Cytek SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cytek Bundle

Cytek's innovative technology presents a significant strength, but understanding the full scope of its market position requires more than just highlights. Our comprehensive SWOT analysis delves into their unique opportunities and potential threats, providing actionable insights.

Want the full story behind Cytek's competitive advantages and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Cytek Biosciences' proprietary Full Spectrum Profiling (FSP) technology is a significant strength, allowing for unprecedented cellular analysis. This patented innovation enables the simultaneous detection of over 40 fluorochromes, a substantial leap beyond traditional flow cytometry capabilities. This high-resolution, high-dimensional, and high-sensitivity analysis provides researchers with deeper insights from a single sample, offering a distinct competitive edge.

Cytek Biosciences boasts a comprehensive and integrated product portfolio designed to cover the entire cell analysis workflow. This includes their flagship FSP instruments, such as the Cytek Aurora and Northern Lights systems, alongside the Aurora CS cell sorter, the Cytek Orion reagent cocktail preparation system, and established Amnis and Guava brand products. This extensive range, coupled with their proprietary reagents, software like Cytek Cloud, and dedicated services, delivers a complete end-to-end solution for researchers.

Cytek's expanding global presence is a significant strength, evidenced by its installed base of 3,295 instruments by Q2 2025. This consistent growth in instrument placements directly fuels a substantial and increasing stream of recurring revenue.

The company's focus on services and reagents is paying off, with this segment seeing a robust 16-18% increase compared to Q2 2024. This growing recurring revenue now represents a solid 32% of Cytek's trailing 12-month sales, providing a predictable and expanding income source.

Continuous Innovation and New Product Launches

Cytek's dedication to pushing boundaries in its field is a significant strength. The company consistently brings fresh solutions to market, keeping its product portfolio dynamic and competitive.

This commitment is clearly demonstrated by recent product introductions. For instance, the Cytek Aurora Evo system, launched in May 2025, offers enhanced throughput and automation capabilities, appealing to users seeking greater efficiency. Additionally, the introduction of the Cytek Muse Micro system in March 2025 provides an accessible, user-friendly option, effectively expanding Cytek's reach into both premium and entry-level market segments.

- Innovation Drive: Regular introduction of new products enhances market competitiveness.

- Product Expansion: Launches like Aurora Evo (May 2025) and Muse Micro (March 2025) cater to diverse user needs.

- Market Reach: New products broaden appeal to both high-end and entry-level customers.

Strategic Positioning in High-Growth Research Areas

Cytek Biosciences is strategically positioned at the forefront of high-growth research areas, with its advanced flow cytometry solutions playing a pivotal role. The company's technology is instrumental in accelerating research and development in critical fields like immunology, oncology, and single-cell analysis, areas experiencing significant investment and scientific advancement. This focus aligns perfectly with the increasing demand for sophisticated tools to understand complex biological systems.

The company's commitment to these burgeoning scientific sectors is further evidenced by its active participation and prominent sponsorship at key industry events. For instance, its platinum sponsorship of CYTO 2025 and IMMUNOLOGY2025 demonstrates a clear intent to lead and shape the future of these critical research domains. Such engagements not only highlight Cytek's dedication but also solidify its reputation as a key enabler of scientific breakthroughs.

- Crucial for drug discovery and clinical applications in immunology and oncology.

- Enables cutting-edge single-cell analysis, a rapidly expanding research frontier.

- Platinum sponsorship of CYTO 2025 and IMMUNOLOGY2025 highlights leadership in key growth areas.

- Strategic focus on high-growth research areas positions Cytek for sustained market relevance.

Cytek's proprietary Full Spectrum Profiling (FSP) technology is a core strength, enabling over 40-color multiplexing in flow cytometry, far exceeding traditional capabilities. This innovation provides researchers with deeper, more nuanced cellular insights from single samples, a significant competitive advantage.

The company offers an integrated workflow solution, encompassing instruments like the Aurora and Northern Lights, the Aurora CS cell sorter, reagent preparation systems, and established Amnis and Guava brands. This comprehensive suite, supported by proprietary reagents and software, delivers an end-to-end experience for users.

Cytek's expanding global footprint is demonstrated by its growing installed base, reaching 3,295 instruments by Q2 2025, which translates to a substantial and increasing recurring revenue stream.

The services and reagents segment is a key growth driver, showing a 16-18% increase year-over-year as of Q2 2025. This segment now constitutes 32% of trailing 12-month sales, providing a predictable and expanding income source.

Cytek consistently introduces innovative products, keeping its portfolio competitive and catering to diverse market needs. For example, the Aurora Evo system launched in May 2025 enhances throughput and automation, while the Muse Micro system, released in March 2025, broadens market reach to entry-level users.

| Product/Segment | Key Feature | Impact | Date |

|---|---|---|---|

| Full Spectrum Profiling (FSP) | 40+ fluorochrome detection | Unprecedented cellular analysis depth | Ongoing |

| Integrated Portfolio | End-to-end workflow solutions | Comprehensive user experience | Ongoing |

| Installed Base | 3,295 instruments (Q2 2025) | Growing recurring revenue | Q2 2025 |

| Services & Reagents | 16-18% YoY growth (Q2 2025) | 32% of TTM sales, stable income | Q2 2025 |

| Aurora Evo | Enhanced throughput & automation | Appeals to efficiency-focused users | May 2025 |

| Muse Micro | Accessible, user-friendly | Expands to entry-level market | March 2025 |

What is included in the product

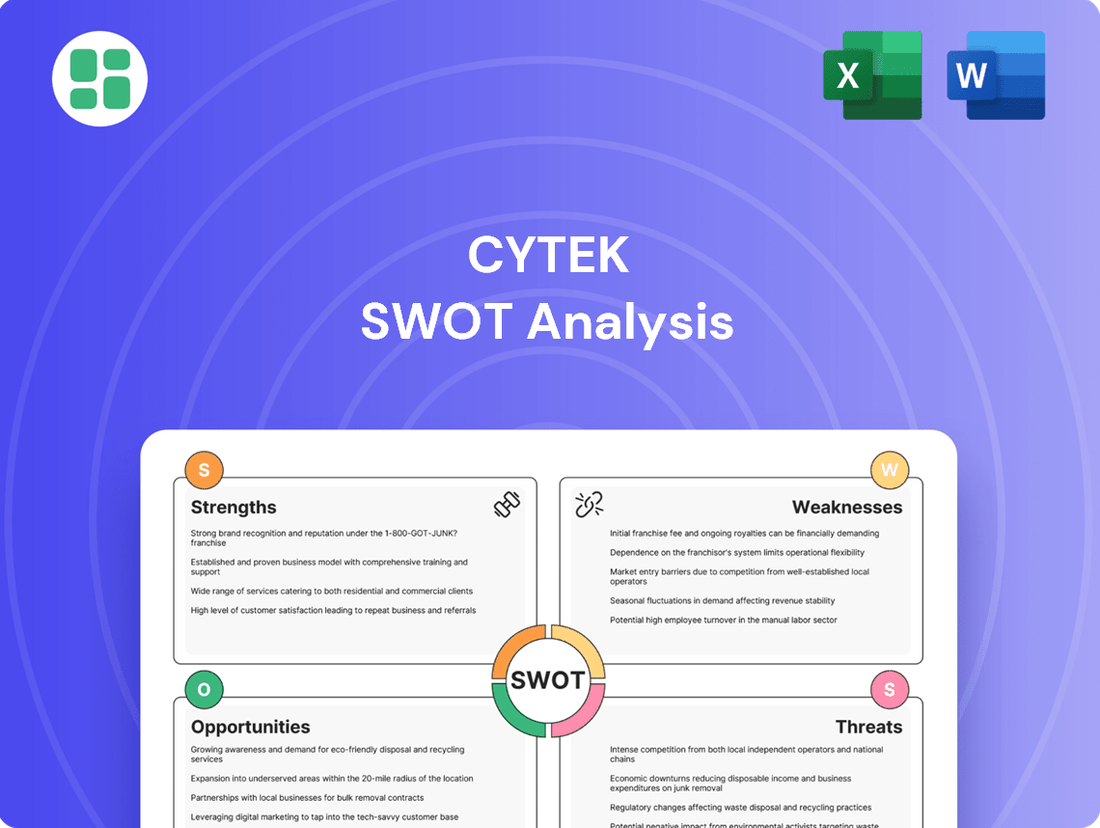

Delivers a strategic overview of Cytek’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities for growth.

Weaknesses

Cytek Biosciences faced a 2% dip in total revenue for the second quarter of 2025 when compared to the same period in the previous year. This revenue contraction has prompted the company to adjust its full-year 2025 revenue outlook downwards. The revised guidance now anticipates growth between -2% and +2% over the 2024 fiscal year, a notable shift from earlier, more optimistic projections.

Cytek has encountered notable headwinds in its instrument sales, with the EMEA and APAC regions showing particular weakness. This regional underperformance directly impacted overall revenue, contributing significantly to recent quarterly declines and highlighting disparities in global market reception.

Cytek Biosciences has faced a persistent challenge with consistent profitability, reporting a net loss for five consecutive years leading up to 2025. While the company showed progress with a narrowed net loss of $5.6 million in Q2 2025, down from $10.4 million in Q2 2024, this still represents an ongoing struggle to achieve positive earnings.

High Instrument and Reagent Costs

The sophisticated nature of Cytek's Flow Sorter Platform (FSP) technology, including its instruments and specialized reagents, can lead to significant upfront expenses for users. This elevated cost structure may deter adoption by smaller research laboratories or institutions operating with constrained financial resources, thereby potentially limiting Cytek's broader market reach.

For instance, while specific pricing varies, advanced flow cytometry systems can easily range from tens of thousands to hundreds of thousands of dollars, making the initial investment substantial. This barrier is particularly relevant when considering that many academic labs and emerging biotech firms operate on tight budgets, prioritizing cost-effectiveness in their equipment acquisitions.

- High Capital Investment: The initial purchase price of Cytek's FSP instruments can be a considerable hurdle for smaller organizations.

- Ongoing Reagent Expenses: The specialized reagents required for FSP analysis also contribute to the overall cost of ownership.

- Market Penetration Challenges: Budgetary limitations may restrict the adoption rate among institutions with less financial flexibility.

Vulnerability to Macroeconomic Conditions and Capital Spending Fluctuations

Cytek Biosciences' financial health is closely tied to broader economic trends and shifts in capital spending. When economies face headwinds or market uncertainty, research institutions and government bodies often scale back their investments in new laboratory equipment, directly impacting Cytek's sales cycles.

This sensitivity was evident in recent performance, with Cytek reporting a revenue decline. For instance, in the first quarter of 2024, the company saw a year-over-year revenue decrease, partly attributed to these challenging market conditions and a slowdown in capital expenditure by its key customer segments.

- Macroeconomic Sensitivity: Cytek's revenue is susceptible to recessions and economic downturns that curb research funding.

- Capital Expenditure Cycles: Fluctuations in government and academic budgets directly affect demand for Cytek's high-performance flow cytometry instruments.

- Impact on Revenue: A slowdown in capital spending, a common occurrence during economic uncertainty, has contributed to revenue declines for Cytek in recent periods.

- Navigating Funding Landscape: The company must adapt to the unpredictable nature of research grants and institutional budgets to maintain stable growth.

Cytek's profitability remains a significant concern, as the company has not achieved net income in five consecutive years leading up to 2025. While Q2 2025 saw a narrowed net loss of $5.6 million, this still indicates ongoing financial struggles. The high upfront cost of its advanced Flow Sorter Platform technology, potentially hundreds of thousands of dollars, can be a deterrent for smaller institutions with limited budgets, impacting broader market penetration.

What You See Is What You Get

Cytek SWOT Analysis

This is the actual Cytek SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Cytek's strategic position.

This is a real excerpt from the complete Cytek SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

The global cell analysis market is anticipated to reach USD 84.01 billion by 2034, growing at a compound annual growth rate of 9.81% starting from 2025. This robust growth presents a significant opportunity for Cytek, whose advanced technologies are perfectly aligned with the increasing demand for sophisticated cell analysis tools.

Furthermore, the single-cell analysis market is projected to surpass USD 21.97 billion by 2035, demonstrating an impressive CAGR of 16.55%. Cytek's innovative solutions are ideally positioned to capture a substantial share of this rapidly expanding segment, driven by critical applications in drug discovery, diagnostics, and fundamental biological research.

Cytek's Northern Lights-CLC system and specific reagents have received crucial clinical use approvals in China and the European Union, marking a significant stride towards the clinical diagnostics market. This regulatory green light positions Cytek to tap into the burgeoning global diagnostics sector, estimated to reach over $100 billion by 2025, directly benefiting from the increasing demand for personalized medicine.

Cytek can significantly expand its reach by targeting emerging economies where its current market penetration is low. This geographic expansion offers a substantial growth avenue, tapping into new customer bases and revenue streams.

Strategic partnerships, exemplified by the January 2024 collaborations with CRG and UPF, are crucial. These alliances not only drive technological innovation and scientific advancement but also unlock new applications for Cytek's solutions, directly contributing to an enhanced global market position.

Leveraging Cytek Cloud for Enhanced Data Analysis and Customer Engagement

Cytek Cloud's rapidly expanding user base, surpassing 20,500 individuals by June 2025, creates a significant avenue for deepening data analysis and strengthening customer relationships. This growth allows for the collection of richer datasets, enabling more sophisticated insights and personalized user experiences.

Integrating advanced analytics, such as artificial intelligence and machine learning, into the Cytek Cloud platform offers a distinct competitive advantage. These technologies can automate complex data interpretation, accelerate research workflows, and provide predictive capabilities, thereby enhancing the value proposition for researchers.

The opportunity lies in leveraging this expanding user base to:

- Develop advanced AI-driven data interpretation tools to offer deeper insights from flow cytometry experiments.

- Enhance customer engagement through personalized data insights and support, fostering loyalty and retention.

- Streamline research workflows by automating data processing and analysis, increasing researcher productivity.

- Create a community around data sharing and collaborative analysis, further solidifying Cytek's position in the market.

Diversification of Product Offerings and Applications

Cytek's opportunity lies in broadening its product portfolio beyond its foundational FSP technology. This expansion could involve strategic acquisitions or internal development to cater to a wider array of research requirements, potentially tapping into new market segments.

The versatility of instruments like the Aurora Evo, which can analyze both minute particles and larger cellular structures on a single platform, opens doors to novel research applications. This includes advancements in the study of extracellular vesicles and viruses, areas experiencing significant growth in scientific interest.

- Expanding into new research verticals: Cytek can leverage its core technology to develop solutions for fields like virology and exosome research, which are projected to see substantial growth in the coming years. For instance, the global extracellular vesicle detection market was valued at approximately $1.2 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030.

- Strategic partnerships and acquisitions: Collaborating with or acquiring companies specializing in complementary technologies could accelerate product diversification and market penetration, allowing Cytek to offer more comprehensive solutions to researchers.

- Enhancing instrument capabilities: Continued innovation in instrument design, focusing on increased throughput and sensitivity for analyzing challenging sample types, will further solidify Cytek's position in diverse research applications.

Cytek is well-positioned to capitalize on the expanding global cell analysis market, projected to reach USD 84.01 billion by 2034 with a 9.81% CAGR. The single-cell analysis segment, specifically, is set to exceed USD 21.97 billion by 2035, growing at an impressive 16.55% CAGR, presenting a significant opportunity for Cytek's innovative solutions in drug discovery and diagnostics.

Regulatory approvals for Cytek's Northern Lights-CLC system in China and the EU open doors to the diagnostics market, estimated to exceed $100 billion by 2025, aligning with the personalized medicine trend. Furthermore, Cytek can expand its market reach by targeting emerging economies, tapping into new customer bases and revenue streams.

Strategic collaborations, like those in January 2024, drive innovation and unlock new applications, enhancing Cytek's global standing. The growing user base of Cytek Cloud, exceeding 20,500 by June 2025, offers opportunities for advanced AI-driven data interpretation, personalized user experiences, and workflow streamlining.

Expanding the product portfolio into areas like virology and exosome research, which saw the extracellular vesicle detection market reach approximately $1.2 billion in 2023 with a projected 15% CAGR, represents another key growth avenue.

| Market Segment | Projected Market Size (USD Billion) | CAGR (%) | Cytek Opportunity |

|---|---|---|---|

| Global Cell Analysis | 84.01 (by 2034) | 9.81 (2025-2034) | Leverage advanced technologies for growing demand. |

| Single-Cell Analysis | 21.97 (by 2035) | 16.55 (projected) | Capture share in critical applications like drug discovery. |

| Diagnostics Market | >100 (by 2025) | N/A | Tap into clinical use approvals for personalized medicine. |

| Extracellular Vesicle Detection | ~1.2 (2023) | >15 (through 2030) | Expand into new research verticals with instrument versatility. |

Threats

Cytek Biosciences operates in a fiercely competitive landscape, contending with established giants in the life sciences sector. Companies like BD Biosciences, Beckman Coulter, and Thermo Fisher Scientific are significant rivals, actively seeking to expand their presence in the crucial flow cytometry and cell analysis markets. These established players often possess greater resources and broader product portfolios, presenting a formidable challenge for Cytek.

The life sciences tools sector is a hotbed of innovation, with competitors consistently rolling out novel technologies or enhancing current ones. This rapid pace means Cytek must remain agile to avoid falling behind.

Emerging alternatives, such as next-generation sequencing and sophisticated single-cell analysis techniques being developed by rivals, pose a direct threat. If Cytek doesn't match or exceed these advancements, its market share could diminish.

For instance, in 2023, the global genomics market, which includes sequencing technologies, was valued at approximately $26.3 billion and is projected to grow significantly, highlighting the competitive pressure from these alternative platforms.

Economic downturns and persistent inflationary pressures present a significant threat to Cytek's sales. High-value capital equipment purchases are often discretionary, making them vulnerable to reduced corporate and institutional spending during periods of economic uncertainty. For instance, a prolonged recession could lead to budget cuts in research and development, directly impacting demand for Cytek's advanced cell analysis systems.

Fluctuations in research funding, particularly from government bodies like the National Institutes of Health (NIH), pose another substantial risk. In 2024, the NIH's budget faced scrutiny, and potential future reductions could directly curtail the ability of academic and research institutions to invest in cutting-edge technologies. A decrease in NIH funding, which supports a significant portion of life science research, could dampen sales volumes for Cytek's instruments.

Regulatory Hurdles and Compliance Risks

Cytek operates within the life sciences, a field subject to stringent and ever-changing regulations. For instance, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) continually update their guidelines for diagnostic tools and research applications. These evolving standards can necessitate costly product redesigns or extended validation periods, potentially impacting Cytek's 2024 and 2025 product development timelines and market entry strategies.

Navigating these diverse regulatory requirements across different global markets presents a significant challenge. Failure to comply with regional regulations, such as those concerning data privacy (e.g., GDPR in Europe) or specific testing protocols, could lead to fines or market exclusion. This adds a layer of risk to Cytek's international expansion plans, requiring substantial investment in compliance infrastructure and expertise.

- Increased compliance costs: Regulatory changes can directly inflate operational expenses for Cytek.

- Delayed market access: New or revised regulations may slow down the approval process for Cytek's innovative technologies.

- Potential for product restrictions: Non-compliance could lead to limitations on where or how Cytek's products can be used or sold.

Supply Chain Disruptions and Increasing Operational Costs

Global supply chain vulnerabilities, exacerbated by geopolitical events and logistical challenges, pose a significant threat to Cytek. Rising material costs, particularly for specialized components in diagnostic and research tools, directly impact manufacturing overhead. For instance, the average cost of key raw materials in the life sciences sector saw an increase of approximately 8-12% in late 2024 compared to the previous year, according to industry reports.

These disruptions can lead to extended production lead times and affect Cytek's ability to meet customer demand promptly. Such delays and increased costs directly pressure the company's gross margins, potentially impacting overall profitability and competitive pricing strategies for its advanced cell analysis solutions.

- Increased manufacturing overhead due to higher component and logistics costs.

- Potential for extended production lead times, impacting customer fulfillment.

- Pressure on gross margins due to rising input expenses.

- Risk of reduced profitability and competitive pricing challenges.

Cytek faces intense competition from established life science giants like BD Biosciences and Thermo Fisher Scientific, who possess greater resources and broader product offerings. The rapid pace of innovation in cell analysis technology means Cytek must continuously adapt to avoid being outpaced by emerging alternatives such as next-generation sequencing, a market valued at approximately $26.3 billion in 2023.

Economic downturns and inflation pose a significant threat, as high-value capital equipment purchases are often discretionary and vulnerable to reduced R&D spending. Fluctuations in crucial research funding, exemplified by scrutiny of the NIH's budget in 2024, can directly impact institutional purchasing power for advanced technologies.

Evolving regulatory landscapes, including updated FDA and EMA guidelines, necessitate costly product redesigns and can delay market entry for Cytek's innovations, impacting 2024-2025 development timelines. Furthermore, global supply chain vulnerabilities and rising material costs, with key component expenses increasing by an estimated 8-12% in late 2024, directly pressure manufacturing overhead and gross margins.

SWOT Analysis Data Sources

This Cytek SWOT analysis is built upon a foundation of robust data, drawing from comprehensive financial reports, detailed market intelligence, and expert industry analysis to provide a thorough and actionable strategic overview.