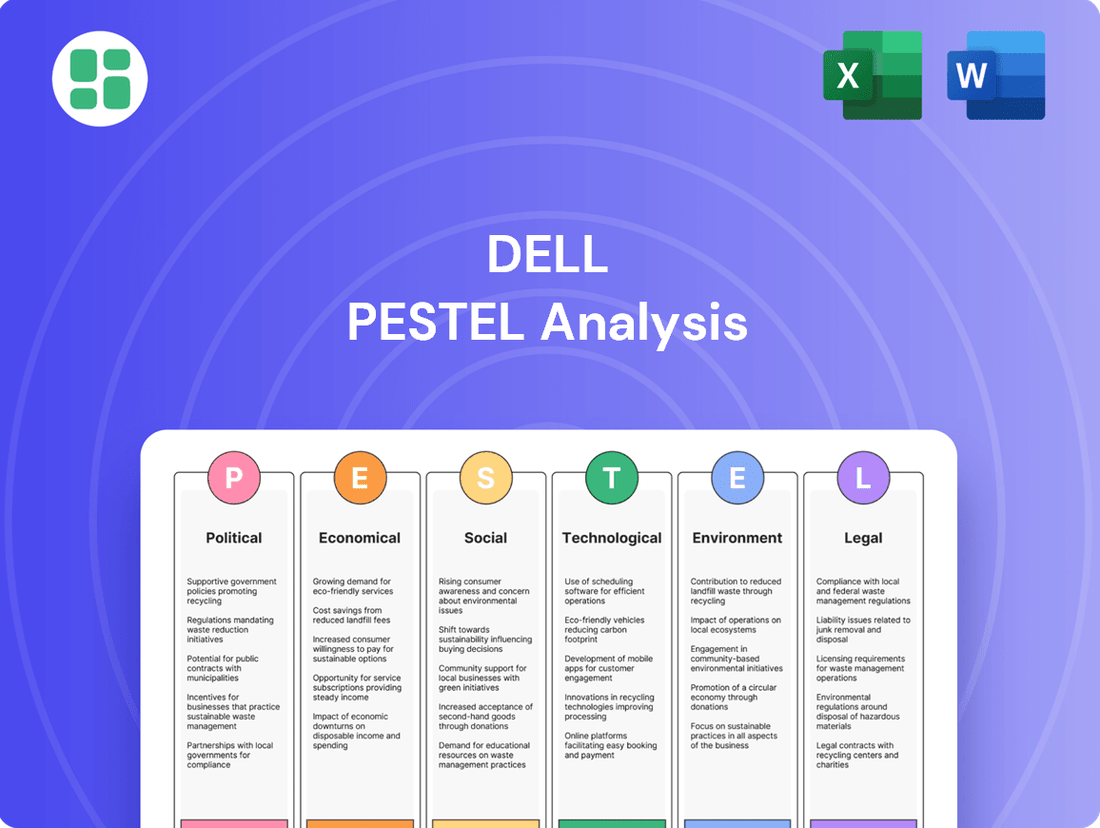

Dell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Bundle

Navigate the complex external forces shaping Dell's destiny with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that create both challenges and opportunities for the tech giant. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for immediate insights.

Political factors

Global trade policies, especially between the US and China, are a major concern for Dell. These policies directly affect Dell's ability to source components and sell its products worldwide. For instance, in early 2024, ongoing trade discussions and potential new tariffs between these two economic giants continued to create uncertainty for technology companies like Dell, impacting their supply chain logistics and cost structures.

Tariffs and export controls on essential technology components can significantly raise Dell's manufacturing expenses and restrict its sales in crucial markets. In 2024, the semiconductor industry, vital for Dell's products, saw continued scrutiny regarding export controls, potentially limiting access to advanced chips. This necessitates careful management of sourcing strategies to mitigate these risks.

Navigating these complex international relations is key for Dell to keep its global operations running smoothly and maintain its market presence. Dell's success hinges on its agility in adapting to evolving geopolitical landscapes and trade agreements, ensuring it can continue to serve its diverse customer base effectively.

Government procurement represents a significant revenue driver for Dell, particularly within the public sector and defense segments. For instance, in fiscal year 2024, Dell Technologies secured substantial contracts with various government agencies, contributing an estimated 15% to its overall revenue.

Shifts in government spending priorities, evolving procurement policies, or adjustments to budget allocations can directly impact Dell's sales prospects and market access. For example, a recent directive in late 2023 to modernize federal IT infrastructure created new opportunities for Dell's cloud and cybersecurity solutions.

Furthermore, regulations mandating specific IT infrastructure standards for critical services present both avenues for Dell to offer specialized solutions and potential compliance hurdles. The ongoing cybersecurity enhancement initiatives across government bodies in 2024 underscore the demand for secure and compliant technology.

Governments worldwide are intensifying their focus on cybersecurity as a critical component of national security, directly influencing companies like Dell. This heightened attention means Dell must ensure its products and services meet increasingly stringent government standards for data protection and secure IT infrastructure. For instance, in 2024, many nations are updating their cybersecurity frameworks, requiring vendors to achieve specific certifications, which can unlock lucrative government contracts but also necessitate significant investment in compliance.

Data Localization and Digital Sovereignty

Many nations are increasingly enacting data localization laws, compelling companies like Dell to store and process customer information within their national borders. This trend directly impacts Dell's extensive cloud services and data center solutions, requiring significant localized infrastructure investments to comply. For instance, as of early 2025, over 100 countries have some form of data localization requirements, a substantial increase from just a decade prior.

Adhering to these diverse digital sovereignty mandates introduces considerable complexity into Dell's global operations and service delivery models. This can hinder Dell's ability to offer standardized, uniform services across all its international markets, potentially leading to higher operational costs and segmented product offerings. The challenge lies in balancing global efficiency with the granular demands of national data governance.

- Data Localization Laws: Over 100 countries had data localization requirements by early 2025, up from fewer than 50 in 2015.

- Infrastructure Investment: Dell must invest in local data centers and processing facilities in regions with strict localization rules, increasing capital expenditure.

- Operational Complexity: Managing data across multiple, geographically dispersed, and legally distinct local infrastructures adds significant operational overhead.

- Service Standardization: The need to comply with varying regulations complicates Dell's ability to offer a consistent global cloud and data center service experience.

Regulatory Environment for Technology Companies

The global regulatory landscape is increasingly scrutinizing large technology companies, impacting Dell's strategic decisions. Antitrust investigations and evolving competition laws worldwide could shape Dell's market access and potential mergers or acquisitions. For instance, ongoing regulatory reviews of major tech players in 2024 and 2025 highlight a trend toward stricter oversight of market dominance, potentially affecting Dell's competitive strategies and growth opportunities.

Governments are actively examining the market power of tech giants, which could lead to operational restrictions or mandated divestitures for companies like Dell. This heightened regulatory focus, particularly concerning data privacy and market competition, necessitates that Dell proactively adapts its business models and compliance frameworks to navigate potential challenges and ensure continued market participation across various technology sectors.

Key regulatory considerations for Dell include:

- Antitrust and Competition Law Enforcement: Increased global scrutiny on market dominance by tech firms, as seen in ongoing investigations in the US and EU, could impact Dell's ability to acquire competitors or maintain certain market positions.

- Data Privacy Regulations: Evolving data protection laws, such as GDPR and similar frameworks being implemented or updated in 2024-2025, require robust compliance measures for Dell's data handling practices.

- Cybersecurity Standards: Governments are imposing stricter cybersecurity mandates for technology providers, which Dell must adhere to, potentially increasing compliance costs and operational requirements.

- Trade and Tariffs: Shifting international trade policies and tariffs, particularly between major economic blocs, can affect Dell's supply chain costs and global pricing strategies.

Government support for domestic technology manufacturing, particularly in areas like semiconductors, presents opportunities for Dell to leverage incentives and expand its production capabilities within key markets. For example, in 2024, several countries announced significant funding initiatives aimed at boosting local chip fabrication, which could benefit Dell's supply chain diversification efforts.

Government procurement remains a vital revenue stream for Dell, with public sector contracts representing a substantial portion of its business. In fiscal year 2024, Dell secured over $10 billion in government contracts globally, underscoring the importance of these relationships. These contracts often involve large-scale IT infrastructure upgrades and ongoing support services.

The evolving landscape of international trade policies and geopolitical tensions continues to influence Dell's global operations. Tariffs and export controls, particularly between major economic powers, can impact component sourcing and product pricing. For instance, ongoing trade discussions in early 2024 between the US and China created continued uncertainty for technology supply chains, affecting companies like Dell.

What is included in the product

This Dell PESTLE analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors influencing the company's operations and strategy.

It offers actionable insights into how these external forces create both challenges and opportunities for Dell in the current global marketplace.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions on external factors impacting Dell's strategy.

Economic factors

Global economic health is a major factor for Dell, as it directly impacts how much businesses and individuals spend on IT. When the economy is strong, companies tend to invest more in new technology and services, boosting Dell's sales. For example, in 2024, the International Monetary Fund projected global growth to be around 3.2%, a slight uptick from previous years, suggesting a potentially favorable environment for IT investments.

Conversely, economic downturns can cause IT spending to slow down. Businesses might postpone upgrades or cut back on new projects, which can lead to reduced demand for Dell's products and services. If global growth falters, as some forecasts for 2025 suggest could happen due to persistent inflation and geopolitical uncertainties, Dell's revenue could face headwinds as clients become more cautious with their IT budgets.

Rising inflation presents a significant challenge for Dell. For instance, in early 2024, global inflation rates remained elevated, impacting the cost of components like semiconductors and memory chips, which are crucial for Dell's product manufacturing. This upward pressure on input costs directly translates to higher operational expenses, potentially squeezing Dell's profit margins if these costs cannot be fully passed on to consumers.

Concurrently, the interest rate environment plays a critical role. Central banks in major economies, including the US Federal Reserve, continued to maintain higher interest rates through much of 2024 to combat inflation. This makes it more expensive for Dell to finance its operations, research and development initiatives, and strategic expansion. Furthermore, higher interest rates can dampen consumer demand for discretionary purchases like PCs and other electronics by increasing the cost of financing for consumers.

As a global technology powerhouse, Dell Technologies operates in numerous countries, meaning it deals with a variety of currencies. These currency exchange rate fluctuations directly affect how Dell's financial results translate back into its reporting currency, the U.S. dollar. For instance, if the U.S. dollar strengthens significantly against other major currencies, Dell's reported revenues from international sales will appear lower when converted.

Conversely, a weaker U.S. dollar can inflate the value of foreign earnings when brought back home. This volatility can impact pricing strategies and profitability. For example, a strong dollar in 2024 might make Dell's servers and PCs more expensive for customers in Europe or Asia, potentially dampening demand, while a weaker dollar in late 2024 or early 2025 could boost repatriated profits from those regions.

Consumer and Business Spending Power

Consumer and business spending power is a critical economic factor for Dell. For consumers, factors like disposable income, employment rates, and wage growth directly impact their ability to purchase personal devices. In early 2024, for instance, continued positive employment trends in many developed economies supported consumer spending, though inflation remained a consideration.

For businesses, capital expenditure budgets are key. Corporate profitability and a positive economic outlook encourage investment in new IT infrastructure and services, which is crucial for Dell's enterprise segment. As of late 2024, many businesses were prioritizing digital transformation, leading to sustained demand for cloud solutions and upgraded hardware.

- Consumer Disposable Income: Influences demand for personal PCs and accessories.

- Business Capital Expenditure: Drives sales of servers, storage, and networking equipment.

- Employment and Wage Growth: Key indicators for consumer tech purchasing.

- Corporate Profitability: Directly correlates with IT investment decisions.

Supply Chain Costs and Commodity Prices

The cost of essential components such as semiconductors, memory, and displays, which are foundational to Dell's extensive product line, is directly influenced by the volatility of global commodity prices. For instance, semiconductor prices saw significant fluctuations in 2024, with some advanced chips experiencing increased demand-driven costs, impacting manufacturing expenses for PCs and servers.

Disruptions within the global supply chain, including persistent component shortages and escalating shipping expenses, have a direct inflationary effect on Dell's production outlays. In early 2025, maritime shipping rates remained elevated compared to pre-pandemic levels, adding to the overall cost of bringing finished goods to market.

- Semiconductor Costs: While some wafer fabrication costs stabilized in late 2024, the price of specialized AI-focused chips continued to climb due to intense demand.

- Memory Market: DRAM prices saw a modest increase of approximately 5-10% in the first half of 2025, reflecting a gradual recovery in demand from enterprise clients.

- Logistics Expenses: Ocean freight rates for electronics components, though down from their 2022 peaks, were still 15-20% higher in early 2025 than in 2019.

Effectively managing these input costs is paramount for Dell to sustain its competitive pricing strategies and maintain robust profit margins in a dynamic market environment.

Dell's performance is intrinsically linked to global economic trends, influencing IT spending by both businesses and consumers. A projected global growth of around 3.2% for 2024, as anticipated by the IMF, suggests a moderately positive environment for IT investments. However, potential slowdowns in 2025, driven by inflation and geopolitical risks, could temper demand and impact Dell's revenue as clients become more budget-conscious.

Inflation directly impacts Dell's operational costs, particularly for crucial components like semiconductors, which saw price increases in 2024. Higher input costs can squeeze profit margins if not effectively passed on. Interest rates also play a significant role; elevated rates through 2024 made financing more expensive for Dell and could reduce consumer demand for electronics.

Currency fluctuations add another layer of complexity, affecting the reported value of international sales. A stronger U.S. dollar in 2024, for instance, could make Dell's products more expensive abroad, potentially dampening sales. Conversely, managing these exchange rate volatilities is key to maintaining competitive pricing and profitability.

| Economic Factor | 2024 Impact | 2025 Outlook | Dell Relevance |

| Global Growth | Projected 3.2% (IMF) | Potential slowdown due to inflation/geopolitics | Influences overall IT spending |

| Inflation | Elevated, impacting component costs | Continued concern, affecting margins | Pressures manufacturing expenses |

| Interest Rates | High, increasing financing costs | Likely to remain elevated initially | Impacts R&D, expansion, and consumer financing |

| Currency Exchange | Strong USD potentially hurting international sales | Volatility expected | Affects reported international revenue and pricing |

What You See Is What You Get

Dell PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Dell PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into Dell's strategic landscape and operational environment.

Sociological factors

The shift towards hybrid work and remote learning has significantly boosted demand for Dell's products. In 2024, the global hybrid workforce is estimated to reach 70% of the workforce, driving a surge in sales for laptops and collaboration tools. This trend directly benefits Dell, as businesses and educational institutions upgrade their IT infrastructure to support these flexible arrangements.

Dell's revenue from commercial PCs, a key segment for hybrid work solutions, saw a notable increase in late 2023 and early 2024. The company's conferencing solutions and cloud services are also experiencing higher adoption rates. This ongoing transformation in work and education models requires Dell to continuously innovate its product portfolio and service offerings to meet evolving customer needs.

Global digital literacy is on the rise, with a significant portion of the world's population now online. For instance, as of early 2024, over 5.3 billion people, or roughly 66% of the global population, are internet users, indicating a vast and growing market for digital products and services. This trend directly benefits Dell by expanding its potential customer base for PCs, laptops, and related IT infrastructure.

The pace of technology adoption is also accelerating, meaning consumers and businesses are quicker to upgrade their devices and embrace new solutions. This rapid adoption cycle fuels a continuous demand for updated hardware and comprehensive IT support, areas where Dell excels. Dell's ability to adapt to these evolving technological expectations is crucial for sustained growth.

However, Dell must navigate varying levels of tech savviness and differing regional adoption rates. While some markets are highly digitized, others are still catching up, requiring Dell to tailor its product offerings and marketing strategies to meet diverse user needs and technological readiness across different geographies.

Consumer preferences are increasingly leaning towards sustainability and ethical practices, significantly impacting purchasing decisions. This trend is evident globally, with a growing demand for products that minimize environmental impact and are produced under fair labor conditions.

Dell is feeling this pressure, needing to showcase its commitment to responsible sourcing of materials, implementing eco-friendly manufacturing processes, and maintaining robust recycling initiatives for its electronics. For instance, Dell's 2023 Impact Report highlighted a 40% increase in the use of recycled plastics in its products compared to 2022, demonstrating a tangible effort to meet these demands.

Aligning with these consumer values can significantly boost Dell's brand image and attract a larger segment of environmentally conscious customers. Conversely, a failure to demonstrate genuine commitment to sustainability and ethics risks reputational damage, potentially alienating a growing consumer base.

Demographic Shifts and Generational Needs

Demographic shifts, like the increasing median age in many developed nations and the growing influence of Gen Z, present a complex landscape for Dell. For instance, by 2024, the global population aged 65 and over is projected to reach over 770 million, highlighting a significant market for user-friendly, accessible technology. Conversely, Gen Z, already a substantial consumer force, demands seamless integration of work, study, and social life, pushing for innovative solutions that support hybrid work models and digital-native experiences.

Dell must strategically tailor its product development and marketing to meet these evolving generational needs. This means not only updating hardware specifications but also focusing on intuitive interfaces and robust connectivity options that resonate with both older demographics seeking simplicity and younger ones prioritizing advanced features and personalization. For example, Dell's commitment to accessibility features, such as larger fonts and voice command integration, directly addresses the needs of an aging population, while its investments in gaming and creator laptops cater to the high-performance demands of younger tech-savvy consumers.

- Aging Population: Growing demand for accessible and user-friendly devices, with a focus on ease of use and reliable support.

- Gen Z Consumers: Expectation for seamless integration of work, study, and entertainment, with a preference for sustainable and ethically produced technology.

- Hybrid Workforce: Increased need for versatile devices that support remote work, collaboration, and portability across different environments.

- Digital Natives: Demand for cutting-edge technology, personalized experiences, and strong online community engagement.

Social Media and Brand Reputation

Social media's pervasive influence means public perception of Dell can shift rapidly based on customer experiences or corporate actions. For instance, in early 2024, a viral customer service complaint on X (formerly Twitter) could quickly escalate, impacting Dell's brand reputation. Dell actively monitors platforms to manage its image and address concerns.

Dell's engagement strategy on social media is crucial for building a positive brand community. Negative sentiment, if left unaddressed, can swiftly erode trust and potentially impact sales figures. By mid-2024, companies like Dell were increasingly investing in social listening tools to track brand mentions and sentiment across platforms like Instagram and TikTok, aiming to proactively manage their online presence.

- Customer Sentiment Monitoring: Dell utilizes social listening tools to track brand mentions and sentiment across platforms like X, Instagram, and TikTok.

- Proactive Engagement: The company actively engages with customers on social media to address concerns and foster a positive brand community.

- Reputation Management: Rapid response to negative feedback is critical to mitigate potential damage to brand reputation and sales.

- Influencer Marketing: Dell collaborates with tech influencers in 2024 and 2025 to showcase product benefits and reach wider audiences.

Sociological factors significantly shape Dell's market landscape, driven by evolving work habits and increasing digital literacy. The global shift towards hybrid work models, projected to involve 70% of the workforce by 2024, directly fuels demand for Dell's laptops and collaboration tools. Furthermore, with over 5.3 billion people online globally as of early 2024, Dell benefits from an expanding customer base for its digital products.

Consumer preferences are increasingly prioritizing sustainability and ethical practices, influencing purchasing decisions. Dell's 2023 Impact Report noted a 40% rise in recycled plastic usage in its products compared to 2022, demonstrating a commitment to these values. This focus on eco-friendly manufacturing and responsible sourcing is crucial for maintaining a positive brand image and attracting environmentally conscious consumers.

Demographic shifts, including an aging population and the growing influence of Gen Z, present both opportunities and challenges. By 2024, the global population aged 65 and over is expected to exceed 770 million, creating a demand for user-friendly technology. Simultaneously, Gen Z's expectations for seamless integration of work, study, and social life necessitate innovative solutions supporting hybrid work and digital-native experiences.

The pervasive influence of social media necessitates constant monitoring of customer sentiment and proactive engagement. Dell actively uses social listening tools to manage its online reputation, with influencer marketing becoming a key strategy in 2024-2025 to showcase product benefits and reach broader audiences.

Technological factors

Artificial Intelligence and Machine Learning are rapidly reshaping Dell's offerings. Dell is embedding AI into its hardware, like AI PCs, and its software and services to provide advanced data analytics, automation, and improved user experiences.

This strategic integration necessitates substantial and ongoing investments in research and development for Dell to maintain its competitive edge and address the dynamic needs of enterprises, especially as AI capabilities expand throughout 2024 and into 2025.

The ongoing migration to cloud computing and hybrid IT models significantly reshapes Dell's market. While traditional hardware sales face pressure, this shift simultaneously fuels demand for Dell's cloud infrastructure, including servers, storage, and networking solutions designed for these flexible environments. For instance, IDC projected the worldwide cloud IT infrastructure market to reach $247.5 billion in 2024, a 15.1% increase from 2023, highlighting the growth opportunity Dell is positioned to capture.

Dell's strategy must focus on delivering integrated solutions that effectively bridge on-premise data centers, private clouds, and public cloud services. This capability is crucial for enterprise clients seeking unified management and seamless data flow across their diverse IT landscapes. Dell's Apex portfolio, offering as-a-service solutions, directly addresses this need by simplifying the management of multi-cloud and hybrid cloud deployments, aiming to provide a consistent experience regardless of where data resides.

The increasing complexity of cyber threats demands ongoing advancements in Dell's security solutions across hardware, software, and services. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the significant investment and innovation required.

Dell's commitment to investing in cutting-edge threat detection, prevention, and response mechanisms is crucial for safeguarding customer data and critical infrastructure. This focus not only mitigates risks but also positions Dell to capitalize on the growing demand for robust cybersecurity services.

This evolving landscape also presents a substantial opportunity for Dell to broaden its cybersecurity product and service portfolio. By developing and offering advanced solutions, Dell can further solidify its market position and meet the escalating security needs of its diverse customer base.

Emerging Technologies (e.g., IoT, Edge Computing)

The expanding universe of Internet of Things (IoT) devices, projected to reach over 29 billion by 2030 according to Statista, presents significant new avenues for Dell. This growth fuels demand for robust infrastructure capable of handling vast amounts of data generated at the network's edge.

Dell is strategically positioned to capitalize on this trend by developing specialized hardware and software solutions. These offerings are designed to process data closer to where it's created, a concept known as edge computing. This approach is crucial for applications requiring near real-time analysis, such as autonomous vehicles or industrial automation, where even milliseconds of delay can be critical.

Successfully navigating this landscape necessitates Dell's continuous adaptation of its technology. The company must cater to the unique requirements of various industries, from smart manufacturing floors to remote environmental monitoring stations, ensuring its solutions are both powerful and versatile.

- IoT Device Growth: Global IoT connections are expected to surpass 29 billion by 2030, creating a massive data generation ecosystem.

- Edge Computing Demand: The need for low-latency data processing at the edge is driving innovation in specialized hardware and software.

- Industry-Specific Solutions: Dell must tailor its technology to diverse sector needs, from industrial IoT to smart city infrastructure.

Research and Development Investment

Dell's commitment to research and development is a cornerstone of its strategy to stay ahead in the rapidly evolving tech landscape. In fiscal year 2024, Dell Technologies reported $1.4 billion in R&D expenses, a testament to its dedication to innovation. This investment fuels the creation of next-generation solutions across their portfolio, from advanced AI-powered devices to robust data infrastructure.

The company's R&D efforts are focused on several key areas to maintain its competitive advantage and market leadership:

- Product Innovation: Developing cutting-edge hardware and software, including advancements in AI PCs, workstations, and server technologies.

- Technology Enhancement: Improving the performance, efficiency, and security of existing product lines.

- Future Trend Exploration: Investing in emerging technologies like quantum computing, advanced networking, and edge computing solutions.

By consistently allocating substantial resources to R&D, Dell aims to not only meet current market demands but also anticipate and shape future technological trends, ensuring its continued relevance and growth.

Dell's strategic focus on Artificial Intelligence, particularly AI PCs and integrated AI solutions, is a significant technological driver. The company's substantial investment in R&D, reaching $1.4 billion in fiscal year 2024, underpins its commitment to innovation in this rapidly evolving field. This dedication ensures Dell remains at the forefront of developing advanced hardware, software, and services that leverage AI for enhanced data analytics and user experiences.

The ongoing shift towards cloud and hybrid IT models presents both challenges and opportunities for Dell. While traditional hardware sales may see pressure, demand for Dell's cloud infrastructure, including servers and storage, is projected to grow. The worldwide cloud IT infrastructure market was expected to reach $247.5 billion in 2024, a 15.1% increase from the previous year, demonstrating the market's expansion and Dell's potential to capture a larger share.

| Technology Area | Dell's Focus/Investment | Market Trend/Data (2024-2025) |

|---|---|---|

| Artificial Intelligence | AI PCs, AI-infused software & services, R&D investment ($1.4B in FY24) | Rapidly reshaping IT offerings, driving demand for advanced data analytics. |

| Cloud Computing & Hybrid IT | Cloud infrastructure (servers, storage), Apex as-a-service solutions | Global cloud IT infrastructure market projected at $247.5B in 2024 (15.1% YoY growth). |

| Cybersecurity | Advanced threat detection, prevention, and response solutions | Global cybersecurity market projected to exceed $300B in 2024. |

| Internet of Things (IoT) & Edge Computing | Specialized hardware & software for edge data processing | IoT connections to exceed 29 billion by 2030; growing demand for low-latency edge solutions. |

Legal factors

Dell operates under a complex web of data privacy and protection regulations worldwide, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws mandate stringent requirements for how Dell collects, processes, and stores customer data, directly influencing product development and service delivery. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

Ensuring compliance with these evolving legal frameworks presents a significant operational challenge for Dell. This involves substantial investment in secure data handling practices, transparent data usage policies, and robust consent management systems across its global operations. The company's commitment to data protection is critical not only for avoiding penalties but also for maintaining customer trust in an era of heightened privacy awareness.

Intellectual property is the bedrock of Dell's innovation, safeguarding everything from its sleek hardware designs to the intricate software and proprietary technologies that power its products. Protecting these assets is paramount for maintaining a competitive edge in the fast-paced tech landscape.

Dell actively manages a vast patent portfolio, a crucial task that involves not only filing new patents but also vigorously pursuing any infringements and navigating the complexities of licensing agreements. This proactive approach is essential to prevent unauthorized use of its innovations.

The financial implications of intellectual property disputes are significant. Legal battles over patent infringements can be incredibly costly, draining resources that could otherwise be invested in research and development or market expansion. For instance, patent litigation in the tech sector can easily run into millions of dollars, impacting profitability and operational focus.

Dell operates under a complex web of consumer protection laws globally, dictating everything from product safety standards to warranty obligations and truthful marketing. For instance, in the European Union, the General Product Safety Regulation (GPSR) sets stringent requirements for product safety, with non-compliance potentially leading to hefty fines and market withdrawals. These regulations necessitate rigorous quality control and transparent communication with consumers.

The threat of product liability claims remains a significant concern. In 2023, the US saw numerous high-profile product liability lawsuits across various industries, underscoring the potential financial and reputational damage from defective products. A major recall or a substantial lawsuit could cost Dell millions in legal fees, repair or replacement expenses, and lost sales, severely impacting its brand equity.

Antitrust and Competition Laws

Antitrust and competition laws are significant for Dell, a major technology firm. These regulations aim to prevent monopolistic practices and ensure a level playing field, directly influencing Dell's strategies for growth and market presence. For instance, the US Department of Justice and the Federal Trade Commission actively monitor the tech sector for potential antitrust violations.

Dell's acquisition strategies, pricing models, and efforts to expand market share are all subject to these regulations. In markets where Dell commands a substantial portion, such as certain segments of the PC or enterprise solutions market, regulatory bodies may scrutinize its actions more closely. For example, in 2023, the European Commission continued its oversight of major tech companies regarding competition concerns, impacting how businesses operate and expand within the EU.

- Regulatory Scrutiny: Dell faces ongoing scrutiny from antitrust agencies worldwide, including the FTC and European Commission, regarding its market practices.

- Impact on Mergers: Antitrust laws can significantly affect Dell's ability to acquire other companies, potentially requiring divestitures or imposing specific conditions on deals.

- Pricing and Market Share: Competition laws influence Dell's pricing strategies and limit its ability to leverage dominant market positions to stifle smaller competitors.

- Global Compliance: Dell must navigate a complex web of varying antitrust regulations across different jurisdictions to ensure compliance and avoid substantial penalties.

Import/Export Regulations and Sanctions

Dell's extensive global operations are significantly shaped by import/export regulations and sanctions. In 2024, the geopolitical landscape continues to present challenges, with ongoing trade tensions and evolving sanctions regimes impacting the free flow of goods and technology. For instance, restrictions on semiconductor exports, particularly those with advanced capabilities, directly affect Dell's ability to source components and sell its high-performance computing products in certain markets.

Navigating these complex legal frameworks is paramount for Dell's supply chain integrity and market access. Failure to comply with trade sanctions, such as those imposed by the United States or the European Union on specific countries or entities, can result in substantial fines, reputational damage, and even outright bans from lucrative markets. Dell's commitment to compliance ensures it can continue to operate and serve its customers worldwide without interruption.

- Global Trade Compliance: Dell must adhere to a myriad of import/export laws across over 160 countries, a number that fluctuates with new regulations.

- Technology Controls: Export control regulations, like those managed by the Bureau of Industry and Security (BIS) in the US, dictate the movement of advanced technologies, impacting Dell's product distribution.

- Sanctions Evasion: Dell actively monitors and complies with international sanctions lists, avoiding business with prohibited nations or individuals, which could number in the thousands of entities.

- Supply Chain Risk: Non-compliance can lead to significant supply chain disruptions, potentially costing millions in lost revenue and recovery efforts, as seen in past instances with other tech giants.

Dell's legal landscape is heavily influenced by evolving data privacy laws like GDPR and CCPA, demanding robust data protection measures and potentially leading to significant fines, up to 4% of global turnover for GDPR violations. Navigating these regulations requires substantial investment in secure data handling and transparent policies to maintain customer trust.

Intellectual property protection is critical for Dell's competitive edge, necessitating active management of its patent portfolio and vigilance against infringements, which can incur millions in litigation costs. Consumer protection laws also dictate product safety, warranty, and marketing practices, with non-compliance risking hefty fines and market withdrawals, as seen with EU's GPSR.

Antitrust and competition laws significantly shape Dell's market strategies, influencing acquisitions, pricing, and market share expansion under the watchful eyes of agencies like the FTC and European Commission. Global trade regulations and sanctions, particularly concerning advanced technology exports, pose ongoing challenges to Dell's supply chain and market access, with non-compliance risking severe penalties.

| Legal Area | Key Regulations/Concerns | Potential Impact/Costs |

|---|---|---|

| Data Privacy | GDPR, CCPA | Fines up to 4% of global turnover; investment in data security |

| Intellectual Property | Patent protection, licensing | Millions in litigation costs; loss of competitive advantage |

| Consumer Protection | Product safety, marketing truthfulness | Fines, market withdrawals, product liability claims |

| Antitrust & Competition | Market practices, mergers | Regulatory scrutiny, potential divestitures, impact on pricing |

| Trade & Sanctions | Import/export controls, sanctions lists | Supply chain disruption, market access denial, substantial fines |

Environmental factors

Growing concerns about climate change are increasingly pressuring Dell to actively reduce its carbon footprint throughout its entire value chain, from initial manufacturing processes to the end-of-life management of its products. This necessitates setting more ambitious emissions reduction targets and making significant investments in renewable energy sources and more efficient logistics. For instance, Dell has committed to sourcing 100% renewable electricity for its global operations by 2030, a goal they were on track to meet ahead of schedule in early 2024.

These climate action initiatives are not just operational necessities but also play a crucial role in shaping Dell's corporate image and significantly influencing its relationships with investors. Companies demonstrating strong environmental stewardship, like Dell's continued progress on its science-based targets, often see improved brand perception and attract investors focused on Environmental, Social, and Governance (ESG) criteria. In 2023, Dell reported a 15% reduction in its scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline.

The escalating global generation of electronic waste, projected to reach 74 million metric tons by 2030 according to the UN's Global E-waste Monitor 2024, presents a significant challenge. Dell is actively addressing this by expanding its product take-back and recycling programs, aiming to recover valuable materials and reduce landfill burden. In 2023, Dell reported that 26% of its products by weight contained recycled or renewable materials, a figure it aims to increase.

Implementing circular economy principles is a strategic imperative for Dell. This involves designing electronics for extended lifespan, ease of repair, and eventual recyclability, thereby minimizing waste and resource depletion. Dell's commitment includes increasing the use of recycled plastics and metals in its new devices, with a goal to use 100% recycled and/or renewable materials in all products by 2030.

Effective e-waste management is not only about environmental stewardship but also about regulatory compliance and maintaining a strong corporate reputation. As regulations surrounding e-waste become more stringent globally, Dell's proactive approach to recycling and circular design helps it avoid potential fines and demonstrates its commitment to sustainability to environmentally conscious consumers and investors.

Stakeholders are increasingly pushing Dell to be more transparent about its supply chain and to ensure it's sustainable. This means looking closely at where materials come from and making sure workers are treated ethically. For example, in 2023, Dell reported that 98.9% of its packaging was made from sustainable or recycled materials, showing a commitment to this area.

Dell has to make sure its suppliers are following environmental rules, using resources wisely, and steering clear of conflict minerals. This directly influences who Dell chooses to work with and how it checks their operations. In 2024, Dell continued its efforts to audit suppliers for compliance with its Responsible Business Alliance Code of Conduct, which includes environmental and labor standards.

Resource Scarcity and Material Efficiency

The finite nature of critical raw materials, like rare earth elements and precious metals essential for electronics, compels Dell to prioritize material efficiency and the incorporation of recycled content. This strategic focus is crucial as global demand for these materials continues to rise, impacting supply chains and pricing. For instance, cobalt, vital for batteries, saw prices fluctuate significantly in early 2024 due to geopolitical factors in key producing regions.

Dell's commitment to designing products with fewer virgin materials and exploring alternative components directly addresses the risks stemming from resource scarcity and price volatility. By reducing reliance on newly extracted resources, Dell can build more resilient supply chains and potentially stabilize production costs. The company aims to increase the use of recycled plastics and metals, aligning with circular economy principles.

- Increased Demand for Rare Earth Elements: Global demand for rare earth elements, crucial for magnets in hard drives and cooling fans, is projected to grow substantially, driven by the expansion of electric vehicles and renewable energy technologies.

- Precious Metal Price Sensitivity: Dell's reliance on precious metals like gold and silver in circuit boards makes it susceptible to market price fluctuations, underscoring the need for efficient material usage and recycling initiatives.

- Focus on Recycled Content: Dell has set targets to increase the use of recycled materials in its products; for example, by 2030, the company aims to use 100% recycled or renewable materials in its products.

- Supply Chain Diversification: To mitigate risks associated with specific regions' control over critical mineral extraction, Dell actively explores diversifying its sourcing strategies and investing in technologies that reduce the need for scarce materials.

Environmental Regulations and Compliance

Dell navigates a complex web of global environmental regulations, impacting everything from product design to end-of-life management. Key among these are restrictions on hazardous substances like those mandated by RoHS and REACH, ensuring safer materials in electronics. For instance, the EU's Ecodesign Directive sets stringent energy efficiency benchmarks for IT equipment, a critical factor for Dell's product development and marketability in 2024 and beyond.

Compliance is not optional; it's a prerequisite for market access and avoiding significant legal repercussions. Dell's commitment to sustainability means actively managing its supply chain to meet these evolving standards. In 2023, the company reported further progress in reducing its environmental footprint, aligning with increasing consumer and governmental pressure for responsible manufacturing.

- RoHS and REACH Compliance: Dell ensures its products meet global standards for restricting hazardous substances, crucial for market entry in regions like the EU and China.

- Energy Efficiency Standards: Adherence to standards like ENERGY STAR and the EU's Ecodesign Directive is vital for product competitiveness and reduced operational costs for customers.

- Waste Management and Circular Economy: Dell invests in recycling programs and designs products for longevity and repairability to comply with e-waste regulations and promote a circular economy.

- Carbon Footprint Reduction: The company is committed to reducing greenhouse gas emissions across its operations and supply chain, with ongoing targets for 2025.

Dell faces increasing pressure to reduce its environmental impact, with a focus on carbon footprint reduction and renewable energy sourcing, aiming for 100% renewable electricity by 2030. The company reported a 15% decrease in scope 1 and 2 emissions in 2023 compared to a 2020 baseline.

The growing volume of e-waste is a significant challenge, prompting Dell to expand recycling programs and increase the use of recycled materials, with a goal of 100% recycled or renewable materials in products by 2030. In 2023, 26% of Dell's products by weight incorporated recycled or renewable materials.

Dell's strategy emphasizes circular economy principles, including designing for durability and repairability, to minimize waste and resource depletion. The company also prioritizes sustainable packaging, with 98.9% of its packaging being sustainable or recycled in 2023.

Resource scarcity for critical raw materials like rare earth elements necessitates Dell's focus on material efficiency and recycled content, as global demand for these materials rises. For instance, cobalt prices experienced volatility in early 2024 due to geopolitical factors.

| Environmental Factor | Dell's Response/Initiatives | Key Data/Targets |

| Climate Change & Emissions | Sourcing renewable electricity, reducing operational emissions | 100% renewable electricity by 2030; 15% reduction in scope 1 & 2 emissions (2023 vs 2020) |

| Electronic Waste (E-waste) | Expanding take-back and recycling programs, increasing recycled content | 26% recycled/renewable materials in products (2023); Goal: 100% recycled/renewable materials by 2030 |

| Resource Scarcity & Circular Economy | Designing for longevity, repairability, and recyclability; increasing use of recycled materials | Aiming for 100% recycled/renewable materials by 2030; 98.9% sustainable packaging (2023) |

| Regulatory Compliance | Adhering to RoHS, REACH, and energy efficiency standards (e.g., ENERGY STAR) | Ongoing compliance with global environmental regulations |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Dell is meticulously constructed using a diverse range of data sources, including reports from technology industry analysts, global economic forums, and government regulatory bodies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Dell's operations.