De La Rue Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

De La Rue Bundle

De La Rue faces intense competition, with significant pressure from rivals and the constant threat of new entrants disrupting the secure authentication and currency printing markets. Understanding the bargaining power of their buyers and suppliers is crucial for navigating this landscape.

The complete report reveals the real forces shaping De La Rue’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

De La Rue's reliance on a select group of specialized suppliers for critical components like security inks and holographic foils significantly bolsters supplier bargaining power. These unique, high-tech materials are indispensable for the company's anti-counterfeiting solutions and product durability.

The limited availability of alternative suppliers for these advanced inputs, such as De La Rue's proprietary Safeguard® polymer, grants these existing suppliers considerable leverage. This scarcity can translate into increased costs for De La Rue, impacting its profitability and operational expenses.

Suppliers possessing patents or proprietary technology for distinctive security features or advanced material science can wield considerable bargaining power. De La Rue's reliance on these specialized innovations for its anti-counterfeiting solutions means switching suppliers can incur substantial research and development costs and necessitate significant product redesign.

The concentration of suppliers significantly impacts De La Rue's bargaining power. In specialized areas, such as the production of secure polymer substrates for banknotes, the supplier pool can be quite small. De La Rue itself manufactures its Safeguard® polymer, but other critical components might rely on a limited number of providers. This scarcity of alternatives grants these suppliers greater leverage in price negotiations and contract terms, as De La Rue has fewer options to turn to.

High Switching Costs

High switching costs significantly bolster the bargaining power of suppliers for De La Rue, particularly when it comes to critical, customized components used in banknote and security document manufacturing. The intricate nature of these materials often necessitates extensive re-testing and recertification if a new supplier is introduced. This process can be both time-consuming and financially burdensome, effectively locking De La Rue into existing supplier relationships and reinforcing their leverage.

Consider the implications of these costs:

- Re-tooling and Integration: New suppliers may require De La Rue to invest in new machinery or adapt existing processes, representing a considerable upfront expense.

- Certification Hurdles: Obtaining the necessary regulatory and security certifications for new materials can take months, delaying production and adding to overall project costs.

- Intellectual Property and Design Lock-in: Customized components often involve proprietary designs or specific material formulations, making it difficult and costly to find alternative sources without compromising product integrity.

Quality and Reliability Requirements

For De La Rue, the demands for exceptional quality and unwavering reliability in its secure printing operations significantly bolster supplier bargaining power. Suppliers capable of consistently delivering materials that meet these exacting standards, such as specialized inks and security paper, become critical to De La Rue's product integrity. This dependence means De La Rue has limited alternatives when these specific quality benchmarks are non-negotiable, giving these suppliers leverage.

The specialized nature of materials used in secure documents, like banknotes and passports, means there are fewer suppliers capable of meeting the necessary security and durability specifications. For instance, the global market for high-security banknote paper is concentrated among a few key producers. This limited supplier base, coupled with De La Rue's need for absolute product integrity, strengthens the negotiating position of these select few. In 2024, the ongoing global demand for secure identity documents and currency, estimated to be in the billions annually, underscores the critical importance of these reliable material sources.

- High-Security Materials: Suppliers of specialized security inks and papers possess significant leverage due to the niche and demanding specifications required for secure printing.

- Limited Supplier Pool: The restricted number of manufacturers capable of meeting De La Rue's stringent quality and security standards concentrates bargaining power among these few entities.

- Criticality of Reliability: De La Rue's inability to compromise on product integrity means it must rely on suppliers who consistently meet these demanding requirements, making them indispensable partners.

De La Rue faces considerable supplier bargaining power due to the specialized nature of its raw materials, such as security inks and holographic foils. These inputs are critical for the company's high-security products, and the limited number of qualified suppliers means they hold significant leverage. For example, the global market for high-security banknote paper is dominated by a few key producers, and De La Rue's need for absolute product integrity reinforces their negotiating position.

The high switching costs associated with changing suppliers for these critical components further empower them. Re-tooling, integration, and extensive recertification processes can be both time-consuming and financially burdensome for De La Rue. This dependence on existing suppliers, especially for proprietary or highly customized materials, allows suppliers to dictate terms and prices.

Suppliers who own patents or proprietary technology for unique security features also command strong bargaining power. De La Rue's reliance on these innovations for its anti-counterfeiting solutions makes switching suppliers a costly endeavor, often requiring significant R&D investment and product redesign. The ongoing global demand for secure identity documents and currency, estimated in the billions annually, highlights the critical importance of these reliable material sources for De La Rue's operations.

| Factor | Impact on De La Rue | Supplier Leverage |

| Specialized Materials (e.g., security inks, foils) | Critical for product integrity and anti-counterfeiting features | High |

| Limited Supplier Pool | Few manufacturers meet stringent security and quality standards | High |

| High Switching Costs (re-tooling, certification) | Significant time and financial burden to change suppliers | High |

| Proprietary Technology/Patents | Essential for unique security features, difficult to replicate | High |

What is included in the product

This analysis systematically breaks down the competitive landscape for De La Rue by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry.

Instantly identify and mitigate competitive threats with a comprehensive, visual breakdown of De La Rue's market landscape.

Customers Bargaining Power

Central banks and national governments represent De La Rue's primary customer base, and these entities wield significant bargaining power. Their sheer size and the substantial volumes of banknotes, passports, and identity cards they purchase allow them to exert considerable influence over pricing and contract terms. For instance, in 2023, De La Rue secured a significant contract with the Bank of England for new polymer banknotes, demonstrating their ability to win business from major governmental entities.

The bargaining power of customers in the banknote and security printing industry, particularly for a company like De La Rue, is significantly influenced by long-term contracts and government procurement cycles. These cycles often involve extensive tendering processes where price, quality, and security features are heavily scrutinized, giving governments considerable leverage.

In 2024, De La Rue secured multi-year polymer-based banknote contracts and extensions for digital tax stamp solutions. While these represent significant wins, they are typically the culmination of rigorous bidding processes. These long-term agreements, while providing revenue visibility, can also lock customers into specific terms, but often include stringent performance clauses that can penalize the supplier for deviations, thereby enhancing customer power.

Government and central bank budgets, despite the critical nature of security printing, face public scrutiny and fiscal limitations. This inherent budgetary constraint translates into significant price sensitivity for De La Rue's products. For instance, in 2023, many nations were focused on deficit reduction, meaning large printing contracts would be subject to intense cost-benefit analysis.

This price sensitivity directly impacts De La Rue's ability to command premium pricing, especially on high-volume orders. Companies like De La Rue must therefore maintain highly competitive pricing strategies to secure these substantial contracts, which can put pressure on their overall profit margins. The need to balance security features with cost-effectiveness is a constant negotiation.

In-house Production Capability (Limited)

While De La Rue specializes in advanced security printing, some major nations possess their own state-owned printing facilities. This capability, even if not fully operational for all security features, grants these customers a degree of leverage. It signifies a potential for in-house production, which can reduce their dependence on external suppliers like De La Rue, thereby strengthening their bargaining position.

This latent ability to self-produce acts as a significant bargaining chip. For instance, a government with a well-established national printing bureau might negotiate more favorable terms or explore alternative sourcing options, especially for less complex security elements. This internal capacity limits the extent to which De La Rue can dictate terms, as customers retain the option to bring production in-house, particularly if cost or strategic control becomes a paramount concern.

- Limited In-house Production: While rare for highly advanced security features, some nations maintain state-owned printing facilities.

- Bargaining Leverage: This latent ability to self-produce, even if not fully utilized, serves as a bargaining chip for customers.

- Reduced Reliance: It lessens customer dependence on external manufacturers like De La Rue, enhancing their negotiation power.

- Strategic Control: For governments, retaining in-house capabilities offers greater strategic control over sensitive production processes.

Demand for Innovation and Customization

Customers, particularly governments and large financial institutions, increasingly demand cutting-edge security features and enhanced product durability. This drive for innovation, especially to counter sophisticated counterfeiting efforts, places significant bargaining power in their hands. They can leverage De La Rue's need to invest heavily in research and development to negotiate better pricing and push for customized solutions tailored to their specific security requirements.

This demand for innovation translates into tangible costs for De La Rue. For instance, the ongoing arms race against counterfeiters necessitates continuous investment in new technologies, such as advanced holographic security features and sophisticated material science for banknotes and identity documents. In 2024, De La Rue continued to focus on these areas, as evidenced by their ongoing work with central banks on next-generation currency security. The ability of customers to request and often secure these bespoke features, which require specialized R&D and manufacturing processes, amplifies their negotiating leverage.

- Customer Demand for Innovation: Clients require advanced security features to combat counterfeiting.

- Investment in R&D: De La Rue must continually invest in research and development to meet these demands.

- Bespoke Features: Customers can leverage the need for innovation to negotiate for customized product specifications.

- Negotiating Power: The drive for advanced solutions grants customers greater leverage in securing favorable terms.

De La Rue's primary customers, central banks and governments, possess substantial bargaining power due to their large order volumes and the critical nature of security printing. Their ability to switch suppliers, although complex, and their stringent procurement processes allow them to negotiate favorable pricing and contract terms. For example, in 2023, De La Rue's ability to secure a significant contract with the Bank of England for polymer banknotes highlights the competitive bidding environment where customer leverage is high.

What You See Is What You Get

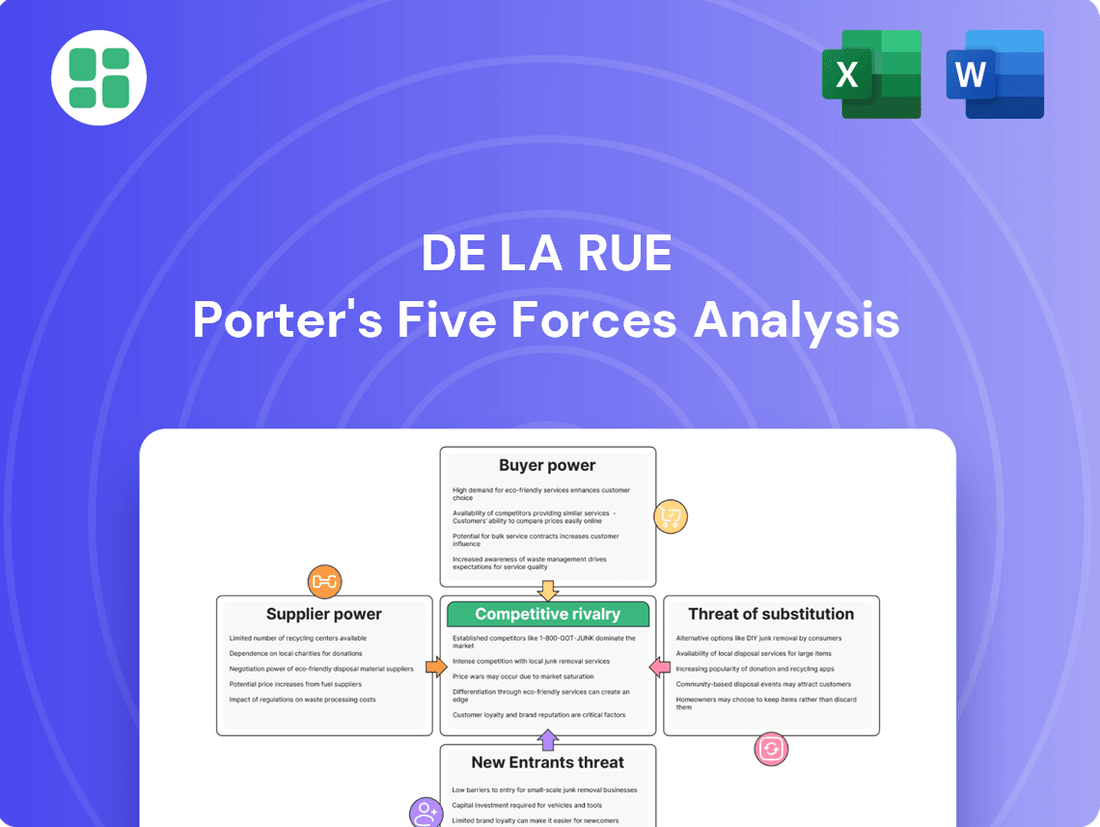

De La Rue Porter's Five Forces Analysis

This preview showcases the complete De La Rue Porter's Five Forces analysis, offering a detailed examination of the competitive landscape for the company. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase. You can be confident that no placeholders or sample content are present; this is the exact deliverable, ensuring you get the full, actionable insights you need.

Rivalry Among Competitors

The secure printing market, essential for banknotes and vital documents, is a specialized global niche. This arena features a select group of highly capable companies, fostering significant rivalry.

De La Rue faces stiff competition from established players like Giesecke+Devrient (G+D), Bundesdruckerei, Crane Currency, and Oberthur Fiduciaire. These companies vie intensely for lucrative contracts, particularly from central banks and governments worldwide.

In 2023, the global banknote printing market was valued at approximately $10 billion. De La Rue, a significant player, reported revenues of £436 million for the fiscal year ending March 2024, highlighting the substantial scale of operations within this competitive landscape.

The security printing industry, where De La Rue operates, is defined by substantial fixed costs. These are tied to specialized, high-security manufacturing equipment and advanced research and development for anti-counterfeiting technologies. For instance, setting up a new banknote printing line can cost tens of millions of pounds.

This high cost base compels companies to aggressively pursue market share. The imperative to achieve high capacity utilization means that firms are often willing to accept lower profit margins on contracts to keep their expensive facilities running efficiently. This directly fuels competitive rivalry as companies compete fiercely for every available order.

In 2024, De La Rue reported that its security printing division, which includes banknotes and identity documents, faced a competitive landscape where securing sufficient volume was crucial. The company’s focus on operational efficiency reflects the industry’s need to manage these significant fixed overheads, underscoring the intense pressure to win contracts and maintain production levels.

Competitive rivalry in the currency and identity solutions sector is heavily influenced by product differentiation. Companies like De La Rue compete by offering advanced security features, enhanced durability, and sophisticated anti-counterfeiting technologies. This technological edge is crucial for securing and maintaining valuable contracts with governments and central banks.

De La Rue's strategic emphasis on polymer banknotes and its innovative ASSURE™ polymer substrate exemplifies this drive for technological superiority. In 2024, the global banknote paper and polymer market is projected to grow, with polymer banknotes increasingly favored for their longevity and security. De La Rue's investment in such technologies directly addresses the intense competition and the need to offer superior, tamper-evident solutions.

Importance of Reputation and Trust

In the currency and security printing industry, a company's reputation and the trust it has cultivated are incredibly powerful competitive advantages. De La Rue, with its history stretching back over two centuries, has built a formidable reputation for reliability and integrity. This long-standing trust is particularly crucial when dealing with central banks and governments, who entrust these companies with the production of their national currencies and sensitive security documents.

Established relationships and a proven track record are not easily replicated by newer market entrants. De La Rue's ability to secure bids often stems from this deeply ingrained trust and its consistent delivery of high-quality, secure products. For example, in 2024, De La Rue continued to highlight its long-term partnerships with numerous central banks, underscoring the importance of these enduring relationships in maintaining its market position.

The competitive rivalry is intensified by the fact that a single breach of trust or a security lapse could have catastrophic consequences for a company's reputation and future business prospects. This makes the ongoing investment in security, quality control, and ethical practices a non-negotiable aspect of competing in this sector. Consequently, De La Rue's emphasis on its heritage and commitment to security serves as a significant barrier to entry for rivals seeking to challenge its established position.

- Reputation as a Barrier: De La Rue's centuries-old history and established trust with central banks create a significant hurdle for new competitors.

- Trust in Security Printing: The paramount importance of integrity in currency and security document production means long-standing relationships are highly valued.

- Securing Bids: A proven track record and a reputation for reliability are key factors in winning contracts with governments and financial institutions.

- Risk of Lapses: Any security breach or failure in integrity can severely damage a company's standing and future business opportunities.

Impact of Digital Transformation on Traditional Print Volumes

While the banknote printing market, a core area for De La Rue, continues to see growth, the wider printing industry faces significant disruption from digitalization. This shift necessitates a strategic pivot for companies like De La Rue to adapt to evolving market demands and maintain a competitive edge.

Competitors are grappling with the decline in traditional print volumes across various sectors. To counter this, there's a strong imperative to invest in and develop digital solutions. This includes areas such as digital identity management and brand protection software, which offer new avenues for revenue diversification.

- Digitalization Impact: The broader printing industry is experiencing a downturn in traditional print volumes due to digital alternatives. For instance, the global print market, excluding packaging, has seen a contraction in recent years, with many segments facing secular decline.

- Diversification Strategy: Companies like De La Rue are actively pursuing diversification into digital services. In 2023, De La Rue reported growth in its Identity Solutions segment, highlighting the importance of this strategic shift.

- Revenue Stream Evolution: The move towards digital solutions is crucial for maintaining and growing revenue streams. This involves leveraging existing expertise in security printing and applying it to new digital platforms and services.

The competitive rivalry within De La Rue's secure printing sector is intense, driven by a limited number of highly capable global players vying for significant contracts. This dynamic is shaped by high fixed costs associated with specialized equipment, compelling companies to aggressively pursue market share and maintain high capacity utilization, often accepting lower margins. For instance, in 2024, De La Rue's security printing division faced this pressure, emphasizing operational efficiency to manage overheads and secure production volumes.

Product differentiation through advanced security features and anti-counterfeiting technologies is a key battleground, with De La Rue investing in innovations like polymer banknotes. The industry also heavily relies on reputation and trust, where De La Rue's long history and established relationships with central banks serve as a significant advantage, making it difficult for new entrants to gain traction. Any lapse in security can severely damage a company's standing, reinforcing the need for unwavering integrity.

The broader printing industry's shift towards digitalization presents both challenges and opportunities. While traditional print volumes decline, companies like De La Rue are diversifying into digital solutions such as identity management and brand protection software to maintain revenue streams and competitive relevance. De La Rue's own Identity Solutions segment showed growth in 2023, reflecting this strategic pivot.

| Competitor | Key Offerings | Estimated Market Presence (2024) |

|---|---|---|

| Giesecke+Devrient (G+D) | Banknotes, security paper, digital security solutions | Global leader in banknote production, significant share in identity solutions |

| Crane Currency | Banknote paper, security threads, polymer substrates | Major supplier of banknote paper to central banks worldwide |

| Oberthur Fiduciaire | Banknotes, security documents, smart cards | Strong presence in Europe and Africa, expanding globally |

SSubstitutes Threaten

The most significant substitute threat to De La Rue's core business stems from the global shift towards digital payments and the emergence of central bank digital currencies (CBDCs). While physical cash still holds relevance, the accelerating adoption of digital transactions and the potential widespread rollout of CBDCs could diminish the long-term demand for physical banknotes.

For instance, by the end of 2023, over 130 countries were exploring or piloting CBDCs, representing a substantial portion of the global population. This trend, coupled with the increasing convenience and acceptance of mobile payment systems and other digital alternatives, presents a clear substitute for traditional currency, impacting the market for banknote printing and related security features.

Digital identity solutions, including biometric verification, present a significant threat to traditional security document providers like De La Rue. As these technologies advance, they offer increasingly viable alternatives for secure authentication in sectors like finance, travel, and government, potentially diminishing the demand for physical documents such as passports and identity cards.

The digital identity solutions market is experiencing robust expansion, with projections indicating substantial growth in the coming years. This surge is fueled by the escalating need for secure authentication methods across various industries, suggesting a future where reliance on physical security documents may decrease.

In the brand protection sector, traditional physical security measures are increasingly vulnerable to substitution by sophisticated digital authentication solutions. These digital alternatives offer enhanced capabilities for safeguarding brands against counterfeiting and illicit trade.

Advanced digital technologies, such as artificial intelligence for anomaly detection in online marketplaces and blockchain for immutable supply chain records, are emerging as powerful substitutes. For instance, the global brand protection market, which includes digital solutions, was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, indicating a strong shift towards these digital alternatives.

Furthermore, the development of digital twins, virtual replicas of physical products, allows for unique digital identities and verifiable provenance, directly challenging the reliance on purely physical security features. Companies are investing heavily in these digital tools, with some reports suggesting that over 60% of brand protection budgets are now allocated to digital solutions, underscoring their growing substitutive power.

Shift Towards Hybrid Security Solutions

The threat of substitutes for De La Rue's traditional secure printing services is evolving. Instead of direct replacement, we're seeing a significant shift towards hybrid security solutions. These integrate physical security features with digital verification methods, creating a more complex landscape where traditional paper-based security is augmented, not entirely abandoned.

This trend means De La Rue must adapt by incorporating digital authentication into its portfolio. For example, many governments and businesses are now looking for ways to link physical documents, like passports or identity cards, to secure digital records. This blurring of lines between physical and digital security demands that De La Rue expand its capabilities beyond just printing to include robust digital verification platforms. In 2024, the global digital identity market was valued at over $30 billion, indicating a strong and growing demand for these integrated solutions.

- Hybridization: Secure printing now often includes QR codes, NFC chips, or blockchain integration for digital verification.

- Digital Verification Demand: Governments and corporations increasingly require secure links between physical assets and digital identities.

- Market Growth: The digital identity sector, a key area for hybrid solutions, saw substantial growth in 2024, exceeding $30 billion globally.

- Adaptation Imperative: De La Rue faces pressure to offer integrated physical and digital security services to remain competitive.

Reduced Travel and Digitalization of Processes

The increasing digitalization of processes and the potential reduction in physical travel represent a significant threat of substitutes for companies involved in producing physical travel documents. Global events and a sustained push towards digital solutions are reshaping how individuals and governments manage identity and border crossings. For instance, many countries are investing heavily in digital identity systems and advanced biometric screening at borders, aiming to streamline passenger flow and enhance security. This shift could gradually lessen the reliance on traditional physical documents like passports in certain scenarios.

The impact of this trend on the demand for physical passport production is a key consideration. While passports remain a primary form of identification for international travel, the long-term trajectory suggests a potential evolution. For example, the International Civil Aviation Organization (ICAO) continues to promote the adoption of Machine Readable Travel Documents (MRTDs), which incorporate digital elements and biometrics, signaling a move beyond purely physical documents. By 2024, a significant portion of global passports are expected to incorporate advanced security features and digital components, indicating a market adapting to technological advancements.

- Digital Identity Solutions: The rise of digital identity platforms and mobile passports could offer alternative verification methods, reducing the need for physical document presentation.

- Biometric Border Control: Increased adoption of facial recognition and fingerprint scanning at airports and borders can expedite processing without solely relying on physical passports.

- E-Visas and Digital Travel Authorizations: Many nations are already moving towards electronic visa systems and online travel authorizations, which can sometimes be linked to digital identity rather than a physical passport stamp.

- Reduced Business Travel: Post-pandemic trends and advancements in virtual collaboration tools might lead to a structural decrease in business travel, indirectly affecting the volume of passports issued or renewed.

The primary substitute threat to De La Rue's secure printing business comes from the accelerating global shift towards digital transactions and identity management. The increasing adoption of Central Bank Digital Currencies (CBDCs) and sophisticated digital identity solutions, like biometrics, directly challenge the demand for physical banknotes and traditional security documents.

For instance, by mid-2024, over 130 countries were actively exploring or piloting CBDCs, indicating a significant move away from physical cash. Simultaneously, the digital identity market was projected to surpass $30 billion globally in 2024, highlighting the growing preference for digital verification methods over physical documents such as passports and identity cards.

Furthermore, advancements in digital brand protection, including AI-driven anomaly detection and blockchain for supply chain integrity, offer robust alternatives to physical security features. The global brand protection market, which saw digital solutions capture a significant share by 2023, is expected to continue its growth, pushing companies to allocate more budget towards these digital strategies.

| Substitute Area | Key Technologies | Market Trend/Data (2023-2024) | Impact on De La Rue |

|---|---|---|---|

| Currency | CBDCs, Digital Wallets | Over 130 countries exploring CBDCs (mid-2024); Cash usage declining | Reduced demand for banknote printing |

| Identity Management | Biometrics, Digital IDs, Mobile Passports | Digital Identity Market >$30 billion (2024 est.); Increased border digitalization | Lower demand for physical passports, ID cards |

| Brand Protection | AI, Blockchain, Digital Twins | Brand Protection Market (incl. digital) ~$1.5 billion (2023); 60%+ budgets shifting to digital | Decreased need for physical anti-counterfeiting features |

Entrants Threaten

The secure printing sector, where De La Rue operates, demands substantial upfront capital. Think millions, if not hundreds of millions, for specialized printing machinery, secure production sites, and robust anti-counterfeiting technologies. This high barrier means only well-funded entities can even consider entering the market.

For instance, setting up a facility capable of printing advanced security features like those found on banknotes or passports requires specialized inks, intricate engraving equipment, and secure supply chains, all contributing to enormous initial costs. These investments are not easily replicated.

In 2023, the global secure printing market was valued at approximately $30 billion, with growth driven by demand for identity documents and currency. This substantial market size attracts investment, but the sheer scale of entry requirements remains a significant deterrent for newcomers.

The threat of new entrants in the currency and secure document printing industry is significantly dampened by stringent regulatory requirements and the need for specialized certifications. Companies must navigate a complex web of international standards and often require extensive security clearances. For instance, securing approval from governments and central banks, a prerequisite for printing official currency or sensitive documents, is a protracted and resource-intensive undertaking.

This demanding landscape presents a substantial barrier for potential newcomers. The process of obtaining necessary approvals and establishing the requisite trust with issuing authorities can take years and incur significant upfront investment. In 2024, companies like De La Rue, a long-standing player, continue to demonstrate the value of these established relationships and compliance frameworks, making it difficult for nascent competitors to penetrate the market without substantial commitment.

De La Rue's significant investment in proprietary technology and intellectual property acts as a substantial barrier to new entrants. Their portfolio includes patents on advanced security features for banknotes and identity documents, as well as specialized polymer substrates and intricate manufacturing techniques. For instance, in 2024, De La Rue continued to highlight its innovative security thread technologies, a result of decades of R&D.

The cost and time required to replicate or develop comparable technology are prohibitive for most potential competitors. Acquiring such advanced capabilities would necessitate massive capital expenditure and extensive research and development efforts, making it difficult for newcomers to compete on a technological level. This deep technological moat protects De La Rue's market position.

Established Customer Relationships and Trust

De La Rue's established customer relationships, particularly with central banks and governments, represent a significant hurdle for potential new entrants. These relationships, forged over decades, are built on a foundation of trust, proven reliability, and stringent security protocols, making it exceptionally difficult for newcomers to gain the confidence of these critical clients.

New entrants face the challenge of replicating De La Rue's deep-rooted connections, which are not easily transferable. The company's long history of service and its reputation for safeguarding sensitive operations are invaluable assets that new competitors would struggle to match in the short to medium term.

Consider the implications for market entry:

- Customer Loyalty: Existing contracts and long-term partnerships with sovereign entities create a high degree of customer loyalty, limiting opportunities for new players.

- Reputational Barrier: De La Rue's established reputation for security and discretion in areas like currency printing and identity solutions acts as a significant reputational barrier to entry.

- Switching Costs: The administrative, security, and logistical complexities involved in switching from a trusted, long-term supplier like De La Rue are substantial for government and central bank clients.

Expertise in Secure Design and Anti-Counterfeiting

The threat of new entrants in the secure design and anti-counterfeiting sector is significantly mitigated by the immense expertise required. Developing proficiency in advanced material science, intricate secure design principles, and cutting-edge anti-counterfeiting technologies demands years of specialized training and research. This high barrier to entry means potential newcomers must invest heavily in acquiring or cultivating a deep bench of highly skilled professionals, a process that is both time-consuming and capital-intensive.

For instance, companies like De La Rue, a leader in security printing and identification solutions, have built their competitive advantage over centuries, accumulating invaluable intellectual property and practical know-how. New entrants would face the daunting task of replicating this depth of knowledge. Consider the complexity of security features on banknotes; these involve sophisticated intaglio printing, holographic foils, optically variable inks, and microtext, all requiring specialized equipment and highly trained personnel. The investment in research and development alone for such capabilities can run into millions of dollars annually for established players.

- Specialized Knowledge: Expertise in secure design, material science, and anti-counterfeiting technologies is a significant barrier.

- Talent Acquisition: New entrants need to recruit or develop a deep pool of specialized experts, which is challenging and costly.

- Intellectual Property: Established companies possess extensive patents and trade secrets related to security features.

- Capital Investment: Significant upfront investment in specialized equipment and R&D is necessary to compete effectively.

The threat of new entrants in De La Rue's core markets, like secure currency and identity document printing, is exceptionally low. This is primarily due to the massive capital investment required, estimated in the hundreds of millions, for specialized machinery, secure facilities, and advanced anti-counterfeiting technologies. Regulatory hurdles and the need for government certifications also present substantial, time-consuming barriers, making it incredibly difficult for newcomers to gain traction.

Furthermore, De La Rue's extensive intellectual property, including patents on security features, and its deeply entrenched customer relationships with central banks and governments, built over decades, create a formidable competitive advantage. The specialized expertise and talent needed in material science and secure design also act as significant deterrents, as replicating this knowledge base is both costly and lengthy.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront costs for specialized machinery and secure facilities. | Prohibitive for most potential competitors. |

| Regulatory & Certifications | Stringent government approvals and security clearances needed. | Lengthy and resource-intensive process, delaying market entry. |

| Intellectual Property | Patented security features and proprietary manufacturing techniques. | Difficult and expensive to replicate, hindering technological parity. |

| Customer Relationships | Long-standing trust and proven reliability with sovereign entities. | New entrants struggle to gain credibility and secure contracts. |

| Specialized Expertise | Deep knowledge in material science, secure design, and anti-counterfeiting. | Requires significant investment in talent acquisition and development. |

Porter's Five Forces Analysis Data Sources

Our De La Rue Porter's Five Forces analysis is built upon a foundation of comprehensive data, including De La Rue's annual reports, investor presentations, and public financial filings. We supplement this with industry-specific market research reports and analyses from reputable financial institutions to capture the broader competitive landscape.