Cytek Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cytek Bundle

Cytek's competitive landscape is shaped by intense rivalry and the looming threat of substitutes. Understanding these forces is crucial for strategic positioning.

The complete report reveals the real forces shaping Cytek’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cytek Biosciences' reliance on highly specialized components and reagents for its Full Spectrum Profiling (FSP) technology significantly shapes the bargaining power of its suppliers. These unique inputs, crucial for achieving the high-resolution and high-dimensional cellular analysis that defines Cytek's offerings, are not readily available from a broad market. This specialization inherently narrows the pool of potential suppliers, granting those who can provide these critical materials considerable leverage.

For instance, the intricate nature of reagents designed for advanced spectral flow cytometry means that only a handful of manufacturers possess the expertise and manufacturing capabilities to produce them to Cytek's exacting standards. This limited supplier base can translate into less favorable pricing and terms for Cytek. In 2023, Cytek reported Cost of Revenue of $70.5 million, highlighting the significant investment in these specialized inputs.

The development of advanced cell analysis instruments, like those offered by Cytek, frequently hinges on proprietary components or specialized manufacturing techniques. This can create a situation where Cytek is dependent on a limited number of suppliers, or even a single source, for critical inputs. For instance, in 2024, the semiconductor industry, a key supplier for complex electronics, experienced ongoing supply chain constraints, with lead times for certain advanced chips extending to over a year in some cases, highlighting the potential for such dependencies.

This reliance on sole or single-source suppliers significantly bolsters their bargaining power. If a supplier decides to raise prices or encounters production disruptions, Cytek may find itself with few viable alternatives, potentially impacting its cost structure and production schedules. For example, a report from late 2023 indicated that the cost of rare earth metals, essential for certain high-performance components in scientific instrumentation, saw price increases of up to 15% due to geopolitical factors and concentrated mining operations.

Switching suppliers for critical components in Cytek's advanced flow cytometry instruments, such as the Aurora and Northern Lights, presents substantial hurdles. These aren't simple part replacements; they often necessitate extensive product redesign and rigorous process revalidation.

The financial and operational implications of such a switch are considerable. Companies can face significant expenses related to engineering, testing, and regulatory compliance, not to mention the potential disruption to production schedules and product quality assurances. For instance, a shift in a key optical component might require recalibrating the entire detection system, a process that could take months and cost hundreds of thousands of dollars.

These high switching costs effectively bolster the bargaining power of Cytek's current suppliers. When it's costly and time-consuming for Cytek to find and integrate an alternative, existing suppliers can leverage this situation to negotiate more favorable terms, potentially impacting Cytek's cost of goods sold and overall profitability.

Supplier's Forward Integration Potential

While suppliers integrating forward into instrument manufacturing is a theoretical risk, it's less common in highly specialized scientific instrumentation due to significant capital and R&D barriers. For instance, developing a flow cytometer requires deep expertise in optics, fluidics, electronics, and software, demanding investments in the tens of millions of dollars for initial development and manufacturing setup.

Suppliers of critical components or proprietary intellectual property, however, could potentially leverage their unique position to extract greater value. For example, a sole provider of a specialized laser or detector crucial for Cytek's instrument performance might command higher prices if no viable alternatives exist. In 2023, the global market for scientific instruments was valued at approximately $65 billion, highlighting the significant revenue potential for component suppliers within this ecosystem.

Cytek's strategy of vertical integration for certain key aspects, such as in-house development of proprietary reagents or advanced optical modules, and forging strategic partnerships with key technology providers can effectively mitigate the bargaining power of suppliers. This approach allows Cytek to control critical value chain elements and reduce reliance on external parties, thereby strengthening its competitive position.

- Forward Integration Risk: Theoretical, but high capital and R&D barriers limit supplier integration into instrument manufacturing.

- IP Leverage: Suppliers of essential, unique technologies or intellectual property can exert pricing power.

- Mitigation Strategies: Cytek's vertical integration and strategic partnerships help counter supplier leverage.

- Market Context: The $65 billion global scientific instrument market in 2023 underscores the importance of managing supplier relationships.

Industry Consolidation Among Suppliers

Industry consolidation within the life sciences supply chain, where larger entities acquire smaller, specialized suppliers, could further reduce the number of available vendors for companies like Cytek. This trend often leads to fewer competitive options, potentially increasing the pricing power of the remaining, larger suppliers. For instance, in 2023, the global life science reagents market saw significant M&A activity, with major players acquiring niche technology providers, a trend expected to continue into 2024.

This consolidation directly impacts Cytek's bargaining power by concentrating supply. When fewer, larger companies dominate, they can dictate terms more effectively. Monitoring the supplier landscape for such mergers and acquisitions is therefore crucial for Cytek to anticipate shifts in supplier leverage and potential cost increases.

- Reduced Vendor Options: Consolidation shrinks the pool of potential suppliers.

- Increased Supplier Pricing Power: Fewer competitors allow dominant suppliers to raise prices.

- Strategic Monitoring: Tracking M&A in the supply chain is vital for risk assessment.

Cytek's suppliers of specialized reagents and components for its advanced flow cytometry instruments hold significant bargaining power. This power stems from the unique, high-quality nature of these inputs, which are not easily sourced elsewhere, and the high costs associated with switching suppliers.

The limited number of manufacturers capable of producing these intricate materials to Cytek's exacting standards grants existing suppliers leverage. For instance, in 2023, Cytek's Cost of Revenue was $70.5 million, reflecting substantial expenditure on these critical, specialized inputs.

The high costs and technical challenges involved in redesigning and revalidating instruments for new components mean Cytek faces substantial hurdles when considering supplier changes. This situation allows current suppliers to negotiate more favorable terms, potentially impacting Cytek's profitability.

Industry consolidation further exacerbates this, reducing vendor options and increasing the pricing power of remaining suppliers, making proactive management of supplier relationships essential for Cytek.

| Factor | Impact on Cytek | Example/Data Point |

|---|---|---|

| Supplier Specialization | High bargaining power due to unique, critical inputs | Reagents for advanced spectral flow cytometry |

| Limited Supplier Pool | Reduced negotiation leverage for Cytek | Few manufacturers possess necessary expertise |

| High Switching Costs | Bolsters existing supplier power | Extensive redesign and revalidation required for component changes |

| Industry Consolidation | Further concentrates power with fewer suppliers | M&A activity in the life science reagents market (2023-2024) |

What is included in the product

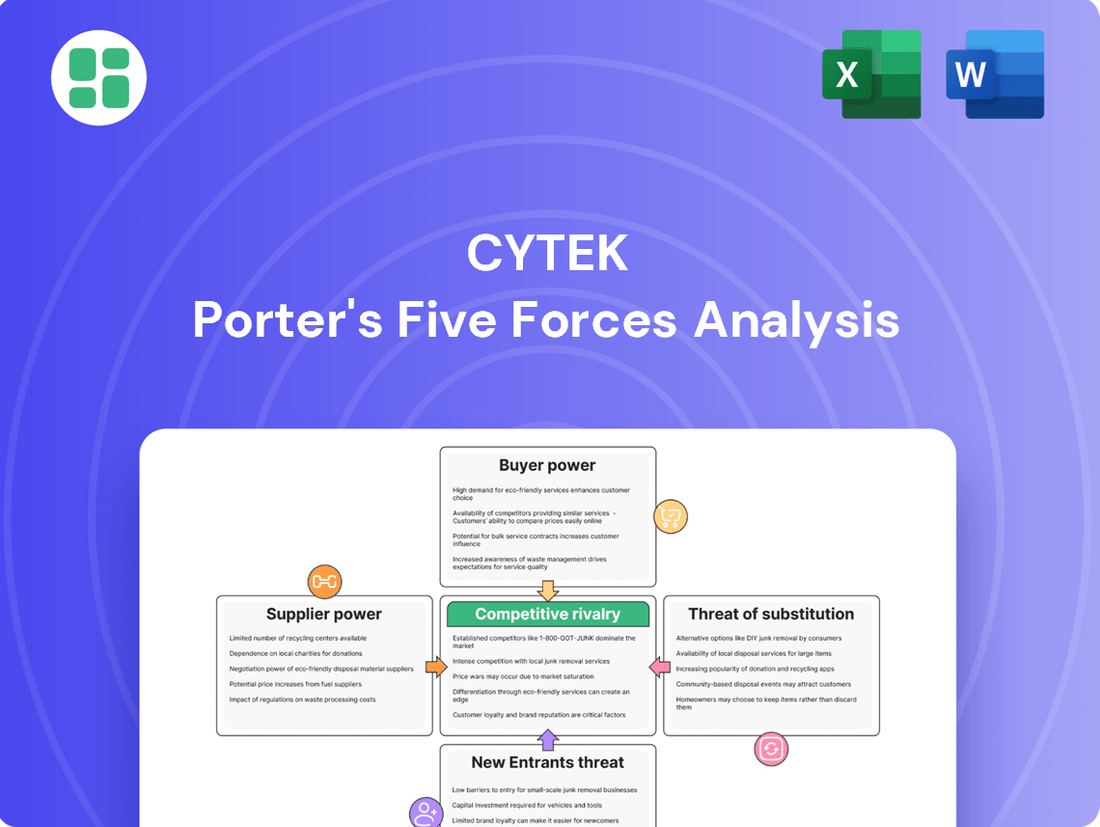

Cytek's Porter's Five Forces Analysis dissects the competitive intensity and profitability potential within its market, examining threats from new entrants, the power of buyers and suppliers, the risk of substitutes, and the intensity of existing rivalry.

Effortlessly visualize competitive intensity with dynamic threat level indicators, simplifying complex market dynamics.

Customers Bargaining Power

Cytek's customer base spans academic and research labs, biotech and pharma firms, and CROs. This diversity, however, can lead to concentrated power within specific segments or regions. For instance, North America represents a substantial portion of Cytek's clientele, meaning larger customers or key regional players could wield significant bargaining influence.

Cytek's Full Spectrum Profiling (FSP) instruments, such as the Aurora and Northern Lights systems, lock in research institutions and pharmaceutical companies due to significant switching costs. These costs encompass the initial capital outlay for the instruments, the specialized training required for staff, and the intricate integration into established laboratory workflows. For instance, a single Aurora instrument can cost upwards of $400,000, representing a substantial investment that makes frequent replacement or switching to a competitor economically unfeasible.

Furthermore, the compatibility of historical research data with new platforms presents another formidable barrier. Organizations that have amassed years of valuable data using Cytek's technology are hesitant to transition to a different system that might not readily support or interpret their existing datasets. This data stickiness reinforces customer loyalty and effectively dampens their immediate bargaining power.

Cytek's advanced Flow Cytometry with Single Particle (FSP) technology, delivering unparalleled resolution and content in cell analysis, significantly enhances customer research capabilities. This allows for deeper understanding of complex biological systems, crucial for drug discovery and clinical trials.

The superior performance of Cytek's FSP technology, offering high sensitivity and detailed insights into immune responses, makes it a valuable asset for researchers. This unique value proposition inherently reduces the bargaining power of customers by creating a high switching cost, as alternative solutions may not match its advanced analytical performance.

Price Sensitivity and Funding Environment

Customers, especially academic and research institutions, often face tight budgets, making them quite sensitive to the cost of instruments and reagents. This sensitivity is amplified by fluctuating funding cycles, directly impacting purchasing decisions.

Even pharmaceutical and biotech firms, typically possessing larger R&D budgets, are not immune to price pressures. Recent industry headwinds and the cyclical nature of demand for life science capital equipment can lead these customers to become more price-conscious, thereby diminishing Cytek's pricing leverage.

- Price Sensitivity: Academic and research institutions are particularly vulnerable to price changes due to budget constraints and funding availability.

- Industry Headwinds: Pharmaceutical and biotech companies, while having substantial R&D budgets, are increasingly affected by industry challenges, leading to greater price sensitivity.

- Demand Cycles: The life science capital equipment market experiences cyclical declines, making customers more inclined to negotiate on price.

Availability of Alternative Technologies

The availability of alternative cell analysis technologies, even if less sophisticated than Cytek's Full Spectrum Profiling (FSP), can give customers some bargaining power. For instance, traditional flow cytometry remains a viable option for many standard applications, offering a lower cost entry point. In 2024, the global flow cytometry market was estimated to be worth billions, indicating its continued relevance and widespread adoption.

While Cytek's FSP technology offers significant advantages in terms of spectral unmixing and panel design, customers can still leverage the existence of these other methods. This is particularly true for less complex assays where the advanced capabilities of FSP might not be strictly necessary. The market for next-generation sequencing also continues to expand, providing another avenue for biological analysis that could be considered an alternative depending on the research question.

- Alternative Technologies: Traditional flow cytometry, next-generation sequencing, and various imaging modalities.

- Customer Leverage: Perceived availability of alternatives can influence pricing and contract terms.

- Application Specificity: Bargaining power is higher for less complex applications where advanced features are not critical.

Cytek's customers, particularly those in academic research, possess significant bargaining power due to budget constraints and reliance on grant funding, making them sensitive to price. Even larger pharmaceutical clients, despite robust R&D budgets, are increasingly cost-conscious due to industry headwinds and cyclical demand for life science equipment. In 2024, the life science tools market saw varied performance, with some segments experiencing increased price pressure.

The presence of alternative cell analysis technologies, such as traditional flow cytometry, provides customers with a degree of leverage. While these alternatives may not match Cytek's advanced capabilities, they remain viable for less complex assays, especially given the substantial investment required for Cytek's instruments, often exceeding $400,000 per unit.

Switching costs are a key factor mitigating customer bargaining power, as integrating Cytek's Full Spectrum Profiling (FSP) technology involves significant capital, training, and workflow adjustments. The value of accumulated historical data generated on Cytek platforms further anchors customers, making them less inclined to switch and thus reducing their immediate leverage.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Context |

| Price Sensitivity | High for academic/research; Moderate for pharma/biotech | Academic budgets are often tight; Pharma faces industry headwinds impacting 2024 spending. |

| Switching Costs | Low to Moderate | High initial investment ($400k+ for Aurora); Data compatibility and workflow integration are significant barriers. |

| Availability of Alternatives | Moderate | Traditional flow cytometry and other modalities exist for less complex applications. The global flow cytometry market remains substantial in 2024. |

Full Version Awaits

Cytek Porter's Five Forces Analysis

This preview showcases the complete Cytek Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this actionable intelligence, ready for immediate use in your strategic planning.

Rivalry Among Competitors

The cell analysis and flow cytometry arena is intensely competitive, featuring formidable global entities. Cytek Biosciences contends with giants like Thermo Fisher Scientific, Danaher Corporation (through its Beckman Coulter division), and BD (Becton, Dickinson and Company). These established players possess significant advantages, including expansive product lines, substantial research and development funding, and deeply entrenched global distribution channels, making market entry and expansion a considerable challenge.

In 2023, Thermo Fisher Scientific reported revenues exceeding $42 billion, showcasing its vast operational scale and market penetration. Danaher Corporation, a conglomerate with significant holdings in life sciences, also commands a substantial market share. These companies' established reputations and existing customer relationships create a high barrier to entry for newer entrants like Cytek, demanding significant differentiation and strategic investment to gain traction.

The single cell analysis market is booming, expected to hit USD 9.77 billion by 2030, growing at a robust 13.10% CAGR from 2025. This rapid expansion acts as a magnet for intense competition, pushing companies to innovate relentlessly to secure their piece of the pie.

Companies are locked in a fierce race, with innovation being the primary weapon. Cytek, for instance, is leveraging its Full Spectrum Profiling (FSP) technology and new systems like the Aurora Evo to stand out. These advancements are crucial for capturing market share in such a dynamic and fast-growing sector.

Cytek Biosciences distinguishes itself through its proprietary Full Spectrum Profiling (FSP) technology, a significant leap in multiplexing and sensitivity over traditional flow cytometry. This technological edge has been a crucial factor in its competitive standing, contributing to strong unit volume growth in specific market segments during 2024.

This innovation allows for more comprehensive and precise cellular analysis, a key differentiator in a market where advanced capabilities are increasingly valued. While Cytek leads, rivals are also channeling substantial investments into cutting-edge technologies and the integration of artificial intelligence, signaling an intensifying technological race.

Industry Headwinds and Cyclical Demand

The life science tools sector faced headwinds in 2024, with a cyclical downturn in capital equipment demand impacting the industry. This macroeconomic pressure heightened competitive rivalry as companies vied for fewer capital expenditure opportunities.

Cytek's financial performance reflected these industry trends. For instance, the company reported a slight revenue decrease in Q1 and Q2 of 2025 when compared to the same periods in the prior year, underscoring the challenging market conditions.

- Cyclical Downturn: 2024 saw a noticeable dip in capital equipment spending within the life science tools sector.

- Intensified Competition: The reduced demand forced companies like Cytek to compete more fiercely for market share.

- Revenue Impact: Cytek's Q1 and Q2 2025 revenues indicated a year-over-year decline, directly linked to these industry pressures.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships are significant drivers of competitive rivalry. Companies actively pursue these avenues to broaden their product offerings and extend their market presence.

Cytek's own strategic moves, such as its early 2023 acquisition of the Amnis and Guava product lines, exemplify this trend. These acquisitions demonstrably bolstered Cytek's market reach and contributed to a notable improvement in its service business gross margin, reaching a 2024 figure of 60.5%.

Competitors are similarly engaged in consolidating their market positions and developing more comprehensive, integrated solutions through these strategic maneuvers.

- Strategic Acquisitions: Companies acquire others to gain new technologies, expand product lines, and enter new markets.

- Partnerships: Collaborations allow firms to share resources, co-develop products, and access new customer segments.

- Market Consolidation: These activities often lead to a more consolidated market, with fewer, larger players.

- Enhanced Offerings: The goal is typically to provide customers with more complete and competitive solutions.

The competitive landscape for Cytek Biosciences is characterized by intense rivalry from well-established global players like Thermo Fisher Scientific and Danaher Corporation. These giants leverage their extensive R&D budgets and broad distribution networks, making it challenging for newer entrants. The market's rapid growth, projected to reach USD 9.77 billion by 2030, fuels this competition, pushing companies to innovate aggressively.

Cytek differentiates itself with its Full Spectrum Profiling (FSP) technology, offering enhanced multiplexing and sensitivity. This innovation is crucial in a sector where advanced capabilities are highly valued, especially as competitors also invest heavily in new technologies and AI integration. The industry faced a cyclical downturn in capital equipment spending in 2024, intensifying the competition for market share and impacting revenue streams, as evidenced by Cytek's year-over-year revenue declines in early 2025.

Strategic acquisitions and partnerships are key competitive tactics. Cytek's acquisition of Amnis and Guava product lines in early 2023, which boosted its service business gross margin to 60.5% in 2024, exemplifies this trend. Competitors are also consolidating their positions and developing integrated solutions through similar strategic maneuvers.

| Competitor | 2023 Revenue (Approx.) | Key Strengths | Cytek's Differentiator |

|---|---|---|---|

| Thermo Fisher Scientific | >$42 billion | Vast product lines, R&D funding, global distribution | Full Spectrum Profiling (FSP) technology |

| Danaher Corporation (Beckman Coulter) | Significant market share | Established reputation, broad market presence | Aurora Evo systems |

| BD (Becton, Dickinson and Company) | Significant market share | Entrenched customer relationships, diverse portfolio | Enhanced sensitivity and precision |

SSubstitutes Threaten

Traditional flow cytometry systems from established players like BD Biosciences and Thermo Fisher Scientific pose a significant threat of substitution for Cytek. These conventional instruments, while often less advanced in multiplexing capabilities, can be perceived as a more cost-effective solution for researchers with less demanding applications. For instance, a standard 10-color flow cytometer might suffice for many basic immunology studies, presenting an alternative to Cytek's higher-end, multi-parameter platforms.

Next-generation sequencing (NGS) and single-cell omics technologies represent a significant threat of substitutes for traditional flow cytometry in certain research applications. These advanced genomic and transcriptomic analysis methods can provide a more comprehensive molecular understanding of cells than phenotypic data alone. For instance, while flow cytometry excels at identifying cell surface markers, NGS can delve into gene expression patterns and mutations, offering a deeper layer of insight.

The market for single-cell analysis, which encompasses both flow cytometry and NGS, is experiencing robust growth. By 2024, the global single-cell analysis market was valued at approximately $7.2 billion, with projections indicating continued expansion. This growth highlights the increasing adoption of these technologies as researchers seek more detailed cellular information, directly impacting the demand for alternative analytical approaches.

Advanced microscopy and imaging techniques, such as spatial transcriptomics and high-resolution imaging, present a significant threat of substitutes to traditional flow cytometry. These methods offer a deeper understanding of cellular behavior by providing spatial context, something flow cytometry typically lacks. For instance, spatial transcriptomics allows researchers to map gene expression within tissues, revealing cellular neighborhoods and interactions crucial for understanding disease progression, a level of detail not achievable with standard flow analysis.

These imaging capabilities serve as a viable alternative for specific applications where spatial information or intricate morphological analysis is critical. While flow cytometry excels at high-throughput cell counting and phenotyping, advanced imaging can provide complementary or even superior insights for tasks like identifying cellular structures, tracking cell movement within complex environments, or visualizing protein localization, thus directly competing for research budgets and project focus.

The market for these advanced imaging solutions is growing robustly. For example, the global spatial biology market, which includes spatial transcriptomics, was valued at approximately $1.5 billion in 2023 and is projected to reach over $5 billion by 2028, indicating a strong demand for these alternative analytical approaches. This growth signifies a direct challenge to the market share and perceived indispensability of flow cytometry in certain research domains.

Emerging Technologies and AI-Enabled Solutions

The threat of substitutes for Cytek's cell analysis solutions is amplified by the rapid evolution of technology, particularly in areas like AI-enabled bioinformatics and integrated end-to-end platforms. These advancements could introduce novel approaches that streamline cell analysis workflows, offering a compelling alternative to current methods.

Emerging solutions might deliver greater automation, enhanced data interpretation capabilities, or entirely new paradigms for uncovering cellular insights. For instance, the increasing sophistication of AI algorithms in analyzing complex biological data could provide faster and more accurate results than traditional Cytek platforms. This could diminish the competitive advantage of existing technologies as these new substitutes gain traction.

Consider the impact of AI-driven image analysis in microscopy, which in 2024 is rapidly improving its ability to identify subtle cellular changes that might be missed by human observation or less advanced automated systems. Furthermore, the development of cloud-based, integrated platforms that combine sample preparation, data acquisition, and analysis could offer a more seamless and potentially cost-effective workflow, posing a significant substitute threat.

- AI-powered image analysis: Companies are investing heavily in AI for faster and more accurate cell identification and characterization.

- Integrated workflow platforms: The trend towards end-to-end solutions that combine multiple steps in cell analysis is gaining momentum.

- Novel assay development: Breakthroughs in assay design could enable new methods of cellular interrogation that bypass existing technologies.

- Open-source bioinformatics tools: The availability of powerful, free bioinformatics software can reduce reliance on proprietary Cytek solutions for data analysis.

Cost-Effectiveness of Alternative Methods

For laboratories with tighter budgets or for routine analytical tasks, the cost-effectiveness of alternative methods presents a significant threat. Cheaper instruments or outsourced services can become attractive substitutes if they deliver acceptable results at a substantially lower total cost of ownership. For instance, while Cytek's Aurora system offers advanced capabilities, the market for flow cytometry is diverse, with many labs still relying on less sophisticated, lower-cost platforms for basic cell counting and analysis.

The overall cost-effectiveness of alternative methods, including less expensive instruments or services, can pose a threat to Cytek, particularly for budget-constrained laboratories or those focused on routine applications. While Cytek's FSP technology provides unique value, if alternative technologies can achieve 'good enough' results at a considerably lower total cost of ownership, they become compelling substitutes. For example, the cost of reagents and maintenance for high-parameter flow cytometry systems can be substantial, making simpler, lower-parameter instruments or even service-based providers a more appealing option for certain research or clinical needs.

- Lower Capital Investment: Traditional flow cytometers or even cell sorters from competitors can have lower upfront purchase prices compared to Cytek's advanced spectral systems.

- Reduced Reagent Costs: While spectral flow cytometry can reduce the need for compensation, the cost of specialized reagents for high-parameter panels can still be a factor.

- Service and Maintenance: The complexity of advanced systems may translate to higher ongoing service and maintenance contracts, which budget-conscious labs may seek to avoid.

- Outsourcing Options: Contract research organizations (CROs) offering flow cytometry services can provide access to advanced technology without the capital expenditure and operational overhead for individual labs.

The threat of substitutes for Cytek's advanced cell analysis platforms is multifaceted, encompassing both established and emerging technologies. Traditional flow cytometry systems from competitors like BD Biosciences and Thermo Fisher Scientific offer a more cost-effective alternative for less demanding applications, providing a baseline threat. Furthermore, next-generation sequencing (NGS) and single-cell omics technologies, along with advanced microscopy and spatial transcriptomics, are increasingly providing deeper molecular and spatial insights, directly competing for research focus and budgets.

The market for these alternative technologies is substantial and growing. For instance, the global single-cell analysis market was valued at approximately $7.2 billion in 2024, signaling strong demand for comprehensive cellular insights. Similarly, the spatial biology market, including spatial transcriptomics, reached about $1.5 billion in 2023 and is projected to exceed $5 billion by 2028, underscoring the competitive landscape.

The rapid advancement of AI-enabled bioinformatics and integrated workflow platforms also presents a significant substitute threat. These innovations promise greater automation, enhanced data interpretation, and novel analytical paradigms, potentially diminishing the competitive advantage of existing Cytek solutions. For example, AI-driven image analysis in microscopy is rapidly improving cell identification capabilities in 2024.

Cost-effectiveness remains a critical factor, with less expensive instruments and outsourced services posing a threat to budget-conscious laboratories. While Cytek's spectral flow cytometry offers unique value, if alternative technologies can achieve satisfactory results at a lower total cost of ownership, they become compelling substitutes, especially considering the ongoing costs of reagents and maintenance for high-parameter systems.

| Substitute Technology | Key Advantage | Market Context (2024 Data) | Potential Impact on Cytek |

|---|---|---|---|

| Traditional Flow Cytometry | Lower upfront cost, established user base | Significant portion of the overall flow cytometry market | Threat for basic research and routine diagnostics |

| NGS & Single-Cell Omics | Deeper molecular insights (genomics, transcriptomics) | Global single-cell analysis market valued at ~$7.2 billion in 2024 | Substitution for applications requiring molecular profiling |

| Advanced Microscopy & Spatial Biology | Spatial context, intricate cellular morphology | Spatial biology market ~$1.5 billion in 2023, projected to exceed $5 billion by 2028 | Alternative for research focused on cellular neighborhoods and interactions |

| AI-Enabled Bioinformatics & Integrated Platforms | Enhanced automation, data interpretation, novel workflows | Rapid advancements in AI for image analysis (2024) | Potential to offer more efficient and insightful analysis |

Entrants Threaten

The cell analysis and scientific instrumentation market, especially for cutting-edge technologies like Full Spectrum Profiling, demands significant upfront capital. This includes substantial investment in research and development, building advanced manufacturing facilities, and establishing robust global distribution channels.

Newcomers encounter considerable financial hurdles. Creating instruments and reagents that can compete effectively is an expensive and lengthy process. For instance, companies developing novel flow cytometry technologies often spend tens of millions of dollars on R&D before a product even reaches the market, a figure that can easily escalate with regulatory approvals and scaling up production.

Cytek Biosciences' patented Full Spectrum Profiling (FSP) technology acts as a formidable barrier to new entrants in the flow cytometry market. This proprietary innovation, which allows for the simultaneous detection of a high number of fluorescent markers, is protected by a robust intellectual property portfolio. For instance, as of early 2024, Cytek held numerous patents globally covering aspects of their FSP technology, making it exceptionally challenging for newcomers to replicate their capabilities without infringing on existing IP rights.

The significant investment required for both cutting-edge research and development, alongside the substantial legal costs associated with navigating and potentially challenging existing patents, deters many potential competitors. Developing comparable technology that can effectively compete with Cytek's established FSP system demands not only scientific ingenuity but also considerable financial and legal resources, creating a high hurdle for new companies seeking to enter this specialized segment of the life sciences industry.

The life sciences and clinical applications market presents significant regulatory hurdles for new entrants. Companies must navigate rigorous testing, certifications, and compliance with standards like FDA approval for medical devices, which can take years and millions of dollars. For instance, the average cost to bring a new drug to market is estimated to be over $2 billion, a substantial barrier for startups.

Brand Recognition and Established Customer Relationships

Cytek has cultivated significant brand recognition, underscored by its expanding installed base of over 3,000 instruments as of early 2025. This, combined with robust customer engagement through dedicated teams and the user-friendly Cytek Cloud platform, creates a formidable barrier for new entrants. Overcoming this established loyalty and building the necessary trust with major research institutions and pharmaceutical firms is a time-consuming and resource-intensive endeavor.

New competitors face the challenge of replicating Cytek's established brand equity and deep-rooted customer relationships. This requires not only superior technology but also a sustained investment in marketing and sales to build credibility in a market where trust is paramount.

- Brand Loyalty: Cytek's over 3,000 installed instruments by early 2025 represent a substantial customer base with established trust.

- Customer Relationships: Strong ties with key research institutions and pharmaceutical companies are difficult for new entrants to penetrate quickly.

- Digital Ecosystem: The popular Cytek Cloud enhances customer stickiness and provides a competitive advantage that new players must contend with.

- Time to Market: Building equivalent brand recognition and customer relationships can take years, delaying a new entrant's ability to gain significant market share.

Need for Specialized Expertise and Talent

Developing and commercializing advanced cell analysis tools, like those offered by Cytek, requires deep scientific and engineering knowledge. This specialized expertise is not easily acquired, creating a hurdle for potential new competitors.

Newcomers would struggle to attract and keep the skilled professionals needed in fields like flow cytometry, optics, software engineering, and cellular biology. The limited availability of this talent pool is a major barrier to entry.

- Talent Scarcity: The global market for highly specialized scientists and engineers in biotech is intensely competitive. For instance, demand for bioinformaticians, a key role in cell analysis data interpretation, saw a projected 30% growth in job postings between 2023 and 2024.

- High Recruitment Costs: Companies like Cytek invest heavily in recruiting and retaining top talent, often offering significant compensation and benefits packages, which new entrants would need to match or exceed.

- Intellectual Property & Know-how: Beyond raw talent, the specialized knowledge and proprietary techniques developed over years by established players are difficult for new entrants to replicate quickly.

The threat of new entrants into the advanced cell analysis market, particularly for technologies like Cytek's Full Spectrum Profiling, is significantly mitigated by substantial barriers. These include immense capital requirements for R&D and manufacturing, robust intellectual property protection, and stringent regulatory landscapes. Furthermore, established brand loyalty, deep customer relationships, and the scarcity of specialized talent create formidable challenges for any potential competitor seeking to enter this high-tech scientific instrumentation space.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (as of early 2024/2025) |

| Capital Requirements | High R&D, manufacturing, and distribution costs. | Deters entry due to significant upfront investment. | Tens of millions in R&D for novel flow cytometry tech. |

| Intellectual Property | Patented FSP technology. | Difficult to replicate without infringement. | Numerous global patents held by Cytek. |

| Regulatory Hurdles | FDA approval, certifications. | Time-consuming and costly compliance. | Millions of dollars and years for new medical devices. |

| Brand & Customer Relationships | Established trust and loyalty. | Requires extensive time and resources to build. | Over 3,000 instruments installed by Cytek; dedicated sales teams. |

| Talent & Expertise | Scarcity of specialized scientists/engineers. | High recruitment costs and competition for talent. | 30% projected growth in bioinformatician job postings (2023-2024). |

Porter's Five Forces Analysis Data Sources

Our Cytek Porter's Five Forces analysis is built upon a robust foundation of data, including detailed company financial statements, market research reports from leading firms, and industry-specific trade publications. This multi-faceted approach ensures a comprehensive understanding of competitive dynamics.