CSE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSE Bundle

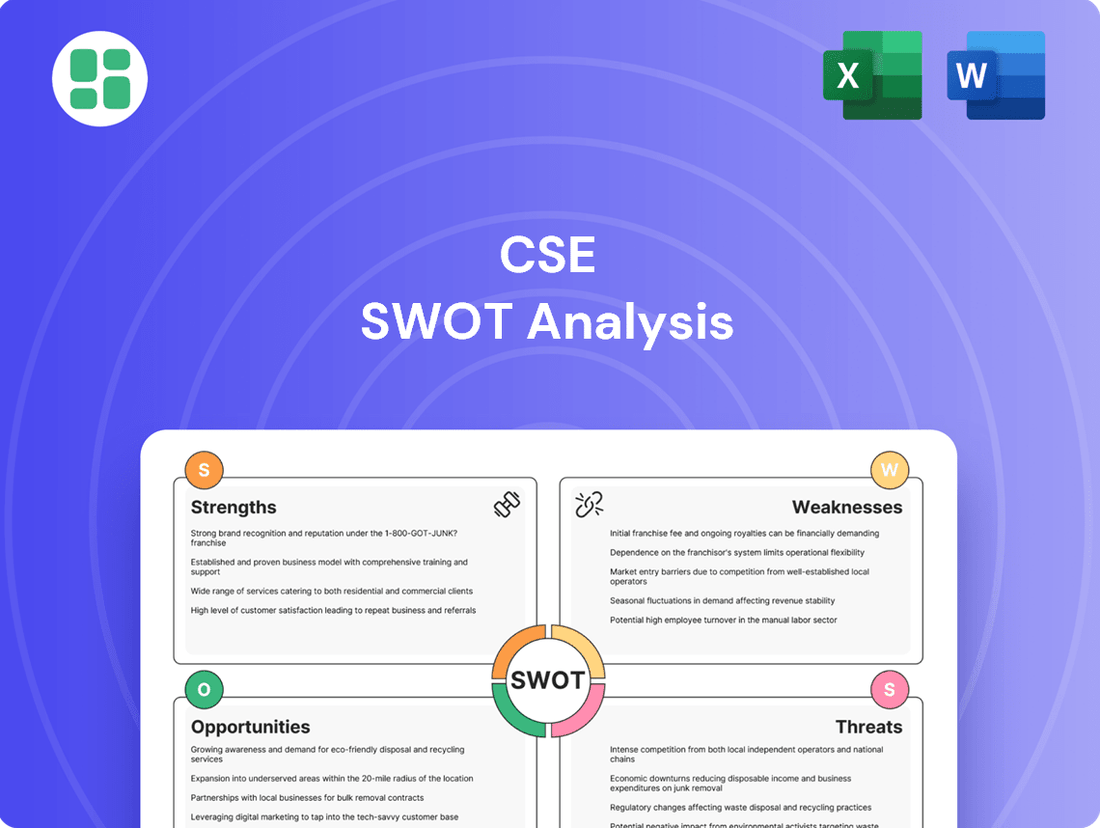

The CSE SWOT Analysis reveals crucial insights into the company's competitive edge and potential challenges. Understand the core strengths driving success and the emerging opportunities for expansion. Don't miss out on the full picture.

Ready to leverage this data for your strategic advantage? Purchase the complete SWOT analysis for a detailed, actionable roadmap. It's your key to informed decision-making and unlocking future growth.

Strengths

CSE Global boasts a remarkable history of profitability, maintaining consistent earnings for over thirty years. This enduring success underscores the strength of its business model and operational execution.

The company's financial stability is further evidenced by its commitment to regular dividend payments, a testament to its focus on rewarding shareholders. In the fiscal year ending September 2023, CSE Global reported a net profit after tax of S$32.6 million, a significant increase from S$24.1 million in the previous year.

Prudent capital management is a cornerstone of CSE Global's strategy, with improved net gearing ratios, such as a reduction to 14.5% as of September 2023 from 20.3% a year prior, bolstering its financial resilience and capacity for future growth.

CSE Global boasts a remarkably stable financial foundation, with roughly 90% of its income generated from its ongoing 'Flow business.' This consistent revenue stream provides a strong predictability that is highly valued in the market, offering a solid base for future growth and investment.

The company's strategic diversification across automation, telecommunications, and environmental solutions significantly reduces its exposure to sector-specific downturns. This broad market presence allows CSE Global to tap into various growth opportunities and adapt to changing economic landscapes, making it a resilient player.

CSE Global's impressive order book, reaching S$672.6 million as of December 31, 2024, offers significant revenue visibility for the coming periods.

The company's finely tuned engineering expertise allows for the successful execution of intricate, large-scale projects, even when faced with difficult circumstances.

This proven track record in both securing and completing substantial contracts solidifies CSE Global's standing in its respective markets.

Extensive Engineering Expertise and Global Presence

CSE Global's extensive engineering expertise, honed across diverse industrial sectors, positions it as a leading provider of integrated systems solutions. This deep well of specialized knowledge allows the company to tackle complex projects effectively, making it a go-to partner for clients seeking advanced technological capabilities.

The company boasts a significant global presence, with operations strategically located across the Americas, Asia Pacific, Europe, the Middle East, and Africa. This international footprint, as evidenced by its project wins in regions like Australia and Southeast Asia during 2024, enables CSE Global to effectively serve a broad and varied client base, securing and managing projects on a worldwide scale.

- Deep Engineering Acumen: CSE Global possesses specialized engineering skills vital for integrated systems across multiple industries.

- Global Operational Footprint: The company operates in key regions including the Americas, Asia Pacific, Europe, Middle East, and Africa, facilitating international project execution.

- Client Service Diversity: This widespread presence allows CSE Global to cater to a diverse global clientele, enhancing its project acquisition capabilities.

- Project Management Capability: Its international network supports the effective management of projects worldwide.

Strategic Acquisitions and Diversification

CSE Global's strategic acquisitions and diversification efforts are a significant strength, fueling its expansion into new and promising markets. This proactive approach has allowed the company to broaden its service offerings and customer base, enhancing its resilience and market position.

A key aspect of this strategy involves integrating complementary capabilities, which not only bolsters CSE's core business but also unlocks new revenue streams. For instance, the company's expansion into data centers and renewable energy sectors demonstrates a clear vision for future growth and adaptation to evolving industry demands. In fiscal year 2023, CSE reported a substantial increase in its order book, reflecting the success of these strategic moves.

- Strategic Acquisitions: CSE Global has a proven track record of identifying and integrating businesses that align with its growth objectives, thereby expanding its technological expertise and geographic reach.

- Diversification into High-Growth Sectors: The company's successful entry into markets like data centers and renewable energy provides a hedge against cyclicality in traditional sectors and taps into significant future growth potential.

- Synergistic Integration: By acquiring and integrating firms with adjacent capabilities, CSE strengthens its end-to-end solutions and creates cross-selling opportunities, leading to enhanced value for clients and shareholders.

CSE Global demonstrates robust financial health, consistently achieving profitability for over three decades. This sustained performance is further solidified by a strong order book, reaching S$672.6 million as of December 31, 2024, providing excellent revenue visibility.

The company's strategic diversification across automation, telecommunications, and environmental solutions, alongside successful expansion into high-growth areas like data centers and renewable energy, mitigates sector-specific risks and capitalizes on emerging market trends.

CSE Global's deep engineering expertise enables the successful execution of complex, large-scale projects, a capability supported by its global operational footprint spanning multiple continents, allowing it to serve a diverse international clientele effectively.

| Metric | FY2023 (Sep) | FY2024 (Dec) |

|---|---|---|

| Net Profit After Tax | S$32.6 million | N/A (2024 data not yet fully reported at time of writing) |

| Net Gearing Ratio | 14.5% | N/A (2024 data not yet fully reported at time of writing) |

| Order Book | N/A | S$672.6 million |

What is included in the product

Provides a comprehensive analysis of CSE's internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable framework to identify and address critical weaknesses and threats, thereby alleviating strategic uncertainty.

Weaknesses

CSE Global's significant presence in major economies such as the United States, Australia, and the United Kingdom means it's highly susceptible to currency fluctuations. For instance, if the Singapore Dollar strengthens against the US Dollar, revenues earned in the US would translate to fewer Singapore Dollars, potentially impacting reported earnings. This foreign exchange exposure is a constant factor that needs careful management.

While CSE's order book is generally robust, recent trends indicate a weakening in new order intake. For instance, the first quarter of 2025 saw a 11.3% year-on-year drop in new orders.

The electrification segment was particularly affected, with a significant 52.4% decrease in new orders during Q1 2025. This downturn is partly attributed to a strategic pivot from municipal projects to the data center market.

These fluctuations in order flow can create challenges for short-term revenue forecasting and complicate operational resource allocation.

CSE Global's significant reliance on a few key geographical markets presents a notable weakness. In fiscal year 2024, the United States alone contributed a substantial 63% of the company's revenue, highlighting a pronounced dependency.

This concentration exposes CSE Global to considerable risk. Economic downturns, shifts in government policy, or political instability within these dominant regions could have a disproportionately negative impact on the company's overall financial performance and stability.

Ongoing Legal Proceedings

CSE is currently entangled in legal proceedings, notably a dispute concerning a US$6 million payment tied to a standby letter of guarantee. While the company anticipates recovering these funds, these legal entanglements represent a significant drain on resources, diverting valuable management attention and potentially unsettling investor sentiment.

These ongoing legal battles underscore the inherent risks associated with CSE's complex contractual agreements and highlight potential financial and operational vulnerabilities.

- Legal Dispute: A US$6 million payment dispute under a standby letter of guarantee is a key ongoing legal matter for CSE.

- Resource Drain: Such proceedings consume significant financial resources and management time, impacting operational focus.

- Investor Confidence: Legal challenges can negatively affect investor perception and confidence in the company's stability.

- Contractual Risk: The situation emphasizes the risks inherent in CSE's complex contractual relationships.

Unmet Long-Term ESG Targets

While CSE Global has demonstrated a commitment to environmental, social, and governance (ESG) principles, including robust ESG reporting, the company has encountered difficulties in fully achieving certain long-term environmental objectives. Specifically, formal decarbonization goals and greenhouse gas reduction targets remain areas of ongoing development and challenge for the company.

The potential impact of not meeting these evolving sustainability standards and targets could be significant. This includes risks to CSE Global's brand reputation, which is increasingly scrutinized by stakeholders for its environmental stewardship. Furthermore, failure to align with these standards might limit access to specific investment pools that prioritize sustainable portfolios, and could also pose challenges for future regulatory compliance as environmental regulations become more stringent.

- Decarbonization Goals: CSE Global is still working towards formalizing and achieving its long-term decarbonization targets.

- Greenhouse Gas Reduction: The company faces ongoing challenges in meeting its stated greenhouse gas reduction objectives.

- Reputational Risk: Not meeting ESG targets can negatively impact brand perception among customers and investors.

- Investment Access: A failure to align with sustainability standards could restrict access to ESG-focused investment funds.

CSE Global's substantial reliance on the United States market, which accounted for 63% of its revenue in fiscal year 2024, presents a significant concentration risk. This dependency makes the company highly vulnerable to economic downturns, policy shifts, or political instability within the US, potentially leading to disproportionately negative impacts on its overall financial performance.

The company experienced a notable 11.3% year-on-year decline in new orders during the first quarter of 2025, with the electrification segment particularly affected by a 52.4% decrease. This slowdown in order intake poses challenges for revenue forecasting and operational planning.

CSE Global faces ongoing legal challenges, including a US$6 million dispute related to a standby letter of guarantee. These proceedings divert crucial financial resources and management attention, potentially impacting operational focus and investor confidence.

While CSE Global emphasizes ESG principles, it faces challenges in achieving formal decarbonization goals and greenhouse gas reduction targets. This could negatively affect its brand reputation and access to ESG-focused investment funds.

| Weakness | Description | Impact | Relevant Data |

|---|---|---|---|

| Geographic Concentration | High reliance on a few key markets, especially the US. | Vulnerability to regional economic/political factors. | US revenue contribution: 63% (FY2024) |

| Order Book Volatility | Fluctuations in new order intake. | Challenges in revenue forecasting and resource allocation. | Q1 2025 new orders down 11.3% YoY; Electrification orders down 52.4% YoY. |

| Legal Proceedings | Involvement in significant payment disputes. | Resource drain, management distraction, potential reputational damage. | US$6 million dispute over standby letter of guarantee. |

| ESG Target Achievement | Difficulty in meeting decarbonization and GHG reduction goals. | Reputational risk, potential impact on investment access. | Ongoing development of formal targets. |

Full Version Awaits

CSE SWOT Analysis

This is the actual CSE SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

The preview below is taken directly from the full CSE SWOT report you'll get. Purchase unlocks the entire in-depth version, ready for your strategic planning.

This preview reflects the real CSE SWOT analysis document you'll receive—professional, structured, and ready to use for your business needs.

Opportunities

The global AI market is projected to reach $1.8 trillion by 2030, fueling massive data center expansion. This surge in AI adoption directly translates to increased demand for robust power infrastructure and specialized electrification solutions, areas where CSE Global excels. The company is well-positioned to benefit from this multi-year growth trend by supplying critical power systems for these next-generation facilities.

CSE Global is strategically positioning itself for significant growth through market expansion, with a particular focus on the United States. The company aims to more than triple its US operational capacity by the 2027/28 fiscal year, a bold move indicating strong confidence in the US market's potential. This expansion is supported by substantial investments, with FY2023 capital expenditure reaching S$34.1 million, a significant portion allocated to enhancing capabilities.

Complementary acquisitions are a key pillar of CSE's expansion strategy, targeting businesses that bolster its presence in high-growth sectors like critical communications and security solutions. For instance, the acquisition of Acal Energy in late 2023 for approximately S$14.7 million strengthened its position in the UK's energy sector, demonstrating a clear pattern of acquiring synergistic businesses to drive future revenue streams and market leadership.

The global push for sustainability presents a substantial opportunity for CSE Global within the renewable energy and energy storage sectors. The company's established capabilities in electrical distribution systems are crucial for developing the next-generation power grid.

CSE Global is actively involved in solar energy projects, demonstrating its commitment to this growing market. Furthermore, their work in optimizing urban water management aligns with climate-friendly initiatives, showcasing a diversified approach to green technologies.

Government and Public Infrastructure Investments

Government and public infrastructure investments are a significant tailwind for CSE Global. Many governments worldwide are channeling substantial funds into upgrading and expanding their infrastructure, creating a robust pipeline of projects. These initiatives directly translate into opportunities for CSE's core offerings in energy, infrastructure, and utilities sectors.

For example, Singapore's commitment to infrastructure development, highlighted by the Monetary Authority of Singapore's (MAS) SGD5 billion market liquidity program, is a key driver. This program, alongside other large-scale government-backed contracts, is expected to boost demand for CSE's specialized solutions. The company is strategically positioned to capitalize on these substantial public spending plans.

- Singapore's MAS market liquidity program: SGD5 billion dedicated to enhancing market stability and potentially funding infrastructure projects.

- Global infrastructure spending: Projections indicate continued growth in public infrastructure investment, with significant outlays expected in 2024 and 2025 across various regions.

- CSE's positioning: The company's expertise in energy, infrastructure, and utilities aligns perfectly with the focus of these government initiatives.

Leveraging Recurring Revenue for Upselling

CSE Global's substantial recurring revenue, particularly from its 'Flow business', creates a robust financial foundation. This predictability allows for strategic upselling and cross-selling of premium services, enhancing customer lifetime value. For instance, in fiscal year 2024, the company reported a strong performance in its recurring revenue segments, demonstrating the stability that underpins these growth opportunities.

This consistent income stream naturally fosters deeper customer loyalty and opens doors to expanding the scope of current agreements. CSE can leverage these established relationships to introduce new, high-margin offerings. The company's focus on service contracts within the Flow business, which often include ongoing maintenance and support, directly contributes to this recurring revenue model.

- Stable Financial Base: Recurring revenue from the 'Flow business' provides predictable income.

- Upselling Potential: This stability enables strategic offers of additional high-value services.

- Customer Loyalty: Consistent service delivery strengthens client relationships and retention.

- Contract Expansion: Opportunities arise to broaden the scope of existing service agreements.

The burgeoning demand for AI infrastructure presents a significant opportunity for CSE Global, as the global AI market is projected to reach $1.8 trillion by 2030, necessitating massive data center expansion and robust power solutions. CSE's expertise in supplying critical power systems for these facilities positions them to capitalize on this multi-year growth trend.

CSE's strategic market expansion, particularly in the United States, aims to more than triple its operational capacity by FY2027/28, backed by substantial FY2023 capital expenditure of S$34.1 million. This aggressive growth plan is further bolstered by complementary acquisitions, such as Acal Energy in late 2023 for S$14.7 million, which strengthens their position in high-growth sectors like critical communications and energy.

The global sustainability drive offers a substantial avenue for CSE within renewable energy and energy storage, leveraging their electrical distribution capabilities for next-generation power grids. Furthermore, government infrastructure investments worldwide, exemplified by Singapore's MAS SGD5 billion market liquidity program, create a robust pipeline of projects that align directly with CSE's core offerings in energy, infrastructure, and utilities.

CSE Global benefits from a strong recurring revenue base, primarily through its 'Flow business', which provides a stable financial foundation for upselling premium services and fostering deeper customer loyalty. This predictable income stream allows for strategic expansion of existing agreements and the introduction of new, high-margin offerings, as demonstrated by strong performance in recurring revenue segments in fiscal year 2024.

Threats

CSE Global faces significant headwinds from global macroeconomic volatility. Persistent inflationary pressures, as seen in the US CPI reaching 3.4% year-over-year in April 2024, and ongoing geopolitical tensions in regions like Eastern Europe and the Middle East, create an unpredictable operating environment. These factors directly impact supply chain reliability and can lead to increased operational costs, potentially delaying or deterring client investments in CSE's infrastructure projects.

The market for integrated automation, telecommunications, and environmental solutions is becoming increasingly crowded, with many companies competing for the same customers. This intense rivalry can force prices down and squeeze profit margins, making it harder for CSE Global to earn as much. For instance, in 2023, the global industrial automation market, a key segment for integrated solutions, was valued at approximately $200 billion, with growth projections indicating significant new entrants and established players expanding their offerings.

To stay ahead, CSE Global needs to constantly innovate and offer unique value. This means not just providing technology, but also ensuring superior service and support that competitors can't easily match. Failing to differentiate could lead to losing business to rivals who offer similar services at lower costs or with perceived better performance.

CSE Global, as a worldwide operator, faces significant threats from supply chain disruptions. These can directly affect project timelines and cost management, as seen with ongoing global logistics challenges. For instance, the Suez Canal blockage in early 2024 caused significant shipping delays, impacting numerous industries and highlighting the vulnerability of global trade routes.

Geopolitical tensions and natural disasters remain key drivers of these disruptions. The conflict in Eastern Europe, for example, has continued to impact energy and raw material prices, indirectly affecting the availability and cost of components for CSE Global's projects. These events necessitate proactive risk mitigation and flexible sourcing strategies to maintain operational efficiency.

Regulatory and Compliance Risks

CSE Global faces significant regulatory and compliance risks due to its global operations. Navigating the intricate and constantly shifting legal landscapes across various jurisdictions requires substantial resources and vigilance. For instance, in 2024, companies in the technology and engineering sectors have seen increased scrutiny on data privacy regulations like GDPR and CCPA, which could impact CSE's service delivery and data handling practices. Failure to comply can result in hefty fines, legal battles, and severe damage to its reputation, potentially impacting its market standing and investor confidence.

The company must proactively manage these challenges through robust compliance programs and continuous adaptation. For example, a key aspect of managing these risks involves investing in legal and compliance expertise, as well as technology solutions that automate compliance monitoring. In 2024, many companies have reported increased spending on compliance technology, with the global regulatory compliance market projected to reach over $100 billion by 2025, highlighting the growing importance of this area. CSE's ability to stay ahead of regulatory changes will be crucial for its sustained success and operational stability.

- Geographical Complexity: CSE's presence in multiple countries necessitates adherence to diverse and evolving regulations, from environmental standards to labor laws.

- Potential Penalties: Non-compliance can lead to substantial fines, legal injunctions, and operational disruptions, as seen with penalties levied against multinational corporations for breaches in financial reporting or data security in 2024.

- Reputational Impact: Regulatory violations can erode customer trust and investor confidence, negatively affecting market perception and share value.

- Adaptation Costs: Continuously updating policies and processes to meet new regulatory requirements incurs ongoing operational costs and demands significant management attention.

Litigation and Contractual Disputes

CSE Global's project-heavy business model inherently exposes it to the threat of litigation and contractual disputes with its clients. These disagreements can arise from various project-related issues, leading to significant financial and operational disruptions.

A prime example of this threat materialized when CSE Global faced a US$6 million payment dispute with a customer. Such incidents underscore the potential for unexpected financial settlements and the considerable diversion of management attention and resources away from core business activities.

- Contractual Complexity: The intricate nature of large-scale, project-based contracts increases the likelihood of differing interpretations and potential disputes.

- Financial Impact: Litigation can lead to substantial financial settlements, legal fees, and reputational damage, impacting profitability and cash flow.

- Resource Diversion: Managing legal challenges requires significant management time and internal resources, detracting from strategic growth initiatives.

Intensifying competition within CSE Global's core markets poses a significant threat. As the global industrial automation market, a key area for integrated solutions, was valued at approximately $200 billion in 2023, increased competition can lead to price wars and reduced profit margins. This necessitates continuous innovation and a focus on differentiated service offerings to maintain market share and profitability.

CSE Global is vulnerable to supply chain disruptions, exacerbated by geopolitical instability and natural disasters. For instance, ongoing conflicts and shipping challenges, like those experienced in early 2024, can delay projects and increase operational costs. Proactive risk management and flexible sourcing strategies are crucial to mitigate these impacts.

Navigating diverse and evolving global regulations presents a substantial risk. Increased scrutiny on data privacy, as seen with GDPR and CCPA in 2024, can lead to significant fines and reputational damage if not managed effectively. CSE must invest in compliance expertise and technology to adapt to these dynamic legal landscapes.

Project-based contracts inherently carry the risk of litigation and disputes. A past US$6 million payment dispute highlights the potential for financial and operational disruptions. Managing contractual complexity and ensuring clear communication are vital to minimize these risks.

| Threat Category | Specific Risk Example | Impact on CSE Global | Mitigation Strategy | 2024/2025 Data Point |

|---|---|---|---|---|

| Market Competition | Price erosion due to new entrants | Reduced profit margins | Focus on value-added services and innovation | Global industrial automation market valued at ~$200B in 2023 |

| Supply Chain Disruptions | Logistics delays from geopolitical events | Project delays and increased costs | Diversified sourcing and robust logistics planning | Suez Canal blockage in early 2024 caused widespread shipping delays |

| Regulatory & Compliance | Non-compliance with data privacy laws | Fines and reputational damage | Investment in compliance technology and legal expertise | Global regulatory compliance market projected to exceed $100B by 2025 |

| Contractual Disputes | Payment disagreements with clients | Financial loss and resource diversion | Clear contract terms and proactive dispute resolution | Past US$6M payment dispute with a customer |

SWOT Analysis Data Sources

This CSE SWOT analysis draws from a robust combination of internal financial reports, comprehensive market research data, and expert industry insights. These sources provide a well-rounded and data-driven perspective for strategic evaluation.