Dabur India Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dabur India Bundle

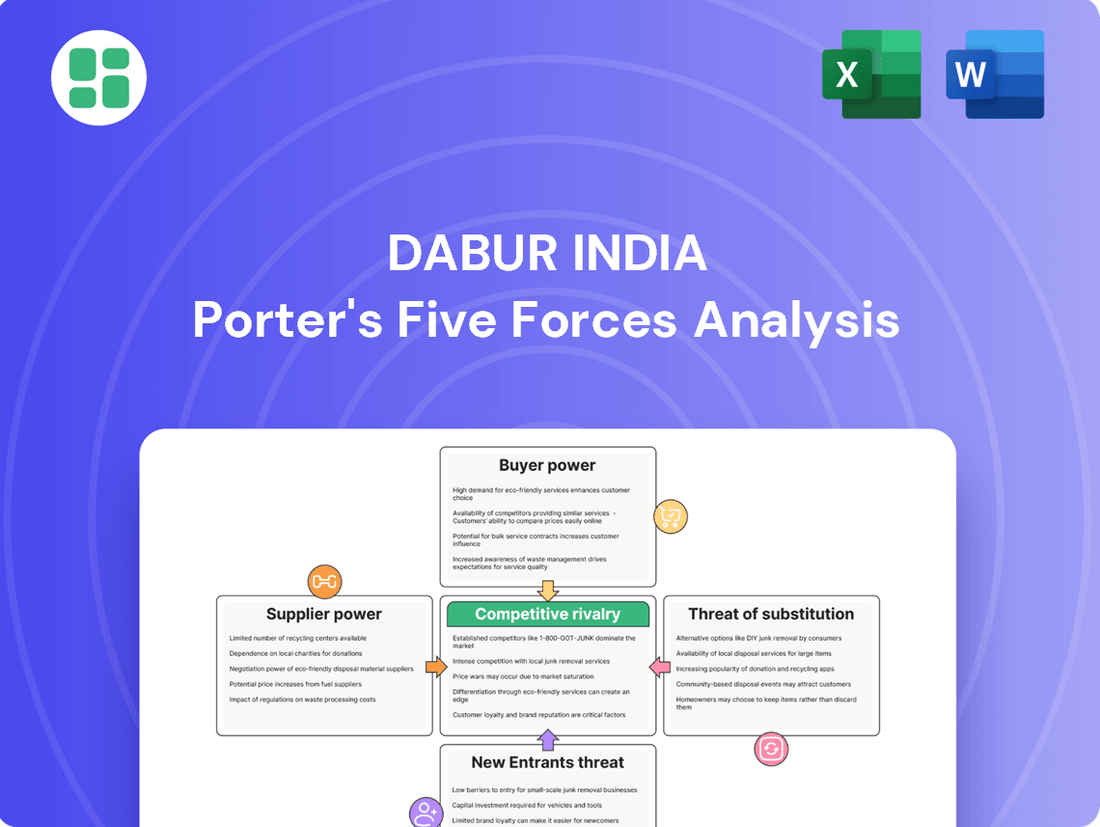

Dabur India navigates a competitive landscape shaped by moderate buyer power and intense rivalry from established players and emerging brands. The threat of substitutes, particularly in the health and wellness sector, also demands strategic attention.

The complete report reveals the real forces shaping Dabur India’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dabur's reliance on specific herbs and natural ingredients means that if these raw materials are sourced from a limited number of suppliers, those suppliers gain significant leverage. This concentration can drive up input costs for Dabur, impacting its profitability, especially given the company's focus on natural and Ayurvedic products which often require specialized agricultural inputs.

Inflationary pressures have significantly impacted the FMCG sector, including Dabur, by driving up the costs of essential inputs like raw materials and packaging. This economic trend can bolster the bargaining power of suppliers, enabling them to command higher prices. For instance, global commodity price volatility in 2023 and early 2024 has been a persistent concern for companies like Dabur, directly affecting their cost of goods sold.

This scenario can put pressure on Dabur's profit margins if these increased costs cannot be fully passed on to consumers. To counter this, Dabur has been actively pursuing cost-saving measures across its operations and strategically implementing price adjustments on select products. These actions are crucial for maintaining profitability in a challenging economic environment.

For Dabur, the bargaining power of suppliers is influenced by supplier switching costs, particularly for specialized Ayurvedic ingredients. These costs can include rigorous quality control, extensive testing to ensure efficacy and purity, and the time and effort required to build trust and reliable relationships with new suppliers. This makes it challenging and expensive for Dabur to switch providers for critical raw materials.

These high switching costs effectively increase the bargaining power of existing suppliers. Dabur's flexibility in sourcing is reduced because finding and validating new sources for unique, often proprietary, Ayurvedic ingredients is a complex and lengthy undertaking. This reliance on established suppliers for specialized inputs strengthens their position in negotiations.

Threat of Forward Integration by Suppliers

While it's not a widespread concern for most individual raw material providers, there's a theoretical possibility for large agricultural cooperatives or specialized ingredient processors to move into product manufacturing. For instance, if a major supplier of Ayurvedic herbs began producing and selling their own finished wellness products, they would directly challenge Dabur's market position, significantly boosting their own bargaining power.

This scenario is generally considered a low threat for Dabur. The company's strong brand recognition and extensive distribution network create substantial barriers to entry for any supplier contemplating forward integration. Dabur's market share in the Indian FMCG sector, particularly in Ayurvedic products, is a significant deterrent.

- Low Likelihood of Supplier Forward Integration: The threat of suppliers integrating forward into manufacturing is typically low for Dabur, given the company's established market presence.

- Potential Impact: If suppliers were to forward integrate, they could directly compete, increasing their leverage over Dabur.

- Deterrents: Dabur's strong brand equity and robust distribution channels act as significant barriers against this threat.

Importance of Dabur to Suppliers

Dabur India Limited is a substantial force in the natural and Ayurvedic ingredient sector, acting as a major buyer. This scale means many smaller or specialized suppliers rely heavily on Dabur for a significant portion of their revenue.

For these suppliers, Dabur's consistent and large-volume demand offers stability. However, this very dependence can diminish their individual bargaining power. The risk of losing such a crucial client often makes suppliers hesitant to push for more favorable terms.

- Dabur's Market Presence: Dabur's extensive reach in the FMCG sector translates into significant purchasing power for raw materials.

- Supplier Dependence: Many suppliers, particularly those dealing in niche Ayurvedic ingredients, find Dabur to be their primary or a very significant customer.

- Reduced Leverage for Suppliers: The prospect of losing Dabur's business can deter suppliers from demanding higher prices or more favorable contract terms.

- Impact on Pricing: This dynamic can help Dabur secure raw materials at competitive prices, influencing the overall cost structure of its products.

Dabur's bargaining power with its suppliers is significantly influenced by the concentration of its raw material sourcing. When suppliers are few and specialize in unique Ayurvedic ingredients, their leverage increases, potentially driving up input costs for Dabur. For instance, the company's reliance on specific herbs necessitates strong relationships with a limited number of cultivators or processors, making it difficult to switch providers due to high validation costs.

Inflationary pressures, particularly evident in global commodity price volatility throughout 2023 and early 2024, have amplified supplier bargaining power. This economic environment allows suppliers to command higher prices for essential inputs like raw materials and packaging, directly impacting Dabur's cost of goods sold and profit margins. Dabur's strategy to mitigate this involves cost-saving initiatives and selective price adjustments.

The bargaining power of suppliers is also shaped by Dabur's substantial market presence, which makes many smaller or specialized suppliers heavily dependent on the company for revenue. This dependence can limit their ability to negotiate more favorable terms, helping Dabur secure raw materials at competitive prices.

| Factor | Impact on Dabur | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases supplier leverage | Reliance on specialized Ayurvedic ingredient suppliers |

| Inflationary Pressures | Bolsters supplier pricing power | Global commodity price volatility in 2023-2024 impacted input costs |

| Supplier Switching Costs | Reduces Dabur's flexibility | Rigorous quality control and validation for unique ingredients |

| Dabur's Market Dominance | Reduces individual supplier leverage | Many suppliers depend on Dabur for significant revenue |

What is included in the product

This analysis uncovers the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes specifically for Dabur India within the FMCG sector.

Instantly identify competitive pressures and opportunities within the FMCG sector, enabling proactive strategic adjustments for Dabur India.

Customers Bargaining Power

Indian consumers, especially in cities, are quite sensitive to price changes. With food prices going up and the general cost of living increasing, people have less money to spend. This means they're more likely to look for cheaper options or buy less of certain products, giving them more influence over pricing.

Dabur's own financial reports from 2024 have shown that demand for their products has been a bit slow, and a key reason for this is indeed these economic pressures on consumers. When people have tighter budgets, they naturally become more powerful in dictating what they will and won't pay for.

The Indian Fast-Moving Consumer Goods (FMCG) market is intensely competitive, featuring a vast array of companies. This crowded landscape means customers have many choices, significantly boosting their bargaining power.

With numerous national and regional brands readily available, consumers can easily switch between products. This is particularly true in segments like natural and Ayurvedic products, where Dabur operates, as a multitude of alternatives exist, giving customers considerable leverage.

The proliferation of digital and e-commerce channels has amplified customer bargaining power. Platforms like Amazon and Flipkart, along with quick commerce services, offer unparalleled product accessibility and price transparency. This allows consumers to effortlessly compare offerings from Dabur and its competitors, driving a need for competitive pricing and continuous product innovation.

Increasing Health and Wellness Consciousness

Consumers are increasingly prioritizing health and wellness, actively seeking natural, organic, and chemical-free products. This heightened awareness directly aligns with Dabur's established portfolio, particularly its Ayurvedic offerings.

This trend, while beneficial for Dabur, also significantly strengthens the bargaining power of customers. They are now empowered to demand specific product attributes, greater transparency in ingredients, and verifiable health benefits, favoring brands that demonstrably meet these evolving preferences.

For instance, in 2024, the Indian packaged foods market saw a notable surge in demand for products with ‘natural’ or ‘organic’ labels, with consumers willing to pay a premium. This customer demand puts pressure on companies like Dabur to maintain high standards and clearly communicate their product sourcing and manufacturing processes.

- Increased demand for natural and organic products: Consumers actively seek out products free from artificial additives and chemicals.

- Customer preference for transparency: Buyers expect clear information on ingredients, sourcing, and manufacturing practices.

- Willingness to pay a premium: Health-conscious consumers are often prepared to spend more on products that meet their wellness criteria.

- Influence on product development: Customer preferences are driving companies to innovate and reformulate products to align with health trends.

Brand Loyalty vs. Switching Costs

Dabur benefits from significant brand loyalty, with its power brands contributing over 70% to its consolidated revenue. This loyalty is a strong defense against customer bargaining power. For instance, brands like Dabur Chyawanprash and Dabur Honey have deep-rooted consumer trust.

However, in many Fast-Moving Consumer Goods (FMCG) sectors, switching costs for consumers are inherently low. This means customers can easily opt for a competitor if they find better value, superior quality, or more appealing innovation. For example, a consumer might switch from one toothpaste brand to another based on a promotional offer or a new product launch.

- Brand Loyalty: Dabur's power brands, representing over 70% of consolidated revenue, demonstrate strong consumer attachment.

- Low Switching Costs: For many FMCG products, consumers face minimal barriers to changing brands, impacting bargaining power.

- Dabur's Strategy: The company actively invests in brand building and product innovation to strengthen customer loyalty and mitigate this power.

Dabur's customers possess considerable bargaining power, largely driven by the intensely competitive Indian FMCG market and increasing consumer price sensitivity, especially with rising living costs observed in 2024. The availability of numerous alternatives, amplified by digital platforms offering price transparency, allows consumers to easily compare and switch brands, putting pressure on Dabur to maintain competitive pricing and innovative product offerings.

The growing consumer demand for natural and organic products, a segment where Dabur has a strong presence, also empowers customers. They now expect greater transparency in ingredients and verifiable health benefits, influencing product development and demanding higher standards from companies like Dabur, as seen with increased demand for ‘natural’ labeled products in the packaged foods market in 2024.

| Factor | Impact on Dabur's Customer Bargaining Power | Supporting Data/Observation (2024) |

| Price Sensitivity | High | Increased cost of living and food prices in 2024 led to reduced consumer spending power. |

| Availability of Alternatives | High | Intense competition in the Indian FMCG sector with numerous national and regional brands. |

| Digital Channels & Transparency | High | E-commerce platforms enable easy price comparison and product accessibility. |

| Health & Wellness Trends | Moderate to High | Growing demand for natural/organic products, with consumers willing to pay premiums for specific attributes. |

Same Document Delivered

Dabur India Porter's Five Forces Analysis

This preview displays the complete Dabur India Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape impacting the company. You'll gain insights into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you'll receive instantly after purchase, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

The Indian Fast-Moving Consumer Goods (FMCG) market is a battleground with many strong players. Companies like Hindustan Unilever, ITC, Nestle, Patanjali, Marico, and Emami are all vying for market share. This crowded field means intense competition, often leading to aggressive advertising and price wars as brands try to stand out.

Dabur India itself is a significant force, ranking as the fourth largest FMCG company in the country. This position means Dabur operates within a very dynamic and competitive environment, constantly needing to innovate and adapt to the strategies of its numerous rivals across various product segments.

Competitive rivalry is a defining characteristic of Dabur India's operating environment, evident in the constant struggle for market share. In Q4 FY25, Dabur reported gains in market share across a substantial 90% of its product portfolio, demonstrating its ability to attract and retain consumers amidst this intense competition.

However, this success is not uniform across all segments. The beverages category, for instance, continues to experience significant competitive pressures from well-established rival brands, highlighting areas where market share battles remain particularly fierce and require ongoing strategic focus.

FMCG companies, including Dabur, are locked in a fierce battle for consumer mindshare, pouring significant resources into advertising, promotions, and relentless new product development.

Dabur’s commitment to this is evident in its increased advertising and promotion expenditure. For instance, in the fiscal year 2023-24, the company strategically allocated more funds to marketing initiatives to bolster its brand presence and drive sales.

The company is also actively expanding its product portfolio and focusing on premiumization strategies. This includes launching innovative products and reformulating existing ones to cater to evolving consumer preferences and capture higher market share in a highly competitive landscape.

Price Competition and Market Conditions

The Indian Fast-Moving Consumer Goods (FMCG) market, particularly segments like hair oil, is characterized by intense price competition. This rivalry is further amplified by challenging demand conditions, including persistent high food inflation and a general slowdown in urban consumer spending, which puts pressure on discretionary purchases.

Dabur India's financial results for the fiscal year ending March 31, 2025 (FY25) underscore these market pressures. The company reported a notable decline in its net profit, a direct consequence of the heightened price-based competition and the subdued consumer sentiment impacting sales volumes.

- Intensified Price Wars: Key product categories, such as hair oil, are witnessing aggressive pricing strategies from competitors.

- Economic Headwinds: High food inflation and weaker urban demand in FY25 are squeezing consumer budgets, making price a more critical factor in purchasing decisions.

- Impact on Profitability: Dabur India's net profit fell by 10.5% to ₹545 crore in FY25, reflecting the margin pressures from this competitive environment.

- Volume Growth Challenges: The company's volume growth also faced headwinds, with rural demand showing signs of recovery but urban markets remaining sluggish.

Extensive Distribution Network and Rural Penetration

Competitive rivalry in the FMCG sector, particularly in India, is intense, with companies constantly vying for dominance in distribution. This is especially true in reaching the vast and diverse rural consumer base.

Dabur India has cultivated a significant competitive advantage through its extensive distribution network. By the end of fiscal year 2023-24, Dabur had successfully penetrated approximately 1.5 million rural stores and reached an impressive 80% of Indian households. This deep reach allows them to effectively serve a broad customer segment, a feat that rivals actively attempt to replicate.

Competitors are therefore compelled to invest heavily in expanding their own distribution channels to match Dabur's penetration. This makes distribution infrastructure and reach a critical battleground, influencing market share and consumer access to products.

- Distribution Reach: Companies compete fiercely on the breadth and depth of their distribution networks, especially in India's extensive rural markets.

- Dabur's Advantage: Dabur India's rural footprint is a key differentiator, reaching 1.5 million rural stores and 80% of Indian households as of FY24.

- Competitive Imperative: Competitors must strive for similar deep penetration, making distribution a crucial area of strategic focus and investment.

Competitive rivalry is a defining characteristic of Dabur India's operating environment, with numerous strong players like HUL, ITC, and Nestle constantly vying for market share. This intense competition often leads to price wars and significant marketing investments, as seen in Dabur's increased advertising and promotion expenditure in FY24 to bolster brand presence.

The pressure is particularly acute in categories like hair oil, where aggressive pricing strategies are common. This, coupled with economic headwinds such as high food inflation and subdued urban demand in FY25, directly impacts profitability. Dabur India's net profit saw a decline of 10.5% to ₹545 crore in FY25, illustrating the margin pressures faced due to these competitive dynamics and challenging demand conditions.

Dabur's extensive distribution network, reaching approximately 1.5 million rural stores and 80% of Indian households by FY24, provides a significant competitive advantage. However, rivals are compelled to invest heavily in their own distribution channels to match this reach, making it a critical battleground for market access.

| Metric | Dabur India (FY25) | Key Competitors (Indicative) |

|---|---|---|

| Market Share Gains | 90% of product portfolio | Varies by segment |

| Net Profit Change | -10.5% to ₹545 crore | Varies by segment |

| Rural Distribution Reach (FY24) | 1.5 million rural stores, 80% of households | Actively expanding |

| Advertising & Promotion Spend | Increased in FY24 | High, strategic allocation |

SSubstitutes Threaten

The threat of substitutes for Dabur India's healthcare and wellness products is substantial, primarily from allopathic medicines and other wellness solutions. Consumers often turn to allopathic treatments for immediate symptom relief, presenting a direct challenge to Ayurvedic and natural remedies. For instance, in 2024, the Indian pharmaceutical market was projected to reach USD 65 billion, highlighting the strong presence and consumer trust in conventional medicine.

Furthermore, a diverse range of alternative wellness approaches, including yoga, meditation, and other traditional healing systems, also offer substitutes. While Dabur benefits from a growing consumer preference for natural and Ayurvedic products, which research indicates is a significant trend, the accessibility and perceived efficacy of allopathic alternatives remain a key competitive pressure. This dynamic suggests that Dabur must continue to innovate and effectively communicate the benefits of its offerings to counter the appeal of readily available substitutes.

The natural and organic product market is experiencing significant growth, with numerous brands, both established and emerging, entering the fray. These competitors offer chemical-free alternatives across personal care, food, and health categories, directly challenging Dabur's established position in Ayurvedic products. For instance, the Indian organic food market alone was projected to reach $743.7 million in 2023 and is expected to grow at a CAGR of 9.5% through 2028, indicating a substantial competitive landscape.

Consumer trust in the efficacy and safety of Ayurvedic products significantly influences the threat of substitutes for Dabur India. If consumers perceive a lack of scientific validation or harbor concerns about potential side effects, they may gravitate towards alternatives. For instance, negative publicity surrounding the rigorous testing of some Ayurvedic ingredients could push consumers towards allopathic medicines or other wellness products perceived as more scientifically robust.

Innovations in Conventional Products

Traditional Fast-Moving Consumer Goods (FMCG) companies are not standing still; they're actively innovating their existing product ranges. This often involves adding elements that sound natural or highlight specific wellness benefits, potentially positioning them as substitutes for Dabur's core natural and Ayurvedic products. For example, a large FMCG brand might introduce a shampoo featuring botanical extracts, which a consumer might opt for over a traditional Ayurvedic hair oil if it promises comparable results with greater convenience or a more attractive price.

This competitive pressure from conventional product innovation is significant. In 2024, the Indian FMCG market saw continued growth, with major players investing heavily in R&D to enhance their product portfolios. For instance, Hindustan Unilever Limited (HUL) has consistently launched new variants across its personal care brands, many incorporating natural ingredients to tap into consumer demand for wellness. This strategy directly challenges niche players like Dabur by offering familiar brands with a natural appeal.

- Innovation in Conventional Products: Mainstream FMCG brands are enhancing existing product lines with natural-sounding ingredients and wellness benefits.

- Perceived Value and Convenience: Consumers may choose these innovated conventional products over specialized natural alternatives if they offer similar benefits with greater convenience or lower cost.

- Market Dynamics in 2024: Major FMCG players like HUL are actively investing in R&D to introduce new variants with natural ingredients, increasing competitive pressure on brands like Dabur.

DIY and Home Remedies

The threat of substitutes for Dabur India's personal care and health products, particularly from DIY and home remedies, is a significant consideration. In India, a strong cultural inclination towards traditional practices means many consumers, especially in rural areas and among those with lower incomes, may turn to readily available natural ingredients for their health and beauty needs. This can directly impact the market size for Dabur's packaged Ayurvedic offerings.

For instance, while Dabur commands a strong presence in categories like hair oil and oral care, the accessibility and low cost of ingredients like coconut oil, turmeric, or neem for home use present a direct alternative. This is particularly relevant for budget-conscious consumers. In 2023, the Indian FMCG market saw continued growth, but the penetration of branded products in rural areas still faces competition from these traditional, low-cost alternatives. Dabur's sales volume in its Ayurvedic BPC segment, which includes many such products, is therefore influenced by the persistent appeal of these home-grown solutions.

- Cultural Affinity: Deeply rooted Indian traditions favor home remedies for common ailments and personal care.

- Cost-Effectiveness: DIY solutions using common household ingredients are often perceived as cheaper than branded products.

- Rural Market Impact: The threat is more pronounced in rural and semi-urban areas where access to and affordability of packaged goods can be a challenge.

- Addressable Market Reduction: These substitutes limit the potential customer base for Dabur's packaged Ayurvedic products.

The threat of substitutes for Dabur India's product portfolio remains a significant factor, primarily stemming from readily available allopathic medicines and a growing array of alternative wellness solutions. Consumers often opt for conventional pharmaceuticals for immediate symptom relief, posing a direct challenge to Dabur's Ayurvedic and natural offerings. For example, the Indian pharmaceutical market was valued at approximately USD 65 billion in 2024, underscoring the strong consumer reliance on allopathic treatments.

Beyond pharmaceuticals, various other wellness practices like yoga and meditation also serve as substitutes, appealing to consumers seeking holistic health. While Dabur benefits from the increasing preference for natural products, the accessibility and perceived effectiveness of allopathic alternatives continue to exert competitive pressure. This necessitates ongoing innovation and clear communication of benefits from Dabur to maintain its market position against these substitutes.

Furthermore, the rise of DIY and home remedies presents another layer of substitution, particularly for Dabur's personal care and health products. India's cultural inclination towards traditional practices means many consumers, especially in rural areas, utilize readily available natural ingredients for their health and beauty needs. This directly impacts the market for packaged goods, as cost-effective home solutions like coconut oil or neem offer a direct alternative to Dabur's branded offerings.

| Substitute Category | Examples | Impact on Dabur | Market Data (2024 Est.) |

| Allopathic Medicines | Prescription drugs, Over-the-counter (OTC) pain relievers | Direct competition for symptom relief products | Indian Pharma Market: USD 65 billion |

| Alternative Wellness | Yoga, Meditation, Homeopathy | Appeals to holistic health seekers | Growing consumer interest in natural health |

| DIY/Home Remedies | Coconut oil, Neem, Turmeric for personal care/health | Cost-effective alternatives, especially in rural markets | Significant penetration in rural FMCG segments |

Entrants Threaten

The Indian Fast-Moving Consumer Goods (FMCG) sector demands significant upfront capital to compete effectively. New entrants need to invest heavily in establishing manufacturing capabilities, building robust distribution channels, and creating strong brand recognition to even approach the scale of established players like Dabur.

Dabur's extensive reach, serving approximately 8.4 million retail outlets across India as of recent reports, highlights the immense challenge for newcomers to replicate this penetration. This vast distribution network is a formidable barrier, requiring substantial investment in logistics and relationships to match.

Dabur's strength lies in its stable of 'power brands' like Dabur Chyawanprash and Dabur Honey, which enjoy deep-rooted consumer loyalty built over many years. This established brand equity makes it incredibly difficult for newcomers to gain traction.

New entrants must overcome the significant hurdle of establishing brand trust and recognition, a process demanding substantial investment in marketing and a considerable amount of time. For instance, in fiscal year 2023-24, Dabur reported a consolidated revenue of ₹12,474 crore, underscoring the scale of operations and brand presence they command.

Dabur's established and extensive distribution network presents a formidable barrier to new entrants. The company's reach into approximately 80% of Indian households, encompassing both bustling urban centers and remote rural areas, means that new competitors face a significant challenge in matching this market penetration.

Establishing a comparable distribution infrastructure would require immense capital investment and intricate logistical planning, making it a daunting task for any newcomer aiming to compete effectively against Dabur's entrenched presence.

Regulatory Landscape for Ayurvedic Products

The Ayurvedic and natural products sector, while benefiting from government backing, faces stringent regulatory hurdles. New players must contend with specific rules governing product formulation, accurate labeling, and substantiated health claims. This complexity can significantly increase the cost and time required for market entry, acting as a deterrent.

For instance, in India, the Drugs and Cosmetics Act, 1940, along with the Drugs and Magic Remedies (Objectionable Advertisements) Act, 1954, and subsequent amendments, govern the manufacturing, sale, and advertising of Ayurvedic products. New entrants must secure manufacturing licenses, ensure raw material quality, and adhere to Good Manufacturing Practices (GMP). In 2023, the Ayush Ministry continued its focus on strengthening regulatory oversight, with over 10,000 licenses issued for Ayurvedic drug manufacturers, highlighting the established framework that newcomers must navigate.

- Regulatory Compliance Costs: New entrants face significant initial investments in R&D, quality control, and legal counsel to ensure compliance with Indian regulatory standards for Ayurvedic products.

- Product Approval Timelines: Obtaining approvals for new Ayurvedic formulations can be a lengthy process, potentially delaying market entry and impacting the first-mover advantage.

- Labeling and Claim Verification: Strict guidelines on product labeling and the substantiation of health claims require substantial investment in clinical research and documentation, adding to the barrier.

- Market Access Challenges: Existing regulatory frameworks and the need for specific certifications can create difficulties for smaller or foreign entities seeking to enter the established Indian Ayurvedic market.

Emergence of Digital-First and D2C Models

The emergence of digital-first and direct-to-consumer (D2C) models significantly reshapes the threat of new entrants for companies like Dabur. While established players benefit from brand recognition and distribution networks, these new digital channels offer a less capital-intensive pathway for agile competitors to reach consumers directly.

These digital-first entrants can bypass the traditional, often costly, distribution and retail partnerships that act as barriers for brick-and-mortar businesses. They can focus on niche markets, build strong online communities, and leverage data analytics for targeted marketing. For instance, the D2C beauty and wellness market has seen rapid growth, with many smaller brands gaining traction through social media and online sales without needing extensive physical retail presence.

Dabur is actively addressing this evolving landscape. In 2024, the company continued to invest in its digital infrastructure and e-commerce capabilities, aiming to strengthen its online presence and direct customer engagement. Furthermore, Dabur has been exploring strategic acquisitions and partnerships with digitally native brands to integrate innovative business models and expand its reach within the digital-first consumer base.

The impact of these digital entrants is evident in market share shifts within certain categories. For example, in the online personal care segment, D2C brands have captured a notable share, demonstrating the effectiveness of their digital strategies. Dabur's response, including its focus on expanding its own D2C offerings and potentially acquiring digital-native brands, is a proactive measure to mitigate this threat and capitalize on new market opportunities.

The threat of new entrants for Dabur India is moderate, primarily due to high capital requirements for manufacturing and distribution, coupled with strong brand loyalty for established players. While digital-first strategies offer a lower-entry barrier, replicating Dabur's extensive reach, serving approximately 8.4 million retail outlets as of recent reports, remains a significant challenge for newcomers.

Navigating the stringent regulatory landscape for Ayurvedic products, as governed by acts like the Drugs and Cosmetics Act, 1940, also poses a substantial hurdle. New entrants must invest in R&D, quality control, and legal compliance, with the Ayush Ministry's continued focus on oversight in 2023, issuing over 10,000 licenses for Ayurvedic drug manufacturers, underscoring the established framework.

Despite these barriers, the rise of D2C models presents an avenue for agile competitors to bypass traditional channels. Dabur's proactive investment in digital infrastructure and potential acquisitions of digital-native brands in 2024 aims to counter this evolving threat and capitalize on new market opportunities.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dabur India is built upon a foundation of comprehensive data, including Dabur's annual reports, investor presentations, and publicly available financial statements. We also incorporate insights from reputable market research firms, industry-specific publications, and government economic data to provide a robust understanding of the competitive landscape.