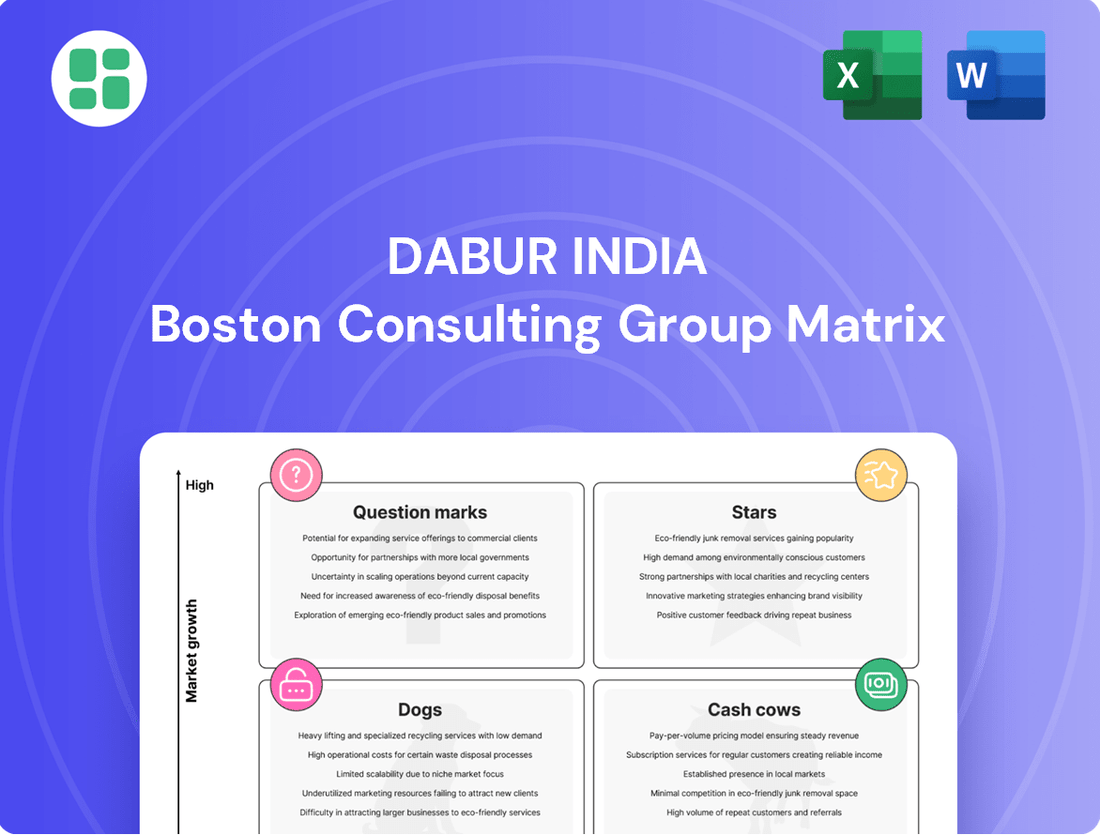

Dabur India Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dabur India Bundle

Curious about Dabur India's market performance? Our BCG Matrix analysis reveals which of their iconic brands are thriving Stars, steady Cash Cows, potential Dogs, or intriguing Question Marks.

Unlock the full strategic potential by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of Dabur's product portfolio, enabling you to make informed investment decisions and capitalize on growth opportunities.

Don't miss out on actionable insights! Get the full BCG Matrix for Dabur India and equip yourself with the knowledge to navigate the competitive landscape and drive your business forward.

Stars

Dabur Real Activ 100% Fruit Juice is a shining star in Dabur's portfolio. In Q1 FY26, it saw a remarkable 20% growth, a clear sign of its popularity in the booming health-conscious beverage market.

This product line has not only grown but also captured a larger piece of the pie, reinforcing its leading position in the juices and nectars category. Its commitment to 100% fruit content perfectly taps into the growing consumer demand for natural and healthy choices.

Dabur Red Paste, a cornerstone of Dabur India's oral care portfolio, continues to shine as a Star in the BCG matrix. Its strong herbal positioning has consistently captured consumer interest, driving both high growth and market share expansion within the competitive oral care sector.

The natural oral care segment, in particular, is a significant growth driver, and Dabur Red Paste's established market leadership and deep consumer penetration are key advantages. As of early 2024, the Indian oral care market is projected to grow at a CAGR of around 7-9%, with the natural segment outperforming the overall market.

Dabur's strategic intent to refresh and expand the Dabur Red product line underscores its commitment to maintaining and enhancing this brand's star status. These investments aim to capitalize on evolving consumer preferences and solidify its leadership in the burgeoning natural oral care space.

Dabur Hajmola, a stalwart in the digestives market, demonstrated impressive performance in FY24, achieving robust double-digit growth. This continued success is underscored by its increasing market share, which reached an impressive 54.8% in Q4 FY22-23, solidifying its leadership position.

The digestives business, spearheaded by Hajmola, exhibits sustained strong consumer traction, reflecting its high market share within a consistently growing segment. This widespread daily consumption pattern is a testament to its enduring brand strength and suggests significant potential for ongoing expansion.

Dabur Odomos

Dabur Odomos is a shining example of a Star within Dabur India's portfolio. Its market share has surged significantly, demonstrating robust growth and a commanding presence in the mosquito repellent market. This performance is a testament to its strong brand equity and effective market strategies.

The brand's impressive market share gains, including a 677 basis point increase in FY24 and a further 518 basis point gain in Q1 FY25, highlight its dominance. This consistent upward trajectory in a category with perennial demand, particularly during peak seasons, solidifies its Star status.

- Market Share Growth: Odomos achieved a notable 677 basis point increase in market share in FY24 and an additional 518 basis point gain in Q1 FY25.

- Category Strength: The mosquito repellent market, where Odomos operates, experiences consistent demand, contributing to its strong performance.

- Segment Performance: Odomos's success is further bolstered by the healthy growth observed in Dabur's overall home care segment.

- Brand Positioning: These gains underscore Odomos's powerful brand positioning and its ability to capture a larger share of a competitive market.

Dabur Honitus

Dabur Honitus holds a strong second position in the over-the-counter (OTC) cough syrup market, a testament to its consistent performance and brand strength.

The product thrives on the enduring consumer preference for natural health solutions, operating within a healthcare sector that, while normalizing post-pandemic, remains substantial and dynamic.

Key factors contributing to its success include:

- Significant Market Share: Dabur Honitus has successfully captured a notable share of the cough syrup market, establishing itself as a leading player.

- Natural Remedy Appeal: The product aligns with the growing consumer demand for natural and herbal remedies for common ailments.

- Brand Loyalty: Strong brand recognition and consumer trust have fostered significant brand loyalty, ensuring repeat purchases.

- Market Penetration: Effective distribution and marketing strategies have allowed Dabur Honitus to reach a wide consumer base across various regions.

Dabur Real Activ 100% Fruit Juice is a shining star in Dabur's portfolio. In Q1 FY26, it saw a remarkable 20% growth, a clear sign of its popularity in the booming health-conscious beverage market. This product line has not only grown but also captured a larger piece of the pie, reinforcing its leading position in the juices and nectars category. Its commitment to 100% fruit content perfectly taps into the growing consumer demand for natural and healthy choices.

Dabur Red Paste, a cornerstone of Dabur India's oral care portfolio, continues to shine as a Star in the BCG matrix. Its strong herbal positioning has consistently captured consumer interest, driving both high growth and market share expansion within the competitive oral care sector. The natural oral care segment, in particular, is a significant growth driver, and Dabur Red Paste's established market leadership and deep consumer penetration are key advantages. As of early 2024, the Indian oral care market is projected to grow at a CAGR of around 7-9%, with the natural segment outperforming the overall market. Dabur's strategic intent to refresh and expand the Dabur Red product line underscores its commitment to maintaining and enhancing this brand's star status. These investments aim to capitalize on evolving consumer preferences and solidify its leadership in the burgeoning natural oral care space.

Dabur Hajmola, a stalwart in the digestives market, demonstrated impressive performance in FY24, achieving robust double-digit growth. This continued success is underscored by its increasing market share, which reached an impressive 54.8% in Q4 FY22-23, solidifying its leadership position. The digestives business, spearheaded by Hajmola, exhibits sustained strong consumer traction, reflecting its high market share within a consistently growing segment. This widespread daily consumption pattern is a testament to its enduring brand strength and suggests significant potential for ongoing expansion.

Dabur Odomos is a shining example of a Star within Dabur India's portfolio. Its market share has surged significantly, demonstrating robust growth and a commanding presence in the mosquito repellent market. This performance is a testament to its strong brand equity and effective market strategies. The brand's impressive market share gains, including a 677 basis point increase in FY24 and a further 518 basis point gain in Q1 FY25, highlight its dominance. This consistent upward trajectory in a category with perennial demand, particularly during peak seasons, solidifies its Star status.

Dabur Honitus holds a strong second position in the over-the-counter (OTC) cough syrup market, a testament to its consistent performance and brand strength. The product thrives on the enduring consumer preference for natural health solutions, operating within a healthcare sector that, while normalizing post-pandemic, remains substantial and dynamic. Dabur Honitus has successfully captured a notable share of the cough syrup market, establishing itself as a leading player, aligning with the growing consumer demand for natural and herbal remedies.

| Product | BCG Category | Key Performance Indicators (as of early 2024/FY24-25) | Market Dynamics | Strategic Outlook |

| Dabur Real Activ 100% Fruit Juice | Star | 20% growth (Q1 FY26); Leading market share in juices & nectars. | Booming health-conscious beverage market; demand for natural products. | Capitalize on health trends; expand product variants. |

| Dabur Red Paste | Star | Strong market share expansion; high growth in natural oral care. | Indian oral care market projected to grow 7-9% CAGR (2024); natural segment outperforming. | Refresh and expand product line; maintain leadership in natural oral care. |

| Dabur Hajmola | Star | Double-digit growth (FY24); 54.8% market share (Q4 FY22-23). | Consistently growing digestives segment; high daily consumption. | Leverage brand strength; explore new product formats. |

| Dabur Odomos | Star | 677 bps market share increase (FY24); 518 bps increase (Q1 FY25). | Consistent demand in mosquito repellent market; peak season driven. | Strengthen distribution; enhance product efficacy. |

| Dabur Honitus | Star | Strong second position in OTC cough syrup market. | Healthcare sector normalizing post-pandemic; sustained demand for natural remedies. | Reinforce brand loyalty; expand reach in OTC segment. |

What is included in the product

Dabur India's BCG Matrix analysis highlights strategic insights into its diverse product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

A clear Dabur India BCG Matrix visually clarifies business unit performance, easing the pain of resource allocation decisions.

Cash Cows

Dabur Amla Hair Oil exemplifies a classic Cash Cow within Dabur India's portfolio. It holds a commanding position as a market leader, recently reaching an impressive 19% market share in the hair oils category, an increase of 214 basis points. This sustained dominance allows it to generate substantial cash flow with minimal need for aggressive marketing spend, even amidst competitive pricing pressures in the broader market.

Dabur Chyawanprash, a cornerstone of Dabur India's portfolio, exemplifies a Cash Cow within the BCG Matrix. It commands a significant market share in the health supplements sector, having recently increased its share by 111 basis points, even as the broader market experiences a slowdown after the pandemic surge.

Despite a recent plateau in growth, attributed to a high base and delayed winter seasons, Chyawanprash's enduring brand recognition and deep-rooted market presence guarantee a steady stream of revenue for Dabur. This stability is characteristic of a mature product with a strong competitive advantage.

Dabur is actively pursuing strategies to revitalize Chyawanprash's growth trajectory. These initiatives include repositioning the product as suitable for all seasons and launching contemporary product formats, aiming to broaden its appeal and capture new market segments.

Dabur Honey is a prime example of a Cash Cow within Dabur India's portfolio. Its impressive 50% market share, particularly strong in burgeoning e-commerce and modern retail channels, highlights its dominance. This established product is a major revenue driver for the company's healthcare segment.

The success of Dabur Honey is further amplified by its strategic positioning in the premium honey market, exemplified by offerings like Dabur Organic Honey. This segment appeal reinforces its status as a consistent and reliable profit generator, underpinning Dabur India's financial stability.

Dabur Pudin Hara

Dabur Pudin Hara, a prominent digestive aid, exemplifies a classic cash cow within Dabur India's diverse product portfolio. Its deep-rooted market presence and consistent consumer demand in the herbal digestive segment translate into a reliable source of stable cash flow for the company. In fiscal year 2024, Dabur's Fast Moving Consumer Goods (FMCG) business, which includes Pudin Hara, experienced robust growth, indicating the continued strength of such established brands.

The brand's strong equity and consistent demand mean it requires minimal additional investment for marketing or expansion. This allows it to contribute significantly to overall profitability without needing substantial capital allocation. Dabur's overall revenue from its consumer care business, which houses Pudin Hara, has shown consistent upward trends, underscoring the mature yet profitable nature of these offerings.

- High Market Recognition: Dabur Pudin Hara is a household name in India for digestive relief.

- Stable Cash Generation: Its established market position ensures consistent sales and profitability.

- Low Investment Needs: Strong brand loyalty reduces the need for significant promotional spending.

- Contribution to Portfolio: It supports the growth of other, newer products within Dabur's offerings.

Dabur Gulabari

Dabur Gulabari stands as a quintessential product within the Indian skincare landscape, appealing to a consumer base that values natural and time-honored beauty remedies. Despite the skincare market's continuous evolution and increasing sophistication, Gulabari has managed to secure a steadfast, high market share within its established niche. This enduring consumer loyalty and its position in a relatively mature market segment solidify its status as a consistent cash cow.

Its role as a cash cow means it generates substantial, reliable profits for Dabur India with comparatively lower investment needs for marketing and development. For instance, in the fiscal year 2023-24, Dabur India reported a consolidated revenue of INR 11,770 crore, with its Personal Care segment, which includes brands like Gulabari, being a significant contributor. The brand's established equity allows for efficient resource allocation, enabling it to fund other ventures within the company's portfolio.

Key characteristics of Dabur Gulabari as a cash cow include:

- Dominant Niche Market Share: Gulabari commands a significant portion of the rose water-based skincare segment, a testament to its enduring appeal.

- Consistent Profitability: The brand reliably contributes to Dabur's revenue streams with minimal need for aggressive expansion strategies.

- Low Marketing Investment: Consumer familiarity and brand loyalty reduce the necessity for substantial marketing expenditure compared to newer product launches.

- Brand Equity and Trust: Decades of presence have built strong consumer trust, ensuring sustained demand even in a competitive market.

Dabur's Cash Cows, like Dabur Amla Hair Oil and Dabur Chyawanprash, represent established brands with high market share and consistent revenue generation. These products require minimal investment for growth, allowing them to contribute significantly to Dabur India's overall profitability. Their strong brand recognition and deep market penetration ensure a stable cash flow, supporting the company's strategic initiatives.

| Product | Category | Market Share (approx.) | Key Characteristic |

| Dabur Amla Hair Oil | Hair Oils | 19% | Market Leader, Stable Cash Flow |

| Dabur Chyawanprash | Health Supplements | Significant | Enduring Brand Recognition, Steady Revenue |

| Dabur Honey | Honey | 50% | Major Revenue Driver, Premium Positioning |

| Dabur Pudin Hara | Digestive Aid | Strong | Consistent Demand, Reliable Profitability |

| Dabur Gulabari | Skincare | Dominant in Niche | Consistent Profitability, Low Marketing Needs |

Delivered as Shown

Dabur India BCG Matrix

The Dabur India BCG Matrix preview you are viewing is the complete, unedited document you will receive upon purchase. This means you'll get the full strategic analysis, ready for immediate application, without any watermarks or sample data. It's a professionally formatted report designed for actionable insights into Dabur's product portfolio, allowing you to directly leverage its findings for your own business planning and competitive strategy.

Dogs

Dabur Vedic Tea has been strategically exited by Dabur India, signaling its position as a 'Dog' in the company's BCG Matrix. This move reflects a portfolio restructuring aimed at shedding low-performing assets.

The Vedic tea segment likely suffered from a low market share and minimal growth opportunities, which can negatively impact overall profitability and dilute margins. Dabur's decision to divest underscores a commitment to optimizing its business by concentrating on more promising and profitable product lines.

Dabur's strategic decision to exit the diaper market underscores the segment's underperformance, firmly placing it in the 'Dog' category of the BCG Matrix. This move reflects a challenging market environment characterized by intense competition, where Dabur struggled to gain significant traction.

The diaper segment likely represented a drain on resources, tying up capital without yielding satisfactory returns. In 2024, the Indian baby diaper market, while growing, is dominated by established players, making it difficult for new entrants or underperforming brands to capture substantial market share.

Dabur's strategic exit from the breakfast cereals market firmly places this segment in the 'Dog' category of the BCG Matrix. This move indicates the business likely struggled with a low market share within a highly competitive and potentially stagnant market. In 2024, the Indian breakfast cereal market experienced moderate growth, but Dabur's specific product lines may not have captured significant consumer interest or achieved economies of scale.

Dabur Sanitisers

Dabur Sanitisers, once a significant player during the pandemic, has been strategically exited by Dabur India. This move reflects the natural lifecycle of products in a dynamic market.

The sharp decline in demand post-pandemic, coupled with an increasingly competitive landscape, shifted sanitisers from a potential 'Star' or 'Question Mark' to a 'Dog' in Dabur's portfolio.

Dabur's exit signifies a focus on resource allocation towards more promising business segments, moving away from a category with diminishing returns.

- Category Exit: Dabur has exited the hand sanitiser market.

- Market Normalization: Post-pandemic demand for sanitisers has significantly decreased.

- Strategic Shift: The move indicates a reallocation of resources from a low-growth, competitive category.

- BCG Matrix Classification: Sanitisers likely transitioned from a 'Star' or 'Question Mark' to a 'Dog' due to market dynamics.

Dabur Vita (Malted Food Drink)

Dabur India's decision to divest its malted food drink brand, Vita, strongly indicates its classification as a 'Dog' within the BCG Matrix. This category is characterized by low market share in either a slow-growing or highly competitive market. For instance, the malted food drink segment in India faces significant competition from established players and evolving consumer preferences for healthier alternatives, contributing to Vita's likely struggles.

The divestment of Vita aligns with Dabur's strategic objective to optimize its product portfolio and enhance overall profitability. By exiting brands that are underperforming or require substantial investment to regain market traction, the company can reallocate resources to more promising segments. This move is typical for companies looking to shed non-core or underperforming assets, thereby streamlining operations and focusing on growth drivers.

- Dabur Vita's Divestment: Dabur India's exit from the malted food drink Vita brand signals its classification as a 'Dog' in the BCG Matrix.

- Market Position: This category typically signifies a low market share in a market with limited growth potential or intense competition.

- Strategic Rationale: Divesting 'Dogs' allows companies to streamline their product portfolio and improve overall financial performance by removing underperforming assets.

- Industry Context: The malted food drink market in India, while established, faces competition and evolving consumer health trends, potentially impacting brands like Vita.

Dabur India's strategic divestment of its malted food drink brand, Vita, firmly places it in the 'Dog' category of the BCG Matrix. This classification is due to its likely low market share within a competitive segment, where evolving consumer preferences towards healthier alternatives pose ongoing challenges.

The exit from Vita aligns with Dabur's broader strategy to optimize its portfolio by shedding underperforming assets. This allows for the reallocation of capital and resources to more promising and profitable business segments, thereby enhancing overall financial performance and streamlining operations.

The Indian malted food drink market, while mature, is characterized by intense competition from established brands. In 2024, brands that fail to innovate or adapt to changing health consciousness may struggle to maintain or grow their market presence, reinforcing the 'Dog' status for brands like Vita.

This strategic move is a common practice for large corporations aiming to focus on core competencies and high-growth areas, ensuring that investments are directed towards segments with greater potential for return on investment.

| Dabur India Business Segment | BCG Matrix Category | Rationale | 2024 Market Context |

| Vedic Tea | Dog | Low market share, limited growth opportunities, strategic exit. | Portfolio restructuring. |

| Diapers | Dog | Intense competition, low market share, resource drain. | Dominated by established players in a growing market. |

| Breakfast Cereals | Dog | Low market share, competitive/stagnant market. | Moderate growth, but specific product lines lacked traction. |

| Sanitisers | Dog | Post-pandemic demand decline, competitive landscape. | Transitioned from potential Star/Question Mark to Dog. |

| Vita (Malted Food Drink) | Dog | Low market share, competitive market, evolving preferences. | Faces competition and health trend challenges. |

Question Marks

Siens by Dabur is Dabur's recent foray into the burgeoning nutraceuticals market, a segment experiencing robust growth fueled by heightened consumer focus on health and wellness. This new wellness brand, featuring products like marine collagen, gummies, and multivitamins, taps into a high-potential area for expansion.

While the nutraceuticals sector presents a significant opportunity, Siens is currently in its nascent stages, meaning Dabur's market share within this specific category is minimal. This positions Siens as a Question Mark in the BCG matrix, requiring careful strategic consideration and resource allocation.

To elevate Siens from a Question Mark to a potential Star, substantial investments in marketing campaigns and ongoing product development are essential. These efforts will be critical for driving market adoption and establishing a strong foothold in this competitive and rapidly evolving space.

Dabur's Real Cheers represents a strategic entry into the burgeoning cocktail mixer segment, aiming to capture the interest of younger consumers, millennials and Gen Z, who are driving growth in non-alcoholic ready-to-drink beverages. This new venture leverages the established strength of Dabur's Real fruit juice brand but faces the challenge of building market presence in a relatively nascent category for the company.

As a new entrant in a high-growth niche, Real Cheers likely possesses a low market share currently, fitting the profile of a 'question mark' in the BCG matrix. Significant investment in marketing and distribution will be crucial to gain traction and establish a strong foothold, moving it towards a potential 'star' status if market acceptance is achieved.

Dabur India is actively venturing into the new age beverage segment, a strategic move reflecting the growing consumer demand for premium and health-focused drinks. This aligns with a significant market trend where consumers are increasingly seeking specialized beverages that cater to specific wellness needs.

The market for these innovative drinks is experiencing robust growth, fueled by shifting consumer preferences towards healthier lifestyles and functional ingredients. For instance, the Indian health and wellness market, which includes beverages, was projected to reach approximately $29.2 billion in 2024, showcasing substantial expansion potential.

Despite the high growth potential, Dabur's new age beverages are currently in a nascent stage. As new entrants, they possess a relatively low market share within this competitive landscape. Consequently, substantial investment in marketing and brand building is necessary to carve out a stronger market position and attract a wider customer base.

Premium Skincare and Salon Products Expansion

Dabur India is strategically expanding its presence in the premium skincare and salon product segments. This move capitalizes on the increasing disposable incomes and growing consumer demand for specialized beauty solutions, a trend particularly pronounced in 2024. The company aims to leverage this growth opportunity to enhance its market share in a high-potential, aspirational category.

While Dabur possesses established brands, its premium skincare and salon product portfolio is still in the development or scaling phase. This suggests a current low market share within a rapidly expanding market. The success of this expansion hinges on Dabur's ability to create distinct product offerings and implement precise marketing strategies to attract and retain discerning customers.

- Market Growth: The premium beauty segment in India is projected to grow significantly, with reports indicating a compound annual growth rate (CAGR) of over 15% leading up to 2025.

- Consumer Trends: Increased awareness of ingredients and efficacy, coupled with a desire for aspirational brands, is driving demand for premium skincare.

- Dabur's Position: Dabur's existing strength in the mass-market beauty segment provides a foundation, but capturing the premium segment requires a different approach to branding and product development.

- Competitive Landscape: The premium beauty market is highly competitive, featuring both established international players and emerging domestic brands, necessitating strong differentiation.

Ayurvedic Therapeutics Division

Dabur's Ayurvedic Therapeutics division is positioned as a Star in the BCG Matrix. This strategic move consolidates existing Ayurvedic medicines with new offerings targeting lifestyle diseases and baby care, emphasizing engagement with medical professionals.

The division is designed to capitalize on the increasing consumer preference for natural remedies for chronic conditions, a segment demonstrating significant growth potential.

While this focus on the medical fraternity and lifestyle diseases represents a high-growth avenue, its current market share is relatively modest, necessitating ongoing investment to establish a stronger foothold.

- Market Focus: Lifestyle diseases and baby care, leveraging Ayurvedic principles.

- Growth Potential: Tapping into the expanding market for natural chronic ailment solutions.

- Investment Needs: Requires sustained funding to build market presence and physician advocacy.

- Current Standing: Relatively low market share due to its nascent stage and specialized distribution.

Question Marks in Dabur India's portfolio represent areas with high growth potential but currently low market share, demanding careful strategic evaluation and investment. These ventures, like Siens nutraceuticals and Real Cheers beverage mixers, are in their early stages, requiring significant marketing and product development to gain traction. Dabur's new age beverages and premium skincare lines also fall into this category, needing substantial resources to compete effectively in rapidly expanding, yet nascent, market segments.

| Dabur Business Unit | BCG Matrix Category | Market Growth Rate | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Siens (Nutraceuticals) | Question Mark | High | Low | Requires significant investment in marketing and R&D to increase market share. |

| Real Cheers (Cocktail Mixers) | Question Mark | High | Low | Needs strong promotional activities and distribution network expansion. |

| New Age Beverages | Question Mark | High | Low | Focus on brand building and product innovation to capture market share. |

| Premium Skincare & Salon Products | Question Mark | High | Low | Strategic differentiation and targeted marketing are crucial for growth. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.