CyberAgent Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CyberAgent Bundle

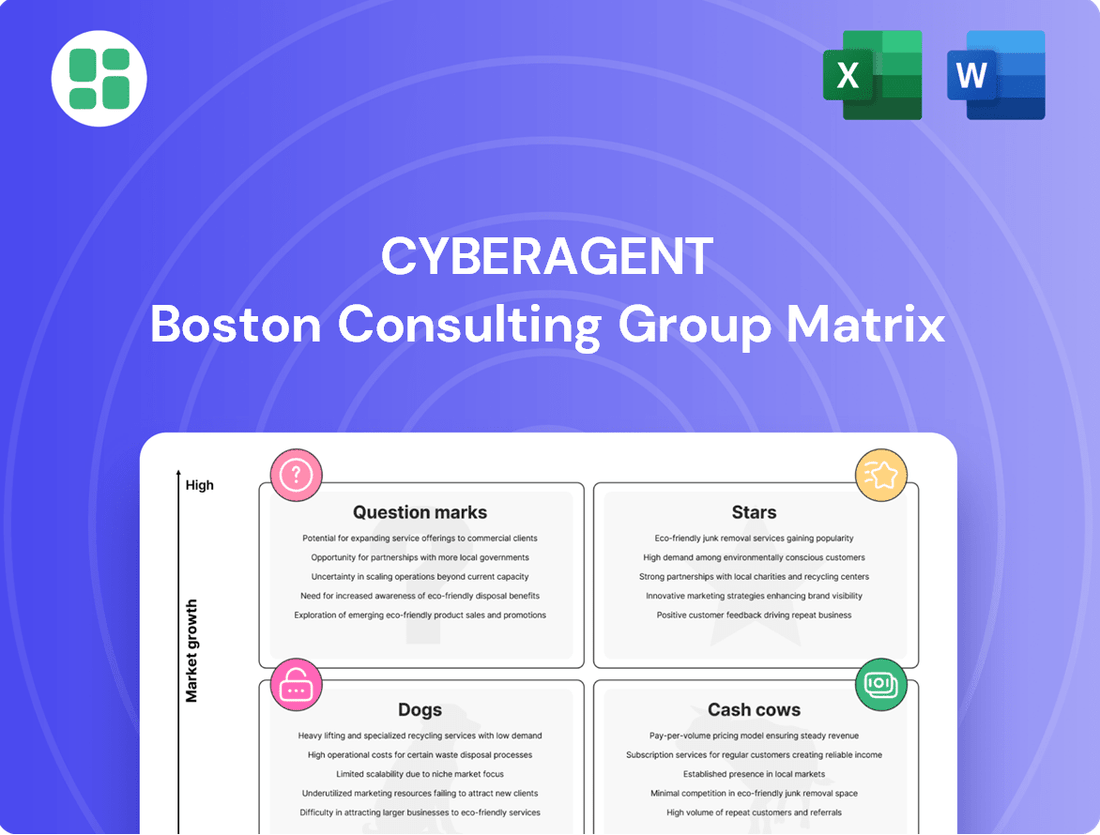

Curious about CyberAgent's strategic product positioning? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges.

To truly understand where CyberAgent's innovations stand as Stars, Cash Cows, Dogs, or Question Marks, and to unlock actionable insights for your own business, dive deeper.

Purchase the full BCG Matrix for a comprehensive breakdown and strategic roadmap to optimize your portfolio and investment decisions.

Stars

AbemaTV is a significant player in Japan's expanding video streaming sector, a market expected to grow at a robust 22.50% CAGR between 2025 and 2034, ultimately reaching an estimated USD 60,908.02 million by 2034.

The platform has seen impressive user adoption, with its app surpassing 11 million monthly active users by March 2025, highlighting its strong appeal and growing reach within this dynamic industry.

Its emphasis on live programming, particularly in sports and news, is a key differentiator that positions AbemaTV to capitalize on continued market growth and user engagement.

Despite a slight revenue dip in the first half of 2024 for the Japanese mobile gaming market, attributed to the yen's weakness, its global standing as the third-largest remains robust, with projections indicating a healthy 10.3% CAGR from 2025 to 2033.

CyberAgent, via its Cygames arm, has a proven track record of creating successful original IPs, a strategy that continues to pay off.

Recent launches such as 'Gakuen Idolmaster' and 'Jujutsu Kaisen Parade' have demonstrated strong performance, illustrating the potential for new, popular titles to capture significant market share within this competitive landscape.

CyberAgent is heavily investing in AI to boost its digital advertising effectiveness, a key part of its business. The Japanese digital ad market is projected to expand by 9.7% in 2025, with video ads leading the charge.

Their innovative 'Kiwami Prediction Series' uses generative AI to automatically create compelling ad copy and visuals. This technological advantage positions CyberAgent’s AI-driven advertising solutions as a strong contender in a rapidly expanding market.

Programmatic Advertising Offerings

Programmatic advertising is a significant growth engine for the internet advertising market, and CyberAgent is a major player. In 2023, the global programmatic ad spending was projected to reach over $375 billion, showcasing the immense scale of this sector. CyberAgent's sales in this segment have not only kept pace but have actually grown faster than the overall market, demonstrating their increasing dominance. This strong performance is fueled by their ongoing commitment to enhancing their technological capabilities and optimizing their organizational structure, reinforcing their position as a Star in the BCG matrix.

CyberAgent's programmatic advertising offerings are strategically positioned for continued success. Their ability to consistently outperform market growth rates in this high-potential area highlights their competitive advantage.

- CyberAgent's programmatic segment growth outpaces the overall internet advertising market.

- The company is heavily invested in technological advancements and organizational improvements.

- This strong performance solidifies their Star status within the BCG matrix.

Global IP Expansion in Gaming

CyberAgent's new medium-to-long-term strategy is heavily focused on developing globally successful intellectual properties (IPs) for its gaming division. This approach aims to tap into high-growth international markets, moving beyond its strong domestic performance in Japan. Cygames, a key subsidiary, is set to launch over six new games in 2025, including localized versions of existing popular titles, signaling a significant push for global reach.

The localization of 'Umamusume Pretty Derby' serves as an early indicator of this strategy, showcasing high-growth potential in new territories. While initial market share in these overseas markets might be low, these ventures are positioned as potential future stars within CyberAgent's portfolio. This global IP expansion is crucial for diversifying revenue streams and capturing a larger share of the international gaming market, which is projected to reach over $200 billion by 2025.

- Global IP Focus: CyberAgent's strategy prioritizes creating games with international appeal.

- Cygames' Expansion: Over six new games planned for 2025, including global releases.

- Localization Efforts: 'Umamusume Pretty Derby' localization exemplifies the strategy to enter new markets.

- Market Potential: Targeting high-growth international markets with the aim of replicating domestic success.

CyberAgent's programmatic advertising segment is a standout performer, demonstrating growth that outpaces the broader internet advertising market. This robust expansion is driven by significant investments in technology and operational enhancements.

Their commitment to AI, exemplified by the 'Kiwami Prediction Series,' further solidifies their competitive edge in the digital advertising space. These factors collectively position their programmatic advertising as a Star in the BCG matrix.

The company's strategic focus on developing globally appealing intellectual properties (IPs) for its gaming division, with Cygames planning over six new game launches in 2025, also represents a significant growth opportunity. These international ventures, like the localization of 'Umamusume Pretty Derby,' are poised to become future Stars by tapping into the projected over $200 billion global gaming market by 2025.

| Segment | Market Growth | CyberAgent Performance | BCG Status |

| Programmatic Advertising | High (9.7% in 2025 for Japanese digital ads) | Outperforming market | Star |

| Global Gaming IP Development | High (>$200 billion by 2025 globally) | New launches, localization efforts | Potential Star |

What is included in the product

CyberAgent's BCG Matrix offers a strategic overview of its business units, categorizing them by market share and growth potential.

A clear CyberAgent BCG Matrix visualizes each business unit's strategic position, relieving the pain of unclear resource allocation.

Cash Cows

CyberAgent's core digital advertising business is a powerhouse, generating approximately half of its total revenue and solidifying its position as a major player in Japan's digital ad market. This segment, characterized by its high market share, functions as a cash cow, benefiting from established platform relationships and a loyal client base that ensures consistent profitability and market dominance.

CyberAgent’s portfolio includes established mobile game titles, often referred to as ‘catalogue titles,’ which serve as significant cash cows. Games like ‘Monster Strike’ and ‘The Idolmaster Cinderella Girls: Starlight Stage’ have been operating for many years, demonstrating the company's ability to create enduring original intellectual property.

These long-running titles, while experiencing slower growth compared to new releases, consistently generate substantial revenue. Their large, dedicated player bases mean they require less ongoing investment to maintain profitability, providing a reliable and stable cash flow for CyberAgent. For example, in fiscal year 2023, CyberAgent's game segment revenue was approximately ¥229.5 billion, with a significant portion attributed to these mature titles.

CyberAgent's ad technology solutions are a cornerstone of its digital advertising segment, holding a strong market position in Japan. These offerings are mature, having been developed and optimized over many years, leading to a substantial market share within the ad-tech industry. For instance, CyberAgent's revenue from its internet advertising business, which includes these solutions, reached ¥277.7 billion in the fiscal year ending September 2023, showcasing their significant contribution.

Ameba Blog Service

Ameba Blog Service, a long-standing platform operated by CyberAgent, represents a stable component within the company's media business. Despite the blog market's maturity and typically low growth rates, Ameba leverages its substantial established user base and extensive content library to generate a consistent, albeit modest, revenue. This longevity and strong brand recognition in Japan solidify its position as a reliable, low-maintenance cash generator for CyberAgent.

In 2024, CyberAgent's media segment, which includes Ameba, continued to be a significant contributor to overall revenue. While specific segment breakdowns are not always detailed, the stability of established platforms like Ameba is crucial for offsetting investments in newer, higher-growth areas. For example, CyberAgent reported total revenue of ¥630.8 billion for the fiscal year ended September 2023, with its media business consistently demonstrating resilience.

- Ameba's Role: Acts as a mature, stable revenue generator within CyberAgent's media portfolio.

- Market Position: Benefits from a mature market with established brand recognition in Japan.

- Revenue Contribution: Provides a consistent, low-growth but reliable income stream.

- Strategic Value: Supports investment in newer, high-growth ventures by offering financial stability.

WINTICKET (Internet Betting Service)

WINTICKET, CyberAgent's internet voting service for bicycle and auto races, operates within the company's media segment. It's a mature product, contributing steadily to revenue. While precise growth figures for WINTICKET itself aren't publicly detailed, its established presence in a specific market implies a strong, stable position.

As a Cash Cow, WINTICKET likely holds a high market share in its niche. This maturity means it generates consistent cash flow, a vital component for supporting CyberAgent's investments in other, more rapidly expanding ventures. Its reliable earnings help balance the portfolio.

- Established Market Presence: WINTICKET serves a dedicated user base for bicycle and auto race betting.

- Revenue Contribution: It's a stable contributor to CyberAgent's media segment revenue.

- Cash Flow Generation: Its mature status suggests consistent cash flow, supporting other business areas.

- Strategic Role: Acts as a reliable income source, offsetting investments in growth-oriented projects.

CyberAgent's established digital advertising business and mature mobile games, like Monster Strike, are prime examples of its cash cows. These segments benefit from high market share and loyal customer bases, ensuring consistent profitability. For instance, the game segment generated approximately ¥229.5 billion in fiscal year 2023, with these long-standing titles forming a significant, stable revenue base.

The ad technology solutions and Ameba Blog Service also function as cash cows, leveraging their established market positions and user bases for reliable income. CyberAgent's internet advertising business, including these solutions, brought in ¥277.7 billion in fiscal year 2023. These mature offerings provide essential financial stability, allowing for investment in newer, high-growth areas.

WINTICKET, an internet voting service, also contributes as a cash cow within the media segment. Its established presence in a niche market generates steady revenue, balancing the company's overall portfolio. These cash cows are crucial for funding CyberAgent's expansion and innovation efforts.

| Business Segment | Cash Cow Example | FY2023 Revenue (Approx.) | Key Characteristic |

| Digital Advertising | Ad Technology Solutions | ¥277.7 billion (Internet Advertising) | High Market Share, Mature Offering |

| Games | Catalogue Titles (e.g., Monster Strike) | ¥229.5 billion (Games Segment) | Enduring IP, Loyal Player Base |

| Media | Ameba Blog Service | N/A (Included in Media Segment) | Established User Base, Brand Recognition |

| Media | WINTICKET | N/A (Included in Media Segment) | Niche Market Dominance, Stable Contributor |

What You See Is What You Get

CyberAgent BCG Matrix

The CyberAgent BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This ensures you know exactly what you're getting: a professionally formatted, analysis-ready report with no hidden surprises or watermarks. You can confidently use this preview to assess the quality and relevance of the strategic insights before committing. Upon purchase, you'll gain instant access to this comprehensive tool, ready for your immediate business planning and decision-making needs.

Dogs

CyberAgent's Q1 FY2025 results highlighted a downturn in its game sector, with sales and operating profit falling. This dip was largely due to the underperformance of its older, catalogue game titles.

These catalogue games, once popular, now struggle to maintain player interest and revenue in the fast-paced mobile gaming arena. They represent a drain on resources, offering little in terms of growth or significant cash generation.

Outdated ad formats and platforms represent CyberAgent's potential Dogs. As the digital advertising landscape rapidly shifts from static display ads to dynamic video and social media content, any legacy offerings that haven't kept pace are likely to see declining market share and minimal growth. For instance, in 2024, while video ad spending continued its ascent, projected to reach over $100 billion globally, traditional banner ad revenue saw a much slower, if any, increase.

These underperforming assets would be categorized as Dogs within the CyberAgent BCG Matrix. They consume valuable resources and development time but offer little in terms of competitive returns or future potential. CyberAgent would need to carefully assess whether to divest these assets or attempt a turnaround, though the latter is often challenging in fast-moving digital markets where innovation is key.

Within CyberAgent's diverse digital offerings, some services might be classified as Non-core, Stagnant. These are likely older platforms or niche digital services that have seen minimal user growth and hold a small market share. For instance, a legacy advertising platform that hasn't adapted to newer programmatic buying methods could fall into this category.

These stagnant services often represent a drain on resources without contributing significantly to overall revenue. CyberAgent's 2023 financial reports, for example, might show certain smaller digital segments with declining revenue streams or flat growth rates, indicating a lack of market traction. Such offerings are often prime candidates for divestiture or a strategic pivot to avoid further investment without clear return potential.

Less Popular Niche Media Content

Within CyberAgent's broad media landscape, certain niche content or specialized channels might be classified as Dogs in the BCG Matrix. These are offerings that operate in low-growth market segments and haven't captured a significant audience. For instance, a channel focused on a highly specific hobby with limited appeal or a niche news service in a saturated market could fall into this category.

These Dog assets typically require minimal investment to maintain, as their low market share and low growth potential don't warrant significant capital allocation. CyberAgent, known for its diverse digital offerings, likely has some of these less popular niche media content pieces. While AbemaTV is a Star and Ameba is a Cash Cow, these niche areas represent a different strategic challenge.

- Low Market Share: These niche content areas likely have a small, dedicated but not growing, user base.

- Low Market Growth: The specific sub-segments of the media market they operate in are not expanding significantly.

- Minimal Investment: CyberAgent would likely maintain these assets with minimal operational costs, avoiding substantial reinvestment.

- Potential Divestment: In some cases, CyberAgent might consider divesting these non-core, underperforming assets if they don't align with future strategic goals.

Early-stage Ventures without Traction

CyberAgent's Investment Development segment, a key area for its venture capital activities, often encounters early-stage ventures that, despite initial promise, struggle to gain market traction. These ventures, characterized by low market share and diminishing growth prospects, are categorized as 'Dogs' within the BCG matrix framework. Their potential for future success is significantly limited, necessitating careful consideration for strategic adjustments or divestment.

For instance, if an early-stage venture within CyberAgent's portfolio, initially projected for rapid expansion, fails to capture a meaningful market share by mid-2024 and shows no signs of accelerating growth, it would be classified as a Dog. Such a scenario highlights the inherent risks in venture capital, where a significant portion of investments may not yield the anticipated returns. By 2024, many venture capital firms, including those with segments like CyberAgent's, are re-evaluating portfolios to identify underperforming assets.

- Low Market Share: Ventures in this category typically hold a minimal percentage of their target market, often below 5% by 2024, indicating a failure to gain competitive footing.

- Stagnant or Declining Growth: Despite initial high expectations, these ventures exhibit minimal or negative year-over-year revenue growth in the 2024 fiscal year.

- High Risk of Discontinuation: Due to their poor performance and limited future potential, these ventures are prime candidates for being phased out or sold off to minimize further capital expenditure.

- Need for Strategic Re-evaluation: A thorough assessment of the market, competitive landscape, and internal execution is required to determine if any turnaround strategy is feasible or if discontinuation is the more prudent path.

CyberAgent's "Dogs" represent business units or products with low market share and low growth potential. These are often legacy offerings that have failed to adapt to market changes or new ventures that haven't gained traction. For example, older, less popular game titles within their portfolio would fit this description, as seen with the Q1 FY2025 results where catalogue games underperformed.

These segments consume resources without generating significant returns, posing a challenge for resource allocation. In 2024, the digital advertising landscape saw continued growth in video, while static banner ads experienced stagnation, highlighting how outdated formats can become Dogs.

CyberAgent's strategy likely involves minimizing investment in these Dog categories or considering divestment to reallocate capital to more promising areas. The company's venture capital segment also faces the risk of early-stage investments becoming Dogs if they fail to achieve market share or growth targets by mid-2024.

Such underperforming assets require a critical evaluation to determine their future. For instance, a niche media channel with a small, non-expanding audience would be a Dog, requiring minimal upkeep and potentially being sold off if it doesn't align with strategic goals.

| Category | Market Share | Market Growth | CyberAgent Example | Strategic Implication |

| Dogs | Low | Low | Underperforming catalogue games, legacy ad formats | Minimize investment, potential divestment |

| Dogs | Low | Low | Niche media content with limited appeal | Low operational cost, consider divestment |

| Dogs | Low | Low | Early-stage ventures failing to gain traction | High risk of discontinuation or sale |

Question Marks

CyberAgent is actively introducing new mobile game intellectual properties (IPs), with notable examples like 'SAKAMOTO DAYS Dangerous Puzzle' and the 'Chiikawa Smartphone App' slated for April 2025. These ventures enter a dynamic and expanding mobile gaming sector, yet at their inception, they typically hold a modest share of the market.

The trajectory of these new releases is inherently uncertain, demanding substantial investment in marketing and ongoing development. The objective is to cultivate a substantial user base, with the ultimate goal of transforming these initial Question Marks into high-performing Stars within CyberAgent's portfolio.

AbemaTV's introduction of a Premium with Ads plan mirrors strategies seen in the broader streaming industry, aiming to capture a wider audience by offering a lower price point. This move positions AbemaTV to potentially gain market share in the rapidly expanding streaming landscape, though its specific segment is still maturing.

While the overall streaming market is experiencing robust growth, the monetization strategy of premium tiers with advertisements is a newer avenue for AbemaTV. As of early 2024, the precise market share AbemaTV holds within this developing ad-supported premium streaming sub-segment is still being established, indicating a high-potential but unproven venture.

CyberAgent's AI-driven new business development, distinct from its core advertising, highlights its aggressive push into emerging tech. Their July 2024 release of an in-house Japanese large-scale language model (LLM) exemplifies this, targeting high-growth areas with substantial investment but currently low market penetration.

These ventures, while experimental, represent a strategic move into nascent technological frontiers. For instance, their commitment to AI research and development, with significant capital allocation in 2024, aims to unlock new revenue streams beyond their established digital advertising forte.

International Expansion of Media Content (e.g., anime)

CyberAgent's involvement in anime, like the upcoming 'The Summer Hikaru Died' on Netflix and 'Project M,' positions it within the high-growth, high-investment category of Stars or Question Marks in a BCG matrix. The global anime market is booming, with projections indicating continued strong growth. For instance, the Japanese animation market was valued at approximately ¥2.9 trillion (around $19 billion USD) in 2023, and this is expected to expand further.

While CyberAgent is actively participating, its direct international media distribution or content licensing market share might be relatively small compared to established global players. This suggests a need for substantial investment to capture a significant portion of this rapidly expanding international demand.

- High Growth Potential: The global demand for Japanese anime continues to surge, offering significant opportunities for expansion.

- Investment Needs: To compete effectively and gain substantial international traction, CyberAgent will likely need to make considerable investments in content production, marketing, and distribution channels.

- Market Position: Despite growing involvement, CyberAgent's current international market share in direct media distribution or licensing may be modest, classifying its anime ventures as potential Question Marks requiring strategic focus.

- Strategic Importance: These ventures represent a key area for CyberAgent to leverage the global popularity of anime, aiming to transition them into Stars through strategic resource allocation and market penetration.

Specific Niche Mobile Game Genres with Emerging Popularity

The mobile gaming landscape is constantly evolving, with niche genres like otome games and titles featuring innovative gameplay mechanics showing significant emerging popularity. CyberAgent's strategic investment in these less saturated, high-potential areas, where they may not yet hold a dominant position, aligns with the question mark phase of the BCG matrix.

These specific niche genres, while currently possessing limited market share, represent a significant growth opportunity. For instance, the global mobile game market was valued at approximately $91.2 billion in 2023, with projections indicating continued expansion, and these niche segments are poised to capture a portion of that growth.

- Emerging Genres: Otome games and titles with unique gameplay mechanics are gaining traction.

- Market Potential: These niches represent high-growth potential within the broader mobile gaming market.

- Strategic Investment: CyberAgent's focus on these areas signifies a move to capitalize on future market shifts.

- BCG Alignment: This strategy places these ventures in the question mark category, requiring careful investment and analysis.

CyberAgent's new mobile game IPs, like 'SAKAMOTO DAYS Dangerous Puzzle' and the 'Chiikawa Smartphone App' (April 2025), are positioned in a growing market but start with low market share.

These ventures require significant investment for user acquisition and development, aiming to elevate them from Question Marks to Stars.

The company's AI-driven initiatives, including a July 2024 large-scale language model, represent high-growth potential but currently low market penetration, demanding substantial capital.

Similarly, CyberAgent's anime projects, such as 'The Summer Hikaru Died' (Netflix), tap into a booming global market valued at approximately $19 billion USD in 2023, but their international market share is still developing.

| Venture Type | Market Growth | Current Market Share | Investment Needs | BCG Status |

|---|---|---|---|---|

| New Mobile Games | High | Low | High | Question Mark |

| AI Language Models | Very High | Very Low | Very High | Question Mark |

| Anime Distribution | High | Low to Moderate | High | Question Mark |

BCG Matrix Data Sources

Our CyberAgent BCG Matrix leverages comprehensive data, including financial performance reports, cybersecurity market trend analyses, and threat intelligence gathered from industry-leading sources.