Monte Pacific invests significantly in Research and Development (R&D) and Innovation Costs to fuel its long-term growth and maintain a competitive edge. These expenditures cover the development of novel products, enhancements to existing offerings, and the exploration of cutting-edge technologies within the food and beverage sector.

The company's commitment to innovation is evident in its strategic focus on new product launches. For instance, the introduction of products like Joyba bubble tea demonstrates a tangible allocation of resources towards expanding its market presence and catering to evolving consumer preferences. These investments are crucial for staying relevant and driving future revenue streams.

- R&D Investment: Del Monte Pacific allocates substantial resources to R&D, essential for developing new products and improving existing ones.

- Innovation Focus: The company actively explores new technologies and market trends to drive innovation, exemplified by launches like Joyba bubble tea.

- Competitiveness: These costs are vital for maintaining market share and ensuring long-term competitiveness in the dynamic food and beverage industry.

- Cost Management: While crucial, these investments require careful management to ensure a positive return and sustainable growth.

Del Monte Pacific's cost structure is heavily influenced by its extensive agricultural sourcing and manufacturing operations. Key expenses include raw materials, manufacturing overheads, logistics, and significant marketing and administrative outlays.

For fiscal year 2024, the company navigated challenges such as volatile commodity prices impacting raw material procurement and high warehousing costs, particularly in the US market. These factors directly affected gross profit margins, underscoring the need for continuous supply chain optimization.

The company's commitment to innovation, demonstrated through new product launches, also represents a notable investment. Del Monte Pacific actively manages its cost base through strategies like operational consolidation and inventory reduction to enhance profitability and maintain a competitive edge.

| Cost Category | Key Components | Fiscal Year 2024 Impact/Focus |

| Raw Materials | Fresh produce, packaging | Volatile commodity prices, reduced supply impacting margins |

| Manufacturing & Processing | Wages, energy, maintenance, overheads | Operational consolidation, productivity improvements |

| Logistics, Warehousing & Distribution | Storage, inventory management, transportation | High costs in US market, focus on inventory reduction |

| Marketing, Sales & Administrative (SG&A) | Advertising, sales force, general overhead | $339.5 million reported, focus on efficiency |

| R&D and Innovation | New product development, technology exploration | Investment in launches like Joyba bubble tea |

Revenue Streams

The primary engine of revenue for Del Monte Pacific Limited is the sale of packaged fruits and vegetables. This encompasses a wide array of products, including canned fruits, vegetables, and tomatoes, all marketed under well-recognized brands such as Del Monte, S&W, and Contadina. These items are readily available to consumers across extensive retail networks in key markets like the Philippines, the United States, and the broader Asia-Pacific region.

This core revenue stream is fundamentally propelled by consistent consumer demand and Del Monte Pacific's established market share dominance. For the fiscal year ending May 2024, Del Monte Pacific reported a notable increase in sales for its branded consumer products segment, which is largely driven by this packaged goods category, indicating robust performance in its core offerings.

Del Monte Pacific generates substantial revenue from its diverse beverage product sales. This includes a range of juices, juice drinks, and other convenient beverage formats. A key offering is their 100% pineapple juice, a staple in many households.

The company is also innovating in the beverage space, introducing products like Joyba bubble tea and Fruity Zing, which cater to evolving consumer preferences. These newer, more dynamic product lines are designed to capture market share and drive sales growth.

The beverage segment is a significant contributor to Del Monte Pacific's overall sales, particularly in the Philippines market. For the fiscal year ending March 31, 2024, the company reported a notable increase in beverage sales, driven by both strong performance in established markets and the successful introduction of new products.

Del Monte Pacific generates significant revenue from selling culinary sauces and condiments, including popular items like tomato sauce and spaghetti sauce. These products are widely recognized under established brands such as Del Monte and Kitchen Basics, making them household staples.

These essential food items reach consumers through various channels, encompassing both retail grocery stores and the foodservice industry. The company actively works to solidify its position as a market leader in these core condiment categories.

For the fiscal year 2024, Del Monte Pacific reported strong performance in its branded consumer food business, which heavily features these sauce and condiment lines. This segment is a cornerstone of their revenue generation, demonstrating consistent consumer demand.

Sales of Fresh Pineapples

Del Monte Pacific generates significant revenue from the export and sale of fresh pineapples, a key component of its international business. This segment primarily operates under the well-regarded S&W brand, targeting lucrative North Asian markets.

The company's focus on premium offerings, such as the S&W Deluxe Pineapple, has been a major driver of growth in this area. These high-quality fruits command better prices and appeal to consumers seeking superior taste and quality.

Key markets for these fresh pineapple exports include China, South Korea, and Japan, where the S&W brand has established a strong presence. This strategic market focus has contributed substantially to Del Monte Pacific's overall international sales figures.

- Revenue Source: Export and sale of fresh pineapples.

- Primary Brand: S&W.

- Key Markets: North Asia (China, South Korea, Japan).

- Growth Driver: Premium S&W Deluxe Pineapple.

Foodservice and Industrial Sales

Del Monte Pacific generates significant revenue through its Foodservice and Industrial Sales segment. This involves supplying products in bulk to a wide array of institutional clients. These include major players in the hospitality sector like hotels and restaurants, as well as other food manufacturers who incorporate Del Monte products into their own offerings.

This B2B channel is a key focus for the company's growth strategy. Del Monte Pacific is actively working to expand its reach and sales within the foodservice industry. For instance, in the fiscal year ended April 30, 2024, the company reported that its Philippines operations saw a notable increase in sales, partly driven by the foodservice sector.

- Foodservice and Industrial Sales: Revenue from bulk sales to restaurants, hotels, and other food manufacturers.

- B2B Focus: Strategic emphasis on growing this business-to-business segment.

- Growth in Philippines: Fiscal year 2024 saw increased sales in the Philippines, with foodservice contributing to this growth.

- Product Range: Includes various packaged goods and industrial products utilized by other businesses.

Del Monte Pacific's revenue is primarily driven by its branded consumer products, encompassing packaged fruits and vegetables, beverages, and culinary sauces. The company also generates substantial income from the export of fresh pineapples, particularly under the S&W brand in North Asian markets. Additionally, its Foodservice and Industrial Sales segment contributes significantly by supplying bulk products to the hospitality industry and other food manufacturers.

For the fiscal year ending May 31, 2024, Del Monte Pacific reported a robust performance across its key segments. The branded consumer products segment, which includes packaged goods and beverages, saw strong demand, especially in the Philippines. The company's strategic focus on premium offerings, like the S&W Deluxe Pineapple, continues to bolster its fresh fruit export revenues.

| Revenue Stream | Key Products | Primary Brands | Key Markets |

| Packaged Fruits & Vegetables | Canned fruits, vegetables, tomatoes | Del Monte, S&W, Contadina | Philippines, USA, Asia-Pacific |

| Beverages | Juices, juice drinks, bubble tea | Del Monte, Joyba | Philippines, Asia-Pacific |

| Culinary Sauces & Condiments | Tomato sauce, spaghetti sauce | Del Monte, Kitchen Basics | Global Retail & Foodservice |

| Fresh Pineapple Exports | Premium pineapples | S&W | North Asia (China, South Korea, Japan) |

| Foodservice & Industrial Sales | Bulk packaged goods, industrial ingredients | Del Monte | Hospitality, Food Manufacturers |

Business Model Canvas Data Sources

The Del Monte Pacific Business Model Canvas is informed by a blend of internal financial statements, extensive market research reports, and competitive analysis. This comprehensive data approach ensures each component of the canvas accurately reflects the company's operational realities and strategic objectives.