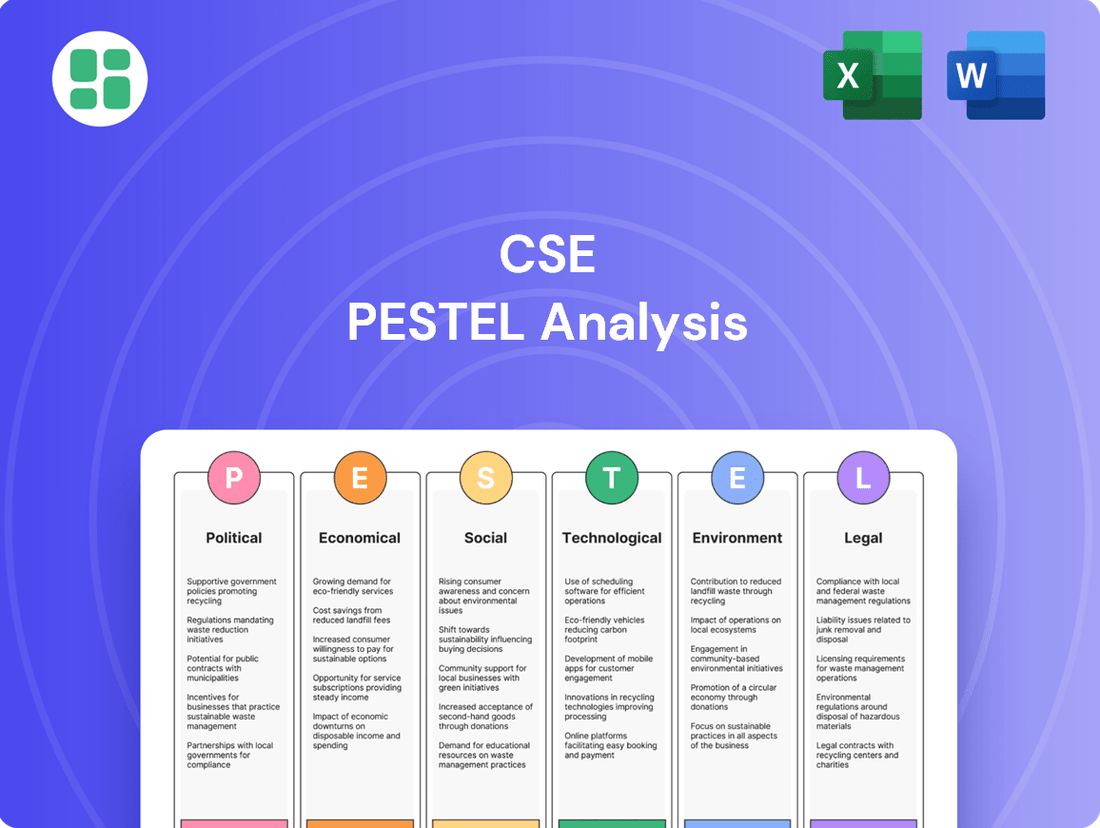

CSE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSE Bundle

Unlock the critical external factors shaping CSE's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage. Download the full PESTLE analysis now for immediate insights.

Political factors

Government policies and funding for critical infrastructure projects, especially in energy, maritime, and public utilities, directly impact CSE Global's order book and revenue streams.

Increased government investment in sectors like data centers and renewable energy infrastructure, exemplified by the US$70 billion allocated for AI and energy infrastructure in the United States, presents substantial growth opportunities for CSE.

These government initiatives foster a consistent demand for CSE's core offerings in electrification, communications, and automation solutions, underpinning the company's market position.

Global trade policies, including tariffs and trade agreements, directly influence CSE Global's operational costs and the availability of essential components for its integrated solutions. For instance, the ongoing trade tensions between major economies in 2024 could lead to increased import duties on critical materials, impacting project profitability. Geopolitical stability across CSE's key markets like the Americas, Asia Pacific, Europe, Middle East, and Africa is paramount for uninterrupted supply chains and successful project execution.

Disruptions stemming from regional conflicts or shifts in international relations can significantly impede project timelines and increase logistical expenses. For example, instability in the Middle East, a region where CSE Global has active projects, can create challenges in sourcing materials and ensuring the safety of personnel. Maintaining strong diplomatic ties and navigating evolving trade landscapes are therefore critical for CSE Global's ability to deliver on its global commitments in 2024 and 2025.

Governments worldwide are intensifying regulations around critical infrastructure, particularly concerning cybersecurity. For instance, the EU's NIS2 Directive, which came into effect in January 2023 and is being transposed into national laws throughout 2024, mandates stricter security measures for entities operating in sectors like energy, transport, and digital infrastructure. This creates a significant market opportunity for companies like CSE Global, whose automation and communication solutions are designed to meet these rigorous compliance demands, ensuring operational integrity and safety.

Government Support for Green Technologies

Government incentives and support for green technologies are major political forces. Initiatives focused on energy transition and decarbonization directly influence companies like CSE Global, which provides electrification solutions for the evolving electricity grid and renewable energy sector.

Policies that encourage clean energy investments are particularly beneficial. For instance, the global expenditure on clean energy technologies reached a significant milestone, with an estimated $2 trillion invested in 2024 alone. This substantial financial commitment by governments worldwide creates a favorable environment for businesses expanding in this area.

- Government incentives: Tax credits, subsidies, and grants for renewable energy projects and green technology adoption.

- Energy transition policies: National and international targets for reducing carbon emissions and increasing the share of renewables in the energy mix.

- Regulatory frameworks: Standards and regulations promoting energy efficiency, grid modernization, and the integration of distributed energy resources.

Political Stability and Investment Climate

The political stability in key markets like Singapore and the United States significantly shapes investor confidence and the ease of securing project financing for companies such as CSE Global. A predictable political landscape reduces perceived risk, making it more attractive for both domestic and international capital to flow into industrial solutions and infrastructure projects.

Government initiatives play a crucial role in fostering a favorable investment climate. For instance, Singapore's Monetary Authority of Singapore (MAS) Equity Market Development Program, initially launched with S$5 billion, has been instrumental in enhancing market liquidity and supporting the valuations of listed companies. This program, by encouraging participation and improving market infrastructure, directly benefits companies like CSE Global by potentially boosting their stock performance and improving access to capital for expansion and strategic acquisitions.

- Singapore's S$5 billion MAS Equity Market Development Program aims to bolster market liquidity and valuations.

- US political stability is a critical factor for CSE Global's operations and investment decisions in the region.

- Stable political environments are essential for attracting long-term investments in industrial sectors.

- Government policies directly influence the cost of capital and the feasibility of strategic growth initiatives.

Government policies directly shape CSE Global's market opportunities through infrastructure spending and sector-specific incentives. For example, the US$70 billion allocated for AI and energy infrastructure in the United States highlights significant growth potential for CSE's automation and electrification solutions in 2024-2025.

Evolving global trade policies and geopolitical stability are critical for CSE Global's operational costs and supply chain integrity. Trade tensions in 2024 could increase import duties on essential components, impacting project profitability, while regional conflicts can disrupt project timelines and increase logistical expenses.

Stricter cybersecurity regulations, such as the EU's NIS2 Directive, create demand for CSE's secure automation and communication solutions. Furthermore, government support for green technologies, with an estimated US$2 trillion invested globally in clean energy in 2024, directly benefits CSE's electrification offerings.

| Political Factor | Impact on CSE Global | Supporting Data/Examples (2024-2025 focus) |

| Government Infrastructure Spending | Boosts order book and revenue | US$70 billion allocated for AI/energy infrastructure in the US |

| Trade Policies & Geopolitics | Affects operational costs and supply chains | Potential import duty increases due to trade tensions; regional conflicts impacting logistics |

| Cybersecurity Regulations | Creates demand for secure solutions | EU's NIS2 Directive implementation driving need for compliant automation |

| Green Technology Incentives | Drives growth in renewable energy sector | Global clean energy investment estimated at US$2 trillion in 2024 |

What is included in the product

The CSE PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the business, providing a holistic view of the external landscape.

Provides a structured framework to identify and analyze external factors, alleviating the pain of strategic uncertainty and enabling proactive decision-making.

Economic factors

Global economic growth directly influences CSE Global's performance, as a healthy economy spurs investment in energy, infrastructure, and maritime sectors. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 3.1% in 2023, indicating a potentially favorable environment for CSE's clients to increase capital expenditure.

Industrial activity, a key driver for CSE's offerings, also reflects this economic health. Manufacturing PMIs (Purchasing Managers' Indexes) provide a snapshot; for example, the JPMorgan Global Manufacturing PMI stood at 50.3 in April 2024, signaling a marginal expansion in global manufacturing output, which could translate to increased demand for CSE's services.

Conversely, a slowdown in these areas poses a risk. If global growth falters, perhaps due to geopolitical tensions or inflation concerns, clients might delay or scale back projects, leading to lower order intake for CSE. For example, if the projected 2025 global growth forecast of 3.2% by the IMF were to be revised downwards significantly, it would likely impact CSE's revenue projections.

Volatility in commodity prices, especially for oil and gas, directly influences the investment plans and profitability of CSE Global's clients within the energy sector. For example, Brent crude oil prices have seen significant swings, averaging around $83 per barrel in early 2024, a figure that impacts upstream investment decisions.

Despite CSE's diversification efforts, a substantial part of its business remains linked to these commodity-driven industries. Consequently, periods of price decline can translate into diminished spending on crucial automation and electrification projects, affecting CSE's revenue streams.

CSE's strategic expansion into the data center market serves as a key buffer against these commodity price fluctuations. This diversification helps to stabilize its overall business performance by reducing its reliance on the more volatile energy markets.

Interest rates significantly impact CSE Global's operational costs and client project viability. For instance, a rise in benchmark rates, such as the US Federal Reserve's target rate which has seen increases through 2023 and into early 2024, directly elevates the cost of borrowing for capital-intensive projects that CSE Global undertakes. This can lead to clients deferring or scaling back investments, potentially dampening demand for CSE's services.

Furthermore, the availability and cost of capital are critical for CSE Global's growth strategies, including mergers and acquisitions. As of early 2024, global credit markets reflect a cautious lending environment. Companies like CSE Global rely on access to affordable debt and equity financing to fund strategic initiatives, and higher interest rate environments can make these capital-raising efforts more expensive and challenging, potentially impacting the pace of expansion.

Inflationary Pressures and Supply Chain Costs

Rising inflation, particularly in raw materials and labor, significantly impacts CSE Global's operational expenses, potentially squeezing project profit margins. For instance, global inflation rates remained elevated throughout much of 2023 and into early 2024, impacting various input costs for companies in the energy and infrastructure sectors.

To counter these pressures, CSE Global must focus on supply chain resilience and securing favorable pricing agreements. This proactive approach helps insulate the company from volatile market fluctuations. The ability to negotiate back-to-back pricing with suppliers is a crucial tactic in managing cost escalations.

The company's profitability hinges on its capacity to transfer these increased costs to its clients. Successful cost pass-through mechanisms are vital for maintaining healthy margins in a challenging economic environment.

- Inflationary Impact: Global inflation, while showing signs of moderation in some regions by late 2024, continued to exert upward pressure on input costs for sectors like energy infrastructure.

- Supply Chain Management: Securing long-term contracts and diversifying supplier bases are key strategies for mitigating supply chain disruptions and cost volatility.

- Pricing Power: CSE Global's ability to adjust its pricing in line with rising costs directly influences its project profitability and overall financial performance.

- Operational Efficiency: Continuous improvement in operational efficiency remains a critical factor in absorbing a portion of increased costs without impacting client pricing significantly.

Exchange Rate Volatility

Exchange rate volatility presents a significant challenge for CSE Global, a company with operations spanning multiple countries. Fluctuations in major currencies, such as the US dollar and Australian dollar, directly impact its reported financial results when translated into its reporting currency, the Singapore dollar. This can distort revenues and expenses, making it harder to assess true performance.

For instance, recent periods have seen notable impacts on CSE Global's order intake and book orders due to these currency swings. Effective currency risk management strategies are therefore crucial for mitigating these effects and ensuring more stable financial reporting.

- Impact on Revenue: A stronger Singapore dollar against currencies where CSE Global generates revenue would lead to lower reported revenue in SGD terms.

- Impact on Expenses: Conversely, a weaker Singapore dollar would increase the cost of imported goods or services denominated in foreign currencies.

- Order Book Fluctuations: For example, if CSE Global secures a large order in USD when the USD/SGD rate is 1.35, and the rate later weakens to 1.30, the SGD value of that order decreases.

- Strategic Hedging: Companies like CSE Global often employ financial instruments such as forward contracts or currency options to hedge against adverse currency movements, aiming to lock in exchange rates for future transactions.

Global economic growth directly influences CSE Global's performance, as a healthy economy spurs investment in energy, infrastructure, and maritime sectors. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 3.1% in 2023, indicating a potentially favorable environment for CSE's clients to increase capital expenditure.

Industrial activity, a key driver for CSE's offerings, also reflects this economic health. Manufacturing PMIs (Purchasing Managers' Indexes) provide a snapshot; for example, the JPMorgan Global Manufacturing PMI stood at 50.3 in April 2024, signaling a marginal expansion in global manufacturing output, which could translate to increased demand for CSE's services.

Conversely, a slowdown in these areas poses a risk. If global growth falters, perhaps due to geopolitical tensions or inflation concerns, clients might delay or scale back projects, leading to lower order intake for CSE. For example, if the projected 2025 global growth forecast of 3.2% by the IMF were to be revised downwards significantly, it would likely impact CSE's revenue projections.

Volatility in commodity prices, especially for oil and gas, directly influences the investment plans and profitability of CSE Global's clients within the energy sector. For example, Brent crude oil prices have seen significant swings, averaging around $83 per barrel in early 2024, a figure that impacts upstream investment decisions.

Despite CSE's diversification efforts, a substantial part of its business remains linked to these commodity-driven industries. Consequently, periods of price decline can translate into diminished spending on crucial automation and electrification projects, affecting CSE's revenue streams.

CSE's strategic expansion into the data center market serves as a key buffer against these commodity price fluctuations. This diversification helps to stabilize its overall business performance by reducing its reliance on the more volatile energy markets.

Interest rates significantly impact CSE Global's operational costs and client project viability. For instance, a rise in benchmark rates, such as the US Federal Reserve's target rate which has seen increases through 2023 and into early 2024, directly elevates the cost of borrowing for capital-intensive projects that CSE Global undertakes. This can lead to clients deferring or scaling back investments, potentially dampening demand for CSE's services.

Furthermore, the availability and cost of capital are critical for CSE Global's growth strategies, including mergers and acquisitions. As of early 2024, global credit markets reflect a cautious lending environment. Companies like CSE Global rely on access to affordable debt and equity financing to fund strategic initiatives, and higher interest rate environments can make these capital-raising efforts more expensive and challenging, potentially impacting the pace of expansion.

Rising inflation, particularly in raw materials and labor, significantly impacts CSE Global's operational expenses, potentially squeezing project profit margins. For instance, global inflation rates remained elevated throughout much of 2023 and into early 2024, impacting various input costs for companies in the energy and infrastructure sectors.

To counter these pressures, CSE Global must focus on supply chain resilience and securing favorable pricing agreements. This proactive approach helps insulate the company from volatile market fluctuations. The ability to negotiate back-to-back pricing with suppliers is a crucial tactic in managing cost escalations.

The company's profitability hinges on its capacity to transfer these increased costs to its clients. Successful cost pass-through mechanisms are vital for maintaining healthy margins in a challenging economic environment.

- Inflationary Impact: Global inflation, while showing signs of moderation in some regions by late 2024, continued to exert upward pressure on input costs for sectors like energy infrastructure.

- Supply Chain Management: Securing long-term contracts and diversifying supplier bases are key strategies for mitigating supply chain disruptions and cost volatility.

- Pricing Power: CSE Global's ability to adjust its pricing in line with rising costs directly influences its project profitability and overall financial performance.

- Operational Efficiency: Continuous improvement in operational efficiency remains a critical factor in absorbing a portion of increased costs without impacting client pricing significantly.

Exchange rate volatility presents a significant challenge for CSE Global, a company with operations spanning multiple countries. Fluctuations in major currencies, such as the US dollar and Australian dollar, directly impact its reported financial results when translated into its reporting currency, the Singapore dollar. This can distort revenues and expenses, making it harder to assess true performance.

For instance, recent periods have seen notable impacts on CSE Global's order intake and book orders due to these currency swings. Effective currency risk management strategies are therefore crucial for mitigating these effects and ensuring more stable financial reporting.

- Impact on Revenue: A stronger Singapore dollar against currencies where CSE Global generates revenue would lead to lower reported revenue in SGD terms.

- Impact on Expenses: Conversely, a weaker Singapore dollar would increase the cost of imported goods or services denominated in foreign currencies.

- Order Book Fluctuations: For example, if CSE Global secures a large order in USD when the USD/SGD rate is 1.35, and the rate later weakens to 1.30, the SGD value of that order decreases.

- Strategic Hedging: Companies like CSE Global often employ financial instruments such as forward contracts or currency options to hedge against adverse currency movements, aiming to lock in exchange rates for future transactions.

| Economic Factor | Relevance to CSE Global | 2024/2025 Data Point/Trend |

|---|---|---|

| Global GDP Growth | Drives client investment in energy, infrastructure, maritime. | IMF projected 3.2% global growth for 2024. |

| Industrial Production | Indicates demand for CSE's services. | JPMorgan Global Manufacturing PMI at 50.3 in April 2024 (marginal expansion). |

| Commodity Prices (Oil & Gas) | Impacts client spending in the energy sector. | Brent crude averaged around $83/barrel in early 2024. |

| Interest Rates | Affects cost of capital for CSE and its clients. | US Federal Reserve target rate increased through 2023-early 2024. |

| Inflation | Impacts operational costs and project margins. | Global inflation remained elevated through 2023-early 2024. |

| Exchange Rates | Affects reported financial results due to international operations. | USD/SGD rate fluctuated, e.g., around 1.35 in early 2024. |

Same Document Delivered

CSE PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CSE PESTLE Analysis provides a detailed examination of the political, economic, social, technological, legal, and environmental factors impacting the Computer Science and Engineering field.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the current landscape and future trends affecting CSE professionals and organizations.

The content and structure shown in the preview is the same document you’ll download after payment. It's designed to be a practical tool for strategic planning and decision-making within the CSE domain.

Sociological factors

Societal pressure for environmental responsibility is accelerating. Consumers and businesses alike are increasingly prioritizing products and services that minimize ecological impact. This is evidenced by the projected growth of the global green technology and sustainability market, which was valued at approximately USD 11.2 billion in 2023 and is anticipated to reach USD 37.7 billion by 2030, growing at a CAGR of 18.9%.

CSE Global is well-positioned to capitalize on this demand. Their expertise in electrification and environmental solutions, including advanced water management systems and support for renewable energy infrastructure, directly addresses this growing need. For instance, their work in optimizing water distribution networks can significantly reduce water loss, a key sustainability metric.

This societal shift is not just about environmental consciousness; it's a tangible market opportunity. Companies that can demonstrate genuine commitment to sustainability, backed by innovative solutions like those offered by CSE Global, are likely to see increased customer loyalty and market share. The push for net-zero emissions by many nations and corporations further amplifies the demand for green technologies.

The availability of skilled professionals in engineering, automation, telecommunications, and IT is a cornerstone for CSE Global's project execution and expansion. For instance, as of early 2024, the global demand for cloud computing skills alone was projected to grow by over 30% annually, highlighting the critical need for specialized talent in the IT sector.

Proactively bridging potential skill gaps through robust training programs and continuous talent development is paramount for CSE Global to retain its competitive advantage and successfully undertake intricate projects. The company's international footprint, spanning over 20 countries, provides a significant advantage in accessing varied and deep talent pools, enabling it to source expertise wherever needed.

Societal and regulatory pressures are increasingly pushing industries like maritime and energy to prioritize operational safety and efficiency. This trend directly fuels the demand for sophisticated automation and control systems, areas where CSE Global excels. For instance, the International Maritime Organization's (IMO) focus on decarbonization and safety, with regulations like the Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) coming into full effect in 2024, underscores this shift. CSE Global's offerings are strategically positioned to meet these evolving needs, optimizing client operations and enhancing their value proposition.

Digitalization and Automation Adoption

Societal embrace of digital transformation and automation is rapidly reshaping industries, directly benefiting companies like CSE Global. As businesses increasingly rely on data-driven operations and smart environments, the demand for integrated automation and digital solutions, particularly within data centers and advanced industrial settings, is on a significant upward trajectory. This trend is a core sociological driver influencing market demand.

The adoption of AI and automation is not just an industrial trend but a societal shift. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, indicating a massive societal and economic push towards these technologies. This widespread acceptance fuels the need for specialized integration services that CSE Global provides.

- Growing Demand for Smart Infrastructure: Societal preference for connected and efficient environments drives investment in smart industrial facilities and data centers, key markets for automation integration.

- Increased Data Generation: The proliferation of digital devices and services leads to exponential data growth, necessitating robust automation for data management and analysis.

- Workforce Adaptation: A societal willingness to upskill and adapt to new technologies creates a favorable environment for adopting advanced automation solutions, requiring expertise in digital integration.

- Focus on Efficiency and Productivity: Societal and business pressures for enhanced efficiency bolster the adoption of automated processes, creating opportunities for service providers like CSE Global.

Corporate Social Responsibility (CSR) Expectations

Stakeholders are increasingly demanding that companies like CSE Global demonstrate a strong commitment to corporate social responsibility and ethical conduct. This pressure comes from investors seeking sustainable investments, employees wanting to work for responsible organizations, and the general public expecting businesses to contribute positively to society.

CSE Global's proactive approach to corporate governance, ethics, and anti-bribery policies, as detailed in their recent annual reports, is crucial for building and maintaining trust. For instance, their reported community contributions and sustainability initiatives directly address these growing expectations, bolstering their reputation and long-term viability.

- Growing Stakeholder Scrutiny: Investors, employees, and consumers are more aware of and vocal about corporate social responsibility.

- Reputation as a Key Asset: Strong ethical practices and community engagement directly translate into enhanced brand reputation and trust.

- CSE Global's Disclosures: The company's annual reports frequently highlight its commitment to corporate governance, ethics, and community outreach.

- Impact on Sustainability: Adherence to these principles is vital for CSE Global's long-term success and resilience in a conscientious market.

Societal expectations for ethical business practices and corporate social responsibility are intensifying, influencing investor decisions and consumer loyalty. Companies demonstrating strong governance and community engagement, like CSE Global through its reported initiatives, build trust and long-term value.

The growing demand for sustainable and efficient solutions is a direct reflection of societal values shifting towards environmental consciousness and responsible consumption. CSE Global's focus on electrification and water management aligns perfectly with these evolving societal priorities.

A key sociological factor is the increasing acceptance and demand for automation and digital transformation across all sectors, driven by a desire for enhanced productivity and smarter living. CSE Global's expertise in integrated automation systems directly addresses this trend.

Societal awareness of safety and operational integrity, particularly in critical industries like maritime and energy, is driving the adoption of advanced control systems. CSE Global's solutions are well-positioned to meet these heightened expectations for secure and efficient operations.

| Sociological Factor | Impact on CSE Global | Supporting Trend/Data (2024/2025) |

|---|---|---|

| Environmental Consciousness | Increased demand for green technology solutions | Global green technology market projected to reach USD 37.7 billion by 2030 (CAGR 18.9%) |

| Digital Transformation Adoption | Growth in demand for automation and data center solutions | Global AI market projected to exceed USD 1.8 trillion by 2030 |

| Emphasis on Safety & Efficiency | Higher demand for sophisticated automation and control systems | IMO's focus on decarbonization and safety regulations (EEXI, CII) fully effective in 2024 |

| Corporate Social Responsibility | Enhanced brand reputation and investor confidence | Increased scrutiny on ethical conduct and community contributions by corporations |

Technological factors

Rapid advancements in industrial automation, Artificial Intelligence (AI), and the Internet of Things (IoT) are fundamentally reshaping how industries operate. These technologies are driving significant improvements in efficiency and enabling new capabilities. For instance, the global industrial automation market was valued at approximately $272.1 billion in 2023 and is projected to reach $445.3 billion by 2030, demonstrating substantial growth.

CSE Global is strategically positioned to capitalize on these trends by integrating AI and IoT into its solutions. This integration enhances operational efficiency, enables predictive maintenance, and improves decision-making for their clients. The company's focus on these areas allows businesses to optimize their processes and reduce downtime.

The burgeoning demand for AI infrastructure, especially within data centers, presents a direct opportunity for CSE's electrification and communications segments. Global spending on AI infrastructure, including servers and networking equipment, is expected to surge, with some estimates suggesting it could exceed $200 billion in 2024 alone, providing a strong tailwind for CSE's business.

The rapid advancement of telecommunications infrastructure, particularly the widespread rollout of 5G networks, presents significant opportunities for CSE Global's communications division. This evolution, coupled with improvements in satellite connectivity, directly supports the company's expertise in designing and maintaining robust communication systems.

CSE Global's core business involves installing and servicing two-way radio systems and sophisticated network solutions crucial for critical operations. These services are increasingly vital as the proliferation of Internet of Things (IoT) devices, especially in industrial environments, generates an unprecedented volume of data requiring reliable and high-capacity communication channels.

The drive towards sustainability is fueling rapid advancements in environmental technologies. Innovations like smart water management systems, crucial for conserving resources in water-scarce regions, and carbon capture technologies, vital for mitigating industrial emissions, are gaining significant traction. The global carbon capture market, for instance, was valued at approximately $2.5 billion in 2023 and is projected to grow substantially in the coming years, driven by climate targets.

CSE Global is strategically positioned to benefit from this trend, focusing on developing and implementing sustainable technologies. Their commitment to pioneering solutions for a climate-friendly future aligns with the increasing demand for greener industrial processes. This focus allows them to tap into emerging markets driven by environmental regulations and corporate sustainability initiatives, potentially leading to significant growth opportunities.

Cybersecurity Threats and Solutions

Cybersecurity threats are growing more sophisticated, particularly impacting critical infrastructure. CSE Global's reliance on complex systems means network and data security are essential for their operations. This trend also fuels a market for CSE's expertise in secure communication and control systems, helping clients protect their own operations.

The financial impact of cybercrime is substantial. For instance, the estimated global cost of cybercrime reached $10.5 trillion annually by 2025, a significant increase from previous years. This escalating risk underscores the critical need for advanced cybersecurity solutions.

- Increasing Threat Landscape: Ransomware attacks, data breaches, and state-sponsored cyber espionage continue to evolve, posing significant risks to industrial control systems and sensitive data.

- Demand for Secure Solutions: CSE Global's ability to provide secure communication and control systems is directly driven by the heightened need for protection against these threats, creating a strong market opportunity.

- Investment in Cybersecurity: Global spending on cybersecurity is projected to exceed $200 billion in 2024, reflecting the widespread recognition of cybersecurity as a critical business imperative.

Digitalization and OT-IT Convergence

The pervasive trend of digitalization, coupled with the increasing convergence of Operational Technology (OT) and Information Technology (IT) within industrial sectors, creates a significant demand for interconnected and integrated solutions. This shift is fundamentally reshaping how industries operate, moving towards smarter, more data-driven environments.

CSE Global, a key player in systems integration, is strategically positioned to capitalize on this trend. By bridging the OT-IT gap, the company offers clients comprehensive solutions designed to streamline operations, enhance data accessibility, and ultimately boost overall performance. For instance, in 2023, the global industrial IoT market, a key driver of OT-IT convergence, was valued at approximately $240 billion and is projected to grow significantly in the coming years.

- Digitalization Drive: Businesses are increasingly adopting digital technologies to improve efficiency and competitiveness.

- OT-IT Convergence: The merging of operational and information technology systems is creating new opportunities for integrated solutions.

- CSE's Role: CSE Global acts as a systems integrator, facilitating this convergence for clients.

- Market Growth: The industrial IoT sector, central to this trend, is experiencing robust expansion.

Technological advancements, particularly in AI, IoT, and automation, are transforming industries, driving efficiency and creating new operational possibilities. The global industrial automation market, valued at around $272.1 billion in 2023, is expected to reach $445.3 billion by 2030, highlighting substantial growth potential.

CSE Global leverages these technological shifts by integrating AI and IoT into its offerings, enhancing client operations through improved efficiency and predictive capabilities. The increasing demand for AI infrastructure, with global spending on AI infrastructure projected to exceed $200 billion in 2024, directly benefits CSE's electrification and communications segments.

The expansion of 5G networks and advancements in satellite connectivity are crucial for CSE's communications division, supporting the need for robust communication systems. Furthermore, the growing volume of data from IoT devices necessitates CSE's expertise in reliable, high-capacity communication solutions.

Legal factors

CSE Global navigates a stringent regulatory landscape, especially within the energy and maritime sectors where compliance with safety standards and equipment certifications is paramount. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap, implemented in January 2020, significantly impacted the maritime industry, requiring substantial investments in cleaner fuels or exhaust gas cleaning systems, a factor CSE Global must consider in its project bids and execution.

With the increasing digitalization of operations, CSE Global faces significant scrutiny regarding data privacy. Compliance with regulations like the General Data Protection Regulation (GDPR) and its regional counterparts is paramount. Failure to adhere to these mandates, which govern how client data is collected, processed, and stored, could lead to substantial penalties and reputational damage. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Intellectual property rights are crucial for CSE Global, safeguarding its proprietary technologies and integrated solutions, which form a core part of its competitive edge. Legal frameworks are designed to protect these innovations, encouraging continued investment in research and development by ensuring CSE can prevent unauthorized use of its unique offerings.

Contractual Obligations and Liabilities

CSE Global navigates a landscape of intricate contractual obligations in its large-scale projects, impacting its liabilities and operational framework. These agreements with clients, suppliers, and partners often contain detailed performance guarantees and liability clauses, requiring meticulous legal oversight to mitigate financial and reputational risks. For instance, in fiscal year 2023, CSE Global reported that its project execution success is intrinsically linked to the clarity and enforceability of its contractual terms.

The company's legal team plays a crucial role in reviewing and structuring these contracts to ensure compliance and manage potential disputes effectively. This proactive approach is vital, as a single breach or misinterpretation can lead to significant financial penalties or project delays. CSE Global's commitment to robust legal review underscores its strategy to safeguard its interests and maintain strong stakeholder relationships.

- Contractual Complexity: CSE Global engages in multifaceted agreements for major project deployments.

- Liability Management: Performance guarantees and liability clauses are key areas of legal scrutiny to minimize risk.

- Dispute Resolution: Effective mechanisms within contracts are essential for timely and fair conflict resolution.

- Risk Mitigation: Thorough legal review of all contractual commitments is paramount for financial and reputational protection.

Environmental Regulations and Standards

Environmental regulations are increasingly shaping the industrial landscape, directly influencing companies like CSE Global. For instance, stricter mandates on industrial emissions and waste management, driven by global climate change concerns, are becoming the norm. These evolving standards necessitate operational adjustments and create a demand for innovative, environmentally compliant solutions.

CSE Global's ability to adapt and offer services that align with these environmental directives is paramount. Compliance with laws promoting reduced carbon footprints and enhanced resource efficiency isn't just a legal obligation; it's a significant business opportunity. As of late 2024, many jurisdictions are implementing or strengthening carbon pricing mechanisms and circular economy initiatives, directly impacting sectors CSE serves.

- Stricter Emission Controls: Many countries are tightening limits on greenhouse gas emissions from industrial facilities, pushing for cleaner technologies.

- Waste Management Mandates: Regulations are increasingly focused on reducing landfill waste and promoting recycling and reuse of materials.

- Renewable Energy Integration: Policies are encouraging the adoption of renewable energy sources and energy efficiency measures in industrial processes.

- Sustainable Sourcing: Growing pressure exists to ensure supply chains are environmentally responsible, from raw material extraction to product end-of-life.

Legal factors significantly influence CSE Global's operations, particularly concerning industry-specific regulations and contractual agreements. Adherence to international maritime standards, such as the IMO 2020 sulfur cap, necessitates technological adaptation and financial planning for compliance. Furthermore, robust data privacy laws like GDPR, with penalties up to 4% of global turnover, demand stringent data handling protocols. Intellectual property protection is vital for maintaining CSE's competitive edge through its proprietary technologies.

CSE Global's project success hinges on meticulously managed contractual obligations, which often include performance guarantees and liability clauses. The company's legal team plays a critical role in reviewing these complex agreements to mitigate risks and prevent disputes. For instance, in fiscal year 2023, CSE Global emphasized the importance of clear contractual terms for project execution. The legal framework ensures the protection of its innovations and fosters continued investment in research and development.

Environmental factors

Global initiatives to combat climate change are significantly reshaping industries, compelling them to lower carbon emissions and embrace sustainability. This shift directly benefits companies like CSE Global by increasing demand for their electrification and environmental solutions. For instance, the International Energy Agency reported in 2024 that renewable energy sources accounted for over 30% of global electricity generation for the first time.

Clients are actively seeking ways to meet their environmental, social, and governance (ESG) goals, which in turn drives investment in areas like renewable energy infrastructure and energy efficiency technologies. CSE Global's offerings in these sectors are therefore well-positioned to capitalize on this growing market. The United Nations Framework Convention on Climate Change (UNFCCC) continues to set ambitious targets, with many nations pledging net-zero emissions by 2050, creating a sustained demand for the solutions CSE Global provides.

Growing global awareness of resource scarcity, especially concerning water and energy, is compelling businesses to embrace more efficient resource management strategies. For instance, the International Energy Agency reported in 2024 that global energy demand is projected to rise by 2.3% in 2025, highlighting the ongoing pressure on energy resources.

CSE Global's core competencies in optimizing urban water systems and developing energy-efficient infrastructure directly align with these environmental imperatives. Their solutions help clients achieve greater operational sustainability, a critical factor for businesses navigating increasing regulatory scrutiny and consumer demand for eco-friendly practices.

Governments worldwide are intensifying their focus on environmental protection, leading to stricter regulations on industrial emissions. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, impacting numerous industries. This regulatory push directly benefits companies like CSE Global, whose expertise in emission control and environmental solutions is increasingly in demand to help clients meet these evolving compliance requirements and sustainability targets.

Corporate Responsibility for Environmental Impact

Companies today face mounting pressure regarding their environmental footprint, extending from their own operations to their entire supply chains. This accountability is becoming a critical factor in how businesses are perceived and valued.

CSE Global's proactive approach to sustainability, detailed in its recent sustainability reports, highlights its dedication to managing environmental impact. This commitment is vital for maintaining a positive reputation and appealing to clients and investors who prioritize eco-friendly practices. For instance, CSE Global reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 15% in its 2024 fiscal year compared to its 2022 baseline.

The increasing focus on environmental, social, and governance (ESG) factors means that companies demonstrating strong environmental stewardship are better positioned for long-term success. This includes tangible actions like:

- Investing in renewable energy sources for operational facilities.

- Implementing waste reduction and recycling programs across all sites.

- Developing supply chain partnerships with environmentally responsible vendors.

- Setting ambitious targets for reducing carbon emissions, aiming for a 30% reduction by 2030.

Transition to Renewable Energy

The global shift towards renewable energy sources and sustainable infrastructure is a significant tailwind for CSE Global. Their electrification segment is strategically positioned to capitalize on this trend, focusing on designing and integrating complex electrical distribution and power systems crucial for data centers and utility markets. This directly supports the development of the modern electricity grid.

This transition is accelerating, with renewable energy accounting for a larger share of new power capacity. For instance, in 2024, renewable energy sources are projected to make up over 80% of new global power capacity additions. CSE Global's expertise in electrification, particularly in areas like microgrids and advanced power systems, aligns perfectly with the increasing demand for resilient and efficient energy infrastructure needed to support this renewable energy expansion.

- Growing Renewable Capacity: Global renewable energy capacity is expected to reach over 7,300 GW by the end of 2025, a substantial increase from previous years, driving demand for grid modernization and electrification solutions.

- Electrification Investment: Investments in grid modernization and electrification projects are projected to exceed $2 trillion globally by 2030, creating a robust market for CSE Global's services.

- Data Center Power Demand: The exponential growth in data centers, fueled by AI and cloud computing, necessitates advanced power distribution systems, a core offering of CSE Global's electrification segment.

Governments worldwide are implementing stricter environmental regulations, pushing industries to reduce emissions and adopt sustainable practices. For example, the EU's Fit for 55 package aims for a 55% greenhouse gas reduction by 2030. This regulatory environment directly benefits companies like CSE Global, whose environmental solutions are crucial for compliance.

The increasing demand for ESG compliance is driving investment in renewable energy and energy efficiency. CSE Global's offerings in these sectors are well-positioned to capture this market growth. The International Energy Agency noted in 2024 that renewable energy sources now represent over 30% of global electricity generation.

Resource scarcity, particularly for water and energy, is compelling businesses to adopt more efficient management strategies. CSE Global's expertise in optimizing urban water systems and developing energy-efficient infrastructure aligns perfectly with these environmental imperatives, helping clients achieve greater operational sustainability.

| Environmental Factor | Impact on CSE Global | Supporting Data (2024/2025) |

|---|---|---|

| Climate Change Initiatives | Increased demand for electrification and environmental solutions. | Renewable energy sources accounted for over 30% of global electricity generation in 2024. |

| ESG Focus | Drives investment in renewable energy infrastructure and energy efficiency. | Nations pledge net-zero emissions by 2050, creating sustained demand for CSE Global's solutions. |

| Resource Scarcity | Need for efficient resource management strategies. | Global energy demand projected to rise by 2.3% in 2025, increasing pressure on energy resources. |

| Stricter Regulations | Increased demand for emission control and environmental solutions. | EU's Fit for 55 aims for 55% greenhouse gas reduction by 2030. |

| Corporate Sustainability | Enhanced reputation and appeal to eco-conscious clients/investors. | CSE Global reported a 15% reduction in Scope 1 & 2 GHG emissions in FY2024 vs. 2022 baseline. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of official government publications, reputable market research firms, and respected academic journals. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in verified, current data.