Day & Zimmermann PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Day & Zimmermann Bundle

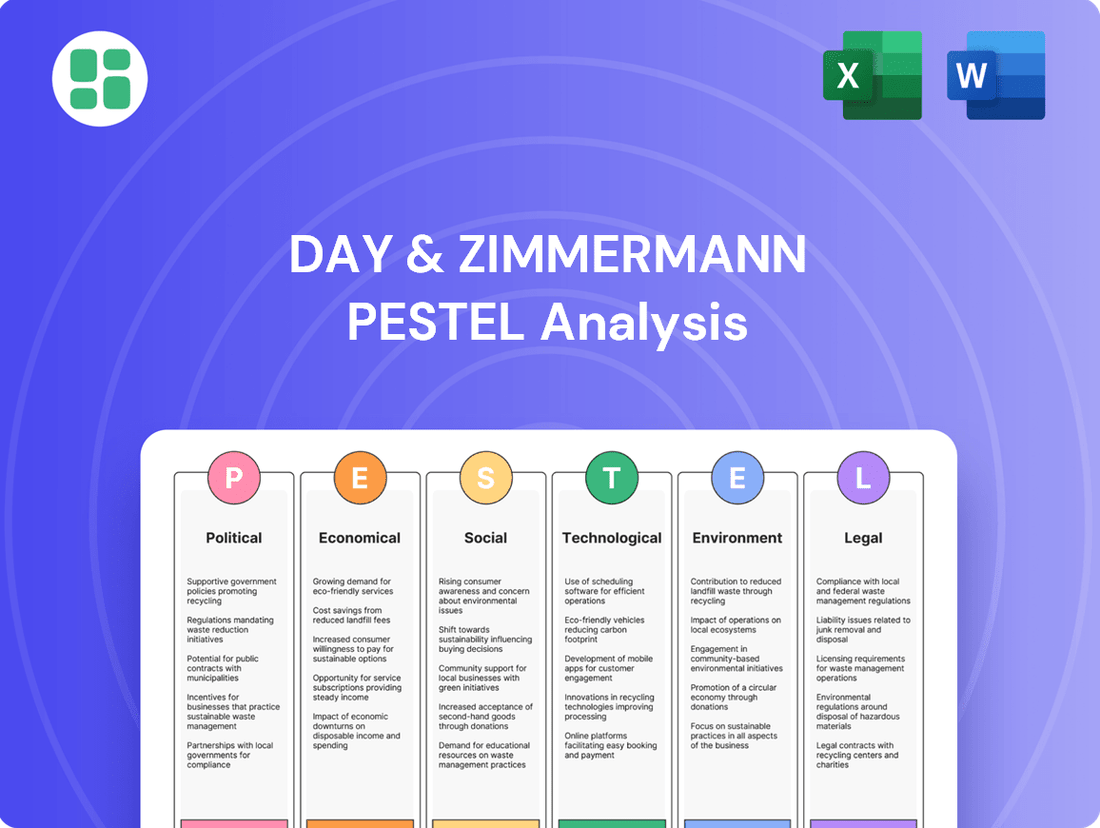

Uncover the intricate web of political, economic, social, technological, legal, and environmental forces shaping Day & Zimmermann's trajectory. This comprehensive PESTLE analysis provides the critical intelligence you need to anticipate market shifts and identify strategic opportunities. Download the full version now to gain a decisive advantage.

Political factors

Day & Zimmermann's significant involvement in munitions production and government services means its fortunes are closely tied to U.S. defense spending and the broader geopolitical landscape. The proposed fiscal year 2025 defense budget, estimated to be around $850 billion, highlights persistent global tensions and a strategic push for defense modernization, directly influencing demand for the company's offerings.

Despite potential fiscal tightening, supplemental budget allocations for international security assistance, such as for Ukraine and Israel, could further stimulate defense sector activity, creating additional opportunities for Day & Zimmermann.

Government initiatives like the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) are major catalysts for Day & Zimmermann's engineering and construction services. These acts are injecting substantial capital into critical infrastructure and industrial plant upgrades, creating a robust demand pipeline expected to extend through 2025 and beyond.

The CHIPS and Science Act further bolsters opportunities, particularly in advanced manufacturing facilities. These legislative efforts are projected to drive significant growth in sectors like transportation, manufacturing, and utilities, directly benefiting Day & Zimmermann's core competencies in delivering large-scale projects.

The sustained commitment to infrastructure development by the U.S. government ensures a predictable and stable stream of work. For example, the IIJA alone allocates over $1 trillion for infrastructure improvements, providing a strong foundation for Day & Zimmermann's project backlog.

Day & Zimmermann's position as a government contractor places it under a stringent regulatory umbrella. Evolving procurement policies, the intricacies of contract awarding, and ever-changing compliance mandates directly influence its operational landscape.

For instance, the U.S. Army awarded Day & Zimmermann a significant contract valued at $497 million in late 2023 for the production of 155mm artillery shells, underscoring the critical need for meticulous adherence to government specifications and competitive bidding processes.

These regulations, including those related to cybersecurity and supply chain integrity, are not static; they require continuous adaptation and investment to ensure ongoing eligibility for government work.

International Relations and Conflicts

Global conflicts and shifting alliances significantly influence the demand for Day & Zimmermann's defense products, especially munitions. Heightened geopolitical instability typically drives increased defense budgets and a greater requirement for military supplies. For instance, global military expenditure is projected to reach USD 2,688.7 billion by 2025, underscoring this trend. Day & Zimmermann's role in supplying essential components to the U.S. military directly reflects these complex international dynamics.

- Geopolitical Instability: Fuels demand for defense products.

- Global Military Spending: Expected to hit USD 2,688.7 billion in 2025.

- U.S. Military Contracts: Day & Zimmermann's core business is tied to international relations.

Political Stability and Election Outcomes

Upcoming elections in the United States, particularly the 2024 presidential election, introduce a degree of uncertainty for companies like Day & Zimmermann. Shifts in political control can lead to altered priorities in defense spending and infrastructure development, directly impacting the long-term contract landscape. For instance, a change in administration might re-evaluate existing defense procurement strategies or accelerate/decelerate infrastructure projects, creating both opportunities and challenges.

The Fiscal Responsibility Act of 2023, which imposed caps on discretionary spending for fiscal years 2024 and 2025, adds another layer of political influence. While these caps are set, subsequent congressional actions or budget negotiations could modify these spending levels. For example, the FY24 defense budget was approximately $886 billion, and any significant deviation in future budgets due to political maneuvering could affect Day & Zimmermann's revenue streams tied to government contracts.

- Defense Budget Fluctuations: Changes in administration and congressional priorities can directly impact the size and allocation of the U.S. defense budget, a key market for Day & Zimmermann.

- Infrastructure Spending Priorities: Different political parties may champion distinct approaches to infrastructure investment, affecting opportunities in sectors where Day & Zimmermann operates.

- Regulatory Environment: Political shifts can also lead to changes in environmental, labor, and trade regulations, influencing operational costs and compliance requirements.

- Fiscal Policy Impacts: Government fiscal policies, including tax rates and spending levels, are subject to political decisions and can affect the overall economic climate for businesses.

Political factors significantly shape Day & Zimmermann's operating environment, particularly concerning government contracts and defense spending. The U.S. fiscal year 2025 defense budget, estimated around $850 billion, underscores the ongoing demand driven by global geopolitical tensions and modernization efforts.

Government legislation like the Infrastructure Investment and Jobs Act, allocating over $1 trillion, and the CHIPS and Science Act, directly fuel opportunities in infrastructure upgrades and advanced manufacturing, benefiting Day & Zimmermann's engineering and construction divisions through 2025.

The company's reliance on government contracts necessitates strict adherence to evolving procurement policies and compliance mandates, as demonstrated by a $497 million contract for artillery shells awarded in late 2023, highlighting the critical nature of regulatory navigation.

Upcoming elections and fiscal policies, such as the Fiscal Responsibility Act of 2023, introduce potential shifts in spending priorities that could impact Day & Zimmermann's revenue streams, necessitating adaptability to changing political landscapes.

| Factor | Impact on Day & Zimmermann | Data Point/Example |

|---|---|---|

| U.S. Defense Spending | Directly influences demand for munitions and defense services. | FY2025 Defense Budget Estimate: ~$850 billion |

| Infrastructure Legislation | Drives opportunities in engineering and construction. | Infrastructure Investment and Jobs Act (IIJA) Allocation: >$1 trillion |

| Government Procurement Regulations | Dictates compliance and operational procedures for contracts. | Late 2023: $497 million U.S. Army contract for artillery shells |

| Political Stability & Elections | Creates potential for shifts in spending priorities and policy. | Fiscal Responsibility Act of 2023 caps discretionary spending for FY24-FY25. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Day & Zimmermann, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, helping to identify potential threats and opportunities within the company's operating landscape.

A clear, actionable summary of Day & Zimmermann's PESTLE analysis, enabling swift identification of external factors impacting strategic decisions.

Economic factors

The overall health of the economy is a major driver for Day & Zimmermann's business. A robust economic environment, marked by expanding GDP and strong industrial production, directly fuels demand for their services in construction, engineering, and maintenance, particularly within the power and manufacturing sectors. For instance, in 2024, projections for US GDP growth are around 2.5%, indicating a generally favorable climate for industrial investment and project execution.

Day & Zimmermann's substantial reliance on government contracts means federal budget allocations are a paramount economic consideration. For fiscal year 2024, the U.S. defense budget was set at approximately $886 billion, indicating continued robust spending in this sector. However, ongoing discussions around national debt and potential future austerity measures could introduce fiscal constraints, impacting the volume and nature of projects awarded.

The availability of skilled labor and rising wage costs are critical factors for Day & Zimmermann, directly impacting both its staffing services and its internal project expenses. The engineering and construction industries, where Day & Zimmermann operates significantly, have consistently reported a substantial talent shortage. For instance, in early 2024, the U.S. Bureau of Labor Statistics indicated hundreds of thousands of unfilled positions in these sectors.

This persistent talent gap forces companies like Day & Zimmermann to invest more in workforce development and training programs. Furthermore, the competition for qualified individuals can drive up wage inflation, leading to increased operational costs. In 2024, average hourly wages in construction saw a notable increase, reflecting this demand pressure, which directly translates to higher project bids and staffing expenses for Day & Zimmermann.

Energy Prices and Commodity Costs

Fluctuations in energy prices and the cost of raw materials directly impact Day & Zimmermann's profitability, particularly in their power plant services and large-scale construction operations. For instance, the average price of West Texas Intermediate (WTI) crude oil, a key indicator for energy costs, saw significant volatility in 2024, impacting transportation and material costs. Stable or declining commodity prices can lead to improved project margins, offering a more predictable financial outlook.

Conversely, sharp increases in the cost of essential materials like steel, concrete, and specialized components create substantial risks for projects with fixed-price contracts. The price of steel, a critical input for many construction projects, experienced upward pressure in late 2024 due to supply chain disruptions and increased global demand. This volatility necessitates robust risk management strategies and careful contract negotiation to mitigate potential losses.

- Energy Cost Impact: Rising oil and natural gas prices increase operational expenses for Day & Zimmermann's fleet and facilities.

- Raw Material Volatility: Steel and other commodity price swings directly affect the cost of materials for construction projects.

- Project Margins: Stable commodity prices enhance profitability, while price surges can erode margins on existing contracts.

- Supply Chain Sensitivity: Global events impacting commodity supply chains can lead to unexpected cost increases for Day & Zimmermann.

Interest Rates and Investment Environment

Interest rates significantly shape the investment environment for companies like Day & Zimmermann. Fluctuations here directly impact the cost of capital for both the company and its clientele. For instance, a supportive interest rate environment can spur significant investment in infrastructure and industrial sectors, key markets for Day & Zimmermann's services.

In 2024 and looking into 2025, central banks have been navigating a complex economic landscape. The Federal Reserve, for example, has signaled a cautious approach to rate cuts, aiming to balance inflation control with economic growth. This delicate balance means that while borrowing costs might remain elevated compared to recent years, there's potential for gradual easing, which could unlock new project financing opportunities.

The impact on Day & Zimmermann's business is multifaceted:

- Financing Costs: Higher interest rates increase the cost of borrowing for clients undertaking large-scale projects, potentially delaying or scaling back investments.

- Project Viability: Conversely, lower or stable interest rates make financing more accessible, encouraging clients to proceed with new construction, maintenance, and modernization efforts.

- Economic Stimulation: An improving lending market, often associated with favorable interest rates, can boost overall economic activity, leading to increased demand for engineering, construction, and maintenance services.

- Investment Decisions: For Day & Zimmermann itself, interest rate trends influence decisions regarding capital expenditures and potential acquisitions.

The economic outlook significantly influences Day & Zimmermann's project pipeline and revenue streams. With U.S. GDP growth projected around 2.5% for 2024, the industrial and construction sectors, key markets for the company, are expected to see continued investment. However, inflation and interest rate policies remain critical variables that could impact project financing and overall demand.

Preview the Actual Deliverable

Day & Zimmermann PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Day & Zimmermann covers political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the external forces shaping its strategic landscape.

Sociological factors

The aging workforce presents a significant hurdle for Day & Zimmermann, with many experienced professionals nearing retirement. This demographic shift exacerbates a persistent skills gap in crucial sectors such as engineering, construction, and defense manufacturing, areas vital to the company's operations.

The demand for new talent is substantial, with the industry requiring hundreds of thousands of new employees annually. For instance, the U.S. Bureau of Labor Statistics projected a need for over 300,000 construction workers in 2024 alone to keep pace with infrastructure projects and housing demand.

Day & Zimmermann's success hinges on its capacity to attract, train, and retain a skilled workforce, especially in highly specialized fields like nuclear operations and munitions production. The company's investment in apprenticeship programs and technical training is therefore critical to bridging this gap and ensuring continued operational capability.

Societal demands for businesses to act ethically, embrace diversity, and contribute to their communities are increasingly shaping corporate landscapes. For Day & Zimmermann, this translates into a need to demonstrate strong corporate social responsibility (CSR) to maintain a positive reputation and attract talent and partners.

The company's focus on safety, integrity, and community engagement, evidenced by its internal programs and investments in workforce development, directly addresses these evolving expectations. For example, Day & Zimmermann's commitment to safety is paramount in its operations, a critical factor for stakeholders. In 2024, the company reported a Total Recordable Incident Rate (TRIR) that reflects its dedication to maintaining a safe working environment, a key component of its CSR profile.

Public sentiment significantly shapes the trajectory of industries like defense and nuclear energy, directly impacting Day & Zimmermann's operations. For instance, a recent Gallup poll in early 2024 indicated that while support for nuclear energy has seen a modest uptick, a substantial portion of the public still harbors concerns regarding safety and waste disposal, a sentiment that can translate into stricter regulations and public opposition to new projects.

In the defense sector, public perception is often tied to geopolitical events and national security debates. A strong national security posture can bolster public support for defense spending, which in turn benefits companies like Day & Zimmermann. However, public scrutiny over defense contracts and the ethical implications of military technology remains a constant, potentially influencing contract awards and the availability of top engineering talent, with surveys in late 2023 showing increased public interest in the transparency of defense spending.

Labor Union Influence and Relations

Day & Zimmermann's significant presence in construction and industrial services means labor union influence is a key factor. In 2024, the construction industry, a core area for D&Z, saw varying union density across regions, with some sectors reporting over 20% union membership, directly impacting wage negotiations and benefit packages. These collective bargaining agreements can shape labor costs and operational flexibility, making positive union relations crucial for project execution.

The potential for labor disputes and strikes remains a consideration. For instance, in late 2023 and early 2024, several major industrial sectors experienced labor actions that led to project delays and increased costs. Day & Zimmermann's ability to navigate these dynamics through proactive engagement and adherence to agreements is vital for maintaining workforce stability and ensuring project continuity, especially as infrastructure spending ramps up.

- Union Density: In sectors where Day & Zimmermann operates, union membership can significantly influence labor costs and work rules.

- Collective Bargaining: The terms of collective bargaining agreements directly impact wages, benefits, and employment conditions, affecting operational expenses.

- Workforce Stability: Strong labor relations are essential for preventing disruptions and ensuring a reliable workforce, particularly during peak project demands.

- Industry Trends: Monitoring union activity and labor relations trends in construction and industrial sectors provides insight into potential challenges and opportunities for Day & Zimmermann.

Health, Safety, and Employee Well-being

A strong commitment to employee health, safety, and overall well-being is a fundamental sociological consideration, particularly for companies operating in sectors with inherent risks, such as industrial manufacturing and defense. Day & Zimmermann's dedication to this is evident in its 'Why Not Zero?' campaign, designed to cultivate a workplace where the prevention of all injuries is the ultimate goal. This proactive approach to safety and well-being directly impacts operational efficiency and company reputation.

Prioritizing employee welfare offers tangible benefits, including boosted productivity and a reduction in staff turnover, which can lead to significant cost savings. For instance, in 2023, companies with robust safety programs often reported lower workers' compensation claims, with some studies indicating a potential 20% reduction in claims for organizations with strong safety cultures. This focus also enhances Day & Zimmermann's public image, attracting talent and fostering positive community relations.

Key aspects of Day & Zimmermann's focus on employee well-being include:

- Safety Culture: Implementing comprehensive safety training and fostering a mindset where every employee feels responsible for safety.

- Health Initiatives: Providing resources and programs that support physical and mental health for employees and their families.

- Risk Mitigation: Continuously assessing and improving safety protocols in high-risk operational environments.

- Employee Engagement: Creating an environment where employees feel valued and supported, leading to higher morale and retention.

Societal expectations for corporate responsibility continue to evolve, pushing companies like Day & Zimmermann to prioritize diversity, equity, and inclusion (DEI) initiatives. Publicly available data from 2024 indicates a growing emphasis on diverse leadership and equitable pay structures, with many large corporations reporting on their DEI progress. This societal shift impacts talent acquisition and retention, as a diverse and inclusive workplace is increasingly seen as a competitive advantage.

Day & Zimmermann's commitment to community engagement and ethical business practices is also a significant sociological factor. In 2024, consumer and investor scrutiny of corporate social responsibility (CSR) remains high. Companies are expected to demonstrate positive contributions beyond profit, influencing brand perception and stakeholder loyalty. This includes transparent reporting on environmental, social, and governance (ESG) metrics.

The perception of industries Day & Zimmermann serves, such as defense and nuclear energy, is heavily influenced by public opinion and media narratives. For instance, ongoing discussions surrounding national security and energy policy in 2024 directly shape public sentiment and regulatory environments. A positive public image is crucial for securing contracts and maintaining operational licenses.

Day & Zimmermann's operational success is intrinsically linked to the availability of skilled labor, a factor heavily influenced by educational trends and workforce development. The demand for specialized skills in engineering and manufacturing remains robust. In 2024, the U.S. Department of Labor highlighted continued shortages in skilled trades, underscoring the importance of robust training and apprenticeship programs for companies like D&Z.

Technological factors

The increasing adoption of AI and automation is reshaping industrial services. For example, in 2024, the global industrial automation market was projected to reach over $200 billion, highlighting a significant trend towards smart factories and data-driven operations that directly influence companies like Day & Zimmermann.

AI's role in enhancing manufacturing precision is crucial, particularly in sectors like defense where Day & Zimmermann operates. Predictive maintenance powered by AI is also a game-changer, with studies in 2025 indicating that AI-driven maintenance can reduce downtime by up to 30% and cut associated costs by 25%.

Day & Zimmermann's operational efficiency is significantly influenced by the increasing adoption of digital transformation in project management. Technologies like Building Information Modeling (BIM) and advanced project management software are becoming essential for navigating the complexities of large-scale engineering and construction projects undertaken by the company.

These digital tools are not just about modernization; they directly impact productivity and safety. For instance, BIM allows for detailed 3D modeling and simulation, which can identify potential clashes and design flaws early in the process, reducing costly rework. This proactive approach is critical for projects in sectors like defense and energy, where precision is paramount.

The integration of digital twins, which are virtual replicas of physical assets, further enhances monitoring and predictive maintenance. This capability is particularly valuable for Day & Zimmermann's clients in industries requiring continuous operation and minimal downtime. By mid-2024, the global market for digital twin technology in construction was projected to reach over $8 billion, highlighting the growing industry reliance on such innovations for improved resource allocation and project oversight.

Day & Zimmermann's reliance on digital platforms for critical functions like project management and defense data makes cybersecurity a major technological consideration. The evolving threat landscape necessitates continuous investment in advanced security protocols.

The defense sector is under increasing pressure to meet stringent digital compliance, with the Cybersecurity Maturity Model Certification (CMMC) Program Final Rule anticipated in mid-2025. Failure to comply could impact contract eligibility and operational continuity.

Implementing robust cybersecurity solutions is crucial for safeguarding sensitive information and maintaining the integrity of Day & Zimmermann's operations, especially given the high stakes involved in defense contracting.

New Materials and Advanced Manufacturing Processes

Innovation in materials science and advanced manufacturing processes, like additive manufacturing, is reshaping industries. For Day & Zimmermann, this means potential improvements in munition production and construction. These technologies can lead to more efficient processes and components that are either lighter or stronger, offering a significant edge for their defense and industrial clients.

The adoption of these new technologies can directly translate into competitive advantages. For instance, the defense sector is actively exploring how 3D printing can reduce lead times for critical parts and enable on-demand production. In 2024, the global additive manufacturing market was valued at approximately $22.1 billion, with projections indicating substantial growth, highlighting the increasing importance of these advancements.

- Additive Manufacturing Adoption: The defense industry is increasingly investing in 3D printing for rapid prototyping and the production of complex, lightweight components, potentially reducing manufacturing costs by up to 30% in some applications.

- Materials Science Advancements: Development of new composite materials and alloys offers enhanced durability and performance characteristics for manufactured goods, directly benefiting clients in sectors requiring high-strength, low-weight solutions.

- Efficiency Gains: Advanced manufacturing processes can streamline supply chains and reduce waste, contributing to more sustainable and cost-effective production cycles, which is critical in a competitive global market.

Emerging Energy Technologies

Day & Zimmermann's position in the energy sector necessitates a keen eye on emerging technologies. This includes advancements in nuclear power, such as small modular reactors (SMRs), and the increasing integration of renewable sources like wind and solar. The company's expertise in engineering and maintenance services is crucial for deploying and managing these evolving energy solutions.

The global push towards decarbonization is a significant driver for these technological shifts. For instance, the International Energy Agency (IEA) reported in 2024 that investments in clean energy technologies reached an estimated $2 trillion globally in 2023, highlighting the scale of this transition. Day & Zimmermann's ability to adapt to and capitalize on these trends, including carbon capture, utilization, and storage (CCUS) technologies, will be vital for its continued success.

- Advanced Nuclear Designs: Opportunities exist for engineering, procurement, and construction (EPC) services for next-generation nuclear reactors, including SMRs, which are gaining traction for their potential to provide reliable, low-carbon power.

- Renewable Energy Integration: Day & Zimmermann can leverage its capabilities in grid modernization and infrastructure development to support the seamless integration of intermittent renewable energy sources into existing power grids.

- Carbon Capture Solutions: The growing demand for CCUS technologies presents a market for Day & Zimmermann's project management and specialized construction services, supporting industries in reducing their carbon footprint.

- Energy Storage Systems: As renewable energy penetration increases, the need for advanced energy storage solutions, such as battery systems and pumped hydro, will grow, creating further service opportunities.

Technological advancements are profoundly impacting industrial services, with AI and automation leading the charge. The global industrial automation market's projected growth past $200 billion in 2024 underscores a significant shift towards smart factories and data-driven operations, directly influencing companies like Day & Zimmermann.

AI's capacity to enhance manufacturing precision and enable predictive maintenance is critical, especially in demanding sectors like defense. Studies in 2025 indicated that AI-driven maintenance could slash downtime by up to 30% and reduce associated costs by 25%, offering substantial efficiency gains.

Digital transformation, including technologies like Building Information Modeling (BIM) and advanced project management software, is essential for Day & Zimmermann's complex engineering and construction projects, boosting productivity and safety. The integration of digital twins, virtual replicas of physical assets, further enhances monitoring and predictive maintenance capabilities, with the digital twin market in construction projected to exceed $8 billion by mid-2024.

| Technology Area | Impact on Day & Zimmermann | Key Data/Projection (2024/2025) |

|---|---|---|

| AI & Automation | Enhanced manufacturing precision, predictive maintenance, operational efficiency | Industrial Automation Market > $200 billion (2024); AI maintenance reduces downtime by up to 30% (2025) |

| Digital Transformation | Improved project management, BIM for design accuracy, digital twins for asset monitoring | Digital Twin Market in Construction > $8 billion (mid-2024) |

| Cybersecurity | Safeguarding sensitive data, ensuring operational integrity, compliance | CMMC Program Final Rule anticipated mid-2025 |

| Advanced Manufacturing | Additive manufacturing for complex components, materials science for enhanced performance | Additive Manufacturing Market ~$22.1 billion (2024) |

| Energy Technologies | Support for SMRs, renewable energy integration, CCUS solutions | Clean Energy Investments ~$2 trillion globally (2023) |

Legal factors

Day & Zimmermann operates as a significant government contractor, necessitating strict adherence to a multifaceted legal landscape. This includes navigating the Federal Acquisition Regulation (FAR), defense procurement statutes, and specific contractual stipulations. Failure to comply with these regulations can have severe consequences, affecting bidding, project management, and financial disclosures.

The company's involvement in government projects, such as its role in supporting the U.S. Navy's fleet readiness, highlights the critical nature of these legal frameworks. For instance, the U.S. government's defense spending was projected to reach $886 billion in fiscal year 2024, underscoring the substantial regulatory environment Day & Zimmermann operates within. Ensuring compliance is paramount for maintaining its status as a trusted partner.

Day & Zimmermann operates under a complex web of environmental compliance laws, particularly given its presence in industrial, power, and defense sectors. These regulations, enforced by bodies like the Environmental Protection Agency (EPA), dictate standards for emissions, waste disposal, and the handling of hazardous substances. For instance, the EPA's stringent rules on greenhouse gas emissions and the management of chemicals such as per- and polyfluoroalkyl substances (PFAS) and trichloroethylene (TCE) directly impact D&Z's ability to secure operational permits and influence the design of their projects, inevitably increasing compliance expenditures.

Day & Zimmermann must navigate a complex web of federal and state labor laws. This includes adhering to wage and hour regulations, such as the Fair Labor Standards Act (FLSA), and maintaining stringent workplace safety standards mandated by the Occupational Safety and Health Administration (OSHA). For instance, in 2024, the U.S. Department of Labor continued to emphasize enforcement of overtime rules, potentially impacting companies with large hourly workforces.

Evolving employment legislation, like potential changes to minimum wage laws or new requirements for independent contractor classification, can directly affect Day & Zimmermann's operational costs and staffing models. A significant increase in the federal minimum wage, for example, could raise labor expenses across its various service sectors. The company also faces ongoing scrutiny regarding non-discrimination policies, with the Equal Employment Opportunity Commission (EEOC) actively pursuing cases of alleged bias.

Health and Safety Regulations

Day & Zimmermann's operations, particularly in industrial, construction, and munitions sectors, demand rigorous adherence to health and safety regulations. Agencies such as the Occupational Safety and Health Administration (OSHA) in the United States establish stringent standards for worker protection. For instance, in 2023, OSHA reported a 1.7% decrease in workplace fatalities compared to 2022, highlighting ongoing efforts and the critical nature of compliance.

Failure to comply with these legal mandates can lead to severe consequences, including substantial fines, operational shutdowns, and significant reputational damage. Maintaining compliance is not merely a legal obligation but a cornerstone for preventing accidents, minimizing liabilities, and ensuring the company's continued ability to operate and secure necessary licenses. Day & Zimmermann's emphasis on a robust safety culture directly reflects the critical importance of these legal frameworks.

- OSHA Fines: In 2024, OSHA's maximum penalty for a willful or repeated violation can reach $15,625 per violation, with a maximum penalty for serious violations at $15,625 per violation.

- Industry Safety Trends: The construction industry, a key area for Day & Zimmermann, saw a total recordable incident rate of 4.1 per 100 full-time workers in 2023, according to the Bureau of Labor Statistics.

- Munitions Safety: Regulations surrounding explosives and munitions are particularly strict, often governed by agencies like the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF), with zero tolerance for safety breaches.

Data Privacy and Cybersecurity Laws

Day & Zimmermann, like all businesses operating in the digital age, faces a complex landscape of data privacy and cybersecurity laws. As a significant player in defense contracting, the company must adhere to stringent regulations designed to protect sensitive information. For example, the Cybersecurity Maturity Model Certification (CMMC) mandates specific practices for safeguarding controlled unclassified information (CUI), with evolving requirements impacting defense supply chains.

Non-compliance with these evolving legal frameworks carries substantial risks. Penalties can range from significant financial fines to severe reputational damage, potentially jeopardizing future contracts and business relationships. The U.S. Federal Trade Commission (FTC), for instance, has been increasingly active in enforcing data security standards, with fines for violations often reaching millions of dollars. In 2023 alone, the FTC reported significant enforcement actions related to data security and privacy breaches.

- CMMC Compliance: Day & Zimmermann must ensure its cybersecurity practices meet CMMC Level 2 or Level 3 standards, depending on contract requirements, to handle CUI.

- Data Breach Notification Laws: The company is subject to state-specific data breach notification laws, requiring timely reporting to affected individuals and regulatory bodies in the event of a compromise.

- Global Data Privacy Regulations: Depending on its international operations, Day & Zimmermann may also need to comply with regulations like the General Data Protection Regulation (GDPR) for data pertaining to EU residents.

- FTC Enforcement: The Federal Trade Commission continues to scrutinize data security practices, with potential fines for inadequate protection of consumer data.

Day & Zimmermann navigates a complex legal environment, particularly due to its significant government contracting roles. Adherence to regulations like the Federal Acquisition Regulation (FAR) and defense procurement statutes is critical, with non-compliance risking bidding eligibility and project continuity. The company's involvement in U.S. defense initiatives, supported by an estimated $886 billion in defense spending for fiscal year 2024, underscores the immense regulatory scope.

Environmental laws, enforced by agencies like the EPA, significantly impact Day & Zimmermann's operations in industrial and defense sectors. Compliance with standards for emissions, waste, and hazardous materials, including PFAS and TCE, is essential for permits and project design, directly influencing operational costs.

Labor laws, including FLSA and OSHA standards, are paramount for Day & Zimmermann. The U.S. Department of Labor's continued focus on overtime enforcement in 2024, alongside potential minimum wage hikes and EEOC scrutiny on non-discrimination, directly affects labor expenses and staffing strategies.

Data privacy and cybersecurity laws, such as CMMC for protecting controlled unclassified information (CUI), are crucial for Day & Zimmermann, especially in defense contracting. The FTC's active enforcement in 2023, with significant fines for data security breaches, highlights the substantial risks of non-compliance.

Environmental factors

Global and national climate change policies, including ambitious carbon emission reduction targets, directly shape the landscape for Day & Zimmermann's energy and industrial services. For instance, the U.S. aims for a 50-52% reduction in greenhouse gas emissions from 2005 levels by 2030, driving demand for cleaner energy infrastructure and sustainable industrial practices.

These evolving regulations and incentives for renewable energy, such as tax credits for solar and wind projects, create significant new business opportunities for Day & Zimmermann in areas like renewable energy project development and carbon capture technologies. Conversely, these policies also impose compliance requirements, necessitating adjustments in existing operations to meet stricter environmental standards.

Day & Zimmermann operates industrial and munitions facilities, making compliance with stringent waste disposal, water discharge, and air pollution regulations a critical operational requirement. These regulations are constantly evolving, demanding ongoing investment in advanced pollution control technologies and robust waste management strategies to ensure adherence.

The increasing focus on emerging contaminants, such as per- and polyfluoroalkyl substances (PFAS), presents a significant challenge. For instance, the U.S. Environmental Protection Agency (EPA) has been developing drinking water standards for PFAS, with final rules anticipated in 2024, requiring substantial upgrades to treatment systems and potentially impacting operational costs for companies like Day & Zimmermann.

Growing awareness of resource scarcity is significantly reshaping supply chains for construction and industrial materials. Companies like Day & Zimmermann are increasingly pressured to adopt sustainable sourcing practices, which can include utilizing recycled content or materials produced with lower environmental impact.

This trend aligns with broader Environmental, Social, and Governance (ESG) expectations, pushing Day & Zimmermann to optimize resource efficiency across its operations. For instance, the global demand for critical minerals essential in manufacturing and energy sectors, such as copper and lithium, saw significant price volatility in 2024, highlighting the real-world impact of scarcity.

Demand for Green Building and Sustainable Infrastructure

The global green building market is experiencing robust growth, with projections indicating a significant expansion in the coming years. For instance, the market size was estimated to be around $300 billion in 2023 and is expected to reach over $500 billion by 2030, driven by increasing environmental awareness and regulatory support. This trend directly translates into a heightened demand for sustainable infrastructure projects.

Clients across both government and commercial sectors are actively seeking out environmentally conscious designs and construction practices. This shift is evidenced by the increasing number of projects pursuing certifications like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method). In 2024, LEED certifications continued to see strong adoption, with thousands of new projects certified globally, reflecting this client preference.

Day & Zimmermann's engineering and construction divisions are well-positioned to capitalize on this burgeoning market. By showcasing and further developing their expertise in sustainable design, renewable energy integration, and eco-friendly material sourcing, the company can effectively meet these evolving client demands. This strategic alignment allows Day & Zimmermann to pursue and secure new contracts within the rapidly expanding green building and sustainable infrastructure sectors.

- Growing Market: The global green building market is projected to exceed $500 billion by 2030, up from approximately $300 billion in 2023.

- Client Prioritization: A significant increase in projects seeking LEED and BREEAM certifications demonstrates client commitment to sustainable practices.

- Opportunity for Day & Zimmermann: Leveraging expertise in green design and construction can lead to securing new contracts in this expanding sector.

- Regulatory Support: Government incentives and environmental regulations are further fueling the demand for sustainable infrastructure.

Impact of Extreme Weather Events

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, pose significant challenges to industries like construction. These events can lead to considerable disruptions in project timelines and cause damage to vital infrastructure, thereby amplifying project risks. For a company like Day & Zimmermann, which actively participates in critical infrastructure development and emergency response, incorporating climate resilience into its strategic planning and operational frameworks is paramount. This proactive approach is essential to minimize potential project delays and mitigate associated cost overruns.

The economic impact of these events is substantial. For instance, the NOAA reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $190 billion in damages. This underscores the financial vulnerability of infrastructure projects and the need for robust mitigation strategies. Day & Zimmermann's exposure to sectors such as energy, defense, and infrastructure means that supply chain disruptions and material availability can be severely impacted by severe weather patterns, affecting project execution and profitability.

- Climate Change Impact: Increasing frequency and intensity of extreme weather events disrupt construction schedules and damage infrastructure.

- Industry Vulnerability: Sectors like energy and defense, where Day & Zimmermann operates, are susceptible to weather-related supply chain disruptions.

- Financial Risk: Extreme weather events in 2023 alone caused over $190 billion in damages in the U.S., highlighting the financial exposure.

- Mitigation Necessity: Day & Zimmermann must prioritize climate resilience in planning and operations to reduce delays and costs.

Stricter environmental regulations and a global push towards sustainability are reshaping business operations. For Day & Zimmermann, this means adapting to evolving emission standards and investing in greener technologies to meet compliance. The increasing focus on emerging contaminants like PFAS, with the EPA anticipating final drinking water standards in 2024, necessitates significant operational adjustments and potential cost increases.

| Environmental Factor | Description | Implication for Day & Zimmermann | Relevant Data/Trend |

|---|---|---|---|

| Climate Change Policies | Global and national efforts to reduce greenhouse gas emissions. | Drives demand for cleaner energy infrastructure; requires operational adjustments for compliance. | U.S. aims for 50-52% GHG reduction from 2005 levels by 2030. |

| Renewable Energy Incentives | Government support for solar, wind, and other clean energy projects. | Creates new business opportunities in renewable energy development and carbon capture. | Tax credits for renewable energy projects. |

| Pollution Control Regulations | Mandates on waste disposal, water discharge, and air emissions. | Requires ongoing investment in pollution control technologies and waste management. | Evolving national and local environmental standards. |

| Emerging Contaminants (PFAS) | Growing concern and regulation of substances like PFAS. | Necessitates upgrades to treatment systems and impacts operational costs. | EPA developing final PFAS drinking water standards (anticipated 2024). |

| Resource Scarcity | Increasing awareness and impact of limited natural resources. | Pressures adoption of sustainable sourcing and resource efficiency. | Price volatility in critical minerals (e.g., copper, lithium) in 2024. |

| Green Building Market Growth | Expansion of environmentally conscious construction and design. | Heightened demand for sustainable infrastructure projects; opportunities in green design. | Market projected to exceed $500 billion by 2030 (from ~$300 billion in 2023). |

| Extreme Weather Events | Increased frequency and intensity of climate-related disasters. | Disrupts project timelines, damages infrastructure, impacts supply chains. | 28 U.S. billion-dollar weather disasters in 2023, totaling over $190 billion in damages. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Day & Zimmermann is built on a robust foundation of publicly available data, including government reports, economic indicators from institutions like the Bureau of Labor Statistics and the Department of Commerce, and industry-specific publications. We also incorporate insights from reputable news outlets and market research firms to capture current trends and potential future impacts.