Day & Zimmermann Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Day & Zimmermann Bundle

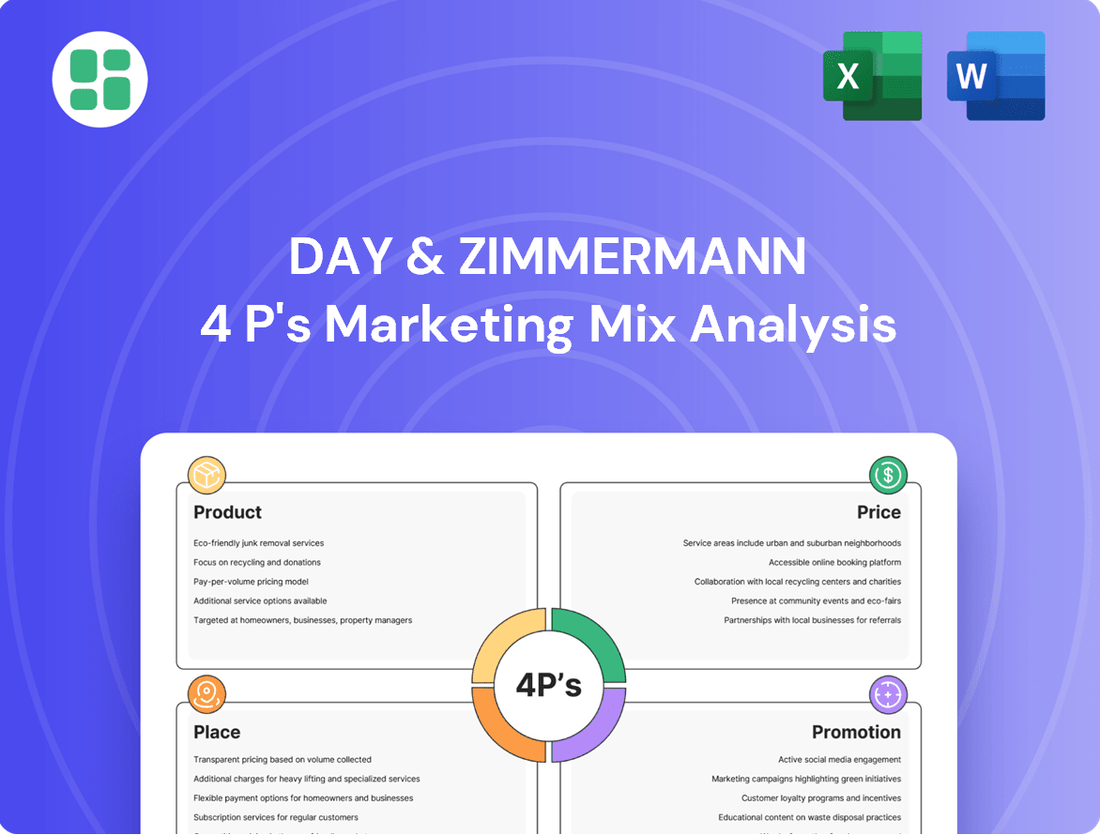

Day & Zimmermann's marketing prowess is built on a strategic alignment of Product, Price, Place, and Promotion. Discover how their innovative solutions, competitive pricing, expansive distribution, and targeted communication create a powerful market presence.

Unlock the full potential of Day & Zimmermann's marketing strategy with our comprehensive 4Ps analysis. Go beyond the surface and gain actionable insights into their product development, pricing architecture, channel management, and promotional campaigns.

Save valuable time and gain a competitive edge. Our ready-made, editable Marketing Mix Analysis for Day & Zimmermann provides a detailed breakdown of each P, perfect for business professionals, students, and consultants seeking strategic advantage.

Product

Day & Zimmermann's diverse service portfolio is a cornerstone of its marketing mix, catering to a broad spectrum of government, commercial, and industrial clients. This extensive range includes highly specialized engineering, construction, and maintenance solutions. For instance, in 2024, the company secured significant contracts for infrastructure upgrades, demonstrating its capability in critical sectors like power generation and industrial facilities.

The company's offerings are meticulously designed to address the intricate demands of complex projects and ongoing operational requirements across the globe. This adaptability allows Day & Zimmermann to serve as a crucial partner in maintaining and enhancing vital infrastructure, a testament to their broad expertise. Their global reach in 2024 involved projects in multiple continents, highlighting their capacity to manage diverse and challenging environments.

Day & Zimmermann's Specialized Staffing Solutions, primarily through its Yoh and DZConneX brands, offer comprehensive talent and outsourcing services. These cater to a broad range of client needs in managing their workforce effectively.

The company's offerings include Recruitment Process Outsourcing (RPO) and Managed Service Programs (MSP), alongside direct sourcing. This integrated approach helps businesses optimize their talent acquisition and management strategies across diverse industries.

In 2024, the global contingent workforce market was valued at over $1.5 trillion, highlighting the significant demand for specialized staffing solutions like those provided by Day & Zimmermann.

Day & Zimmermann's Defense and Munitions segment offers a comprehensive product portfolio centered on the manufacturing, storage, and demilitarization of a vast range of ammunition. This critical offering supports the U.S. government and allied nations, underscoring their pivotal role in global defense readiness.

As a premier ammunition producer, Day & Zimmermann operates government-owned facilities, a testament to their scale and importance. Their capabilities extend to supplying everything from small-caliber rounds to larger ordnance, ensuring a consistent and reliable supply chain for national security needs.

Technical Expertise and Project Management

Day & Zimmermann's core offering hinges on its profound technical knowledge and exceptional project management. This dual strength allows them to tackle highly complex technical challenges and large-scale projects with confidence.

Their specialization in delivering advanced technical solutions means clients in demanding sectors, from aerospace to energy, rely on Day & Zimmermann for intricate project execution. This capability is crucial for clients needing to navigate challenging operational landscapes.

- Deep Technical Bench Strength: Possessing a vast pool of engineers and technical specialists.

- Proven Project Execution: A track record of successfully managing large, complex, and often critical projects.

- Risk Mitigation: Expertise in identifying and managing technical and project-related risks.

- Client-Centric Solutions: Tailoring technical approaches to meet specific client needs and environments.

Critical Infrastructure Support

Day & Zimmermann's Critical Infrastructure Support is a cornerstone of their offering, directly addressing the Product element of the marketing mix. Their services are vital for the ongoing operation and modernization of essential national assets. A prime example is their extensive involvement with U.S. nuclear fleets, where they provide crucial operations and maintenance expertise.

This focus on critical infrastructure ensures the reliable and safe functioning of vital national assets, a service that is increasingly important in the current geopolitical climate. For instance, in 2024, the U.S. nuclear energy sector continued to be a significant contributor to the nation's clean energy goals, underscoring the demand for specialized support services like those offered by Day & Zimmermann.

- Nuclear Fleet Support: Day & Zimmermann holds a substantial presence in maintaining and enhancing U.S. nuclear power plants, ensuring operational integrity.

- Reliability and Safety: Their operations and maintenance services are critical for the dependable and secure functioning of vital national infrastructure.

- National Security Contribution: By supporting critical infrastructure, the company plays a role in safeguarding national security and economic stability.

- Essential Services: The demand for these specialized services is driven by the ongoing need to maintain aging infrastructure and adapt to evolving energy landscapes.

Day & Zimmermann's product offering is characterized by its depth and breadth, spanning critical sectors like defense, aerospace, and energy. Their ammunition manufacturing and demilitarization services are a significant component, supporting national security needs. In 2024, the company continued its role as a key supplier to the U.S. Department of Defense, handling substantial volumes of munitions.

Their specialized engineering and construction services are also vital, addressing complex infrastructure projects. This includes work on power generation facilities and industrial plants, where their technical expertise is paramount. The company's commitment to innovation in these areas was evident in their 2024 project engagements, which often involved cutting-edge technologies.

Day & Zimmermann's product portfolio also encompasses advanced technical solutions and staffing services through its Yoh and DZConneX brands. These offerings are designed to meet the evolving talent needs of businesses in high-demand industries. The global contingent workforce market, valued at over $1.5 trillion in 2024, highlights the scale of this market segment.

| Product Category | Key Offerings | 2024/2025 Relevance |

|---|---|---|

| Defense & Munitions | Ammunition Manufacturing, Storage, Demilitarization | Continued significant supplier to U.S. DoD; high demand for ordnance. |

| Engineering & Construction | Infrastructure Upgrades, Power Generation, Industrial Facilities | Secured major infrastructure contracts; focus on modernization projects. |

| Staffing & Talent Solutions | Recruitment Process Outsourcing (RPO), Managed Service Programs (MSP) | Leveraging global contingent workforce market growth; serving diverse industries. |

| Critical Infrastructure Support | Nuclear Fleet Operations & Maintenance | Essential services for U.S. nuclear energy sector's clean energy goals. |

What is included in the product

This Day & Zimmermann 4P's Marketing Mix Analysis offers a comprehensive examination of their Product, Price, Place, and Promotion strategies, grounded in real-world practices and competitive context.

It's designed for professionals seeking a deep dive into Day & Zimmermann's marketing positioning, providing actionable insights and a structured framework for comparison and strategic planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic ambiguity.

Provides a clear, concise framework for Day & Zimmermann's marketing efforts, resolving the challenge of scattered initiatives.

Place

Day & Zimmermann's marketing strategy heavily relies on direct client engagement, a crucial element for securing substantial contracts within the government, commercial, and industrial sectors. This hands-on approach allows them to deeply understand client needs and tailor complex solutions.

This direct interaction is particularly vital for large-scale projects, where intricate proposals and competitive bidding are standard. For instance, in 2024, the company continued to leverage its established relationships to pursue significant infrastructure and defense contracts, a key driver of their revenue growth.

The effectiveness of this direct engagement is reflected in Day & Zimmermann's consistent success in winning multi-year agreements. Their ability to build trust and demonstrate value through personalized communication underpins their market position.

On-site project delivery is central to Day & Zimmermann's operations, reflecting the hands-on nature of their services. Their teams are deployed directly to client locations, which are often complex industrial environments. This direct engagement is critical for providing specialized engineering, construction, maintenance, and operational support.

Day & Zimmermann's extensive global footprint is a cornerstone of its marketing mix, with over 900 work locations spanning numerous countries. This vast network enables them to effectively serve a diverse international clientele, offering localized support and expertise. Their ability to deploy resources efficiently across these global sites is crucial for managing complex projects in varied geographic markets.

Strategic Division Operations

Day & Zimmermann's strategic division operations are key to its marketing mix, allowing for tailored approaches to distinct market segments. This structure enables the company to effectively reach and serve diverse client needs across its specialized areas. For instance, their Maintenance and Construction division focuses on large-scale industrial projects, while DZConneX targets the specialized needs of the telecommunications sector.

The company's operational divisions are designed for optimal market penetration and service delivery. Day & Zimmermann Lone Star, for example, caters to specific government and defense contracts, showcasing the breadth of their strategic segmentation. This approach ensures that each business unit can develop and execute marketing strategies that resonate with its target audience, maximizing accessibility and impact.

- Maintenance and Construction: Focuses on large-scale industrial projects, leveraging specialized expertise and resources.

- DZConneX: Targets the telecommunications industry with advanced solutions and services.

- Day & Zimmermann Lone Star: Serves government and defense sectors with specialized capabilities.

- Market Segmentation: Each division is structured to optimize accessibility and service delivery channels for its specific client base.

Strategic Partnerships and Alliances

Day & Zimmermann actively pursues strategic partnerships and teaming agreements to broaden its market presence and enhance its service offerings. These alliances are crucial for accessing new business avenues and diversifying its portfolio, particularly in specialized sectors.

A notable example is their collaboration with Nawash Utilities Inc., focusing on the nuclear and hydroelectric markets. This partnership exemplifies their strategy to leverage complementary expertise and gain entry into critical infrastructure projects. Such teaming arrangements are vital for Day & Zimmermann's growth, allowing them to compete effectively in complex, large-scale endeavors.

- Market Expansion: Partnerships enable Day & Zimmermann to tap into new geographic regions and customer segments previously inaccessible.

- Capability Enhancement: Collaborations allow the company to integrate specialized skills and technologies, thereby expanding its service capabilities.

- Risk Mitigation: Teaming agreements can distribute project risks among partners, making larger or more complex projects more manageable.

- Access to New Opportunities: By aligning with other industry players, Day & Zimmermann can identify and bid on projects that might be beyond its sole capacity.

Day & Zimmermann's physical presence is deeply embedded within client operations, with teams deployed directly to project sites, often in challenging industrial settings. This hands-on approach is critical for delivering specialized engineering, construction, and maintenance services. Their extensive network of over 900 work locations globally ensures localized support and efficient resource deployment for diverse international projects.

The company's strategic market segmentation, through divisions like Maintenance and Construction, DZConneX, and Day & Zimmermann Lone Star, ensures tailored service delivery and optimized market penetration. This structure allows each business unit to effectively reach and serve its specific client base, enhancing accessibility and impact across various sectors.

Day & Zimmermann actively cultivates strategic partnerships and teaming agreements to expand its market reach and enhance service capabilities. Collaborations, such as the one with Nawash Utilities Inc. for nuclear and hydroelectric markets, are vital for accessing new opportunities and managing complex infrastructure projects.

| Division | Primary Market Focus | Key Service Areas |

|---|---|---|

| Maintenance and Construction | Industrial Sector | Large-scale industrial projects, specialized expertise |

| DZConneX | Telecommunications | Advanced solutions and services |

| Day & Zimmermann Lone Star | Government and Defense | Specialized capabilities for defense contracts |

Full Version Awaits

Day & Zimmermann 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Day & Zimmermann 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Day & Zimmermann heavily leverages government and industry bidding as a core promotional strategy, particularly for its defense and infrastructure sectors. This involves meticulously crafting proposals that highlight extensive capabilities, proven past performance on similar projects, and a clear articulation of their value proposition to win lucrative contracts.

In 2023, the U.S. Department of Defense alone awarded over $700 billion in contracts, a significant portion of which represents opportunities for companies like Day & Zimmermann. Their success in these competitive arenas is directly tied to their ability to demonstrate reliability and cost-effectiveness in complex project execution.

Day & Zimmermann actively cultivates thought leadership by disseminating expert insights and detailing successful project outcomes via case studies. This strategic approach showcases their proficiency in tackling intricate engineering, construction, and staffing challenges, highlighting innovative solutions and problem-solving capabilities.

Recent industry reports for 2024 indicate a growing demand for specialized engineering and construction services, with companies like Day & Zimmermann leveraging their documented successes to attract new business. Their published case studies often detail significant project cost savings or efficiency improvements, underscoring their value proposition to potential clients.

Day & Zimmermann actively cultivates its public image through strategic public relations, showcasing significant industry achievements. This includes consistent recognition on prestigious lists, such as Forbes' Best Employers for Diversity, underscoring their commitment to an inclusive workplace.

The company also highlights its dedication to operational excellence by promoting safety awards and high scores in corporate equality indices. These recognitions, like their repeated inclusion in the Human Rights Campaign's Corporate Equality Index, reinforce their standing as a responsible and high-performing organization.

Industry Conferences and Associations

Day & Zimmermann actively participates in major industry conferences and trade shows, a vital component of their marketing strategy. This engagement allows them to directly showcase their specialized services to a targeted audience within the government, industrial, and defense sectors. For instance, their presence at events like the Association of the United States Army (AUSA) Annual Meeting provides direct access to key decision-makers and potential clients. In 2024, AUSA reported over 33,000 attendees, underscoring the scale of these networking opportunities.

These industry associations and conferences serve as critical platforms for Day & Zimmermann to build relationships and identify new business opportunities. By engaging with professional networks, they reinforce their brand as a leader in their specialized fields. Membership in organizations like the National Defense Industrial Association (NDIA) further solidifies their industry standing and provides insights into evolving market needs.

- Networking: Direct engagement with potential clients, partners, and government officials at events like AUSA.

- Showcasing Services: Demonstrating specialized capabilities in government, industrial, and defense sectors.

- Industry Insight: Staying abreast of market trends and client needs through association memberships and conference discussions.

- Brand Visibility: Reinforcing Day & Zimmermann's position as a key player through active participation and thought leadership.

Direct Client Relationship Management

Day & Zimmermann prioritizes direct client relationship management as a key promotional strategy. This involves building and nurturing long-term connections with both current and potential clients, fostering loyalty and repeat business.

Dedicated account management teams are instrumental in this process. They ensure consistent communication, understand client needs, and deliver customized solutions, which builds significant trust.

In 2023, Day & Zimmermann reported a strong focus on client retention, with initiatives aimed at enhancing customer satisfaction playing a crucial role in their sustained growth. Their approach emphasizes understanding and addressing client needs proactively.

- Client-Centric Approach: Focus on understanding and meeting individual client requirements.

- Dedicated Account Management: Assigning specific teams to foster strong, ongoing client interactions.

- Relationship Building: Emphasis on long-term partnerships over transactional sales.

- Tailored Solutions: Developing customized offerings to address unique client challenges.

Day & Zimmermann's promotional efforts are deeply rooted in demonstrating expertise and reliability, particularly through government and industry bidding. Their success hinges on meticulously crafted proposals that showcase extensive capabilities and past performance, a strategy vital in securing contracts within sectors like defense and infrastructure. For example, the U.S. Department of Defense awarded over $700 billion in contracts in 2023, highlighting the significant market opportunities Day & Zimmermann targets.

Thought leadership and public relations are also key. By publishing case studies of successful, complex projects and earning recognition on lists like Forbes' Best Employers for Diversity, they build credibility and showcase their commitment to excellence and inclusivity. Their repeated inclusion in the Human Rights Campaign's Corporate Equality Index further solidifies their image as a responsible organization.

Active participation in industry conferences, such as the Association of the United States Army (AUSA) Annual Meeting, which saw over 33,000 attendees in 2024, provides direct engagement with decision-makers. This networking, coupled with memberships in organizations like the National Defense Industrial Association (NDIA), keeps them informed of market needs and reinforces their brand as an industry leader.

Furthermore, Day & Zimmermann prioritizes direct client relationship management, with dedicated account teams fostering loyalty and repeat business. Their 2023 focus on client retention underscores a strategy of understanding and proactively addressing client needs, leading to sustained growth through tailored solutions and trust-building.

| Promotional Tactic | Description | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Government & Industry Bidding | Meticulous proposal crafting highlighting capabilities and past performance. | Securing lucrative contracts in defense and infrastructure. | USD 700+ billion in DoD contracts awarded in 2023. |

| Thought Leadership & PR | Disseminating expert insights via case studies; public recognition. | Building credibility and showcasing operational excellence. | Inclusion in Forbes' Best Employers for Diversity. |

| Industry Conferences & Associations | Direct engagement at events like AUSA; membership in NDIA. | Networking, market insight, and brand visibility. | AUSA 2024 attendance exceeded 33,000. |

| Direct Client Relationship Management | Dedicated account teams, client retention focus. | Fostering loyalty, repeat business, and tailored solutions. | Strong focus on client retention initiatives in 2023. |

Price

Day & Zimmermann's pricing strategy heavily relies on a project-based, contractual model. This means prices are typically determined through competitive bidding processes and negotiated long-term agreements, especially for their large-scale engineering, construction, and maintenance services.

This bespoke pricing approach allows Day & Zimmermann to tailor costs directly to the unique requirements of each project, factoring in scope, complexity, duration, and specific client needs. For instance, in the energy sector, where Day & Zimmermann is a major player, project bids can range from millions to billions of dollars, reflecting the scale of power plant construction or major infrastructure upgrades.

The company's ability to secure multi-year contracts, often valued in the hundreds of millions or even billions, demonstrates the effectiveness of this pricing strategy in the capital-intensive industries it serves. This contractual certainty provides a stable revenue stream and allows for meticulous planning and resource allocation.

Day & Zimmermann's pricing for their specialized services reflects the immense value of their technical expertise, stringent safety protocols, and proven track record in managing complex, critical infrastructure and defense projects. This value-based approach acknowledges the significant impact and unwavering reliability they deliver to their clients.

Their pricing strategy is directly tied to the critical nature of the work and the specialized skills required, ensuring clients receive solutions that minimize risk and maximize operational uptime. For instance, in the defense sector, where precision and security are paramount, Day & Zimmermann's pricing would inherently incorporate the extensive R&D and highly skilled personnel necessary for such demanding engagements, a factor that distinguishes them from less specialized competitors.

Day & Zimmermann actively engages in competitive tendering, particularly for significant government and industrial projects. This strategy requires meticulous pricing to remain competitive while ensuring profitability against substantial operational expenditures.

In 2024, the U.S. federal government awarded over $700 billion in contracts, a market where Day & Zimmermann's competitive bidding is crucial. Their pricing models must account for factors like material costs, labor, and overhead, aiming for bids that are both attractive to clients and financially sound for the company.

Long-Term Service Agreements

Day & Zimmermann leverages long-term service agreements for its facilities maintenance and staffing divisions, offering clients multi-year contracts that ensure predictable costs and uninterrupted support. These agreements are crucial for fostering client loyalty and providing a consistent revenue base for the company.

These multi-year contracts are a cornerstone of Day & Zimmermann's service offering, providing clients with the assurance of continuous operational support and cost management. For the company, they translate into secured, recurring revenue streams, bolstering financial stability and enabling long-term strategic planning.

- Predictable Costs for Clients: Long-term agreements lock in service pricing, shielding clients from market volatility.

- Continuous Support: Ensures clients receive ongoing, reliable facilities management and staffing solutions.

- Stable Revenue for D&Z: Secures consistent income, aiding in resource allocation and business forecasting.

- Client Retention: Builds strong, ongoing relationships by demonstrating commitment and reliability.

Cost Management through Supplier Partnerships

Day & Zimmermann's pricing strategy is significantly bolstered by its proactive cost management, especially through deep collaborations with its most valuable suppliers. This approach allows the company to fine-tune the costs associated with materials and services, a critical factor in maintaining competitive pricing, particularly within the demanding defense sector.

By identifying and nurturing relationships with top-tier suppliers, Day & Zimmermann can negotiate more favorable terms and ensure a consistent supply chain. This efficiency translates directly into cost savings, which are then passed on to clients through more attractive and innovative pricing structures.

For instance, in 2024, companies in the aerospace and defense sector have seen an average increase of 5-7% in raw material costs. Day & Zimmermann's strategic supplier partnerships are designed to mitigate these pressures, aiming to absorb a portion of these increases through volume discounts and long-term agreements, thereby protecting client pricing.

- Supplier Recognition Programs: Implementing programs that acknowledge and reward high-performing suppliers for reliability and quality.

- Joint Cost Optimization Initiatives: Collaborating with suppliers on projects to identify and reduce waste or inefficiencies in the supply chain.

- Long-Term Supply Agreements: Securing predictable pricing and supply by entering into multi-year contracts with key partners.

- Data Sharing for Forecasting: Working with suppliers to share demand forecasts, enabling them to manage their own production and inventory more efficiently, leading to cost benefits.

Day & Zimmermann's pricing is fundamentally project-driven, often determined through competitive bidding and long-term contracts, especially for large-scale engineering and construction projects. This approach allows for tailored costs based on project scope, complexity, and client needs, a model crucial in sectors like energy where projects can range into billions of dollars.

Their strategy also emphasizes value-based pricing, reflecting the immense technical expertise and safety standards required for critical defense and infrastructure projects. This ensures clients pay for the guaranteed reliability and risk mitigation Day & Zimmermann provides.

The company actively competes for significant government contracts, where pricing accuracy is paramount. In 2024, with the U.S. federal government awarding over $700 billion in contracts, Day & Zimmermann's ability to offer competitive yet profitable bids, factoring in material, labor, and overhead costs, is key.

Furthermore, long-term service agreements for facilities maintenance and staffing offer clients predictable costs and continuous support, securing recurring revenue for Day & Zimmermann and fostering client loyalty through demonstrated reliability.

| Pricing Strategy Element | Description | Example/Data Point (2024/2025) |

| Project-Based/Contractual | Pricing determined by competitive bids and negotiated agreements for specific projects. | Large-scale energy projects can be valued in the billions. |

| Value-Based Pricing | Pricing reflects the specialized expertise, safety, and reliability offered. | Defense sector pricing incorporates extensive R&D and highly skilled personnel costs. |

| Competitive Bidding | Essential for securing government and industrial contracts. | U.S. federal contract awards exceeded $700 billion in 2024. |

| Long-Term Service Agreements | Offers predictable costs and continuous support for clients. | Secures recurring revenue streams and enhances client retention. |

4P's Marketing Mix Analysis Data Sources

Our Day & Zimmermann 4P's Marketing Mix Analysis leverages a comprehensive array of data, including official company reports, industry analyses, and market intelligence. We meticulously examine their product offerings, pricing strategies, distribution channels, and promotional activities to provide a robust understanding of their market approach.