Dell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Bundle

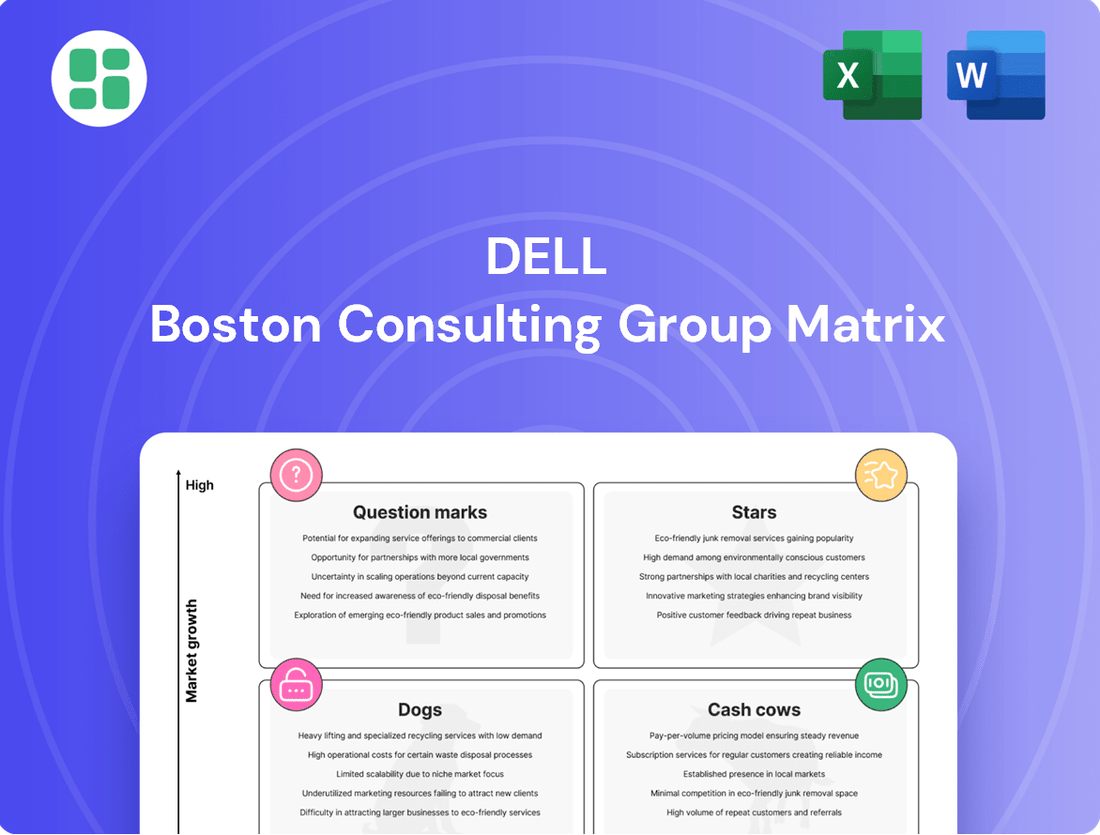

Uncover the strategic positioning of Dell's product portfolio with our comprehensive BCG Matrix analysis. See which products are market leaders (Stars), which generate consistent revenue (Cash Cows), which are underperforming (Dogs), and which hold future potential (Question Marks). Purchase the full report for a detailed breakdown and actionable insights to optimize your investment strategy.

Stars

AI-optimized servers and infrastructure are a clear star for Dell. In Q1 fiscal 2025, their servers and networking revenue surged by an impressive 42% year-over-year, highlighting robust demand. This growth is fueled by the ongoing generative AI revolution and the critical need for advanced digital infrastructure.

The numbers underscore this strong market position. AI-optimized server orders saw a sequential increase, reaching $2.6 billion. Shipments more than doubled, climbing over 100% to $1.7 billion, while the backlog expanded by over 30% to $3.8 billion. These figures demonstrate Dell's ability to scale and meet the escalating needs of the AI market.

Dell APEX embodies a significant pivot to a consumption-based IT model, offering a suite of as-a-service solutions designed for modern infrastructure needs. This strategic move provides customers with enhanced agility and scalability, aligning with evolving market demands for flexible IT consumption.

The APEX portfolio, encompassing offerings like APEX Data Storage Services and APEX Cloud Services, is central to Dell's growth strategy. Industry analysts like IDC projected that by 2024, a substantial 50% of data center infrastructure would be consumed as-a-service, underscoring the market's embrace of this model.

High-performance workstations, exemplified by the Dell Precision line, are a cornerstone of Dell's product portfolio. These machines are vital for demanding tasks in sectors like artificial intelligence, data science, and content creation, all of which are experiencing significant expansion.

Dell's commitment to this segment is evident in its leading market share, holding the number one position in the commercial AI PC market as reported by IDC. This dominance underscores the importance of their workstation offerings to professionals driving innovation in these growth areas.

The company is actively bolstering its AI hardware capabilities and forging stronger alliances with AI chip manufacturers. This strategic focus ensures Dell is well-positioned to meet the escalating demand for advanced, AI-enabled computing solutions, further solidifying the role of products like the Dell Precision series.

Edge Computing Solutions

Edge computing solutions represent a significant growth area for Dell, leveraging its strong position in the global server market. With Dell holding a 19.3% market share in 2025, this segment is driven by the increasing demand for processing data closer to its origin.

Dell's focus on intelligent edge computing offers solutions that are vital for emerging applications requiring real-time data analysis and reduced latency. This strategic move positions Dell to capitalize on the expanding enterprise need for optimized performance in distributed environments.

- Dell's Leadership in Servers: Dell commands a substantial 19.3% share of the global server market as of 2025.

- Edge Computing Growth Driver: The rapid expansion of edge computing is a primary catalyst for server market growth.

- Dell's Edge Strategy: Dell is actively developing intelligent edge solutions to process data at the source.

- Market Opportunity: This segment offers high growth potential as businesses adopt distributed workloads for better performance and lower latency.

Cybersecurity Services & Solutions

Cybersecurity Services & Solutions represent a significant growth area for Dell Technologies. The company is actively investing in and innovating within this critical sector, recognizing its expanding importance in the digital landscape.

The global cybersecurity market is experiencing robust expansion. Projections indicate a growth of USD 107.1 billion between 2024 and 2028, fueled by increasing reliance on mobile devices and the rapid integration of artificial intelligence. This trend underscores the escalating need for advanced security measures.

Dell's commitment extends to pioneering advancements in cybersecurity. They are focusing on next-generation solutions, such as Data Security Posture Management (DSPM), and are at the forefront of developing early AI security solutions to address emerging threats.

- Market Growth: Projected to increase by USD 107.1 billion from 2024-2028.

- Key Drivers: Rising mobile device usage and AI integration.

- Dell's Focus: Investment in next-gen DSPM and early AI security solutions.

Dell's AI-optimized servers and infrastructure are a clear star. In Q1 fiscal 2025, server and networking revenue grew 42% year-over-year, driven by generative AI demand. AI-optimized server orders reached $2.6 billion, with shipments more than doubling to $1.7 billion and a backlog of $3.8 billion, indicating strong market traction and Dell's ability to meet escalating demand.

Dell's APEX, a consumption-based IT model, is also a star. This portfolio, including APEX Data Storage Services and APEX Cloud Services, aligns with the market's shift towards as-a-service IT consumption, a trend expected to see 50% of data center infrastructure consumed this way by 2024.

High-performance workstations, like the Dell Precision line, are stars due to their critical role in AI, data science, and content creation. Dell holds the number one market share in commercial AI PCs, underscoring the importance of these workstations for professionals driving innovation in these expanding sectors.

Dell's edge computing solutions are stars, leveraging its 19.3% global server market share in 2025. The increasing demand for real-time data analysis and reduced latency at the data's origin fuels this segment, positioning Dell to capitalize on distributed workload adoption.

Cybersecurity Services & Solutions are a star for Dell, with the global market projected to grow by USD 107.1 billion between 2024 and 2028. This growth is driven by mobile device usage and AI integration, prompting Dell's investment in next-generation solutions like Data Security Posture Management.

| Product/Service Category | Dell's Position/Performance | Key Growth Drivers | 2024/2025 Data Points |

|---|---|---|---|

| AI-Optimized Servers | Star | Generative AI demand | Q1 FY25 Revenue: +42% YoY; AI Server Orders: $2.6B; AI Server Shipments: $1.7B |

| Dell APEX (As-a-Service) | Star | Shift to consumption-based IT | Projected 50% data center infrastructure as-a-service by 2024 |

| High-Performance Workstations | Star | AI, Data Science, Content Creation | #1 Market Share in Commercial AI PCs (IDC) |

| Edge Computing Solutions | Star | Real-time data analysis, reduced latency | Dell Global Server Market Share: 19.3% (2025) |

| Cybersecurity Services | Star | Mobile device usage, AI integration | Global Cybersecurity Market Growth: $107.1B (2024-2028) |

What is included in the product

Dell's BCG Matrix provides a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This analysis informs decisions on investment, divestment, and resource allocation for Dell's diverse product lines.

Provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Dell's Latitude and OptiPlex lines represent significant cash cows within their product portfolio. In the first quarter of fiscal year 2025, Dell's commercial client revenue reached $10.2 billion, marking a 3% increase compared to the previous year. This steady growth underscores the consistent demand and profitability of these mainstream commercial PCs.

Despite modest overall PC market expansion, Dell's robust market share in the commercial sector solidifies these offerings as dependable revenue engines. The upcoming Windows 11 upgrade cycle, anticipated to gain momentum in 2025, is poised to stimulate commercial PC replacements, thereby sustaining demand for Latitude and OptiPlex devices.

Dell's Standard Server Portfolio, primarily its PowerEdge line, represents a significant Cash Cow. This segment is a powerhouse, evidenced by Dell's servers and networking revenue hitting a record $5.5 billion in Q1 fiscal 2025, a substantial 42% increase year-over-year. This growth is fueled by robust demand in both AI and traditional server markets.

The company's dominance in the global server market, holding a commanding 19.3% share in 2025, underscores the maturity and consistent performance of its PowerEdge servers. These machines are foundational to numerous data centers, ensuring steady revenue streams and a stable market position.

Dell's enterprise storage solutions, like PowerStore and PowerMax, represent a significant part of its business. In Q1 fiscal 2025, Dell's storage revenue remained steady at $3.8 billion. Notably, demand for PowerStore and PowerFlex products saw impressive double-digit growth during this period.

The broader enterprise storage devices market is thriving, fueled by the expansion of cloud computing and the increasing importance of big data analytics. Dell EMC, a key player in this space, benefits from this trend by offering reliable core infrastructure solutions.

These enterprise storage offerings are considered cash cows because they generate consistent, high-margin revenue for Dell. Their stability comes from being essential components of modern IT infrastructure, supporting critical business operations.

IT Consulting and Managed Services

Dell's IT consulting and managed services represent a significant Cash Cow within its business portfolio. These services are characterized by recurring revenue streams derived from long-term contracts and strong customer loyalty in a well-established market. The demand for these services is bolstered by ongoing enterprise needs for digital transformation and, more recently, the integration of artificial intelligence solutions.

While Dell does not break out specific revenue for pure IT consulting, its strategic emphasis on supporting enterprise AI adoption and digital transformation initiatives clearly indicates a robust and growing services component. This focus taps into a mature market where clients consistently seek expertise and reliable support for complex IT infrastructures.

- Recurring Revenue: Long-term contracts for managed services provide predictable income.

- High Retention: Established relationships and essential support lead to low customer churn.

- Mature Market: Consistent demand for IT services in established businesses.

- AI Integration: Dell's focus on enterprise AI adoption drives demand for related consulting and support services.

Monitors and Peripherals

Monitors and peripherals are a key component of Dell's extensive technology offerings, serving both individual consumers and enterprise clients. While specific segment breakdowns for peripherals aren't always granularly detailed in Dell's latest financial statements, this product category generally represents a mature, high-volume market. Dell's strong brand presence and long-standing reputation in this space contribute to a stable demand, generating consistent cash flow for the company.

Dell's commitment to this sector is evident in its continuous innovation and broad product portfolio, which includes everything from essential office monitors to high-performance gaming displays and ergonomic accessories. This consistent demand, coupled with Dell's established market share, positions monitors and peripherals as a reliable Cash Cow within its broader business strategy.

- Market Stability: The demand for monitors and peripherals remains consistently high due to their essential role in computing for both work and leisure.

- Brand Loyalty: Dell's established brand recognition and reputation for quality in this segment foster customer loyalty, ensuring repeat purchases.

- Revenue Generation: These products contribute significant, predictable revenue streams, acting as a stable source of cash for Dell.

- Product Diversification: Dell offers a wide array of monitors and peripherals, catering to diverse customer needs and price points, thereby maximizing market penetration.

Dell's Latitude and OptiPlex lines are strong cash cows, consistently driving revenue. In Q1 FY25, commercial client revenue hit $10.2 billion, a 3% year-over-year increase, highlighting their stable performance. The upcoming Windows 11 upgrade cycle in 2025 is expected to further boost demand for these mainstream commercial PCs.

The PowerEdge server portfolio is another significant cash cow for Dell, demonstrating remarkable growth. Server and networking revenue reached a record $5.5 billion in Q1 FY25, up 42% year-over-year, fueled by AI and traditional server demand. Dell's 19.3% global server market share in 2025 solidifies PowerEdge's mature and consistent performance.

Dell's enterprise storage solutions, such as PowerStore and PowerFlex, are vital cash cows. Storage revenue remained steady at $3.8 billion in Q1 FY25, with PowerStore and PowerFlex experiencing double-digit growth. These offerings are essential for cloud computing and big data analytics, ensuring consistent revenue streams.

IT consulting and managed services are a key cash cow, generating recurring revenue through long-term contracts. While specific figures aren't isolated, Dell's focus on enterprise AI adoption and digital transformation indicates strong demand in this mature market, supporting consistent cash flow.

Monitors and peripherals represent a mature, high-volume market that acts as a reliable cash cow for Dell. Their strong brand presence and consistent demand, catering to both consumer and enterprise needs, contribute significantly to predictable revenue streams.

| Product Segment | Q1 FY25 Revenue | Year-over-Year Change | Key Performance Indicator | Cash Cow Rationale |

| Commercial Client (Latitude/OptiPlex) | $10.2 billion | +3% | Steady demand, upcoming OS upgrade cycle | Consistent revenue, stable market share |

| Servers & Networking (PowerEdge) | $5.5 billion | +42% | Record revenue, AI and traditional demand | Dominant market share, foundational infrastructure |

| Storage (PowerStore/PowerFlex) | $3.8 billion (Storage Revenue) | Double-digit growth (PowerStore/PowerFlex) | Cloud computing and big data analytics demand | Essential IT infrastructure, high-margin revenue |

| IT Consulting & Managed Services | Not Specifically Disclosed | N/A | Enterprise AI adoption, digital transformation | Recurring revenue, long-term contracts, customer loyalty |

| Monitors & Peripherals | Not Specifically Disclosed | N/A | High-volume market, strong brand loyalty | Predictable revenue streams, broad product portfolio |

What You See Is What You Get

Dell BCG Matrix

The Dell BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive strategic analysis ready for your immediate use. You're seeing the actual, professionally formatted report that will be yours to download and implement directly into your business planning. This ensures you get exactly what you expect: a ready-to-go tool for understanding Dell's product portfolio performance and making informed strategic decisions.

Dogs

Dell's legacy consumer desktops and laptops, representing the basic, non-premium segment, are currently positioned as Dogs in the BCG Matrix. This is largely due to the challenging consumer market where competitive pricing puts significant pressure on margins. In the first quarter of fiscal 2025, Dell's consumer revenue saw a notable decrease of 15% year-over-year, reaching $1.8 billion, which underscores the difficulties in this segment.

The overall PC market, particularly the commoditized consumer segment, experienced a decline in shipments in 2024, with Dell's shipments falling by 2.2%. This trend indicates low growth prospects and intense competition, further solidifying the Dog classification for these products as they require significant investment to maintain market share without substantial returns.

Outdated niche consumer accessories within Dell's portfolio likely fall into the Dogs category of the BCG Matrix. These items, such as older model webcams or specialized connectivity adapters, often have a low market share and minimal growth prospects because newer, more integrated technologies have emerged. For instance, sales of dedicated external CD drives for laptops have drastically declined as optical media became obsolete.

Products in this segment typically struggle to generate significant revenue, often breaking even or even incurring losses. This means they tie up capital in inventory and marketing without yielding substantial returns. In 2024, companies across the tech sector saw continued shifts away from peripheral accessories as integrated solutions became standard, further pressuring the market for these older niche items.

Older generation networking hardware, not designed for Software-Defined Networking (SDN) or optimized for Artificial Intelligence (AI) workloads, likely falls into the Dogs quadrant of the Dell BCG Matrix. This category represents products with low market share in a low-growth market.

While Dell's overall networking revenue is robust, largely fueled by AI-driven demand and traditional server upgrades, these legacy systems are being sidelined as businesses prioritize modern, flexible, and intelligent network solutions. Investment in these older, non-optimized hardware offerings would likely result in diminishing returns for Dell.

Specific, Unpopular Software Utilities

Within Dell's business portfolio, specific, unpopular software utilities often fall into the 'dog' category of the BCG Matrix. These are typically older, standalone applications that haven't seen significant development or market adoption compared to newer, integrated, or cloud-based solutions. For instance, a legacy diagnostic tool for an older Dell server model, with minimal current server installations and no active development roadmap, would likely exhibit low market share and low growth potential.

These utilities, while potentially functional for a niche user base, struggle to gain traction in a rapidly evolving IT landscape. Their limited market presence and lack of strategic investment mean they contribute little to Dell's overall revenue or market position. By 2024, the trend towards unified management platforms and Software-as-a-Service (SaaS) further marginalizes these older utilities, pushing them further into the 'dog' quadrant.

- Low Market Share: Many older utilities serve a shrinking installed base of legacy hardware.

- Low Growth Potential: Lack of investment and competition from modern alternatives stifle growth.

- Niche Functionality: Often designed for specific, outdated tasks, limiting broader appeal.

- Replacement by Modern Solutions: Cloud-based management and integrated software suites supersede these utilities.

Low-End Consumer Printers (if offered)

If Dell were still actively participating in the very basic, low-end consumer printer market, this segment would be characterized by fierce competition and a high degree of commoditization. This scenario typically results in low market share and very little growth potential.

Such a market position often transforms these product lines into cash traps, where the resources invested to maintain them yield minimal returns. For example, in 2024, the global printer market, particularly for entry-level inkjet models, saw significant price erosion due to oversupply and intense competition from brands like HP, Canon, and Epson.

- Intense Competition: The low-end consumer printer market is saturated with numerous brands, leading to aggressive pricing strategies.

- Commoditization: Product differentiation is minimal, with features becoming standard across many offerings, further driving down prices.

- Low Growth: The overall market for basic printers has seen stagnant or declining growth as consumers increasingly opt for multifunction devices or forgo home printing.

- Cash Trap Potential: Maintaining profitability in this segment requires high sales volume, which is difficult to achieve with low margins and high marketing costs.

Dell's legacy consumer desktops and laptops, along with outdated niche accessories and older networking hardware, are firmly positioned as Dogs in the BCG Matrix. These products, characterized by low market share and minimal growth prospects, struggle in a competitive landscape where newer technologies and integrated solutions dominate. For instance, Dell's consumer revenue declined 15% in Q1 fiscal 2025, and PC shipments saw a 2.2% drop in 2024, highlighting the challenges in these segments.

These 'Dog' products often become cash traps, requiring investment to maintain market presence without generating substantial returns. The trend towards cloud-based solutions and integrated software further marginalizes older utilities and hardware, making them less relevant. Companies like Dell must strategically manage these offerings, often by divesting or minimizing investment to focus on more promising business units.

Question Marks

Dell is making strides in next-generation quantum computing, particularly with hybrid quantum-classical approaches. This positions them to tap into a market projected for substantial growth, with some forecasts suggesting it could reach hundreds of billions of dollars by the early 2030s.

Currently, Dell's market share in quantum computing is minimal, reflecting its status as a nascent technology. Significant investment in research and development is a key characteristic of this phase, requiring substantial capital outlay before broad commercialization.

Dell's pure-play advanced AI software platforms, while operating in a high-growth market, likely represent a question mark in their BCG matrix. Despite Dell's strong position in AI-optimized hardware, their software offerings in this specialized area face stiff competition from established, focused software vendors, resulting in a currently low market share.

The company's strategic emphasis on enabling generative AI use cases within enterprises signals a commitment to bolstering its software capabilities. This focus suggests Dell views these platforms as crucial for future growth, even if their current market penetration is limited.

Dell's exploration into emerging XR/Metaverse hardware, such as advanced VR headsets or haptic feedback suits, would fall into the question mark category. These nascent markets, while offering substantial future growth potential, currently represent a small fraction of Dell's overall revenue and market share.

Significant investment in research, development, and manufacturing is crucial for Dell to establish a foothold and drive consumer adoption in these rapidly evolving XR and Metaverse hardware spaces. For instance, the global XR market was valued at approximately $20.5 billion in 2023 and is projected to grow significantly, indicating the high-growth, low-market-share dynamic.

Specialized IoT Devices for Niche Industrial Applications

Dell's strategic push into edge computing positions it to potentially offer specialized IoT devices for niche industrial applications. These devices, while targeting high-growth sectors, likely represent a smaller portion of Dell's current market share. This suggests they might be classified as Question Marks in the BCG matrix, requiring significant investment to gain traction.

For instance, consider IoT sensors designed for highly specific environmental monitoring in advanced manufacturing or specialized agricultural settings. These markets, though growing rapidly, are often fragmented and require tailored solutions. Dell's involvement here would necessitate substantial marketing and sales efforts to drive adoption and move these products towards becoming market leaders.

- High-Growth, Low-Share Potential: Specialized IoT devices for niche industrial uses often operate in rapidly expanding markets but currently hold a small market share for individual product lines.

- Investment Requirement: To transition these products from Question Marks to Stars, Dell would need to allocate considerable resources for research, development, marketing, and sales support.

- Market Penetration Challenge: Overcoming the inherent fragmentation and specific needs of niche industrial sectors presents a significant hurdle for broad market adoption.

- Example Scenario: Imagine IoT solutions for predictive maintenance in specialized heavy machinery, a market projected to grow significantly but requiring deep industry expertise and tailored product development.

Sustainable/Circular Economy IT Solutions (New Offerings)

Dell's commitment to sustainability is a key driver for its new IT solutions. The company has ambitious goals, aiming for 100% recycled or renewable content in its products by 2030. This focus positions them to capitalize on the growing demand for environmentally conscious technology.

New offerings like the Environmental Impact Report for asset recovery are designed to meet this demand. This service allows businesses to track the environmental benefits of responsibly disposing of their old IT equipment. While this area shows significant growth potential, these specific new services are still establishing their market presence.

- Environmental Impact Reporting: Dell's new service quantifies the positive environmental outcomes of IT asset recovery, appealing to businesses focused on ESG metrics.

- Circular Economy Integration: The company is actively working to integrate circular economy principles into its product lifecycle, from design to end-of-life management.

- Market Growth Potential: The global market for IT asset disposition and refurbishment is projected to grow substantially, with sustainability being a major influencing factor. For example, the IT asset disposition market was valued at approximately $18.1 billion in 2023 and is expected to reach $34.2 billion by 2030, growing at a CAGR of 9.5%.

- Investment Focus: These nascent sustainable IT solutions represent 'question marks' within Dell's portfolio, requiring strategic investment to build market share and achieve wider adoption.

Dell's foray into specialized AI software platforms, particularly those enabling generative AI use cases, currently fits the question mark profile. While the hardware side of AI is strong, these software offerings face intense competition from established players, resulting in a low market share despite the high-growth nature of the AI software market.

These initiatives require substantial investment to gain traction and build market share. The company's strategic focus on these areas indicates a belief in their future potential, even if current market penetration is limited.

Dell's emerging XR/Metaverse hardware ventures also fall into the question mark category. These are nascent markets with significant future growth potential, but they currently represent a small portion of Dell's overall revenue, necessitating considerable investment to drive adoption.

The global XR market was valued at approximately $20.5 billion in 2023 and is expected to see substantial growth, highlighting the high-growth, low-market-share dynamic characteristic of question mark products.

| Product/Service Area | Market Growth | Current Market Share | BCG Category | Strategic Implication |

| Specialized AI Software Platforms | High | Low | Question Mark | Requires significant R&D and marketing investment to gain share. |

| Emerging XR/Metaverse Hardware | High | Low | Question Mark | Needs substantial capital for development and consumer adoption. |

| Niche Industrial IoT Devices | High | Low | Question Mark | Demands tailored solutions and focused sales efforts for market penetration. |

| Sustainable IT Solutions (e.g., Impact Reporting) | High | Low | Question Mark | Investment needed to build market presence and capitalize on ESG demand. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.