Dell Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Bundle

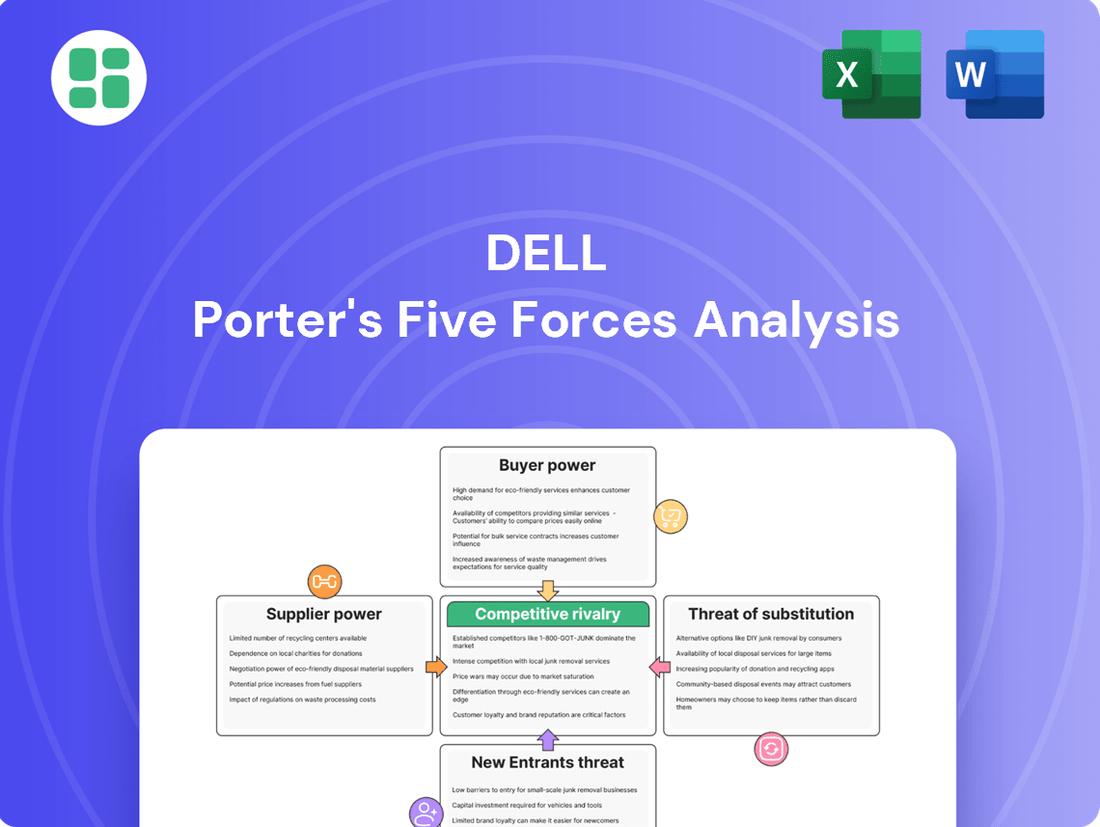

Understanding Dell's competitive landscape through Porter's Five Forces reveals the intense pressures shaping its market. From the bargaining power of buyers to the threat of new entrants, each force significantly impacts Dell's strategic decisions and profitability. This brief overview only scratches the surface of these critical dynamics.

Unlock the full Porter's Five Forces Analysis to explore Dell’s competitive dynamics, market pressures, and strategic advantages in detail, giving you a comprehensive view of its industry positioning.

Suppliers Bargaining Power

The concentration of key component suppliers, such as Intel and AMD for CPUs, and Microsoft for operating systems, significantly bolsters their bargaining power over Dell. When only a few dominant players control essential inputs, they can dictate terms, impacting Dell's cost structure and product development.

This limited supplier base means Dell has fewer alternatives, potentially leading to higher component prices and less favorable supply agreements. For instance, in 2024, the ongoing global chip shortages continued to highlight the leverage held by semiconductor manufacturers, directly affecting PC makers like Dell.

Switching costs for Dell relate to the expenses and disruptions incurred when changing from one major supplier to another. These can include costs associated with finding new suppliers, negotiating contracts, retooling manufacturing processes, and potential delays in production. For instance, if Dell has heavily invested in specialized components or integrated systems from a particular supplier, the effort and expense to transition to a new vendor can be substantial.

High switching costs empower Dell's current suppliers by making it more difficult and costly for Dell to seek alternative sources. This situation can lead suppliers to maintain or even increase prices, as they are aware of the significant hurdles Dell would face in switching away. In 2024, the global semiconductor shortage, for example, significantly increased switching costs for many electronics manufacturers, including Dell, as finding alternative, readily available chip suppliers became exceptionally challenging and expensive.

The bargaining power of suppliers is significantly amplified when their inputs are unique and indispensable to a company like Dell. For instance, specialized components like advanced AI-accelerated processors or proprietary operating system software are not readily available from multiple sources. In 2024, the demand for cutting-edge semiconductors, particularly those enabling AI capabilities, remained extremely high, with companies like Intel and AMD playing a crucial role in supplying these vital parts to PC manufacturers.

When Dell relies heavily on a limited number of suppliers for these critical, hard-to-replicate components, those suppliers gain considerable leverage. This indispensability allows them to potentially dictate pricing, delivery schedules, and even product specifications, directly impacting Dell's cost structure and product development timelines. The ongoing global chip shortage, which persisted into early 2024, underscored this dynamic, giving semiconductor manufacturers significant power over their customers.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to Dell. If key component manufacturers, like those producing advanced processors or specialized memory chips, were to enter the computer or IT services market themselves, they could directly compete with Dell. This potential scenario grants these suppliers greater leverage in price and supply negotiations, as Dell would naturally seek to avoid direct competition from its own upstream partners.

Consider the semiconductor industry, a critical supplier to Dell. Major chip manufacturers have historically focused on design and manufacturing, but the possibility of them offering integrated solutions or even complete computing devices cannot be entirely dismissed. For instance, if a leading chip producer were to launch its own line of pre-built workstations or cloud services leveraging its proprietary technology, it would directly challenge Dell's market position. This strategic move would transform a supplier relationship into a competitive one, significantly altering the bargaining power dynamic.

- Potential for Direct Competition: Suppliers entering Dell's core markets (PCs, IT services) creates direct rivalry.

- Increased Supplier Leverage: Dell's desire to avoid this competition strengthens supplier negotiation power on price and terms.

- Industry Examples: While not a direct Dell competitor, companies like TSMC have explored broader ecosystem plays, hinting at potential shifts in supplier strategies.

- Strategic Implications: Dell must carefully manage supplier relationships to mitigate the risk of its partners becoming its competitors.

Volume of Dell's Purchases and Supplier Dependence

Dell's substantial purchasing volume typically grants it considerable leverage with suppliers, as its orders represent a significant portion of their revenue. This is particularly true for components where Dell is a major client, potentially making suppliers reliant on its business. For instance, in 2023, Dell Technologies reported revenue of $88.4 billion, indicating the scale of its procurement activities across various supply chains.

However, the bargaining power dynamic is nuanced. If a particular component is highly specialized or sourced from a limited number of providers, suppliers may still hold significant sway, even with Dell's large order volumes. This is especially relevant in the fast-evolving tech sector where proprietary technologies or unique manufacturing processes can create supplier dependence on Dell, rather than the other way around.

- Dell's large purchase volumes can translate into significant bargaining power, as seen in its $88.4 billion revenue in 2023, implying substantial component orders.

- Supplier dependence on Dell's business can reduce their bargaining power, making them more amenable to favorable terms.

- Conversely, if suppliers offer unique or highly specialized components with few alternatives, their bargaining power can increase, even with large buyers like Dell.

- The specific nature of the components and the competitive landscape among suppliers ultimately determine the balance of power in Dell's procurement relationships.

The bargaining power of suppliers to Dell is influenced by several factors, including concentration, switching costs, and the threat of forward integration. When key suppliers, like Intel for CPUs or Microsoft for operating systems, are few and dominant, they can dictate terms, impacting Dell's costs and product timelines. For example, the persistent global chip shortages in 2024 highlighted the significant leverage held by semiconductor manufacturers.

| Factor | Impact on Dell | 2024 Relevance |

| Supplier Concentration | High concentration of key component suppliers (e.g., Intel, AMD) grants them significant pricing power. | Continued reliance on a limited number of chip manufacturers due to ongoing shortages. |

| Switching Costs | High costs for Dell to change suppliers, due to integration, retooling, and negotiation. | Increased difficulty and expense in finding alternative suppliers for critical components in 2024. |

| Indispensability of Input | Suppliers of unique or highly specialized components (e.g., AI-accelerated processors) have greater leverage. | High demand for cutting-edge semiconductors for AI, strengthening suppliers' positions. |

| Threat of Forward Integration | Potential for suppliers to enter Dell's markets, creating direct competition and increasing supplier leverage. | While not a direct threat from major chipmakers currently, ecosystem plays by companies like TSMC suggest potential future shifts. |

What is included in the product

This analysis unpacks the competitive intensity within Dell's market, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

A dynamic dashboard that visualizes the impact of each force, allowing you to pinpoint and address competitive threats before they escalate.

Customers Bargaining Power

Customer price sensitivity varies significantly across Dell's market segments. Individual consumers, often purchasing for personal use, tend to be highly sensitive to price, seeking the best value for their budget. This segment is more likely to compare prices across different brands and models before making a purchase.

Small businesses, while still mindful of cost, may balance price with factors like reliability and basic support. They might be less inclined to haggle intensely on price if a slightly higher cost ensures better uptime and fewer disruptions to their operations.

Large enterprise customers, however, often exhibit lower price sensitivity. Their purchasing decisions are frequently driven by total cost of ownership, including service, customization, integration, and long-term support contracts. For instance, a large enterprise might invest in a premium support package that significantly reduces downtime, outweighing a marginal price difference on the hardware itself. In 2024, while consumer PC prices saw some fluctuations, enterprise-level deals often included bundled services and extended warranties, making direct price comparisons less straightforward.

The bargaining power of customers in the PC market is significantly influenced by the sheer availability of alternative products and brands. Dell faces stiff competition from established players like HP, Lenovo, and Apple, alongside a growing market for custom-built PCs. This abundance of choice directly empowers customers, allowing them to readily compare specifications, pricing, and support services.

In 2024, the global PC market shipment volume was estimated to be around 250 million units, according to various industry reports. This vast market size, coupled with the diverse offerings from numerous manufacturers, means customers can easily switch if Dell's pricing or feature set doesn't meet their expectations. For instance, a business looking for bulk laptop purchases can solicit quotes from multiple vendors, leveraging competitive bids to secure better terms.

For many of Dell's standard hardware products, customers face minimal costs and effort when considering a switch to a competitor. This ease of transition significantly amplifies their bargaining power.

In 2024, the competitive landscape for PCs and laptops, a core Dell segment, saw intense price wars. For instance, average selling prices for laptops in the consumer segment experienced a notable decline year-over-year, making it even more appealing for buyers to explore alternatives based on price alone, further empowering them.

Customer Volume and Purchase Frequency

The bargaining power of customers is significantly amplified when they purchase in large volumes and with high frequency, as is often the case with major enterprise clients. These customers wield considerable leverage, enabling them to negotiate for customized product configurations, preferential pricing structures, and more accommodating service level agreements. For instance, in 2024, large corporations often account for a substantial portion of a technology vendor's revenue, making their demands difficult to ignore.

High-volume purchasers can effectively dictate terms due to the sheer scale of their business. This can manifest as demands for tailored software solutions or hardware modifications to meet specific operational needs. Furthermore, their consistent order flow provides them with a strong negotiating position to secure discounts and favorable payment terms, directly impacting a company's profit margins.

- Customer Volume: Large enterprises represent a significant percentage of total sales for many B2B companies.

- Purchase Frequency: Regular, ongoing orders from key clients reduce the seller's ability to switch customers.

- Negotiating Leverage: High-volume buyers can demand price concessions and customized product features.

- Impact on Profitability: Favorable terms negotiated by large customers can directly affect a company's bottom line.

Information Availability for Customers

Customers today have unprecedented access to information, significantly boosting their bargaining power. This readily available data on product specifications, pricing across various retailers, and detailed user reviews empowers them to make highly informed purchasing decisions.

This transparency directly pressures Dell, as customers can easily compare Dell's offerings against competitors. They can identify the best value and use this knowledge to negotiate better prices or demand more favorable terms, effectively increasing their leverage.

- Informed Decision-Making: Consumers can access detailed product specs, competitive pricing, and extensive user reviews online, enabling them to make well-researched choices.

- Price Transparency: Websites and comparison tools allow customers to see pricing from multiple vendors instantly, making it harder for any single company to maintain inflated prices. For instance, in 2024, online price comparison platforms were used by an estimated 70% of online shoppers in developed markets.

- Negotiation Leverage: Armed with market data, customers can confidently negotiate with Dell, demanding better deals or seeking out competitors who offer superior value propositions.

Dell's customers, particularly those in the consumer segment, possess significant bargaining power due to high price sensitivity and the readily available alternatives in the competitive PC market. This power is amplified by the ease with which customers can switch between brands, especially with minimal switching costs for standard hardware. In 2024, the PC market saw intense price competition, with average selling prices for laptops declining year-over-year, further empowering price-conscious buyers to seek the best deals.

Large enterprise customers, however, leverage their substantial purchase volumes and frequency to negotiate favorable terms, including customized configurations and preferential pricing. These high-volume buyers can influence Dell's profitability through their demands. For example, in 2024, major corporations often represented a substantial portion of tech vendors' revenue, making their negotiation leverage considerable.

The widespread availability of information and price transparency further bolsters customer bargaining power. In 2024, an estimated 70% of online shoppers in developed markets utilized price comparison platforms, enabling them to easily identify the best value and negotiate effectively with vendors like Dell.

| Customer Segment | Price Sensitivity | Bargaining Power Factors | 2024 Market Trend Impact |

|---|---|---|---|

| Individual Consumers | High | Price comparison, ease of switching, abundant alternatives | Declining average selling prices, increased focus on value |

| Small Businesses | Moderate | Balance of price, reliability, and basic support | Focus on total cost of ownership, but still price-conscious |

| Large Enterprises | Lower (on unit price) | High volume, frequent purchases, negotiation leverage, customization needs | Significant influence on vendor terms and pricing structures |

Full Version Awaits

Dell Porter's Five Forces Analysis

This preview shows the exact Dell Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive document delves into the competitive landscape of Dell, meticulously detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You'll gain actionable insights into the strategic factors shaping Dell's market position and future opportunities.

Rivalry Among Competitors

Dell faces intense competition from numerous strong players across its product lines. Major rivals like HP, Lenovo, and Apple vie for market share in the PC and laptop segments, each boasting significant brand recognition and diverse product portfolios. The technology market is characterized by rapid innovation, making it difficult for any single company to maintain a dominant position.

The presence of several well-established competitors, including Acer and a growing number of custom-built solutions providers, further intensifies this rivalry. For instance, in 2024, the global PC market saw shipments from major vendors like Lenovo and HP consistently challenging Dell's position, with these companies often trading places in terms of unit sales and market penetration.

The PC and enterprise IT hardware market is experiencing a period of mature growth, with many analysts projecting single-digit annual growth rates through 2024. This slow expansion, often bordering on saturation in developed markets, intensifies competitive rivalry. Companies must aggressively vie for existing customers as opportunities for significant new market penetration diminish.

Dell faces intense competition, particularly in the PC market, where product differentiation is often incremental rather than revolutionary. While Dell offers a range of customizable options and has a strong reputation for business-grade solutions, many competitors like HP and Lenovo also provide similar levels of customization and enterprise support. The pace of innovation is rapid, with new processors, display technologies, and form factors emerging frequently, making it a constant challenge to maintain a distinct edge.

In 2024, the PC industry continues to see a fierce battle for market share, with Dell consistently ranking among the top vendors. For instance, IDC reported Dell holding a significant percentage of the global PC market share in Q1 2024, highlighting its strong presence but also the crowded competitive landscape. The ability to integrate AI capabilities into its hardware and software offerings is emerging as a key differentiator, with companies like Microsoft and Intel pushing this agenda, forcing Dell to innovate rapidly to keep pace and offer unique AI-enhanced solutions.

High Fixed Costs and Exit Barriers

The technology sector, particularly for hardware manufacturers like Dell, is characterized by substantial fixed costs. These include significant investments in manufacturing facilities, ongoing research and development (R&D) to stay competitive, and the complex logistics of a global distribution network. For instance, building and maintaining advanced semiconductor fabrication plants can cost billions of dollars.

These high fixed costs, combined with specialized assets and established brand equity, create formidable exit barriers. Companies may find it more financially viable to continue operating and competing, even at reduced profitability, rather than incurring substantial losses from shutting down operations or selling off specialized assets at a significant discount. This can lead to prolonged periods of intense competition as firms strive to spread their fixed costs over a larger sales volume.

- High Capital Expenditure: Establishing state-of-the-art manufacturing facilities for electronics often requires upfront investments in the tens of billions of dollars.

- R&D Intensity: Companies like Dell invest heavily in R&D to innovate and maintain a competitive edge. In 2023, the global IT R&D spending was projected to exceed $2.5 trillion.

- Brand and Specialized Assets: A strong brand reputation and proprietary technology or specialized equipment act as additional barriers, making it difficult for new entrants to compete and costly for existing players to exit.

Aggressive Pricing and Marketing Strategies

Aggressive pricing and marketing strategies are a hallmark of the competitive landscape, often leading to price wars that erode profitability for all involved. For instance, in the highly competitive PC market, major players like HP, Lenovo, and Acer frequently engage in promotional sales and deep discounts to capture market share. This intense rivalry means that even a company like Dell, known for its direct-to-consumer model, faces constant pressure to match competitor pricing, impacting its gross margins.

This dynamic is particularly evident when new product cycles are introduced or during key sales periods. Companies might offer bundles, extended warranties, or significant price reductions to entice buyers. In 2024, the consumer electronics sector saw continued aggressive promotions, with retailers and manufacturers alike using price as a primary lever to drive sales volume amid economic uncertainties.

- Price Wars: Competitors frequently engage in price reductions to gain market share, directly impacting profit margins.

- Marketing Campaigns: High spending on advertising and promotional activities is common to differentiate products and attract customers.

- Margin Erosion: The constant pressure to compete on price can lead to lower profitability for all players in the industry.

- Market Share Focus: Companies often prioritize increasing their share of the market, even at the expense of short-term profits.

Competitive rivalry is a significant force for Dell, with numerous strong competitors like HP, Lenovo, and Apple actively vying for market share in the PC and enterprise IT hardware sectors. The rapid pace of technological innovation in the industry means that maintaining a distinct competitive edge is a continuous challenge for all players.

In 2024, the global PC market shipments data consistently shows Dell among the top vendors, but often trading positions with rivals like Lenovo and HP, underscoring the intense competition. This rivalry is further fueled by mature market growth, with many analysts projecting only single-digit annual growth rates, pushing companies to aggressively compete for existing customers.

The battle for market share is often characterized by aggressive pricing and marketing strategies, leading to price wars that can erode profitability. For instance, major players frequently engage in promotional sales and deep discounts, forcing Dell to match competitor pricing, which directly impacts gross margins.

| Competitor | 2024 Market Share (Est.) | Key Strengths |

| HP | ~22% | Strong brand, diverse product portfolio, enterprise solutions |

| Lenovo | ~23% | Global reach, strong presence in emerging markets, innovation |

| Apple | ~9% | Premium brand, ecosystem integration, customer loyalty |

| Dell | ~17% | Direct sales model, customization, business-grade solutions |

SSubstitutes Threaten

The rise of cloud computing and virtualization presents a significant threat of substitutes for Dell's traditional hardware offerings. Services like Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) allow businesses to access computing resources and software without owning or managing physical servers. This shift directly impacts Dell's enterprise hardware sales, as companies can opt for scalable, pay-as-you-go cloud solutions instead of investing in on-premise infrastructure.

For instance, global spending on public cloud services was projected to reach over $600 billion in 2024, indicating a strong market preference for these alternatives. Virtualization technologies further enhance this by allowing multiple operating systems and applications to run on a single physical server, maximizing hardware utilization and reducing the overall need for physical machines. This trend effectively substitutes Dell's core product lines, particularly in the server and storage segments, by offering a more flexible and often cost-effective operational model.

The increasing capability of mobile devices like smartphones and tablets presents a significant threat of substitution for traditional PCs, particularly for everyday tasks. Many consumers and small businesses are finding that these portable devices suffice for web browsing, email, social media, and media consumption, reducing the need for a dedicated desktop or laptop computer. This shift directly impacts Dell's consumer and small business PC sales, as a portion of their potential customer base opts for mobile-first solutions.

The increasing prevalence of as-a-Service (aaS) and subscription-based software models presents a significant threat of substitution for Dell's traditional hardware sales. Customers can now access computing power, software functionalities, and even hardware components through flexible, pay-as-you-go arrangements, bypassing the need for large upfront capital expenditures on physical products. This shift directly challenges Dell's established business model by offering compelling alternatives that reduce the perceived value of outright ownership.

Open-Source Software and Hardware Alternatives

The rise of open-source software and hardware presents a significant threat of substitutes for Dell. These alternatives often offer substantial cost savings compared to proprietary solutions, directly impacting Dell's integrated offerings.

For instance, in the server market, companies can build robust infrastructure using open-source operating systems like Linux and affordable hardware components, bypassing the need for Dell's pre-configured, often premium-priced systems. This trend is particularly pronounced in cloud computing and data analytics sectors where flexibility and cost-efficiency are paramount. By mid-2024, the global open-source software market was projected to reach over $135 billion, demonstrating its growing influence.

- Cost Advantage: Open-source solutions eliminate licensing fees, drastically reducing the total cost of ownership for businesses.

- Flexibility and Customization: Users can modify open-source code to fit specific needs, offering greater adaptability than closed systems.

- Growing Ecosystem: A vast community supports many open-source projects, providing extensive documentation, forums, and readily available talent.

- Hardware Commoditization: The availability of high-performance, off-the-shelf hardware components allows for the assembly of systems that can rival or outperform integrated solutions at a lower price point.

Refurbished and Used Equipment Market

The market for refurbished and used IT equipment presents a significant threat of substitutes for Dell. These pre-owned or reconditioned products offer a considerably lower price point, directly appealing to budget-conscious customers who might otherwise consider new Dell systems. For instance, the global market for refurbished electronics was projected to reach over $111 billion in 2023 and is expected to continue growing, indicating a substantial customer base seeking value over brand-new status.

This availability of lower-cost alternatives can siphon off customers, particularly those with less demanding IT requirements or who are purchasing standard hardware configurations. Businesses looking to equip large numbers of employees with basic workstations, for example, might find refurbished laptops or desktops a far more economical choice than purchasing new models from Dell. This segment directly competes for price-sensitive buyers, impacting Dell's market share in those specific customer segments.

- Lower Price Points: Refurbished IT equipment is consistently priced below new products, making it an attractive option for cost-sensitive buyers.

- Growing Market Size: The global refurbished electronics market is expanding, demonstrating increasing consumer and business acceptance of pre-owned technology.

- Targeting Standard Needs: Customers requiring basic functionality for general office tasks or less intensive computing are prime candidates for these substitute offerings.

- Impact on Volume Sales: The threat is most pronounced in Dell's high-volume, lower-margin product categories where price is a dominant purchasing factor.

The proliferation of powerful mobile devices, such as smartphones and tablets, directly substitutes for traditional personal computers for many everyday tasks. Users increasingly rely on these portable gadgets for web browsing, email, and media consumption, diminishing the need for dedicated laptops or desktops, thereby impacting Dell's consumer and small business PC sales.

The growing adoption of Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) models presents a substantial threat to Dell's hardware sales. These cloud-based solutions allow businesses to access computing resources and software on a pay-as-you-go basis, bypassing the need for significant on-premise hardware investments. Global public cloud spending was expected to exceed $600 billion in 2024, highlighting a strong market shift towards these alternatives.

Open-source software and hardware offer a cost-effective substitute for Dell's integrated solutions. Businesses can leverage Linux operating systems and readily available hardware components to build robust IT infrastructure at a lower total cost of ownership. The global open-source software market was projected to surpass $135 billion by mid-2024, underscoring its significant market penetration.

| Substitute Category | Key Characteristics | Impact on Dell | Market Data (2024 Projections) |

| Cloud Services (IaaS, PaaS, SaaS) | Scalable, pay-as-you-go, reduced CapEx | Reduces demand for on-premise servers and storage | Public Cloud Spending: >$600 billion |

| Mobile Devices (Smartphones/Tablets) | Portability, sufficient for basic tasks | Decreases PC sales for consumers and SMBs | Global Smartphone Market: ~1.2 billion units |

| Open Source Solutions | Cost savings, customization, flexibility | Competes with proprietary hardware/software bundles | Open Source Software Market: >$135 billion |

| Refurbished/Used IT Equipment | Lower price point, value-oriented | Siphons off price-sensitive customers | Refurbished Electronics Market: >$111 billion (2023) |

Entrants Threaten

The technology hardware industry, where Dell operates, presents a formidable threat of new entrants due to the sheer volume of capital required. Establishing advanced manufacturing facilities, intricate global supply chains, and robust research and development capabilities demands billions of dollars. For instance, setting up a cutting-edge semiconductor fabrication plant alone can cost tens of billions, a prohibitive sum for most startups.

Furthermore, the ability to achieve economies of scale acts as a significant deterrent. Established players like Dell can leverage their massive production volumes to drive down per-unit costs, offering more competitive pricing than a new entrant could initially match. In 2024, major PC manufacturers continued to benefit from these scale advantages, with companies like Lenovo and HP reporting billions in revenue, underscoring the cost efficiencies that new, smaller competitors struggle to replicate.

Dell's deep-rooted brand loyalty, cultivated over decades through consistent reliability and exceptional customer service, acts as a significant barrier for newcomers. For instance, in 2024, Dell continued to hold a strong position in the PC market, with a significant portion of its customer base demonstrating repeat purchase behavior, a testament to this established trust. New entrants face the arduous task of not only matching Dell's product quality but also replicating the deep customer confidence it has built.

The complexity of Dell's distribution channels and its established global reach act as a formidable barrier to entry for new competitors. Building an equally extensive network of sales, service, and logistics infrastructure worldwide requires massive capital investment and years of operational refinement. For instance, Dell's direct-to-consumer model, while evolving, still relies on sophisticated supply chain management and customer service operations that are incredibly difficult for newcomers to replicate efficiently.

Proprietary Technology and Patents

Dell's significant investment in proprietary technology and its extensive patent portfolio act as a formidable barrier to entry. New competitors would struggle to replicate Dell's advanced manufacturing processes and product designs, which are protected by numerous patents. For instance, in 2024, the global semiconductor industry saw continued high R&D spending, with major players investing billions to maintain their technological edge, a trend that underscores the cost and complexity for newcomers to match established innovators.

Navigating Dell's existing patent landscape presents another substantial hurdle. Potential entrants must conduct thorough patent searches and potentially license existing technologies, adding significant upfront costs and legal complexities. The sheer volume of patents held by established tech giants like Dell means that even seemingly novel ideas could infringe on existing intellectual property, deterring many from entering the market.

- Proprietary Technology: Dell's advanced engineering and manufacturing capabilities, developed over decades, are difficult and costly for new entrants to replicate.

- Patent Portfolio: A vast number of patents protect Dell's innovations, creating significant legal and developmental challenges for new competitors seeking to enter the market.

- R&D Investment: High R&D expenditures by established firms, such as the billions invested annually in the semiconductor sector in 2024, signal the immense capital required to achieve comparable technological parity.

- Licensing Costs: Potential new entrants may face substantial costs and legal hurdles if they need to license existing patented technologies to avoid infringement.

Regulatory Requirements and Compliance Costs

The global technology market is heavily regulated, with stringent industry standards and certifications acting as significant barriers. For instance, compliance with data privacy laws like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) requires substantial investment in infrastructure and legal expertise, estimated to cost businesses millions annually to maintain.

Meeting these complex regulatory requirements and bearing the associated compliance costs can be a major deterrent for potential new entrants in the tech sector. These costs can include obtaining certifications, undergoing audits, and implementing robust security measures, all of which demand considerable upfront capital and ongoing operational expenditure.

- Data Privacy Compliance: Companies must invest in secure data handling and storage solutions to comply with regulations like GDPR, which can involve significant IT infrastructure upgrades.

- Industry Certifications: Obtaining certifications such as ISO 27001 for information security management requires rigorous processes and ongoing adherence, adding to operational costs.

- Product Safety and Standards: For hardware manufacturers, adhering to safety standards like UL or CE marking involves testing and certification fees, increasing the cost of bringing products to market.

- Intellectual Property Protection: Navigating and protecting intellectual property rights globally involves legal fees and patent registration costs, which can be substantial for new technology firms.

The threat of new entrants in the technology hardware sector remains moderate, primarily due to the substantial capital investment required for manufacturing and R&D. Established players benefit from significant economies of scale, which new entrants struggle to match. Brand loyalty and complex distribution networks further solidify the positions of incumbents like Dell.

Intellectual property and regulatory compliance also act as significant barriers. Dell's extensive patent portfolio and the high costs associated with navigating global regulations, including data privacy laws, deter many potential new competitors. These factors collectively create a challenging environment for newcomers aiming to gain market share.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for advanced manufacturing, R&D, and supply chains. | Prohibitive for many startups; e.g., semiconductor plant costs in tens of billions. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | New entrants face higher initial costs and less competitive pricing. |

| Brand Loyalty & Customer Trust | Established reputation for reliability and service. | Difficult for new entrants to build comparable customer confidence. |

| Distribution Channels | Extensive global sales, service, and logistics networks. | Requires massive investment and years of operational refinement to replicate. |

| Proprietary Technology & Patents | Protected innovations and extensive patent portfolios. | Creates legal and developmental challenges, potential licensing costs. |

| Regulatory Compliance | Adherence to industry standards, data privacy laws (e.g., GDPR). | Adds significant upfront and ongoing operational costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dell leverages data from company annual reports, investor presentations, and industry-specific market research from firms like Gartner and IDC. We also incorporate financial data from sources such as Bloomberg and S&P Capital IQ to assess competitive intensity and market dynamics.