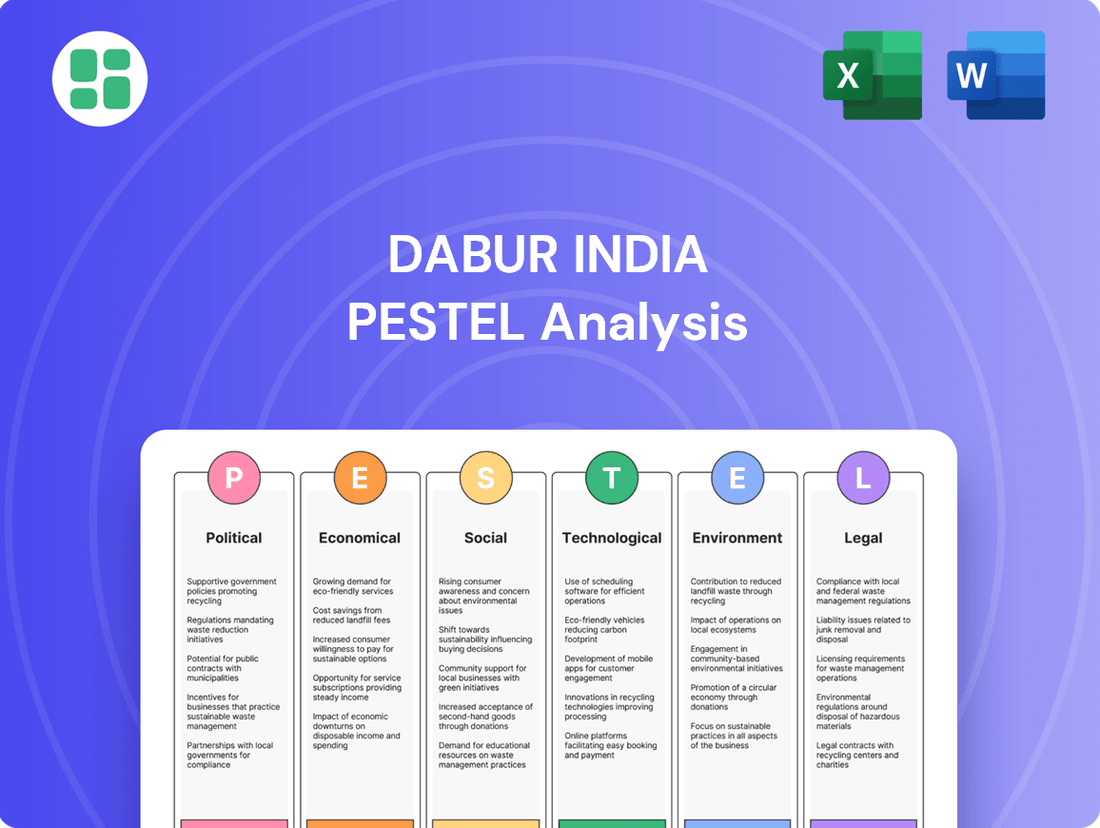

Dabur India PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dabur India Bundle

Unlock the strategic landscape of Dabur India with our comprehensive PESTLE analysis. Understand how political stability, economic growth, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping its market position. Gain actionable intelligence to navigate challenges and capitalize on opportunities.

Don't get left behind in the dynamic Indian market. Our PESTLE analysis of Dabur India provides a crucial understanding of the external forces impacting its operations and future growth. Equip yourself with expert insights to make informed strategic decisions. Purchase the full analysis now and gain a competitive edge.

Political factors

The Indian government's commitment to promoting traditional medicine, particularly Ayurveda, through the Ministry of AYUSH is a significant tailwind for Dabur India. This focus translates into policy support, research grants, and public health campaigns that bolster the market for Ayurvedic products. For instance, the National Health Policy 2017 explicitly advocates for the integration of AYUSH systems into mainstream healthcare, which directly benefits companies like Dabur that specialize in these areas.

Changes in regulations from bodies like FSSAI and the Ministry of Health significantly impact Dabur's product formulations, labeling, and marketing, particularly in food safety and cosmetic standards. For instance, FSSAI's updated standards for packaged foods, effective from 2024, demand stricter adherence to ingredient declarations and nutritional information, requiring formulation adjustments and enhanced packaging processes for Dabur's extensive product portfolio.

Stringent quality control and compliance requirements necessitate continuous adaptation and investment in R&D and manufacturing. Dabur's commitment to quality is reflected in its R&D spending, which has seen a steady increase, with the company investing approximately 2.5% of its revenue in R&D for the fiscal year 2023-24, aiming to meet evolving global and domestic standards.

Government initiatives aimed at improving the ease of doing business, such as the simplification of licensing procedures for food and cosmetic products, can streamline Dabur's operations. These reforms, part of India's broader economic agenda, reduce compliance burdens and facilitate faster market entry for new products, supporting Dabur's growth strategies.

Dabur India's operations are significantly shaped by government trade policies, including tariffs and import duties on essential raw materials like palm oil and essential oils. For instance, changes in import duties can directly impact Dabur's cost of goods sold, influencing its pricing strategies and profitability. The company's reliance on both sourcing and distribution across borders means that favorable trade agreements, such as those within SAARC or bilateral agreements, can streamline customs and reduce logistical expenses, thereby boosting international market competitiveness.

Conversely, protectionist measures or increased import tariffs on finished goods could make Dabur's products less competitive in certain international markets or raise the cost of imported components. In 2023, India's trade deficit widened, prompting discussions around trade policies and potential adjustments to protect domestic industries, which could have implications for Dabur's import-dependent raw material sourcing. Export incentives, on the other hand, can provide a crucial advantage for Dabur's global expansion efforts, making its products more attractive in overseas markets.

Political Stability and Governance

Political stability is a cornerstone for any business, and Dabur India is no exception. A predictable government and consistent policy implementation are vital for long-term strategic planning and investment. For instance, the Indian government's focus on ease of doing business, as evidenced by its consistent ranking improvement in the World Bank's Ease of Doing Business report, reaching 63rd in 2020, signals a commitment to a stable operating environment.

Conversely, political uncertainty or abrupt policy shifts can significantly disrupt operations for FMCG giants like Dabur. Frequent changes in regulations, taxation, or trade policies can create volatility, impacting supply chains, manufacturing costs, and consumer demand. This uncertainty can deter foreign investment and hinder domestic expansion plans.

Dabur, like other FMCG players, benefits from predictable policy frameworks that foster a conducive business climate.

- Stable Governance: Consistent government policies reduce operational risks and encourage long-term investment.

- Policy Predictability: Predictable tax structures and regulatory environments are crucial for financial planning and profitability.

- Impact of Uncertainty: Political instability can lead to supply chain disruptions and affect consumer confidence, impacting sales.

- Government Initiatives: Programs aimed at improving the business environment, such as those promoting manufacturing or digital infrastructure, can provide significant advantages.

'Make in India' and Local Sourcing Push

The Indian government's 'Make in India' initiative and its emphasis on local sourcing directly benefit Dabur India. This policy framework encourages domestic manufacturing, aligning perfectly with Dabur's deep roots and established local supply networks. Such government backing can translate into tangible advantages.

These policies often come with incentives, subsidies, and preferential treatment for goods manufactured within India. For Dabur, this could mean reduced production costs and a stronger competitive position against imported consumer goods. By prioritizing local production, Dabur reinforces its image as a key contributor to the national economy.

- Government Support: 'Make in India' and local sourcing mandates can provide fiscal benefits and streamline regulatory processes for companies like Dabur.

- Cost Efficiency: Preferential treatment for local inputs can lower raw material and manufacturing expenses, improving profit margins.

- Market Advantage: Policies favoring domestic products enhance Dabur's competitiveness against international brands in the Indian market.

- Brand Image: Aligning with national manufacturing initiatives strengthens Dabur's perception as a patriotic and locally invested brand.

Government support for Ayurveda, exemplified by the National Health Policy 2017, directly fuels Dabur's growth in traditional medicine. Stricter FSSAI regulations, effective from 2024, necessitate compliance investments, with Dabur allocating approximately 2.5% of its 2023-24 revenue to R&D to meet these evolving standards. India's improved Ease of Doing Business ranking to 63rd in 2020 signals a more stable operating environment, benefiting Dabur's long-term strategic planning and investment. The 'Make in India' initiative offers fiscal benefits and cost efficiencies for Dabur's local manufacturing operations.

| Policy/Initiative | Impact on Dabur | Key Data/Year |

|---|---|---|

| National Health Policy | Boosts Ayurvedic product market | 2017 |

| FSSAI Food Standards | Requires formulation/packaging adjustments | Effective 2024 |

| R&D Investment | Supports compliance and innovation | ~2.5% of revenue (FY23-24) |

| Ease of Doing Business | Enhances operational stability | Ranked 63rd (2020) |

| 'Make in India' | Provides cost efficiencies, market advantage | Ongoing |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Dabur India, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise, actionable PESTLE analysis for Dabur India, designed to quickly identify and mitigate external threats and opportunities, thereby easing strategic planning and decision-making.

Economic factors

Rising inflation, especially for agricultural goods and packaging, directly affects Dabur's production expenses. For instance, a surge in the prices of key ingredients like wheat or edible oils, which saw significant volatility in 2023-2024 due to global supply chain issues, can directly squeeze their profit margins.

Dabur's reliance on natural ingredients makes it particularly vulnerable. If the cost of sourcing herbs or other botanical inputs increases substantially, as it has for certain Ayurvedic raw materials in early 2025, the company must either absorb these costs or pass them on to consumers, impacting sales volume.

Consumer goods companies like Dabur are inherently sensitive to these input cost swings. Effective management through smart procurement, hedging strategies for commodity prices, or timely price adjustments are crucial to maintaining profitability in such an environment.

Consumer disposable income in India is a significant driver for Dabur's sales, particularly for its health supplements and premium personal care items. As economic growth continues, rising income levels are expected to boost consumer spending on these discretionary products. For instance, India's GDP growth projected around 6.5-7% for FY2024-25 suggests a generally positive environment for increased household spending.

Dabur's strategy of offering products across various price points helps it capture a broad consumer base, from those seeking essential goods to those with higher disposable income willing to spend on premium offerings. The company's ability to adapt to varying economic conditions, such as potential slowdowns that might lead consumers to opt for more budget-friendly options, is crucial for maintaining market share and profitability.

India's economic growth remains a pivotal factor for the FMCG sector, directly influencing Dabur India's performance. A healthy GDP growth rate translates to a larger, more affluent consumer base with greater disposable income, boosting demand for everyday essentials and discretionary FMCG products. For instance, India's GDP grew by an estimated 7.6% in FY24, a strong indicator of expanding consumer purchasing power.

This robust economic expansion fuels increased consumer confidence and spending, directly benefiting companies like Dabur that cater to a wide range of consumer needs. Higher employment rates and wage growth associated with economic upliftment further amplify demand across Dabur's diverse product portfolio, from healthcare to personal care items. The projected GDP growth for FY25 is also expected to remain strong, around 6.5-7.0%, continuing to support market expansion.

Interest Rates and Access to Capital

Changes in interest rates set by the Reserve Bank of India (RBI) directly influence Dabur India's expenses for borrowing. This impacts everything from funding new factories to managing day-to-day operations. For instance, if the RBI's repo rate, which stood at 6.50% as of mid-2024, were to decrease, Dabur's cost of capital for expansion would likely fall, making it more attractive to invest in new projects. Conversely, an increase in rates would raise borrowing costs, potentially slowing down capital expenditure plans.

Lower interest rates generally make it easier and cheaper for companies like Dabur to access the funds needed for growth. This can spur investment in areas like research and development for new products, expanding market reach, and upgrading manufacturing facilities. For example, a favorable interest rate environment in 2024-2025 could support Dabur's ongoing efforts to strengthen its distribution network and introduce innovative consumer goods, thereby enhancing its competitive edge.

The availability of affordable capital is a cornerstone for Dabur's strategic objectives. It underpins the company's ability to invest in product innovation, penetrate new markets, and develop essential infrastructure. Without accessible and reasonably priced financing, Dabur's capacity to launch new health and wellness products or expand its international footprint could be significantly hampered. This directly affects the company's overall financial health and its potential for sustained growth in a dynamic marketplace.

Dabur's financial well-being is intrinsically linked to its ability to secure capital at competitive rates. The company's debt-to-equity ratio, a key indicator of financial leverage, is sensitive to interest rate fluctuations. As of the fiscal year ending March 2024, Dabur maintained a healthy financial position, but sustained higher interest rates could increase its debt servicing burden, potentially impacting profitability and reinvestment capacity.

- Interest Rate Impact: The RBI's repo rate, at 6.50% in mid-2024, directly affects Dabur's borrowing costs for capital expenditure and working capital.

- Growth Facilitation: Lower interest rates in 2024-2025 can encourage Dabur's investment in R&D, market expansion, and infrastructure development.

- Capital Access Vitality: Affordable capital is crucial for Dabur's product innovation and market penetration strategies.

- Financial Health Link: Dabur's debt servicing costs and reinvestment capacity are directly tied to prevailing interest rate levels.

Competitive Landscape and Pricing Pressure

The Indian Fast-Moving Consumer Goods (FMCG) sector is intensely competitive, with Dabur facing significant pricing pressure from a multitude of domestic and international rivals. This dynamic environment means that competitors' pricing adjustments, aggressive promotional campaigns, and the introduction of new products can directly impact Dabur's revenue and profit margins, necessitating strategic responses.

To navigate this, Dabur must continuously innovate and maintain operational efficiency. Strong brand equity is crucial for justifying premium pricing in a market where value for money is a key consumer consideration. For instance, in the 2023-24 fiscal year, while Dabur reported consolidated revenue of approximately INR 12,400 crore, the constant need to counter competitor strategies, such as aggressive discounting by players like Hindustan Unilever and ITC, directly influences its pricing power and market share dynamics.

- Intense Competition: The Indian FMCG market features over 500 brands, with Dabur competing against giants like Hindustan Unilever, ITC, and Patanjali.

- Pricing Pressure: Competitor pricing strategies, especially during festive seasons or promotional periods, can force Dabur to offer discounts, impacting its gross margins which hovered around 40-45% in recent fiscal years.

- Innovation as a Differentiator: Dabur's ability to launch successful new products, like its recent expansions in the health foods and personal care segments, is key to maintaining market share and pricing power.

- Brand Equity: Dabur's long-standing brands, such as Dabur Chyawanprash and Dabur Honey, provide a competitive advantage, allowing it to command a certain price point despite market pressures.

India's economic growth is a primary driver for Dabur, with a projected GDP growth of 6.5-7.0% for FY2024-25. This expansion fuels consumer disposable income, benefiting Dabur's sales of health supplements and premium personal care items. The company's diverse product portfolio, spanning various price points, allows it to adapt to economic fluctuations and capture a broad consumer base.

Interest rates, with the RBI repo rate at 6.50% in mid-2024, directly influence Dabur's borrowing costs for expansion and operations. Lower rates can encourage investment in R&D and market reach, while higher rates increase debt servicing burdens, impacting profitability. Affordable capital access is vital for Dabur's innovation and market penetration strategies.

The competitive FMCG landscape, with players like HUL and ITC, exerts pricing pressure on Dabur. To maintain market share and margins, Dabur relies on strong brand equity and continuous innovation. For instance, in FY23-24, Dabur's consolidated revenue was around INR 12,400 crore, highlighting the need to balance competitive pricing with profitability.

| Economic Factor | Impact on Dabur | Key Data/Trend (2024-2025) |

| Economic Growth (GDP) | Boosts disposable income, increasing demand for FMCG products. | Projected India GDP growth: 6.5-7.0% for FY2024-25. |

| Interest Rates | Affects borrowing costs for capital expenditure and working capital. | RBI Repo Rate: 6.50% (mid-2024). Potential for rate adjustments impacting investment. |

| Competition | Drives pricing strategies and necessitates innovation for market share. | Intense competition from HUL, ITC, Patanjali. Dabur's FY23-24 revenue: ~INR 12,400 crore. |

Preview the Actual Deliverable

Dabur India PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Dabur India Ltd. delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into how these external forces shape Dabur's market position and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of each PESTLE element, offering a robust framework for understanding the broader business landscape relevant to Dabur.

Sociological factors

Indian consumers are increasingly prioritizing health, wellness, and preventative care. This shift directly benefits Dabur's extensive portfolio of Ayurvedic and natural products, driving demand for items like immunity boosters, natural personal care, and healthier food choices. For instance, the Indian wellness market was projected to reach USD 17.7 billion by 2025, showcasing the significant growth potential.

Consumers are increasingly drawn to natural and Ayurvedic products, a trend fueled by a growing distrust of synthetic ingredients and a revival of traditional Indian wellness practices. This shift is particularly evident in categories like hair care, oral care, and health supplements, where authenticity and natural formulations are highly valued.

Dabur, with its deep-rooted expertise in Ayurveda, is strategically positioned to benefit from this movement. The company's extensive portfolio, including brands like Dabur Amla hair oil and Dabur Chyawanprash, directly addresses this demand. In 2023-24, Dabur reported a significant revenue growth, partly attributed to the strong performance of its health and wellness portfolio, which aligns perfectly with this consumer preference.

India's rapid urbanization is profoundly reshaping consumer habits. By 2023, over 40% of India's population resided in urban areas, a figure projected to reach 50% by 2030, according to UN data. This demographic shift translates to increased disposable incomes and greater exposure to global trends, fueling a demand for convenience-oriented products and premium offerings. Dabur must align its strategies to meet these evolving urban needs.

Urban consumers increasingly value convenience, hygiene, and products that offer a premium experience. Dabur's response includes developing smaller, single-use or on-the-go packaging solutions, catering to busy lifestyles. Furthermore, enhancing digital accessibility for product information and purchasing is crucial, as urban dwellers are more digitally connected.

Influence of Digital Media and Social Trends

The pervasive reach of social media and digital platforms profoundly shapes consumer choices, especially for younger audiences. For instance, by the end of 2023, India's internet user base was projected to exceed 900 million, with a significant portion actively engaged on social media, influencing purchasing behaviors across various sectors, including FMCG where Dabur operates.

Dabur must strategically employ digital marketing, collaborate with influencers, and enhance its e-commerce presence to connect with consumers, foster brand loyalty, and adapt to swift social shifts and feedback. In 2024, influencer marketing spend in India was anticipated to grow by 25-30%, highlighting its importance in reaching target demographics.

Online reputation and digital visibility are paramount for shaping brand perception. Studies in 2024 indicated that over 70% of consumers read online reviews before making a purchase, making a strong digital footprint essential for Dabur's success.

- Digital Adoption: India's internet penetration nearing 70% by early 2024 fuels the influence of digital media on consumerism.

- Influencer Impact: The Indian influencer marketing industry is projected to reach $2.8 billion in 2024, underscoring its role in brand engagement.

- E-commerce Growth: Dabur's online sales channels are critical, as India's e-commerce market is expected to reach $350 billion by 2028.

- Brand Perception: Over 70% of consumers rely on online reviews, making digital reputation management vital for Dabur.

Ethical Consumerism and Sustainability Awareness

Consumers are increasingly scrutinizing the ethical and environmental footprint of their purchases. This trend is driving demand for products made with sustainably sourced ingredients, packaged in eco-friendly materials, and produced under fair labor conditions.

Dabur's proactive stance on sustainability and its robust corporate social responsibility programs are key differentiators. These initiatives resonate strongly with a growing segment of conscious consumers, directly influencing their purchasing choices and brand loyalty.

For instance, Dabur's commitment to reducing plastic waste and promoting natural ingredients aligns with consumer preferences. In 2023-24, the company continued its efforts in sustainable sourcing, with a significant portion of its raw materials coming from eco-certified farms, further solidifying its appeal to ethically-minded buyers.

- Growing Consumer Demand: A 2024 survey indicated that over 65% of Indian consumers consider sustainability when making purchasing decisions.

- Dabur's Sustainability Initiatives: The company has set ambitious targets for renewable energy usage and water conservation across its manufacturing units.

- Brand Perception: Dabur's investment in CSR activities, such as rural development and healthcare programs, enhances its brand image as a responsible corporate citizen.

- Market Impact: This focus on ethical consumerism directly supports Dabur's market share growth in categories where sustainability is a primary purchasing driver.

Societal shifts are significantly influencing consumer behavior, with a strong emphasis on health and wellness. This trend directly benefits Dabur's extensive range of Ayurvedic and natural products, boosting demand for items like immunity boosters and natural personal care products. The Indian wellness market was projected to reach USD 17.7 billion by 2025, highlighting substantial growth potential.

Urbanization is reshaping consumer habits, with a growing preference for convenience, premium experiences, and digitally accessible products. Dabur is adapting by offering on-the-go packaging and enhancing its e-commerce presence to cater to these evolving urban needs.

The increasing influence of digital media and social platforms, with India's internet user base projected to exceed 900 million by the end of 2023, is crucial for consumer choices. Dabur's strategic use of digital marketing and influencer collaborations, supported by a projected 25-30% growth in Indian influencer marketing spend for 2024, is vital for brand engagement and adapting to rapid social changes.

Conscious consumerism is on the rise, with over 65% of Indian consumers considering sustainability in 2024. Dabur's commitment to eco-friendly practices and CSR initiatives, such as sustainable sourcing and renewable energy targets, strengthens its appeal to ethically-minded buyers and supports market share growth.

Technological factors

Technological advancements in R&D are a significant driver for Dabur India. Innovations in herbal extraction, formulation science, and quality control allow the company to create new Ayurvedic and natural products that are both effective and safe. For instance, Dabur's investment in advanced extraction techniques ensures higher potency of active ingredients in their offerings.

Dabur's commitment to cutting-edge research, including areas like biotechnology and advanced analytics for product development, helps them maintain a competitive edge. This focus on scientific validation of traditional remedies is key to their product differentiation strategy. In the fiscal year 2023-24, Dabur reported a robust R&D expenditure, underscoring their dedication to innovation and staying ahead in the market.

The rapid growth of e-commerce platforms significantly reshapes FMCG distribution. Dabur's investment in its online presence, including optimizing its e-commerce strategy and integrating with various online retail channels, is crucial for expanding market reach, particularly in tier-2 and tier-3 cities. This digital push caters to the increasing consumer preference for online shopping, offering enhanced convenience and accessibility.

Dabur's integration of technologies like AI, IoT, and advanced analytics is revolutionizing its supply chain. This adoption leads to optimized inventory management, boosting efficiency and cutting down on waste, crucial for an FMCG giant like Dabur.

By implementing automated warehousing and predictive analytics for demand forecasting, Dabur enhances operational efficiency and reduces costs. Real-time tracking further solidifies this, ensuring faster product delivery and improved customer satisfaction. For instance, in 2023, Dabur reported a 15% improvement in on-time delivery rates following significant investments in its logistics technology.

Manufacturing Process Innovation and Efficiency

Dabur India is actively integrating technological advancements into its manufacturing to boost efficiency. For instance, the company has invested in automated packaging lines and advanced quality control systems to ensure product consistency and reduce manual intervention. This focus on technological upgrades directly supports their strategy to scale production effectively.

These innovations are crucial for cost-effectiveness and scalability. By adopting automation and robotics, Dabur can streamline operations, leading to lower per-unit production costs. This is particularly important as they aim to meet the increasing consumer demand for their diverse product portfolio, from health supplements to personal care items.

The impact of these technological factors on Dabur India's operations is evident in their pursuit of enhanced operational excellence. For example, during the fiscal year 2023-24, Dabur highlighted its ongoing efforts in modernizing its manufacturing facilities, which is expected to yield significant improvements in throughput and energy efficiency. This strategic adoption of new technologies allows Dabur to remain competitive and responsive to market dynamics.

- Automation and Robotics: Dabur is implementing automated systems in its plants to improve speed and reduce reliance on manual labor, enhancing overall production capacity.

- Advanced Machinery: Investments in state-of-the-art machinery ensure higher product quality and consistency, critical for maintaining brand trust and meeting regulatory standards.

- Efficiency Gains: Technological upgrades are projected to reduce manufacturing cycle times and operational costs, directly contributing to improved profit margins.

- Scalability: Enhanced manufacturing processes enable Dabur to scale production rapidly to meet growing domestic and international market demands.

Data Analytics for Consumer Insights and Personalization

Dabur leverages big data analytics and AI to understand consumer behavior, preferences, and buying habits. This allows for highly targeted marketing, personalized product suggestions, and the development of products that genuinely meet consumer demands. In the fast-moving consumer goods (FMCG) sector, this deep consumer understanding is crucial for success.

By analyzing vast datasets, Dabur can identify emerging trends and tailor its offerings. For instance, in 2024, the company's investment in digital transformation initiatives, including advanced analytics platforms, aims to enhance customer engagement across its diverse product portfolio, from healthcare to personal care.

- Enhanced Consumer Understanding: Big data analytics provide granular insights into individual consumer preferences and purchasing journeys.

- Personalized Marketing: AI-driven recommendations and targeted campaigns increase engagement and conversion rates.

- Efficient Product Development: Data on consumer needs informs product innovation, reducing market entry risks.

- Increased Customer Loyalty: Personalized experiences foster stronger relationships and repeat purchases.

Dabur India's technological strategy focuses on enhancing R&D through advanced extraction and formulation, aiming for more potent natural products. Their 2023-24 R&D expenditure highlights this commitment to innovation and scientific validation, crucial for differentiating their Ayurvedic offerings.

The company is actively leveraging e-commerce and digital platforms to expand its market reach, especially in smaller cities. This digital transformation, supported by investments in analytics, aims to deepen consumer understanding and drive personalized marketing efforts, as seen in their 2024 digital initiatives.

Operational efficiency is being boosted through automation, AI, and IoT in manufacturing and supply chains. Investments in automated packaging and predictive analytics, exemplified by a 15% improvement in on-time delivery in 2023, are key to scaling production and reducing costs.

| Key Technological Focus Areas | Impact on Dabur India | Supporting Data/Examples |

| R&D and Product Innovation | Development of advanced Ayurvedic and natural products | Investment in advanced extraction techniques; Robust R&D expenditure in FY 2023-24 |

| E-commerce and Digital Presence | Expanded market reach, particularly in tier-2/3 cities | Optimized e-commerce strategy; Increased online sales |

| Supply Chain and Manufacturing Automation | Improved efficiency, reduced costs, enhanced delivery | AI/IoT integration; 15% improvement in on-time delivery (2023); Automated packaging lines |

| Data Analytics and AI | Deeper consumer understanding, personalized marketing | Digital transformation initiatives (2024); Targeted marketing campaigns |

Legal factors

Dabur India, a significant player in the food and beverage sector, must navigate the comprehensive regulations set forth by the Food Safety and Standards Authority of India (FSSAI). These rules cover everything from the ingredients used to how products are made, packaged, and advertised.

Failure to comply with FSSAI standards, which are regularly updated, can lead to severe consequences. These include hefty fines, costly product recalls, and significant damage to Dabur's brand reputation. For instance, in 2023, FSSAI continued its focus on enforcing standards for packaged foods, with reports indicating increased inspections across the country.

Staying ahead of evolving FSSAI guidelines and ensuring strict adherence to all mandates is therefore paramount for Dabur's continued operational success and market standing. This proactive approach helps maintain consumer trust and operational integrity.

Advertising and labeling laws are tightening, especially for health and wellness products, to safeguard consumers from misinformation. Dabur must ensure its marketing and product labels are truthful and adhere to consumer protection acts, avoiding unsubstantiated claims for its Ayurvedic and health supplement lines. For instance, in 2024, the Advertising Standards Council of India (ASCI) continued its focus on ensuring transparency in health product advertising, leading to stricter scrutiny of claims made by companies like Dabur.

Dabur India places significant emphasis on safeguarding its intellectual property, encompassing trademarks for its extensive brand portfolio, patents for proprietary formulations, and copyrights for its creative assets. This legal protection is essential to deterring counterfeiting and unauthorized replication of its innovations, thereby preserving its market standing and substantial investments in research and development. A strong intellectual property rights strategy is fundamental to maintaining Dabur's long-term competitive edge in the consumer goods sector.

Labor and Employment Laws

Dabur India operates within a complex web of Indian labor and employment laws. These regulations cover critical areas such as minimum wages, safe working conditions, employee benefits like provident fund and gratuity, and the framework for industrial relations. For instance, the Code on Wages, 2019, aims to consolidate laws relating to wages, bonus payments, and other remuneration, impacting how Dabur structures its compensation packages.

Adherence to these labor laws is paramount for Dabur to foster a fair and equitable workplace, thereby minimizing the risk of labor disputes and maintaining a positive reputation. The company's compliance efforts directly influence employee morale and productivity. In 2023, India saw continued discussions and phased implementation of new labor codes, which consolidate 29 central labor laws into four codes, including the Code on Industrial Relations, 2020, and the Code on Social Security, 2020. These changes can significantly affect operational costs and necessitate adjustments in human resource management strategies.

- Wage Compliance: Dabur must ensure its wage structures align with the minimum wage provisions stipulated by central and state governments, influenced by the Code on Wages, 2019.

- Working Conditions: Adherence to safety and health standards in factories and workplaces is mandated by laws like the Factories Act, 1948, and potentially updated by the Occupational Safety, Health and Working Conditions Code, 2020.

- Employee Benefits: Dabur provides statutory benefits such as provident fund, employee state insurance (ESI), and gratuity, governed by various social security laws.

- Industrial Relations: The company must navigate regulations concerning trade unions, collective bargaining, and dispute resolution, as outlined in the Code on Industrial Relations, 2020.

Consumer Protection Act and Product Liability

The Consumer Protection Act, 2019, significantly strengthens consumer rights in India, placing a greater onus on manufacturers like Dabur to ensure product safety and quality. This legislation empowers consumers to seek redressal against unfair trade practices and defective goods, making Dabur liable for any product-related harm. For instance, in 2023, the Consumer Protection Authority (CPA) actively pursued cases against companies for misleading advertisements and product defects, highlighting the strict enforcement environment.

Dabur's legal responsibility extends to guaranteeing that all its products, from healthcare to personal care items, meet stringent safety standards and accurately reflect their advertised qualities. Failure to adhere to these mandates can result in severe repercussions, including substantial financial penalties and irreparable damage to the company's reputation. The Act mandates robust quality control processes and effective grievance redressal systems to mitigate these risks.

- Consumer Protection Act, 2019: Enhances consumer rights and manufacturer accountability for product safety and quality.

- Dabur's Liability: Legally bound to ensure products are safe, effective, and meet stated quality standards.

- Consequences of Non-Compliance: Potential for legal action, significant fines, and erosion of consumer trust.

- Mitigation Strategies: Necessity of strong quality assurance and responsive grievance handling mechanisms.

Dabur India must meticulously adhere to the Food Safety and Standards Authority of India (FSSAI) regulations, which govern product safety, labeling, and manufacturing processes. Non-compliance, as seen with increased FSSAI inspections in 2023, can lead to substantial fines and recalls, impacting brand trust.

The company also faces stringent advertising and consumer protection laws, such as the Consumer Protection Act, 2019, which holds manufacturers accountable for product claims and safety. In 2024, the Advertising Standards Council of India (ASCI) intensified its scrutiny of health product claims, necessitating accuracy in Dabur's marketing for its wellness lines.

Navigating India's evolving labor laws, including the consolidated Code on Wages, 2019, and the Occupational Safety, Health and Working Conditions Code, 2020, is crucial for maintaining fair employment practices and minimizing disputes. These legal frameworks impact compensation, working conditions, and employee relations, requiring continuous adaptation by Dabur.

Protecting its intellectual property, including trademarks and patents, is a legal imperative for Dabur to prevent counterfeiting and safeguard its R&D investments, ensuring its competitive edge in the market.

Environmental factors

Dabur India's extensive use of natural and herbal ingredients means sustainable sourcing is paramount. This directly impacts their supply chain resilience and ability to meet growing consumer demand for eco-conscious products. For instance, in 2023, Dabur reported sourcing over 60% of its key raw materials from rural India, highlighting the importance of farmer partnerships for sustainable cultivation.

Dabur, like many consumer goods companies, faces growing pressure to address plastic waste. In 2023, India's Central Pollution Control Board reported that the country generated approximately 3.5 million tonnes of plastic waste annually, highlighting the scale of the challenge. This environmental factor necessitates significant investment in sustainable packaging, such as recyclable or biodegradable materials, to align with evolving consumer expectations and regulatory frameworks.

The company's commitment to Extended Producer Responsibility (EPR) is crucial. Dabur is expected to actively participate in programs for plastic waste collection and recycling, contributing to a circular economy. For instance, by 2025, many companies are aiming to incorporate at least 25% recycled plastic into their packaging, a target Dabur is likely working towards. Innovative packaging not only mitigates environmental impact but also serves as a differentiator, enhancing brand perception among eco-conscious consumers.

Water scarcity is a major environmental hurdle in India, directly affecting industries like Dabur that rely heavily on water for manufacturing. For instance, in 2024, several regions in India faced severe water stress, impacting agricultural output which is crucial for sourcing raw materials.

To counter these risks and show commitment to sustainability, Dabur is focusing on efficient water management. This includes adopting advanced water recycling technologies in its plants and implementing rainwater harvesting systems. By reducing overall water consumption in its production processes, Dabur aims to ensure operational continuity and bolster its environmental credentials.

The company's commitment to sustainable water use is not just about compliance; it's a strategic imperative for long-term business health. By 2025, water conservation efforts are expected to yield significant savings in operational costs and enhance brand reputation among environmentally conscious consumers.

Carbon Footprint Reduction and Energy Efficiency

Dabur India is facing increasing pressure to slash its carbon emissions and boost energy efficiency throughout its manufacturing and distribution networks. This imperative stems from both regulatory expectations and a growing commitment to corporate sustainability. The company is actively exploring avenues like adopting renewable energy sources, such as solar power for its plants, and optimizing logistics to minimize fuel consumption.

In line with these efforts, Dabur has been investing in more energy-efficient machinery and technologies. For instance, by fiscal year 2023-24, the company aimed to increase its renewable energy share in its overall energy consumption. This strategic focus on reducing its environmental footprint is crucial for long-term compliance with evolving climate change policies and for enhancing its brand reputation among environmentally conscious consumers.

- Renewable Energy Adoption: Dabur is increasing its reliance on renewable energy sources to power its operations, aiming for a significant percentage of its energy needs to be met by renewables by 2025.

- Logistics Optimization: Efforts are underway to streamline transportation routes and explore greener logistics solutions, contributing to a reduction in Scope 3 emissions.

- Energy Efficiency Investments: The company continues to invest in upgrading manufacturing facilities with energy-efficient equipment and processes to lower overall energy consumption.

- Sustainability Goals: These initiatives directly support Dabur's broader corporate sustainability objectives, aligning with national and international environmental targets.

Compliance with Environmental Protection Laws

Dabur India operates within a stringent framework of environmental protection laws in India. These regulations cover critical areas such as air and water pollution control, proper waste disposal, and the safe management of hazardous substances. For instance, the Water (Prevention and Control of Pollution) Act, 1974, and the Air (Prevention and Control of Pollution) Act, 1981, are foundational to these compliance requirements.

Failure to comply with these environmental mandates can lead to severe consequences for Dabur. These include substantial financial penalties, potential shutdowns of manufacturing facilities, and significant damage to the company's brand image and public trust. In 2023, the Central Pollution Control Board (CPCB) reported a notable increase in environmental violation notices issued to various industries, underscoring the heightened regulatory scrutiny.

To navigate these challenges effectively, Dabur must maintain continuous monitoring of its environmental impact and actively invest in sustainable, eco-friendly operational processes. This proactive approach is essential not only for ensuring regulatory adherence but also for mitigating environmental risks and fostering long-term business resilience. The company's sustainability reports often highlight investments in wastewater treatment plants and renewable energy sources to meet these objectives.

- Pollution Control: Adherence to CPCB and State Pollution Control Board (SPCB) norms for emissions and effluents.

- Waste Management: Compliance with the Solid Waste Management Rules, 2016, and Hazardous Waste Management Rules.

- Resource Conservation: Initiatives focused on water conservation and energy efficiency across operations.

- Product Stewardship: Ensuring environmentally responsible sourcing and end-of-life management of products.

Dabur India's reliance on natural ingredients makes sustainable sourcing critical, impacting supply chain stability and the ability to meet demand for eco-friendly products. In 2023, over 60% of key raw materials were sourced from rural India, emphasizing the importance of farmer partnerships for sustainable cultivation.

The company faces significant pressure to reduce plastic waste, with India generating millions of tonnes annually. This necessitates investment in sustainable packaging solutions, such as recyclable or biodegradable materials, to align with consumer expectations and regulatory trends, with a target for many companies to incorporate 25% recycled plastic by 2025.

Water scarcity is a growing concern, affecting water-intensive industries like Dabur, particularly as regions experienced severe water stress in 2024, impacting agricultural output. To mitigate this, Dabur is investing in water recycling technologies and rainwater harvesting, aiming for significant cost savings and enhanced brand reputation by 2025.

Dabur is actively working to reduce its carbon footprint by increasing renewable energy adoption, optimizing logistics, and investing in energy-efficient machinery. By fiscal year 2023-24, the company aimed to boost its renewable energy share, aligning with climate change policies and enhancing its brand image.

| Environmental Focus | Key Initiatives | Data Point/Target |

| Sustainable Sourcing | Farmer partnerships for cultivation | Over 60% of key raw materials sourced from rural India (2023) |

| Plastic Waste Management | Investment in sustainable packaging | Aiming for increased recycled plastic content by 2025 |

| Water Conservation | Water recycling and rainwater harvesting | Expected operational cost savings and enhanced brand reputation by 2025 |

| Carbon Footprint Reduction | Renewable energy adoption, logistics optimization | Increased renewable energy share targeted for FY 2023-24 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Dabur India is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Dabur.