CyberAgent Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CyberAgent Bundle

CyberAgent operates in a dynamic digital landscape, facing intense competition and evolving customer demands. Understanding the forces of rivalry, buyer power, supplier leverage, threat of new entrants, and substitutes is crucial for its strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CyberAgent’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CyberAgent's reliance on a limited number of key ad technology and cloud service providers presents a significant supplier bargaining power. For instance, major cloud providers like Amazon Web Services (AWS) and Microsoft Azure dominate the market, with AWS holding an estimated 31% global market share as of Q4 2023. This concentration means CyberAgent has fewer alternatives, potentially leading to higher infrastructure costs and less favorable service agreements.

AbemaTV's media operations are heavily reliant on securing compelling content, which translates into significant acquisition costs. This includes everything from the rights to broadcast major sporting events to the production of exclusive original series.

Suppliers of high-demand content, particularly those offering popular sports or sought-after exclusive series, wield substantial bargaining power. This was evident when AbemaTV incurred considerable operating losses, partly due to the high cost of content like the broadcast rights for the Qatar World Cup.

CyberAgent, as a major player in the mobile gaming industry, faces considerable bargaining power from platform owners like Apple and Google. These companies control app distribution, set commission rates, and influence game visibility, directly impacting CyberAgent's revenue and operational strategies. For instance, in 2023, Apple's App Store and Google Play Store continued to take a standard 30% commission on in-app purchases, a significant cost for developers like CyberAgent.

Talent Pool for Specialized Skills

The digital advertising, media, and mobile gaming sectors, where CyberAgent operates, demand highly specialized expertise. This includes professionals skilled in AI development, ad technology, intricate game design, and creative content production. The scarcity of these specialized professionals directly impacts labor costs and presents significant hurdles in attracting and keeping top talent within CyberAgent.

The intense competition for these niche skill sets intensifies the bargaining power of suppliers, meaning highly sought-after individuals can command higher salaries and more favorable working conditions. For instance, in 2024, the demand for AI engineers in Japan, a key market for CyberAgent, continued to outstrip supply, leading to salary increases of up to 15% for experienced professionals in this field.

- High Demand for AI and Ad Tech Specialists: Industries reliant on data analytics and programmatic advertising face a constant need for experts in AI, machine learning, and ad technology platforms.

- Scarcity in Creative and Technical Roles: Specialized game designers, experienced Unity developers, and innovative content creators are also in short supply, driving up recruitment costs.

- Impact on Labor Costs: As of early 2024, average salaries for senior AI developers in Tokyo ranged from ¥12 million to ¥18 million annually, reflecting the premium placed on these skills.

- Talent Retention Challenges: Companies like CyberAgent must invest heavily in competitive compensation and benefits packages to retain their specialized workforce amidst aggressive recruitment by competitors.

Intellectual Property (IP) Owners in Gaming

The bargaining power of suppliers, particularly intellectual property (IP) owners in the gaming sector, significantly impacts companies like CyberAgent. CyberAgent frequently develops games leveraging popular IPs, such as its work with the Idolmaster franchise, necessitating substantial licensing agreements with the original IP holders.

These IP owners, especially those with highly sought-after franchises, can dictate substantial licensing fees and maintain considerable oversight on game development and monetization strategies. This leverage directly influences CyberAgent's profitability and operational flexibility within its gaming division.

- Licensing Fees: IP owners can command high upfront and ongoing licensing fees, directly impacting a game developer's cost structure. For instance, major anime or character IPs can cost millions to license.

- Creative Control: IP holders often retain veto power over game design, character representation, and monetization methods, limiting the developer's creative freedom and potentially impacting revenue generation.

- Exclusivity Clauses: Agreements may include exclusivity clauses, preventing developers from working with competing IPs or on similar game genres, thereby restricting market opportunities.

- Royalty Structures: The terms of royalty payments from game sales and in-game purchases can be structured to heavily favor the IP owner, reducing the net profit margin for the developer.

CyberAgent's reliance on specialized talent, such as AI engineers and ad tech professionals, grants these individuals significant bargaining power. The scarcity of these skills, particularly in Japan, drove up salaries for senior AI developers by up to 15% in 2024, impacting CyberAgent's labor costs and talent retention efforts.

Platform owners like Apple and Google, controlling app distribution, exert considerable influence. Their standard 30% commission on in-app purchases in 2023 directly affected CyberAgent's revenue streams in the mobile gaming sector.

Intellectual property (IP) owners also hold strong bargaining power, dictating substantial licensing fees and development oversight for games based on popular franchises. This can limit CyberAgent's creative freedom and profit margins.

| Supplier Type | Bargaining Power Factor | Impact on CyberAgent | Example/Data Point |

| Cloud Service Providers | Market Concentration | Higher infrastructure costs, less favorable terms | AWS held 31% global market share (Q4 2023) |

| Content Providers | Demand for popular content | Increased acquisition costs, operational losses | High cost of broadcasting rights (e.g., Qatar World Cup) |

| Platform Owners (App Stores) | Control over distribution | Reduced revenue share from in-app purchases | 30% commission on in-app purchases (2023) |

| Specialized Talent | Scarcity of skills | Increased labor costs, talent retention challenges | AI developer salaries in Japan up 15% (2024) |

| IP Owners | Desirability of franchises | High licensing fees, limited creative control | Millions for major anime/character IPs |

What is included in the product

This analysis dissects the competitive forces impacting CyberAgent, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Instantly identify and address competitive threats by visualizing the intensity of each Porter's Five Force, allowing for focused strategic interventions.

Customers Bargaining Power

CyberAgent operates within a digital advertising landscape characterized by a broad spectrum of clients, ranging from major enterprises to smaller enterprises. This extensive client base means that individual advertisers, even significant ones, typically do not hold a substantial portion of CyberAgent's overall advertising revenue. For instance, while specific client revenue figures are proprietary, the sheer volume of advertisers CyberAgent serves dilutes the power of any single entity to dictate terms.

Advertisers can readily shift their spending between various digital advertising platforms and agencies. This ease of switching, often driven by factors like better campaign performance or lower costs, significantly enhances their leverage. For CyberAgent, this means a constant need to prove its value proposition through superior results and competitive pricing to retain these clients.

Subscribers to streaming services like AbemaTV are highly sensitive to price due to the sheer volume of alternatives available. They expect a lot of bang for their buck, meaning compelling content is key to retaining them.

With major players like Netflix and Amazon Prime Video offering vast libraries, AbemaTV's free-to-watch model with a premium tier faces direct competition. This competitive landscape forces a constant evaluation of pricing and content offerings to stay attractive to consumers.

Player Choice and Loyalty in Mobile Gaming

Mobile game players today face an overwhelming array of choices, with millions of titles available across various platforms. This abundance directly translates into significant bargaining power for consumers. Player loyalty is a constant battle, often won through compelling gameplay, regular content additions, and time-limited in-game events that keep engagement high. If a game falters in delivering value or excitement, players can readily migrate to a competitor. For instance, in 2023, the global mobile gaming market generated over $90 billion in revenue, highlighting the sheer scale of competition and the need for developers to continually attract and retain players.

The ease with which players can switch between games amplifies their power. A single poorly received update or a lack of new content can lead to a rapid exodus of users. This dynamic forces game developers to be highly responsive to player feedback and market trends.

- Vast Selection: Millions of mobile games are available, offering players unparalleled choice.

- Fleeting Loyalty: Player retention is dependent on continuous engagement through updates and events.

- Switching Costs: The low barrier to entry for new games means players can easily abandon underperforming titles.

- Market Value: The global mobile gaming market exceeding $90 billion in 2023 underscores the intense competition for player attention.

Demand for Personalized and Engaging Experiences

Japanese consumers, whether they are advertisers or users of media and games, are becoming more sophisticated with technology. This trend significantly boosts their bargaining power as they now expect highly personalized and engaging experiences. For instance, in 2024, a significant portion of Japanese internet users actively sought out customized content and targeted advertising, demonstrating a clear preference for tailored digital interactions.

This elevated expectation for bespoke content, relevant advertisements, and innovative gameplay directly influences CyberAgent's strategy. The company must continuously invest in artificial intelligence and user experience enhancements to meet these demands. Failure to adapt could lead to customer attrition, as seen in market shifts where platforms offering less personalized experiences saw user engagement decline by as much as 15% in late 2023 and early 2024.

- Growing Demand for Personalization: Japanese consumers actively seek tailored content and advertising.

- Impact on CyberAgent: Requires continuous investment in AI and user experience.

- Customer Leverage: Expectations for engaging and innovative experiences give customers more power.

Customers possess significant bargaining power due to the vast array of digital advertising platforms and streaming services available, forcing CyberAgent to continuously demonstrate value. In 2024, the increasing sophistication of Japanese consumers, who actively seek personalized content and targeted advertising, further amplifies this leverage.

| Factor | Impact on CyberAgent | Supporting Data (2023-2024) |

|---|---|---|

| Availability of Alternatives | Lowers customer switching costs, increasing their power. | Global digital ad spending exceeded $600 billion in 2023, indicating numerous platform choices. |

| Consumer Sophistication | Demands for personalization require continuous investment in AI and UX. | Surveys in early 2024 showed over 60% of Japanese internet users prefer personalized content. |

| Price Sensitivity (AbemaTV) | Requires competitive pricing and compelling content against major streamers. | The subscription video on demand (SVOD) market is highly competitive, with global revenues projected to reach over $100 billion by 2025. |

Preview Before You Purchase

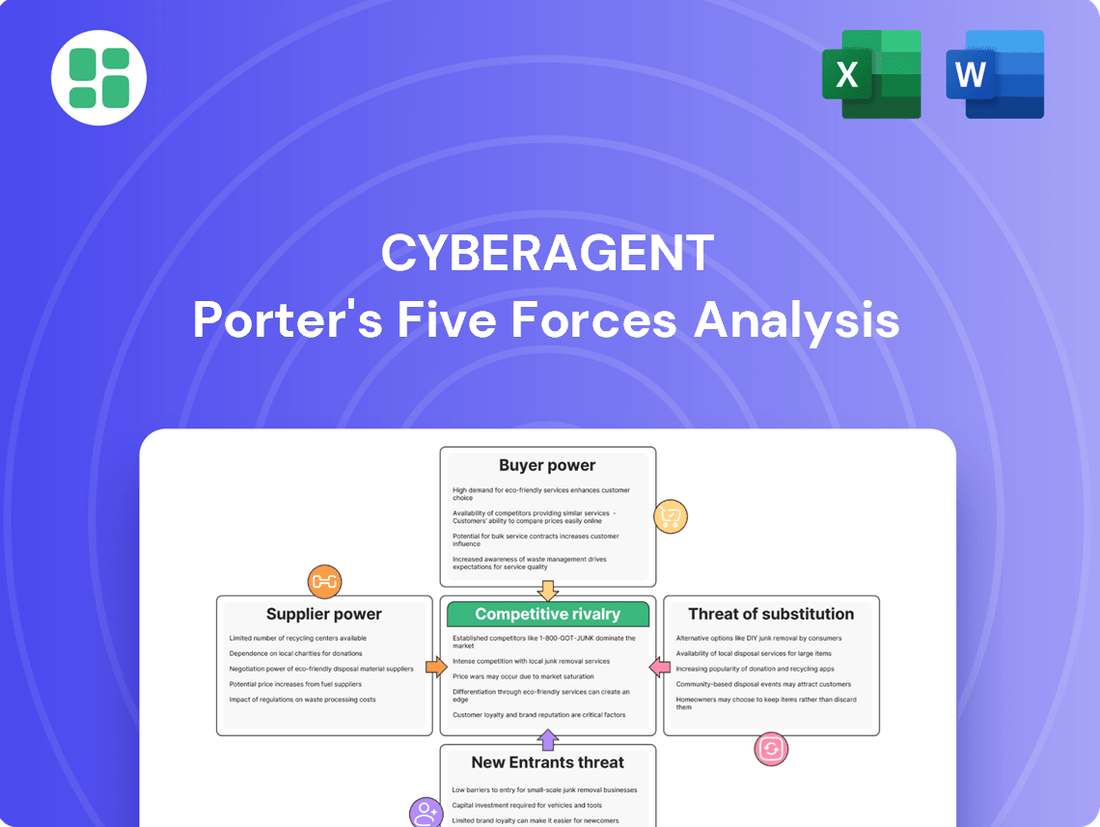

CyberAgent Porter's Five Forces Analysis

This preview showcases the complete CyberAgent Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool. You're looking at the actual, professionally formatted analysis, ready for your immediate use without any placeholders or alterations.

Rivalry Among Competitors

The digital advertising landscape in Japan is incredibly crowded. CyberAgent contends with global titans like Google and Meta, alongside formidable Japanese agencies such as Dentsu and Hakuhodo. This intense rivalry demands constant innovation in ad tech and unwavering client focus to secure and grow market share.

CyberAgent's AbemaTV faces intense competition in Japan's streaming sector from global giants like Netflix and Amazon Prime Video, as well as domestic players such as U-NEXT and Hulu. This crowded market demands constant innovation and significant investment to capture and hold viewer attention.

The Japanese streaming market is experiencing robust growth, with a projected CAGR of over 10% through 2028, fueling a content arms race. Platforms are compelled to pour resources into acquiring and producing exclusive, high-quality content to differentiate themselves and secure subscriber loyalty in this dynamic environment.

The mobile gaming arena in Japan, a market ranking third globally, is intensely competitive. This fierce rivalry stems from low barriers to entry for new games, which frequently causes significant revenue swings for publishers like CyberAgent.

CyberAgent, primarily through its subsidiary Cygames, navigates this landscape by continuously developing new hit titles while simultaneously managing its existing portfolio of long-established games. This dual strategy is crucial for retaining its status as a leading publisher in the dynamic Japanese mobile gaming sector.

Diversified Business Portfolio Mitigates Risk

CyberAgent's broad reach into digital advertising, media, and gaming offers a buffer against intense competition in any one area. This diversification means that a downturn in one sector doesn't necessarily cripple the entire company. For example, in 2023, CyberAgent's revenue from its media segment grew, helping to offset pressures in other markets.

Despite this diversification, each individual business unit contends with formidable direct competitors. The digital advertising space, for instance, is a battleground with giants like Google and Meta. Similarly, the gaming industry sees fierce competition from established players and agile newcomers, demanding constant innovation and strategic marketing to maintain market share. This necessitates ongoing investment in research and development and aggressive customer acquisition strategies across all segments.

- Digital Advertising: CyberAgent competes with major global platforms, requiring continuous adaptation to evolving ad technologies and privacy regulations.

- Media Segment: The company faces rivalry from numerous online content creators and established media outlets, necessitating unique content strategies and audience engagement.

- Gaming: The mobile gaming market is highly saturated, with CyberAgent needing to differentiate its titles through gameplay, monetization, and marketing to stand out.

Constant Need for Innovation and Differentiation

CyberAgent operates in highly dynamic sectors where staying ahead requires constant innovation. In its advertising business, for instance, the development of advanced AI and machine learning algorithms is crucial for optimizing ad delivery and performance, a challenge intensified by the ongoing evolution of digital marketing. This pressure to innovate is a significant factor in its competitive landscape.

The company's media segment, particularly AbemaTV, faces intense rivalry for viewer attention, necessitating the continuous acquisition of exclusive and compelling content. This demand for unique programming means substantial ongoing investment in content rights and production, directly impacting competitive positioning. For example, in 2023, the Japanese online advertising market alone was valued at over ¥5.5 trillion, highlighting the scale of competition.

- Advertising Technology: CyberAgent must continually enhance its AI and data analytics capabilities to maintain an edge in programmatic advertising.

- Content Acquisition: Securing exclusive rights for AbemaTV requires significant capital and strategic foresight to counter competitors.

- Game Development: The mobile gaming industry demands rapid iteration and the creation of novel gameplay experiences to capture and retain users.

CyberAgent faces intense competition across its core businesses, from global tech giants in digital advertising to established and emerging players in the Japanese media and mobile gaming markets. This rivalry necessitates continuous innovation in technology and content to capture and retain market share.

The digital advertising sector is particularly fierce, with companies like Google and Meta dominating global reach, forcing CyberAgent to leverage advanced AI and data analytics. In media, the battle for viewer attention is fierce, requiring substantial investment in exclusive content for platforms like AbemaTV. The mobile gaming market, Japan's third-largest globally, is saturated, demanding constant creation of new hit titles to stand out.

CyberAgent's diversified strategy helps mitigate risk, but each segment operates under significant competitive pressure. For instance, in 2023, the Japanese digital advertising market was valued at over ¥5.5 trillion, underscoring the scale of competition and the need for differentiation.

| Business Segment | Key Competitors | Competitive Challenge |

| Digital Advertising | Google, Meta, Japanese Agencies (Dentsu, Hakuhodo) | Maintaining market share through ad tech innovation and client retention. |

| Media (AbemaTV) | Netflix, Amazon Prime Video, U-NEXT, Hulu | Securing viewer attention with exclusive and compelling content. |

| Mobile Gaming | Numerous global and domestic publishers | Differentiating titles through gameplay, monetization, and marketing in a saturated market. |

SSubstitutes Threaten

While CyberAgent thrives on the move towards digital advertising, traditional channels like TV and print still represent a substitute for some advertisers. However, the landscape is clearly shifting; by 2024, digital advertising in Japan had already surpassed TV advertising in terms of market share, demonstrating a strong preference for platforms like CyberAgent's.

The threat of substitutes for AbemaTV is significant, as consumers have a vast array of entertainment and information options. These include traditional linear television, which still commands a considerable audience, and a growing number of other video streaming services. In 2023, the global video streaming market was valued at over $220 billion, indicating intense competition for viewer attention.

Furthermore, social media platforms like YouTube and TikTok offer a constant stream of user-generated content and short-form videos, directly competing for leisure time. Even console and PC gaming represent a substantial substitute, particularly among younger demographics. Offline entertainment activities, from attending live events to simply socializing, also draw consumers away from digital platforms.

Mobile game users often find alternatives in other digital entertainment. For instance, a significant portion of screen time is now dedicated to social media platforms, streaming services, and online shopping, diverting attention from gaming. In 2024, the global digital advertising market, which includes social media and content platforms, was projected to reach over $600 billion, indicating a massive allocation of consumer attention and spending to these areas.

The increasing popularity of short-form video content, exemplified by platforms like TikTok, offers a compelling substitute. These platforms provide quick, engaging entertainment that can easily fill leisure time previously occupied by mobile games. By mid-2024, TikTok was estimated to have over 1.5 billion active users worldwide, showcasing its immense reach and influence on consumer leisure habits.

Furthermore, social commerce, integrating shopping with social media, presents another avenue for digital engagement. Consumers can spend time browsing and purchasing products directly through social platforms, competing for the same attention and disposable income that might otherwise go towards mobile gaming. The global social commerce market was anticipated to grow substantially in 2024, with some estimates placing its value well over $1 trillion, highlighting its competitive draw.

In-House Marketing and Direct Platform Deals

Advertisers increasingly have the option to bring their digital marketing efforts in-house or forge direct partnerships with major advertising platforms such as Google and Meta. This trend presents a significant threat of substitution for agencies like CyberAgent.

For instance, many companies are building internal digital marketing departments, reducing their reliance on external agencies. This shift is driven by a desire for greater control and potentially lower costs, although it requires substantial investment in talent and technology.

The direct engagement model allows businesses to access platform tools and data more intimately. This bypasses agency intermediaries, posing a direct challenge to CyberAgent's traditional service model.

- In-house marketing teams offer greater control over campaigns and data.

- Direct platform deals can reduce agency fees for advertisers.

- CyberAgent must demonstrate superior expertise and unique value propositions to retain clients.

Emerging Technologies for Content Consumption

Emerging technologies like virtual reality (VR) and augmented reality (AR) present a significant threat of substitution for CyberAgent's core content consumption and gaming businesses. These immersive platforms offer novel ways for users to engage with entertainment, potentially drawing audiences away from traditional digital content and existing gaming ecosystems. For instance, the global VR market was valued at approximately $28.2 billion in 2023 and is projected to grow substantially, indicating a growing user base and increasing adoption of these alternative experiences.

CyberAgent's strategic exploration of new intellectual properties (IPs) is a direct response to this evolving landscape. However, a rapid and widespread adoption of VR/AR technologies could fundamentally reshape consumer preferences and market dynamics. If these technologies mature to offer compelling and accessible alternatives, they could capture a significant share of entertainment spending and user attention that might otherwise be directed towards CyberAgent's current offerings.

- Immersive Alternatives: VR and AR technologies provide highly engaging, interactive experiences that can substitute for passive content consumption and traditional gaming.

- Market Shift Potential: A substantial migration of users to VR/AR platforms could diminish the relevance and profitability of existing digital content and gaming models.

- Industry Investment: Significant investments are being poured into VR/AR development, with global markets expected to reach hundreds of billions by the end of the decade, highlighting the growing competitive threat.

For CyberAgent's digital advertising segment, the threat of substitutes comes from advertisers opting for in-house marketing teams or direct deals with major platforms like Google and Meta. This trend, driven by a desire for greater control and cost efficiency, challenges CyberAgent's agency model.

In the entertainment and gaming sectors, substitutes are diverse, ranging from traditional TV and other streaming services to social media platforms and even offline activities. The global video streaming market alone exceeded $220 billion in 2023, illustrating the intense competition for consumer attention. Emerging technologies like VR and AR also pose a significant threat, offering immersive experiences that could draw users away from CyberAgent's current offerings.

| Substitute Category | Examples | Impact on CyberAgent |

|---|---|---|

| Advertising Channels | TV, Print, Direct Platform Deals (Google, Meta) | Reduces reliance on advertising agencies; potential loss of clients. |

| Entertainment Options | Linear TV, Streaming Services, Social Media (YouTube, TikTok), Gaming, Offline Activities | Divides consumer attention and leisure time; impacts AbemaTV viewership. |

| Emerging Technologies | Virtual Reality (VR), Augmented Reality (AR) | Offers novel, immersive experiences that could displace existing digital content and gaming models. |

Entrants Threaten

Launching a new media and intellectual property (IP) venture, particularly a streaming service like AbemaTV, demands immense capital. This includes hefty spending on acquiring desirable content, building robust technological infrastructure, and extensive marketing campaigns to attract and retain users.

AbemaTV's substantial operating losses in its formative years, reaching approximately ¥30 billion (around $200 million USD at the time) in its first fiscal year ending March 2017, vividly illustrate this significant financial hurdle. These figures underscore the difficulty new players face in competing with established entities that have already amortized their initial investments.

The threat of new entrants into Japan's digital advertising market is relatively low, primarily due to the entrenched dominance of established giants. Companies like Dentsu, Hakuhodo, and CyberAgent have cultivated decades of client relationships and possess deep operational expertise. For instance, CyberAgent reported total revenue of ¥642.4 billion for the fiscal year ending September 2023, showcasing its substantial scale and market presence.

Newcomers face significant hurdles in replicating the advanced AI-driven capabilities and integrated service offerings that these incumbents leverage. These established players not only command substantial market share but also benefit from economies of scale, making it difficult for smaller, emerging agencies to compete effectively on price or service breadth.

The threat of new entrants in CyberAgent's media and gaming sectors is significantly impacted by the high costs associated with building brand recognition and acquiring users. For instance, in 2023, the global mobile gaming market, a key area for CyberAgent, saw user acquisition costs continue to rise, with some titles spending upwards of $50 per install to reach a valuable player. This makes it incredibly difficult for newcomers to gain traction against established platforms like AbemaTV, which has invested heavily in content and marketing, or CyberAgent's own popular game franchises that already command significant user loyalty.

Network Effects and Data Advantages

In the digital advertising realm, new players face substantial hurdles due to powerful network effects. As more users join a platform, it becomes more attractive to advertisers, creating a virtuous cycle that is difficult for newcomers to replicate. This dynamic is amplified by the immense value of data; companies with extensive user data can offer superior targeting and optimization, further solidifying their competitive position.

CyberAgent, with its deep roots in the internet advertising agency sector, possesses a significant data advantage. This accumulated knowledge and data allow for more refined campaign strategies and better performance metrics, making it challenging for less experienced entrants to compete on effectiveness.

Consider these points regarding network effects and data advantages:

- Network Effects: In 2024, platforms with strong network effects in digital advertising, such as social media giants, continue to dominate user attention, attracting a disproportionate share of advertising spend.

- Data Accumulation: Companies like CyberAgent leverage years of user interaction data to refine algorithms for ad placement and audience segmentation, a capability that requires substantial time and investment to build.

- Barriers to Entry: The combined strength of network effects and data advantages creates a high barrier to entry, as new entrants must not only attract a user base but also amass comparable data sets to offer competitive advertising solutions.

Regulatory Landscape and Compliance Costs

The digital advertising and media sector in Japan is subject to a complex web of regulations, including stringent data privacy laws like the Act on the Protection of Personal Information (APPI). For new entrants, particularly foreign companies, understanding and adhering to these regulations can be a significant undertaking. The compliance burden, encompassing data handling, advertising standards, and consumer protection, often involves substantial investment in legal counsel, technology, and operational adjustments. This can effectively raise the barrier to entry, making it more challenging and expensive for potential competitors to establish a foothold in the market.

In 2024, the ongoing evolution of data privacy frameworks globally and within Japan continues to shape compliance requirements. Companies must invest in robust data governance and security measures to meet these standards. For instance, the APPI mandates specific consent mechanisms and data breach notification procedures, adding to the operational costs for any new player. This regulatory environment, while crucial for consumer trust, inherently favors established entities with existing compliance infrastructure.

- Regulatory Complexity: Navigating Japan's data privacy laws, such as the APPI, presents a significant hurdle for new entrants in the digital advertising space.

- Compliance Costs: Implementing and maintaining compliance with these regulations can be expensive, requiring investment in legal expertise, technology, and operational processes.

- Impact on Entry: The substantial compliance costs and complexity act as a deterrent, effectively raising the barrier to entry and potentially limiting the number of new competitors.

The threat of new entrants for CyberAgent is generally low due to high capital requirements, strong network effects, and significant regulatory hurdles. Launching a new streaming service like AbemaTV, for example, demands substantial investment in content acquisition and infrastructure, as evidenced by its early operating losses. Similarly, the digital advertising market is dominated by established players like CyberAgent, which benefit from deep client relationships and economies of scale, making it hard for newcomers to compete.

Porter's Five Forces Analysis Data Sources

Our CyberAgent Porter's Five Forces analysis is built upon a robust foundation of data, drawing from CyberAgent's official investor relations website, annual financial reports, and publicly available market research from reputable firms. We also incorporate insights from industry news and competitor announcements to gain a comprehensive understanding of the competitive landscape.