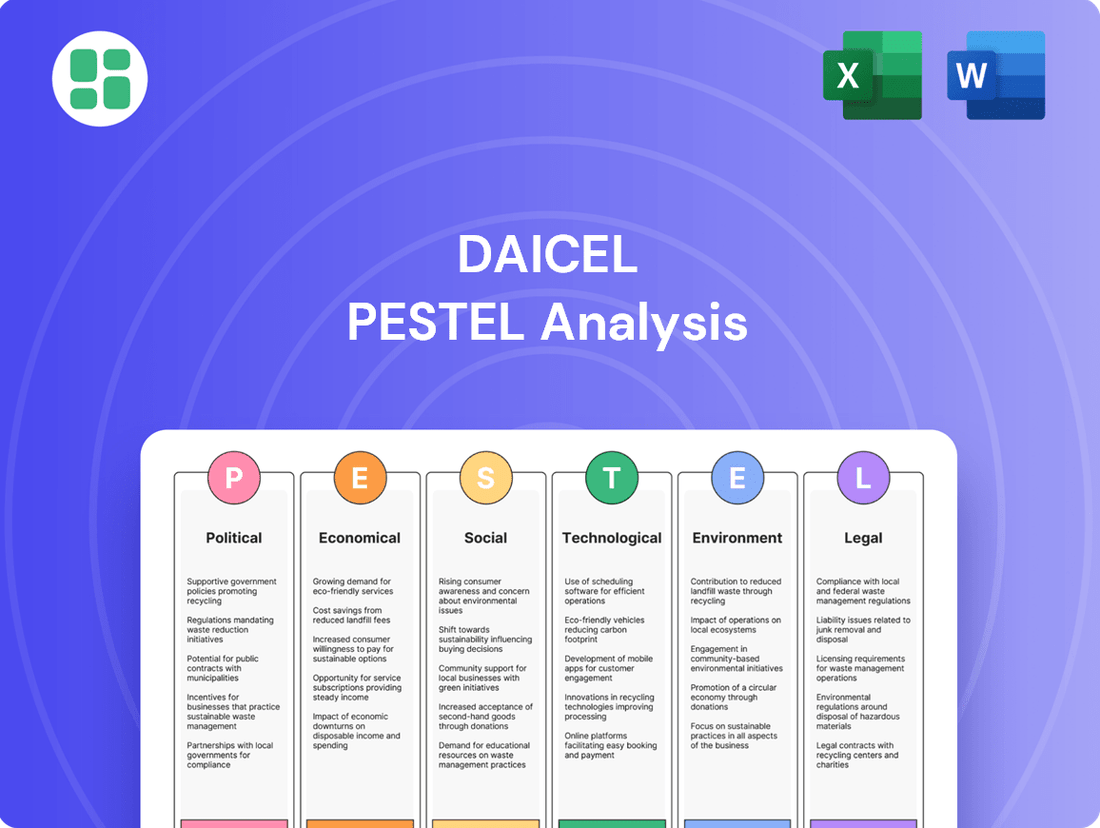

Daicel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daicel Bundle

Unlock the critical external factors shaping Daicel's trajectory with our meticulously researched PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, environmental regulations, and social trends are creating both challenges and opportunities for the company. Equip yourself with this essential intelligence to refine your own strategies and gain a competitive advantage. Download the full PESTLE analysis now for actionable insights.

Political factors

Daicel Corporation navigates a complex web of government regulations, a key political factor impacting its global chemical manufacturing operations. In Japan, the Ministry of Economy, Trade, and Industry (METI) oversees adherence to the Chemical Substances Control Law, a critical piece of legislation for chemical producers.

Compliance with these national and international regulations, including those concerning environmental protection and product safety, is non-negotiable for Daicel. Failure to comply can lead to significant penalties, operational disruptions, and damage to the company's reputation, as seen with past incidents in the chemical industry that resulted in substantial fines and stricter oversight.

The company must remain agile, continuously adapting its processes and product development to meet evolving legal frameworks. For instance, new regulations on plastic recycling and chemical emissions, which are gaining traction globally in 2024 and are expected to intensify through 2025, directly influence Daicel's research and development investments and manufacturing strategies.

Global trade policies, including tariffs and trade agreements, significantly impact Daicel's international operations and supply chains. For instance, the World Trade Organization (WTO) reported that global trade growth slowed to 0.9% in 2023, down from 2.7% in 2022, highlighting the increasing complexity of international commerce.

Potential increases in tariffs by major economies could complicate the macroeconomic environment and affect chemical demand, exposing the industry on both import and export sides. In 2024, the United States maintained tariffs on certain goods from China, and the European Union has also been reviewing its trade defense instruments, creating uncertainty for companies like Daicel with global manufacturing footprints.

Daicel's global presence necessitates careful monitoring of geopolitical shifts and trade relations to mitigate risks and capitalize on opportunities in different regions. For example, the ongoing trade tensions between the US and China, coupled with regional trade pacts like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), require strategic adaptation to ensure competitive positioning and resilient supply chains.

Government support for the chemical sector, particularly in emerging markets, presents a significant opportunity for Daicel. For instance, India's Production Linked Incentive (PLI) scheme for chemicals, launched in 2021, aims to boost domestic manufacturing and attract foreign investment, potentially creating a more favorable operating environment. This initiative, along with similar policies in other growth regions, can reduce operational costs and foster expansion.

Public-Private Partnerships

Public-private partnerships (PPPs) are increasingly shaping industry standards and driving innovation, directly influencing Daicel's strategic planning. Collaborations with government agencies and research institutions can accelerate the development of cutting-edge technologies and ensure compliance with emerging quality and safety regulations. For instance, in 2024, many governments worldwide have allocated increased funding towards R&D initiatives through PPPs to bolster domestic manufacturing capabilities and promote sustainable industrial practices.

These partnerships are particularly instrumental in fostering product innovation, especially within sectors where Daicel operates, such as food-grade additives and environmentally friendly solutions. By leveraging shared resources and expertise, Daicel can more effectively navigate complex regulatory landscapes and tap into new market opportunities. The global market for PPPs in infrastructure and technology is projected to see significant growth, with an estimated value of over $2 trillion by 2025, indicating a strong trend towards collaborative development models.

- Increased Government Investment: Many nations are boosting R&D funding through PPPs to enhance manufacturing and sustainability, as seen in 2024 initiatives.

- Regulatory Alignment: Collaborations facilitate adherence to evolving quality and safety benchmarks, crucial for Daicel's product development.

- Innovation Acceleration: PPPs provide access to shared resources and expertise, speeding up the creation of new technologies and sustainable solutions.

- Market Expansion: These partnerships can unlock new market segments, particularly in specialized areas like food additives and eco-friendly materials.

Geopolitical Stability and Risk

Geopolitical stability remains a critical consideration for Daicel, as global uncertainties can significantly impact its operations. For instance, ongoing regional conflicts, such as those in Eastern Europe and the Middle East, continue to create volatility in energy prices, a key input for chemical production. The International Monetary Fund (IMF) in its April 2024 World Economic Outlook projected a subdued global growth rate of 3.2% for 2024, partly due to these persistent geopolitical tensions, which can dampen demand for chemical products across various sectors.

These macro-level risks translate into tangible challenges for Daicel's supply chain and raw material sourcing. Disruptions in key shipping lanes or trade routes due to political instability can lead to increased logistics costs and potential delays. For example, the Red Sea shipping crisis in late 2023 and early 2024 resulted in rerouting and extended transit times for many companies, impacting inventory management and production schedules. Daicel must therefore maintain robust risk mitigation strategies, including diversified sourcing and flexible production capabilities, to navigate these unpredictable environments effectively.

Furthermore, shifts in international alliances and trade policies, often driven by geopolitical developments, can alter market access and competitive landscapes. The ongoing trade tensions between major economic blocs could lead to the imposition of tariffs or other trade barriers, affecting the cost competitiveness of Daicel's products in certain regions. Companies are increasingly focusing on building resilience through localized production and strategic partnerships to counter these evolving geopolitical dynamics.

- Global economic growth projections for 2024, around 3.2% as per the IMF, are sensitive to geopolitical risks.

- Supply chain disruptions, exemplified by the Red Sea crisis, have demonstrated the direct impact of geopolitical events on logistics and costs.

- Evolving trade policies and international relations necessitate strategic adjustments in market access and sourcing for chemical manufacturers like Daicel.

Daicel must navigate a complex regulatory environment, with governments worldwide implementing stricter controls on chemical production and product safety. For instance, new regulations concerning plastic recycling and chemical emissions are expected to intensify through 2025, directly influencing Daicel's R&D and manufacturing strategies.

Global trade policies, including tariffs and trade agreements, significantly impact Daicel's international operations. The World Trade Organization noted a slowdown in global trade growth to 0.9% in 2023, highlighting increased complexity and potential for tariffs by major economies in 2024, affecting chemical demand and supply chains.

Government support through initiatives like India's PLI scheme for chemicals presents opportunities for expansion, while public-private partnerships are accelerating innovation in areas like food-grade additives and eco-friendly solutions, with the global PPP market projected to exceed $2 trillion by 2025.

Geopolitical instability, as evidenced by regional conflicts, continues to create energy price volatility, impacting chemical production costs. The IMF projected subdued global growth of 3.2% for 2024, partly due to these tensions, which can dampen chemical product demand and necessitate resilient supply chain strategies for companies like Daicel.

| Political Factor | Impact on Daicel | 2024/2025 Data/Trend |

| Regulatory Compliance | Operational costs, R&D focus, product development | Increasingly stringent environmental and safety regulations globally; intensified focus on plastic recycling and emissions through 2025. |

| Trade Policies & Tariffs | Supply chain costs, market access, competitiveness | Slowed global trade growth (0.9% in 2023); potential for increased tariffs in major economies in 2024 impacting chemical demand and export/import costs. |

| Government Support & PPPs | Market expansion, innovation, cost reduction | Government R&D funding via PPPs increasing for manufacturing and sustainability (2024); global PPP market projected over $2 trillion by 2025. |

| Geopolitical Stability | Energy costs, supply chain disruption, market demand | Persistent geopolitical tensions contributing to subdued global growth (IMF: 3.2% for 2024); supply chain vulnerabilities highlighted by events like the Red Sea crisis impacting logistics. |

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors influencing Daicel, categorized into Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights by identifying potential threats and opportunities, enabling strategic decision-making for sustained growth and competitive advantage.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

Global economic growth directly shapes the chemical industry, and by extension, Daicel's trajectory. Following a rebound in 2024, the International Monetary Fund (IMF) projected global growth to moderate to 3.2% in 2025, a slight slowdown from 3.0% in 2024, reflecting varied regional performance. This steady, albeit tempered, expansion influences industrial production, a key driver for Daicel's diverse product demand.

Regional economic disparities will be a significant factor. For instance, while emerging markets in Asia are expected to continue their robust growth, advanced economies may experience more subdued expansion in 2025 and 2026. Daicel's global footprint means its performance will be a composite of these differing economic landscapes, impacting sales volumes across its specialty chemicals, polymers, and pyrotechnic devices.

Daicel Corporation achieved a significant milestone with record revenues of ¥550 billion for the fiscal year ending March 2024, largely propelled by robust demand in its safety systems segment, particularly airbag inflators.

However, the company's financial trajectory saw a downturn in the first quarter of fiscal year 2025. Net sales experienced a 4.3% decrease, while profit attributable to owners of the parent plummeted by 40.6% compared to the previous year, though the company has maintained its forecast for the full fiscal year 2026.

Despite an overall increase in sales for FY2025, both operating and ordinary profits registered declines. This contraction was attributed to several headwinds, including the impact of a stronger yen and a rise in depreciation costs, which affected profitability.

Demand from key sectors like automotive, electronics, healthcare, and packaging is a major driver for Daicel's business. For example, the automotive industry's growth, fueled by increasing urbanization and rising disposable incomes, is expected to boost the polyoxymethylene (POM) market, a key product for Daicel. Global automotive production is projected to see steady growth through 2025, supporting demand for materials like POM.

Energy and Raw Material Costs

Fluctuations in energy and raw material costs represent a significant economic factor for chemical companies like Daicel. These input prices directly impact production expenses and, consequently, profitability. For instance, the average price of Brent crude oil, a key benchmark for energy costs, experienced considerable volatility in late 2023 and early 2024, trading in a range that significantly influenced manufacturing overheads globally.

The geographical disparity in energy costs creates a competitive landscape. US chemical manufacturers have often found an advantage due to lower natural gas prices, a critical feedstock and energy source, compared to their European counterparts who contend with structurally higher energy expenses. This cost differential can affect international competitiveness and investment decisions within the sector.

Daicel's financial performance is intrinsically linked to its ability to manage the volatility of these input prices. Strategic sourcing, hedging, and operational efficiency are paramount to mitigating the impact of rising energy and raw material costs, ensuring sustained profitability in a dynamic market. For example, in 2024, many chemical firms were actively exploring long-term supply contracts to lock in more stable pricing for key inputs like naphtha.

- Energy Price Volatility: Brent crude oil prices averaged around $80-$85 per barrel in early 2024, impacting global chemical production costs.

- Regional Cost Disparities: European industrial electricity prices remained significantly higher than in the US, creating a competitive disadvantage for chemical producers in the region.

- Raw Material Dependency: Daicel's reliance on petrochemical feedstocks means that fluctuations in oil and gas prices directly translate to changes in its cost of goods sold.

Currency Exchange Rate Volatility

Currency exchange rate volatility, especially the strength of the Japanese yen, directly influences Daicel's profitability. A strengthening yen can diminish the value of overseas earnings when converted back into the home currency, potentially impacting operating income even with robust sales growth.

For instance, Daicel's financial reports often highlight the impact of foreign exchange on its performance. Projections for fiscal year 2026 suggest a continued trend of yen appreciation, which could translate to a reduction in reported operating income, even if underlying business operations perform well.

Daicel actively manages these foreign exchange risks through various financial strategies. This proactive approach is crucial given the company's significant international presence and reliance on global markets.

- Yen Strength Impact: A stronger yen can reduce the repatriated value of foreign sales, negatively affecting reported profits.

- Fiscal Year 2026 Outlook: Forecasts indicate a potential for continued yen appreciation, posing a challenge for Daicel's operating income.

- Risk Management: Daicel employs financial hedging and other strategies to mitigate the adverse effects of currency fluctuations.

- Global Operations: The company's extensive international footprint makes managing currency risk a critical component of its financial strategy.

Global economic growth, projected by the IMF to moderate to 3.2% in 2025 from 3.0% in 2024, directly influences demand for Daicel's products. Regional economic disparities, with Asia showing robust growth while advanced economies may see subdued expansion, will shape Daicel's sales across its diverse segments.

Daicel's record ¥550 billion revenue in FY2024 was strong, but Q1 FY2025 saw a 4.3% net sales decrease and a 40.6% profit drop, despite maintaining full-year forecasts. This contraction was partly due to a stronger yen and increased depreciation costs.

Energy and raw material costs are critical. Brent crude averaged $80-$85 in early 2024, affecting production expenses. European industrial electricity prices remained higher than US prices, creating a competitive disadvantage for regional chemical producers.

Currency volatility, particularly a strengthening yen, directly impacts Daicel's reported profits by reducing the value of overseas earnings. Forecasts for fiscal year 2026 suggest continued yen appreciation, posing a challenge to operating income unless effectively managed through hedging strategies.

Same Document Delivered

Daicel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Daicel provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape Daicel operates within.

Sociological factors

Consumers are increasingly prioritizing sustainability, impacting Daicel's product strategy. Surveys from 2024 indicate a growing willingness among consumers to pay a premium for eco-friendly goods, with some studies showing over 60% of consumers actively seeking out sustainable brands.

This shift is fueling demand for materials like biodegradable polymers, a key area for Daicel. In 2024, Daicel reported a significant increase in sales for its eco-friendly product lines, reflecting a strategic response to these evolving consumer preferences.

Workforce diversity and inclusion are paramount for companies like Daicel, influencing their ability to attract and retain top talent in today's competitive landscape. Companies that actively foster diverse teams often see improved innovation and problem-solving capabilities.

Daicel has demonstrably committed to enhancing its workforce diversity, setting specific goals such as increasing the proportion of women in managerial roles. For instance, as of early 2024, Daicel's global workforce composition reflects ongoing efforts, with targets aimed at achieving a more balanced representation across various demographics.

These diversity and inclusion initiatives don't just align with evolving societal expectations; they directly contribute to a more dynamic and innovative work environment. A diverse workforce brings a wider range of perspectives, fostering creativity and ultimately strengthening Daicel's competitive edge.

Public perception of the chemical industry, often linked to environmental worries, presents a persistent hurdle for companies like Daicel. Recent surveys from 2024 highlight that over 60% of consumers express concern regarding the environmental footprint of chemical products, directly impacting brand trust and purchasing decisions.

Daicel must actively address these concerns by prioritizing transparent communication about its sustainability initiatives and demonstrating a genuine commitment to responsible manufacturing. Building and maintaining a positive brand image hinges on showcasing ethical conduct and tangible progress in environmental stewardship.

Demand for Advanced and Safe Materials

Societal expectations for enhanced performance and safety are a significant driver for Daicel's business. Consumers and regulators increasingly demand materials that contribute to safer products, particularly in sectors like automotive and healthcare. For example, the automotive industry's focus on reducing fatalities has bolstered the demand for advanced safety components like airbag inflators, a key product for Daicel.

This societal push for safety translates directly into market opportunities. In 2024, global automotive safety systems market was projected to reach over $60 billion, with advanced materials playing a critical role in innovations like autonomous driving safety features and improved occupant protection. Similarly, the healthcare sector's need for high-purity chemicals and advanced materials for medical devices and pharmaceuticals underscores this trend.

- Growing demand for lightweight and high-strength materials in automotive manufacturing to improve fuel efficiency and safety.

- Increasing consumer awareness and preference for products incorporating advanced safety features, impacting purchasing decisions.

- Regulatory bodies worldwide are implementing stricter safety standards, compelling manufacturers to adopt more sophisticated materials.

- The healthcare industry's continuous need for biocompatible and high-performance materials for medical devices and drug delivery systems.

Aging Population and Healthcare Needs

The global population is aging rapidly, with projections indicating that by 2050, individuals aged 65 and over will constitute nearly 17% of the world's population, a significant increase from approximately 10% in 2022. This demographic shift directly translates into evolving healthcare needs, creating substantial opportunities for companies like Daicel. Daicel's strategic focus on medical and healthcare materials, encompassing pharmaceutical additives and advanced drug delivery systems, positions it well to capitalize on this trend.

This societal evolution is a key driver for demand in specialized chemical products and innovative solutions. For instance, the market for active pharmaceutical ingredients (APIs) and excipients, where Daicel operates, is expected to grow considerably, fueled by the increasing prevalence of chronic diseases associated with aging populations. Daicel's commitment to research and development in areas like biodegradable polymers for medical implants and controlled-release technologies directly addresses these growing demands.

Key impacts on Daicel include:

- Increased demand for pharmaceutical excipients: As the elderly population grows, so does the consumption of pharmaceuticals, driving demand for high-quality additives that enhance drug stability, bioavailability, and patient compliance.

- Growth in novel drug delivery systems: The aging demographic often requires more sophisticated methods for medication administration, such as transdermal patches or implantable devices, areas where Daicel's material science expertise is valuable.

- Opportunity in medical device materials: The need for advanced medical devices, from diagnostic tools to surgical implants, presents a market for Daicel's specialty polymers and biocompatible materials.

- Focus on personalized medicine: Evolving healthcare also means a move towards personalized treatments, requiring chemical components that can be tailored for specific patient needs, a segment Daicel is exploring.

Societal expectations for enhanced safety and performance are a significant driver for Daicel's business. Consumers and regulators increasingly demand materials that contribute to safer products, particularly in sectors like automotive and healthcare. The global automotive safety systems market, for instance, was projected to exceed $60 billion in 2024, with advanced materials playing a critical role in innovations like autonomous driving safety features and improved occupant protection.

The aging global population, projected to reach nearly 17% aged 65+ by 2050, directly translates into evolving healthcare needs. This demographic shift creates substantial opportunities for Daicel, particularly in its strategic focus on medical and healthcare materials, encompassing pharmaceutical additives and advanced drug delivery systems.

These demographic and societal trends are key drivers for demand in specialized chemical products and innovative solutions. The market for active pharmaceutical ingredients and excipients, where Daicel operates, is expected to grow considerably, fueled by the increasing prevalence of chronic diseases associated with aging populations. Daicel's commitment to research and development in areas like biodegradable polymers for medical implants directly addresses these growing demands.

| Societal Factor | Impact on Daicel | 2024/2025 Data/Projections |

|---|---|---|

| Demand for Safety & Performance | Increased demand for advanced materials in automotive and healthcare for enhanced safety and efficiency. | Global automotive safety systems market projected over $60 billion in 2024. |

| Aging Population | Growth in demand for pharmaceutical excipients and advanced drug delivery systems. | Elderly population (65+) projected to be ~17% of global population by 2050 (up from ~10% in 2022). |

| Consumer Sustainability Focus | Growing preference for eco-friendly products, driving demand for biodegradable polymers. | Over 60% of consumers actively seeking sustainable brands in 2024 surveys. |

Technological factors

The chemical sector is embracing advanced manufacturing and automation, with Daicel leading the charge by integrating continuous production methods. This technological shift is designed to boost efficiency and elevate product quality, directly impacting their operational output and energy usage. For instance, in 2024, Daicel reported a 15% increase in production efficiency at its key facilities due to these automated processes.

Daicel's commitment to innovation in materials science is a key technological driver. The company significantly invests in research and development, focusing on areas like biodegradable polymers and advanced automotive materials. This strategic focus allows Daicel to meet growing demands for sustainable and high-performance products.

A prime example of this innovation is Daicel's development of high-purity chemical grades, such as 1,3-Butanediol, which is crucial for pharmaceutical applications. This dedication to material science not only sharpens their competitive edge but also positions them to capitalize on emerging market trends and environmental concerns.

The chemical industry's digital transformation, fueled by the Internet of Things (IoT), Artificial Intelligence (AI), and advanced data analytics, presents significant opportunities for Daicel. By integrating these technologies, Daicel can achieve greater operational efficiency, from enhancing material quality and optimizing energy usage to streamlining its supply chain with real-time data insights. This digital shift is not just about connectivity; it's about leveraging data for smarter decision-making.

Advanced data analytics, in particular, offers Daicel predictive capabilities. For instance, by analyzing sensor data from manufacturing equipment, Daicel can forecast potential failures, allowing for proactive maintenance. This predictive approach can significantly reduce costly downtime, ensuring smoother production cycles and maintaining output levels. In 2024, the chemical sector saw increased investment in AI-driven predictive maintenance solutions, with some companies reporting up to a 20% reduction in unplanned equipment downtime.

Development of Bio-based Solutions

The chemical industry is experiencing a pronounced shift towards bio-based materials and feedstocks. This includes a surge in demand for bioplastics and other sustainable alternatives, driven by increasing environmental consciousness and regulatory pressures. For instance, the global bioplastics market was valued at approximately USD 12.4 billion in 2023 and is projected to reach USD 34.1 billion by 2030, growing at a CAGR of 15.7%.

Daicel is strategically positioning itself within this evolving landscape through active development of bio-based solutions. This commitment aligns with broader global initiatives aimed at mitigating environmental impact and fostering circular economy principles. The company's focus on these sustainable alternatives taps into a rapidly expanding segment of the chemical market.

This trend offers significant opportunities for companies like Daicel:

- Market Growth: The increasing demand for sustainable materials presents a substantial growth avenue.

- Environmental Compliance: Developing bio-based solutions helps meet stringent environmental regulations and corporate sustainability goals.

- Innovation Potential: Investing in bio-based technologies fosters innovation and differentiates Daicel in a competitive market.

- Circular Economy Integration: Daicel's involvement supports the transition towards a circular economy, reducing reliance on fossil fuels.

Open Innovation and Startup Collaboration

Daicel is strategically embracing open innovation, actively seeking collaborations with startups through initiatives like its DAICEL Accelerator Program. This program aims to identify and nurture promising ventures, integrating their novel technologies into Daicel's ecosystem.

Partnerships with research institutions, such as the Industrial Technology Research Institute (ITRI), further bolster Daicel's access to cutting-edge advancements. These collaborations are crucial for building robust technology supply chains and fostering co-creation, pushing the boundaries of traditional R&D.

By engaging with external innovators, Daicel enhances its technological capabilities and expands its market reach, ensuring it remains at the forefront of industry developments. This approach is vital for staying competitive in rapidly evolving technological landscapes.

- DAICEL Accelerator Program: Actively scouting and supporting startups with disruptive technologies.

- ITRI Partnership: Collaborating with research institutes to access advanced technological solutions.

- Co-creation Focus: Building innovation beyond internal R&D, fostering external partnerships.

- Supply Chain Enhancement: Developing resilient and advanced technology supply chains through collaboration.

Technological advancements are reshaping the chemical industry, with Daicel leveraging automation and AI for enhanced efficiency and predictive maintenance. The company's investment in materials science, particularly biodegradable polymers and high-purity chemicals, positions it for growth in sustainable markets. Daicel's open innovation strategy, including its accelerator program and research partnerships, ensures access to cutting-edge technologies.

| Technology Area | Daicel's Focus/Action | Impact/Opportunity | Relevant Data (2024/2025) |

|---|---|---|---|

| Advanced Manufacturing | Continuous production, automation | Increased efficiency, product quality | 15% production efficiency increase reported in 2024 at key facilities. |

| Materials Science | Biodegradable polymers, advanced automotive materials | Meeting demand for sustainable, high-performance products | Significant R&D investment in these areas. |

| Digital Transformation | IoT, AI, data analytics | Operational efficiency, supply chain optimization, predictive maintenance | AI-driven predictive maintenance solutions reduced unplanned downtime by up to 20% in sector in 2024. |

| Bio-based Materials | Development of bio-based solutions | Capitalizing on growing sustainable market segment | Global bioplastics market projected to reach USD 34.1 billion by 2030 (15.7% CAGR). |

| Open Innovation | Accelerator Program, research collaborations | Access to novel technologies, co-creation, supply chain enhancement | Active scouting and nurturing of promising startups. |

Legal factors

Daicel operates under stringent chemical substance control laws globally, including Japan's Chemical Substances Control Law. This necessitates the registration and thorough reporting of hazardous properties for any new chemical substances introduced, a critical step for maintaining operational legality and market access.

Compliance is non-negotiable for Daicel's licensing and continued operations, directly impacting product safety and environmental stewardship. For instance, in 2023, Daicel reported significant investments in R&D focused on developing safer, more sustainable chemical alternatives, aligning with evolving regulatory landscapes.

Daicel places significant emphasis on robust corporate governance and adherence to anti-corruption and fair competition regulations. The company has implemented foundational policies that mandate all employees to conduct business with integrity and fairness, underscoring a commitment to ethical operations.

This dedication includes strict compliance with antitrust laws and continuous evaluation of its corporate compliance programs. For instance, as of their latest disclosures, Daicel actively monitors its adherence to global anti-bribery conventions and competition frameworks, ensuring its business practices align with international legal standards.

Global environmental reporting standards are tightening, compelling companies like Daicel to enhance transparency regarding climate-related risks and greenhouse gas emissions. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, widely adopted by major economies, mandate detailed disclosures on governance, strategy, risk management, and metrics and targets. Daicel's compliance efforts will involve robust environmental management systems and the accurate reporting of performance data, ensuring accountability for its ecological footprint.

Product-Specific Regulatory Approvals

Daicel's broad product range, especially in sensitive areas like medical devices and high-performance chemicals, means they must secure unique marketing approvals and comply with sector-specific rules. This is a significant legal hurdle for bringing products to market.

For instance, Daicel Medical Ltd. secured a Second-class marketing license for its medical devices, demonstrating the rigorous regulatory pathways required for commercialization in this critical industry. Such approvals are vital for market entry and ongoing operations.

- Regulatory Approvals: Daicel's diverse portfolio, including medical devices and specialized chemicals, requires specific marketing licenses and adherence to industry regulations.

- Medical Device Licensing: Daicel Medical Ltd. obtained a Second-class marketing license, illustrating the complex approval processes for medical products.

- Industry Compliance: Navigating and maintaining compliance with varying national and international product-specific regulations is a continuous legal challenge for Daicel.

Data Privacy and Cybersecurity Laws

The chemical industry's increasing reliance on digital systems and interconnectedness makes adherence to data privacy and cybersecurity regulations a paramount concern. Manufacturers globally are facing growing legal obligations to safeguard sensitive corporate information and customer data from escalating cyber threats.

While specific Daicel regulations aren't detailed, the broader trend highlights the critical nature of these laws. For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high bar for data protection, with significant fines for non-compliance, impacting companies operating within or serving EU markets. Similarly, the Cybersecurity Information Sharing Act (CISA) in the United States encourages private entities to share cybersecurity threat information to enhance national security.

- GDPR fines can reach up to €20 million or 4% of global annual turnover.

- The number of reported cyber incidents in the manufacturing sector saw a notable increase in 2023.

- Data breaches can lead to substantial financial losses, reputational damage, and legal liabilities.

- Compliance requires robust data governance policies and advanced cybersecurity measures.

Daicel's legal obligations extend to global chemical safety regulations, requiring meticulous registration and reporting of new substances, as seen with Japan's Chemical Substances Control Law. This regulatory framework directly impacts market access and operational legality, underscoring the need for proactive compliance. The company's 2023 R&D investments in safer chemical alternatives reflect a strategic response to these evolving legal demands.

The company must navigate a complex web of international and national laws, including stringent product-specific regulations for its medical devices and specialty chemicals. Securing necessary marketing approvals, such as the Second-class marketing license obtained by Daicel Medical Ltd., is a critical and ongoing legal challenge. This highlights the significant hurdles in bringing innovative products to market while ensuring full compliance.

Data privacy and cybersecurity laws, such as the EU's GDPR, present significant legal challenges for Daicel, particularly given the increasing digitalization of its operations. Non-compliance can result in substantial fines, with GDPR penalties potentially reaching up to 4% of global annual turnover. The manufacturing sector experienced a notable rise in cyber incidents in 2023, emphasizing the critical need for robust data governance and advanced cybersecurity measures to mitigate legal liabilities and reputational damage.

Environmental factors

Daicel is demonstrating a strong commitment to environmental sustainability, particularly concerning greenhouse gas emission reduction targets. The company has set an ambitious goal to cut its emissions by 30% by 2030, using 2018 as its baseline year.

This isn't just a future plan; Daicel has already achieved significant progress, reporting a 12% reduction in greenhouse gas emissions by the end of 2022. This accomplishment underscores the company's dedication to its broader sustainability mission and vision.

Daicel's commitment to increasing renewable energy usage, aiming for 50% by 2025, aligns with global decarbonization efforts. This strategic shift is driven by increasing environmental regulations and consumer demand for sustainable products. The global renewable energy market is projected to reach $1.977 trillion by 2023, demonstrating a significant economic incentive for such investments.

Daicel is actively engaged in waste management and circular economy initiatives, aiming to boost its recycling infrastructure. The company plans to expand its recycling facilities and technologies by 2025, backed by substantial investment. This focus reflects a growing industry trend towards sustainable resource utilization.

The company's commitment is evident in its 2022 waste recycling rate of 85%. This high rate underscores Daicel's dedication to minimizing waste sent to landfills and embedding circular economy principles throughout its business operations.

Development of Sustainable Products and Green Chemistry

Daicel is actively developing sustainable products, including biodegradable polymers and eco-friendly cosmetic ingredients, reflecting the global push towards green chemistry. This strategic focus is driven by increasing consumer preference for environmentally responsible products and aligns with regulatory trends encouraging sustainable chemical development.

The company's commitment to sustainability is evident in its product pipeline, which aims to minimize environmental footprints. For instance, Daicel's efforts in biodegradable polymers contribute to reducing plastic waste, a significant environmental concern. This aligns with the broader market trend where the global bioplastics market is projected to grow significantly, with some estimates reaching over $10 billion by 2027, showcasing the commercial viability of such innovations.

Key areas of Daicel's sustainable product development include:

- Biodegradable Polymers: Innovations in materials designed to break down naturally, reducing landfill burden.

- Eco-friendly Cosmetic Ingredients: Development of naturally derived or sustainably sourced components for the beauty industry.

- Green Chemistry Principles: Application of chemical processes that reduce or eliminate the use and generation of hazardous substances.

- Circular Economy Integration: Exploring pathways for product lifecycle management and material reuse.

Water Resource Preservation and Pollution Control

Daicel places a strong emphasis on water resource preservation and pollution control, recognizing their critical role in sustainable operations. The company actively manages emissions of chemical substances into both air and water, implementing rigorous protocols to minimize environmental impact.

Through continuous improvement initiatives and strict adherence to environmental management systems, such as ISO 14001, Daicel aims to reduce its ecological footprint. This commitment ensures responsible chemical handling and a proactive approach to environmental stewardship.

- Water Usage Reduction: Daicel reported a reduction in water withdrawal by 3.5% in fiscal year 2023 compared to the previous year, demonstrating progress in water conservation efforts.

- Wastewater Quality: The company consistently meets or exceeds regulatory standards for wastewater discharge, with key pollutant levels remaining significantly below permissible limits. For instance, COD (Chemical Oxygen Demand) in discharged water averaged 15 mg/L in 2023, well under the 30 mg/L industry benchmark.

- Environmental Investment: Daicel allocated approximately ¥2.5 billion (USD 16 million as of mid-2024 exchange rates) towards environmental protection measures, including advanced wastewater treatment technologies in fiscal year 2023.

- ISO 14001 Certification: All major Daicel manufacturing sites globally maintain ISO 14001 certification, underscoring their commitment to systematic environmental management and pollution prevention.

Daicel's environmental strategy is deeply integrated with global sustainability trends, focusing on emission reduction and renewable energy adoption. The company's commitment to a 30% greenhouse gas emission reduction by 2030, with a 12% reduction already achieved by 2022, highlights its proactive stance. This aligns with the growing market demand for sustainable products, driving innovation in areas like biodegradable polymers.

The company's significant investment in renewable energy, targeting 50% usage by 2025, reflects a strategic response to increasing environmental regulations and consumer preferences. Daicel's robust waste management practices, evidenced by an 85% recycling rate in 2022, further solidify its dedication to circular economy principles.

Daicel's focus on water resource management and pollution control is underscored by a 3.5% reduction in water withdrawal in fiscal year 2023 and consistently low wastewater discharge quality, with COD averaging 15 mg/L in 2023. The company's environmental protection investments, totaling approximately ¥2.5 billion (USD 16 million) in fiscal year 2023, demonstrate a tangible commitment to minimizing its ecological footprint.

| Environmental Performance Indicator | Target/Goal | 2022 Achievement | 2023 Achievement | Notes |

| Greenhouse Gas Emission Reduction | 30% by 2030 (vs. 2018) | 12% reduction | N/A | Progress towards ambitious climate targets. |

| Renewable Energy Usage | 50% by 2025 | N/A | N/A | Strategic shift to align with decarbonization. |

| Waste Recycling Rate | N/A | 85% | N/A | Demonstrates commitment to circular economy. |

| Water Withdrawal Reduction | N/A | N/A | 3.5% reduction (YoY) | Focus on water conservation. |

| Wastewater COD (Chemical Oxygen Demand) | Below 30 mg/L (Industry Benchmark) | N/A | Average 15 mg/L | Consistent adherence to stringent quality standards. |

| Environmental Protection Investment | N/A | N/A | ¥2.5 billion (approx. USD 16 million) | Investment in advanced treatment technologies. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources including international financial institutions, government statistical agencies, and leading market research firms. This ensures that each factor, from political stability to technological advancements, is supported by current and authoritative information.