Day & Zimmermann Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Day & Zimmermann Bundle

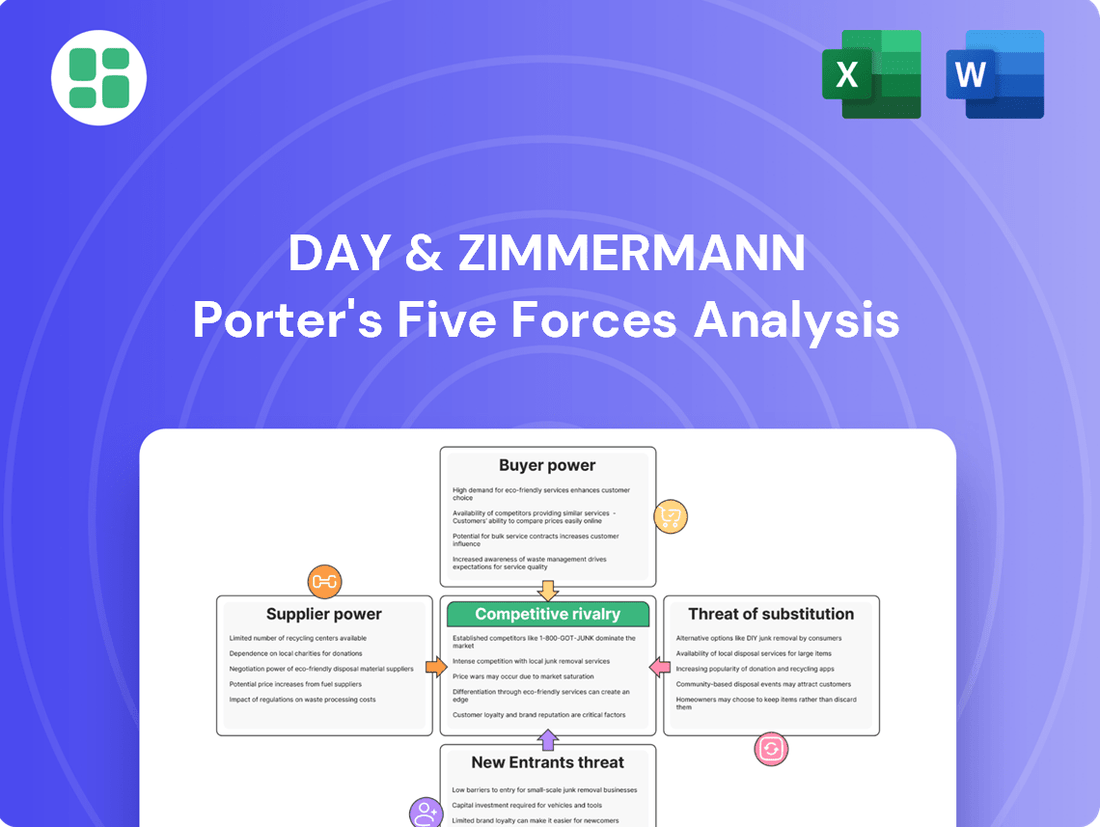

Day & Zimmermann navigates a complex landscape shaped by powerful industry forces, from the intense rivalry among existing players to the constant threat of new entrants. Understanding the bargaining power of both their suppliers and customers is crucial for their strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Day & Zimmermann’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Day & Zimmermann's munition production heavily depends on specialized materials like energetics and brass casings. The suppliers of these niche, high-quality components often wield considerable bargaining power due to limited alternatives, especially for defense-grade specifications.

In 2024, the defense sector has seen increased demand for these specialized materials, potentially strengthening supplier leverage. For instance, the global brass market, crucial for casings, experienced price volatility throughout 2023 and into early 2024, reflecting supply-demand dynamics and raw material costs.

Day & Zimmermann's reliance on skilled labor, such as engineers and specialized tradespeople, significantly influences its bargaining power. The company needs these professionals for its engineering, construction, and maintenance services.

The construction and engineering industries faced a significant talent deficit in 2024, with reports indicating hundreds of thousands of open positions each month. This scarcity empowers skilled workers and the labor agencies that source them, as their expertise becomes a critical and often scarce resource.

Proprietary technology and software providers hold significant bargaining power for Day & Zimmermann, especially as digital transformation accelerates. Companies relying on specialized project management software, AI platforms, or advanced cybersecurity solutions often face high switching costs. For instance, in 2024, the global market for enterprise resource planning (ERP) software, a critical component for many large organizations, was valued at over $50 billion, with specialized modules and custom integrations representing substantial investments.

Logistics and Transportation Providers

For a company like Day & Zimmermann, with its extensive global reach in sectors like defense and infrastructure, the bargaining power of logistics and transportation providers is a significant factor. Disruptions in the global supply chain, a recurring theme in recent years, can amplify the leverage of these service providers. For instance, the Suez Canal blockage in March 2021, which lasted for six days, caused an estimated $9.7 billion in lost trade per day, impacting countless industries and highlighting the vulnerability of global shipping routes.

The increasing complexity of international trade regulations and the demand for specialized transportation, especially for sensitive defense materials, further strengthen the position of logistics firms. As of early 2024, freight rates, while having eased from pandemic peaks, remain sensitive to fuel costs and geopolitical stability. For example, the Red Sea shipping crisis, beginning in late 2023, led to rerouting and increased transit times, pushing up costs for many businesses relying on global logistics.

- Increased Costs: Geopolitical instability and supply chain bottlenecks, such as those seen in 2023-2024, can drive up shipping rates by 10-20% or more for critical routes.

- Project Delays: Reliance on a limited number of specialized logistics providers for defense or infrastructure projects means any service disruption can directly impact project timelines and budgets.

- Limited Alternatives: In highly specialized logistics, such as transporting oversized components for infrastructure or secure military equipment, the number of qualified providers is often small, increasing their bargaining power.

Government Regulations and Compliance Services

Day & Zimmermann's operations within the government and defense sectors mean they navigate a landscape of intricate and ever-changing regulatory compliance. This necessity grants significant leverage to suppliers who provide essential compliance software, expert consulting, or auditing services. Without these specialized offerings, Day & Zimmermann would struggle to secure and retain valuable government contracts, underscoring the suppliers' bargaining power.

The demand for specialized compliance expertise is high, especially given the stringent requirements for government contracts. For instance, in 2024, the U.S. Department of Defense alone awarded billions in contracts, each subject to rigorous oversight and compliance mandates. Suppliers who can demonstrate a proven track record in navigating these complexities, such as those offering cybersecurity compliance solutions aligned with NIST or CMMC standards, are in a strong position.

- High Barrier to Entry for Suppliers: The specialized knowledge and certifications required to serve the government and defense sectors create a high barrier to entry for potential suppliers, limiting the pool of alternatives.

- Criticality of Services: Compliance services are not optional; they are fundamental to Day & Zimmermann's ability to operate and win business in its core markets.

- Supplier Specialization: Firms focusing on niche areas like export control compliance, ITAR, or specific defense manufacturing standards possess unique capabilities that are difficult for Day & Zimmermann to replicate internally.

- Regulatory Evolution: As regulations evolve, suppliers who proactively adapt and offer updated solutions gain an advantage, further solidifying their bargaining power.

Day & Zimmermann's reliance on specialized materials, skilled labor, and proprietary technology means suppliers in these areas hold significant bargaining power. This is amplified by market conditions like talent shortages and high demand for niche components, as seen in 2024. The company's need for compliance services in government contracting further strengthens the position of specialized providers.

The bargaining power of suppliers for Day & Zimmermann is influenced by several factors, including the specialization of their offerings and the criticality of these to the company's operations. For instance, suppliers of specialized defense-grade materials and compliance software providers often face limited competition, allowing them to command higher prices or more favorable terms. The talent deficit in skilled trades and engineering in 2024 also shifted leverage towards labor suppliers.

| Supplier Type | Key Factors Influencing Bargaining Power | 2024 Market Context |

|---|---|---|

| Specialized Material Suppliers (e.g., energetics, brass casings) | Limited alternatives, high quality/defense-grade specifications | Increased demand in defense sector, price volatility in brass market |

| Skilled Labor Providers (e.g., engineers, tradespeople) | Talent deficit, critical expertise for operations | Hundreds of thousands of open positions in construction/engineering |

| Proprietary Technology & Software Providers | High switching costs, essential for digital transformation | Global ERP software market over $50 billion |

| Logistics & Transportation Providers | Supply chain disruptions, specialized needs for sensitive materials | Red Sea crisis impacting freight rates and transit times |

| Compliance & Consulting Services | Regulatory complexity, stringent government contract requirements | Billions in defense contracts subject to rigorous oversight; demand for NIST/CMMC solutions |

What is included in the product

This analysis dissects the competitive forces impacting Day & Zimmermann, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its operating industries.

Instantly visualize competitive pressures with a dynamic, interactive five forces model, allowing for rapid assessment of market dynamics.

Customers Bargaining Power

The U.S. government, especially the Department of Defense, stands as a significant client for Day & Zimmermann's defense sector, particularly in munitions and specialized government services. This consolidated buyer wields considerable influence, frequently setting terms, pricing, and stringent compliance mandates through competitive solicitations and enduring agreements.

Day & Zimmermann's large industrial and commercial clients, particularly those in power and industrial plant sectors, possess considerable bargaining power. These clients often manage massive, multi-year projects, giving them leverage due to the sheer volume of business they represent.

The presence of numerous qualified service providers in the engineering, construction, and maintenance market further amplifies customer bargaining power. For instance, in 2024, the global power plant construction market was valued at approximately $250 billion, indicating a competitive landscape where clients can readily switch between providers if terms are not met.

These sophisticated buyers can effectively negotiate pricing, payment terms, and service level agreements by understanding project economics and the competitive dynamics within the industry. Their ability to influence project scope and demand customized solutions also contributes to their strong negotiating position.

Day & Zimmermann's customers often face significant price sensitivity, especially in sectors like construction and engineering where projects are typically awarded through competitive bidding processes. This means clients can readily compare proposals from multiple providers, leveraging that information to negotiate lower prices, particularly for services that aren't highly specialized. For instance, in 2024, the construction industry continued to grapple with rising material costs, pushing clients to scrutinize every bid more intensely to manage their project budgets effectively.

Criticality of Services and Long-Term Relationships

While customers often have significant bargaining power, the critical nature of services provided by companies like Day & Zimmermann can mitigate this. For instance, in sectors like nuclear plant maintenance or complex defense munitions supply, the need for absolute reliability and specialized expertise often outweighs a customer's ability to simply switch based on price. This is particularly true once a long-term relationship, built on trust and proven performance, is established.

The criticality of these services means that customers are less likely to prioritize cost alone when selecting a supplier. For example, a lapse in nuclear plant maintenance could have catastrophic consequences, making a proven track record and unwavering dependability paramount. Similarly, in defense, the failure of critical munitions is unacceptable, leading to a preference for established, trusted partners.

This dynamic fosters long-term, sticky client relationships. In 2024, the defense sector continued to see significant government investment, with the U.S. Department of Defense budget exceeding $886 billion, underscoring the importance of reliable suppliers for national security. Companies demonstrating consistent quality and deep technical understanding in these critical areas can leverage this to reduce customer bargaining power.

- Criticality Reduces Price Sensitivity: In sectors like nuclear energy and defense, the high stakes involved mean customers prioritize reliability and expertise over the lowest price.

- Long-Term Relationships Foster Stickiness: Established partnerships built on trust and proven performance in critical service areas make it difficult for customers to switch suppliers.

- Defense Spending Supports Reliability: With U.S. defense spending projected to remain robust in 2024 and beyond, companies providing essential munitions and support services benefit from this focus on dependable suppliers.

- Expertise as a Differentiator: Specialized knowledge and a history of successful execution in complex projects or sensitive operations become a significant competitive advantage, limiting customer leverage.

Availability of In-house Capabilities and Alternative Service Models

Customers, especially major corporations and government bodies, can bolster their bargaining power by developing or enhancing their internal engineering, construction, or staffing expertise. This reduces their reliance on external providers like Day & Zimmermann.

The increasing availability of flexible staffing solutions and advanced digital recruitment platforms offers customers more choices. This directly translates into a greater ability to negotiate terms or readily switch to competing service providers, thereby increasing customer bargaining power.

Consider the trend in the aerospace and defense sector, a key market for Day & Zimmermann. In 2024, many large aerospace manufacturers are investing in advanced manufacturing technologies and internal design capabilities, aiming to bring more core competencies in-house. For example, Boeing has been actively expanding its internal engineering and production capacity for certain components, reducing its need for external support in those specific areas.

- In-house Capability Development: Large customers may invest in proprietary technology or talent acquisition to perform services internally, reducing external dependency.

- Alternative Service Models: The growth of on-demand staffing platforms and specialized niche service providers offers customers more flexible and potentially cost-effective alternatives.

- Digital Transformation Impact: Digital recruitment and project management tools empower customers to source talent and manage projects with greater autonomy, increasing their leverage.

Day & Zimmermann's customers, particularly large industrial and government entities, possess significant bargaining power due to their substantial order volumes and the competitive nature of the markets they operate in. This leverage allows them to negotiate pricing, terms, and service specifications effectively.

The sheer scale of projects undertaken by clients in sectors like power generation and defense means Day & Zimmermann's business is heavily reliant on securing and retaining these accounts. For instance, the U.S. Department of Defense's budget for fiscal year 2024 exceeded $886 billion, highlighting the immense purchasing power concentrated within this single client base.

Furthermore, the availability of multiple qualified suppliers in many of Day & Zimmermann's service areas, such as engineering and construction, intensifies customer leverage. The global power plant construction market alone was valued around $250 billion in 2024, indicating a landscape where clients can readily compare and switch providers if terms are unfavorable.

Customers can also enhance their bargaining power by developing in-house capabilities or leveraging advancements in digital platforms for sourcing services, thereby reducing their dependence on external partners and increasing their negotiating strength.

| Customer Type | Leverage Factors | Impact on Day & Zimmermann |

| U.S. Government (Defense Sector) | Massive contract values, stringent compliance, sole-source opportunities for critical items | High reliance on government contracts, pricing influenced by solicitations and long-term agreements |

| Large Industrial Clients (Power & Industrial) | High volume of business, multi-year project commitments, price sensitivity | Significant revenue from these clients, pressure on margins due to competitive bidding |

| General Market Competition | Numerous qualified service providers, availability of alternative solutions | Need for competitive pricing and service differentiation to retain clients |

Same Document Delivered

Day & Zimmermann Porter's Five Forces Analysis

This preview showcases the comprehensive Day & Zimmermann Porter's Five Forces Analysis, presenting the exact document you will receive immediately after purchase. You'll gain immediate access to this professionally formatted analysis, detailing the competitive landscape for Day & Zimmermann without any surprises or placeholders. What you see here is the complete, ready-to-use file, providing actionable insights into the industry's forces.

Rivalry Among Competitors

Day & Zimmermann navigates a complex competitive environment due to its presence in multiple sectors like government services, defense, engineering, construction, and staffing. This diversity means rivalry varies significantly; for instance, the defense sector often features large, established prime contractors, while engineering and staffing markets tend to be more fragmented with numerous smaller players.

The government contracting arena is fiercely competitive, with companies like Day & Zimmermann vying for lucrative federal agreements. Success hinges on stringent compliance, a proven track record, and unique technical skills. For instance, in 2023, the U.S. federal government awarded over $7.4 trillion in contracts, highlighting the immense market size and the intensity of competition for these opportunities.

Talent acquisition and retention are fierce battlegrounds for Day & Zimmermann, directly influencing its competitive standing. The persistent scarcity of skilled professionals in crucial sectors like engineering, construction, and defense means companies are locked in a constant struggle for human capital. This intense competition for talent directly impacts a firm's ability to execute projects efficiently and manage its operational expenses.

In 2024, the demand for specialized engineers, particularly in aerospace and defense, remained exceptionally high, with some estimates suggesting a shortage of over 200,000 engineers in the US alone. This talent crunch forces companies like Day & Zimmermann to invest heavily in recruitment, competitive compensation packages, and robust employee development programs to attract and keep the best minds.

Innovation and Technology Adoption

Competitive rivalry in the defense and government services sector is increasingly fueled by the rapid adoption of cutting-edge technologies. Companies that successfully integrate innovations like artificial intelligence (AI), digital twins, and advanced analytics are poised to gain a substantial advantage.

These technological advancements enable the delivery of more efficient, safer, and higher-quality services. For instance, AI-powered recruitment platforms can streamline talent acquisition, while predictive maintenance solutions can significantly reduce downtime and operational costs for clients.

- AI in Recruitment: Companies leveraging AI for talent sourcing and screening can reduce time-to-hire by up to 50%, according to industry reports from 2024.

- Digital Twins for Operations: The use of digital twins in asset management and operational planning is projected to save businesses billions in maintenance and efficiency gains by 2025.

- Advanced Analytics for Efficiency: Predictive analytics are being deployed to optimize supply chains and project timelines, with some firms reporting a 15-20% improvement in project delivery efficiency in 2024.

Market Growth Rates and Consolidation

Day & Zimmermann operates in markets with diverse growth trajectories. For example, the defense sector saw a notable increase in government spending, with the US Department of Defense budget for fiscal year 2024 reaching $886 billion, indicating robust expansion. Conversely, certain segments of the staffing market, while recovering, might exhibit more moderate growth rates compared to historical peaks.

This uneven market growth directly impacts competitive rivalry. In high-growth areas like defense, firms are aggressively pursuing market share, intensifying competition. In more mature or recovering segments, consolidation trends can further heighten rivalry as companies seek economies of scale or strategic advantages through mergers and acquisitions.

- Defense Market Growth: US defense spending budget for FY2024 was $886 billion, signifying strong demand.

- Staffing Market Recovery: Certain staffing sectors are rebounding, but growth rates may vary.

- Consolidation Impact: Mergers and acquisitions in some sectors are reshaping competitive landscapes.

- Vying for Share: Firms are actively competing for dominance in both expanding and stable market segments.

Day & Zimmermann faces intense competition across its diverse business units, from large prime contractors in defense to numerous smaller firms in staffing and engineering. This rivalry is amplified by the ongoing race to adopt new technologies, where companies leveraging AI and advanced analytics gain a significant edge in efficiency and talent acquisition.

The battle for skilled talent is particularly fierce in 2024, with shortages in engineering and defense sectors driving up recruitment costs. Companies are investing heavily in compensation and development to secure essential human capital, directly impacting operational capabilities and cost structures.

Market growth disparities also shape competition; robust defense spending, exemplified by the $886 billion US defense budget for FY2024, fuels aggressive market share pursuits. Conversely, consolidation in more mature sectors intensifies rivalry as firms seek scale and strategic advantages through M&A.

| Sector | Competitive Intensity | Key Factors |

|---|---|---|

| Defense & Government Services | High | Large established players, technological innovation, government contract competition |

| Engineering & Construction | Moderate to High | Skilled labor availability, project complexity, regional competition |

| Staffing Services | High | Fragmented market, talent scarcity, price sensitivity |

SSubstitutes Threaten

For commercial and industrial clients, the ability to handle engineering, construction, and maintenance internally presents a direct substitute. This is especially relevant for less complex tasks or routine maintenance where clients might see cost savings or better control by managing these functions with their own staff. For example, many large industrial facilities maintain dedicated engineering and maintenance departments capable of handling a significant portion of their operational needs.

Customers looking for workforce solutions have many options beyond traditional staffing firms like Day & Zimmermann's Yoh Services. Direct hiring via online job boards, for instance, has become increasingly prevalent, allowing companies to manage their recruitment in-house.

The rise of the gig economy and freelance platforms presents another significant substitute. These platforms offer businesses greater flexibility and direct control over hiring for temporary or project-based needs, potentially bypassing the need for a staffing agency altogether. In 2024, the freelance economy continued its robust growth, with platforms reporting significant increases in both freelancer sign-ups and project postings.

The rise of modular construction and off-site fabrication presents a significant threat of substitutes to traditional on-site building methods. These innovative approaches, which allow for components to be built in controlled factory environments, are gaining traction due to their potential to accelerate project completion and lower overall costs. For instance, the global modular construction market was valued at approximately $101.2 billion in 2023 and is projected to reach $171.6 billion by 2030, indicating a substantial shift in demand that could impact companies relying solely on conventional construction.

Non-Lethal Alternatives and Diplomacy in Defense

The threat of substitutes for conventional munitions, like those produced by Day & Zimmermann, is growing. Non-lethal alternatives, such as advanced riot control agents or sophisticated surveillance technologies, can fulfill certain security objectives without resorting to lethal force. For instance, in 2023, global spending on cybersecurity, a form of non-kinetic defense, reached an estimated $200 billion, indicating a significant investment in alternative security measures.

Furthermore, diplomatic solutions and de-escalation strategies represent a significant substitute. A focus on international cooperation and conflict resolution can directly reduce the demand for military hardware. For example, a successful peace treaty in a major conflict zone, such as the ongoing efforts in Eastern Europe, could lead to substantial reductions in defense spending by participating nations, impacting the long-term market for munitions.

- Non-Lethal Alternatives: Increased development and adoption of non-lethal technologies in law enforcement and military operations.

- Diplomatic Solutions: A global shift towards de-escalation and conflict resolution, reducing the reliance on kinetic warfare.

- Geopolitical Strategy: Evolving defense doctrines prioritizing cyber, intelligence, and soft power over traditional armament.

- Market Impact: Potential reduction in long-term demand for conventional munitions if non-military interventions become more prevalent.

Digital Tools and Automation

The increasing sophistication of digital tools and automation, including AI, presents a significant threat of substitution for services traditionally offered by companies like Day & Zimmermann. These technologies can perform tasks that previously required human expertise, potentially reducing the demand for certain labor-intensive aspects of engineering and project management.

For instance, AI-powered predictive maintenance systems are emerging as a direct substitute for manual inspection routines, offering greater efficiency and accuracy. Similarly, advanced computer-aided design (CAD) and building information modeling (BIM) software can automate and streamline initial design phases, potentially lessening the reliance on traditional engineering support.

- AI in Predictive Maintenance: Companies are investing heavily in AI for asset management. For example, in 2024, the global AI in predictive maintenance market was valued at approximately $10.5 billion and is projected to grow significantly, indicating a strong trend towards automated inspection and upkeep.

- Automation in Design: Generative design software, powered by AI, can rapidly produce numerous design iterations based on specified parameters, potentially reducing the time and human resources needed in the early stages of engineering projects.

- Digital Twins: The adoption of digital twins, virtual replicas of physical assets, allows for simulation and analysis without direct physical intervention, further substituting for on-site diagnostic work.

The threat of substitutes for Day & Zimmermann's services is substantial, encompassing everything from in-house capabilities to emerging technologies. For instance, direct hiring through online job boards offers an alternative to staffing solutions, while the gig economy provides flexible, project-based labor.

Technological advancements also present significant substitutes. AI-powered predictive maintenance systems are replacing manual inspections, and advanced design software streamlines engineering processes. The global AI in predictive maintenance market was valued at approximately $10.5 billion in 2024, highlighting this trend.

| Substitute Area | Examples | Market Trend/Data Point (2024/Recent) |

|---|---|---|

| Workforce Solutions | Direct Hiring, Gig Economy Platforms | Gig economy platforms saw continued growth in project postings and freelancer sign-ups throughout 2024. |

| Engineering & Construction | Modular Construction, Off-site Fabrication | The modular construction market was valued at approximately $101.2 billion in 2023, with strong projected growth. |

| Defense & Munitions | Non-Lethal Alternatives, Diplomatic Solutions | Global spending on cybersecurity (a non-kinetic defense) reached an estimated $200 billion in 2023. |

| Operations & Maintenance | AI in Predictive Maintenance, Digital Twins | The AI in predictive maintenance market was valued at approximately $10.5 billion in 2024. |

Entrants Threaten

Entering the defense and nuclear services sectors requires immense capital outlays and navigating a labyrinth of regulations. For instance, establishing a new facility for munition production can easily cost hundreds of millions of dollars, not to mention the extensive time and resources needed for security clearances and quality assurance certifications.

These substantial hurdles, including rigorous government oversight and the need for specialized, highly skilled labor, effectively discourage most potential new entrants. The lengthy and costly process of obtaining necessary approvals and accreditations acts as a significant deterrent to anyone considering challenging established players like Day & Zimmermann.

Day & Zimmermann's deep-rooted relationships with government entities, particularly in defense, present a formidable barrier. For instance, their long-standing contracts with the U.S. Department of Defense, a significant portion of their revenue, are not easily transferable. New entrants would find it incredibly challenging to build the trust and operational track record necessary to secure such critical, long-term agreements, especially given the rigorous vetting processes involved.

The company's specialized technical expertise, honed over decades in sectors like munitions production and the management of complex industrial facilities, acts as another significant deterrent. For example, Day & Zimmermann's capabilities in areas such as nuclear-related services require highly specific certifications and a proven history of safety and reliability. Replicating this specialized knowledge and the associated regulatory compliance would demand substantial investment and time, making it difficult for newcomers to compete effectively.

In the realm of large-scale engineering, construction, and defense, established companies like Day & Zimmermann possess a formidable advantage due to significant economies of scale and a well-developed experience curve. This means they can spread their fixed costs over a larger output, leading to lower per-unit costs. For instance, in 2024, the global construction market was valued at approximately $13.4 trillion, with large, integrated firms often securing contracts that allow for greater purchasing power and operational efficiencies.

New companies entering this sector would confront substantial cost disadvantages. They would lack the established supply chains, bulk purchasing power, and optimized processes that seasoned players have cultivated over years, potentially decades. This steep learning curve not only impacts initial profitability but also the ability to compete on price and project execution timelines.

Brand Reputation and Proven Track Record

Day & Zimmermann's century-long history, marked by a proven track record in critical government and industrial sectors, cultivates a robust brand reputation. This deep-seated credibility makes it exceptionally difficult for new entrants to establish comparable trust, particularly in sensitive areas like defense and critical infrastructure.

The challenge for newcomers lies not only in matching service quality but also in overcoming the established reputational capital that Day & Zimmermann has meticulously built over decades. This acts as a significant barrier, deterring potential competitors who lack a similar history of reliability and performance.

- Established Trust: Day & Zimmermann’s long operational history fosters significant trust with its client base.

- High Switching Costs: For clients in critical sectors, the cost and risk associated with switching to an unproven new entrant are substantial.

- Regulatory Hurdles: New entrants face extensive vetting and qualification processes in sectors where Day & Zimmermann already holds necessary certifications.

Talent Scarcity and Workforce Development

Even if a new competitor had ample capital, securing the necessary talent would be a significant hurdle. Day & Zimmermann operates in sectors like engineering, construction, and defense, which demand highly specialized skills and often require security clearances.

The ongoing shortage of skilled professionals in these areas, a trend continuing into 2024, makes it exceptionally difficult for any new entrant to build a qualified workforce. For instance, the U.S. Bureau of Labor Statistics projects a need for over 300,000 additional construction laborers annually through 2032, highlighting the competitive landscape for talent.

- Talent Gap: Difficulty in finding enough engineers and skilled tradespeople.

- Security Clearances: A lengthy and complex process that new firms may struggle to navigate.

- Retention Challenges: Established companies like Day & Zimmermann often have strong retention programs, making it harder for new entrants to poach talent.

- Training Investment: New entrants would need substantial investment in training programs to develop the required expertise.

The threat of new entrants for Day & Zimmermann is significantly low due to immense capital requirements, stringent regulatory environments, and established relationships. For example, the defense sector demands extensive security clearances and proven performance histories, making it a high-barrier entry market. In 2024, the global defense spending was projected to exceed $2.2 trillion, underscoring the scale of investment and the entrenched nature of existing players.

Furthermore, Day & Zimmermann's deep-seated expertise in specialized areas like nuclear services and munitions production requires years of accumulated knowledge and certifications, which are difficult and time-consuming for newcomers to replicate. This technical moat, combined with substantial economies of scale in large projects, creates a formidable challenge for potential competitors seeking to enter these markets.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High initial investment for facilities, technology, and certifications. | Significant deterrent due to the scale of upfront costs. |

| Regulatory Hurdles | Extensive government approvals, security clearances, and compliance. | Lengthy and costly processes that favor established, compliant firms. |

| Brand Reputation & Trust | Decades of proven performance, especially with government clients. | New entrants struggle to build equivalent credibility and client loyalty. |

| Economies of Scale | Cost advantages from large-scale operations and purchasing power. | New entrants face higher per-unit costs and competitive pricing challenges. |

| Technical Expertise & Experience | Specialized knowledge and a track record in niche sectors. | Difficult for newcomers to match the skill sets and operational history. |

Porter's Five Forces Analysis Data Sources

Our Day & Zimmermann Porter's Five Forces analysis is built upon a foundation of comprehensive data, including company annual reports, investor presentations, and industry-specific market research from leading firms.