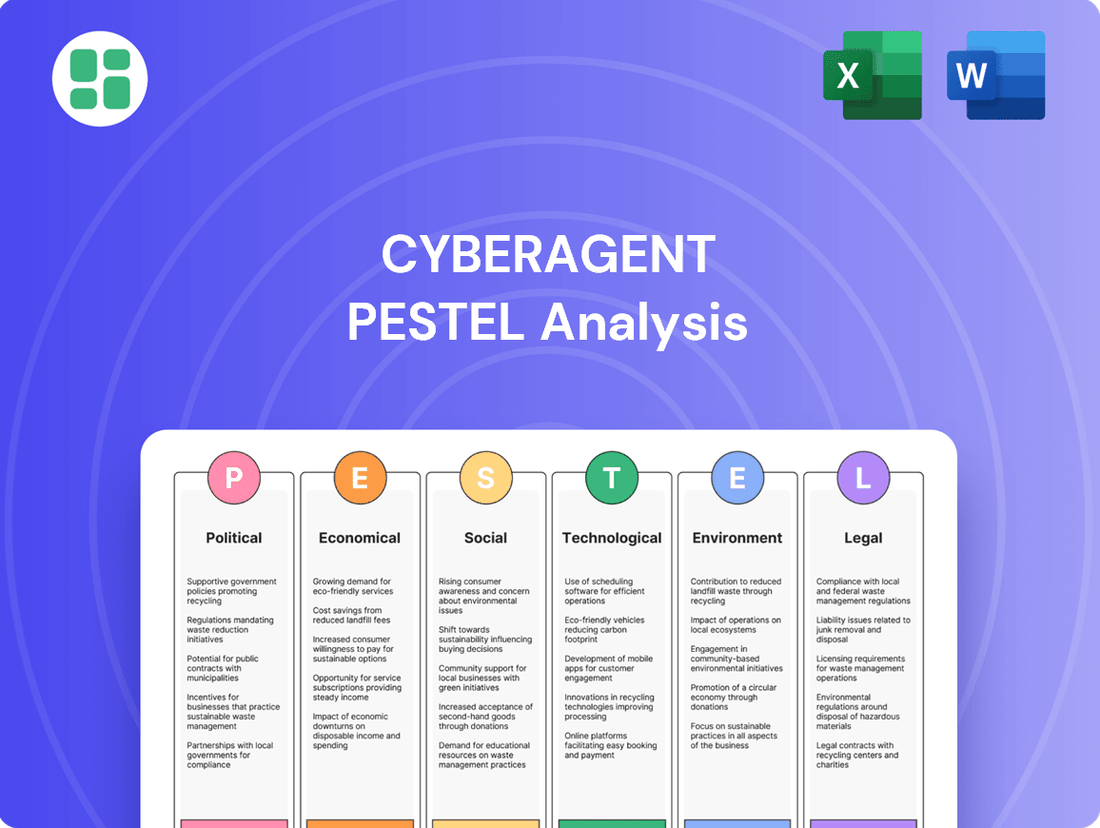

CyberAgent PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CyberAgent Bundle

Uncover the intricate web of external forces shaping CyberAgent's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging social trends, this report provides critical insights for strategic decision-making. Equip yourself with the knowledge to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

The Japanese government's commitment to regulating digital advertising is intensifying, aiming for greater transparency and fairness in the sector. This focus could translate into new legislation or more rigorous enforcement of existing rules concerning data privacy, advertisement content, and consumer safeguards.

These regulatory shifts pose potential challenges for CyberAgent's ad tech offerings and its performance-based advertising models. For instance, stricter data usage policies might affect the targeting capabilities of its platforms, while enhanced consumer protection measures could necessitate adjustments to ad content and disclosure practices.

In 2023, Japan saw a significant increase in consumer complaints related to online advertising, with a notable portion concerning misleading or deceptive practices. This trend underscores the government's impetus to implement more robust oversight, potentially impacting companies like CyberAgent that operate within this digital advertising ecosystem.

Japan's Act on the Protection of Personal Information (APPI) is slated for triennial review, with significant amendments anticipated in 2025. These potential changes, possibly including streamlined reporting for certified entities and new guidelines for AI data utilization without explicit consent, will directly influence CyberAgent's data handling practices across its advertising, media, and gaming operations.

Japan's ongoing discussions about content moderation and platform liability for harmful online content directly impact CyberAgent. As a significant media player with AbemaTV, the company may encounter stricter regulations concerning content standards and user-generated material. For instance, in 2023, Japan saw increased scrutiny on social media platforms regarding defamation, with potential legal ramifications for operators if they fail to act swiftly on complaints.

Anti-Monopoly and Competition Laws

Japan's commitment to fostering competition in its digital landscape, especially concerning app stores and platform power, presents a significant political factor for CyberAgent. A landmark law enacted in June 2024 directly targets monopolistic practices by mandating that dominant platform operators, such as Apple and Google, must permit third-party app stores and payment systems. This regulatory shift is poised to create new avenues for CyberAgent's mobile game distribution, potentially reducing reliance on existing gatekeepers and their associated fees.

The implications of this new legislation are substantial. By forcing open access, the Japanese government aims to level the playing field, encouraging innovation and providing consumers with more choices. For CyberAgent, this could translate into lower distribution costs and greater control over how its games reach users. The expectation is that this will foster a more dynamic market, benefiting companies that can leverage these new opportunities.

Key aspects of this anti-monopoly push include:

- Mandated Third-Party App Stores: Major platform operators must allow alternative app marketplaces.

- Open Payment Systems: Developers can offer alternative payment processing within apps.

- Focus on Platform Dominance: The law specifically targets companies with significant market share in digital distribution.

Geopolitical Stability and International Relations

CyberAgent's global reach, particularly in its burgeoning mobile gaming sector, makes it susceptible to geopolitical shifts. For instance, the ongoing trade disputes between major economic blocs could influence advertising budgets allocated to its digital advertising services, a significant revenue stream. In 2024, global digital ad spending was projected to reach over $700 billion, a market CyberAgent actively participates in.

Furthermore, any escalation in international tensions could disrupt the supply chains for the hardware and software components essential for its gaming and media operations. This could lead to increased costs or delays in product development and deployment. The semiconductor industry, crucial for gaming hardware, experienced significant supply chain volatility in recent years, a factor that remains a concern.

Access to key overseas markets for CyberAgent's popular titles like Granblue Fantasy and Uma Musume Pretty Derby could also be affected by evolving international relations and trade policies. Restrictions or new regulations in major gaming markets could directly impact revenue. The global mobile gaming market was valued at approximately $184 billion in 2024, highlighting the importance of international market access.

- Impact on Advertising: Geopolitical instability can lead to reduced global advertising expenditure, directly affecting CyberAgent's digital ad revenue.

- Supply Chain Disruptions: Tensions can disrupt the flow of essential technology components, increasing operational costs for CyberAgent.

- Market Access: International relations can dictate access to lucrative overseas gaming and media markets, influencing CyberAgent's growth potential.

- Regulatory Changes: Shifts in global trade policies may introduce new compliance burdens or market entry barriers for CyberAgent's international ventures.

Japan's government is actively shaping the digital advertising landscape through new regulations. These efforts aim to enhance transparency and consumer protection, potentially impacting CyberAgent's business models. For example, amendments to the Act on the Protection of Personal Information (APPI) expected in 2025 could alter how CyberAgent handles data.

The political climate in Japan is also fostering greater competition in digital markets. A law enacted in June 2024 mandates that major platforms must allow third-party app stores and payment systems. This could open new distribution channels for CyberAgent's mobile games, potentially lowering costs and increasing user reach.

Geopolitical factors also play a role, with global trade disputes potentially affecting advertising budgets and supply chains for CyberAgent's operations. In 2024, global digital ad spending was projected to exceed $700 billion, a market where CyberAgent is a key player.

| Political Factor | Impact on CyberAgent | Relevant Data/Event |

|---|---|---|

| Digital Advertising Regulation | Potential changes to data usage and ad content practices. | APPI review with anticipated amendments in 2025. |

| Promoting Digital Market Competition | New opportunities for mobile game distribution through open app stores. | Law enacted June 2024 mandating third-party app stores and payment systems. |

| Geopolitical Shifts & Trade Disputes | Influence on global ad spending and technology supply chains. | Global digital ad spending projected over $700 billion in 2024. |

What is included in the product

This CyberAgent PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the company, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within CyberAgent's operating landscape.

A CyberAgent PESTLE analysis provides a structured framework to identify and address external challenges, transforming potential threats into actionable strategies for business growth.

Economic factors

Japan's digital advertising market is on a significant upward trajectory. Projections indicate a 9.7% growth in 2025, with the market expected to reach a substantial USD 31.99 billion by 2035.

This robust expansion is largely fueled by the widespread adoption of mobile-first strategies and the increasing influence of social media platforms.

For CyberAgent, this sustained market growth presents a considerable revenue opportunity, directly benefiting its core advertising business segment.

Consumer spending on digital content and mobile games in Japan continues to show impressive strength. The mobile gaming market, a key area for CyberAgent, was valued at an estimated $16.77 billion in 2024. This figure is expected to climb to $20.9 billion by 2025, indicating a healthy growth trajectory.

This robust consumer demand, especially for popular genres like gacha-style games, directly translates into significant revenue for CyberAgent's gaming division. The sustained spending highlights a strong market appetite for interactive digital entertainment.

Japan's economic outlook for 2025 is cautiously optimistic, with growth projected between 1.1% and 1.2%. This follows a period of sluggish growth in 2024, but the potential for wage increases exceeding inflation could signal a 'nominal renaissance'.

This anticipated rise in real wages could translate to increased consumer spending power. For CyberAgent, a stronger consumer economy directly benefits its advertising and content services, as businesses are likely to increase marketing budgets when consumers have more disposable income.

Shift to Subscription-Based Models

The Japanese subscription market is experiencing a significant shift, with consumers increasingly favoring convenience and value. A prime example is the anticipated rise of 'Super Bundling' as a top consumer trend for 2025. This strategy aims to simplify subscription management by consolidating multiple services under a single, often discounted, offering.

This evolving consumer preference directly impacts companies like CyberAgent, particularly its video streaming service, AbemaTV. The 'Super Bundling' trend presents an opportunity for AbemaTV to refine its premium subscription tiers, potentially integrating them with other CyberAgent services to enhance user retention and attract new subscribers. Such a move could leverage CyberAgent's diverse portfolio, from gaming to advertising technology, creating synergistic value for consumers.

The financial implications are substantial. By offering bundled packages, CyberAgent can potentially increase average revenue per user (ARPU) and reduce churn rates. For instance, if a significant portion of AbemaTV's user base adopts bundled subscriptions, it could lead to a measurable uplift in recurring revenue. Recent market analyses suggest that Japanese consumers are actively seeking ways to streamline their digital spending, making bundled offerings particularly attractive. This could translate into a stronger competitive position for CyberAgent in the crowded digital content landscape.

- Consumer Trend: 'Super Bundling' projected as a top trend in Japan for 2025, simplifying subscription management.

- Impact on AbemaTV: Potential for enhanced premium offerings and new bundling opportunities with other CyberAgent services.

- Financial Benefit: Opportunity to increase ARPU and reduce churn by offering integrated, value-driven subscription packages.

- Market Context: Japanese consumers are increasingly looking for streamlined digital spending solutions.

Impact of Exchange Rates on International Revenue

CyberAgent's international mobile game revenue is directly influenced by currency fluctuations. For instance, if the Japanese Yen weakens against currencies like the US Dollar or Euro, revenue earned in those foreign currencies translates into a larger Yen amount for CyberAgent, positively impacting reported earnings.

Conversely, a strengthening Yen can diminish the Yen-equivalent value of overseas earnings. This dynamic is crucial for understanding the true profitability of their global operations.

Consider these points:

- Yen Weakening Benefit: A weaker Yen generally enhances the reported Yen value of CyberAgent's international game revenue.

- Yen Strengthening Impact: A stronger Yen can reduce the reported Yen value of overseas earnings.

- 2024/2025 Data Context: Throughout 2024 and into early 2025, the Yen has experienced periods of significant weakness against major currencies, potentially providing a tailwind for CyberAgent's international revenue reporting. For example, in early 2024, the Yen traded near multi-decade lows against the US Dollar, a trend that could continue to benefit companies with substantial foreign earnings.

Japan's economic growth is projected at 1.1% for 2025, a slight improvement from 2024. This growth is bolstered by potential wage increases that outpace inflation, suggesting a potential rise in consumer purchasing power.

For CyberAgent, this economic uptick could stimulate increased advertising spending from businesses eager to capture a more affluent consumer base.

The digital advertising market in Japan is expected to grow by 9.7% in 2025, reaching USD 31.99 billion by 2035, driven by mobile-first strategies and social media's influence.

This expansion directly benefits CyberAgent's core advertising business, offering significant revenue opportunities.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on CyberAgent |

|---|---|---|---|

| GDP Growth | Slightly below 1% | 1.1% - 1.2% | Potential for increased consumer spending and advertising budgets. |

| Digital Ad Market Growth | Strong | 9.7% | Direct revenue boost for CyberAgent's advertising segment. |

| Mobile Gaming Market Value | USD 16.77 billion | USD 20.9 billion | Increased revenue for CyberAgent's gaming division. |

Full Version Awaits

CyberAgent PESTLE Analysis

The preview shown here is the exact CyberAgent PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CyberAgent, providing actionable insights for strategic decision-making.

What you’re previewing here is the actual file, offering a detailed examination of CyberAgent's external landscape, ready for immediate download and application.

Sociological factors

Japanese consumers are rapidly shifting their media consumption to digital channels. In 2024, digital advertising spend in Japan is projected to reach ¥3.8 trillion, with video advertising and Connected TV (CTV) showing particularly robust growth, exceeding 20% year-over-year increases. This trend is further fueled by the increasing popularity of social media platforms such as Instagram, LINE, and TikTok, which are becoming primary sources of news and entertainment for a significant portion of the population.

CyberAgent's strategic investments in online content, exemplified by the continued growth of its AbemaTV platform, directly tap into these evolving viewing habits. AbemaTV's focus on live streaming and exclusive content has resonated with audiences seeking on-demand and interactive media experiences, mirroring the broader societal shift away from traditional broadcast television.

In Japan, mobile devices are the dominant gateway to the internet, with approximately 95% of internet users accessing it via smartphones as of early 2024. This pervasive mobile-first mentality directly fuels CyberAgent's core business, particularly its highly successful mobile gaming division, which consistently ranks among the top-grossing app publishers globally.

This deep integration of mobile into daily life means that digital advertising strategies must prioritize mobile optimization to capture consumer attention effectively. CyberAgent's digital advertising segment, a significant contributor to its revenue, thrives on this trend by developing campaigns tailored for seamless mobile experiences, driving user engagement and conversion rates.

Japan's mobile gaming landscape is notably shaped by the enduring popularity of gacha mechanics and Japanese RPGs, particularly among younger demographics. This cultural affinity for specific game types and monetization strategies presents a significant opportunity for companies like CyberAgent.

CyberAgent's strategic emphasis on developing social and gacha-style mobile games directly aligns with these deeply embedded consumer preferences and established revenue models within the Japanese market. For instance, in Q1 2024, CyberAgent reported significant revenue from its gaming segment, driven by titles that leverage these popular mechanics.

Demand for Personalized Experiences

Japanese consumers, particularly younger demographics, are increasingly expecting tailored interactions across all digital platforms. This demand for personalization is a significant sociological shift influencing how companies like CyberAgent must operate.

For CyberAgent, this means leveraging advanced technologies to understand individual user preferences deeply. For instance, in 2024, the global market for AI in marketing was projected to reach $32.7 billion, highlighting the investment in such capabilities. By 2025, this is expected to grow further, pushing companies to adopt AI for hyper-personalization.

This trend translates into specific strategies:

- AI-driven content recommendations: Offering users content that aligns with their viewing history and expressed interests.

- Personalized advertising: Delivering ads that are relevant to individual user demographics and online behavior, increasing click-through rates.

- Customized user interfaces: Adapting the look and feel of services based on user preferences to enhance usability and satisfaction.

Influence of Online Communities and Influencer Marketing

Online communities and influencer marketing remain potent forces in Japan's digital landscape, significantly impacting consumer behavior and brand reach. Influencer partnerships continue to demonstrate effectiveness, particularly with micro-influencers who foster deeper connections within niche audiences, a trend expected to persist through 2025.

For CyberAgent, a strategic focus on these channels offers a robust avenue for enhancing brand engagement and driving user acquisition across its advertising and gaming divisions. In 2024, the influencer marketing market in Japan was estimated to be worth over ¥500 billion, with a significant portion attributed to collaborations with creators who have strong community ties.

Leveraging these online communities and influencer collaborations can translate into tangible results:

- Enhanced Brand Visibility: Micro-influencers, often boasting engagement rates upwards of 5%, can introduce CyberAgent's offerings to highly targeted demographics.

- Improved User Acquisition: Authentic endorsements from trusted online personalities can directly drive downloads and active users for gaming titles.

- Community Building: Fostering active online communities around CyberAgent's brands can lead to increased loyalty and organic growth.

- Data-Driven Campaign Optimization: Tracking influencer performance and community sentiment allows for continuous refinement of marketing strategies.

Japanese society's increasing reliance on digital platforms for information and entertainment is a key sociological driver for CyberAgent. The projected ¥3.8 trillion digital ad spend in Japan for 2024, with video and CTV growing over 20% year-on-year, highlights this shift. This digital immersion fuels CyberAgent's growth by aligning with consumer preferences for on-demand and interactive media experiences, as seen with its AbemaTV platform.

Technological factors

AI and machine learning are revolutionizing ad tech in Japan, driving hyper-personalization and optimizing ad placements. CyberAgent's investment in these technologies is crucial, as seen in the projected growth of Japan's AI market, which was estimated to reach ¥3.7 trillion (approximately $25 billion USD) by 2023, with significant contributions from marketing applications.

These advancements allow for more sophisticated predictive analytics, enabling advertisers to anticipate consumer behavior and allocate budgets more effectively. CyberAgent's ad technology solutions can leverage this to boost campaign performance and deliver a higher return on investment for their clients, a trend supported by the increasing demand for data-driven marketing strategies.

The widespread adoption of smartphones and the ongoing rollout of 5G networks across Japan are fundamentally reshaping the landscape for mobile gaming and streaming services. This technological advancement means faster downloads and smoother streaming, directly benefiting platforms like CyberAgent's AbemaTV.

With 5G's reduced latency and increased bandwidth, the potential for immersive digital content, including augmented reality (AR) and virtual reality (VR) experiences, is significantly amplified. This directly enhances user engagement on services like AbemaTV and within the mobile gaming sector, where CyberAgent holds a strong presence.

As of early 2024, Japan's 5G network coverage continues to expand rapidly, with major carriers reporting significant subscriber growth in 5G-enabled devices. This trend is projected to continue through 2025, creating a fertile ground for innovative mobile content delivery and consumption.

The surge in Connected TV (CTV) and video advertising presents a significant opportunity for CyberAgent. As of 2024, the global CTV ad market is projected to reach over $30 billion, with Japan showing robust growth. This trend directly fuels CyberAgent's media segment, particularly AbemaTV, as advertisers allocate more budget to engaging video content.

Development of Immersive Technologies (AR/VR)

Augmented Reality (AR) and Virtual Reality (VR) are experiencing robust growth, particularly within Japan's dynamic gaming sector. In 2024, the VR gaming market alone was valued at an impressive $1.79 billion. These advanced immersive technologies are opening up entirely new frontiers for how games are conceived and how businesses, including advertising, can engage with consumers.

For a company like CyberAgent, this technological evolution presents a fertile ground for innovation. By integrating AR and VR, CyberAgent can develop novel gaming experiences and create more engaging advertising campaigns, potentially capturing a larger share of this expanding market.

- Market Growth: VR gaming in Japan reached $1.79 billion in 2024, highlighting significant consumer adoption.

- Innovation Avenues: AR/VR offer new platforms for game development and advertising strategies.

- Opportunity for CyberAgent: Potential to enhance existing offerings and create new revenue streams through immersive tech.

Cloud Computing and Data Infrastructure

The digital landscape's evolution, particularly in data-driven marketing and high-volume media streaming, places a premium on advanced cloud computing and data infrastructure. CyberAgent's operational success hinges on its capacity to manage and process substantial data volumes for its advertising technology and media platforms. This capability is fundamental for ensuring scalability, optimizing performance, and maintaining robust security measures.

The global cloud computing market is projected to reach approximately $1.3 trillion by 2025, underscoring the critical nature of this infrastructure. For CyberAgent, this means leveraging cloud services for efficient data storage, real-time analytics, and seamless content delivery to its user base. The company's investment in scalable data infrastructure directly impacts its ability to innovate and compete in the rapidly evolving digital advertising and media sectors.

- Market Growth: The global cloud computing market is expected to grow significantly, reaching an estimated $1.3 trillion by 2025.

- Data Processing Needs: CyberAgent's ad tech and media platforms require robust infrastructure to handle massive data streams for targeted advertising and content delivery.

- Scalability and Performance: Efficient data infrastructure is key to scaling operations and ensuring high performance for millions of users.

- Security Imperative: Protecting vast amounts of user and client data is paramount, necessitating secure and resilient cloud solutions.

AI and machine learning are transforming advertising in Japan, enabling personalized campaigns and optimizing ad delivery. CyberAgent's focus on these technologies is vital, especially as Japan's AI market was projected to hit ¥3.7 trillion (around $25 billion USD) by 2023, with marketing applications being a key driver.

The expansion of 5G networks and smartphone usage in Japan is fundamentally altering mobile gaming and streaming. This means faster, smoother experiences for platforms like CyberAgent's AbemaTV, with 5G's reduced latency enhancing engagement in AR/VR content and gaming.

The growing Connected TV (CTV) and video advertising markets, with the global CTV ad market exceeding $30 billion in 2024, directly benefit CyberAgent's media segment, particularly AbemaTV, as more ad spend shifts to video.

| Technology | 2024/2025 Relevance for CyberAgent | Market Data/Projections |

|---|---|---|

| AI/Machine Learning | Hyper-personalization in ads, campaign optimization | Japan AI Market: Projected ¥3.7 trillion by 2023 |

| 5G Networks | Enhanced mobile gaming & streaming (AbemaTV), AR/VR | Rapidly expanding coverage and subscriber growth in 2024/2025 |

| CTV/Video Advertising | Growth driver for AbemaTV | Global CTV Ad Market: Projected >$30 billion in 2024 |

| AR/VR | Immersive gaming experiences, new advertising formats | VR Gaming Market (2024): Valued at $1.79 billion |

| Cloud Computing | Scalable data infrastructure for ad tech & media | Global Cloud Market: Projected ~$1.3 trillion by 2025 |

Legal factors

Upcoming amendments to Japan's Act on the Protection of Personal Information (APPI) in 2025 are set to reshape data privacy. These changes may ease reporting obligations for organizations with specific certifications, potentially streamlining compliance for companies like CyberAgent. However, new stipulations regarding the use of personal data for AI training without explicit consent will require careful navigation.

CyberAgent needs to proactively assess its data collection and utilization strategies across its diverse business segments, from advertising to entertainment. Ensuring adherence to these evolving APPI regulations is crucial to avoid potential penalties and maintain user trust in its services, especially as data-driven AI development accelerates.

Laws such as Japan's Act against Unjustifiable Premiums and Misleading Representations directly impact CyberAgent's online advertising, requiring transparency and preventing deceptive practices. Failure to comply can result in fines and reputational damage.

The Provider Liability Limitation Act also shapes CyberAgent's content operations, influencing how it handles user-generated content and potential liabilities for third-party information shared on its platforms.

Japan's gaming sector is shaped by laws like the Payment Services Act and the Amusement Business Act. These regulations are crucial for game publishers, influencing how they structure monetization, particularly with mechanics such as gacha, and ensuring consumer safety. CyberAgent's mobile gaming operations must navigate these specific legal requirements.

Anti-Monopoly and Digital Platform Competition Law

A significant development in anti-monopoly law, effective June 2024, targets competition within smartphone software ecosystems. This legislation mandates that major platform operators must permit third-party app stores and alternative payment systems by the close of 2025. This regulatory shift is poised to reshape the digital landscape, potentially lowering distribution expenses and enhancing operational flexibility for companies like CyberAgent involved in mobile gaming.

The implications for CyberAgent are particularly noteworthy as the company navigates the mobile game market. By opening up app distribution channels and payment gateways, this law could dismantle existing barriers to entry and reduce reliance on a single platform's fee structure. Such changes might foster a more competitive environment, allowing CyberAgent to explore new revenue streams and cost-saving opportunities. For instance, if a platform previously charged a 30% commission on in-app purchases, alternative payment options could offer significantly lower rates, directly impacting profitability.

- New Law Impact: Smartphone software competition laws passed in June 2024 require major platforms to allow outside app stores and payment options by end of 2025.

- Potential Benefits for CyberAgent: Reduced distribution costs and increased flexibility for its mobile game business are anticipated.

- Market Dynamics: This could foster a more competitive app marketplace, potentially lowering user acquisition costs and increasing revenue share for developers.

- Financial Ramifications: A reduction in platform fees, which can range from 15% to 30% for app sales and in-app purchases, could lead to substantial margin improvements for CyberAgent's mobile game division.

Intellectual Property Rights Protection

Protecting intellectual property (IP) is paramount for CyberAgent, particularly concerning its popular mobile games and exclusive content broadcast on AbemaTV. Strong legal protections for copyrights, trademarks, and robust anti-piracy measures are essential to secure its valuable creative assets and ensure effective monetization strategies. In 2023, Japan, CyberAgent's primary market, continued to strengthen its IP enforcement mechanisms, offering a more secure environment for digital content creators.

Legal frameworks are critical for CyberAgent to prevent unauthorized use and distribution of its intellectual property. This includes defending against copyright infringement for its game titles and original programming, as well as protecting its brand identity through trademark law. The company's reliance on digital distribution models makes these legal safeguards indispensable for maintaining revenue streams and market position.

- Copyright Enforcement: Safeguarding original game code, character designs, and video content from unauthorized replication.

- Trademark Protection: Ensuring brand names and logos associated with games and AbemaTV are legally protected against imitation.

- Anti-Piracy Measures: Implementing legal strategies to combat the illegal distribution of CyberAgent's digital content.

- Licensing Agreements: Structuring and enforcing agreements for the use of IP in collaborations and merchandise.

Japan's evolving legal landscape presents both opportunities and challenges for CyberAgent. Upcoming amendments to the Act on the Protection of Personal Information in 2025, while potentially easing compliance for certified firms, will introduce stricter rules for AI training data, requiring careful data governance. Furthermore, new anti-monopoly laws effective June 2024 mandate that major smartphone platforms allow third-party app stores and alternative payment systems by the end of 2025, a move that could significantly reduce CyberAgent's distribution costs and increase flexibility in its mobile gaming operations.

CyberAgent must also navigate regulations like the Act against Unjustifiable Premiums and Misleading Representations, ensuring transparency in its advertising practices to avoid penalties. The Provider Liability Limitation Act influences its handling of user-generated content, while specific laws like the Payment Services Act and Amusement Business Act govern its gaming monetization strategies, particularly for gacha mechanics.

Intellectual property protection remains a cornerstone, with Japan's strengthened IP enforcement in 2023 providing a more secure environment for CyberAgent's game titles and AbemaTV content. This legal framework is vital for preventing unauthorized use and distribution, safeguarding revenue streams and market position.

Environmental factors

CyberAgent, like many large internet firms, faces growing pressure to showcase its dedication to environmental sustainability. This involves transparently reporting on its ecological footprint, including CO2 emissions generated by its data centers, a critical aspect of its corporate social responsibility.

In 2023, the global tech industry's energy consumption, largely driven by data centers, continued to be a significant environmental concern, with estimates suggesting it accounts for a substantial portion of global electricity usage. CyberAgent's proactive engagement in reducing its carbon footprint through energy-efficient technologies and renewable energy sourcing is therefore paramount for its long-term viability and stakeholder trust.

CyberAgent's digital services, from its ad tech platforms to the popular AbemaTV streaming service and mobile game infrastructure, are powered by data centers that are major energy consumers. This significant energy demand is a key environmental consideration for the company.

As of 2024, the global data center industry's energy consumption is estimated to be around 1-1.5% of total global electricity consumption, a figure that continues to rise with increasing digital activity. For companies like CyberAgent, this translates to a substantial operational footprint and a growing imperative to address sustainability.

Reducing the environmental impact of this energy consumption is becoming a critical focus for corporate sustainability initiatives. CyberAgent, like many in the tech sector, is likely exploring strategies to optimize energy efficiency and potentially incorporate renewable energy sources for its data center operations to mitigate its environmental impact and meet evolving stakeholder expectations.

CyberAgent's technology infrastructure and employee device usage contribute to electronic waste. As of 2024, global e-waste generation reached an estimated 62 million metric tons, a figure projected to grow. Implementing circular economy principles, like extending hardware lifespans and prioritizing refurbishment over replacement, can significantly mitigate this impact.

By focusing on responsible procurement and end-of-life management for electronic equipment, CyberAgent can improve its environmental standing. For instance, adopting leasing models for IT hardware or partnering with certified e-waste recyclers aligns with these principles. This approach not only addresses environmental concerns but also offers potential cost savings through efficient resource utilization.

Stakeholder Pressure for Green Initiatives

Investors are increasingly scrutinizing environmental, social, and governance (ESG) performance. For instance, in early 2024, global ESG assets were projected to reach $50 trillion by 2025, highlighting the significant capital flow influenced by sustainability. This trend means CyberAgent faces mounting pressure from shareholders to demonstrate tangible progress in reducing its carbon footprint and adopting greener operational strategies.

Consumers are also voting with their wallets, favoring brands that align with their environmental values. A 2024 report indicated that over 70% of consumers consider sustainability when making purchasing decisions. CyberAgent’s proactive stance on environmental initiatives can therefore directly translate into improved customer loyalty and market share, especially within its digital advertising and media segments where brand perception is paramount.

Furthermore, employee expectations are shifting, with a growing demand for workplaces that prioritize sustainability. Companies with strong environmental commitments are more attractive to top talent. CyberAgent’s commitment to green practices can bolster its employer brand, aiding in the recruitment and retention of skilled professionals who are motivated by purpose-driven work.

- Investor Scrutiny: Growing demand for ESG integration in investment portfolios, with ESG assets expected to hit $50 trillion by 2025.

- Consumer Preference: Over 70% of consumers in 2024 prioritize sustainability in purchasing decisions.

- Talent Attraction: Companies with robust environmental initiatives are more appealing to skilled professionals.

Climate Change Impact on Business Continuity

While not a direct cyber threat, the escalating impacts of climate change, particularly the increased frequency of extreme weather events, pose a significant risk to business continuity. For CyberAgent, this could translate into disruptions of critical internet infrastructure or energy supply chains, essential for their online services. For instance, the World Meteorological Organization reported that 2023 was the warmest year on record, with global average temperatures 1.45°C above pre-industrial levels, underscoring the growing intensity of such events.

To mitigate these environmental risks, CyberAgent must proactively develop and refine business continuity plans. These plans should incorporate strategies to ensure uninterrupted service delivery even when faced with environmental challenges.

- Increased Frequency of Extreme Weather: Events like severe storms, floods, and heatwaves can damage data centers, disrupt power grids, and impact network connectivity.

- Supply Chain Vulnerabilities: Climate change can affect the availability and cost of hardware components and the logistics required for their delivery.

- Energy Grid Instability: Reliance on a stable energy supply is paramount; climate-induced strain on power grids could lead to outages affecting CyberAgent's operations.

- Need for Resilient Infrastructure: Investing in geographically diversified data centers and robust backup power solutions becomes crucial for maintaining service uptime.

CyberAgent's environmental impact is primarily linked to its data center energy consumption and e-waste generation. The company must address these to meet growing demands for sustainability from investors, consumers, and employees.

As of 2024, the global data center industry consumes about 1-1.5% of global electricity, a figure expected to rise. CyberAgent's commitment to energy efficiency and renewables is crucial for mitigating this footprint.

Global e-waste reached an estimated 62 million metric tons in 2024, highlighting the need for CyberAgent to implement circular economy principles for its hardware.

Investor focus on ESG is intensifying, with global ESG assets projected to reach $50 trillion by 2025, making CyberAgent's environmental performance a key factor for capital attraction.

PESTLE Analysis Data Sources

Our CyberAgent PESTLE Analysis is meticulously constructed using a blend of public government data, reputable industry research, and leading economic and technological forecasting reports. This ensures a comprehensive and accurate understanding of the macro-environmental factors impacting the digital landscape.