De La Rue Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

De La Rue Bundle

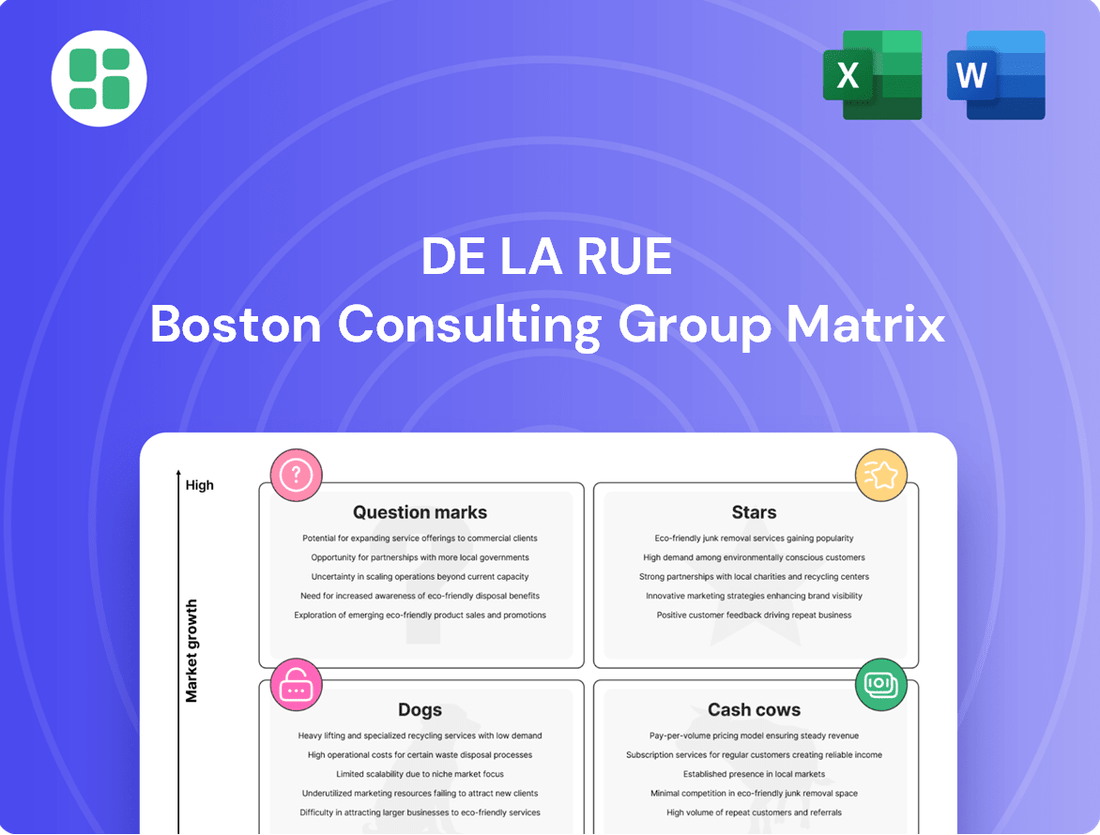

Unlock the strategic potential of De La Rue's product portfolio with a glimpse into its BCG Matrix. See how their offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth.

Don't miss out on the complete picture! Purchase the full BCG Matrix report to gain detailed quadrant placements, actionable insights, and a clear roadmap for optimizing De La Rue's market position and resource allocation.

Stars

De La Rue stands as a fully integrated provider of secure polymer banknote substrates, a segment experiencing robust growth within the global currency market. The demand for polymer banknotes is on the rise, driven by their enhanced durability and environmental benefits like recyclability. In 2024, the banknote market continues its upward trajectory, with polymer adoption being a key driver.

This growing preference for polymer is well-aligned with De La Rue's strategic positioning. The company possesses the operational flexibility to substantially scale up its polymer production capacity without requiring additional capital expenditure. This inherent advantage positions De La Rue to capitalize effectively on the expanding opportunities within this high-growth sector of the banknote industry.

The market for banknote security features is dynamic, constantly pushed by the need to defeat counterfeiters and maintain confidence in money. De La Rue is a leader in this space, using material science and innovative optical engineering to create cutting-edge security elements. This area is characterized by continuous innovation and strong demand for effective anti-counterfeiting solutions within a steadily growing banknote sector.

De La Rue's multi-year polymer banknote contracts are a significant driver of its current market position. These agreements have boosted the company's order book to an impressive £338 million as of November 2024, marking a five-year high. This sustained demand for polymer technology underscores its strong market acceptance.

These long-term contracts ensure consistent manufacturing activity for De La Rue, providing a stable revenue stream and securing production capacity for future fiscal periods. This is particularly valuable in the high-growth polymer banknote sector, where De La Rue has demonstrated clear leadership.

The substantial order book reflects a deep well of customer trust and De La Rue's established dominance in this specialized area of currency production. It signals a healthy pipeline of business that supports its strategic objectives.

Global Banknote Design & Consultancy

Global Banknote Design & Consultancy is a star in De La Rue's BCG Matrix. They are a top designer of banknotes for central banks globally, integrating the latest security features and visual appeal. This service, combined with their manufacturing, taps into the increasing need for fresh, secure currency designs.

De La Rue's banknote design services benefit from a strong global presence and deep-rooted relationships with issuing authorities. In 2024, the company continued to secure significant design contracts, underscoring their leadership in this niche market. The demand for advanced security elements in banknotes, driven by concerns over counterfeiting, fuels the growth of this segment.

- Market Leadership: De La Rue is a primary provider of banknote design services to over 150 countries.

- Innovation Focus: The company invests heavily in R&D for new security features, such as advanced holographic elements and tactile printing techniques.

- Growth Driver: Increasing global demand for secure and aesthetically pleasing currency designs supports the star positioning.

- Revenue Contribution: Design services are a key component of De La Rue's overall revenue, contributing significantly to their profitability.

Strategic Investment in Currency Division

De La Rue is strategically channeling significant investment into its Currency division, a move poised to unlock substantial growth. The company is projecting robust double-digit increases in Currency EBITDA for FY26, driven by the conversion of new orders into revenue. This concentrated investment in their core operations, encompassing polymer and advanced security features, is designed to leverage a strengthening market and reinforce their leading market standing.

The company's outlook for its Currency business indicates a readiness for a significant uplift in activity. This strategic focus is underpinned by several key factors:

- Anticipated Double-Digit EBITDA Growth: De La Rue expects its Currency division to achieve strong double-digit EBITDA growth in FY26.

- New Order Conversion: This growth is directly linked to new orders that are expected to translate into sales.

- Focus on Core Business: Investment is concentrated on polymer and advanced security, areas of core strength.

- Improving Market Environment: The strategy capitalizes on a favorable shift in the overall market for currency solutions.

De La Rue's banknote design and consultancy services are a clear star within its BCG matrix. This segment benefits from high market growth and De La Rue's strong competitive position, consistently securing new contracts and driving innovation in security features. The company's extensive experience and global reach solidify its leadership in this area.

The design and consultancy arm is a significant revenue contributor, bolstered by the increasing global demand for secure and visually appealing currency. De La Rue's ability to integrate cutting-edge security elements into banknote designs keeps it at the forefront of the industry.

This segment is characterized by continuous R&D investment, ensuring De La Rue remains a preferred partner for central banks worldwide seeking to enhance their currency's security and aesthetic appeal. The company's market leadership is evident in its extensive client base and ongoing success in winning design tenders.

The strong performance of this segment is further evidenced by its role in securing De La Rue's substantial order book. It represents a key area of expertise that supports the company's overall strategic growth objectives in the currency market.

| Segment | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Banknote Design & Consultancy | High | High | Star |

What is included in the product

The De La Rue BCG Matrix categorizes business units by market share and growth, guiding strategic decisions.

De La Rue BCG Matrix offers a clear, one-page overview to pinpoint underperforming units, easing the pain of resource misallocation.

Cash Cows

De La Rue's traditional paper banknote production is a classic cash cow. As the globe's largest commercial printer, they supply over half of the world's issuing authorities. This means a consistent demand for their paper currency, even as newer materials emerge.

While polymer banknotes are gaining traction, paper still dominates a large chunk of global currency. This mature market offers a stable, predictable revenue stream, contributing reliably to De La Rue's bottom line. Think of it as a dependable income source that keeps the lights on.

De La Rue's established client relationships, particularly with governments and central banks in 140 countries, represent a significant Cash Cow. These deep, trusted partnerships, cultivated over 200 years, translate into consistent, recurring contracts for banknote supply and related services.

This stability provides De La Rue with a predictable and reliable cash flow, a hallmark of a Cash Cow. The mature nature of these relationships means less need for substantial promotional spending, further solidifying their position as a low-maintenance, high-return business segment.

De La Rue has significantly boosted its operational efficiency in banknote manufacturing, a key factor in its Cash Cow status. By streamlining processes and enhancing flexibility, the company has emerged stronger from difficult trading periods. This focus on efficiency directly supports its high profit margins on currency products, even within a mature market where growth is limited.

The company's commitment to cost control in its manufacturing operations is crucial for generating robust cash flow. For example, in the fiscal year ending March 2024, De La Rue reported an adjusted operating profit of £52 million, demonstrating the effectiveness of these efficiency drives in maintaining profitability from its established currency business.

Secure Features for Existing Banknotes

De La Rue’s Secure Features for Existing Banknotes segment functions as a cash cow within its Business BCG Matrix. This area leverages the company's established expertise in security printing to provide ongoing upgrades and enhancements to currently circulating currency. The persistent threat of counterfeiting necessitates continuous innovation in security features, ensuring a steady demand for De La Rue's solutions.

This segment capitalizes on the enduring relevance of physical cash, even in an increasingly digital world. By offering advanced security elements like sophisticated inks, holograms, and unique identifiers, De La Rue helps central banks maintain the integrity of their national currencies. This translates into a predictable and stable revenue stream, as existing contracts are often renewed and expanded to incorporate the latest anti-counterfeiting technologies. For instance, in fiscal year 2024, De La Rue reported significant contributions from its currency business, which includes these security feature upgrades, underscoring the segment's consistent performance.

- Ongoing Revenue: De La Rue's established relationships with central banks worldwide create a consistent demand for security feature upgrades on existing banknotes.

- Counterfeiting Deterrence: The continuous need to combat sophisticated counterfeiting ensures a perpetual market for advanced security solutions.

- Stable Cash Flow: The longevity of physical currency and the recurring nature of security updates contribute to a reliable and predictable revenue stream.

- Technological Expertise: De La Rue's deep knowledge in security printing technologies allows them to offer cutting-edge features that maintain currency integrity.

Leveraging Global Infrastructure

De La Rue's extensive global infrastructure, spanning five continents, is a critical asset for its currency business, enabling efficient service to a worldwide customer base. This established network significantly reduces operational costs and maximizes the reach of its mature banknote printing operations, reinforcing its position as a Cash Cow.

- Global Reach: Operations across five continents.

- Cost Efficiency: Reduced operational costs due to existing infrastructure.

- Market Penetration: Maximized reach for mature banknote printing.

- Consistent Cash Flow: Global presence supports steady cash generation.

De La Rue's currency business, particularly its established banknote printing operations, functions as a classic cash cow. The company's position as the world's largest commercial printer, supplying over half of the globe's issuing authorities, ensures a consistent demand for paper currency, even as polymer gains traction. This mature market provides a stable and predictable revenue stream, contributing reliably to De La Rue's financial performance.

The company's deep-rooted relationships with governments and central banks in 140 countries, cultivated over two centuries, translate into recurring contracts for banknote supply and security features. These trusted partnerships offer a predictable cash flow, characteristic of a cash cow, with less need for extensive promotional spending, thereby maintaining high profit margins.

De La Rue's focus on operational efficiency and cost control in manufacturing further bolsters its cash cow status. For instance, in fiscal year 2024, the company reported an adjusted operating profit of £52 million, highlighting the effectiveness of these drives in generating robust cash flow from its currency segment.

The Secure Features for Existing Banknotes segment also acts as a cash cow, leveraging De La Rue's expertise to provide ongoing upgrades against counterfeiting. This segment benefits from the persistent need for currency integrity, ensuring a steady demand for advanced security solutions like sophisticated inks and holograms, contributing to consistent revenue.

| Segment | BCG Category | Description | FY24 Performance Indicator |

|---|---|---|---|

| Banknote Printing | Cash Cow | Mature market, consistent demand, stable revenue. | Supplies over 50% of issuing authorities globally. |

| Security Features | Cash Cow | Leverages expertise against counterfeiting, recurring contracts. | Contributes significantly to currency business revenue. |

| Global Infrastructure | Supports Cash Cow | Five continents, reduced operational costs, maximized reach. | Enables efficient global service for currency operations. |

What You’re Viewing Is Included

De La Rue BCG Matrix

The De La Rue BCG Matrix preview you see is the complete, unwatermarked document you will receive upon purchase. This strategic tool, meticulously designed for clarity and actionable insights, will be delivered directly to you, ready for immediate integration into your business planning. You are viewing the exact, professionally formatted report that will empower your decision-making processes, offering a comprehensive analysis of De La Rue's product portfolio. Invest with confidence, knowing you're acquiring a polished, ready-to-use strategic asset.

Dogs

De La Rue's Identity Solutions business, excluding the previously divested passport data pages, reported a nil adjusted operating result for fiscal year 2024. This indicates a lack of profitability and suggests very limited operational activity within this segment.

This financial outcome points to the Identity Solutions segment likely housing discontinued or significantly underperforming product lines. With minimal market share and poor growth prospects, these offerings are strong candidates for divestment or complete discontinuation.

Outdated security technologies, while perhaps once innovative, now represent a challenge for companies like De La Rue. As the security printing industry races forward, older methods of authentication or printing techniques can quickly lose their edge, becoming less effective against sophisticated counterfeiting attempts. These legacy systems often require continued maintenance and investment but struggle to generate substantial returns in a market demanding cutting-edge solutions.

De La Rue's non-core, non-strategic assets represent peripheral business activities outside its primary focus on currency and the recently divested Authentication segment. These might include smaller, legacy operations with limited market share in niche or declining sectors.

The company's ongoing strategic review, which aims to optimize intrinsic value, suggests a clear intention to divest these non-strategic holdings. For instance, in fiscal year 2024, De La Rue reported that its strategic review was progressing well, with a focus on streamlining its portfolio. This implies that assets not contributing significantly to its core currency business or future growth are candidates for divestment.

Underperforming Regional Contracts

Underperforming regional contracts represent a significant challenge for De La Rue, potentially acting as cash drains with limited future prospects. These could be specific projects or ongoing agreements where profitability is consistently low, or where operational hurdles prevent success. For instance, if De La Rue secured a contract for specialized security printing in a region with high political instability or complex regulatory environments, it might lead to cost overruns and delayed payments, impacting overall financial performance.

Such contracts, if not strategically aligned with De La Rue's core strengths in currency and identity solutions, would divert valuable resources from more promising areas. In 2024, De La Rue's focus on optimizing its operational efficiency and divesting non-core assets suggests a proactive approach to identifying and managing these underperformers. The company has been actively working to streamline its operations, which would inherently involve scrutinizing contracts that do not meet profitability or growth targets.

- Low Profitability: Contracts that consistently deliver profit margins below De La Rue's internal benchmarks, potentially due to intense price competition or unforeseen cost increases.

- Operational Inefficiencies: Regional operations hampered by logistical challenges, supply chain disruptions, or local labor issues that inflate costs and reduce output quality.

- Limited Growth Potential: Agreements in markets with stagnant demand for De La Rue's services or where competitive pressures restrict expansion opportunities.

- Resource Drain: Contracts requiring significant management attention and capital investment without generating commensurate returns, impacting the allocation of resources to high-growth areas.

Residual Cash Processing Solutions

Residual Cash Processing Solutions, within De La Rue's BCG Matrix, likely fall into the 'Dogs' category. While De La Rue has a strong heritage in currency manufacturing, the broader market for standalone physical cash processing solutions is facing headwinds in many developed economies. This is largely due to the accelerating adoption of digital payment methods, which is dampening growth prospects for traditional cash handling services.

For De La Rue, any cash processing operations that are not intrinsically linked to their core currency production or their now divested Authentication business could be viewed as Dogs. These segments might exhibit low market share in a low-growth or even declining market environment. For instance, reports from 2024 indicate that while cash usage remains significant in certain emerging markets, its overall share of transaction volumes in many advanced economies has seen a steady decline over the past decade, impacting the growth potential of pure cash processing services.

- Low Market Growth: The global trend towards digital payments is reducing the reliance on physical cash, leading to slower growth in the cash processing sector.

- Potential Low Market Share: If De La Rue's standalone cash processing solutions lack a dominant position, they are more likely to be classified as Dogs.

- Strategic Divestment Consideration: The divesting of the Authentication business suggests a strategic focus on core competencies, potentially leaving less integrated cash processing as non-core.

- Regional Variations: While some regions still show resilience in cash usage, the overall global trajectory points towards a contraction in the demand for traditional cash processing services.

Residual Cash Processing Solutions within De La Rue's portfolio likely represent 'Dogs' in the BCG Matrix. These operations are characterized by low market share in a low-growth or declining market, primarily due to the global shift towards digital payments. For example, data from 2024 shows a continued decline in cash transaction volumes in many developed economies, impacting the growth prospects of standalone cash processing services.

These segments might require ongoing investment for maintenance but offer limited returns, potentially draining resources from more profitable ventures. De La Rue's strategic review, aiming to streamline its portfolio and divest non-core assets, further supports the classification of such operations as Dogs.

The company's focus on core competencies, such as currency production, means that less integrated cash processing activities may be considered for divestment or discontinuation to optimize overall performance.

The inherent challenges in this segment include low market growth driven by digital adoption and the potential for De La Rue to lack a dominant market share in standalone cash processing.

Question Marks

Emerging digital currency security represents a potential high-growth area for De La Rue, particularly as central banks worldwide investigate Central Bank Digital Currencies (CBDCs). De La Rue's established capabilities in secure authentication and physical currency production could translate into valuable solutions for safeguarding digital transactions and identities within these new financial ecosystems. For instance, by mid-2024, over 130 countries were exploring or piloting CBDCs, highlighting the rapid expansion of this nascent market.

Even though De La Rue sold its authentication division, the broader brand protection software market is booming. Projections show this market growing significantly, with Compound Annual Growth Rates (CAGRs) estimated between 8.6% and a robust 18.89%. This indicates substantial opportunity for new entrants or innovative solutions.

If De La Rue were to re-enter this space by developing or acquiring new, specialized digital brand protection software, it would likely begin with a small market share. However, given the sector's strong growth trajectory, these new offerings would possess high potential for future expansion and market penetration.

De La Rue's advanced traceability and supply chain solutions represent a significant growth area, moving beyond traditional physical security. The global market for supply chain traceability software is projected to reach over $20 billion by 2027, driven by a strong demand to combat counterfeiting and ensure product authenticity.

Investing in standalone, cutting-edge software for digital traceability would position De La Rue in a high-growth segment where its current market presence is limited. This strategic move would necessitate substantial investment to develop proprietary technology and capture market share in a competitive landscape.

AI and Data Analytics in Security

AI and data analytics are revolutionizing the security sector, shifting it towards proactive threat management. This technological wave presents a significant opportunity for companies like De La Rue to innovate within their product portfolio.

De La Rue could capitalize on this trend by developing AI-powered solutions for authentication and the verification of security features. This aligns with a high-growth technological area where their current market presence might be nascent, indicating a need for substantial investment to establish a strong foothold.

- AI in Security Market Growth: The global AI in cybersecurity market was valued at approximately $19.8 billion in 2023 and is projected to reach $109.7 billion by 2030, showcasing a compound annual growth rate of 27.5%.

- De La Rue's Potential Investment: Entering this space would require significant R&D investment, potentially in the tens of millions of dollars, to develop sophisticated AI algorithms for anomaly detection and secure data processing.

- Authentication Technology Advancement: AI can enhance the accuracy and speed of verifying complex security features, such as those found on currency and secure documents, reducing counterfeiting risks.

- Data Analytics for Threat Intelligence: Leveraging data analytics allows for the identification of emerging threat patterns, enabling security solutions to adapt and respond more effectively.

Biometric Identity Solutions

Biometric identity solutions represent a burgeoning sector, extending far beyond the physical security of traditional documents. This market encompasses digital identity verification and secure access systems, experiencing robust growth. For a company like De La Rue, entering or expanding in this space would likely mean starting with a modest market share but with substantial potential for growth driven by strategic investment and innovation.

The global digital identity solutions market was valued at approximately USD 28.9 billion in 2023 and is projected to reach USD 71.7 billion by 2028, exhibiting a compound annual growth rate (CAGR) of 19.9% during the forecast period (2023-2028). This indicates a strong upward trend, presenting a significant opportunity for De La Rue to capture market share.

- Market Growth: The digital identity market is expanding rapidly, offering substantial revenue potential.

- Strategic Entry: De La Rue could leverage its existing security expertise to gain a foothold.

- Investment Needs: Significant investment in technology and talent will be crucial for success.

- Competitive Landscape: While competitive, early strategic moves can secure a strong position.

Question Marks represent opportunities for De La Rue that are currently uncertain but hold significant future potential. These areas require further investigation and strategic investment to determine their viability and market impact. For instance, exploring the integration of blockchain technology into secure document issuance could unlock new revenue streams, though the current market adoption is still developing.

The company's foray into advanced cybersecurity solutions, particularly those leveraging AI, falls into this category. While the AI in cybersecurity market is projected for substantial growth, reaching an estimated $109.7 billion by 2030 with a 27.5% CAGR, De La Rue's current market share in this specific niche is nascent. This necessitates a careful assessment of competitive advantages and a commitment to significant research and development, potentially in the tens of millions of dollars, to build robust capabilities.

Similarly, the burgeoning field of digital identity verification presents a Question Mark. The global digital identity solutions market was valued at approximately $28.9 billion in 2023 and is expected to grow to $71.7 billion by 2028, a CAGR of 19.9%. De La Rue's existing security expertise could be a foundation, but penetrating this competitive market would require substantial investment in new technologies and talent to establish a strong foothold.

The potential for De La Rue to develop or acquire specialized digital brand protection software also resides in the Question Mark quadrant. Despite the overall market's strong growth, with CAGRs estimated between 8.6% and 18.89%, De La Rue's re-entry would likely start with a small market share, making its future success dependent on innovation and strategic market positioning.

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, incorporating financial reports, industry analyses, and competitor performance metrics to provide a robust strategic overview.