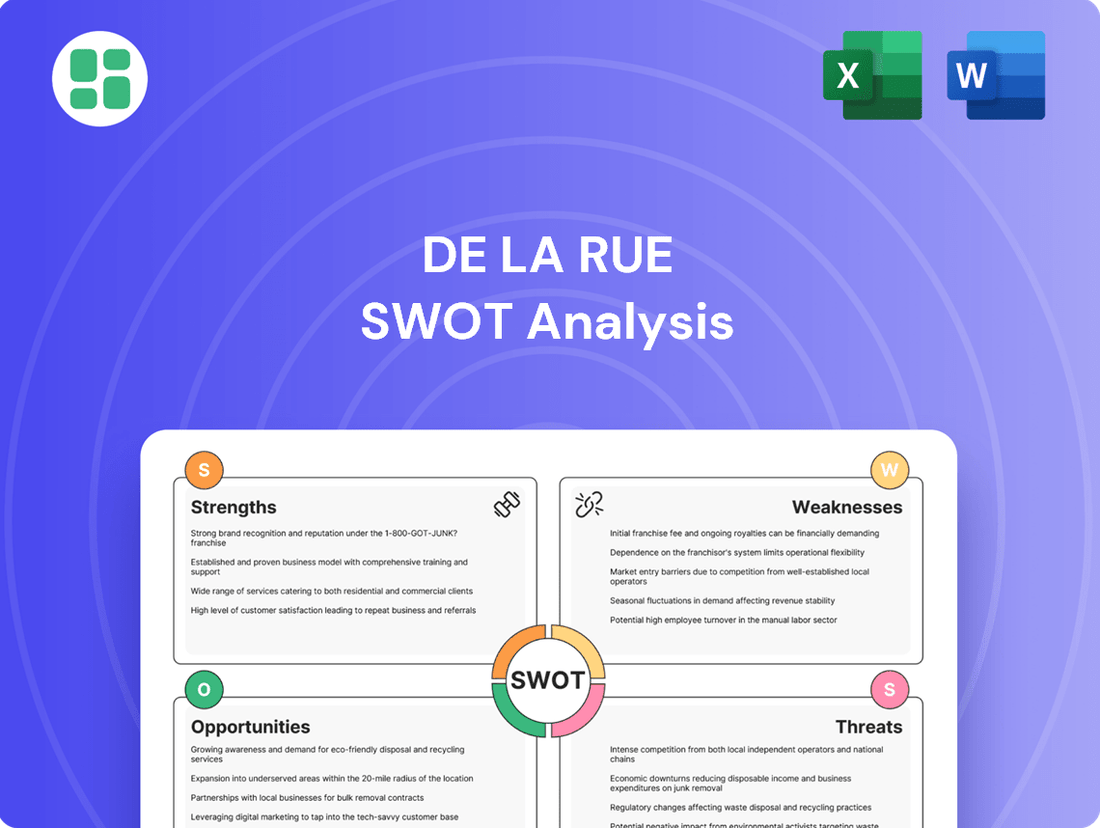

De La Rue SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

De La Rue Bundle

De La Rue, a leader in security printing, faces a dynamic market. While its established reputation and advanced technology are significant strengths, understanding the full scope of its competitive landscape and potential threats is crucial for informed decision-making.

Want the full story behind De La Rue's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

De La Rue's market leadership in currency solutions is a significant strength, with the company serving an impressive half of all central banks and issuing authorities globally. This extensive reach highlights its established reputation and deep integration within the international financial infrastructure.

The company's unique position as the sole fully integrated supplier for both traditional paper and advanced polymer banknotes provides a distinct competitive edge. This comprehensive offering, coupled with a consistently high win rate in banknote tenders, solidifies its market dominance and customer trust.

De La Rue's advanced polymer banknote technology, specifically its SAFEGUARD® substrate, stands out as a significant strength. This innovation provides enhanced durability and environmental advantages over traditional paper currency, making it an attractive option for central banks worldwide.

The company's polymer production saw a notable increase in the first half of fiscal year 2025. Furthermore, De La Rue's order book demonstrates a strong pipeline of polymer-based contracts, with significant manufacturing commitments extending into fiscal year 2026 and beyond, underscoring the market's demand for this technology.

De La Rue's Authentication division is a significant strength, showcasing robust performance with revenue growth of 12.5% in FY24, surpassing its £100 million target. This segment's success is underpinned by securing multi-year contract renewals, projecting future revenues exceeding £350 million, which speaks to its sustained market relevance and financial stability.

Long-standing Customer Relationships and Global Reach

De La Rue's enduring legacy, stretching back over 200 years, has fostered exceptionally strong relationships with a diverse global clientele. This includes governments, central banks, and major international brands, a testament to the trust built over generations. The company's operations now span 140 countries, highlighting its significant global footprint and the deep-seated loyalty of its customer base.

These long-standing customer relationships are a critical strength, providing a stable foundation for recurring revenue and consistent demand for De La Rue's high-security printing services. The established trust within this extensive network acts as a significant barrier to entry for competitors in the specialized security printing market. This allows De La Rue to secure repeat business and explore avenues for growth within its existing partnerships.

- Global Presence: Operates in 140 countries, demonstrating extensive international reach.

- Clientele: Serves governments, central banks, and international brands, indicating high-value relationships.

- Trust and Loyalty: Decades of operation have cultivated deep-rooted trust, ensuring customer retention.

- Revenue Stability: Strong relationships contribute to a predictable and recurring revenue stream.

Expertise in Secure Printing and Authentication Technologies

De La Rue's significant strength is its deep-seated expertise in secure printing and authentication technologies. This includes sophisticated optical engineering, the design of advanced security features, and cutting-edge traceability software, all crucial for combating counterfeiting. Their solutions are vital for maintaining the integrity of identity documents, trade, and the global movement of goods.

This specialized knowledge allows De La Rue to create highly secure products that are exceptionally difficult to replicate. For instance, their security features are integrated into currency, passports, and tax stamps, safeguarding government revenues and national security. In 2023, the global secure printing market was valued at approximately $35 billion, with De La Rue holding a notable position in specialized segments.

- Core Competence: Profound expertise in secure printing, optical engineering, security feature design, and traceability software.

- Counterfeit Resilience: Development of highly secure solutions that are resilient against counterfeiting attempts.

- Global Impact: Offerings span physical and digital tools, ensuring the integrity of identity, trade, and the movement of goods worldwide.

- Market Relevance: Secure printing is a critical component of a global market valued in the tens of billions of dollars annually.

De La Rue's market leadership in currency solutions is a significant strength, serving half of all central banks globally. This extensive reach highlights its established reputation and deep integration within the international financial infrastructure.

The company's unique position as the sole fully integrated supplier for both traditional paper and advanced polymer banknotes provides a distinct competitive edge. This comprehensive offering, coupled with a consistently high win rate in banknote tenders, solidifies its market dominance and customer trust.

De La Rue's advanced polymer banknote technology, specifically its SAFEGUARD® substrate, stands out as a significant strength, offering enhanced durability and environmental advantages over traditional paper currency.

The company's Authentication division showcased robust performance with revenue growth of 12.5% in FY24, surpassing its £100 million target and securing multi-year contract renewals projecting future revenues exceeding £350 million.

De La Rue's enduring legacy, spanning over 200 years, has fostered exceptionally strong relationships with governments, central banks, and major international brands across 140 countries, building deep-seated trust and ensuring customer loyalty.

These long-standing customer relationships provide a stable foundation for recurring revenue and consistent demand for De La Rue's high-security printing services, creating a significant barrier to entry for competitors.

De La Rue's deep-seated expertise in secure printing and authentication technologies, including sophisticated optical engineering and advanced security features, is a core competence vital for combating counterfeiting and maintaining the integrity of identity documents and trade.

| Metric | Value | Year/Period |

|---|---|---|

| Central Banks Served | 50% of global | Ongoing |

| Authentication Revenue Growth | 12.5% | FY24 |

| Projected Authentication Revenue | >£350 million | Future |

| Global Operations | 140 countries | Ongoing |

What is included in the product

Delivers a strategic overview of De La Rue’s internal and external business factors, highlighting its strengths in security printing and brand recognition alongside challenges in market diversification and operational efficiency.

Offers a clear, actionable framework to address De La Rue's identified weaknesses and threats, transforming potential challenges into strategic opportunities.

Weaknesses

De La Rue's currency division is facing significant headwinds, with revenue dropping 18.7% in FY24 to £207.1m, down from £254.6m in FY23. This substantial decline reflects a broader downturn in the currency industry, directly impacting the company's traditional revenue base. While the sector shows some signs of stabilization, this persistent trend presents a considerable challenge for De La Rue's financial performance.

De La Rue faces a significant challenge with a material uncertainty regarding its ability to continue as a going concern. This is largely due to a substantial revolving credit facility (RCF) that matures in July 2025, requiring repayment.

While the company plans to sell its Authentication division to address this debt, the successful completion and precise timing of this sale are dependent on external market conditions. This dependency introduces considerable financial risk and could erode investor confidence.

De La Rue faces a significant long-term challenge with the accelerating global shift towards digital payments and contactless transactions. This trend directly impacts the demand for physical banknotes, a core segment of the company's operations.

In 2024, the continued growth of mobile payments and digital wallets further erodes the reliance on cash. For instance, global digital payment transaction volume was projected to exceed $1.5 trillion in 2024, highlighting the scale of this transition.

Consequently, De La Rue's reliance on banknote printing represents a substantial weakness. The company must effectively adapt to this evolving payments landscape and diversify its revenue streams to ensure sustained future growth and relevance.

High Net Debt Position

De La Rue's financial standing is currently weighed down by a significant net debt. As of March 30, 2024, the company reported a net debt of £89.4 million, a figure that regrettably climbed to £109.4 million by September 28, 2024. This increase was partly driven by the need to build up inventory in anticipation of future customer orders.

While the planned divestment of its Authentication division is intended to help reduce this debt burden, the existing high level of borrowing inherently curtails De La Rue's financial agility. This can translate into a reduced capacity to pursue new strategic investments or respond effectively to unexpected economic downturns.

- Net Debt Figures: £89.4m (March 30, 2024) to £109.4m (September 28, 2024).

- Contributing Factor: Inventory build-up for future deliveries.

- Strategic Mitigation: Planned sale of the Authentication division.

- Financial Impact: Limited flexibility for new investments and increased vulnerability to market volatility.

Cyclicality of the Currency Industry

De La Rue operates in a mature and highly competitive currency printing market, which is also inherently cyclical. This means the company's financial performance, including earnings and revenue, can experience significant swings. These fluctuations are largely driven by global demand for banknotes, a demand that is sensitive to broader economic conditions and geopolitical events. For instance, periods of economic stability might see increased demand for new currency, while recessions or political instability can lead to reduced orders.

This cyclical nature presents a considerable challenge for De La Rue in maintaining consistent growth and achieving stable financial results. The unpredictability of demand makes long-term financial planning and investment forecasting more complex. For example, in fiscal year 2023-2024, while overall demand for banknotes remained a key factor, the specific order book for currency printing can shift quarter by quarter, impacting revenue recognition and profitability.

The volatility inherent in the currency industry impacts De La Rue's ability to project future revenue streams with certainty. This can affect its capital allocation strategies and investment decisions. The company must navigate these cycles by diversifying its revenue streams and managing its cost base effectively to mitigate the impact of downturns in the banknote printing sector.

- Mature Market: The global market for banknote printing is well-established, with limited organic growth potential in many developed economies.

- Demand Volatility: Banknote demand is influenced by factors like inflation, central bank policies, and the shift towards digital payments, leading to unpredictable order volumes.

- Competitive Landscape: De La Rue faces competition from other established security printers, which can put pressure on pricing and margins.

- Economic Sensitivity: Global economic health directly correlates with the demand for physical currency, making De La Rue susceptible to recessions or economic slowdowns.

De La Rue's significant reliance on banknote printing, a sector facing decline due to the global shift towards digital payments, poses a substantial weakness. The company's revenue from currency saw an 18.7% drop in FY24 to £207.1m. This trend is exacerbated by the accelerating growth of mobile payments, with global digital payment transaction volume projected to exceed $1.5 trillion in 2024.

Full Version Awaits

De La Rue SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and guarantees you get the complete, professional SWOT analysis for De La Rue.

You’re viewing a live preview of the actual SWOT analysis file for De La Rue. The complete version, packed with detailed insights, becomes available immediately after checkout.

Opportunities

The global market for authentication and brand protection is booming, expected to reach US$6.68 billion by 2030. This surge is fueled by a growing need for strong security measures against counterfeiting, illegal trade, and identity fraud.

De La Rue's deep knowledge in secure printing, coupled with its cutting-edge digital authentication technologies, places it advantageously to capitalize on this expanding market. The company is well-positioned to secure a more significant portion of this lucrative sector.

The global shift towards polymer banknotes presents a significant growth avenue. De La Rue's SAFEGUARD® polymer substrate is already a proven success, featured in over 50 banknote denominations as of March 2022. This increasing adoption by central banks worldwide directly translates to heightened demand for De La Rue's advanced polymer solutions and manufacturing capabilities.

De La Rue can capitalize on its secure printing expertise to develop and offer advanced track and trace software and digital tax stamp solutions. This leverages their core competency in authentication for a growing digital market.

The global demand for secure digital identities and transparent supply chains is a significant growth opportunity. For instance, the digital identity market is projected to reach $32.2 billion by 2027, growing at a CAGR of 17.8%, according to MarketsandMarkets.

By investing in and commercializing next-generation digital security features, De La Rue can diversify its revenue. This strategic move aims to lessen its dependence on traditional physical currency production, which has seen fluctuating demand.

Strategic Partnerships and Acquisitions

De La Rue's strategic maneuvers, like the proposed sale of its Authentication division to Crane NXT for approximately $170 million, highlight a clear intent to concentrate on its core currency operations. This divestment allows for a more focused approach and resource allocation.

Looking ahead, De La Rue has opportunities to forge new strategic partnerships or pursue targeted acquisitions. These moves could bolster its standing in the currency printing sector and potentially expand its capabilities in the growing brand protection market. Such actions are crucial for maintaining a competitive edge and adapting to market shifts.

- Focus on Core Business: The divestment of Authentication allows De La Rue to channel resources into its primary currency printing and security features.

- Market Expansion: Strategic alliances or acquisitions can open doors to new geographic markets or customer segments.

- Technological Advancement: Partnerships can provide access to cutting-edge technologies in security printing, digital authentication, or supply chain management.

- Enhanced Brand Protection: Acquisitions in related fields could strengthen De La Rue's offerings in anti-counterfeiting and brand integrity solutions.

Recovery in the Currency Market

The global currency market has been on an upward trajectory since late 2023, signaling a welcome recovery after a period of industry-wide contraction. This positive trend directly benefits De La Rue, a key player in banknote production.

De La Rue's currency order book saw a substantial boost in 2024, achieving its strongest position in over five years. This impressive growth is attributed to the company's success in securing a high proportion of banknote tenders, demonstrating its competitive edge in the market.

The resurgence in currency demand offers a significant opportunity for De La Rue to expand its revenue streams and enhance profitability. Capitalizing on this market rebound is crucial for strengthening its core currency business.

Key indicators of this recovery include:

- Increased Banknote Tender Wins: De La Rue's strong win rate in recent tenders highlights a growing demand for their currency products.

- Strong Order Book Growth: The company reported its highest currency order book in at least five years in 2024, reflecting renewed market confidence.

- Potential for Revenue and Profitability Gains: The recovering currency market provides a direct avenue for De La Rue to improve its financial performance.

De La Rue is well-positioned to benefit from the expanding global market for authentication and brand protection, projected to reach US$6.68 billion by 2030. The company's expertise in secure printing and digital authentication technologies allows it to capture a larger share of this growing sector.

The increasing global adoption of polymer banknotes presents a significant opportunity, with De La Rue's SAFEGUARD® polymer substrate already used in over 50 banknote denominations. This trend drives demand for their advanced polymer solutions.

Furthermore, De La Rue can leverage its secure printing capabilities to offer track and trace software and digital tax stamp solutions, tapping into the growing digital security market. The digital identity market alone is anticipated to reach $32.2 billion by 2027.

The company's strategic divestment of its Authentication division allows for a focused approach on its core currency operations, potentially leading to new partnerships or acquisitions to bolster its market standing and capabilities.

| Opportunity Area | Market Projection/Data | De La Rue Relevance |

| Authentication & Brand Protection | US$6.68 billion by 2030 | Leverages secure printing and digital tech |

| Polymer Banknotes | Increasing global adoption | Proven SAFEGUARD® substrate in 50+ denominations |

| Digital Security & Supply Chains | Digital Identity Market: $32.2 billion by 2027 (17.8% CAGR) | Develop track and trace, digital tax stamps |

| Core Currency Business | Strong order book growth (highest in 5+ years in 2024) | Capitalize on recovering currency demand |

Threats

The accelerating global shift towards digital payments, online banking, and contactless transactions presents a significant long-term threat to the demand for physical currency. This societal evolution could lead to a sustained contraction in the core market for De La Rue's currency division.

For instance, the Bank for International Settlements (BIS) reported in 2023 that while cash usage remains significant in some economies, the trend towards cashless societies is undeniable, with digital payment volumes expanding rapidly. This necessitates De La Rue's continuous adaptation and diversification into non-cash security solutions to mitigate potential revenue declines.

De La Rue operates in a fiercely competitive secure printing market, contending with established players like Giesecke & Devrient, CCL Secure, and Crane NXT. This intense rivalry puts pressure on pricing, potentially squeezing profit margins and impacting De La Rue's market share, especially in critical areas such as polymer banknotes and security features.

As De La Rue ventures further into digital authentication, traceability software, and secure digital identity solutions, its exposure to advanced cybersecurity threats escalates. These new digital frontiers present a more complex attack surface than traditional physical security. The company's success in these areas hinges directly on its ability to safeguard sensitive data and maintain system integrity.

A major cybersecurity incident, such as a data breach or system compromise, could have catastrophic consequences. Customer trust, a cornerstone for security product providers, would be severely eroded, potentially leading to significant financial losses from contract cancellations and decreased sales. For instance, reports indicate that the average cost of a data breach in 2024 reached $4.73 million globally, a figure that could disproportionately impact a company like De La Rue if its core digital offerings are compromised.

Beyond immediate financial impacts, such an event would inflict substantial reputational damage, making it challenging to regain market confidence. Furthermore, regulatory bodies are increasingly stringent regarding data protection; a breach could trigger costly legal repercussions and hefty fines, further compounding the negative effects on the company's bottom line and future growth prospects.

Geopolitical and Macroeconomic Instability

De La Rue's significant dependence on government contracts for banknotes and security printing exposes it to considerable risk from geopolitical and macroeconomic turbulence. Fluctuations in global political stability, economic recessions, or shifts in government spending agendas in key client nations can directly curtail demand and jeopardize contract execution. For example, recent political instability in Sudan has already led to a noticeable impact on sales within De La Rue's Authentication division, underscoring this vulnerability.

The company's exposure is amplified by its global customer base. Economic downturns in emerging markets, for instance, could reduce the capacity of central banks to commission new currency, a core revenue stream for De La Rue. Furthermore, geopolitical tensions can disrupt supply chains for critical raw materials needed in banknote production, potentially increasing costs and delaying deliveries.

- Geopolitical Risk: Political unrest or regime changes in client countries can lead to contract renegotiations or cancellations.

- Macroeconomic Downturns: Recessions can decrease government spending on security documents and currency, impacting De La Rue's revenue.

- Supply Chain Disruptions: Global instability can affect the availability and cost of essential materials like cotton fiber and security inks.

Dependency on Government Contracts

De La Rue's reliance on government contracts for its banknote and identity document printing presents a significant threat. A substantial portion of its revenue, historically around 60-70% from government and central bank work, is tied to these agreements. For instance, in the fiscal year ending March 2024, the security printing segment, which includes these contracts, remained a core revenue driver. However, shifts in government spending priorities, the emergence of new national printing facilities, or changes in currency issuance policies in key markets could directly impact De La Rue's financial performance and stability.

This dependency also exposes De La Rue to the risk of policy changes or budget cuts within client governments. A country deciding to bring its banknote production in-house, a trend observed in some emerging economies, would eliminate a significant revenue stream. Furthermore, geopolitical instability or economic downturns in countries that are major clients could lead to contract renegotiations or cancellations, directly affecting De La Rue's order book and future revenue projections.

- Revenue Concentration: A significant percentage of De La Rue's income is linked to contracts with national governments and central banks.

- Policy & Budget Risks: Changes in government fiscal policies or budget allocations can directly impact the demand for De La Rue's services.

- In-house Production Trend: The potential for countries to develop their own currency and identity document printing capabilities poses a competitive threat.

- Geopolitical Sensitivity: Economic or political instability in client nations can lead to contract disruptions.

The increasing adoption of digital payment methods globally poses a significant threat to De La Rue's traditional currency printing business. As central banks and governments explore alternatives to physical cash, the demand for banknotes could decline, impacting a core revenue stream. For example, the Bank for International Settlements noted in 2023 that digital payment volumes are rapidly expanding, indicating a long-term shift away from cash in many economies.

De La Rue faces intense competition from established players in the secure printing market, such as Giesecke & Devrient and CCL Secure. This rivalry can lead to pricing pressures, potentially squeezing profit margins and affecting market share, particularly for advanced security features and polymer banknotes. The company's expansion into digital identity and cybersecurity solutions also exposes it to sophisticated cyber threats, where a single breach could severely damage customer trust and lead to substantial financial losses, with global data breach costs averaging $4.73 million in 2024.

Furthermore, De La Rue's heavy reliance on government contracts makes it vulnerable to geopolitical instability and macroeconomic downturns. Political unrest or economic recessions in key client nations can result in contract cancellations or reduced orders. For instance, the company has already seen impacts on its Authentication division due to political instability in Sudan. This concentration risk is significant, as government and central bank contracts historically represent a substantial portion of its income, with shifts in government spending priorities or the trend towards in-house production by some emerging economies posing direct threats to revenue stability.

| Threat Category | Specific Risk | Impact on De La Rue | Supporting Data/Trend |

|---|---|---|---|

| Digitalization of Payments | Declining demand for physical currency | Reduced revenue from banknote printing | BIS reports rapid expansion of digital payment volumes (2023) |

| Market Competition | Intense rivalry in secure printing | Price pressure, margin squeeze, loss of market share | Key competitors: Giesecke & Devrient, CCL Secure |

| Cybersecurity Risks | Data breaches and system compromises in digital solutions | Loss of customer trust, financial losses, reputational damage | Average global data breach cost: $4.73 million (2024) |

| Geopolitical & Macroeconomic Factors | Political instability, economic downturns in client nations | Contract renegotiations, cancellations, reduced orders | Impact on Authentication division due to political instability in Sudan |

| Government Contract Dependency | Policy changes, budget cuts, in-house production trends | Revenue concentration risk, potential loss of core business | Government contracts historically 60-70% of revenue |

SWOT Analysis Data Sources

This De La Rue SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analysis to provide a thorough strategic overview.