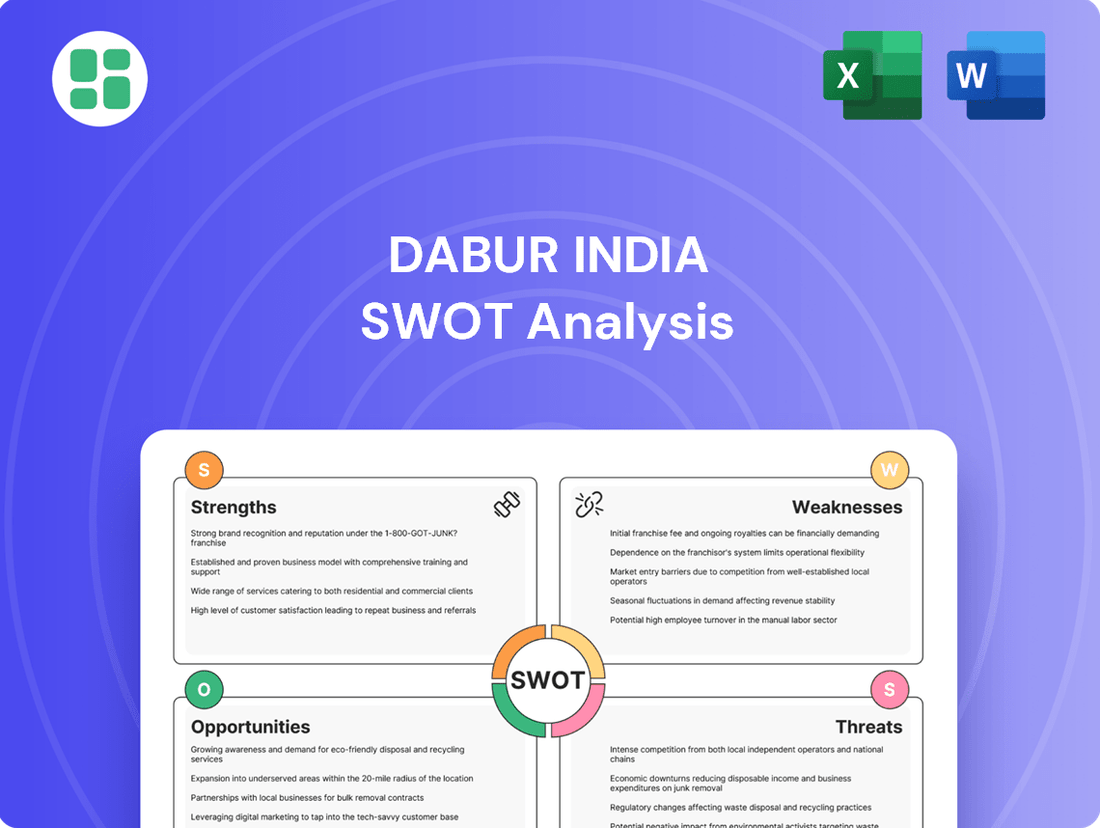

Dabur India SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dabur India Bundle

Dabur India boasts a strong brand portfolio and extensive distribution network, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Dabur's market position, growth drivers, and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Dabur's 140-year legacy is a cornerstone of its strength, fostering deep consumer trust, especially in its Ayurvedic and natural product lines. This heritage translates into a significant competitive advantage, allowing Dabur to command premium pricing and brand loyalty.

The company's consistent focus on its Ayurvedic and natural healthcare offerings solidifies its leadership position in this growing market segment. This specialization ensures an enduring edge, as consumers increasingly seek natural and traditional wellness solutions.

Dabur India's distribution network is a significant competitive advantage, reaching an impressive 7.9 million retail outlets and 1,22,000 villages across India. This extensive reach was further bolstered in FY24 with the addition of 2 lakh new outlets, the highest number added by any FMCG company that fiscal year. This deep penetration is crucial for capturing growth, particularly in rural markets where demand is currently outperforming urban centers.

Dabur India boasts a robust and expanding product range, a significant strength in its market position. The company has demonstrated impressive performance, achieving market share gains in a substantial 90-95% of its product portfolio during fiscal year 2024. This broad-based success highlights the company's ability to resonate with consumers across its diverse offerings.

The company's strategic focus on innovation is evident in its consistent product pipeline, with 14 new products launched in FY24 alone. By concentrating on 'Power Brands,' Dabur is effectively driving future growth and pushing for premiumization. This strategy is particularly noticeable in key segments such as oral care, digestives, and foods, where enhanced product development is meeting evolving consumer demands.

Robust International Business Performance

Dabur's international operations are a significant strength, demonstrating impressive resilience and growth. In the fourth quarter of FY24-25, the company achieved a robust 19% constant currency growth, with full-year growth reaching 17%. This global expansion, particularly in key markets such as Egypt, Turkey, and Sub-Saharan Africa, offers a vital buffer against domestic market fluctuations and opens up substantial new avenues for revenue generation.

The company's strategic focus on international markets is yielding tangible results, diversifying its revenue base and enhancing overall financial stability. This geographical diversification is crucial for mitigating risks and capitalizing on emerging opportunities worldwide.

- International revenue growth: 19% constant currency growth in Q4 FY24-25 and 17% for the full year.

- Key growth regions: Egypt, Turkey, and Sub-Saharan Africa are showing strong performance.

- Strategic advantage: Global diversification provides resilience against domestic market challenges.

- Revenue stream expansion: International business creates new and important revenue streams.

Strategic Focus on Premiumization and Digital Channels

Dabur India is strategically prioritizing premiumization and contemporization across its product portfolio. This focus targets evolving consumer demands for higher-quality, modern offerings.

The company is also heavily invested in digital channels, with e-commerce and digital-first brands showing significant traction. In fiscal year 2024, these digital initiatives alone surpassed ₹100 crore in revenue.

This dual strategy positions Dabur to capitalize on growth in modern retail and the rapidly expanding quick commerce sector.

- Premiumization Drive: Dabur is actively upgrading its product lines to appeal to consumers seeking enhanced quality and contemporary features.

- Digital Revenue Growth: E-commerce and digital-first brands achieved over ₹100 crore in sales during FY24, highlighting the success of this channel strategy.

- Channel Expansion: The focus on digital aligns with capturing opportunities in modern trade and the fast-growing quick commerce segments.

Dabur's extensive distribution network is a formidable strength, reaching approximately 7.9 million retail outlets and 122,000 villages in India. The company further expanded its reach by adding 200,000 new outlets in fiscal year 2024, the highest for any FMCG company that year, underscoring its ability to penetrate deep into both rural and urban markets.

The company's product portfolio demonstrates remarkable strength, with Dabur achieving market share gains in 90-95% of its product categories during FY24. This broad-based success across its diverse offerings highlights strong consumer acceptance and effective market strategies.

Dabur's commitment to innovation is evident through its consistent new product launches, with 14 new products introduced in FY24. This focus on 'Power Brands' drives future growth and premiumization, particularly in key segments like oral care, digestives, and foods, aligning with evolving consumer preferences.

International operations are a significant growth driver, with Q4 FY24-25 reporting 19% constant currency growth and a full-year growth of 17%. Key markets like Egypt, Turkey, and Sub-Saharan Africa are contributing significantly, diversifying revenue and providing resilience against domestic market volatility.

| Key Strength | Description | Supporting Data (FY24/FY25) |

| Distribution Reach | Extensive penetration across India | 7.9 million retail outlets, 122,000 villages; added 200,000 new outlets in FY24 |

| Product Portfolio Performance | Market share gains across categories | Gains in 90-95% of product portfolio in FY24 |

| Innovation Pipeline | Consistent new product launches | 14 new products launched in FY24; focus on 'Power Brands' |

| International Growth | Strong performance in global markets | 19% constant currency growth (Q4 FY24-25); 17% full-year growth |

What is included in the product

Delivers a strategic overview of Dabur India’s internal and external business factors, highlighting its strong brand equity and distribution network while acknowledging challenges in product innovation and competition.

Identifies key strengths and weaknesses, helping Dabur India address market challenges and capitalize on opportunities for sustained growth.

Weaknesses

Dabur's domestic operations, especially in urban centers, have encountered headwinds from elevated food inflation and a noticeable tightening of urban consumer budgets. This has directly impacted the company's overall revenue expansion, a trend particularly evident in the second quarter of fiscal year 2025.

This sensitivity to broader economic conditions and shifts in consumer purchasing behavior poses a significant risk. For instance, the observed slowdown in urban demand during Q2 FY25 highlights how macroeconomic pressures can directly translate into challenges for Dabur's profitability and sales volumes.

Dabur India's beverage segment, a significant contributor to its revenue, faces considerable vulnerability due to seasonal and weather-related disruptions. Unfavorable weather patterns, such as unseasonal rains or extended dry spells, directly impact consumer demand for beverages, particularly those consumed out-of-home.

For instance, during periods of heavy rainfall or flooding in key markets, sales of Dabur's beverage products can experience a noticeable downturn. This was evident in certain quarters where adverse weather led to a decline in out-of-home consumption, a critical channel for beverage sales, and simultaneously created inventory management challenges for the company.

The Indian Fast-Moving Consumer Goods (FMCG) sector is a battlefield, with established giants and agile startups constantly vying for consumer attention and market share. This intense rivalry often translates into aggressive pricing strategies, forcing companies like Dabur to engage in price wars that can significantly erode profit margins. For instance, in the fiscal year 2023-24, the FMCG sector witnessed heightened promotional activities and discounts, impacting overall industry profitability.

Dabur, despite its strong brand equity and diverse product portfolio, is not immune to these pressures. The need to continuously innovate with new product launches and maintain competitive pricing requires substantial investment in research and development, marketing, and distribution. This can put a strain on the company's bottom line, even as it strives to maintain its market position against formidable competitors who are equally committed to capturing a larger slice of the growing Indian consumer market.

Dependence on General Trade Channel Dynamics

Dabur's reliance on general trade channels, while historically a strength, presents a vulnerability. A recent strategic effort to recalibrate distributor inventory within this traditional channel, though intended to foster long-term health, created short-term headwinds. This necessary correction resulted in a mid-single-digit dip in consolidated revenue and a negative impact on profitability during the second quarter of fiscal year 2025.

The strategic inventory correction in the general trade channel, while crucial for future stability, directly affected Dabur's financial performance in Q2 FY25. This situation underscores the sensitivity of Dabur's revenue streams to the operational dynamics of its vast, yet sometimes complex, distribution network.

- Strategic Inventory Correction: Dabur actively managed distributor inventory levels in traditional general trade channels.

- Q2 FY25 Impact: This led to a mid-single-digit decline in consolidated revenue and affected profitability.

- Channel Dependence: Highlights the inherent risks associated with a strong dependence on general trade dynamics.

Inconsistent Domestic Revenue Growth

Dabur's domestic revenue faced headwinds in FY24-25, with a reported decline of approximately 3.4% in constant currency. This performance highlights an ongoing struggle to maintain consistent growth across its Indian product portfolio.

The company's reliance on international markets for growth becomes more apparent when contrasted with this domestic slowdown. Despite ambitious targets for overall double-digit CAGR by FY28, the current domestic performance suggests significant challenges remain in achieving this goal.

- Domestic Revenue Decline: Approximately 3.4% constant currency decrease in FY24-25.

- Category Challenges: Difficulty in sustaining consistent growth across all Indian business segments.

- Growth Discrepancy: A notable difference between robust international performance and domestic stagnation.

Dabur's domestic performance in FY24-25 saw a decline of approximately 3.4% in constant currency, indicating challenges in maintaining consistent growth across its Indian product portfolio. This slowdown, particularly in urban centers due to inflation, contrasts with its international market performance, highlighting a significant growth discrepancy and the difficulty in achieving its ambitious FY28 double-digit CAGR targets.

Full Version Awaits

Dabur India SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis, covering Dabur India's Strengths, Weaknesses, Opportunities, and Threats.

Unlock the full report when you purchase to gain comprehensive insights into Dabur India's strategic positioning.

Opportunities

The escalating global and domestic consumer focus on health, wellness, and natural/organic products is a prime opportunity for Dabur, leveraging its deep-rooted expertise in Ayurveda. This trend is evident in the robust growth of the Indian wellness market, projected to reach $100 billion by 2025, with a significant portion driven by natural and Ayurvedic offerings.

Dabur's strategic expansion, including its new manufacturing facility in Tamil Nadu, is well-positioned to capitalize on this demand. This investment, part of a larger capital expenditure plan for FY24-25, aims to boost production capacity and enhance market reach, particularly for its Ayurvedic and natural product portfolio, which saw a 12% year-on-year growth in the last fiscal year.

Dabur's strategic push into rural markets is a significant opportunity. The company aims to extend its reach to 1.3 lakh villages by the close of FY24-25, a move that taps into a promising growth segment.

This expansion is particularly timely as rural demand showed stronger growth than urban demand in the first quarter of FY25, indicating a robust recovery in these areas. This deep penetration allows Dabur to capture a larger share of an often underserved market, unlocking substantial untapped potential.

Dabur can significantly expand its direct-to-consumer (D2C) sales by capitalizing on the booming e-commerce and quick commerce sectors. This digital push allows for enhanced market penetration and the execution of highly personalized marketing campaigns, reaching consumers more effectively.

The company is proactively investing in and adapting its strategies to harness the growth of quick commerce and e-commerce. For instance, Dabur has seen a substantial increase in its online sales, with digital channels contributing over 15% of its total revenue in recent fiscal periods, demonstrating the tangible impact of these channels.

Strategic Acquisitions and Portfolio Rationalization

Dabur India is actively pursuing strategic acquisitions to bolster its presence in high-potential sectors like new-age healthcare, wellness foods, and premium personal care. This proactive approach aims to create a portfolio better suited for future market demands. For instance, in the fiscal year 2023-24, Dabur continued its focus on inorganic growth, although specific acquisition details for this period were not publicly disclosed at the time of this analysis, the company has historically shown a willingness to invest in synergistic businesses.

Simultaneously, Dabur is undertaking a rationalization of its underperforming business segments. This strategic move allows for the efficient reallocation of capital and management attention towards categories demonstrating stronger growth trajectories and higher profitability. By shedding less productive assets, Dabur can concentrate its resources on areas with greater potential for expansion and market leadership, thereby enhancing overall financial performance.

The company's strategy involves:

- Targeting M&A in emerging consumer categories to align with evolving market preferences.

- Divesting non-core or underperforming assets to improve operational efficiency.

- Reinvesting freed-up capital into high-growth segments like health supplements and organic foods.

- Leveraging acquired brands to expand market reach and product offerings.

Product Innovation and Premiumization Drive

Dabur India's strategic shift towards premiumization and contemporization is a significant opportunity. By focusing on higher-value segments and introducing innovative products, such as liquid vaporizers and gel toothpaste, the company aims to capture a larger share of the market. This approach allows Dabur to cater to evolving consumer preferences for more advanced and effective personal care solutions, driving revenue growth.

Expanding its 'Power Brands' into 'Power Platforms' is another key opportunity for sustained growth. This strategy involves leveraging the equity of established brands to introduce new product variations and enter adjacent categories. For instance, Dabur's recent product launches in 2024, like the enhanced formulations in their hair oil range and the expansion of their health supplements, demonstrate this platform-based innovation. This allows for cross-selling and up-selling, deepening customer engagement and loyalty.

- Product Innovation: Dabur has been actively introducing new SKUs and reformulations, particularly in categories like oral care and home care, to meet evolving consumer demands for efficacy and convenience.

- Premiumization: The company's focus on premium offerings, such as specialized skincare and health products, aims to capture higher-margin segments of the market.

- Emerging Categories: Dabur's entry into categories like mosquito repellent liquid vaporizers and gel toothpaste reflects an opportunity to capitalize on growing consumer needs in these spaces.

- Brand Extension: The strategy to transform 'Power Brands' into 'Power Platforms' allows for broader market penetration and sustained growth by introducing related products under a trusted brand umbrella.

Dabur's strategic focus on expanding its direct-to-consumer (D2C) channels presents a significant growth avenue, driven by the burgeoning e-commerce and quick commerce sectors. The company's digital sales have seen a notable surge, contributing over 15% of its total revenue in recent fiscal periods, underscoring the effectiveness of this digital push.

The company's proactive approach to inorganic growth, through strategic acquisitions in high-potential areas like new-age healthcare and wellness foods, is another key opportunity. This strategy aims to diversify its portfolio and align with shifting consumer preferences, as evidenced by Dabur's historical investments in synergistic businesses.

Dabur's expansion into rural markets, with a target of reaching 1.3 lakh villages by the end of FY24-25, taps into a promising segment. This move is particularly opportune as rural demand demonstrated stronger growth than urban demand in Q1 FY25, indicating substantial untapped potential in these regions.

The premiumization and contemporization of its product offerings, including innovative items like liquid vaporizers and gel toothpaste, allows Dabur to cater to evolving consumer demands for advanced personal care solutions. This focus on higher-value segments is expected to drive revenue growth and capture greater market share.

Threats

The FMCG market is a battleground, with Dabur facing a multi-front war. Established global giants like Unilever and P&G continue to exert significant pressure, while nimble Indian startups are rapidly gaining traction, particularly in the natural and Ayurvedic product spaces where Dabur has a strong heritage. This intensified rivalry means market share gains are harder fought, and the need for aggressive pricing and promotional strategies is ever-present, potentially impacting profit margins.

Dabur's reliance on natural ingredients like herbs and agricultural products exposes it to significant raw material price volatility. For instance, fluctuations in the prices of key inputs such as Amla, Tulsi, or honey, driven by monsoon performance or global commodity markets, can directly impact manufacturing costs. This vulnerability was evident in fiscal year 2023-24, where adverse weather conditions in certain regions led to increased procurement costs for some of its herbal raw materials.

Supply chain disruptions, whether from climate events, geopolitical factors, or logistical challenges, pose another substantial threat. A disruption in the availability of a critical ingredient could halt production lines or necessitate costly sourcing from alternative, potentially more expensive, suppliers. This was a concern highlighted in early 2024 when certain global shipping routes experienced delays, impacting the timely delivery of various inputs for FMCG companies.

Consumer preferences are evolving at a breakneck pace, and Dabur faces a significant threat from this dynamism. For instance, the growing demand for personalized wellness solutions and the increasing skepticism towards traditional health claims necessitate constant adaptation. Competitors are actively leveraging these shifts with targeted campaigns, potentially eroding Dabur's established brand loyalty, especially if the current natural and Ayurvedic trend falters or is superseded by novel health movements.

Regulatory and Compliance Challenges

Dabur India operates in sectors like health, wellness, and food, which are heavily regulated. These regulations cover everything from how products are made and what's on their labels to how they're advertised and their overall safety. Staying compliant with these ever-changing rules requires constant vigilance and can be a significant operational hurdle.

Navigating these complex regulatory environments can lead to substantial expenses for Dabur, including costs for testing, documentation, and legal counsel. Failure to comply can result in hefty fines, product recalls, and damage to the company's reputation, impacting consumer trust and market share. For instance, in 2023, the Food Safety and Standards Authority of India (FSSAI) continued to update its guidelines on packaged foods and ingredients, requiring ongoing adaptation from companies like Dabur.

- Evolving Regulations: Dabur must continuously adapt to new or revised regulations from bodies like FSSAI and AYUSH, impacting product formulations and marketing claims.

- Compliance Costs: Ensuring adherence to stringent standards for product safety, labeling accuracy, and advertising practices incurs significant operational and R&D expenditure.

- Reputational Risk: Non-compliance can lead to penalties, product bans, and negative publicity, potentially eroding consumer confidence in Dabur's trusted brands.

Economic Slowdown and Inflationary Pressures

Persistent high food inflation and a general slowdown in consumer demand, particularly in urban markets, can continue to impact Dabur's sales volume and revenue growth. For instance, India's retail inflation hovered around 5% in early 2024, with food prices being a significant contributor, potentially dampening consumer purchasing power.

This economic environment can squeeze discretionary spending, affecting sales of non-essential items and overall market performance. A slowdown in rural demand, which is crucial for Dabur's extensive distribution network, could further exacerbate these challenges.

- Impact on Sales: Elevated inflation can reduce the real disposable income of consumers, leading to lower sales volumes for Dabur's product portfolio.

- Discretionary Spending Squeeze: Categories like health foods and personal care, while essential to some extent, can face reduced demand if consumers prioritize basic necessities.

- Urban Market Slowdown: Urban consumers, often more sensitive to economic downturns and inflation, may cut back on non-essential purchases, affecting Dabur's performance in these key regions.

- Rural Demand Concerns: A slowdown in rural economic activity, often linked to agricultural output and government support, directly impacts Dabur's penetration in these vital markets.

Intense competition from both global players and emerging domestic brands poses a significant threat, potentially pressuring Dabur's market share and profitability. Raw material price volatility, driven by factors like weather and global markets, directly impacts manufacturing costs, as seen with increased procurement costs for herbal inputs in FY23-24. Supply chain disruptions, whether from climate events or geopolitical issues, risk halting production or forcing costly sourcing alternatives.

| Threat Category | Specific Example/Impact | Relevant Period/Data |

|---|---|---|

| Intensified Competition | Pressure from Unilever, P&G, and agile Indian startups in natural/Ayurvedic segments. | Ongoing; intensified in 2024. |

| Raw Material Price Volatility | Increased procurement costs for herbal inputs (e.g., Amla, Tulsi) due to adverse weather. | FY23-24 |

| Supply Chain Disruptions | Potential for production halts or increased sourcing costs due to global shipping delays. | Early 2024 |

| Evolving Consumer Preferences | Shift towards personalized wellness and skepticism towards traditional claims. | Ongoing trend, impacting brand loyalty. |

| Regulatory Environment | Need for continuous adaptation to evolving food and AYUSH regulations (e.g., FSSAI updates). | Ongoing; FSSAI updates in 2023. |

| Economic Headwinds | Impact of food inflation (around 5% in early 2024) on consumer spending and sales volumes. | Early 2024 |

SWOT Analysis Data Sources

This SWOT analysis for Dabur India is built upon a foundation of credible data, including their official financial statements, comprehensive market research reports, and expert industry analyses to ensure a robust and informed assessment.