Dell SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Bundle

Dell, a titan in the tech industry, boasts strong brand recognition and a robust direct-to-customer model, but faces intense competition and evolving market demands. Understanding these dynamics is crucial for anyone navigating the tech landscape.

Want the full story behind Dell’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dell Technologies commands impressive global brand recognition, consistently ranking as a top technology provider. Its strong market position, particularly within the PC manufacturing sector, places it among the top three vendors worldwide.

Dell boasts a broad product range, from personal computers and laptops to critical enterprise infrastructure like servers, storage, and networking equipment. This extensive offering, coupled with a suite of software and IT services, allows Dell to serve a diverse customer base, from individual users to large corporations.

This diversification is a key strength, enabling Dell to weather fluctuations in specific market segments. For instance, while PC sales might see cyclical downturns, demand for enterprise solutions like servers and cloud services often remains more robust, providing a stabilizing effect on overall revenue.

Dell's strategic emphasis on integrated solutions, particularly for data centers and cloud environments, further solidifies its market position. By offering end-to-end capabilities, Dell becomes a more valuable partner for businesses looking to streamline their IT operations, moving beyond being just a hardware vendor to a comprehensive solutions provider.

Dell's commitment to AI and innovation is a significant strength. The company has poured substantial resources into research and development, with R&D expenses consistently reflecting its dedication to staying at the forefront of technological advancements. This focus is crucial in the fast-paced tech industry.

The company is strategically positioned to thrive in the AI era. Dell is experiencing robust demand for its AI servers, evidenced by a growing backlog of orders. This indicates a strong market reception for their AI-focused hardware solutions.

Dell is actively embedding AI across its product portfolio. This includes the development of new AI-powered PCs and a concerted effort to accelerate the adoption of AI within enterprise environments, further solidifying its innovative edge.

Robust Financial Performance and Shareholder Returns

Dell has showcased impressive financial resilience, even amidst shifting economic landscapes. For fiscal year 2025, the Infrastructure Solutions Group (ISG) reported significant revenue growth, driven by strong demand in servers and networking solutions. This financial strength is a key advantage.

The company's dedication to shareholder value is evident through its consistent capital return programs. Dell has actively increased cash dividends and authorized substantial share repurchases, directly benefiting its investors. This financial discipline bolsters confidence in its management.

- Fiscal Year 2025 ISG Revenue Growth: Dell's ISG segment saw robust performance, indicating strong market demand for its core infrastructure offerings.

- Shareholder Return Initiatives: Increased cash dividends and ongoing share repurchase programs demonstrate a commitment to rewarding investors.

- Profitability Focus: The company's ability to maintain profitability even during economic uncertainty highlights its operational efficiency and strategic financial management.

Efficient Direct Sales Model and Supply Chain Management

Dell's direct sales model, a cornerstone since its inception, significantly cuts out middlemen. This approach not only potentially boosts profit margins but also allows for a more personalized customer experience, offering tailored solutions. For instance, in fiscal year 2024, Dell reported a revenue of $88.4 billion, with its direct sales contributing a substantial portion.

The company’s commitment to supply chain optimization is evident in its build-to-order strategy. This minimizes excess inventory and associated waste, leading to greater efficiency. Dell’s focus on supply chain resilience is also a key strength, with initiatives like encouraging suppliers to diversify manufacturing locations to mitigate risks.

- Direct Sales Efficiency: Reduced intermediaries lead to potentially higher margins and customized customer solutions.

- Build-to-Order Model: Minimizes inventory waste and costs, enhancing operational efficiency.

- Supply Chain Resilience: Proactive measures to diversify supplier facilities bolster against disruptions.

Dell's extensive product portfolio, spanning PCs to enterprise infrastructure, provides significant diversification. This broad offering allows them to cater to a wide range of customers, from individuals to large corporations, mitigating risks associated with reliance on a single market segment. Their focus on integrated solutions, particularly for data centers and cloud, positions them as a comprehensive technology partner.

Dell's strategic investment in AI is a major strength, with significant R&D spending and a growing backlog for AI servers. They are actively integrating AI across their product lines, including new AI-powered PCs, positioning them for growth in this critical technology area. This commitment to innovation ensures they remain competitive.

The company demonstrates strong financial performance and a commitment to shareholder value. For fiscal year 2025, Dell's Infrastructure Solutions Group (ISG) showed robust revenue growth, driven by strong demand in servers and networking. Dell consistently returns capital to shareholders through increased dividends and share repurchases.

Dell's direct sales model and optimized supply chain are key operational strengths. The build-to-order approach minimizes inventory costs, while supply chain resilience efforts, like diversifying manufacturing locations, reduce disruption risks. This efficiency contributes to their profitability and customer responsiveness.

| Key Strengths | Description | Supporting Data/Facts |

| Diversified Product Portfolio | Broad range of offerings from consumer PCs to enterprise solutions. | Serves individuals, small businesses, and large enterprises. |

| AI and Innovation Focus | Significant R&D investment and growing AI server demand. | Positive backlog for AI servers; AI integration across product lines. |

| Financial Strength & Shareholder Returns | Robust ISG revenue growth and consistent capital returns. | FY25 ISG revenue growth; increased cash dividends and share repurchases. |

| Operational Efficiency | Direct sales model and optimized supply chain. | FY24 Revenue: $88.4 billion; build-to-order strategy minimizes inventory. |

What is included in the product

Analyzes Dell’s competitive position through key internal and external factors, highlighting its strong brand and diversified portfolio against market shifts and competition.

Identifies key competitive advantages and areas for improvement, enabling targeted strategic adjustments.

Weaknesses

Dell Technologies shoulders a substantial debt load, a consequence of strategic moves like the acquisition of EMC Corporation. As of the first quarter of fiscal year 2025, Dell reported total debt of approximately $32.8 billion, a figure that can constrain its financial agility.

This leveraged position can present hurdles for the company when it aims to allocate significant capital towards innovation, research and development, or even weathering economic downturns, especially when contrasted with competitors boasting healthier balance sheets.

Consequently, a key strategic imperative for Dell remains the diligent management and reduction of this debt, a continuous process to bolster its long-term financial resilience and competitive standing.

Dell's research and development (R&D) investment, while significant, has been noted by some analyses as a smaller percentage of its sales compared to key rivals. For instance, in fiscal year 2024, Dell reported R&D expenses of $3.5 billion, representing approximately 3.5% of its total revenue. This contrasts with some competitors who may allocate a higher proportion of their revenue to R&D, potentially impacting Dell's agility in capitalizing on emerging technological trends.

This relatively lower R&D spend could pose a challenge in rapidly evolving sectors, particularly in areas where Dell's market presence is less established, such as the highly competitive mobile technology space. Continuous innovation is paramount in the fast-paced technology landscape, and a more focused R&D strategy might be needed to ensure Dell remains at the forefront of critical growth opportunities.

Dell's significant reliance on hardware sales, especially PCs and laptops, presents a notable weakness. This segment is increasingly commoditized, leading to thinner profit margins and heightened price competition. For instance, in fiscal year 2024, Dell Technologies reported that its Infrastructure Solutions Group (ISG) revenue grew by 11% to $36.2 billion, while the Client Solutions Group (CSG) revenue declined by 12% to $46.9 billion, highlighting the PC market's volatility.

This dependence makes Dell vulnerable to shifts in consumer and business spending on hardware. As the PC market matures and growth slows, Dell faces challenges in achieving substantial revenue increases or differentiating its products effectively. The intense competition means that price often becomes the primary differentiator, squeezing profitability and limiting opportunities for innovation-driven margin expansion.

Complex Organizational Structure

Dell's corporate structure has grown increasingly intricate, largely due to its significant acquisition history, most notably the 2016 acquisition of EMC Corporation for approximately $67 billion. This complex web of integrated businesses, while aiming for synergy, can sometimes hinder agility and create internal operational friction. Such complexity can lead to slower decision-making processes and challenges in unifying diverse product lines and service offerings under a single, streamlined operational umbrella.

The integration challenges stemming from its acquisition-heavy past can impact Dell's ability to pivot quickly in response to rapidly evolving market demands. For instance, managing distinct business units with varying cultures and operational protocols requires substantial management overhead. This can potentially slow down the rollout of new technologies or the adaptation of existing ones across the entire organization.

Maintaining operational flexibility across its broad portfolio of products and services, from PCs to enterprise solutions, becomes a significant undertaking. This can manifest in difficulties in resource allocation and a less cohesive go-to-market strategy for certain integrated offerings.

- Acquisition Integration: The $67 billion EMC acquisition in 2016 significantly complicated Dell's organizational structure.

- Operational Inefficiencies: Complex structures can lead to slower decision-making and resource allocation challenges.

- Market Responsiveness: Integration hurdles may impact the speed at which Dell can adapt to market shifts.

Supply Chain Bottlenecks and Component Shortages

Dell has grappled with persistent supply chain vulnerabilities, notably impacting its ability to fulfill the intense demand for AI servers. Shortages of critical components, particularly high-performance GPUs, have been a recurring impediment. For instance, in early 2024, the company, like many in the industry, faced significant lead times for these essential chips, directly affecting production schedules.

These supply chain disruptions extend beyond just component availability. Technical complexities associated with advanced AI racks have previously led to production setbacks. These issues have contributed to order backlogs, potentially hindering Dell's capacity to fully capitalize on the burgeoning AI market opportunities in 2024 and into 2025.

- GPU Shortages: Continued scarcity of high-end GPUs, crucial for AI workloads, has constrained server production throughout 2024.

- AI Rack Engineering: Past technical hurdles in advanced AI rack design and manufacturing have created production delays and increased costs.

- Order Backlogs: The combination of component shortages and production challenges has resulted in extended wait times for AI server orders, impacting revenue realization.

Dell's substantial debt, around $32.8 billion as of Q1 FY25, can limit its financial flexibility for innovation and weathering economic downturns compared to less leveraged competitors.

The company's R&D spending, approximately 3.5% of revenue in FY24 ($3.5 billion), is lower than some rivals, potentially slowing its ability to capitalize on emerging tech trends.

A heavy reliance on the commoditized PC market, which saw a 12% revenue decline in CSG in FY24, exposes Dell to thinner margins and intense price competition.

Dell's complex structure, a legacy of acquisitions like EMC ($67 billion in 2016), can lead to slower decision-making and integration challenges, impacting market responsiveness.

Supply chain issues, particularly GPU shortages in 2024, have hampered Dell's ability to meet demand for AI servers, creating order backlogs and impacting revenue realization.

| Weakness | Description | Financial Impact/Data Point |

| High Debt Load | Consequence of acquisitions like EMC. | Total Debt: ~$32.8 billion (Q1 FY25) |

| R&D Investment | Lower percentage of sales than some competitors. | FY24 R&D: $3.5 billion (approx. 3.5% of revenue) |

| Hardware Dependence | Commoditized PC market with lower margins. | FY24 CSG Revenue Decline: 12% |

| Organizational Complexity | Result of significant acquisitions. | EMC Acquisition: $67 billion (2016) |

| Supply Chain Vulnerabilities | Component shortages impacting AI server production. | GPU shortages in 2024 leading to production delays. |

Preview Before You Purchase

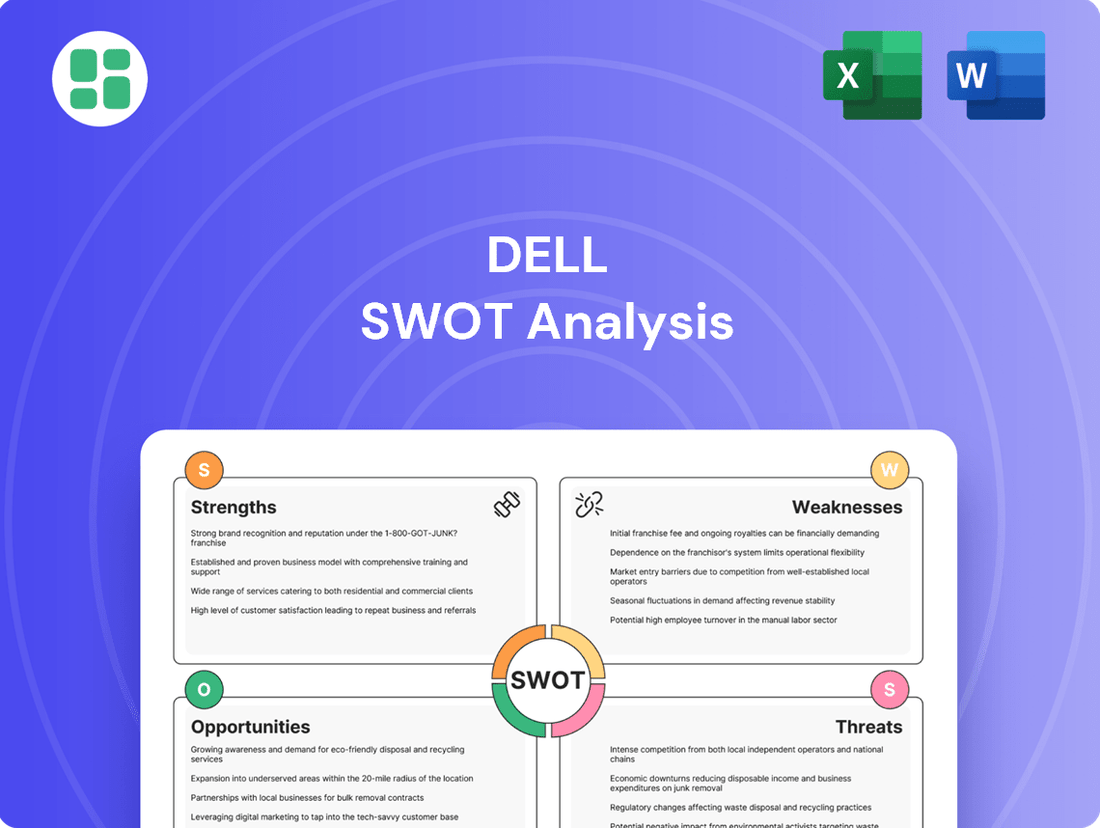

Dell SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Dell SWOT analysis, providing a clear glimpse into its comprehensive insights.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase, gaining access to all the strategic details for Dell.

Opportunities

The burgeoning demand for Artificial Intelligence (AI) capabilities, coupled with the widespread adoption of hybrid cloud strategies, creates substantial avenues for Dell's expansion. Dell's robust infrastructure portfolio is ideally suited to capture a larger share of the data center and cloud services market.

Dell is experiencing particularly strong demand for its AI-optimized servers, a key indicator of its ability to capitalize on this technological shift. For instance, in Q1 FY25, Dell reported a significant increase in revenue from its AI-ready server solutions, reflecting the market's appetite for high-performance computing infrastructure.

Emerging markets across Asia, Latin America, and Africa represent significant growth avenues for Dell. These regions are experiencing rapid technological adoption, creating substantial demand for personal computing devices and robust enterprise solutions. Dell can leverage this trend to expand its market presence and sales volume.

The increasing digitalization in these developing economies fuels demand for cloud computing and data center infrastructure, areas where Dell excels. For instance, by 2025, the cloud computing market in Southeast Asia alone is projected to reach tens of billions of dollars, offering a lucrative opportunity for Dell to supply its advanced services and hardware.

The burgeoning Internet of Things (IoT) and edge computing sectors present significant avenues for Dell's expansion. As an increasing volume of data is processed closer to its source, Dell's focus on enabling AI at the edge, rather than solely relying on centralized data centers, positions it favorably.

Dell's investment in AI-powered edge devices is crucial, as it allows for more immediate and efficient data analysis. This strategy directly addresses the growing demand for real-time insights in industries ranging from manufacturing to retail, where latency is a critical factor.

The global edge computing market is projected to reach substantial figures, with some estimates suggesting it could exceed $200 billion by 2027, indicating a massive opportunity for companies like Dell that can provide robust hardware and software solutions for this decentralized data processing paradigm.

Strengthening Cybersecurity and Services Offerings

Dell, as a significant player in IT infrastructure, has a prime opportunity to bolster its cybersecurity and broader IT services portfolio. The escalating landscape of cyber threats and the continuous demand for advanced data protection present a clear path for growth. By focusing on these high-margin segments, Dell can solidify its role as a comprehensive solutions provider.

This strategic expansion aligns with market trends, as businesses increasingly outsource their security and IT management needs. For instance, the global cybersecurity market was projected to reach over $231 billion in 2024, a figure expected to climb further. Dell's ability to integrate robust security solutions with its existing hardware and software offerings creates a compelling value proposition.

- Expand cybersecurity services: Deepen offerings in threat detection, incident response, and managed security services.

- Enhance cloud security solutions: Develop and promote integrated security for multi-cloud environments.

- Invest in AI-driven security: Leverage artificial intelligence for proactive threat intelligence and automated defense mechanisms.

- Strengthen data protection services: Offer advanced backup, disaster recovery, and data governance solutions.

PC Refresh Cycle and AI PCs

The market is signaling a robust PC refresh cycle, fueled by an aging installed base and the impending end of support for Windows 10. This creates a substantial opportunity for Dell to capitalize on renewed hardware demand.

The emergence of AI PCs, with their enhanced processing capabilities and user experiences, is a key driver of this refresh. Dell is strategically positioning itself with new AI-powered PC portfolios to capture this growing segment.

Analysts project the AI PC market to see significant growth. For instance, IDC forecasts that AI PCs will represent over 60% of the commercial notebook market by 2027, a trend Dell is poised to benefit from.

- PC Refresh Cycle: An aging installed base and Windows 10 end-of-support are prompting businesses and consumers to upgrade.

- AI PC Adoption: The demand for PCs with integrated AI capabilities for improved performance and efficiency is accelerating.

- Dell's AI Portfolio: Dell's proactive launch of AI-enabled laptops and desktops positions them to meet this evolving market need.

- Market Growth Projections: Industry forecasts, such as those from IDC, indicate a substantial shift towards AI PCs in the coming years, promising increased sales for leading vendors like Dell.

Dell's strategic focus on AI infrastructure, particularly its AI-ready servers, is a significant opportunity, as evidenced by strong Q1 FY25 revenue growth in this segment. The company is well-positioned to benefit from the increasing demand for high-performance computing driven by AI adoption and hybrid cloud strategies.

Emerging markets offer substantial growth potential for Dell, with rapid technological adoption fueling demand for personal computing and enterprise solutions. The projected growth of the cloud computing market in regions like Southeast Asia by 2025, potentially reaching tens of billions of dollars, highlights this opportunity.

The expanding Internet of Things (IoT) and edge computing sectors present avenues for Dell, especially with its focus on AI at the edge. The global edge computing market, anticipated to surpass $200 billion by 2027, underscores the value of Dell's investments in AI-powered edge devices for real-time data analysis.

Dell can capitalize on the global cybersecurity market, projected to exceed $231 billion in 2024, by enhancing its security and IT services portfolio. This expansion aligns with businesses increasingly outsourcing these functions, creating a strong value proposition for Dell's integrated solutions.

The PC refresh cycle, driven by an aging installed base and Windows 10 end-of-support, presents a significant opportunity for Dell. The rise of AI PCs, with IDC forecasting them to be over 60% of the commercial notebook market by 2027, further strengthens Dell's position with its new AI-enabled portfolios.

Threats

Dell faces a relentless competitive landscape, battling giants like HP, Apple, and Lenovo. These companies vie fiercely for market share through aggressive pricing, superior product quality, and continuous innovation. This intense rivalry can trigger price wars, squeezing profit margins and demanding constant strategic adaptation to stay ahead.

Dell's primary revenue stream, hardware sales, faces a persistent threat from shrinking profit margins. This sector is increasingly commoditized, making it difficult for Dell to stand out and boost profitability when rivals offer comparable products at lower price points. For instance, in Q1 2024, Dell's Infrastructure Solutions Group (ISG) saw a 5% year-over-year revenue increase to $8.7 billion, but the overall PC market experienced a slight decline in shipments during 2024, putting pressure on hardware pricing.

Dell's extensive global supply chain, while a strength for reach, also presents a significant threat. Geopolitical instability, like ongoing trade disputes or regional conflicts, can directly impact the flow of components and finished goods. For instance, disruptions in key manufacturing hubs or shipping lanes can lead to production slowdowns and increased costs, affecting Dell's ability to fulfill orders promptly.

Component shortages, a recurring issue in recent years, continue to pose a risk. The demand for advanced semiconductors, crucial for Dell's AI server offerings, is particularly high. In 2024, the global semiconductor shortage continued to affect various industries, and while improvements were noted, supply chain bottlenecks for specialized chips remained a concern. This can directly impact Dell's production capacity and delivery timelines for critical, high-margin products.

Rapid Technological Change and Obsolescence

The relentless pace of technological evolution, marked by the swift introduction of novel products and services, presents a persistent risk of Dell's current offerings becoming outdated. This dynamic necessitates substantial and ongoing investment in research and development to align with shifting customer demands and to prevent market share erosion by emerging, disruptive technologies or agile competitors.

For instance, in the rapidly advancing IT sector, the average product lifecycle continues to shorten. Companies that fail to innovate quickly risk falling behind. Dell's commitment to R&D is crucial, with the company historically investing billions annually to stay at the forefront. In fiscal year 2024, Dell Technologies reported R&D expenses of approximately $3.9 billion, underscoring the significant resources dedicated to combating technological obsolescence.

- Shortening Product Lifecycles: The speed at which new hardware and software emerge means that even recently launched products can quickly become less competitive.

- Disruptive Innovations: New market entrants or existing players introducing fundamentally different technological approaches can rapidly capture market share, rendering established products obsolete.

- R&D Investment Necessity: Continuous and significant investment in research and development is essential for Dell to anticipate future trends and develop next-generation products and services.

- Market Share Risk: Failure to adapt to technological shifts can lead to a decline in sales and a loss of competitive standing in key market segments.

Cybersecurity and Data Breaches

Dell, as a significant player in IT infrastructure, faces substantial cybersecurity threats. The company's vast network and sensitive customer data make it a prime target for malicious actors. A recent report in late 2024 indicated a rise in ransomware attacks targeting IT service providers, underscoring the persistent danger.

The risk of data breaches is a constant concern for Dell. Incidents exposing customer or employee information can lead to severe financial penalties and lasting damage to its reputation. For instance, regulatory fines for data privacy violations have increased significantly in recent years, with some companies facing multi-million dollar penalties.

Protecting its vast IT systems and the data entrusted to it is a critical and ongoing challenge for Dell. The evolving nature of cyber threats requires continuous investment in advanced security measures and vigilant monitoring. Failure to do so could result in significant operational disruptions and loss of customer confidence.

- Constant Target: Dell's position as a major IT infrastructure provider makes it a high-value target for cyberattacks.

- Data Breach Impact: Past incidents highlight the potential for exposure of sensitive employee and customer data.

- Evolving Threats: The dynamic nature of cybersecurity requires ongoing adaptation and investment in defense mechanisms.

- Financial & Reputational Risk: Successful breaches can lead to substantial fines and severe damage to Dell's brand image.

The global PC market, while showing some recovery in late 2024, still faces pressures from economic uncertainties and shifting consumer spending habits, impacting Dell's traditional hardware sales. Emerging markets, though offering growth potential, often come with lower average selling prices and intense local competition, further squeezing margins.

The increasing demand for specialized AI hardware and cloud services creates a dual threat: it requires massive R&D investment to compete, and supply chain constraints for critical components like advanced GPUs can limit Dell's ability to meet this demand, potentially ceding ground to more agile competitors.

Dell's reliance on a complex global supply chain makes it vulnerable to geopolitical tensions and trade policy shifts. For instance, ongoing trade disputes between major economies could disrupt the flow of essential components, leading to production delays and increased costs throughout 2024 and into 2025.

The rapid advancement of AI and other emerging technologies means that Dell's current product portfolio could become obsolete quickly. Maintaining a competitive edge requires substantial and continuous investment in research and development, a challenge given the increasing cost of cutting-edge chip development and manufacturing.

| Threat Area | Description | Impact on Dell |

| Intense Competition | Rivals like HP, Apple, and Lenovo aggressively compete on price and innovation. | Pressure on profit margins, need for constant strategic adaptation. |

| Commoditization of Hardware | PC market faces shrinking margins due to comparable products offered at lower prices. | Difficulty in differentiating and increasing profitability. |

| Supply Chain Vulnerability | Geopolitical instability and trade disputes can disrupt component flow and increase costs. | Production slowdowns, inability to fulfill orders promptly. |

| Component Shortages | High demand for advanced semiconductors, especially for AI servers, leads to bottlenecks. | Impacts production capacity and delivery timelines for high-margin products. |

| Rapid Technological Obsolescence | Fast-paced innovation requires significant R&D investment to prevent offerings from becoming outdated. | Risk of market share erosion if unable to keep pace with emerging technologies. |

SWOT Analysis Data Sources

This Dell SWOT analysis is built upon a foundation of robust data, drawing from official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and insightful perspective.