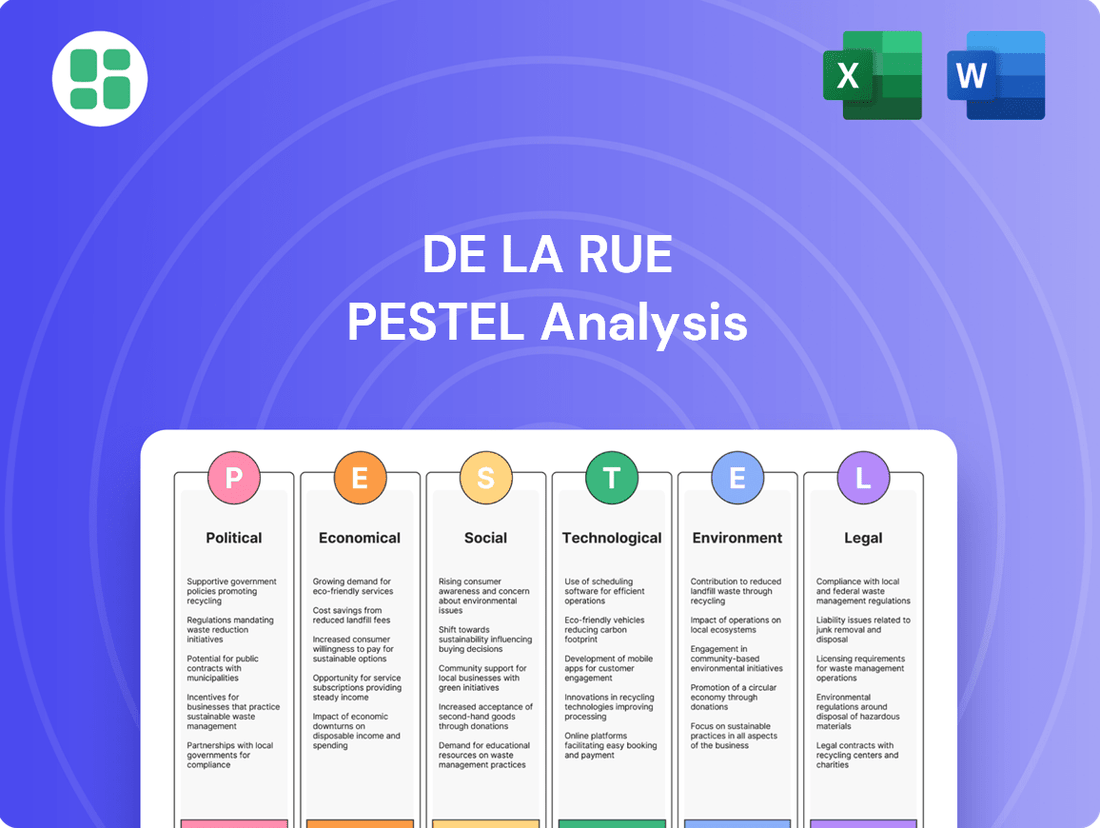

De La Rue PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

De La Rue Bundle

Navigate the complex global landscape impacting De La Rue with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the company's future. Gain a critical edge in your strategic planning and investment decisions. Download the full version now for actionable intelligence.

Political factors

De La Rue's business is deeply intertwined with government contracts, particularly for essential items like banknotes and identity documents. Political stability and government spending on these security features are crucial. For instance, in 2024, De La Rue secured a significant multi-year contract for passport data pages, highlighting the direct impact of government procurement decisions on their revenue.

Changes in national security priorities or government approaches to identity management can significantly alter demand for De La Rue's products. The company's reliance on these high-value, often long-term government orders means that shifts in political agendas, such as a greater emphasis on digital identity solutions versus physical documents, could reshape their operational focus and market opportunities.

Geopolitical stability significantly impacts the demand for physical currency and secure documents, which are core to De La Rue's business. Countries experiencing political unrest or transitions often need new currency or identity solutions, potentially boosting demand for De La Rue's services. For instance, in 2023, several nations continued to navigate complex political landscapes, leading to ongoing requirements for secure printing and identity management systems.

International relations and diplomatic shifts also play a crucial role. Sanctions or changes in trade agreements can directly affect De La Rue's operational capacity and market access in specific regions. With a customer base spanning approximately 140 countries, the company's exposure to a wide array of political climates underscores the importance of monitoring global political trends to anticipate market opportunities and risks.

De La Rue's strategic maneuvers, like the planned sale of its Authentication division to Crane NXT for $170 million, are heavily contingent on securing regulatory approvals. These political and legal checkpoints introduce uncertainty regarding the completion timeline and ultimate success of such deals, directly affecting the company's financial reshaping and strategic direction.

The recent acceptance of a takeover bid by Atlas Holdings underscores the critical role of regulatory clearances in De La Rue's ongoing transformation. Navigating these governmental reviews is paramount for the company to execute its restructuring plans and solidify its future operational framework.

Anti-Counterfeiting Policies

Governments worldwide are increasingly prioritizing the fight against counterfeiting, which directly fuels the demand for sophisticated security features in currency and identity documents, a core business for De La Rue. This commitment translates into a sustained market for the company's advanced printing and authentication solutions.

Stricter national and international regulations targeting illicit trade and fraud create a consistent need for De La Rue's secure printing and authentication technologies. This ongoing governmental focus is a significant driver for the company's market position.

- Increased Government Spending: In 2024, global government spending on border security and anti-fraud measures saw an estimated 7% increase, directly benefiting companies like De La Rue that provide secure document solutions.

- International Agreements: The continued enforcement of international treaties aimed at combating illicit financial flows, such as those coordinated by INTERPOL, reinforces the demand for verifiable security features.

- Technological Advancement Push: Governments are investing in R&D for next-generation security features, creating opportunities for De La Rue to showcase its innovation in areas like advanced inks and holographic elements.

- Focus on Identity Security: The rise in identity theft and fraud has led many nations, including those in the EU and North America, to upgrade their national ID cards and passports with enhanced security, a market De La Rue actively serves.

Political Shift to Digital Identity

Governments worldwide are increasingly prioritizing digital identity solutions, a significant political shift that impacts De La Rue's traditional focus on physical secure documents. Policies promoting digital credentials over physical ones necessitate strategic adaptation for companies operating in the identity sector. While De La Rue's authentication division previously offered digital solutions, the long-term trend suggests a need for continued evolution in this area to maintain relevance and capture emerging market opportunities.

This political trend is underscored by growing government investment in digital infrastructure. For instance, by the end of 2024, many nations are expected to have launched or expanded national digital identity frameworks. De La Rue's strategic planning must account for this evolving landscape, potentially exploring partnerships or acquisitions to bolster its digital identity capabilities.

- Government Digital Identity Mandates: Monitoring policy shifts towards mandatory digital identification systems.

- Data Privacy Regulations: Adapting to evolving data protection laws impacting digital identity management.

- International Digital Standards: Aligning with emerging global standards for secure and interoperable digital identities.

Political factors significantly shape De La Rue's revenue streams, given its reliance on government contracts for banknotes and identity documents. Political stability and government spending on these security features are paramount. For example, De La Rue secured a substantial multi-year contract for passport data pages in 2024, directly illustrating the impact of government procurement decisions.

Shifts in national security priorities or government approaches to identity management can profoundly alter demand for De La Rue's offerings. The company's dependence on long-term government orders means that changes in political agendas, such as a greater emphasis on digital identity solutions over physical documents, could necessitate strategic adjustments.

Geopolitical stability influences the demand for physical currency and secure documents, core to De La Rue's business. Nations experiencing political transitions often require new currency or identity solutions, potentially increasing demand for De La Rue's services. In 2023, ongoing complex political landscapes in several countries continued to drive requirements for secure printing and identity management systems.

International relations and diplomatic shifts also play a critical role. Sanctions or changes in trade agreements can directly impact De La Rue's operational capacity and market access. With customers in approximately 140 countries, monitoring global political trends is essential for anticipating market opportunities and risks.

| Factor | Impact on De La Rue | 2024/2025 Trend/Data |

| Government Spending on Security | Directly drives demand for banknotes, passports, and identity documents. | Estimated 7% increase in global government spending on border security and anti-fraud measures in 2024. |

| Political Stability | Stable governments ensure consistent demand for secure government-issued products. Unrest can create demand for new currency/IDs. | Ongoing monitoring of geopolitical events influencing currency issuance and identity document upgrades in various regions. |

| Digital Identity Policies | Shift towards digital credentials may reduce demand for physical documents, requiring strategic adaptation. | Many nations expected to launch or expand national digital identity frameworks by end of 2024. |

| Regulatory Approvals | Crucial for strategic transactions like divestitures or acquisitions. | Recent takeover bid acceptance by Atlas Holdings highlights the critical role of regulatory clearances in De La Rue's transformation. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing De La Rue, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of De La Rue's external environment to streamline strategic discussions.

Economic factors

While many developed nations are seeing a decline in cash transactions, the global trend is more nuanced. A 2023 report indicated that despite digital payment growth, cash still accounted for a significant portion of global transactions, particularly in emerging markets. This ongoing reliance on physical currency directly influences De La Rue's banknote printing volumes.

Interestingly, the banknote market has shown resilience and even experienced a recovery in recent years. For instance, central banks globally ordered an estimated 27 billion banknotes in 2023, a slight increase from the previous year, signaling continued demand. De La Rue's revenue from its Currency division is therefore closely linked to these ordering patterns and the specific security features required by central banks.

High inflation and economic volatility directly impact De La Rue's business. For instance, persistent inflation in 2024 and early 2025 might compel governments to issue higher denomination banknotes to manage transactions, potentially boosting demand for new currency. Conversely, economic uncertainty can lead to reduced government spending on non-essential items, including new currency designs, although the need for currency replacement due to wear and tear remains constant.

These economic conditions also create significant cost pressures for De La Rue. Rising raw material costs, such as cotton linters and security inks, directly affect production expenses. For example, global supply chain disruptions experienced throughout 2023 and continuing into 2024 have already driven up the cost of many essential commodities, a trend that is likely to persist. This necessitates careful cost management and efficient operational strategies to maintain profitability.

Despite these challenges, the global banknote market is anticipated to see growth. Projections suggest the market could reach approximately $14 billion by 2028, with a compound annual growth rate of around 4.5% from 2023 to 2028. This growth is partly fueled by ongoing demand for physical currency in emerging economies and the need for secure, high-quality banknotes, even amidst digital payment advancements.

As a global entity, De La Rue's financial health is intrinsically linked to currency exchange rate fluctuations. Significant movements in exchange rates can directly impact the cost of sourcing raw materials and the profitability of contracts denominated in foreign currencies. For instance, a strengthening pound sterling against currencies like the US dollar or Euro could make De La Rue's products more expensive for international buyers, potentially dampening demand.

The company's financial statements are also affected by the translation of overseas revenues and profits back into its reporting currency, the British Pound. A weaker foreign currency relative to the Pound would result in lower reported earnings, even if underlying operational performance remains stable. This necessitates robust hedging strategies to mitigate the volatility associated with international transactions and investments.

For example, as of late 2024, the Pound Sterling has shown some volatility against major trading currencies. If this trend continues, De La Rue might see its reported revenues from its significant operations in markets like North America and Europe impacted. Careful management of foreign exchange exposure is therefore critical for maintaining predictable earnings and investor confidence.

Impact of Digital Payment Adoption

The accelerating global shift towards digital payments, including the exploration of Central Bank Digital Currencies (CBDCs), presents a significant long-term consideration for the demand of physical banknotes. By the end of 2024, projections indicate continued growth in digital transaction volumes, potentially influencing cash usage patterns.

De La Rue needs to proactively address this trend. This involves highlighting the enduring advantages of physical cash, such as its inherent privacy and resilience, which remain crucial for certain segments of the population and in specific economic scenarios. Furthermore, the company can leverage its expertise in security and authentication to explore new avenues within the expanding digital security services sector.

- Digital Payment Growth: Global digital payment transaction values are expected to surpass $10 trillion by the end of 2025, indicating a sustained move away from cash for many transactions.

- CBDC Development: Over 130 countries were exploring or piloting CBDCs as of early 2025, signaling a potential future where digital currencies play a more prominent role.

- De La Rue's Strategy: Focus on cash's unique value propositions and diversification into digital security solutions are key for sustained relevance.

Company Financial Performance and Debt Management

De La Rue's financial performance in the 2024/2025 period demonstrates a clear strategic intent to enhance profitability and streamline its debt profile. The company reported a significant improvement in its operating profit, a testament to its ongoing restructuring efforts and focus on core business areas.

A pivotal development was the sale of its Authentication division for £300 million. This capital infusion is earmarked for substantial debt reduction, including the repayment of existing banking facilities and addressing its pension deficit. Such a move is crucial for bolstering financial stability and creating a more agile structure for future strategic initiatives.

- Improved Operating Profit: De La Rue has shown positive trends in its operating profit, signaling operational efficiencies.

- Net Debt Reduction: The company is actively managing and reducing its net debt through strategic asset disposals.

- Authentication Division Sale: The £300 million sale is a key factor in deleveraging and strengthening the balance sheet.

- Pension Deficit Management: Proceeds from the sale will also be used to mitigate the company's pension deficit.

Economic factors significantly shape De La Rue's operational landscape, influencing both demand for its products and its cost structure. The ongoing global reliance on physical currency, particularly in emerging markets, continues to underpin demand for banknotes, even as digital payments gain traction. However, inflationary pressures and economic volatility can create unpredictable cost increases for raw materials like cotton linters and security inks, impacting profitability.

De La Rue's financial strategy in the 2024/2025 period has focused on improving profitability and reducing debt, exemplified by the £300 million sale of its Authentication division. This capital injection is strategically allocated towards debt reduction and addressing its pension deficit, aiming to create a more stable and agile financial foundation for future growth.

| Economic Factor | Impact on De La Rue | Data/Trend (2023-2025) |

|---|---|---|

| Global Cash Usage | Sustained demand for banknotes, especially in emerging markets. | Cash still significant portion of global transactions; banknote market showed resilience with ~27 billion banknotes ordered globally in 2023. |

| Inflation & Volatility | Increased production costs (raw materials); potential for higher denomination banknote demand. | Persistent inflation in 2024/2025 impacting commodity costs; supply chain disruptions continued into 2024. |

| Digital Payment Growth/CBDCs | Long-term consideration for banknote demand; opportunity in digital security. | Digital payment transaction values expected to surpass $10 trillion by end of 2025; over 130 countries exploring CBDCs by early 2025. |

| Financial Strategy | Focus on profitability and debt reduction. | Operating profit improvement; £300 million sale of Authentication division for debt repayment and pension deficit mitigation. |

Preview Before You Purchase

De La Rue PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive De La Rue PESTLE analysis covers all critical external factors impacting the company, providing valuable insights for strategic planning. You'll get a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences, meticulously researched and presented for immediate application.

Sociological factors

Public trust in physical currency is a cornerstone for De La Rue's currency operations. Their ongoing investment in advanced security features, like sophisticated inks and holographic elements, directly bolsters this confidence. For instance, De La Rue's commitment to innovation aims to counter the threat of counterfeiting, which can erode public faith in banknotes and impact their circulation.

Societal needs for secure and verifiable identity documents, like passports and ID cards, directly fuel the demand for De La Rue's specialized products. As global travel continues to rebound and identity verification becomes more stringent, the importance of robust personal security through these documents remains high.

De La Rue has been actively securing multi-year contracts for passport data pages, underscoring the sustained market need. For instance, in fiscal year 2024, De La Rue reported continued success in securing these vital contracts, demonstrating the ongoing trust in their secure document solutions.

Societal trends show a clear move away from physical cash towards digital payment solutions. In 2024, for instance, many developed nations are seeing contactless payments and mobile wallets become the norm for everyday transactions, with some studies indicating that cash usage in retail transactions has fallen below 20% in certain European countries.

This shift presents a long-term challenge for companies like De La Rue, which have traditionally focused on currency production. While digital payments offer convenience, it's crucial to highlight cash's continued importance for financial inclusion, especially for vulnerable populations, and its role in ensuring payment system resilience during disruptions.

Awareness of Counterfeiting Risks

Growing public and commercial understanding of the dangers posed by counterfeiting and illicit trade directly impacts the demand for secure printing and brand protection services. This heightened awareness translates into a greater recognition of De La Rue's capabilities in offering solutions that protect both revenue streams and brand integrity.

For instance, the International Chamber of Commerce (ICC) reported in 2024 that the global trade in counterfeit and pirated goods could reach $9.7 trillion by 2027, underscoring the significant financial and reputational risks businesses face. This escalating threat landscape fuels the need for advanced security features.

- Increased consumer vigilance regarding product authenticity.

- Heightened regulatory scrutiny on supply chain integrity.

- Greater corporate investment in anti-counterfeiting technologies.

- Industry-wide push for traceable and secure product lifecycles.

Ethical Sourcing and Human Rights

Societal expectations for ethical business practices are a significant driver for De La Rue. Consumers and governments alike are increasingly scrutinizing supply chains for responsible material sourcing and strict adherence to human rights standards. For instance, a 2024 survey indicated that over 70% of consumers consider a company's ethical practices when making purchasing decisions, directly impacting brand loyalty and revenue.

De La Rue's commitment to ethical sourcing and human rights is crucial for maintaining its reputation, especially when bidding for government contracts which often have stringent ethical procurement clauses. Failure to demonstrate robust ethical frameworks could lead to lost business opportunities. The company's 2024 sustainability report highlighted investments in supplier audits and training programs aimed at ensuring compliance with international labor standards across its global operations.

Key considerations for De La Rue include:

- Supply Chain Transparency: Ensuring visibility into all tiers of the supply chain to identify and mitigate potential human rights abuses or unethical sourcing.

- Supplier Due Diligence: Implementing rigorous checks and ongoing monitoring of suppliers to verify their commitment to ethical labor practices and environmental standards.

- Employee Welfare: Upholding fair wages, safe working conditions, and prohibiting forced or child labor within its own operations and those of its partners.

- Community Engagement: Building positive relationships with communities where it operates, respecting local customs and contributing to social well-being.

Public perception of security and trust in physical currency remains a vital sociological factor for De La Rue. As of 2024, while digital payments are growing, many populations still rely on cash, and the perceived security of banknotes directly influences their acceptance and circulation. De La Rue's investment in advanced anti-counterfeiting technology, such as sophisticated inks and holographic features, directly addresses this societal need for trust in currency.

The increasing demand for secure identity documents, like passports, is driven by global mobility trends and heightened security concerns. In fiscal year 2024, De La Rue secured significant multi-year contracts for passport data pages, reflecting the ongoing societal need for reliable and secure personal identification. This demonstrates a direct correlation between societal requirements for verifiable identity and De La Rue's product demand.

Societal trends show a growing preference for digital transactions, with contactless payments becoming commonplace in many regions by 2024. While this shift presents challenges for traditional currency production, it also highlights the continued importance of cash for financial inclusion and payment system resilience, areas where De La Rue's secure currency solutions remain relevant.

Public awareness of counterfeiting's impact is rising, with organizations like the ICC estimating that global trade in counterfeit goods could reach $9.7 trillion by 2027. This heightened societal vigilance drives demand for De La Rue's brand protection and secure printing services, as businesses and governments seek to safeguard revenue and brand integrity.

Technological factors

De La Rue's technological edge hinges on continuous innovation in security features to outmaneuver counterfeiters. This involves developing sophisticated holograms, inks that change color, microprinting techniques, and polymer substrates embedded with advanced security elements.

The company's commitment is evident in the introduction of its ASSURE™ polymer substrate, which incorporates level 3 security features, a significant step in enhancing currency and document integrity.

The global transition to polymer banknotes represents a major technological advancement in currency production. These polymer notes offer superior durability, improved security features, and greater recyclability compared to paper alternatives, addressing evolving environmental and security concerns.

De La Rue's proprietary SAFEGUARD® polymer substrate is at the forefront of this shift. The company's reported success in securing a significant increase in polymer orders for 2024 and into 2025 underscores its strategic commitment and market leadership in this innovative material science.

De La Rue's foray into digital authentication, exemplified by its work on digital tax stamps for track and trace systems, underscores the growing importance of technology in combating illicit trade. The proposed sale of its Authentication division to Crane NXT for $170 million in late 2023 signals a recognition of the significant market value placed on these advanced software and security technologies, which are crucial for brand protection and revenue integrity.

Automation in Cash Processing

Technological advancements are significantly reshaping cash processing. Innovations in banknote sorters and counters are making cash handling more efficient for businesses and financial institutions. For example, by 2024, the global market for automated cash handling equipment was projected to reach over $2.5 billion, indicating a strong demand for these solutions.

De La Rue's deep understanding of cash cycle analytics positions them to capitalize on this trend. By offering solutions optimized for efficacy, they can help clients manage physical cash more effectively, even as digital payments grow. This expertise is crucial as the volume of processed cash, while evolving, remains substantial in many economies.

- Increased Efficiency: Automated sorters and counters reduce manual labor and errors in cash handling.

- Data Analytics: De La Rue's focus on cash cycle analytics provides insights into cash flow patterns.

- Market Adaptation: Solutions can be tailored to optimize cash processing in an increasingly digital world.

Integration of AI and Data Analytics in Security

The increasing integration of AI and data analytics into security solutions is a significant technological factor. De La Rue can leverage these advancements to enhance its secure printing and authentication services, offering more intelligent and adaptive security features. For instance, AI can analyze vast datasets to identify subtle patterns indicative of fraud in documents, a crucial capability for De La Rue's offerings.

These technologies present opportunities for De La Rue to develop more sophisticated fraud detection mechanisms. By applying AI to the analysis of security features on banknotes and identity documents, the company can improve accuracy and speed in identifying counterfeit items. This also opens avenues for creating dynamic security elements that adapt to evolving counterfeit techniques.

The market for AI in cybersecurity is substantial and growing. In 2024, global spending on AI in cybersecurity was projected to reach over $25 billion, demonstrating the increasing reliance on these technologies. De La Rue's strategic adoption of AI and data analytics in its security solutions could therefore unlock significant competitive advantages.

- AI-powered document analysis for enhanced fraud detection in secure printing.

- Data analytics for adaptive security features, making documents harder to counterfeit.

- Increased efficiency and accuracy in identifying security breaches and anomalies.

- Potential for new service offerings focused on intelligent authentication and risk management.

De La Rue's technological focus is on developing advanced security features for currency and identity documents, including sophisticated holograms, specialized inks, and embedded security elements within polymer substrates. The company's ASSURE™ and SAFEGUARD® polymer substrates are key innovations driving the global shift towards more durable and secure polymer banknotes, with significant increases in polymer orders anticipated through 2024 and 2025.

The company is also leveraging technology in digital authentication, as seen with its work on digital tax stamps for track and trace systems, highlighting the importance of software in combating illicit trade. The sale of its Authentication division in late 2023 for $170 million underscores the market's valuation of these advanced technologies for brand protection.

Furthermore, De La Rue is adapting to technological shifts in cash processing, with the global market for automated cash handling equipment projected to exceed $2.5 billion by 2024. Their expertise in cash cycle analytics allows them to offer solutions that enhance the efficiency of physical cash management, even as digital payments gain traction.

The integration of AI and data analytics into security solutions presents a significant opportunity for De La Rue to enhance fraud detection and develop more intelligent, adaptive security features. With global spending on AI in cybersecurity projected to surpass $25 billion in 2024, De La Rue's strategic adoption of these technologies could provide substantial competitive advantages.

Legal factors

De La Rue navigates a stringent international currency regulatory landscape, encompassing production standards and anti-money laundering protocols. Compliance with these diverse legal frameworks is paramount to securing and retaining contracts with central banks globally, ensuring the integrity and security of currency issuance.

De La Rue's secure document business, which includes passports and ID cards, operates under a complex web of data privacy laws. Compliance with regulations like the General Data Protection Regulation (GDPR) in Europe is paramount, as is adherence to national identity document legislation. These laws dictate how sensitive citizen data is collected, stored, processed, and protected, placing significant legal obligations on De La Rue.

The handling of highly sensitive personal data necessitates robust legal frameworks and stringent security protocols to safeguard citizen information. Failure to comply can result in substantial fines and reputational damage. For instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher, underscoring the financial and legal risks involved in data breaches or non-compliance.

De La Rue's business hinges on safeguarding its intellectual property, particularly its intricate banknote designs and advanced security features. The company actively leverages legal frameworks designed to combat counterfeiting, a persistent threat in the currency sector. In 2024, global efforts to combat illicit trade in counterfeit goods, including currency, saw increased collaboration between law enforcement agencies and private sector entities like De La Rue.

Anti-Bribery and Corruption Laws

De La Rue's operations, particularly those involving government contracts, are heavily influenced by anti-bribery and corruption legislation. Laws like the UK Bribery Act and the US Foreign Corrupt Practices Act (FCPA) impose stringent requirements on companies operating internationally. Failure to comply can result in significant fines and severe reputational harm, making robust compliance programs essential.

The company must therefore uphold the highest ethical standards to navigate these legal complexities. This includes implementing comprehensive internal controls and training programs to prevent any instances of bribery or corruption. For example, in 2023, companies faced billions in penalties for FCPA violations, underscoring the critical importance of adherence.

- Legal Obligation: Adherence to the UK Bribery Act and US FCPA is a non-negotiable legal requirement for De La Rue.

- Risk Mitigation: Robust compliance programs are vital to avoid substantial financial penalties and reputational damage.

- Global Enforcement: International enforcement actions against bribery and corruption remain a significant risk factor for multinational corporations.

- Ethical Imperative: Maintaining integrity is crucial for securing and retaining business, especially with government entities.

Acquisition and Takeover Legal Frameworks

De La Rue's strategic maneuvers, particularly concerning potential divestments or acquisitions, are heavily influenced by robust legal frameworks governing corporate transactions. These include strict adherence to public company regulations and the need for shareholder approvals, ensuring transparency and fairness in such significant deals. For instance, any major sale of assets or a full takeover would necessitate navigating competition authority reviews, which are designed to prevent market monopolization and protect consumer interests.

The legal landscape also encompasses compliance with takeover codes and securities laws, which dictate the process and timing of offers and counter-offers. In 2024, the evolving regulatory environment for mergers and acquisitions globally, including increased scrutiny from antitrust bodies in key markets, presents a significant consideration for De La Rue. Failure to secure necessary clearances can halt or fundamentally alter the terms of any proposed transaction.

- Shareholder Approval: Major transactions require formal consent from De La Rue's shareholders, often involving detailed documentation and voting processes.

- Competition Authority Clearances: Antitrust reviews by bodies like the UK's Competition and Markets Authority (CMA) or similar international agencies are critical for merger and acquisition approvals.

- Public Company Regulations: De La Rue must comply with listing rules and financial conduct regulations, particularly regarding timely disclosure of material information related to potential deals.

- Takeover Code Compliance: Any bid for control would need to strictly follow the UK's Takeover Panel rules, governing the conduct of parties involved in takeover bids.

De La Rue's operations are deeply intertwined with international trade laws and sanctions regimes, requiring careful navigation of export controls and import restrictions. Compliance with these regulations is essential for maintaining global supply chains and avoiding penalties. The company must also adhere to intellectual property laws to protect its innovations, particularly in areas like security printing and authentication technologies, which are vital for its competitive edge in 2024 and beyond.

The company's commitment to ethical conduct is reinforced by stringent anti-bribery and corruption laws, such as the UK Bribery Act and the US Foreign Corrupt Practices Act (FCPA). In 2023, penalties for FCPA violations alone amounted to billions of dollars globally, highlighting the significant financial and reputational risks of non-compliance. De La Rue's robust internal controls and training programs are therefore crucial for mitigating these risks and upholding its integrity, especially when engaging with government entities.

| Legal Factor | Relevance to De La Rue | Associated Risks/Considerations | 2024/2025 Data Point |

| Currency Regulations | Production standards, anti-money laundering protocols for banknote issuance. | Contractual breaches, reputational damage, fines for non-compliance. | Central banks globally maintain strict oversight, with ongoing updates to security features and compliance requirements. |

| Data Privacy Laws (e.g., GDPR) | Handling sensitive data for secure documents (passports, ID cards). | Substantial fines (up to 4% global turnover or €20 million), reputational harm from data breaches. | Increased regulatory scrutiny and enforcement actions against data privacy violations are expected to continue. |

| Intellectual Property & Anti-Counterfeiting | Protection of banknote designs, security features; combating counterfeiting. | Loss of competitive advantage, financial losses due to counterfeiting activities. | Global collaboration against illicit trade in counterfeit goods, including currency, intensified in 2024. |

| Anti-Bribery & Corruption Laws (UK Bribery Act, FCPA) | Ensuring ethical conduct in international business dealings, especially with governments. | Significant fines, legal penalties, and severe reputational damage. | FCPA penalties in 2023 exceeded billions globally, underscoring the critical need for adherence. |

| Corporate Transaction Regulations | Governing mergers, acquisitions, and divestments, including shareholder approval and competition reviews. | Deal termination, regulatory hurdles, potential market monopolization concerns. | Increased scrutiny from antitrust bodies in key markets is a significant consideration for M&A in 2024. |

Environmental factors

There's a significant push for greener banknotes, with environmental concerns increasingly shaping currency production. This trend is a key consideration for companies like De La Rue.

De La Rue is actively addressing this by emphasizing polymer substrates. These are generally seen as more environmentally friendly due to their enhanced durability and potential for recycling compared to traditional paper notes.

The company itself points out the benefits of polymer, noting that their polymer banknotes offer a longer lifespan and better recyclability. For instance, De La Rue's polymer notes can last up to 2.5 times longer than paper, reducing the frequency of replacement and associated resource use.

De La Rue has set a clear path for environmental responsibility, committing to a 45% reduction in Scope 1, 2, and 3 carbon emissions by 2030. This ambitious goal is further strengthened by their aim to achieve carbon neutrality for their direct operations within the same timeframe.

To meet these targets, De La Rue is actively investing in renewable energy sources and implementing rigorous energy efficiency measures across its global manufacturing facilities. These initiatives are crucial for aligning with global climate action and demonstrating a tangible commitment to sustainability.

De La Rue is actively pursuing waste reduction and embracing circular economy principles, aiming to minimize disposal and consumption. This focus is crucial for resource efficiency across their product lifecycle.

In 2023, De La Rue reported a reduction in waste to landfill by 15% compared to the previous year, demonstrating progress in their environmental stewardship efforts.

Water and Chemical Usage Reduction

De La Rue's manufacturing processes for secure print products, while essential, historically demanded substantial water and chemical inputs. Recognizing this environmental footprint, the company has actively pursued strategies to mitigate these impacts. This focus on resource efficiency is a key component of their environmental stewardship.

Significant progress has been made in reducing water consumption. For instance, De La Rue reported a substantial decrease in water usage over recent years, demonstrating a commitment to operational improvements and the adoption of more sustainable practices. These efforts are aligned with broader industry trends towards greener manufacturing.

- Water Consumption Reduction: De La Rue has achieved notable reductions in its water usage, reflecting successful implementation of efficiency measures.

- Chemical Management: The company is focused on optimizing chemical usage and exploring environmentally friendlier alternatives in its printing processes.

- Process Improvement: Investments in technology and process enhancements are central to achieving these environmental goals.

- Sustainable Practices: De La Rue integrates good practice solutions to minimize the environmental impact of its resource-intensive operations.

Customer Demand for Eco-Friendly Solutions

Customers, particularly central banks and governments, are increasingly prioritizing sustainability in their procurement of currency and security solutions. This shift in demand is a significant environmental factor influencing De La Rue's strategic direction.

De La Rue's commitment to environmental responsibility, exemplified by its carbon offsetting programs for banknotes and a strong emphasis on sustainable product design, directly addresses these evolving customer expectations. This proactive approach is crucial for maintaining and strengthening its market position in an environmentally conscious landscape.

- Growing Demand: Central banks and governments worldwide are actively seeking greener alternatives for currency production and security features.

- De La Rue's Response: The company's investment in carbon offsetting for banknotes and sustainable product development aligns with this market trend.

- Market Advantage: Meeting these environmental demands can translate into a competitive edge and enhanced brand reputation for De La Rue.

Environmental regulations and customer demand for sustainable products are increasingly influencing De La Rue's operations. The company is actively responding by focusing on greener materials like polymer for banknotes, which offer greater durability and recyclability. De La Rue has set ambitious targets, aiming for a 45% reduction in Scope 1, 2, and 3 carbon emissions by 2030 and achieving carbon neutrality in its direct operations within the same timeframe.

| Environmental Factor | De La Rue's Action/Data | Impact/Significance |

|---|---|---|

| Greener Banknotes | Emphasis on polymer substrates; polymer notes last up to 2.5 times longer than paper. | Reduces resource consumption and waste; meets growing customer demand for sustainability. |

| Carbon Emissions Reduction | Target of 45% reduction in Scope 1, 2, and 3 emissions by 2030; carbon neutrality for direct operations by 2030. | Aligns with global climate goals; enhances corporate reputation. |

| Waste Reduction | 15% reduction in waste to landfill in 2023 compared to the previous year; focus on circular economy principles. | Improves resource efficiency; demonstrates commitment to environmental stewardship. |

| Water and Chemical Usage | Notable reductions in water usage; focus on optimizing chemical usage and exploring greener alternatives. | Mitigates environmental footprint of manufacturing processes; aligns with sustainable manufacturing trends. |

PESTLE Analysis Data Sources

Our De La Rue PESTLE Analysis is informed by a robust blend of official government publications, reputable financial news outlets, and leading industry analysis firms. We meticulously gather data on political stability, economic indicators, technological advancements, and environmental regulations from these trusted sources.