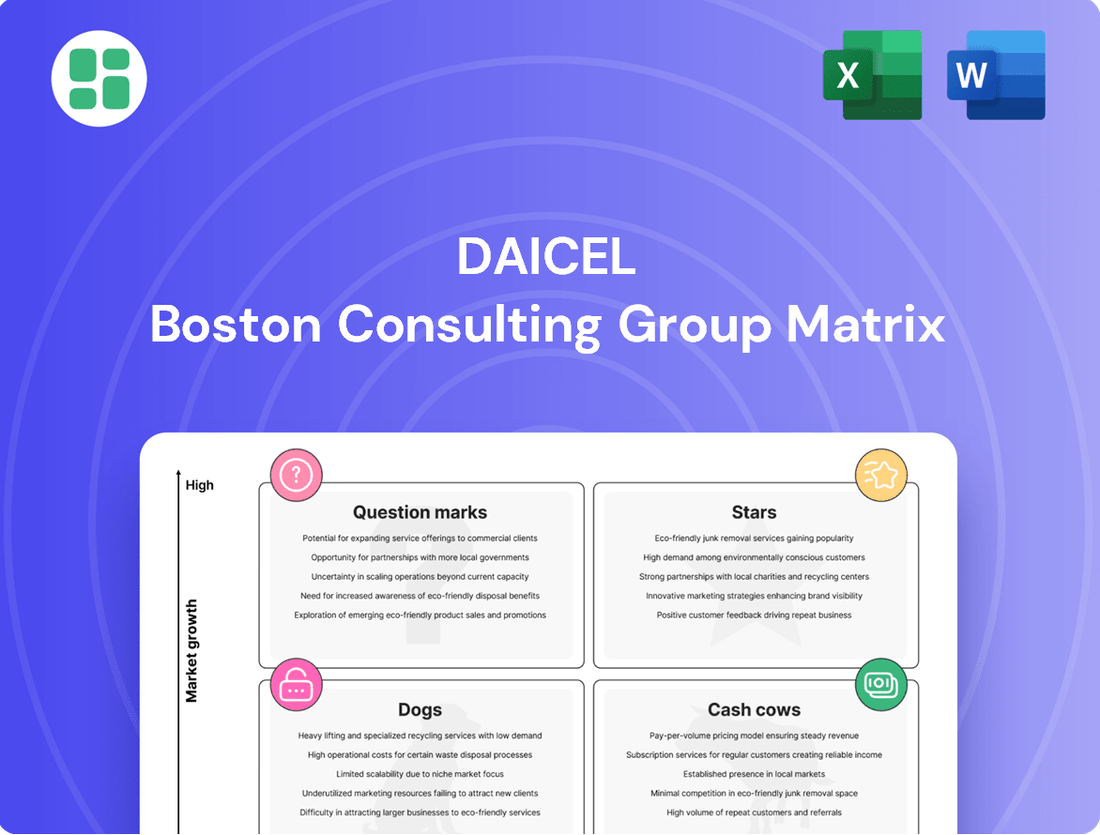

Daicel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daicel Bundle

Curious about Daicel's product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but to truly harness strategic growth, you need the full picture. Discover which of Daicel's offerings are Stars, Cash Cows, Dogs, or Question Marks, and unlock actionable insights for your own business strategy.

Don't just wonder about Daicel's market position; understand it. The complete BCG Matrix report provides a detailed quadrant-by-quadrant analysis, empowering you to make informed decisions about resource allocation and future investments. Purchase the full version for a comprehensive roadmap to competitive advantage.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Daicel commands a substantial global market share in automotive safety components, including vital airbag inflators and seatbelt pretensioners. This sector is experiencing strong, consistent demand, fueled by rising vehicle production in key emerging economies like China and India.

The global automotive safety systems market is anticipated to expand considerably, propelled by stricter safety mandates and growing consumer consciousness regarding vehicle safety. In 2024, the automotive safety systems market was valued at approximately $50 billion, with projections indicating a compound annual growth rate (CAGR) of over 7% through 2030.

Daicel's strategic emphasis on advancing its technological prowess and cultivating strategic alliances is poised to solidify its market standing and boost revenue within this rapidly expanding segment.

Daicel's Polyplastics subsidiary is actively boosting its production of Polyacetal (POM) and Liquid Crystal Polymer (LCP). This strategic move addresses robust market demand, particularly in China where the POM market is projected to grow at an annual rate of 3.0% to 3.5%.

The increasing adoption of LCP, driven by advancements in smartphone technology like larger and more sophisticated camera modules, signifies a high-growth application area. Daicel is responding to this trend by investing in new POM plant operations and aiming to solidify its position as a leader in the LCP industry by exploring new market opportunities.

Daicel is actively contributing innovative solutions to the robustly growing electronic materials sector. This market, while experiencing some past plateaus, is on track for substantial expansion, with projections indicating a compound annual growth rate (CAGR) of 6.70% between 2024 and 2035.

The company's high-performance epoxy compounds, renowned for their exceptional heat resistance, are finding critical applications in high-growth segments. Specifically, these materials are being utilized in components such as EV motor insulators and power modules, positioning Daicel favorably within this expanding and dynamic market.

High-Performance Organic Chemicals

Daicel's prowess in organic chemistry underpins its high-performance organic chemicals segment, particularly in acetyl chains. These advanced materials are crucial for industries demanding superior functionality and reliability.

The company actively innovates within this sector, ensuring its offerings align with the dynamic needs of its global clientele. This commitment to continuous improvement is a cornerstone of Daicel's strategy.

Daicel's mid-term management plan emphasizes bolstering these established businesses. For instance, in fiscal year 2023, Daicel reported consolidated net sales of ¥372.5 billion, with its chemicals segment playing a significant role.

- Acetyl Products: Daicel is a leading global producer of acetic acid and derivatives, essential building blocks for various industries.

- Performance Chemicals: This category includes specialty chemicals like cellulose acetate, used in filters and films, and high-purity solvents.

- Industry Applications: These chemicals find use in automotive, electronics, pharmaceuticals, and consumer goods, highlighting their broad market reach.

- R&D Focus: Daicel invests heavily in research and development to create next-generation organic chemicals with improved environmental profiles and enhanced performance characteristics.

Innovation-Driven Core Products

Daicel's strategic focus on innovation fuels its core products, aiming to establish new business ventures through its distinct material science and technological capabilities. This commitment is underscored by a significant R&D restructuring in April 2024, designed to accelerate the transition of research findings into profitable commercial products. The company's consistent investment in its foundational chemical product lines is key to cultivating next-generation offerings poised for market leadership.

This forward-thinking approach is crucial for maintaining competitiveness. For instance, Daicel's investment in advanced materials for the automotive sector, a key area for innovation, saw significant growth in demand throughout 2024. The company reported that its cellulose acetate products, vital for applications like cigarette filters and films, continued to be a stable revenue generator, providing the financial base for investing in more cutting-edge research.

Key aspects of Daicel's innovation-driven core products include:

- Leveraging proprietary material technologies: Daicel utilizes its deep expertise in areas like organic synthesis and polymer science to create differentiated products.

- Accelerated R&D to commercialization: The April 2024 organizational changes aim to shorten the innovation cycle, bringing new solutions to market faster.

- Focus on next-generation solutions: Continuous investment ensures that core product categories evolve to meet future market demands and technological advancements.

- Financial backing for future growth: Stable performance in established product lines provides the capital necessary to fund ambitious R&D initiatives.

Daicel's automotive safety components, like airbag inflators, are Stars in the BCG matrix. This segment benefits from consistent demand driven by increasing vehicle production in emerging markets and stricter global safety regulations. The automotive safety systems market was valued at around $50 billion in 2024 and is expected to grow at over 7% annually.

Daicel's Polyplastics business, particularly its Polyacetal (POM) and Liquid Crystal Polymer (LCP) offerings, also fits the Star category. The POM market in China, for instance, is projected for 3.0% to 3.5% annual growth. LCP adoption is accelerating due to advancements in consumer electronics, especially smartphones, creating a high-growth application area for Daicel.

The company's electronic materials, particularly high-performance epoxy compounds used in EV components, represent another Star. This market is anticipated to expand with a CAGR of 6.70% between 2024 and 2035. Daicel's investment in new POM plants and its leadership in LCP further solidify these positions.

Daicel's strong performance in its core chemical products, such as acetyl chains, also places them in the Star quadrant. These are foundational businesses generating stable revenue, which Daicel reinvests into R&D for next-generation products. For example, cellulose acetate, used in cigarette filters and films, continues to be a reliable revenue stream, funding more innovative ventures.

| Daicel Business Segment | BCG Category | Market Growth | Market Share | Key Drivers |

|---|---|---|---|---|

| Automotive Safety Components | Star | High | Substantial Global | Rising Vehicle Production, Stricter Safety Mandates |

| Polyplastics (POM & LCP) | Star | High | Leading | Demand in Emerging Markets, Consumer Electronics Advancements |

| Electronic Materials (Epoxy Compounds) | Star | High | Growing | EV Component Demand, Technological Advancements |

| Acetyl Products | Star | Moderate to High | Leading Global | Essential Industrial Building Blocks, Diverse Applications |

What is included in the product

The Daicel BCG Matrix categorizes business units by market share and growth rate, guiding strategic decisions.

It helps identify which units to invest in, hold, or divest for optimal portfolio management.

The Daicel BCG Matrix offers a clear, actionable framework to identify underperforming units, simplifying strategic resource allocation and relieving the pain of inefficient investment.

Cash Cows

Cellulose acetate represents a significant cash cow for Daicel. The company is a major global supplier in this mature market, which is expected to see growth. Projections indicate a compound annual growth rate (CAGR) of 1.99% from 2025 to 2030, and a higher 7.32% from 2025 to 2033, primarily fueled by established uses in cigarette filters and textiles.

This segment consistently delivers robust revenue and cash flow, underpinning Daicel's financial stability. The company's strong brand recognition and ongoing efforts to expand sales internationally are key factors in its ability to maintain a leading market position and capitalize on this steady income stream.

Daicel's established acetyl chain products, like ethyl acetate, represent its cash cows. These are mature offerings with consistent demand across various industries, providing a stable revenue stream. Their long history and optimized production contribute to strong profitability.

Daicel's traditional plastics portfolio, while not experiencing high growth like its engineering plastics, forms a crucial part of its business. These products cater to established markets where Daicel leverages its deep expertise in polymer chemistry and its long-standing customer relationships.

These traditional plastics are characterized by stable revenue streams and predictable demand, operating within mature market segments that are less prone to significant volatility. This stability is a key factor in their classification as cash cows.

To maintain and enhance the cash flow generated by these offerings, Daicel focuses on strategic investments in supporting infrastructure and implements rigorous cost reduction measures. For example, in fiscal year 2023, Daicel reported that its chemicals segment, which includes many of these traditional plastics, contributed significantly to its operating income, demonstrating the consistent cash-generating ability of these mature product lines.

Automotive Safety System Components (Mature)

Within Daicel's broader automotive safety segment, specific established components, such as airbag inflators and seatbelt pretensioners, likely operate as Cash Cows. These are mature products with stable, predictable demand in established vehicle markets. Daicel's deep-rooted supply agreements for these critical safety parts translate into consistent sales volumes year after year.

The company benefits from high market share in these particular product categories. This dominance, coupled with comparatively lower marketing and development expenditures for these established items, allows Daicel to generate substantial cash flow. For instance, the global automotive safety systems market was valued at approximately $30 billion in 2023 and is projected for steady, albeit modest, growth.

- Established Components: Products like airbag inflators and seatbelt pretensioners represent mature offerings.

- Stable Demand: These components benefit from consistent demand in established automotive markets.

- High Market Share: Daicel maintains a strong position in supplying these essential safety parts.

- Cash Generation: Lower investment needs for mature products translate into significant cash flow.

1,3-Butylene Glycol (1,3-BG)

Daicel's 1,3-Butylene Glycol (1,3-BG) is a prime example of a Cash Cow within their portfolio. This chemical, with its diverse industrial uses, operates in a mature market where Daicel holds a significant and stable position.

The consistent demand for 1,3-BG, coupled with Daicel's efficient production processes, ensures a reliable and steady stream of cash flow for the company. For instance, in fiscal year 2023, Daicel reported that its Chemicals segment, which includes products like 1,3-BG, contributed significantly to operating profit, demonstrating its cash-generating capabilities.

- Established Market Position: Daicel benefits from a strong foothold in the 1,3-BG market, a segment characterized by predictable demand.

- Consistent Cash Generation: The product reliably contributes to Daicel's overall financial health due to its stable sales and efficient manufacturing.

- Operational Efficiency: Daicel's ongoing focus on streamlining operations and cost reduction across its business units further bolsters the profitability of mature product lines like 1,3-BG.

Daicel's cellulose acetate, a key product in cigarette filters and textiles, exemplifies a Cash Cow. This segment benefits from a mature market with projected growth, ensuring consistent revenue. Daicel's strong market presence and international sales expansion reinforce its stable cash flow generation.

Established acetyl chain products, such as ethyl acetate, are also considered Cash Cows. Their consistent demand across industries and optimized production contribute to Daicel's robust profitability and stable revenue streams.

Traditional plastics within Daicel's portfolio, while not high-growth, act as Cash Cows due to their stable revenue and predictable demand in mature markets. Daicel's expertise and customer relationships solidify their position, with the chemicals segment, including these plastics, significantly contributing to operating income in fiscal year 2023.

Mature automotive safety components, like airbag inflators, are likely Cash Cows for Daicel. These products have stable demand in established markets, supported by deep-rooted supply agreements and high market share, leading to substantial cash flow with comparatively lower investment needs.

| Product Segment | Market Status | Cash Flow Contribution | Key Drivers |

|---|---|---|---|

| Cellulose Acetate | Mature, Stable Growth | High | Cigarette filters, Textiles, Global Sales |

| Acetyl Chain Products (e.g., Ethyl Acetate) | Mature, Consistent Demand | High | Diverse Industrial Uses, Optimized Production |

| Traditional Plastics | Mature, Predictable Demand | High | Established Markets, Customer Relationships |

| Automotive Safety Components (e.g., Airbag Inflators) | Mature, Stable Demand | High | Supply Agreements, High Market Share |

Delivered as Shown

Daicel BCG Matrix

The Daicel BCG Matrix analysis you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no missing sections—just the complete, professionally designed strategic tool ready for your immediate use. You can be confident that the insights and structure presented here are exactly what you'll be leveraging for your business planning and decision-making. This comprehensive report is designed to provide clear, actionable insights into Daicel's product portfolio, enabling you to identify growth opportunities and manage potential challenges effectively.

Dogs

Daicel's membrane business, specifically its separation membrane modules for water treatment, saw a dip in sales for the fiscal year ending March 31, 2025. This downturn indicates potential struggles in a market that might be experiencing slow growth or intense competition.

This segment's performance suggests it could be a 'Dog' in the BCG matrix, characterized by low market share and low growth. Such units often drain capital and management attention without yielding substantial profits, prompting a need for careful strategic evaluation.

Daicel's strategic decision to divest its resin compound business, Daicel Miraizu, in 2024 significantly boosted its net profit through the sale of affiliated company shares. This move suggests the business was likely a cash cow or a dog in the BCG matrix, characterized by low growth and market share, prompting Daicel to reallocate resources.

Within Daicel's diverse organic chemicals segment, certain specialized products may find themselves in shrinking markets or facing fierce competition, leading to a low market share and minimal growth. These underperforming niche areas, though not specifically detailed, likely contribute little to the company's overall financial success and could be candidates for strategic divestment or restructuring. For instance, in 2023, the global specialty chemicals market saw varied performance, with some segments experiencing slowdowns due to economic headwinds.

Older, Less Differentiated Plastic Products

Daicel's portfolio may include older plastic products that are less distinct from competitors. These items often operate in mature or shrinking market segments, leading to limited growth opportunities and significant price pressures. For instance, commodity plastics with established production methods and widespread availability tend to fall into this category.

These less differentiated products typically hold a small share of their respective markets. Their sales might be stable but not growing, and the competition focuses heavily on cost. This scenario can make it challenging to achieve significant profit margins, even with efficient production.

While these products might not demand substantial new investment, they also generate modest returns. This can tie up valuable capital and resources that could be more effectively deployed in areas with higher growth potential or greater strategic importance for Daicel.

- Market Position: Low market share in mature or declining plastic sub-segments.

- Competitive Landscape: High price competition due to lack of differentiation.

- Investment & Returns: Minimal investment required, but also yields low returns.

- Capital Allocation: Potential for capital to be tied up, hindering investment in more promising areas.

Segments Affected by Specific Market Declines

Within the automotive safety sector, while the overall outlook remains robust, specific segments tied to certain manufacturers or regions might be experiencing headwinds. For instance, Daicel's products catering to Japanese automakers operating in the Chinese market could be seeing reduced demand. In 2023, Chinese auto sales saw growth, but the market share of Japanese brands faced pressure from domestic competitors and shifting consumer preferences, impacting component suppliers like Daicel.

If these specific product lines or geographic sub-segments within Daicel's portfolio have a low market share and lack a clear strategy for improvement, they would fit the profile of a Dog in the BCG matrix. For example, a particular airbag inflator component used exclusively by a Japanese automaker with declining sales in China, and which Daicel has not diversified away from, would represent such a scenario. This situation highlights how localized market challenges can impact even strong overall industries.

Consider the following points regarding segments affected by specific market declines:

- Impact of China Market Slowdown: Sluggish demand for Japanese automotive manufacturers in China directly affects Daicel's component sales in that region. In the first half of 2024, sales figures for some Japanese automakers in China showed year-on-year declines, putting pressure on their supply chains.

- Low Market Share and Recovery Path: If Daicel has a niche product line with minimal market share and no clear innovation or market expansion plan, it risks becoming a Dog. For example, a specific type of sensor for a vehicle model that is being phased out could fall into this category.

- Geographic Concentration Risk: Over-reliance on a single geographic market for a specific product can be detrimental if that market experiences a downturn. Daicel’s exposure to the European automotive market, for instance, could be a concern if regulatory changes or economic slowdowns occur there.

Daicel's portfolio may include products in mature or declining markets with low market share and intense price competition. These "Dog" segments, such as certain commodity plastics or specialized chemicals facing obsolescence, offer limited growth and modest returns, potentially tying up capital. For instance, while specific Daicel product lines aren't publicly categorized as Dogs, the company's 2024 divestment of Daicel Miraizu, a resin compound business, suggests a strategic move away from underperforming assets.

The membrane business, particularly for water treatment, experienced a sales dip in the fiscal year ending March 31, 2025, indicating potential challenges that align with Dog characteristics. Similarly, older plastic products with little differentiation and high cost competition also fit this profile. These segments require careful evaluation to determine if divestment or a minimal resource strategy is most appropriate for Daicel.

In 2023, the global specialty chemicals market showed varied performance, with some areas experiencing slowdowns, which could impact niche Daicel products. If these products hold low market share and face shrinking demand, they would be considered Dogs. For example, a component for a phasing-out vehicle model with minimal sales for Daicel in a declining market segment would fit this description.

Daicel's strategic decisions, like the 2024 divestment of its resin compound business, highlight a willingness to shed underperforming assets. This aligns with managing Dog segments, which drain resources without significant returns. The company's focus on reallocating capital to more promising areas is a common strategy for dealing with such business units.

Question Marks

Daicel is strategically investing in Cellulose Nanofiber (CNF) as a key driver for future growth, recognizing its potential in the burgeoning sustainable products market. This market, encompassing bio-based materials, is anticipated to expand robustly, with projections indicating a compound annual growth rate of 7.7% between 2025 and 2033.

While CNF is positioned within a high-growth sector, Daicel's current market share in this emerging technology is likely modest. Significant investment will be necessary to establish a strong market presence and elevate CNF to a 'Star' category within the BCG matrix, signifying high growth and high market share.

New bio-based and sustainable materials represent a promising area for Daicel, fitting into the Question Marks quadrant of the BCG matrix. Daicel is actively investing in biodegradable plastics and eco-friendly alternatives, aligning with a global push for sustainability.

The market for sustainable packaging, including bio-based plastics, is experiencing rapid expansion. For instance, the global bioplastics market was valued at approximately $11.5 billion in 2023 and is projected to reach over $30 billion by 2028, demonstrating significant growth potential.

While these materials are in a high-growth market, Daicel's current market share is relatively low. This situation calls for substantial investment in research and development, scaling up production capabilities, and implementing robust market adoption strategies to capitalize on this burgeoning sector.

Daicel's engagement in the healthcare sector is a prime example of a potential Stars or Question Marks, depending on market penetration and growth. The company is actively developing advanced materials and solutions for health and medical supplies, areas known for their high growth potential. This strategic focus indicates significant R&D investment aimed at capturing future market share in a sector that demands rigorous development and regulatory approval.

Emerging applications in healthcare, such as novel drug delivery systems or biocompatible materials for medical devices, represent Daicel's investment in high-growth, albeit currently low-market-share, segments. For instance, the global medical device market was projected to reach over $600 billion in 2024, with significant growth driven by innovation in areas where Daicel is likely focusing its R&D. These nascent healthcare products, while promising, would typically exhibit low initial sales volumes as they navigate market adoption and regulatory hurdles.

Advanced Materials for Next-Gen Electronics/EVs

Daicel is strategically targeting the burgeoning market for advanced materials in next-generation electronics and electric vehicles (EVs). Their focus on enhancing automotive safety and performance through innovative material solutions, particularly epoxy compounds for EV motor insulators and power modules, positions them in a high-growth sector.

The broader advanced materials market for semiconductors is projected to experience a significant compound annual growth rate (CAGR) of 12.10% between 2023 and 2033, indicating substantial opportunity. While Daicel is investing in these cutting-edge applications, their current market share in these specific advanced material segments may still be in a developmental phase, necessitating ongoing investment to solidify leadership.

- Focus on Automotive: Daicel is developing advanced materials for the automotive sector, specifically targeting improvements in safety and performance.

- EV Applications: The company is providing epoxy compounds crucial for insulating EV motors and power modules, key components for electric vehicle technology.

- Semiconductor Market Growth: The advanced materials market for semiconductors is set for robust expansion, with an estimated CAGR of 12.10% from 2023 to 2033.

- Market Position: Daicel's presence in these advanced material niches is growing, but continued investment is vital to capture significant market share and leadership.

Strategic Alliances and M&A Initiatives

Daicel's strategic blueprint, Accelerate 2025, heavily emphasizes expansion through mergers, acquisitions, and alliances. This proactive approach is designed to penetrate new, high-growth sectors or bolster its presence in nascent markets where its current market share is minimal.

These strategic maneuvers are inherently capital-intensive and carry substantial risk. Their ultimate success hinges on considerable investment and seamless integration to transform nascent opportunities into dominant market positions. For instance, Daicel's acquisition of the specialty chemicals business of Sumitomo Chemical in 2023, though not explicitly tied to Accelerate 2025's launch, exemplifies this strategy by aiming to strengthen its foothold in specific chemical segments.

- Strategic Expansion: Daicel's Accelerate 2025 strategy prioritizes M&A and alliances to enter high-growth markets.

- Risk and Investment: These initiatives require significant capital outlay and carry inherent risks due to integration complexities.

- Market Share Growth: The goal is to leverage these moves to increase market share in areas where Daicel currently has a limited presence.

- Past Examples: Acquisitions, like the one from Sumitomo Chemical in 2023, illustrate Daicel's commitment to inorganic growth.

Question Marks represent Daicel's investments in high-growth, but currently low-market-share, business areas. These segments require substantial investment to develop and capture market potential, with the aim of transforming them into future Stars.

Daicel's focus on new sustainable materials, like Cellulose Nanofiber (CNF), exemplifies this. While the bio-based materials market is projected to grow robustly, Daicel's current share in CNF is likely modest, necessitating significant R&D and production scaling.

Similarly, emerging healthcare applications and advanced materials for next-generation electronics, including EV components, are positioned as Question Marks. These areas offer high growth potential, with the semiconductor materials market alone expected to grow at a CAGR of 12.10% between 2023 and 2033, but require Daicel to invest heavily to build market presence.

Strategic mergers, acquisitions, and alliances are key to Daicel's approach to developing these Question Marks. These capital-intensive moves aim to accelerate market penetration and increase market share in nascent or high-growth sectors.

| Business Area | Market Growth Potential | Daicel's Current Market Share | Strategic Focus |

|---|---|---|---|

| Cellulose Nanofiber (CNF) | High (Bio-based materials market CAGR 7.7% 2025-2033) | Low/Emerging | R&D, Production Scaling |

| Sustainable Packaging/Bioplastics | High (Global bioplastics market ~$11.5B in 2023, projected >$30B by 2028) | Low | Investment in R&D, Market Adoption |

| Healthcare Materials | High (Global medical device market projected >$600B in 2024) | Low/Emerging | R&D, Regulatory Approval |

| Advanced Materials for EVs/Electronics | High (Semiconductor materials CAGR 12.10% 2023-2033) | Low/Developing | Investment in Innovation, Market Penetration |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitive landscape analysis, to accurately position each business unit.