Day & Zimmermann SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Day & Zimmermann Bundle

Day & Zimmermann's robust history in government contracting and diverse service offerings present significant strengths, but navigating evolving defense budgets and intense competition poses notable challenges.

Want to fully understand the strategic advantages and potential vulnerabilities that shape Day & Zimmermann's future? Purchase the complete SWOT analysis to unlock a comprehensive, research-backed report that will empower your strategic planning and investment decisions.

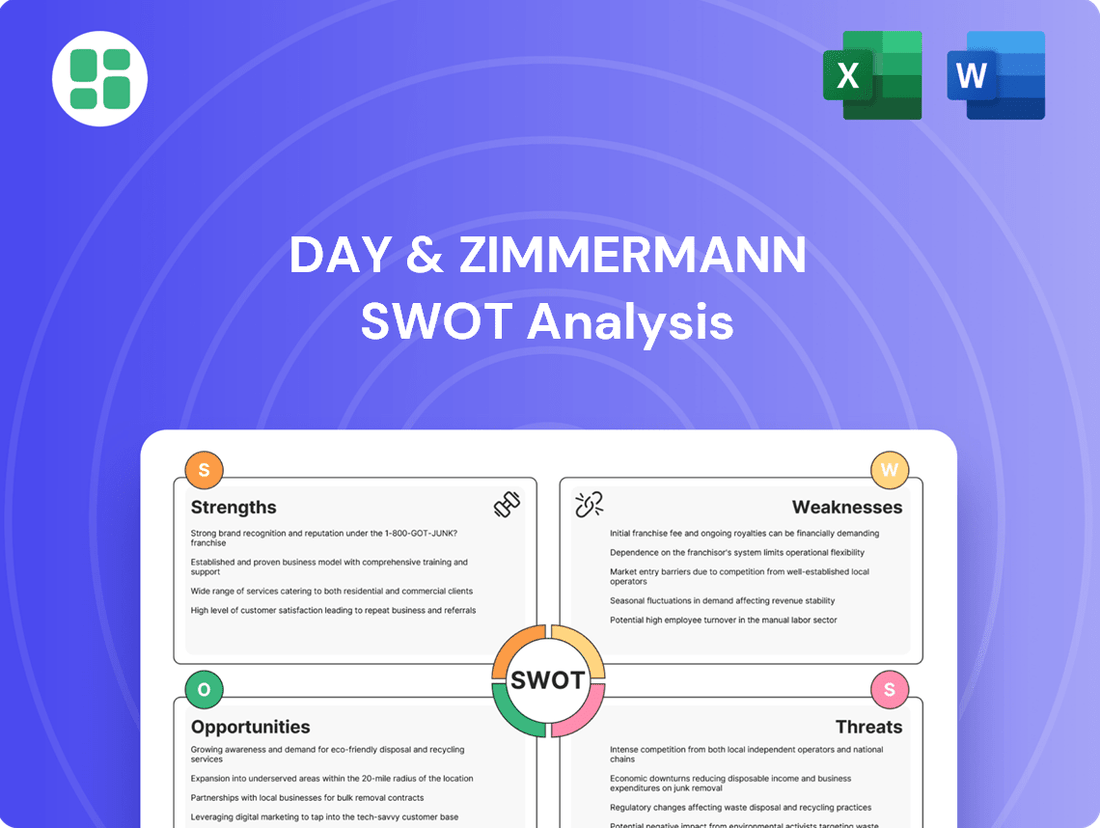

Strengths

Day & Zimmermann boasts a remarkably diverse service portfolio, encompassing engineering, construction, maintenance, staffing, and even munition production. This broad offering acts as a significant strength, insulating the company from downturns in any single sector and ensuring multiple avenues for revenue generation. For instance, in 2023, their government services segment, which includes munition production, saw continued robust demand, while their industrial services also performed well amidst infrastructure investment trends.

Day & Zimmermann's deep roots in the government and defense sector are a significant strength, particularly evident in their substantial munition production and related services. This engagement translates into a reliably strong revenue stream, often bolstered by high-value contracts.

The defense industry's inherent stability, characterized by long-term agreements and reduced sensitivity to typical commercial market swings, provides a robust foundation for the company's overall business. This sector demands and rewards specialized knowledge and rigorous adherence to security protocols.

For instance, in 2024, Day & Zimmermann was awarded a notable contract by the U.S. Army for the production of 155mm artillery shells, a testament to their ongoing critical role in national defense supply chains.

Day & Zimmermann possesses extensive technical expertise in complex engineering and construction, especially for critical infrastructure like power and industrial facilities. This deep knowledge allows them to tackle challenging projects effectively.

Their robust project management skills are a significant strength, ensuring projects stay on track and are delivered successfully. This capability is crucial for managing large-scale, intricate endeavors and fostering client confidence, leading to repeat business.

Critical Infrastructure Focus

Day & Zimmermann's strategic focus on critical infrastructure makes it an indispensable partner across vital sectors. By providing essential services for power generation, industrial operations, and defense, the company underpins national security and economic stability, fostering a consistent demand for its expertise.

This specialization offers inherent resilience, buffering the company against broader economic fluctuations. For instance, the energy sector, a key area for Day & Zimmermann, saw significant investment in grid modernization and renewable energy projects throughout 2024, indicating sustained activity. The defense sector also continues to be a strong driver, with ongoing government spending supporting long-term contracts.

- Essential Services: Supports power plants, industrial facilities, and defense, crucial for national security and economic continuity.

- Resilience: Less susceptible to economic downturns due to the non-discretionary nature of critical infrastructure services.

- Consistent Demand: Ongoing needs in energy, manufacturing, and defense ensure a stable revenue base.

Established Client Relationships and Reputation

Day & Zimmermann's established client relationships, cultivated over decades of service to government, commercial, and industrial sectors, are a significant strength. Their consistent delivery on complex workforce needs and project management excellence have fostered a strong reputation for reliability and quality. This enduring brand image is critical for securing new business and retaining their existing client base.

The company's long-standing presence, dating back to 1901, underpins its robust client network. For instance, in 2023, Day & Zimmermann reported a significant portion of its revenue derived from repeat business, a testament to client loyalty built on trust and performance. This deep well of client satisfaction directly translates into a competitive advantage.

Their reputation for navigating intricate government contracts, particularly within defense and infrastructure, is a key differentiator. Day & Zimmermann's ability to consistently meet stringent requirements and deliver on time has solidified their standing. This track record is invaluable when bidding for new, high-stakes projects, as seen in their continued success in securing multi-year agreements with major federal agencies.

Key aspects of their client relationship strength include:

- Long-term partnerships: Many clients have worked with Day & Zimmermann for over a decade, indicating high satisfaction and trust.

- Proven track record: Successful completion of numerous large-scale projects across diverse industries reinforces their reliability.

- Brand loyalty: A strong reputation for quality and service encourages repeat business and positive word-of-mouth referrals.

- Government sector expertise: Deep understanding and experience with government procurement processes facilitate strong relationships with public sector clients.

Day & Zimmermann's diverse service offerings, spanning engineering, construction, maintenance, staffing, and munition production, provide significant resilience. This broad operational scope shields the company from sector-specific downturns, ensuring multiple revenue streams. For example, their government services, including munition manufacturing, experienced strong demand in 2023, mirroring robust performance in their industrial services driven by infrastructure investments.

The company's deep expertise in complex engineering and construction for critical infrastructure, such as power and industrial facilities, is a key asset. This allows them to effectively manage and execute challenging, large-scale projects, fostering client trust and repeat business through consistent delivery.

Day & Zimmermann's strategic focus on essential services for power, industry, and defense makes it a vital partner. This specialization in critical infrastructure ensures consistent demand, as seen in 2024 energy sector investments in grid modernization and renewable energy, alongside sustained government spending in defense, underpinning their stable revenue base.

Their established client relationships, built over decades of reliable service in government, commercial, and industrial sectors, are a major strength. A significant portion of their 2023 revenue came from repeat business, highlighting client loyalty and confidence in their project management and workforce solutions.

| Strength Area | Description | Supporting Fact/Data |

|---|---|---|

| Diversified Services | Broad portfolio reduces reliance on any single market. | Robust performance in both government (munitions) and industrial services in 2023. |

| Critical Infrastructure Focus | Essential services ensure consistent demand. | Sustained activity in 2024 energy sector investments and ongoing defense spending. |

| Client Relationships | Long-term partnerships and repeat business. | Significant portion of 2023 revenue from repeat clients, indicating high satisfaction. |

| Technical Expertise | Proficiency in complex engineering and construction. | Ability to effectively manage large-scale projects across vital sectors. |

What is included in the product

Delivers a strategic overview of Day & Zimmermann’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and mitigating Day & Zimmermann's strategic challenges.

Weaknesses

Day & Zimmermann's substantial reliance on government contracts, especially within the defense sector, presents a notable weakness. A significant portion of their revenue is directly linked to these public sector agreements, making them vulnerable to shifts in government spending priorities and policy changes.

This dependency means that fluctuations in the political climate or budget allocations can directly impact the volume and profitability of their work. For instance, a decrease in defense spending, a common occurrence during periods of perceived peace or economic downturn, could significantly affect Day & Zimmermann's financial performance.

Day & Zimmermann's significant exposure to engineering, construction, and maintenance services for commercial and industrial clients makes it vulnerable to economic cycles. During economic downturns, businesses often cut back on capital expenditures, leading to fewer new projects and delayed maintenance work. This directly impacts Day & Zimmermann's revenue streams and profitability in these crucial sectors.

The staffing services sector and the construction/engineering markets are incredibly crowded. Day & Zimmermann faces significant competition from many established companies and emerging players, making it tough to stand out.

This intense rivalry often leads to price wars, squeezing profit margins. For instance, the global staffing market was valued at approximately $600 billion in 2023 and is projected to grow, but this growth attracts more competitors, intensifying pressure on Day & Zimmermann.

Attracting and keeping top talent is also a major challenge in these competitive landscapes. Companies need to constantly innovate their service offerings and nurture strong client connections to maintain a competitive edge against numerous rivals vying for the same business and skilled workers.

Labor-Intensive Operations and Skilled Workforce Challenges

Day & Zimmermann's reliance on hands-on services, particularly in areas like construction and maintenance, means a significant portion of its operations are labor-intensive. This inherent characteristic demands a substantial pool of skilled workers, posing a consistent challenge in attracting, developing, and retaining talent, especially within niche technical domains. For instance, the construction industry, a key sector for the company, faced an estimated shortage of over 500,000 skilled workers in the US in 2023, a trend that continued into 2024, directly impacting project timelines and cost management.

The increasing cost of labor and the ongoing scarcity of qualified professionals present a direct threat to Day & Zimmermann's project execution efficiency and overall profitability. This dynamic can lead to budget overruns and delays, particularly in large-scale projects where specialized expertise is critical. Data from the Bureau of Labor Statistics in early 2024 indicated that average hourly earnings for construction laborers rose by approximately 5% year-over-year, a cost pressure that directly affects companies like Day & Zimmermann.

- Labor Intensity: Core services in construction, maintenance, and staffing require significant human capital.

- Skilled Workforce Gap: Difficulty in recruiting and retaining specialized talent, especially in technical trades.

- Rising Labor Costs: Increased wages and benefits impact project budgets and margins.

- Potential Shortages: Ongoing scarcity of qualified professionals can hinder project delivery and growth.

Regulatory and Compliance Burdens

Day & Zimmermann's operations in defense, critical infrastructure, and other heavily regulated industries present a significant challenge. The company must navigate a complex web of safety, environmental, and government contracting rules. For instance, in 2023, the U.S. defense industry alone saw increased scrutiny on supply chain compliance, impacting companies like Day & Zimmermann.

Maintaining strict adherence to these regulations is not only costly but also resource-intensive. Failure to comply can result in severe consequences, including substantial fines, damage to the company's reputation, and the potential loss of vital contracts. This necessitates ongoing investment in compliance programs and personnel.

- Complex Regulatory Landscape: Operating in sectors like aerospace, defense, and energy demands constant vigilance regarding evolving safety and environmental standards.

- Cost of Compliance: Implementing and maintaining robust compliance systems represents a significant operational expense, impacting profitability.

- Risk of Non-Compliance: Penalties, contract termination, and reputational harm are ever-present threats for companies in these regulated fields.

- Government Contracting Rules: Adherence to specific procurement regulations and ethical standards is paramount for securing and retaining government business.

The company's heavy reliance on government contracts, particularly in defense, makes it susceptible to budget cuts and policy shifts. In 2023, defense spending faced increased scrutiny, impacting companies like Day & Zimmermann. This dependency creates revenue volatility.

Day & Zimmermann's labor-intensive nature, especially in construction and maintenance, faces a persistent shortage of skilled workers, a challenge noted in the US construction sector with over 500,000 fewer workers than needed in 2023. This scarcity drives up labor costs, with average hourly earnings for construction laborers rising approximately 5% year-over-year in early 2024, directly affecting project budgets and profitability.

The company operates in highly regulated industries, requiring significant investment in compliance with evolving safety, environmental, and government contracting rules. Failure to adhere can lead to severe penalties, contract loss, and reputational damage, as seen with increased supply chain compliance scrutiny in the U.S. defense industry in 2023.

| Weakness | Description | Impact | Supporting Data/Trend |

| Government Contract Reliance | Significant revenue tied to government agreements, especially defense. | Vulnerability to budget changes and policy shifts. | Increased scrutiny on U.S. defense spending in 2023. |

| Labor Intensity & Shortages | Operations require substantial skilled labor, facing recruitment challenges. | Project delays, cost overruns, and reduced efficiency. | US construction skilled labor shortage exceeded 500,000 in 2023; average construction laborer wages rose ~5% YoY in early 2024. |

| Regulatory Complexity | Operating in regulated sectors demands constant compliance. | High compliance costs, risk of penalties, and reputational damage. | Heightened supply chain compliance demands in the U.S. defense sector in 2023. |

Full Version Awaits

Day & Zimmermann SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The push for infrastructure renewal is a significant tailwind. In 2024, the U.S. government continued to allocate substantial funds towards infrastructure projects, with over $100 billion earmarked for grid modernization and transportation upgrades through various federal programs. This focus on upgrading aging power grids and industrial facilities directly aligns with Day & Zimmermann's core competencies in engineering, construction, and maintenance.

Day & Zimmermann is well-positioned to capitalize on this trend. Their proven track record in managing complex projects, particularly in the energy sector, makes them an attractive partner for government agencies and private entities undertaking these large-scale modernization efforts. The demand for reliable and efficient infrastructure is a necessity, not just an economic stimulus, creating a sustained opportunity for companies like Day & Zimmermann.

The global momentum towards renewable energy and sustainability presents a substantial growth opportunity. By 2024, the renewable energy sector is projected to see continued robust investment, with solar and wind power leading the charge. Day & Zimmermann's established expertise in engineering and construction can be strategically applied to develop and manage these critical infrastructure projects.

The company is well-positioned to assist industrial clients in their transition to greener operations, a trend increasingly driven by environmental regulations and corporate social responsibility initiatives. For instance, by 2025, many nations are expected to have stricter emissions standards, creating demand for sustainable solutions that Day & Zimmermann can provide.

Geopolitical tensions are driving significant increases in global defense budgets. For instance, NATO members committed to spending at least 2% of their GDP on defense, with many exceeding this target in 2024. Day & Zimmermann, as a key supplier to government defense initiatives, is well-positioned to benefit from this trend through increased demand for munitions, advanced weapons systems, and maintenance services.

Technological Advancements in Construction and Project Management

Embracing cutting-edge technologies like Building Information Modeling (BIM), predictive analytics, and automation offers significant opportunities for Day & Zimmermann. These advancements can dramatically boost efficiency, cut expenses, and elevate safety standards across construction and project management. For instance, the global construction technology market was valued at approximately $11.5 billion in 2023 and is projected to grow substantially, highlighting the demand for such innovations.

By strategically investing in these technological frontiers, Day & Zimmermann can solidify its competitive position. Streamlining operations through digital transformation allows for the delivery of more sophisticated and value-added solutions to clients, optimizing their entire service delivery chain. The adoption of advanced robotics alone is expected to reduce construction project costs by up to 15% in certain applications.

- Enhanced Efficiency: Implementing BIM can reduce design errors by up to 30% and construction time by 10-15%.

- Cost Reduction: Predictive analytics can help forecast and mitigate potential project delays and cost overruns, saving an estimated 5-10% on project budgets.

- Improved Safety: Automation and robotics can take over hazardous tasks, potentially reducing workplace accidents by up to 20%.

- Competitive Advantage: Early adoption of these technologies positions Day & Zimmermann as an industry leader, attracting clients seeking modern, data-driven project execution.

Strategic Acquisitions and Partnerships

Day & Zimmermann can strategically acquire smaller, specialized companies or forge partnerships to broaden its service portfolio and gain entry into new geographic or industry markets. This approach to inorganic growth is crucial for accelerating market penetration and enhancing overall capabilities. For instance, in 2024, the defense sector saw significant M&A activity, with companies like RTX acquiring SEAKR Engineering for $1.35 billion to bolster its space capabilities, demonstrating the value of such strategic moves.

These collaborations can also serve as a conduit for acquiring cutting-edge technologies or tapping into entirely new client segments, thereby solidifying market share in critical sectors. The aerospace and defense industry, a key area for Day & Zimmermann, continues to see substantial investment in technology, with a projected market size of over $1.2 trillion globally by 2025, offering ample opportunities for synergistic partnerships.

Key opportunities through strategic acquisitions and partnerships include:

- Expanding Service Offerings: Acquiring firms with complementary services, such as advanced cybersecurity or specialized engineering solutions, can create a more comprehensive value proposition for clients.

- Market Entry and Penetration: Partnerships with established players in emerging markets can provide immediate access and reduce the risks associated with organic market entry.

- Technology and Expertise Acquisition: Buying or partnering with innovative startups can bring in new technologies and specialized knowledge, keeping Day & Zimmermann at the forefront of industry advancements.

- Consolidating Market Share: Acquiring competitors or companies with strong regional presence can lead to increased market dominance and operational efficiencies.

Day & Zimmermann is positioned to benefit from increased global defense spending, with NATO members committing to at least 2% of GDP on defense in 2024, driving demand for their munitions and advanced weapons systems. The company can also leverage technological advancements like BIM and predictive analytics, which are projected to significantly boost efficiency and reduce costs in the construction sector, a market valued at $11.5 billion in 2023. Furthermore, strategic acquisitions and partnerships, exemplified by RTX's $1.35 billion acquisition of SEAKR Engineering in 2024, offer avenues for expanding service offerings and market reach within the growing aerospace and defense industry, which is projected to exceed $1.2 trillion by 2025.

| Opportunity Area | Key Drivers | 2024/2025 Data Points |

|---|---|---|

| Infrastructure Renewal | Government funding for upgrades | Over $100 billion allocated for U.S. infrastructure (2024) |

| Renewable Energy Transition | Demand for sustainable solutions | Robust investment in solar and wind power |

| Defense Budget Increases | Geopolitical tensions | NATO spending at least 2% of GDP on defense (2024) |

| Technology Adoption | Efficiency and cost reduction needs | Construction tech market valued at $11.5 billion (2023) |

| Strategic Growth (M&A/Partnerships) | Market expansion and capability enhancement | Aerospace & Defense market projected over $1.2 trillion by 2025 |

Threats

A significant economic downturn or extended period of sluggish growth presents a substantial threat to Day & Zimmermann. Such conditions often compel commercial and industrial clients to scale back their capital expenditures. This directly impacts the demand for the company's core services, including construction, engineering, and maintenance.

When businesses face economic uncertainty, they tend to postpone or cancel major projects. This can lead to a direct reduction in Day & Zimmermann's revenue streams, particularly in sectors heavily reliant on new infrastructure development or facility upgrades. For instance, if industrial clients cut their planned spending by 10-15% due to recessionary fears, as seen in some sectors during the 2008 financial crisis, it would significantly affect Day & Zimmermann's project pipeline.

Day & Zimmermann faces significant threats from a crowded marketplace. Established players and emerging companies in engineering, construction, staffing, and defense create a highly competitive environment. This can drive down prices as clients seek the most cost-effective solutions.

The pressure to lower prices to win bids, particularly for more standardized services, could squeeze Day & Zimmermann's profit margins. This dynamic makes it challenging to maintain profitability and secure new business, impacting overall financial health.

Global supply chain vulnerabilities, exacerbated by geopolitical events and ongoing inflationary pressures, present a significant threat to Day & Zimmermann. These factors can lead to unpredictable disruptions and sharp swings in the cost of essential raw materials and equipment. For instance, the global semiconductor shortage, which continued to impact various industries through early 2024, demonstrated how geopolitical tensions can ripple through supply chains, affecting lead times and pricing for critical components.

This volatility directly impacts Day & Zimmermann's ability to accurately bid on projects and maintain profitability. Unexpected increases in material costs, potentially reaching double-digit percentages for certain commodities as seen in some sectors during 2023-2024, can erode profit margins or necessitate costly project delays. The difficulty in forecasting these fluctuations makes long-term project planning and budget adherence a considerable challenge.

Skilled Labor Shortages and Wage Inflation

Day & Zimmermann, operating in sectors like construction and specialized engineering, faces a significant threat from skilled labor shortages. The demand for experienced professionals in these fields often outstrips supply, a trend exacerbated by an aging workforce and fewer new entrants. For instance, the U.S. Bureau of Labor Statistics projected a 5% growth in construction jobs between 2022 and 2032, requiring many new skilled workers.

This scarcity directly fuels wage inflation. As companies compete for a limited pool of talent, salaries and benefits are driven upward, increasing Day & Zimmermann's operational costs. This wage pressure can impact project profitability and make it harder to offer competitive pricing. Indeed, average hourly wages for construction laborers saw an approximate 4.5% increase in 2023, according to industry reports.

The difficulty in attracting and retaining qualified personnel poses a substantial risk to Day & Zimmermann's capacity to undertake and complete projects efficiently. A lack of skilled workers can lead to project delays, increased rework, and a diminished ability to scale operations to meet client demands. This challenge directly affects their competitiveness in securing new contracts and maintaining project timelines.

- Skilled Labor Scarcity: Industries like construction and engineering are experiencing a deficit in qualified workers.

- Wage Inflationary Pressure: Competition for limited talent is driving up labor costs, impacting operational budgets.

- Capacity and Competitiveness Risk: Difficulty in hiring and retaining staff threatens project delivery and market position.

- Project Delivery Impact: Shortages can lead to delays, increased costs, and reduced ability to meet client needs.

Changes in Government Regulations and Funding Priorities

Sudden shifts in government regulations, particularly those impacting environmental standards or defense procurement, pose a significant threat to Day & Zimmermann. For instance, changes in environmental compliance could necessitate substantial capital expenditures to upgrade facilities, directly impacting profitability.

Furthermore, alterations in defense spending priorities by major governments, such as the United States Department of Defense, could lead to a reduction in contract awards for services and manufacturing that Day & Zimmermann provides. The company's reliance on government contracts means that shifts in funding allocations, driven by geopolitical events or domestic policy changes, can directly affect revenue streams.

The ongoing geopolitical landscape and evolving policy frameworks create an environment of political uncertainty. This uncertainty can make long-term strategic planning challenging, as future contract opportunities and regulatory landscapes remain fluid.

- Regulatory Impact: New environmental regulations, if enacted, could increase operational costs for Day & Zimmermann's manufacturing and infrastructure divisions.

- Defense Budget Fluctuations: A projected decrease in the U.S. defense budget for FY2025, if realized, could reduce available contract opportunities for defense-related services.

- Policy Uncertainty: Evolving trade policies or sanctions could impact Day & Zimmermann's supply chain and international project viability.

Day & Zimmermann faces threats from intense competition, potentially leading to price wars and squeezed profit margins, especially in standardized service offerings. Economic downturns also pose a risk, as clients may cut back on capital expenditures, directly impacting demand for the company's services like construction and engineering. For example, a 10% reduction in client capital spending, observed in some sectors during economic slowdowns, could significantly affect Day & Zimmermann's project pipeline.

Supply chain disruptions, fueled by geopolitical instability and inflation, present ongoing challenges. These can cause unpredictable cost increases for materials and equipment, impacting project bidding accuracy and profitability. For instance, the volatility in steel prices, which saw fluctuations of up to 15% in certain periods of 2023-2024, directly affects construction project costs.

Skilled labor shortages are a persistent threat, driving up wages and increasing operational costs. This scarcity can hinder the company's ability to scale operations and meet project demands, potentially leading to delays and reduced competitiveness. Reports from early 2024 indicated a 5% year-over-year increase in average wages for skilled trades in the construction sector.

Changes in government regulations and defense spending priorities can also impact Day & Zimmermann. New environmental compliance rules might require significant investment, while shifts in defense budgets could reduce contract opportunities. For instance, a potential 5% reduction in the U.S. defense budget for FY2025, as debated, could affect revenue streams for defense-related services.

SWOT Analysis Data Sources

This Day & Zimmermann SWOT analysis draws from a robust blend of public financial reports, comprehensive market intelligence, and expert industry commentary. These sources provide a well-rounded perspective on the company's internal capabilities and external environment.