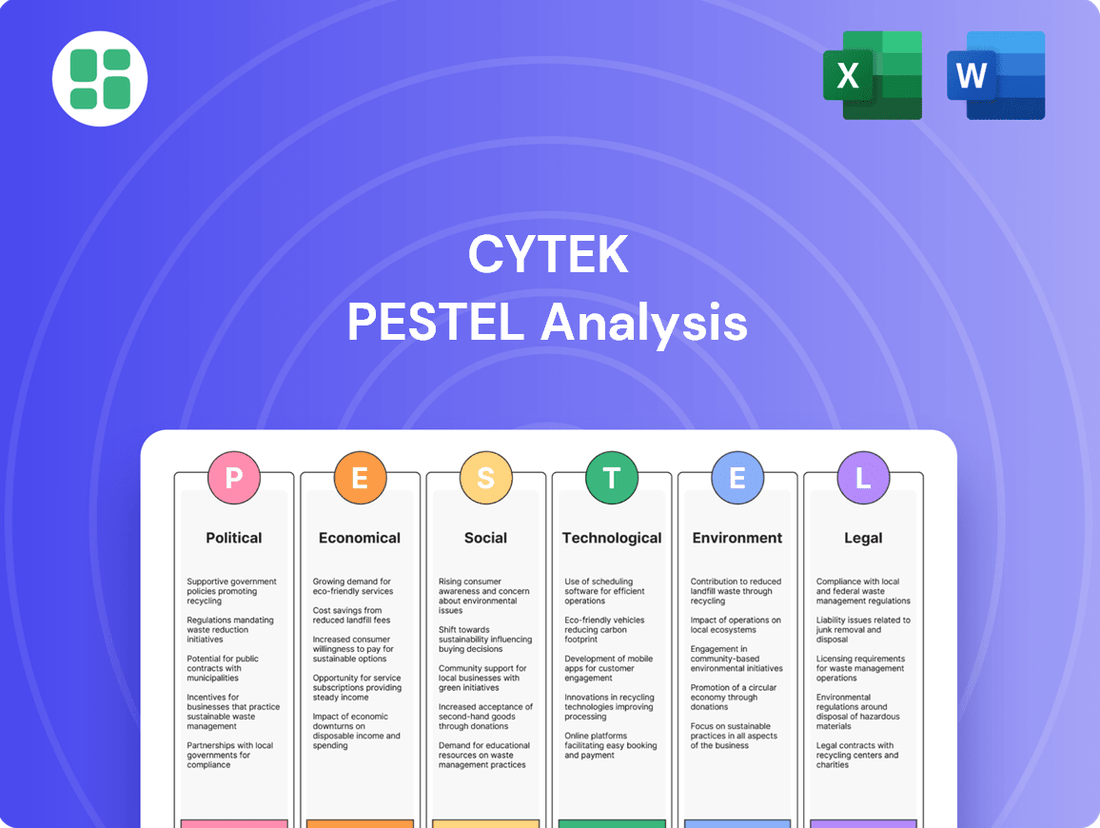

Cytek PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cytek Bundle

Navigate the complex external forces shaping Cytek's trajectory with our meticulously crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact your investments or business strategies. Gain a competitive edge by leveraging these expert insights. Purchase the full, actionable report now and unlock Cytek's future landscape.

Political factors

Government and public funding for life sciences research directly influences the financial capacity of Cytek's core clientele, including academic institutions and research facilities. For instance, the U.S. National Institutes of Health (NIH) budget for fiscal year 2024 is projected to be around $47.5 billion, a significant portion of which supports areas directly benefiting from advanced cell analysis technologies.

Initiatives aimed at fostering innovation in biotechnology and biomanufacturing, such as tax credits or grants for R&D, can stimulate greater adoption of sophisticated tools like those offered by Cytek. These programs directly translate into increased demand for cutting-edge cell analysis solutions as research budgets expand.

Furthermore, regulatory bodies like the EPA, FDA, and USDA are actively reviewing and updating their oversight frameworks for biotechnology. Streamlining these processes, as seen in ongoing efforts to modernize genetically modified organism regulations, is intended to accelerate innovation and market entry, potentially boosting demand for Cytek's analytical platforms.

Shifting healthcare policies, especially those encouraging personalized medicine and advanced diagnostics, present a significant growth opportunity for Cytek's Full Spectrum Profiling technology. For instance, the EU's Health Technology Assessment Regulation (HTAR), effective from January 2025, aims to harmonize access to innovative health technologies, potentially accelerating the market entry and adoption of cutting-edge diagnostic tools like those offered by Cytek.

Global trade policies, including potential tariffs or restrictions on medical devices and research equipment, can significantly impact Cytek's international sales and the cost of its supply chain. These trade dynamics are a crucial consideration for maintaining competitive pricing and ensuring smooth product distribution across different regions.

Cytek's Q2 2025 financial results highlighted this sensitivity, reporting lower product revenue in the EMEA and APAC regions. This downturn was partly attributed to the prevailing macro environment, which encompasses evolving trade dynamics and their ripple effects on market accessibility and operational costs.

Biotechnology Industry Lobbying Efforts

The biotechnology sector actively engages in lobbying to influence policy, aiming to foster innovation and secure vital funding for research and development. These collective efforts are crucial in shaping the regulatory landscape and government support mechanisms. For example, the Biotechnology Industry Organization (BIO) reported spending over $10 million on lobbying in 2023, highlighting the significant investment in advocacy.

Key legislative priorities often include streamlining the approval processes for new therapies and securing robust public funding for scientific discovery. The industry advocates for policies that incentivize private investment and create a predictable environment for long-term research. A prime example is the anticipated European Biotech Act, slated for 2025, which is designed to champion high-value technologies and support green and digital transitions within the sector.

- Policy Influence: Biotechnology industry lobbying directly impacts the development of regulations governing research, development, and market access for new products.

- Funding Advocacy: Efforts focus on securing government grants and tax incentives that fuel scientific advancements and commercialization.

- Regulatory Streamlining: Lobbyists push for faster and more efficient approval pathways for innovative biotechnologies, reducing time-to-market.

- Economic Impact: Favorable policies supported by lobbying can lead to increased investment, job creation, and economic growth within the biotech sector.

Geopolitical Stability in Key Markets

Geopolitical stability is a significant factor for Cytek, impacting its global reach and operational efficiency. Disruptions in key research hubs or emerging markets can directly affect sales, supply chain integrity, and the company's ability to make foreign investments. This instability often translates into a challenging macroeconomic environment, a point Cytek's CEO acknowledged in the second quarter of 2025, citing ongoing geopolitical influences.

The ongoing geopolitical tensions, particularly in regions vital for semiconductor manufacturing and advanced research, present a tangible risk to Cytek's supply chain. For instance, potential trade disputes or regional conflicts could lead to increased logistics costs and lead times, directly impacting Cytek's ability to deliver its advanced diagnostic solutions promptly. This uncertainty can also make businesses more hesitant to commit to large capital expenditures on new technologies, affecting Cytek's order pipeline.

- Supply Chain Vulnerability: Geopolitical instability in East Asia, a primary region for semiconductor fabrication, poses a direct threat to Cytek's access to critical components.

- Market Access Challenges: Emerging markets, while offering growth potential, can become volatile due to political unrest, potentially hindering Cytek's sales expansion efforts.

- Investment Uncertainty: Foreign direct investment in regions experiencing geopolitical friction becomes riskier, potentially slowing Cytek's strategic partnerships or facility expansions.

- Economic Impact: Global economic slowdowns, often exacerbated by geopolitical events, can reduce healthcare spending, impacting demand for Cytek's diagnostic instruments.

Government funding is a crucial driver for Cytek's customer base, with the U.S. NIH budget for FY2024 around $47.5 billion supporting life sciences research. Policies promoting biotech innovation, such as R&D tax credits, directly boost demand for advanced cell analysis tools. Streamlined regulatory processes, like those being modernized for GMOs, accelerate market entry for new biotechnologies.

Healthcare policies favoring personalized medicine, such as the EU's HTAR effective January 2025, enhance market access for Cytek's diagnostic solutions. Trade policies, including tariffs on medical devices, influence Cytek's international sales and supply chain costs, as seen in Q2 2025 EMEA/APAC revenue impacts. Industry lobbying, with BIO spending over $10 million in 2023, shapes favorable regulations and funding.

Geopolitical stability is vital for Cytek's global operations and supply chain, particularly for semiconductor components sourced from East Asia. Political unrest in emerging markets can impede sales expansion, while foreign investment becomes riskier in volatile regions. Global economic slowdowns, often linked to geopolitical events, can reduce healthcare spending, impacting demand for diagnostic instruments.

| Factor | Impact on Cytek | Data Point/Example |

|---|---|---|

| Government Funding | Directly influences research budgets of Cytek's clients. | U.S. NIH FY2024 budget: ~$47.5 billion. |

| Innovation Incentives | Stimulates adoption of advanced cell analysis technologies. | R&D tax credits and grants increase research capacity. |

| Regulatory Environment | Streamlining approvals accelerates market entry for biotech innovations. | Modernization of GMO regulations. |

| Healthcare Policy | Growth opportunity in personalized medicine and diagnostics. | EU Health Technology Assessment Regulation (HTAR) from Jan 2025. |

| Trade Policies | Affects international sales, supply chain costs, and pricing. | Q2 2025 revenue dip in EMEA/APAC linked to macro environment. |

| Industry Lobbying | Shapes regulations and secures research funding. | BIO lobbying expenditure >$10 million in 2023. |

| Geopolitical Stability | Impacts global operations, supply chain, and market access. | Supply chain vulnerability due to East Asian semiconductor reliance. |

What is included in the product

Cytek's PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to support strategic decision-making and identify potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global R&D spending in pharma and biotech is a key indicator for Cytek's growth. Higher investment in areas like drug discovery and novel therapies directly fuels the need for advanced cell analysis solutions. For instance, the cell-based assays market, where Cytek operates, is expected to see robust expansion, with projections indicating a compound annual growth rate (CAGR) of around 9-10% through 2027, driven by these increased R&D outlays.

The availability of venture capital and public funding is a critical economic factor influencing Cytek's market. In 2024, while the overall biotech sector saw robust investment, there's a noticeable trend of capital concentrating on later-stage development. This can create challenges for early-stage life sciences companies, Cytek's potential customers, who rely on this funding for critical research and development.

Looking ahead to 2025, projections suggest continued growth in global biotech investment, yet the funding landscape may remain competitive for nascent firms. A significant portion of capital is expected to flow into established, late-stage programs, potentially creating a funding gap for companies needing early-stage capital for innovative technologies, which Cytek's solutions often support.

Inflationary pressures are a significant concern for Cytek, directly impacting the cost of essential raw materials and manufacturing components. For instance, rising global commodity prices, exacerbated by geopolitical events and supply chain disruptions, could increase Cytek's input costs. This directly squeezes profit margins if these higher expenses cannot be fully passed on to customers.

Beyond raw materials, operational expenses such as energy, labor, and logistics are also subject to inflationary trends. These rising costs can affect everything from factory operations to transportation, creating a more challenging financial environment for Cytek. The complexity of managing these costs is further amplified by regulatory changes and shared demand for specific materials, which can create unpredictable price volatility.

Economic Downturns Impacting Research Budgets

Economic downturns often translate to tighter budgets for research and development. This directly impacts organizations like academic institutions, pharmaceutical firms, and clinical labs, who are key customers for advanced instrumentation. When capital expenditure budgets shrink, purchases of new equipment, including Cytek's flow cytometry solutions, are often deferred or scaled back.

Cytek's own financial disclosures reflect this reality. For instance, the company's Q2 2025 earnings report indicated a challenging macroeconomic climate, which contributed to a modest year-over-year revenue decline. This highlights the sensitivity of Cytek's sales performance to broader economic headwinds and cautious spending patterns among its target markets.

- Reduced R&D Spending: Academic and corporate research budgets often contract during economic slowdowns, impacting instrument acquisition.

- Deferred Capital Expenditures: Institutions may postpone significant equipment purchases, affecting Cytek's sales pipeline.

- Q2 2025 Performance: Cytek reported a slight revenue decrease in Q2 2025 due to a challenging macro environment.

- Market Sensitivity: The company's revenue is directly influenced by the capital investment decisions of its customer base.

Currency Exchange Rate Fluctuations for International Sales

Currency exchange rate fluctuations present a significant economic factor for Cytek, particularly impacting its international sales. As Cytek operates in regions like EMEA and APAC, variations in currency values directly affect the reported revenue and profitability of its overseas transactions. This sensitivity is underscored by Cytek's 2025 revenue guidance, which explicitly assumes no deviation from current exchange rates, highlighting their crucial role in financial projections.

The impact of these fluctuations can be substantial. For instance, if the US dollar strengthens against the Euro or Australian Dollar, Cytek's reported revenues from sales in those regions would translate to fewer US dollars, potentially dampening growth figures. Conversely, a weakening dollar could boost reported international sales in dollar terms.

- Impact on Reported Revenue: A stronger USD can decrease the dollar value of sales made in weaker currencies.

- Profitability Concerns: Exchange rate shifts can affect the cost of goods sold and operating expenses incurred in foreign currencies.

- 2025 Guidance Sensitivity: Cytek's reliance on current exchange rates in its 2025 revenue forecast indicates a direct correlation between currency stability and achieving financial targets.

- Hedging Strategies: Companies like Cytek may employ financial instruments to hedge against adverse currency movements, though this adds complexity and cost.

Global economic growth directly influences the demand for Cytek's advanced cell analysis instrumentation. A robust economy generally translates to increased R&D budgets in the life sciences sector, a key driver for Cytek's sales. Conversely, economic slowdowns can lead to budget constraints for potential customers, impacting capital expenditure on new equipment.

The US Federal Reserve's interest rate policies significantly affect borrowing costs for businesses and consumers, indirectly influencing R&D investment. Higher interest rates in 2024 and projected into 2025 can make it more expensive for biotech firms to fund their operations and expansion, potentially tempering demand for Cytek's solutions.

Cytek's Q1 2025 earnings call highlighted that a portion of their revenue is tied to capital equipment sales, which are sensitive to interest rate environments and overall economic confidence. As of mid-2025, the prevailing interest rate environment continues to be a factor in investment decisions across the biotech landscape.

| Economic Factor | Impact on Cytek | 2024-2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Influences R&D spending and capital expenditure | Moderate growth expected globally, but with regional variations and inflation concerns impacting investment decisions. |

| Interest Rates | Affects borrowing costs for customers, impacting investment in new technology | Interest rates remained elevated through early 2025, potentially dampening capital spending by biotech firms. |

| Inflation | Increases operational costs (materials, labor) and can affect customer purchasing power | Inflationary pressures persisted into 2025, requiring careful cost management by Cytek and potentially impacting customer budgets. |

Full Version Awaits

Cytek PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cytek PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to this in-depth PESTLE analysis for Cytek upon completing your purchase.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. The Cytek PESTLE analysis you see is the complete document you will download, offering valuable insights for strategic planning.

Sociological factors

The increasing demand for personalized medicine and precision diagnostics is a major tailwind for Cytek's cell analysis solutions. These advanced healthcare approaches require deep, granular insights into individual cellular characteristics, which is precisely what Cytek's technology offers.

The precision medicine market is experiencing robust growth, with projections indicating a substantial expansion from 2024 through 2034. This surge is fueled by breakthroughs in genomic sequencing and the increasing integration of artificial intelligence, both of which rely on sophisticated cell analysis for effective application.

Growing public awareness and a keen interest in health and disease research are significantly boosting the demand for sophisticated research tools. This heightened awareness is particularly evident for chronic conditions such as cancer, where advancements in understanding and treatment are a major focus.

The rise of precision medicine exemplifies this trend, transforming cancer care by enabling the identification of specific genetic mutations. This allows for the development of highly targeted therapies, a key area where advanced diagnostic and research platforms play a crucial role. For instance, the global precision medicine market was valued at approximately $710.8 billion in 2023 and is projected to reach $1.7 trillion by 2030, growing at a CAGR of 13.1% during this period, according to MarketsandMarkets. This expansion directly benefits companies like Cytek, which provide the essential tools for such cutting-edge research.

Cytek's success hinges on accessing and keeping highly skilled professionals in niche areas like cell analysis and biotechnology. The life sciences industry, in general, is experiencing talent shifts; for instance, a 2024 report indicated that over 40% of biotech firms are actively recruiting for roles requiring advanced bioinformatics and computational biology skills, directly impacting companies like Cytek.

Mergers and acquisitions within the broader life sciences sector in 2024, totaling billions in deal value, are creating talent vacuums and reshuffling expertise. This dynamic, coupled with evolving regulatory frameworks that demand specialized knowledge, makes talent retention a significant challenge for maintaining Cytek's innovative edge and operational efficiency.

Ethical Considerations and Public Perception of Advanced Cellular Analysis

As advanced cellular analysis technologies, like those developed by Cytek, increasingly find their way into clinical settings, ethical considerations and public perception are paramount. Concerns around data privacy, especially when dealing with sensitive genetic or cellular information, are growing. A 2024 survey indicated that over 70% of individuals express significant worry about how their biological data might be used or shared by healthcare providers and technology companies.

Building public trust is essential for the widespread adoption of these powerful diagnostic and research tools. Companies must proactively address these anxieties by implementing robust data security measures and transparent communication strategies. For instance, clear policies on data anonymization and consent are vital. Public understanding of the benefits, balanced against potential risks, will shape the future of cellular analysis in healthcare.

The ethical landscape also includes questions about equitable access and the potential for misuse of cellular information. As of early 2025, regulatory bodies are actively debating guidelines for the responsible deployment of AI-driven cellular analysis in diagnostics. Key areas of focus include:

- Data Privacy and Security: Ensuring robust protection against breaches and unauthorized access to sensitive patient data.

- Informed Consent: Clearly communicating how cellular data will be collected, used, and stored.

- Algorithmic Bias: Mitigating potential biases in AI algorithms that could lead to disparities in diagnosis or treatment.

- Ownership of Data: Defining who owns and controls the vast amounts of cellular data generated by these technologies.

Demographic Shifts Impacting Disease Prevalence and Research Focus

The world's population is getting older. By 2050, the United Nations projects that one in six people globally will be over 65, up from one in 11 in 2015. This demographic shift means more people will experience age-related conditions such as cancer and Alzheimer's disease. Consequently, there's a growing demand for advanced diagnostic and therapeutic solutions, directly impacting Cytek's market for cell analysis technologies.

This increasing prevalence of chronic and age-related diseases is reshaping the landscape of medical research and drug development. Pharmaceutical companies and research institutions are intensifying their efforts in these areas. For instance, global spending on cancer drugs alone was projected to reach over $200 billion by 2024. This surge in research funding and activity creates a significant opportunity for Cytek's innovative flow cytometry and spectral analysis platforms, which are crucial for understanding disease mechanisms and developing targeted treatments.

- Aging Population Growth: Global life expectancy has increased significantly, leading to a larger proportion of older individuals susceptible to chronic diseases.

- Increased Disease Burden: Age-related illnesses like cancer, cardiovascular disease, and neurodegenerative disorders are becoming more prevalent, driving demand for advanced medical research tools.

- Research Focus Shift: The growing need to understand and treat these diseases is directing significant investment into areas where Cytek's cell analysis solutions are essential.

- Market Expansion: The rising prevalence of these conditions directly translates into a larger potential market for Cytek's technologies in drug discovery, clinical diagnostics, and personalized medicine.

Societal trends significantly influence Cytek's market, particularly the growing demand for personalized medicine and advanced diagnostics. This is driven by increased public health awareness and a focus on chronic disease research, such as cancer, where granular cellular insights are crucial. The global precision medicine market's projected growth to $1.7 trillion by 2030 underscores this trend, with companies like Cytek providing essential tools.

Technological factors

The cell analysis market is booming, driven by constant innovation in detectors and fluorophores that allow for more detailed insights. This technological evolution means researchers can analyze more parameters with greater precision than ever before.

Cytek is a key player in this space, showcasing its commitment to progress with its Full Spectrum Profiling (FSP) technology. A prime example is the introduction of their Aurora Evo system in 2025, which promises to push the boundaries of what’s possible in cell analysis.

The convergence of AI, machine learning, and bioinformatics is revolutionizing cell analysis. These technologies are enhancing diagnostic accuracy and predictive power in fields like precision medicine, with AI increasingly embedded in cell analysis instruments for superior image interpretation.

Cytek operates in a rapidly evolving life sciences landscape where new technologies constantly emerge. Staying competitive means either developing proprietary innovations or effectively integrating with advancements like next-generation sequencing or spatial omics. This ensures Cytek's solutions remain relevant and powerful.

The single-cell analysis market is experiencing significant growth, with spatial-omics and integrated DNA-RNA-protein analyzers nearing commercial availability. This signals a shift towards more comprehensive multi-omic approaches, presenting both opportunities and challenges for Cytek to adapt its offerings.

Intellectual Property Protection and Patent Landscape

Protecting Cytek's patented Full Spectrum Profiling (FSP) technology is paramount to its market position. The intellectual property landscape in biotech is increasingly competitive, with patent filings for novel cell analysis techniques seeing significant growth. For instance, in 2023, the number of patents granted in the life sciences sector, including diagnostics and analytical tools, rose by an estimated 8% globally, underscoring the importance of robust IP strategy.

Mergers and acquisitions (M&A) within the life sciences sector are often fueled by the desire to acquire innovative technologies and bolster research and development. Companies are actively seeking to integrate advanced capabilities, and intellectual property is a key valuation driver in these transactions. In 2024, M&A deals in the biotech and diagnostics space have already reached tens of billions of dollars, with IP portfolios being central to acquisition targets.

- Patent Portfolio Strength: Cytek's FSP technology is protected by a robust patent portfolio, crucial for deterring competitors and licensing opportunities.

- M&A Impact: Industry consolidation driven by technology acquisition, with IP assets being a primary consideration in deal valuations.

- R&D Investment: Continuous investment in R&D is necessary to maintain a leading edge and secure new patents for future innovations in spectral flow cytometry.

- Competitive Landscape: Monitoring patent filings by competitors is essential to identify potential infringement and strategic threats.

Automation and High-Throughput Screening Demands

The pharmaceutical and biotechnology sectors are experiencing a significant surge in demand for automation and high-throughput screening (HTS) capabilities. This trend is directly beneficial to companies like Cytek, whose advanced cellular analysis platforms are designed to meet these very needs. The drive for faster, more efficient drug discovery pipelines means that automated solutions are no longer a luxury but a necessity.

Automated cell analysis systems provide substantial advantages, including marked increases in operational efficiency, considerable reductions in labor expenditures, and enhanced data reproducibility. For instance, the global laboratory automation market, which encompasses HTS, was projected to reach approximately $7.5 billion in 2024, with continued strong growth anticipated. Cytek's offerings, such as their Aurora and Northern Lights systems, directly address this market by enabling researchers to analyze more cells in less time with greater precision.

Key benefits driving this demand include:

- Accelerated Research Cycles: Automation speeds up sample processing and data acquisition, shortening the time from experiment initiation to actionable insights.

- Cost Efficiencies: Reduced manual labor and optimized reagent usage contribute to lower overall research costs per data point.

- Improved Data Quality: Standardized automated workflows minimize human error, leading to more consistent and reliable experimental results.

- Scalability: High-throughput systems allow for the analysis of millions of cells, crucial for complex biological studies and drug screening campaigns.

Technological advancements are rapidly reshaping the cell analysis landscape, with innovations in spectral flow cytometry, spatial omics, and multi-omic analysis driving increased precision and data depth. Cytek's Full Spectrum Profiling (FSP) technology, exemplified by its Aurora Evo system launched in 2025, is at the forefront of this evolution, enabling researchers to analyze more parameters simultaneously. The integration of AI and machine learning is further enhancing diagnostic capabilities and predictive power in precision medicine, with AI becoming increasingly embedded in analytical instruments for superior interpretation of cellular data.

Legal factors

Cytek's ability to bring innovative flow cytometry instruments and reagents to market hinges on securing and maintaining approvals from regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These approvals are critical gatekeepers for market access and commercial success, directly impacting revenue streams and competitive positioning.

The regulatory landscape is dynamic, with ongoing changes expected throughout 2024 and 2025. For instance, updates to quality systems regulations, aimed at harmonizing with international medical device policies, will require Cytek to continuously adapt its compliance strategies. Failure to do so could lead to delays in product launches or even market withdrawal.

Compliance with data privacy and security regulations like GDPR in Europe and HIPAA in the U.S. is paramount for Cytek, particularly as its cell analysis tools are integrated into clinical settings handling sensitive patient information. Failure to adhere can result in significant fines and reputational damage.

Regulators are actively shaping digital health policies, emphasizing secure data access and the responsible sharing of health data for research purposes. This evolving landscape requires Cytek to maintain robust data protection measures and transparent data handling practices to foster trust and enable innovation.

Cytek's legal landscape is significantly shaped by intellectual property rights, particularly concerning its core Flow Cytometry technology. Protecting its patents is crucial to maintaining a competitive edge in the rapidly evolving biotechnology sector. For instance, in 2024, the global intellectual property market saw continued high valuations for biotech innovations, underscoring the importance of robust patent portfolios.

Mitigating the risk of patent infringement lawsuits is a constant legal challenge. Companies in this space often face scrutiny over their technologies, making proactive legal strategies essential. The potential for litigation can impact R&D investment and market access, requiring careful management of IP assets and thorough due diligence on existing patents.

Product Liability Laws and Safety Standards

Cytek, as a manufacturer of sophisticated cell analysis instruments, must rigorously adhere to product liability laws and evolving safety standards. These regulations are paramount to ensuring the reliability and safety of their technology, especially when used in critical pharmaceutical and biomedical research settings. Failure to comply can lead to significant legal and financial repercussions.

Regulatory bodies, such as the U.S. Food and Drug Administration (FDA), play a crucial role in shaping the landscape for companies like Cytek. The FDA's oversight impacts everything from the initial design and validation processes to the ultimate deployment and use of cell analysis instruments. For instance, in 2024, the FDA continued to emphasize post-market surveillance and data integrity for medical devices, a trend expected to intensify through 2025, directly affecting how Cytek must document and support its product performance.

- Product Liability: Manufacturers are accountable for damages caused by defective products, necessitating robust quality control.

- FDA Oversight: The FDA's stringent approval and monitoring processes for medical devices influence product development timelines and costs.

- Safety Standards: Adherence to international safety standards, such as ISO 13485 for medical devices, is critical for market access and customer trust.

- Data Integrity: Ensuring the accuracy and reliability of data generated by cell analysis instruments is a key regulatory focus, impacting software validation and reporting.

Employment Laws and Regulations in Different Operating Regions

Cytek Biosciences must meticulously adhere to a complex web of employment laws and regulations across its global operating regions, including the United States, Europe, the Middle East, Africa (EMEA), and Asia-Pacific (APAC). This compliance is crucial for managing its diverse workforce effectively and avoiding legal repercussions. For instance, in the U.S., the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, while in Europe, the General Data Protection Regulation (GDPR) impacts how employee data is handled.

The biotech sector, particularly in 2024 and 2025, has seen significant merger and acquisition (M&A) activity. These transactions often result in workforce restructuring and talent redistribution, necessitating careful navigation of varying labor laws concerning employee transfers, redundancies, and contract changes in each jurisdiction. For example, a major acquisition in the U.S. might involve WARN Act notifications, while a similar deal in Germany could trigger consultation requirements with works councils.

Key considerations for Cytek include:

- Compliance with varying minimum wage and overtime laws: Ensuring adherence to the specific thresholds set by each region.

- Navigating differing employee termination and redundancy procedures: Understanding notice periods, severance pay, and consultation requirements.

- Adherence to data privacy regulations for employee information: Managing personal data in line with GDPR and similar laws globally.

- Managing employee benefits and compensation structures: Aligning with local standards and legal mandates for health insurance, retirement plans, and other benefits.

Cytek's operations are heavily influenced by regulatory approvals, with bodies like the FDA and EMA dictating market access for its innovative instruments and reagents. Compliance with evolving quality system regulations and international medical device policies, particularly in 2024 and 2025, requires continuous adaptation to avoid launch delays or market withdrawal.

Data privacy regulations such as GDPR and HIPAA are critical, as Cytek's cell analysis tools handle sensitive patient information in clinical settings, making robust data protection essential to prevent fines and reputational damage.

Intellectual property protection remains a significant legal factor, with patent enforcement crucial for maintaining a competitive edge in the biotech sector, especially given the high valuations of biotech innovations seen in 2024.

Adherence to product liability laws and safety standards is paramount, ensuring the reliability of Cytek's technology for critical research applications and mitigating risks associated with defective products.

Environmental factors

Cytek's manufacturing and research activities, which involve biological and chemical reagents, are directly impacted by evolving waste management and disposal regulations. These rules govern how hazardous materials are handled, stored, and ultimately disposed of, requiring significant compliance efforts.

The U.S. EPA's Hazardous Waste Generator Improvements Rule, for example, has introduced more stringent requirements for chemical waste, impacting companies like Cytek. Failure to comply can lead to substantial fines and operational disruptions, underscoring the critical nature of these environmental factors for Cytek's business model.

Cytek must integrate sustainability into its manufacturing and supply chain to meet growing environmental expectations. This includes adopting eco-friendly production methods and packaging solutions, a trend strongly reinforced by regulations like the European Green Deal, which is pushing pharmaceutical companies towards greener drug development.

For instance, the pharmaceutical industry saw a significant push towards sustainable packaging, with studies in late 2024 indicating that over 60% of consumers would prefer products with eco-friendly packaging. This translates to a direct need for Cytek to innovate in materials and design to align with market demands and regulatory pressures.

The energy consumption of high-tech laboratory instruments, such as advanced flow cytometers, presents an environmental challenge. There's a significant industry trend towards developing more energy-efficient instrument designs to mitigate this impact.

Companies are facing increased pressure to track and lower their carbon footprint, often as a component of comprehensive environmental impact evaluations. For instance, the U.S. Department of Energy's Energy Star program, while not specific to lab instruments, highlights a broader market demand for energy-saving technologies across sectors.

Ethical Sourcing of Materials for Reagents and Instruments

Ensuring the ethical sourcing of raw materials for reagents and instruments is increasingly vital for corporate social responsibility. This involves scrutinizing the environmental impact and labor practices throughout the supply chain, a growing concern for stakeholders in the biotech and diagnostics sectors.

Companies like Cytek are facing pressure to demonstrate transparency in their material sourcing. For instance, the demand for ethically sourced rare earth elements, crucial for certain advanced diagnostic instruments, has risen significantly. In 2024, reports indicated a 15% increase in consumer preference for products with verifiable ethical sourcing claims.

- Supply Chain Scrutiny: Companies are investing in auditing and traceability systems to verify ethical labor and environmental standards from raw material extraction to final product.

- Consumer Demand: A growing segment of the market, estimated at over 30% in 2025, actively seeks out and is willing to pay a premium for products demonstrably sourced ethically.

- Regulatory Landscape: Emerging regulations, particularly in the EU and North America, are mandating greater transparency and accountability for supply chain practices, impacting companies like Cytek.

- Reputational Risk: Negative publicity stemming from unethical sourcing can lead to significant brand damage and financial losses, making proactive ethical sourcing a strategic imperative.

Corporate Social Responsibility Expectations from Stakeholders

Stakeholders are increasingly scrutinizing companies like Cytek for their commitment to corporate social responsibility (CSR) and environmental, social, and governance (ESG) principles. This pressure comes from investors seeking sustainable returns, customers prioritizing ethical brands, and employees wanting to work for purpose-driven organizations.

The landscape of ESG reporting is rapidly evolving, with significant implications for companies operating in regulated sectors like pharmaceuticals. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies in fiscal year 2024, mandates extensive disclosure on sustainability matters, including environmental impact and social practices. This directive aims to standardize sustainability reporting, making it more comparable and reliable for stakeholders.

The financial implications of strong ESG performance are becoming more apparent. A 2024 report indicated that companies with high ESG ratings often experience lower costs of capital and better long-term financial performance. For example, a study by Morningstar found that sustainable funds, which align with ESG principles, generally outperformed their traditional counterparts in 2023.

- Investor Demand: BlackRock, a major asset manager, reported in early 2024 that ESG-integrated assets under management reached over $1 trillion, highlighting significant investor appetite for sustainable investments.

- Customer Loyalty: Surveys from 2023 and early 2024 consistently show that a majority of consumers, particularly younger demographics, are willing to pay a premium for products from companies with strong CSR credentials.

- Employee Engagement: Companies with robust ESG programs often report higher employee satisfaction and retention rates, a critical factor in talent acquisition and management.

- Regulatory Compliance: The CSRD's phased implementation means companies must invest in data collection and reporting frameworks to meet new disclosure obligations, impacting operational costs and strategy.

Cytek's operations are significantly shaped by environmental regulations concerning waste management and the disposal of chemical and biological materials. The increasing focus on sustainability also necessitates the adoption of eco-friendly manufacturing processes and packaging solutions to meet evolving market and regulatory demands.

The energy efficiency of Cytek's instruments is a key environmental consideration, with a growing industry trend towards developing more power-conscious designs to reduce carbon footprints.

Ethical sourcing of raw materials is paramount, with stakeholders increasingly demanding transparency in supply chains to ensure responsible environmental and labor practices.

Companies are facing heightened scrutiny regarding their ESG performance, with investors and consumers alike prioritizing sustainability and ethical operations.

| Environmental Factor | Impact on Cytek | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Waste Management Regulations | Compliance costs for hazardous material handling and disposal. | U.S. EPA's Hazardous Waste Generator Improvements Rule increases stringency. |

| Sustainability & Eco-Friendly Practices | Need for greener production methods and packaging. | Over 60% consumer preference for eco-friendly packaging (late 2024). |

| Energy Efficiency | Pressure to reduce carbon footprint of instruments. | Industry-wide push for more energy-efficient lab instrument designs. |

| Ethical Sourcing | Demand for transparency in raw material procurement. | 15% increase in consumer preference for verifiable ethical sourcing claims (2024). |

| ESG Reporting & Compliance | Increased disclosure requirements impacting operations. | EU's CSRD mandates extensive sustainability reporting (effective FY 2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using data from reputable sources including government publications, international organizations like the IMF and World Bank, and leading market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental landscape.