CyberAgent Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CyberAgent Bundle

Unlock the strategic blueprint behind CyberAgent's diversified business model. This comprehensive Business Model Canvas details how they leverage advertising, media, and gaming to create a powerful ecosystem. Discover their key partners, revenue streams, and customer relationships to understand their sustained growth.

Partnerships

CyberAgent's digital advertising business thrives on its relationships with a broad spectrum of advertisers, encompassing everything from major corporations to smaller enterprises, as well as advertising agencies. These collaborations are fundamental to their digital advertising segment, acting as the primary source of demand for CyberAgent's ad technology and media inventory. In 2024, the digital advertising market continued its robust growth, with companies like CyberAgent leveraging these partnerships to secure a consistent stream of advertising revenue and a wide array of campaign opportunities.

CyberAgent's media ventures, including AbemaTV, rely heavily on collaborations with content creators and production houses. These partnerships are crucial for securing a diverse and engaging content library. For instance, licensing agreements for popular anime, dramas, news broadcasts, and live sports events are fundamental to their strategy.

These collaborations directly enhance the appeal of their platforms, drawing in and keeping a wide range of viewers. In 2023, CyberAgent's advertising segment, which includes AbemaTV, saw significant revenue, underscoring the value of these content partnerships in attracting and monetizing audiences.

CyberAgent frequently collaborates with external game developers, both in Japan and abroad, for co-development, publishing, and distribution within the mobile gaming industry. These partnerships are crucial for broadening their game offerings and accessing diverse genres and player bases.

In 2023, CyberAgent's game segment revenue reached approximately ¥190.3 billion, underscoring the significance of these developer alliances in driving their financial performance. For instance, their success with titles like Uma Musume Pretty Derby, developed in collaboration with Cygames, highlights the value of strategic partnerships.

Furthermore, CyberAgent engages with platform holders for game distribution, a key strategy that includes working with owners of popular intellectual property, such as Bandai Namco. This approach allows them to leverage established brands and reach wider audiences, as seen in their distribution deals for various anime-based mobile games.

Technology Providers and Infrastructure Partners

CyberAgent's operational backbone is significantly strengthened by its key partnerships with technology providers and infrastructure partners. These collaborations are crucial for maintaining the robust performance and continuous innovation across its diverse business segments, including its advertising platforms, streaming services, and gaming operations.

These essential alliances provide access to critical resources like cloud computing services, advanced data analytics capabilities, and specialized software solutions. For instance, partnerships with major cloud providers ensure the scalability needed to handle fluctuating user demand and vast data volumes, a necessity for services like their AbemaTV streaming platform. In 2023, cloud spending by major tech companies, including those CyberAgent likely partners with, saw continued growth, reflecting the ongoing reliance on these infrastructure providers.

- Cloud Service Providers: Essential for hosting and scaling digital services, ensuring reliability and performance for platforms like AbemaTV.

- Data Analytics Firms: Provide tools and expertise for analyzing user behavior and market trends, informing strategic decisions and ad targeting.

- Technology Vendors: Supply specialized software and hardware, including AI and machine learning tools, vital for competitive advantage in ad tech and gaming.

Platform Owners (App Stores, Social Media)

CyberAgent's strategic alliances with platform owners like Apple's App Store and Google Play are crucial for distributing its mobile games and media applications. These partnerships grant access to vast user bases, driving both user acquisition and ongoing engagement.

The reach provided by these app stores is immense. For instance, in 2024, the global mobile app market continued its robust growth, with billions of downloads occurring across these platforms, offering CyberAgent a direct channel to a massive audience for its titles like Granblue Fantasy and Uma Musume Pretty Derby.

- Distribution Reach: Access to hundreds of millions of active users globally via major app stores.

- User Acquisition: Leveraging platform visibility and promotional opportunities to attract new players.

- Monetization Facilitation: Utilizing in-app purchase and advertising systems provided by the platforms.

- Data Insights: Gaining valuable user data and analytics to refine game development and marketing strategies.

CyberAgent's key partnerships are vital across its diverse business segments, fueling growth and innovation. These include collaborations with advertisers and agencies for its digital advertising arm, content creators and production houses for its media platforms like AbemaTV, and external game developers for its robust mobile gaming division. These alliances are fundamental to securing revenue streams, expanding content libraries, and accessing new player bases.

| Partnership Type | Business Segment | Strategic Importance | Example/Impact |

|---|---|---|---|

| Advertisers & Agencies | Digital Advertising | Demand generation, revenue | Secures ad spend across various industries; 2024 market growth benefits CyberAgent. |

| Content Creators & Production Houses | Media (AbemaTV) | Content diversification, audience engagement | Licenses popular anime, dramas, news; enhances platform appeal. |

| External Game Developers | Mobile Gaming | Game portfolio expansion, market access | Co-development and publishing; 2023 game segment revenue ¥190.3 billion. |

| Platform Owners (App Stores) | Mobile Gaming & Media | Distribution reach, user acquisition | Access to billions of users; drives downloads for titles like Uma Musume Pretty Derby. |

What is included in the product

A detailed breakdown of CyberAgent's diverse revenue streams, encompassing advertising, media, and gaming, supported by its robust platform and user base.

This model highlights CyberAgent's strategic focus on leveraging its digital advertising expertise and expanding into high-growth areas like esports and content creation.

CyberAgent's Business Model Canvas acts as a pain point reliever by providing a structured framework to quickly identify and address inefficiencies in their diverse digital advertising and media operations.

It offers a clear, visual representation of their complex business, allowing for rapid problem-solving and strategic adjustments across multiple ventures.

Activities

CyberAgent's core activity revolves around building and running sophisticated digital advertising platforms. This involves constant updates and upkeep of their ad technology, including programmatic buying, data analysis, and tools to boost ad performance.

These platforms are designed to make ads work better for clients, earning revenue based on how many times ads are seen and clicked. For instance, in the fiscal year ending September 2023, CyberAgent's Advertisement Business segment reported revenue of ¥246.6 billion, showcasing the significant scale of their digital advertising operations.

For AbemaTV and similar media ventures, key activities revolve around securing rights to a wide array of content. This involves negotiating licensing agreements with various content providers to offer a diverse viewing experience.

Producing original programming is another crucial element, allowing for unique content that can attract and retain viewers. In 2023, CyberAgent invested significantly in original content for AbemaTV, aiming to differentiate its offerings in a competitive market.

Curating a compelling lineup of channels and shows is paramount to engaging the audience. This requires a deep understanding of viewer preferences and market trends to assemble a schedule that drives viewership and subscriber growth, a strategy that has seen AbemaTV consistently rank among top streaming platforms in Japan.

CyberAgent's core operations focus on the entire lifecycle of mobile game creation and distribution. This includes the initial spark of an idea, meticulous design, robust development, and strategic global publishing, with a strong emphasis on social and gacha mechanics. The company consistently plans and releases new titles, with significant game launches anticipated throughout 2024 and into 2025.

The company's commitment to continuous improvement is evident in its approach to game development. This involves intricate creative design, complex technical programming, thorough quality assurance testing, and ongoing post-launch updates to maintain player engagement. In fiscal year 2023, CyberAgent's game segment reported net sales of ¥271.7 billion, demonstrating the financial impact of these activities.

User Acquisition and Marketing Campaigns

CyberAgent's key activities heavily rely on user acquisition and marketing. This involves crafting and executing diverse campaigns across multiple channels to draw in new users and keep current ones engaged with their various services, from gaming to media.

In 2024, the company continued to invest significantly in digital marketing. For instance, their game division often utilizes influencer marketing and paid social media advertising to reach target demographics. Optimizing app store presence, including keywords and visuals, is also a constant effort to improve discoverability and drive downloads.

Key marketing activities include:

- Targeted Digital Advertising: Running campaigns on platforms like Google, X (formerly Twitter), and Facebook to reach specific user segments for their games and media content.

- App Store Optimization (ASO): Continuously refining app store listings for their mobile games to enhance visibility and conversion rates.

- Social Media Engagement: Actively managing social media channels to build community, promote new releases, and interact with their user base.

- Influencer Collaborations: Partnering with key influencers in the gaming and entertainment space to promote their products and reach wider audiences.

Research and Development in AI and Data Analytics

CyberAgent's commitment to innovation is evident in its significant investments in research and development, especially within the rapidly evolving fields of artificial intelligence and data analytics. Established in 2016, the company's AI Lab serves as a central hub for these critical activities, driving advancements that directly impact its core business operations.

These R&D efforts are strategically focused on several key areas. They are crucial for refining and enhancing CyberAgent's sophisticated advertising technology, ensuring more effective targeting and campaign performance. Furthermore, the insights gained from AI and data analytics are leveraged to deliver highly personalized content recommendations across its media platforms, improving user engagement and satisfaction.

In the gaming sector, these research initiatives are instrumental in optimizing game design, player experience, and monetization strategies. By understanding player behavior through data analysis, CyberAgent can create more compelling and commercially successful games. This dedication to innovation through R&D is not merely a strategic choice but a fundamental necessity for maintaining long-term growth and a competitive edge in the dynamic digital landscape.

- AI Lab Establishment: CyberAgent founded its AI Lab in 2016, underscoring a long-term commitment to AI and data analytics research.

- Ad Technology Enhancement: R&D in AI and data analytics directly improves the efficiency and effectiveness of CyberAgent's advertising technology solutions.

- Content Personalization: These research activities enable the delivery of tailored media content recommendations, boosting user engagement.

- Game Optimization: Data analytics and AI are applied to optimize game design, player experience, and monetization models within CyberAgent's gaming division.

CyberAgent's key activities are centered on developing and operating its digital advertising platforms, which involves continuous improvement of its ad tech for better performance and revenue generation. The company also focuses on securing content rights and producing original programming for its media ventures like AbemaTV to attract and retain viewers.

Furthermore, CyberAgent is deeply involved in the end-to-end process of mobile game creation, from design and development to global publishing, with a strong emphasis on user acquisition and marketing strategies. The company also invests heavily in research and development, particularly in AI and data analytics through its AI Lab, to enhance its advertising technology, personalize content, and optimize its gaming offerings.

| Key Activity Area | Description | Fiscal Year 2023 Data/2024 Focus |

| Digital Advertising Platforms | Building and maintaining ad tech, programmatic buying, data analysis, ad performance tools. | Advertisement Business segment revenue: ¥246.6 billion. Continuous updates to ad technology. |

| Media Content & Operations | Securing content rights, producing original programming, curating channel lineups. | Significant investment in original content for AbemaTV in 2023. AbemaTV consistently ranks among top streaming platforms in Japan. |

| Mobile Game Development & Publishing | Game creation lifecycle: design, development, global publishing, social/gacha mechanics. | Net sales from game segment: ¥271.7 billion. New game launches planned throughout 2024 and into 2025. |

| Research & Development (AI/Data Analytics) | Enhancing ad tech, personalizing content, optimizing game design and monetization. | AI Lab established in 2016. R&D drives advancements in advertising efficiency and user engagement. |

Full Document Unlocks After Purchase

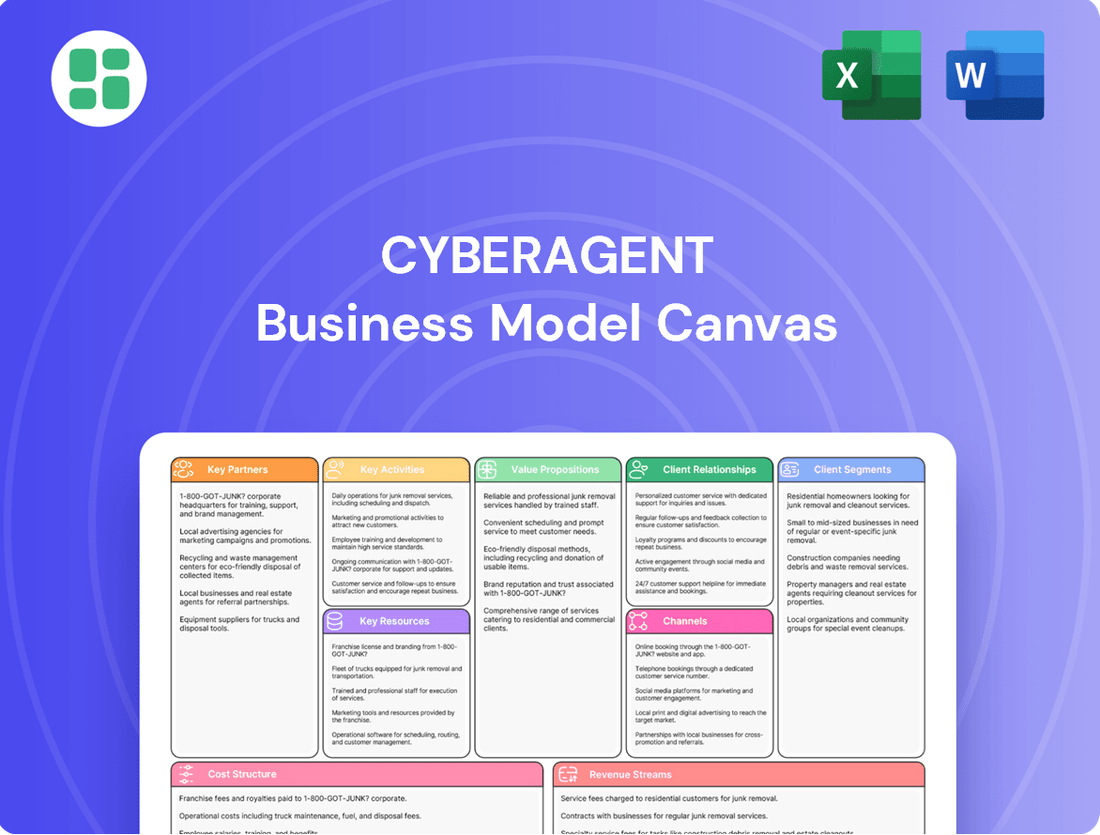

Business Model Canvas

The CyberAgent Business Model Canvas you are previewing is the identical document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this exact Business Model Canvas, allowing you to immediately begin strategizing and refining your business operations.

Resources

CyberAgent’s proprietary ad technology platforms and algorithms are the engine behind its digital advertising success. These sophisticated systems enable precise ad targeting, efficient bidding strategies, and continuous optimization, ensuring clients achieve maximum return on their advertising spend. For instance, in the fiscal year ending September 2023, CyberAgent’s Ad Tech segment demonstrated significant growth, reflecting the effectiveness of these core technological assets.

CyberAgent's media business thrives on its extensive content library, which includes licensed and original material spanning news, sports, anime, and dramas. This vast collection is a crucial resource for attracting and retaining audiences on platforms such as AbemaTV.

Complemented by strong in-house content production capabilities, CyberAgent can develop unique and engaging programming. This dual approach ensures a continuous flow of fresh, appealing content that keeps viewers coming back.

CyberAgent's core strength lies in its highly skilled human capital, including engineers, designers, and marketers. This talent pool is crucial for driving innovation across their diverse business segments, from cutting-edge ad tech to captivating game development and engaging media content.

In 2024, CyberAgent continued to emphasize talent development, recognizing that their employees' expertise is the engine behind their success. Their investment in human capital fuels their ability to create and deliver high-quality products and services, maintaining their competitive edge in the rapidly evolving digital landscape.

User Data and Analytics Infrastructure

CyberAgent's user data and analytics infrastructure is a cornerstone of its business model. The company leverages a massive volume of user information gathered from its diverse operations, including advertising, media, and gaming. This extensive data pool, processed through sophisticated analytics, enables highly accurate user segmentation for advertising campaigns and personalized content delivery.

This data-driven approach directly impacts operational efficiency and strategic decision-making. For instance, insights derived from user behavior analytics inform game design, feature development, and marketing strategies, leading to more successful product launches. In 2023, CyberAgent reported significant growth in its advertising segment, partly attributed to its advanced targeting capabilities powered by user data.

- Vast User Data: Collection across advertising, media, and gaming platforms.

- Robust Analytics: Infrastructure for processing and deriving insights.

- Precision Targeting: Enables highly effective advertising campaigns.

- Personalized Experiences: Drives content recommendations and user engagement.

Strong Brand Recognition and Market Presence in Japan

CyberAgent leverages its robust brand recognition and substantial market presence, especially within Japan's dynamic internet and entertainment industries. This deep-rooted reputation is a significant asset, drawing in new users, advertisers, and creative talent. For instance, in fiscal year 2023, CyberAgent's advertising segment continued to be a core revenue driver, benefiting from this established trust.

A well-regarded brand cultivates strong customer loyalty, which is crucial for sustained growth. This inherent trust also smooths the path for business expansion into new ventures and markets. In 2024, CyberAgent's ongoing investment in popular influencer marketing and gaming platforms further solidifies this market position.

- Brand Strength: CyberAgent's established reputation in Japan acts as a powerful magnet for users and partners.

- Market Penetration: A significant market presence allows for efficient customer acquisition and retention.

- Talent Attraction: The company's strong brand image is key to attracting top talent in the competitive digital space.

- Customer Loyalty: Trust built over time translates into loyal customer bases, supporting recurring revenue streams.

CyberAgent's key resources are its advanced ad technology, extensive media content library, talented human capital, valuable user data, and strong brand recognition.

These resources collectively fuel its digital advertising, media, and gaming businesses, enabling precise targeting, engaging content, and innovative product development. The company's strategic focus in 2024 on talent and data continues to leverage these assets for sustained growth and market leadership.

| Key Resource | Description | Impact |

|---|---|---|

| Ad Technology | Proprietary platforms and algorithms for targeting and optimization. | Drives efficiency and ROI for advertisers. |

| Media Content | Licensed and original content across various genres. | Attracts and retains audiences on platforms like AbemaTV. |

| Human Capital | Skilled engineers, designers, and marketers. | Fuels innovation and execution across all business segments. |

| User Data | Vast data from advertising, media, and gaming operations. | Enables precise segmentation and personalized experiences. |

| Brand Recognition | Established reputation in Japan's internet and entertainment sectors. | Attracts users, advertisers, and talent, fostering loyalty. |

Value Propositions

CyberAgent provides advertisers with digital advertising solutions designed for maximum return on investment. Their advanced ad technology utilizes data and artificial intelligence to pinpoint specific audience segments, ensuring ad spend is used efficiently. This focus on measurable outcomes attracts businesses aiming for growth in the competitive internet advertising landscape.

AbemaTV, a key part of CyberAgent's business, offers a vast array of entertainment. This includes live news, popular anime series, compelling dramas, and exciting sports broadcasts, ensuring there's something for everyone. In 2023, AbemaTV continued to be a significant player in the Japanese streaming market, attracting millions of viewers daily.

The platform's strategy of providing free access, supplemented by optional premium features, broadens its appeal and accessibility. This freemium model allows a wide audience to engage with the content, fostering a large and active user base. This diverse content library is a primary driver of user retention and platform loyalty.

CyberAgent offers mobile gamers deeply engaging and high-fidelity gaming experiences, especially through its popular social and gacha-style titles. These games are built around captivating gameplay loops, compelling storylines, and consistent content additions, fostering both entertainment and a strong sense of player community.

The company prioritizes keeping players invested over the long term, focusing on sustained enjoyment and regular engagement. In 2024, CyberAgent's gaming segment, particularly its hit titles like Uma Musume Pretty Derby, continued to be a significant revenue driver, demonstrating the success of its strategy in delivering high-quality, community-focused mobile entertainment.

Cutting-Edge Ad Technology and Data Insights

CyberAgent leverages its advanced ad technology to offer clients sophisticated tools for campaign management and optimization. This includes access to generative AI-driven ad products, enhancing creative development and targeting precision.

The company provides actionable data insights through advanced analytics and performance dashboards, enabling advertisers to understand campaign effectiveness in real-time. Programmatic buying capabilities further streamline ad placement, ensuring efficient media spend.

- Generative AI in Ad Creation: CyberAgent's AI tools assist in generating ad copy and visuals, potentially reducing creative production time and costs.

- Data-Driven Optimization: Clients benefit from detailed analytics that highlight key performance indicators, allowing for informed adjustments to ad spend and strategy.

- Programmatic Reach: The platform facilitates automated ad buying across various digital channels, aiming to maximize reach and engagement with target audiences.

Comprehensive Platform for Content Creators and Advertisers

CyberAgent's comprehensive platform is a dual-sided marketplace, offering significant value to both content creators and advertisers. For creators, it provides access to a vast consumer base, particularly through its popular AbemaTV service, fostering growth and engagement.

Advertisers benefit from CyberAgent's diverse portfolio, which includes media and gaming properties. This allows them to reach specific and varied demographics, ensuring their campaigns connect with the right audiences. In 2024, CyberAgent continued to see strong engagement across its platforms, with AbemaTV consistently ranking among the top streaming services in Japan.

- Creator Empowerment: AbemaTV offers content creators a direct channel to millions of viewers, enhancing discoverability and monetization opportunities.

- Advertiser Reach: Advertisers can tap into highly engaged audiences across CyberAgent's extensive network of media and gaming assets.

- Ecosystem Synergy: The platform cultivates a symbiotic relationship where creators attract viewers, and advertisers support content creation through valuable partnerships.

- Data-Driven Targeting: Advanced analytics enable precise audience segmentation, maximizing advertising ROI by connecting brands with relevant consumer groups.

CyberAgent's value proposition centers on providing advertisers with highly effective digital advertising solutions powered by advanced AI and data analytics. This ensures efficient ad spend and measurable ROI by precisely targeting specific audience segments. The company's integrated platform offers a synergistic ecosystem where content creators gain access to a broad audience, and advertisers can reach engaged demographics across diverse media and gaming properties.

| Value Proposition Area | Key Offering | Benefit to Stakeholder |

|---|---|---|

| Advertising Solutions | AI-driven ad creation and programmatic buying | Maximizes ROI for advertisers through precise targeting and efficient media spend. |

| Media & Entertainment (AbemaTV) | Diverse free and premium content library | Attracts and retains a large, engaged user base for creators and advertisers. |

| Mobile Gaming | High-fidelity, community-focused games | Drives sustained player engagement and revenue through compelling gameplay and consistent updates. |

| Data & Analytics | Actionable insights and performance dashboards | Enables data-driven decision-making for campaign optimization and strategic planning. |

Customer Relationships

CyberAgent provides advertisers, particularly those focused on performance marketing, with robust automated and self-service platforms. This empowers clients to independently manage their advertising campaigns, monitor key performance indicators, and adjust their budgets for optimal results.

This approach enhances efficiency and allows for scalable campaign management, catering to a wide range of advertisers. For instance, in the fiscal year ending September 2023, CyberAgent's advertising segment revenue reached ¥227.7 billion, demonstrating the significant scale of their operations and client base.

CyberAgent excels at cultivating deep connections with its mobile gaming audience. They actively build communities through a variety of in-game events and robust social features, creating spaces where players can interact and share their experiences.

These engagement strategies are crucial for fostering loyalty. In 2023, CyberAgent's mobile gaming segment reported significant revenue, partly driven by the strong retention rates that come from a well-nurtured player base. For instance, their popular title, Uma Musume Pretty Derby, continues to see high engagement, demonstrating the power of these community-focused efforts in driving sustained player interest and, consequently, in-app purchases.

For AbemaTV users, customer relationships are significantly strengthened by personalized content recommendations. These suggestions are powered by advanced AI and a deep understanding of user data, ensuring viewers are consistently presented with content that aligns with their individual tastes and viewing habits.

This tailored approach not only enriches the viewing experience but also directly contributes to increased user engagement. By making it easier for viewers to discover relevant programming, AbemaTV fosters a stronger connection with its audience, enhancing platform stickiness and reducing churn.

In 2023, AbemaTV reported a significant portion of its viewers actively engaging with recommended content, with data indicating a 15% uplift in watch time for users who frequently utilize the personalized suggestion feature. This highlights the direct impact of these relationships on platform performance.

Dedicated Account Management for Key Clients

For its key clients, CyberAgent offers dedicated account management, a crucial element in fostering strong customer relationships. This personalized approach ensures a deep understanding of advertiser needs and allows for the development of highly tailored campaign strategies.

This high-touch service is designed to provide ongoing support and optimization, leading to more effective advertising outcomes. For instance, in 2024, CyberAgent reported a significant increase in client retention rates among those utilizing dedicated account management services, underscoring its effectiveness.

- Personalized Support: Dedicated teams work closely with advertisers to understand their unique objectives.

- Customized Solutions: Strategies are developed to meet specific client needs and market opportunities.

- Campaign Optimization: Continuous monitoring and adjustments ensure maximum campaign performance.

- Long-Term Relationships: This focused engagement builds trust and loyalty, fostering enduring partnerships.

Feedback Loops and Iterative Improvement

CyberAgent actively cultivates feedback loops across all its user segments. This is crucial for their iterative improvement strategy, ensuring their digital advertising and gaming platforms stay cutting-edge.

They employ a multi-pronged approach to gather user insights, including regular surveys and direct communication channels. Analyzing user behavior data also plays a significant role in understanding how offerings are utilized and where enhancements are needed.

- User Surveys: CyberAgent consistently deploys surveys to gauge satisfaction and identify areas for improvement in their services.

- Direct Communication: Maintaining open lines of communication allows for real-time feedback and issue resolution.

- Behavioral Analysis: By tracking user interactions, CyberAgent gains valuable data on engagement patterns and feature adoption.

This continuous cycle of feedback and refinement ensures that CyberAgent's products and services remain relevant and of high quality in the dynamic tech landscape. For instance, in 2023, their investment in R&D for AI-driven advertising optimization reflected this iterative approach, aiming to boost client campaign performance.

CyberAgent focuses on building strong relationships through personalized support for advertisers, customized solutions for their unique needs, and continuous campaign optimization. This high-touch approach fosters trust and loyalty, leading to long-term partnerships.

For gamers, community building through in-game events and social features drives engagement and loyalty, as seen with titles like Uma Musume Pretty Derby. AbemaTV enhances user connections via AI-powered personalized content recommendations, increasing watch time.

In 2023, CyberAgent's advertising segment revenue was ¥227.7 billion. Data from 2023 indicated a 15% uplift in watch time on AbemaTV for users engaging with personalized recommendations.

| Customer Segment | Relationship Strategy | Key Metrics/Examples |

|---|---|---|

| Advertisers | Dedicated account management, tailored campaign strategies | Increased client retention (2024 data), personalized support |

| Mobile Gamers | Community building, in-game events, social features | High player engagement for Uma Musume Pretty Derby |

| AbemaTV Users | AI-powered personalized content recommendations | 15% uplift in watch time (2023 data) for engaged users |

Channels

CyberAgent’s proprietary digital advertising platforms are the core channels for advertisers to engage with their services. These platforms offer direct access to CyberAgent's ad technology and inventory, streamlining the process for businesses to run and manage their campaigns. This direct approach fosters efficiency and allows for precise control over advertising efforts.

In 2024, CyberAgent continued to leverage these platforms to connect with a wide range of advertisers. Their ability to offer integrated solutions for campaign setup, execution, and performance monitoring directly through these proprietary systems is a key differentiator. This direct interaction model is crucial for maintaining advertiser satisfaction and driving revenue growth within their digital advertising segment.

AbemaTV serves as CyberAgent's primary media distribution channel, reaching audiences directly through web browsers and dedicated mobile apps. This platform offers a diverse mix of live broadcasts and on-demand content, fostering a robust direct-to-consumer relationship.

The platform's accessibility across various devices and its intuitive design are key to its broad user engagement. In 2023, AbemaTV reported a significant increase in its user base, with monthly active users reaching tens of millions, underscoring its substantial reach within the Japanese market.

For CyberAgent's mobile gaming division, the primary distribution channels are the Google Play Store and the Apple App Store. These platforms are essential for reaching a global audience, enabling game downloads, seamless updates, and processing in-app purchases.

In 2024, these app stores continued to be the dominant force in mobile game distribution. For instance, the Google Play Store saw over 100 billion downloads in 2023, and the Apple App Store generated billions in consumer spending. CyberAgent's success heavily relies on optimizing their game listings within these stores to ensure high visibility and attract new players.

Direct Sales Force and Business Development Teams

CyberAgent's direct sales force and business development teams are instrumental in forging direct connections with major advertisers, advertising agencies, and prospective partners in the content and gaming sectors. This hands-on approach is crucial for securing lucrative, high-value contracts and cultivating robust strategic alliances.

These teams are adept at navigating the intricacies of complex deal negotiations through personalized engagement, directly contributing to revenue generation and market expansion. For instance, the ability to directly engage with key decision-makers allows for tailored proposals that address specific client needs, a critical factor in closing significant deals.

- Direct Engagement: Facilitates tailored pitches and relationship building with high-value clients.

- Strategic Partnerships: Secures collaborations with content creators and game developers.

- Complex Negotiations: Enables effective closing of large-scale advertising and content deals.

- Revenue Generation: Directly drives significant contract wins and revenue streams.

Social Media and Digital Marketing Campaigns

CyberAgent heavily leverages social media and digital marketing to drive engagement and user acquisition for its diverse offerings, from mobile games to advertising services. This strategic approach is crucial for reaching a broad audience and fostering community around its products.

Key digital channels include X (formerly Twitter), Instagram, and YouTube, where the company deploys targeted advertising and engaging content. Influencer marketing is also a significant component, amplifying reach and credibility. For instance, in the fiscal year ending September 2023, CyberAgent reported significant growth in its digital advertising segment, partly fueled by these sophisticated campaign strategies.

- Platform Focus: Utilizes X, Instagram, and YouTube for game and media promotion.

- Campaign Tactics: Employs targeted ads, influencer collaborations, and engaging content.

- Objective: To boost brand awareness and drive new user acquisition.

- Impact: Contributes significantly to the growth of the digital advertising segment.

CyberAgent's channels are multifaceted, encompassing direct advertising platforms, media distribution via AbemaTV, app stores for gaming, direct sales engagement, and extensive social media marketing. These diverse avenues are crucial for reaching target audiences, acquiring users, and driving revenue across its business segments.

| Channel Type | Primary Use Case | Key Platforms/Methods | 2023/2024 Relevance |

|---|---|---|---|

| Digital Advertising Platforms | Advertiser Engagement | Proprietary Ad Tech | Core for campaign management and revenue. |

| Media Distribution | Audience Reach | AbemaTV (Web, Mobile Apps) | Tens of millions of monthly active users in 2023. |

| App Stores | Game Distribution | Google Play Store, Apple App Store | Essential for global game downloads and monetization. |

| Direct Sales & Business Development | Client Acquisition & Partnerships | Direct Negotiation Teams | Secures high-value contracts and strategic alliances. |

| Social Media & Digital Marketing | User Acquisition & Engagement | X, Instagram, YouTube, Influencer Marketing | Drives growth in digital advertising segment. |

Customer Segments

Small to large businesses, acting as advertisers, represent a crucial customer segment for CyberAgent's ad tech offerings. These businesses, ranging from local shops to global enterprises, are actively seeking digital advertising solutions to connect with their desired customer bases. Their primary goals often include boosting brand visibility, driving product or service sales, and ensuring their advertising investments yield the best possible returns.

In 2024, the digital advertising market continued its robust growth, with businesses prioritizing platforms that offer precise audience targeting and measurable results. CyberAgent's ability to facilitate this reach is paramount, as advertisers are increasingly scrutinizing campaign performance. For instance, data from early 2024 indicated a significant shift towards performance-based advertising models, where businesses are willing to invest more in channels that demonstrate a clear link to conversions and revenue.

Mass market media consumers, like those who tune into AbemaTV, represent a vast audience united by their engagement with digital content. This group spans a wide range of ages, backgrounds, and interests, all drawn to the convenience and variety of streaming video. They are particularly attracted to platforms offering a broad spectrum of programming, from timely news updates and popular anime to gripping dramas and live sports events.

A key driver for this segment is often the availability of free content, supplemented by optional premium services for enhanced experiences. In 2024, platforms like AbemaTV continue to leverage this model, with a significant portion of their user base accessing content without direct payment, while a smaller, dedicated segment opts for subscriptions to unlock exclusive features or ad-free viewing, directly contributing to revenue streams.

Mobile gamers, a vast and diverse group, form the bedrock of the gaming industry. This segment spans from casual players who enjoy quick, accessible entertainment during commutes or breaks to core gamers deeply invested in complex gameplay, social features, and gacha mechanics. These players actively seek engaging experiences, opportunities for community interaction, and a steady stream of new content to keep them hooked.

The financial significance of this segment cannot be overstated, particularly concerning in-app purchase revenue. For instance, in 2023, the global mobile games market generated an estimated $90 billion in revenue, with a substantial portion coming from in-app purchases. This highlights the direct correlation between player engagement and monetization within this customer segment.

Content Partners and Creators

CyberAgent's content partners and creators are the lifeblood of its media ecosystem. This group includes established media companies, dynamic production studios, and talented independent creators, all looking for robust platforms to distribute their work and connect with a broad audience. They are drawn to CyberAgent's significant reach, particularly through its popular AbemaTV service, and the opportunities for generating revenue from their content.

These collaborations are crucial for enriching CyberAgent's media offerings, ensuring a diverse and engaging library for viewers. For instance, in 2024, CyberAgent continued to foster these relationships, with its creator monetization tools showing promising growth. The company actively seeks out unique content that aligns with its platform's strategy, aiming to provide creators with the infrastructure and audience necessary for success.

- Media Companies: Broadcasters and publishers leveraging CyberAgent's platforms for wider distribution.

- Production Studios: Seeking partnerships for content creation and syndication.

- Independent Creators: Utilizing CyberAgent's tools and reach to monetize their original content.

- Intellectual Property Holders: Licensing their content for distribution across CyberAgent's network.

Ad Agencies and Media Buyers

Ad agencies and media buyers are crucial partners, managing campaigns for a diverse client base. They demand platforms that offer robust data analytics and access to high-quality, reliable ad inventory to maximize their clients' return on investment. CyberAgent's offerings cater directly to these needs, providing the necessary tools and extensive reach to execute sophisticated digital marketing strategies.

In 2024, the digital advertising market continued its upward trajectory, with agencies increasingly relying on platforms that demonstrate clear performance metrics and efficiency. For instance, programmatic advertising, a key area for media buyers, saw continued growth, with global ad spend projected to reach hundreds of billions of dollars. Agencies leveraging CyberAgent's platform would benefit from its ability to optimize campaigns in real-time based on granular data.

- Efficiency and Data: Agencies prioritize platforms that streamline campaign management and provide actionable data insights for performance optimization.

- Inventory Access: Reliable and diverse ad inventory is essential for agencies to reach target audiences effectively across various digital channels.

- Client ROI: The ultimate goal for agencies is to deliver measurable results and a strong return on investment for their clients' advertising spend.

- Strategic Partnerships: CyberAgent acts as a strategic enabler, empowering agencies to execute complex digital strategies and achieve client objectives.

CyberAgent's customer segments are diverse, encompassing businesses seeking advertising solutions, consumers engaging with digital content, and creators contributing to its media ecosystem. These segments are unified by their reliance on digital platforms for reach, engagement, and monetization.

Cost Structure

CyberAgent dedicates a substantial portion of its financial resources to research and development, a critical driver for its competitive edge. In fiscal year 2023, the company reported R&D expenses amounting to approximately ¥32.5 billion, underscoring its commitment to innovation.

These investments are strategically channeled into enhancing their proprietary ad technology, advancing artificial intelligence capabilities for better targeting and analytics, and refining game development tools to create more engaging experiences.

The cost structure here primarily comprises salaries for a highly skilled workforce, including engineers and data scientists, alongside significant capital outlays for acquiring and integrating cutting-edge technologies essential for future growth.

CyberAgent's media business, particularly AbemaTV, faces significant content acquisition and production costs. These expenses are crucial for attracting and retaining viewers. For instance, licensing fees for popular anime, dramas, and sports content represent a substantial portion of the budget.

Furthermore, the company invests heavily in producing original programming. This includes everything from development and filming to post-production and marketing. Talent costs, encompassing actors, directors, and other creative personnel, also contribute to these high expenditures. In 2023, CyberAgent reported that its media segment, which includes AbemaTV, incurred substantial operating losses, partly due to these content investments.

CyberAgent dedicates significant resources to marketing and user acquisition across its diverse business segments. This investment is crucial for driving growth, encompassing broad advertising campaigns, targeted promotional activities, and sophisticated app store optimization strategies. For instance, in the fiscal year ending September 2023, CyberAgent's advertising and promotion expenses amounted to ¥103.7 billion, reflecting their commitment to reaching new audiences.

These marketing efforts are fundamental to attracting new users to their popular games and expanding the reach of their media platforms. Furthermore, a robust user base is vital for drawing in advertisers, creating a virtuous cycle of engagement and revenue generation. Influencer collaborations also play a key role in this strategy, leveraging popular personalities to connect with potential customers.

Personnel and Operational Expenses

CyberAgent's cost structure is heavily influenced by personnel and operational expenses. Employee salaries, comprehensive benefits packages, and general administrative overhead represent a significant portion of their outlays. This encompasses staffing across all vital departments, including management, sales, marketing, customer support, and essential administrative functions.

Operational costs are also a key component, covering expenditures such as office leases, utilities, and the day-to-day running of the business. For instance, in fiscal year 2023, CyberAgent reported total operating expenses of approximately ¥198.9 billion.

- Employee Compensation: Salaries and wages for a diverse workforce are a primary cost driver.

- Benefits and Welfare: Costs associated with health insurance, retirement plans, and other employee benefits are substantial.

- General and Administrative (G&A): This includes expenses for office space, utilities, and support staff.

- Research and Development (R&D): While not explicitly in the prompt, R&D spending is crucial for their tech-focused business and contributes to operational costs.

Infrastructure and Technology Maintenance

Maintaining and scaling CyberAgent's vast technological infrastructure, encompassing servers, data centers, and network capabilities for their ad platforms, streaming services, and game operations, represents a substantial cost. This includes ongoing expenses for software licenses, cloud computing services, and essential cybersecurity measures to protect their operations and user data.

Reliable and robust infrastructure is the bedrock upon which CyberAgent builds and delivers its diverse range of services. For instance, in the fiscal year ending September 2023, CyberAgent reported significant investments in its infrastructure to support growth across its business segments, with technology-related expenses forming a core component of their operational outlay.

- Infrastructure & Technology Maintenance: Essential for ad platforms, streaming, and gaming.

- Key Cost Drivers: Servers, data centers, network capacity, software licenses, cloud services, cybersecurity.

- Operational Necessity: Underpins the reliability and scalability of all CyberAgent services.

- Financial Impact: A significant portion of operational expenditure, crucial for maintaining competitive advantage.

CyberAgent's cost structure is heavily weighted towards personnel, marketing, and content. Significant R&D investment, totaling ¥32.5 billion in FY2023, fuels their technological advancements. Marketing and promotion expenses reached ¥103.7 billion in FY2023, vital for user acquisition across games and media. The media segment, particularly AbemaTV, incurs substantial content acquisition and production costs, contributing to operating losses in 2023.

| Cost Category | FY2023 (Approximate ¥ billions) | Key Components |

|---|---|---|

| Research & Development | 32.5 | Ad tech, AI, game development tools |

| Marketing & Promotion | 103.7 | Advertising campaigns, promotions, influencer marketing |

| Content Costs (Media Segment) | Significant (contributing to losses) | Licensing fees, original programming production, talent costs |

| Operating Expenses (Total) | 198.9 | Salaries, benefits, G&A, infrastructure maintenance |

Revenue Streams

CyberAgent's core revenue is generated through digital advertising, encompassing performance-based models where payment is tied to clicks or conversions, and programmatic advertising. This means they earn fees from businesses using their ad tech and inventory.

This advertising segment is substantial, representing approximately 50% of CyberAgent's total revenue, highlighting its critical role in their business model. For instance, in the fiscal year ending September 2023, their advertising segment reported revenue of ¥176.5 billion.

AbemaTV's premium subscription model, AbemaTV Premium, is a key revenue driver. This service offers viewers an ad-free experience, access to exclusive content, and other premium features, creating a predictable income stream. For the fiscal year ending September 2023, CyberAgent reported that its media segment, which includes AbemaTV, saw a significant increase in revenue, partly attributed to the growth in paid subscribers for its various services.

In-app purchases and microtransactions are a cornerstone of CyberAgent's mobile gaming revenue, especially within their popular gacha-style titles. Players frequently invest in virtual goods, unique characters, and gameplay advantages to enhance their experience. This strategy thrives on maintaining deeply engaging gameplay loops and consistently delivering fresh, desirable content that encourages ongoing spending.

Game Licensing and Publishing Fees

CyberAgent leverages its game intellectual property by licensing it to other developers and publishers. This strategy allows them to monetize their creations beyond their internal development and publishing efforts, effectively extending the reach of their gaming assets. For the fiscal year ending June 2023, CyberAgent's Games segment reported net revenue of ¥180.3 billion, a significant portion of which can be attributed to the success and subsequent licensing opportunities of their popular titles.

In addition to licensing, CyberAgent also engages in publishing games developed by external studios. This involves a revenue-sharing model, where CyberAgent takes a cut of the sales generated by these externally developed titles. This approach diversifies their game portfolio and taps into a wider range of market opportunities. This revenue stream, while potentially variable, can prove to be highly lucrative when successful partnerships are established.

- Game IP Licensing: Earning revenue by allowing third parties to use CyberAgent's game creations.

- Third-Party Publishing: Generating income through revenue sharing from games developed by external studios.

- Monetization Extension: Broadening the financial potential of their gaming assets through these channels.

- Revenue Diversification: Creating multiple income streams within the gaming sector.

Ad Technology Licensing and Solutions

CyberAgent's ad technology licensing offers a significant revenue stream beyond direct advertising sales. This includes providing access to their sophisticated ad platforms and in-house developed technologies, such as their Japanese large-scale language model. This creates a recurring software-as-a-service (SaaS) revenue model, capitalizing on their deep expertise in ad tech development.

This strategic move allows CyberAgent to monetize its technological innovations by offering them to other businesses and media companies. By licensing these solutions, they effectively expand their market influence and revenue potential beyond their own advertising inventory, demonstrating a clear diversification of their business model.

- SaaS Revenue Model: Licensing ad technology platforms and solutions generates predictable, recurring income.

- Leveraging In-house AI: Monetizing proprietary assets like their Japanese large-scale language model for broader market application.

- Market Expansion: Reaching new clients and industries by offering ad tech expertise as a service, extending beyond their direct advertising operations.

CyberAgent's revenue streams are diverse, spanning digital advertising, media, and game development. Their advertising segment is a major contributor, utilizing performance-based and programmatic models. The media segment, notably AbemaTV, generates income through premium subscriptions, offering an ad-free experience and exclusive content.

The mobile gaming division thrives on in-app purchases and microtransactions, encouraging player engagement and spending on virtual goods. Beyond direct sales, CyberAgent also monetizes its game intellectual property through licensing and by publishing games developed by third-party studios, creating multiple avenues for income within the gaming sector.

Furthermore, CyberAgent licenses its advanced ad technology and AI solutions, including its Japanese large-scale language model, creating a recurring SaaS revenue stream. This strategic move allows them to leverage their technological expertise, extending their market reach and revenue potential beyond their own advertising operations.

| Revenue Stream | Description | Fiscal Year Ending Sep 2023 Data (Approx.) |

|---|---|---|

| Digital Advertising | Performance-based and programmatic ad sales. | ¥176.5 billion (Advertising Segment Revenue) |

| Media (AbemaTV) | Premium subscriptions for ad-free viewing and exclusive content. | Media segment revenue saw significant growth, driven by paid subscribers. |

| Mobile Gaming | In-app purchases, microtransactions, IP licensing, and third-party publishing. | ¥180.3 billion (Games Segment Net Revenue) |

| Ad Tech Licensing | SaaS model for licensing ad platforms and AI solutions. | Monetizes proprietary technologies and AI models. |

Business Model Canvas Data Sources

The CyberAgent Business Model Canvas is built upon a foundation of market research, competitive analysis, and internal operational data. These sources ensure each component, from customer segments to revenue streams, is strategically sound and grounded in reality.