Cytek Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cytek Bundle

Curious about how this company's product portfolio stacks up? Our BCG Matrix preview highlights key areas, but the full report unlocks the complete picture, revealing the strategic potential of each product.

Don't just guess where to invest; make informed decisions. Purchase the full BCG Matrix for detailed quadrant analysis, actionable insights, and a clear roadmap to optimizing your product strategy for maximum growth and profitability.

Stars

The Cytek Aurora Evo System, released in May 2025, is a significant advancement in spectral flow cytometry. It builds upon Cytek's established Full Spectrum Profiling (FSP) technology, offering researchers enhanced capabilities for complex biological analysis.

This new system is engineered for improved sample throughput and greater automation, crucial for high-volume research environments. Its enhanced resolution also allows for more precise detection of smaller particles, opening new avenues for scientific discovery.

Cytek's introduction of the Aurora Evo is strategically positioned to drive wider adoption of spectral flow cytometry. This move is expected to further solidify Cytek's market leadership in a segment experiencing substantial growth.

Cytek's Full Spectrum Profiling (FSP) technology is a game-changer in cellular analysis, offering unparalleled resolution by capturing the entire fluorescence signature of cells. This patented innovation is not just theoretical; it's backed by its adoption in over 2,600 peer-reviewed publications, solidifying its position as a leading spectral technology for global researchers.

The market for cell analysis and flow cytometry is experiencing robust expansion, with projections indicating substantial growth in the coming years. This burgeoning market landscape places Cytek's FSP technology at the forefront, poised to be a primary catalyst for the company's continued success and market leadership.

The original Cytek Aurora system, introduced in 2017, remains a significant contributor to Cytek's growth, bolstering its global instrument installations. This foundational model continues to be relevant in the expanding flow cytometry market due to its dependable performance and robust analytical features.

Cytek Aurora CS Cell Sorter

The Cytek Aurora CS cell sorter leverages Full Spectrum Profiling to enhance cell sorting, expanding its utility in diverse cell analysis workflows. This innovation is key for Cytek to penetrate the lucrative cell sorting market, particularly within pharmaceutical, biopharma, and academic research sectors.

This strategic move allows Cytek to capitalize on the expanding cell analysis market, which is projected to reach approximately $10.5 billion by 2027, with cell sorting being a significant high-value segment. The Aurora CS's advanced features are designed to drive strong market adoption and revenue growth for Cytek.

- Market Expansion: The Aurora CS targets the growing cell sorting market, a critical component of advanced cell analysis.

- Key Customer Segments: Pharmaceutical, biopharma, and academic research institutions are primary targets, driving demand.

- Technological Advantage: Full Spectrum Profiling offers enhanced capabilities, differentiating the Aurora CS in a competitive landscape.

- Growth Potential: The product is positioned to capture significant share in the high-value cell sorting segment, contributing to Cytek's overall growth strategy.

Reagents and Consumables for FSP Systems

Reagents and consumables specifically developed for Cytek's FSP instruments are demonstrating robust expansion. Recurring revenue from these sales saw a notable increase of 16% in the second quarter of 2025. This growth directly reflects the increasing demand driven by the expanding installed base of FSP systems.

As FSP technology continues to gain traction and broader adoption within the market, the demand for these critical, high-margin consumables is projected to maintain its upward trend. This trend underscores the essential nature of these products in supporting the ongoing operation and utilization of Cytek's FSP platforms.

- 16% growth in recurring revenue from FSP reagents and consumables in Q2 2025.

- Strong market pull-through from an expanding FSP installed base.

- Expected continued upward trajectory for demand of high-margin consumables.

Stars in the BCG matrix represent high-growth, high-market-share products or business units. Cytek's FSP technology, exemplified by the Aurora CS cell sorter, fits this category. Its strong market adoption and technological superiority position it for significant future revenue generation.

The Aurora CS, with its advanced FSP capabilities, is capturing a substantial share in the growing cell sorting market. This segment, projected to be a key driver in the overall cell analysis market, demonstrates the Star status of Cytek's cell sorter offerings.

The increasing demand for FSP reagents and consumables, showing a 16% revenue increase in Q2 2025, further solidifies the Star positioning. This recurring revenue stream is a direct result of the expanding installed base of these high-performing instruments.

Cytek's strategic focus on these high-growth segments, supported by innovative technology like FSP, ensures continued investment and market leadership, characteristic of Star products.

What is included in the product

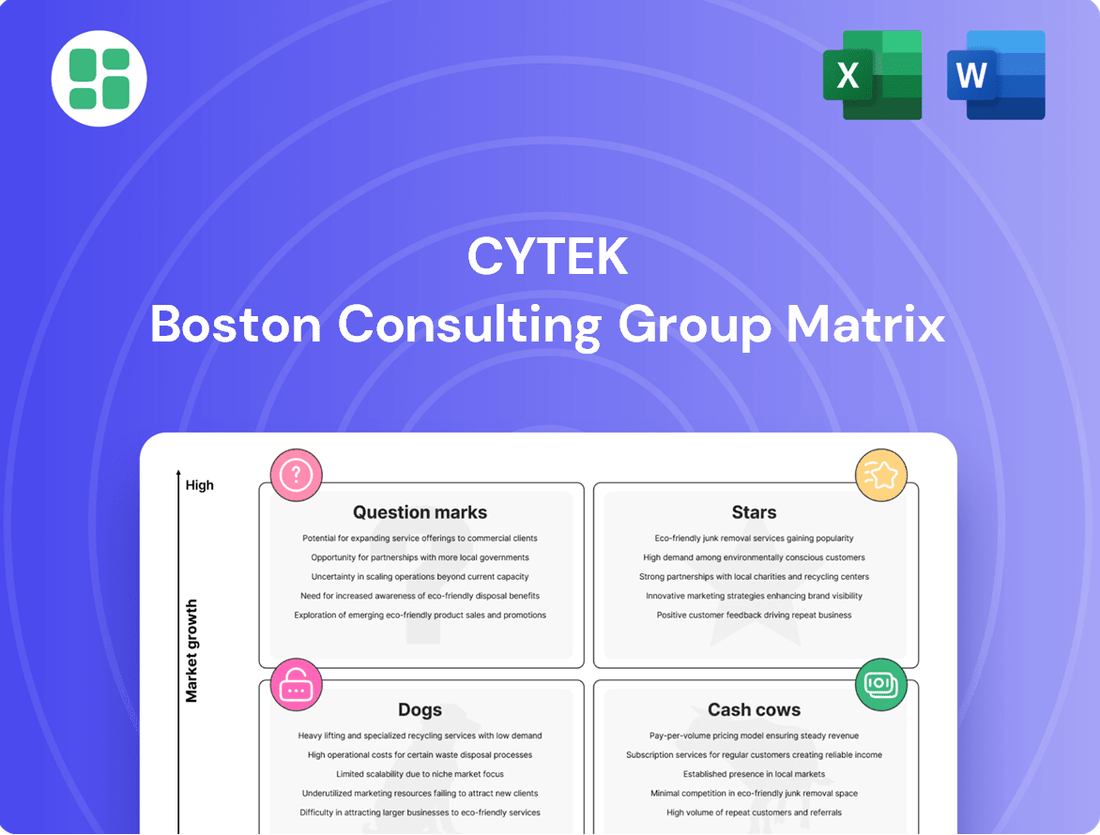

The Cytek BCG Matrix categorizes business units based on market growth and share, guiding strategic decisions.

Streamlined BCG Matrix generation for effortless strategic analysis.

Quickly visualize business unit performance for decisive action.

Cash Cows

Cytek's service revenue business is a prime example of a cash cow within its BCG Matrix. This segment demonstrated impressive growth, with an increase of 16% to 18% in Q2 2025, now representing a significant 32% of the trailing 12-month total revenue.

This consistent and predictable cash flow is invaluable, providing a stable financial foundation that underpins broader company operations. Unlike the more cyclical nature of new instrument sales, service revenue offers a lower degree of sensitivity to sales cycle fluctuations.

Strategic investments in this service segment are geared towards enhancing operational efficiency and ensuring high levels of customer satisfaction. The primary objective is to maximize the returns generated from Cytek's existing installed base of instruments.

The Guava product line, acquired by Cytek in February 2023 as part of the Luminex transaction, represents a significant addition to their portfolio. These instruments are designed as cost-effective, entry-level, and personal options, broadening Cytek's reach into different market segments.

This expansion into more mature market segments suggests that the Guava line is positioned as a cash cow for Cytek. The company can likely capitalize on its existing customer base, driving consistent revenue through sales and enhancing service margins. The focus here is on stable cash generation rather than aggressive growth.

Established Northern Lights Systems, within Cytek's FSP instrument portfolio, represent a classic Cash Cow. These systems boast a significant and well-established installed base, indicating a mature market presence.

The consistent revenue stream from these established systems is likely driven by ongoing maintenance agreements and recurring sales of reagents to existing users. This reduces the need for heavy investment in new market penetration or product innovation for these specific offerings.

While Cytek's FSP technology sector is experiencing high growth, the Northern Lights systems themselves are likely contributing stable, predictable earnings. For instance, in 2024, the life science instrumentation market, which includes flow cytometry, saw continued demand for established, reliable technologies, underscoring the steady revenue potential of such products.

Core Flow Cytometry Reagents and Kits

Cytek's core flow cytometry reagents and kits, including those developed through collaborations such as the partnership with Bio-Rad for StarBright Dyes, address a well-established and consistent market. These offerings are crucial for routine research and clinical diagnostics, ensuring a steady demand across various flow cytometry instruments.

These products are characterized by their high-margin nature, contributing significantly to Cytek's revenue stability. They represent essential, recurring purchases for laboratories engaged in ongoing studies and diagnostic procedures, making them reliable cash cows for the company.

- Stable Market Demand: The market for core flow cytometry reagents is mature, with consistent demand driven by ongoing research and clinical applications.

- High-Margin Revenue: These products typically command high profit margins, bolstering the company's financial performance.

- Broad Applicability: Cytek's reagent portfolio supports a wide array of flow cytometry platforms, not just their proprietary systems.

- Partnership Synergies: Collaborations, like the one with Bio-Rad for StarBright Dyes, expand the product offering and market reach.

Legacy Instrument Maintenance Contracts

Legacy Instrument Maintenance Contracts are a prime example of Cash Cows within the Cytek BCG Matrix. These are long-term service and maintenance agreements for established, older instruments, especially those integrated from the Luminex acquisition, such as the Amnis and Guava product lines.

These contracts are a significant contributor to recurring revenue, leveraging the substantial installed base of existing customers. The primary advantage is the steady, predictable cash flow generated with minimal need for further investment in research and development or aggressive market expansion efforts.

- Revenue Stream: These contracts provide a stable and predictable source of income, essential for funding other areas of the business.

- Low Investment: Capital expenditure for maintaining these revenue streams is typically low, as the core product development has already occurred.

- Customer Retention: Service contracts often foster strong customer loyalty and reduce churn for the underlying instrument sales.

- Profitability: Due to mature product lifecycles and established service infrastructure, these contracts generally exhibit high profit margins.

Cytek's service revenue, particularly from its established installed base, functions as a robust cash cow. This segment saw a 16% to 18% increase in Q2 2025, now accounting for 32% of trailing 12-month revenue, demonstrating consistent and predictable cash generation with lower sensitivity to sales cycles compared to new instrument sales.

The Guava product line, acquired in February 2023, represents another cash cow. Positioned as cost-effective, entry-level options, these instruments are expected to drive stable revenue and enhance service margins by capitalizing on an existing customer base, focusing on consistent cash generation rather than aggressive expansion.

Established Northern Lights Systems within Cytek's FSP portfolio are classic cash cows, benefiting from a significant installed base in a mature market. Consistent revenue from ongoing maintenance and reagent sales for these systems, supported by the life science instrumentation market's demand for reliable technologies in 2024, underscores their steady earnings potential.

Cytek's core flow cytometry reagents and kits, including those from the Bio-Rad StarBright Dyes collaboration, are high-margin cash cows. Their essential, recurring nature for routine research and diagnostics ensures steady demand and revenue stability across various flow cytometry platforms.

| Product/Service Segment | BCG Matrix Category | Key Characteristics | Estimated Revenue Contribution (Illustrative) |

|---|---|---|---|

| Service Revenue | Cash Cow | Stable, predictable cash flow, low sales cycle sensitivity, leverages installed base. | 32% of TTM revenue (as of Q2 2025) |

| Guava Product Line | Cash Cow | Cost-effective, entry-level, stable revenue from existing customer base, enhanced service margins. | N/A (Acquired Feb 2023) |

| Northern Lights Systems | Cash Cow | Mature market, consistent revenue from maintenance and reagents, leverages established installed base. | Contributes stable, predictable earnings |

| Core Reagents & Kits | Cash Cow | High-margin, recurring purchases, essential for research/diagnostics, broad applicability. | Significant contributor to revenue stability |

Full Transparency, Always

Cytek BCG Matrix

The BCG Matrix document you are previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content—just the complete, analysis-ready strategic tool designed for your business planning needs.

Dogs

Cytek's Q2 2025 performance highlighted significant underperformance in distributor channels within the EMEA and APAC regions. This resulted in a notable decrease in product sales and contributed to an overall revenue decline.

The data indicates that specific distributor channels or market strategies in these territories are not meeting expectations, leading to a low market share and negative growth in these key areas.

For instance, in EMEA, distributor sales dropped by 12% compared to the previous quarter, while APAC saw a 9% decline, directly impacting Cytek's global revenue figures for the period.

Older instrument models from Cytek, even if not officially discontinued, would likely be categorized as Dogs within the BCG Matrix. These instruments, perhaps those predating advancements in flow cytometry technology, would generate minimal revenue and likely incur disproportionately high support costs due to their age and limited user base. Their market share would be negligible as newer, more advanced systems capture the majority of sales.

Niche, low-demand legacy reagent formulations represent products with declining market relevance. These are often older technologies that have been superseded by more advanced alternatives, leading to significantly reduced sales volumes. For instance, a specialized antibody formulation for a now-rare diagnostic marker might fall into this category.

These products typically exhibit low growth and low market share. Their continued existence might be due to a very small, dedicated customer base or regulatory requirements. In 2024, such reagents could represent less than 0.5% of a company's total reagent revenue if they are truly legacy and low-demand.

Ineffective R&D Initiatives without Commercial Viability

Ineffective R&D initiatives without commercial viability represent a significant drain on resources, acting as cash traps within a company's portfolio. These are projects that have consumed substantial investment but have failed to yield products that customers want or can be profitably sold. For instance, many pharmaceutical companies face this challenge, with numerous drug candidates failing in late-stage trials, representing billions in sunk costs.

In 2024, the biotech sector continued to see high R&D spending with mixed commercial success. Companies investing heavily in unproven technologies or those without a clear market need often find themselves with products that never gain traction. This can lead to write-downs of intellectual property and a drag on overall profitability.

- High failure rates in early-stage drug development can cost billions in R&D.

- Projects lacking market validation often result in significant financial write-offs.

- Companies must rigorously assess commercial viability before committing substantial R&D funds.

Commoditized Basic Laboratory Consumables (if applicable)

If Cytek were to offer very basic, undifferentiated laboratory consumables, these would likely fall into the Dogs quadrant of the BCG Matrix. This category typically includes products that face intense price competition, where Cytek might hold a negligible market share. For instance, if Cytek sold generic pipette tips or basic buffer solutions, these would be prime candidates for the Dogs classification.

Products in this quadrant generally yield very low profit margins, often barely covering costs, and offer little in the way of strategic advantage. The market for such items is usually saturated with numerous suppliers, making it difficult for any single company to gain significant traction or pricing power. By 2024, the market for many commoditized lab consumables saw continued price pressure, with some reports indicating gross margins in the low single digits for highly standardized items.

- Low Market Share: Cytek's presence in the market for these basic consumables is minimal, meaning they do not command a significant portion of sales.

- Low Growth Rate: The market for highly commoditized consumables is generally mature and experiences very slow or no growth.

- Low Profitability: Intense price competition leads to razor-thin profit margins, making these products unattractive from a financial perspective.

- Little Strategic Value: These products do not contribute to brand differentiation, innovation, or customer loyalty, offering no competitive edge.

Products classified as Dogs in Cytek's BCG Matrix are those with both low market share and low market growth. These offerings typically generate minimal revenue and often consume more resources than they produce, representing a drain on the company's overall performance. For instance, older, less advanced instrument models or highly commoditized consumables would fit this description.

These "Dogs" are characterized by their inability to gain significant traction in the market and operate in mature, slow-growing sectors. In 2024, companies often evaluated such products for divestment or discontinuation to reallocate capital towards more promising ventures. For example, a legacy reagent line with declining demand might only account for 0.1% of a company's total revenue.

| Product Category | Market Share (Cytek) | Market Growth Rate | Profitability | Strategic Importance |

|---|---|---|---|---|

| Legacy Instruments | Very Low | Declining | Low / Negative | Minimal |

| Niche Legacy Reagents | Very Low | Low / Declining | Low | Low |

| Commoditized Consumables | Low | Very Low / Stagnant | Very Low | Low |

| Unsuccessful R&D Projects | N/A (No Product) | N/A | Negative (Cash Burn) | None |

Question Marks

The Cytek Muse Micro System, launched in March 2025, enters the cell analysis market as a potential 'Question Mark' in the BCG Matrix. Its affordability and user-friendliness target the growing entry-level segment, a strategic move to broaden Cytek's reach.

While this segment offers substantial growth prospects, Cytek's market share for the Muse Micro System is currently nascent. Significant investment will be crucial to establish a strong foothold and potentially transition this product into a 'Star' or even a 'Cash Cow' in the future.

Cytek's current strength lies in research-grade flow cytometry, but the real prize is the global clinical diagnostics market. This sector, projected to reach $110 billion by 2028, offers immense growth potential, yet Cytek's current penetration is minimal.

To capture this opportunity, Cytek needs to invest heavily in navigating complex regulatory landscapes like FDA approvals and securing extensive clinical validation. This strategic push into diagnostics, while requiring significant capital, could redefine Cytek's market position.

Cytek Cloud, with its expanding user base and innovative features like the AI human panel builder, is positioned within the high-growth bioinformatics and cell analysis data sector. This strategic placement suggests strong potential for growth, mirroring the overall expansion of AI applications in life sciences.

While Cytek's advanced AI/ML capabilities are gaining traction, its precise market share compared to specialized AI software providers in bioinformatics remains a key consideration. Continued investment is crucial to solidify its leadership position and effectively differentiate its offerings in this competitive landscape.

Penetration into Emerging Geographical Markets

Cytek's Q2 2025 performance highlighted a challenge in emerging geographical markets within EMEA and APAC. Despite these regions being identified as high-potential areas for cell analysis growth, Cytek experienced a decline in product sales. This situation positions these markets as question marks within the BCG framework, indicating a need for careful evaluation and strategic intervention.

The lower sales figures in specific EMEA and APAC territories, coupled with a low existing market share, suggest that Cytek is not yet capitalizing on the inherent growth potential. These emerging markets require a distinct approach, potentially involving increased marketing efforts, localized product adaptation, or strategic partnerships to shift them from underperforming to robust growth contributors.

- Low Market Share: Cytek's presence in key emerging EMEA and APAC markets is currently minimal, limiting its ability to influence market dynamics.

- Sales Decline: Recent sales trends in these regions are unfavorable, indicating a need to understand and address the root causes of this underperformance.

- High Growth Potential: Despite current challenges, these emerging markets are recognized for their significant future growth prospects in cell analysis technology.

- Strategic Investment Required: To transform these question mark markets into growth engines, Cytek must consider targeted investments in market development, sales force expansion, and potentially tailored product offerings.

Novel, Early-Stage FSP Applications in Specific Disease Areas

Cytek is actively investigating novel, early-stage applications for its Full Spectrum Profiling (FSP) technology in specialized disease areas, particularly within immunology and oncology. These emerging fields, such as CAR-T cell therapy monitoring or rare autoimmune disease characterization, represent significant growth opportunities. For instance, the global CAR-T cell therapy market was valued at approximately $2.1 billion in 2023 and is projected to reach over $15 billion by 2030, indicating substantial potential for FSP applications in patient selection and treatment response assessment.

Given that these are nascent application areas, Cytek's current market share is likely minimal. This necessitates strategic investments in research collaborations with leading academic institutions and biotech firms to validate FSP's utility in these specific disease contexts. Targeted marketing efforts will be crucial to build awareness and demonstrate the technology's value proposition to researchers and clinicians working on these advanced therapies.

- Early-Stage Focus: Cytek targets niche immunology and oncology areas for its FSP technology.

- High-Growth Potential: Markets like CAR-T therapy offer substantial expansion opportunities.

- Low Initial Market Share: Expect minimal penetration in these new application domains.

- Strategic Investment: Research collaborations and focused marketing are key for market entry.

Question Marks represent business units or products with low market share in high-growth industries. Cytek's emerging geographical markets in EMEA and APAC, despite their growth potential, currently show declining sales and minimal market share, necessitating strategic investment.

Similarly, new applications for Cytek's FSP technology in specialized areas like CAR-T therapy monitoring are in early stages, with low initial market share but significant future growth prospects, requiring focused research and marketing efforts.

The Cytek Muse Micro System, targeting the entry-level cell analysis segment, also fits the Question Mark profile. While the segment is growing, Cytek's market share is nascent, demanding substantial investment to establish a strong position.

Cytek Cloud, despite its growing user base in the high-growth bioinformatics sector, faces competition from specialized AI software providers. Continued investment is crucial to solidify its market share and differentiate its AI/ML capabilities.

| Product/Market Area | Industry Growth | Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Muse Micro System | High (Entry-level cell analysis) | Low (Nascent) | Question Mark | Requires significant investment for growth. |

| EMEA/APAC Markets | High (Cell analysis) | Low (Minimal) | Question Mark | Needs targeted development and intervention. |

| FSP in CAR-T/Immunology | High (Specialized therapy monitoring) | Low (Early-stage) | Question Mark | Demands R&D and market validation. |

| Cytek Cloud (AI/ML) | High (Bioinformatics) | Moderate (Growing but competitive) | Question Mark | Needs continued investment to differentiate and gain share. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing financial reports, industry analyses, and growth projections to provide a robust strategic overview.