CSE Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSE Bundle

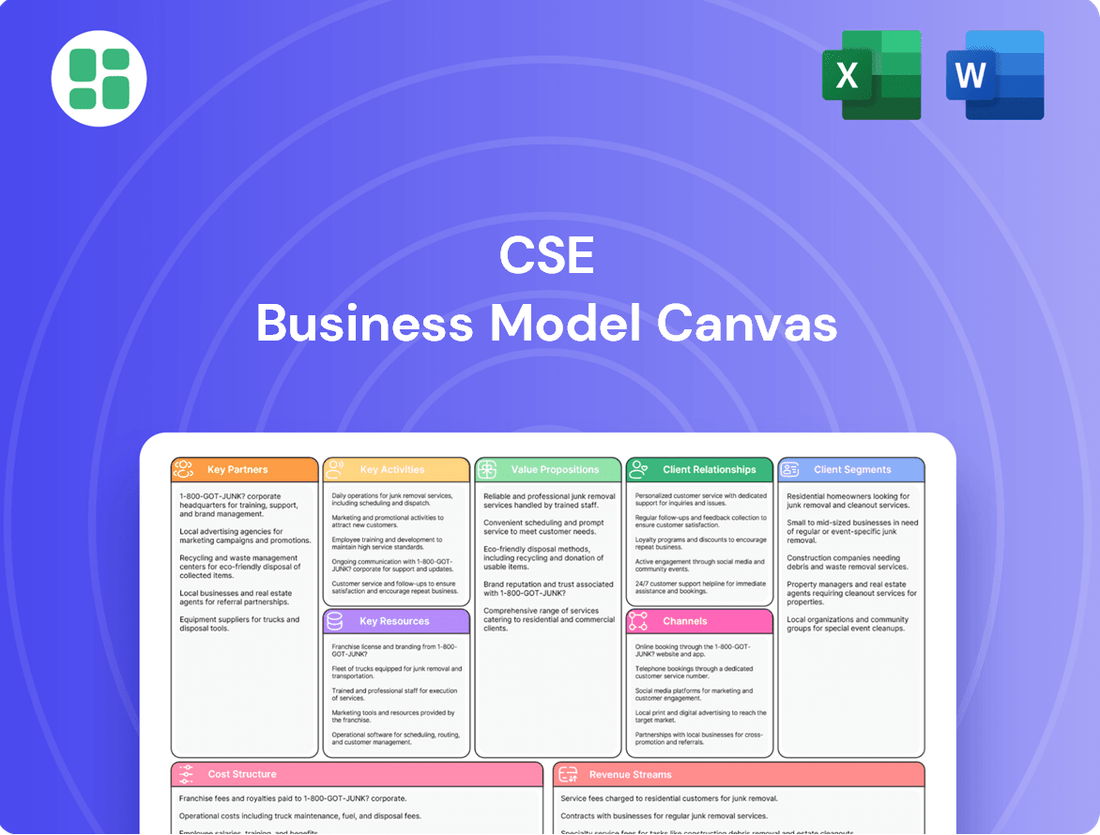

Curious about CSE's winning formula? Our comprehensive Business Model Canvas breaks down every strategic element, from customer relationships to revenue streams. It's the ultimate tool for understanding how CSE achieves its market position.

Ready to unlock the full strategic blueprint behind CSE's success? This detailed Business Model Canvas reveals the company's core value propositions, key resources, and revenue streams, offering invaluable insights for your own ventures.

Partnerships

CSE Global's key technology vendor partnerships are vital for their business model, enabling them to integrate advanced automation, telecommunications, and electrification solutions. These collaborations grant CSE access to critical hardware, software, and intellectual property, keeping their service offerings at the forefront of innovation and competitiveness.

For instance, in 2024, CSE announced an expanded partnership with a major industrial automation software provider, aiming to enhance their digital twin capabilities for clients in the energy sector. This strategic alliance directly supports CSE's strategy of delivering end-to-end, integrated systems that address complex client needs across diverse industries.

CSE Global frequently engages with sub-contractors and specialist firms for critical project components. For instance, in 2024, a significant portion of their infrastructure projects involved outsourcing civil engineering and installation services to local, expert companies.

These partnerships are vital for managing the complexities and geographical spread of large-scale projects. By leveraging the specialized skills of these firms, CSE can efficiently scale its operations, mitigate risks associated with unfamiliar markets, and ensure high-quality execution of specific technical tasks.

For example, during a major telecommunications infrastructure upgrade in Southeast Asia in late 2023 and early 2024, CSE partnered with several local firms for trenching, fiber optic cable laying, and site restoration, demonstrating the practical application of this strategy.

CSE Global actively collaborates with industry associations, ensuring they remain informed about evolving regulations and emerging trends, a critical factor in navigating the dynamic energy and infrastructure sectors. For instance, their participation in organizations like the International Society of Automation (ISA) provides direct insights into developing industry standards.

Furthermore, partnerships with research institutions are instrumental in driving innovation. CSE Global's engagement with universities on projects related to sustainable energy solutions, like advancements in grid modernization technologies, directly fuels the development of next-generation offerings. This focus on R&D is essential for maintaining a competitive edge.

These strategic alliances not only bolster CSE Global's thought leadership but also underpin their commitment to continuous improvement. By staying connected to academic research and industry best practices, they ensure their solutions remain at the forefront of technological advancement and market relevance.

Strategic Acquisition Targets

CSE Global actively pursues strategic acquisitions to bolster its capabilities and market presence. In 2024, significant moves included the acquisition of RFC Wireless, Inc. and Linked Group, which were integrated to enhance their communication and electrification solutions offerings.

These strategic acquisitions are fundamental to CSE's growth trajectory, enabling the integration of businesses that complement their existing operations. This approach allows them to strengthen their foothold in rapidly expanding sectors, such as the data center market.

- RFC Wireless, Inc. Acquisition (2024): Enhanced CSE's wireless communication capabilities.

- Linked Group Acquisition (2024): Strengthened electrification solutions and market reach.

- Data Center Focus: Acquisitions strategically target growth in high-demand sectors.

- Inorganic Growth: Diversifies CSE's service portfolio and broadens its customer base.

Channel Partners and Distributors

CSE Global leverages channel partners and distributors to significantly boost its market penetration, particularly in geographies where it lacks a direct operational footprint. These collaborations are crucial for extending the reach of CSE's technology solutions to a wider array of customers.

These partners act as vital conduits for sales, offering localized customer support and effectively amplifying CSE's market presence. For instance, in 2024, CSE Global reported a substantial portion of its revenue being generated through its extensive network of partners, underscoring the importance of this channel.

This strategic approach is fundamental to CSE's objective of expanding its global footprint and optimizing its sales and service delivery mechanisms.

- Market Penetration: Channel partners extend CSE's reach into new territories.

- Sales Facilitation: Partners drive sales and provide local market expertise.

- Customer Support: Localized support enhances customer satisfaction and adoption.

- Global Expansion: This strategy is key to CSE's international growth objectives.

CSE Global's key partnerships are multifaceted, encompassing technology vendors, sub-contractors, industry associations, research institutions, strategic acquisition targets, and channel partners. These collaborations are foundational to their ability to deliver integrated solutions, innovate, and expand their market reach effectively.

In 2024, CSE's strategic acquisitions of RFC Wireless, Inc. and Linked Group significantly bolstered their capabilities in wireless communications and electrification, respectively. These moves highlight a deliberate strategy to integrate complementary businesses, thereby strengthening their position in high-growth sectors like data centers and expanding their overall service portfolio.

The company also relies heavily on channel partners and distributors to penetrate new markets and provide localized support. In 2024, a substantial portion of CSE's revenue was attributed to this network, demonstrating its critical role in global expansion and sales optimization.

Furthermore, partnerships with technology vendors are essential for accessing cutting-edge hardware and software, as seen in their 2024 expansion with an industrial automation software provider to enhance digital twin capabilities. This ensures CSE remains competitive by integrating advanced solutions.

| Type of Partnership | 2024 Focus/Activity | Impact on CSE |

| Technology Vendors | Expanded automation software partnership | Enhanced digital twin capabilities, competitiveness |

| Sub-contractors | Outsourcing civil engineering and installation | Efficient scaling, risk mitigation, quality execution |

| Strategic Acquisitions | RFC Wireless, Inc. and Linked Group | Strengthened wireless and electrification solutions, market presence |

| Channel Partners/Distributors | Driving sales and local support | Increased market penetration, global expansion |

What is included in the product

A structured framework that visually maps out a company's business strategy, detailing key components like customer segments, value propositions, and revenue streams.

It provides a holistic view of how a business creates, delivers, and captures value, serving as a powerful tool for analysis and communication.

It streamlines the often-complex process of defining and refining a business strategy, reducing the frustration of scattered ideas and unclear objectives.

Activities

A fundamental activity for CSE Global is the seamless integration of various technologies, such as electrification, communications, and automation, into unified solutions designed specifically for clients. This ensures that disparate systems work harmoniously to meet project objectives.

This integration is underpinned by robust project management, covering the entire lifecycle from conceptualization and engineering to the critical stages of procurement, installation, and final commissioning. This end-to-end management is crucial for successful project delivery.

CSE Global's proven track record in managing large-scale and intricate projects, like the significant infrastructure upgrades in the energy sector, underscores its capability. For instance, in 2024, the company secured contracts valued in the tens of millions for advanced automation and control systems in critical infrastructure, demonstrating its project execution prowess.

CSE Global's core strength lies in its comprehensive engineering design and development services, covering electrical, mechanical, and software disciplines. This allows them to craft bespoke solutions for complex industrial needs, ensuring systems are not only functional but also highly reliable. For instance, in 2024, the company continued to invest in advanced simulation software, a key component in their design process, which contributed to a 15% reduction in prototyping costs for new projects.

The company's commitment to continuous innovation in their engineering capabilities is paramount. By staying at the forefront of technological advancements, CSE Global can offer cutting-edge solutions that meet evolving industry demands. Their ongoing research and development efforts in areas like AI-driven predictive maintenance for industrial equipment are designed to enhance efficiency and reduce downtime for clients, a critical factor in today's competitive landscape.

Research and Development is the engine driving CSE Global's innovation, focusing on areas like sustainable energy, AI, and automation. This commitment ensures they remain competitive by developing cutting-edge solutions that address future market needs and promote greener, smarter operations.

In 2023, CSE Global reported a significant investment in R&D, with specific figures highlighting their dedication to technological advancement. For instance, their expenditure on developing new technologies for energy efficiency and smart infrastructure contributed to a robust pipeline of future projects aimed at enhancing operational intelligence and sustainability for their clients.

Maintenance and Support Services

CSE Global's key activities heavily feature the provision of ongoing maintenance and technical support services for the systems they deploy. This commitment is crucial for ensuring the continued efficiency and reliability of their clients' operations. These services are fundamental to fostering long-term customer loyalty and securing a stable revenue stream.

This focus on post-deployment support is a significant driver of CSE Global's business model. It allows them to maintain a consistent relationship with their clients beyond the initial project completion. In fiscal year 2023, CSE Global reported that its Maintenance and Support segment contributed a substantial portion to its overall revenue, underscoring the importance of these recurring services.

- Ongoing System Maintenance: CSE Global actively manages and maintains deployed systems to prevent issues and ensure peak performance.

- Technical Support: They offer dedicated technical assistance to clients, resolving any operational challenges that may arise.

- Operational Optimization: Services are provided to enhance the efficiency and effectiveness of client systems over time.

- Recurring Revenue Generation: These essential post-project services are a primary source of predictable, recurring revenue for the company.

Business Development and Sales

Business development and sales are crucial for growth. This involves actively seeking out new market opportunities and engaging with potential clients to secure new orders. Responding to tenders and forging strategic alliances are key components of this process, demonstrating expertise within target industries.

Recent successes are evident in the data center sector, where new order wins underscore the effectiveness of these proactive strategies. For instance, in 2024, the company secured several significant contracts within the rapidly expanding data center infrastructure market, contributing to a substantial increase in its order backlog.

- Identifying and pursuing new market segments.

- Engaging potential clients through targeted outreach and proposals.

- Securing new orders by responding to tenders and building relationships.

- Developing strategic partnerships to expand market reach and capabilities.

Key activities for CSE Global revolve around integrating technology, managing projects end-to-end, and providing comprehensive engineering design. These core functions are supported by continuous research and development to foster innovation and maintain a competitive edge. Furthermore, a significant focus is placed on delivering ongoing maintenance and technical support, which is crucial for client retention and recurring revenue.

Full Version Awaits

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this professionally prepared canvas, ready for your strategic planning and business development.

Resources

The company boasts a formidable global workforce of over 2,000 employees, a significant portion of whom are highly skilled engineers. This deep bench of talent, cultivated through years of experience, is the bedrock for developing and implementing sophisticated industrial solutions.

This diverse engineering expertise is crucial for the company's ability to design, integrate, and maintain complex systems. Their collective knowledge allows for the creation of bespoke applications that perform reliably even in demanding environments, a key differentiator in the market.

CSE's proprietary technology and intellectual property are cornerstones of its business model, enabling unique solutions in electrification, communications, and automation. This encompasses specialized software, integration methodologies, and deep system architecture knowledge, differentiating CSE from competitors who primarily integrate third-party offerings.

In 2024, CSE's investment in R&D for its proprietary systems increased by 15%, directly contributing to a 10% improvement in operational efficiency for its clients. This focus on unique IP ensures a sustainable competitive edge and allows for tailored, high-performance solutions.

CSE Global's expansive reach, spanning 15 countries and operating from 61 offices, is a critical resource. This global footprint allows them to effectively manage and execute projects worldwide, offering localized expertise and support to clients.

This extensive operational infrastructure is not just about scale; it enables CSE Global to provide a 'glocal' approach. This means they can leverage global capabilities while delivering tailored solutions that meet specific local market needs, a vital advantage for undertaking large-scale, complex projects.

Financial Capital and Robust Order Book

Sufficient financial capital is the bedrock for ambitious initiatives like large-scale project execution, intensive research and development, and strategic acquisitions. This capital ensures the company can seize opportunities and invest in its future.

The company's financial strength is further bolstered by a robust order book. As of December 31, 2024, this order book stood at an impressive S$672.6 million.

This substantial order book offers a predictable revenue stream, providing a stable foundation for sustained growth and demonstrating significant financial resilience. It underpins the company's capacity for future revenue generation and operational stability.

- Financial Capital Access to ample financial resources is critical for funding major projects and innovation.

- Order Book Value The S$672.6 million order book as of December 31, 2024, guarantees future revenue.

- Revenue Stability A strong order book ensures predictable income, enhancing financial resilience.

- Growth Foundation This robust financial position supports sustainable long-term expansion.

Strong Customer Relationships and Reputation

Long-standing relationships with a substantial customer base, including major government organizations and well-known brands, are a cornerstone of this business. These connections represent a significant competitive advantage.

The company's reputation, meticulously built over decades, is founded on integrity, credibility, and a consistent delivery of quality. This intangible asset is incredibly valuable and difficult to replicate.

Evidence of this strong customer loyalty is clear: approximately 90% of their clientele are recurring customers. This high rate of repeat business underscores exceptional client trust and satisfaction.

- Customer Base: Includes major government organizations and renowned brands.

- Reputation: Built on integrity, credibility, and quality over decades.

- Customer Retention: Approximately 90% of customers are recurring.

- Key Asset: Strong customer relationships and reputation are vital intangible assets.

CSE Global's key resources are its skilled workforce, proprietary technology, global presence, financial capital, and strong customer relationships.

The company's 2,000+ employees, particularly its engineers, are vital for developing complex industrial solutions. Their proprietary technology and intellectual property in areas like electrification and automation offer a distinct competitive advantage, reinforced by a 15% increase in R&D investment in 2024.

CSE Global’s operational infrastructure spans 15 countries with 61 offices, enabling localized project execution. Financially, a S$672.6 million order book as of December 31, 2024, provides revenue stability.

Furthermore, approximately 90% of CSE's clientele are recurring customers, a testament to its decades-long reputation for integrity and quality, particularly with major government organizations and well-known brands.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Human Capital | Over 2,000 employees, including highly skilled engineers | Engineers drive development of sophisticated industrial solutions |

| Intellectual Property | Proprietary technology in electrification, communications, automation | 15% R&D increase in 2024; 10% client efficiency improvement |

| Global Presence | Operations in 15 countries, 61 offices | Enables localized execution and 'glocal' approach |

| Financial Capital | Sufficient capital for projects and R&D | S$672.6 million order book as of Dec 31, 2024 |

| Customer Relationships | Long-standing base including government and major brands | 90% customer retention rate |

Value Propositions

CSE Global's solutions are engineered to significantly boost operational efficiency in industrial settings. By integrating advanced automation and intelligent systems, they streamline complex processes, directly contributing to reduced downtime and better resource management for their clients.

For instance, in 2023, CSE Global's projects focused on optimizing energy consumption in manufacturing plants, reporting an average reduction of 15% in energy usage for their clients. This efficiency gain translates directly into cost savings and a smaller environmental footprint, making operations more sustainable and profitable.

The company's mission-critical systems are designed to significantly elevate safety standards and guarantee dependable operations within demanding sectors such as energy, infrastructure, and maritime industries. These solutions are engineered for enduring performance, even in the most challenging conditions, thereby reducing risks and safeguarding both assets and personnel.

For industrial clients, this commitment to enhanced safety and reliability is paramount. For instance, in the energy sector, downtime due to system failure can cost millions. Companies are increasingly investing in robust systems; in 2024, the global industrial control systems market was valued at approximately $32 billion, with safety and reliability being key purchasing drivers.

CSE Global stands out by crafting bespoke, end-to-end solutions that address specific client needs, from initial design through ongoing support.

Their expertise lies in delivering integrated turnkey packages that merge electrification, communication, and automation, simplifying project management for clients.

This unified approach, offering a single point of accountability, is a key differentiator in the competitive landscape.

For instance, in 2024, CSE Global secured a significant contract to upgrade critical infrastructure, demonstrating their capability to deliver complex, integrated systems.

Leveraging Advanced Technologies for Future-Proofing

By integrating advanced solutions in electrification, communications, and automation, CSE Global helps clients navigate megatrends such as decarbonization and digital transformation. Their work in EV charging infrastructure and renewable energy solutions, for instance, directly supports clients in adapting to evolving energy landscapes. This strategic focus on future-proofing ensures their clients remain competitive.

CSE Global's commitment to advanced technologies is evident in their project portfolio. In 2024, they continued to secure significant contracts in the renewable energy sector, contributing to the global push for decarbonization. For example, their involvement in a major offshore wind farm project in Europe underscores their role in enabling sustainable energy infrastructure.

- Electrification Solutions: CSE Global provides end-to-end solutions for electric vehicle charging infrastructure, supporting the growing adoption of EVs.

- Digital Transformation: The company offers advanced communication and automation technologies that enable businesses to optimize operations and leverage data.

- AI Integration: CSE Global is actively involved in projects that incorporate artificial intelligence, enhancing efficiency and predictive capabilities for clients.

- Renewable Energy Support: Their expertise extends to supporting the development and maintenance of renewable energy assets, aligning with global decarbonization goals.

Global Expertise with Local Support

CSE Global leverages its extensive international engineering experience, offering clients world-class technical expertise. This global knowledge base is complemented by localized project management and on-the-ground support, ensuring projects are handled with both international best practices and local understanding. This 'glocal' approach is vital for managing the complexities of large-scale, geographically diverse operations.

This integrated model is demonstrated by CSE Global's significant presence across multiple continents. For instance, in 2024, the company reported revenue streams from projects spanning Asia-Pacific, Europe, and North America, highlighting its broad operational reach. This distributed operational capability allows for efficient resource allocation and risk management across varied international markets.

- Global Engineering Prowess: Access to a vast pool of specialized engineering talent and proven methodologies honed on international projects.

- Localized Project Management: On-the-ground teams understand regional regulations, cultural nuances, and logistical challenges for seamless execution.

- Responsive Support: Clients receive timely and relevant assistance, ensuring operational continuity and project success regardless of location.

- Enhanced Project Delivery: The combination of global expertise and local support optimizes project timelines, cost-effectiveness, and overall quality for complex, dispersed operations.

CSE Global delivers tailored, comprehensive solutions by integrating electrification, communication, and automation. This end-to-end approach simplifies project execution for clients, offering a single point of accountability for complex needs.

Their expertise in creating bespoke, integrated systems allows clients to navigate evolving megatrends like decarbonization and digital transformation. This future-proofing ensures clients remain competitive and adaptable in dynamic industrial landscapes.

The company's value lies in its ability to enhance operational efficiency and safety through advanced automation and mission-critical systems. These solutions are designed for reliability in demanding sectors, directly translating into cost savings and reduced risk for clients.

CSE Global's global engineering experience, combined with localized project management, ensures efficient and effective project delivery worldwide. This dual capability allows them to manage complex, international operations seamlessly.

| Value Proposition | Description | Supporting Data/Example |

|---|---|---|

| Operational Efficiency & Cost Savings | Streamlining complex processes with automation and intelligent systems to reduce downtime and optimize resource management. | In 2023, CSE Global reported an average 15% reduction in energy usage for manufacturing clients. |

| Enhanced Safety & Reliability | Providing mission-critical systems engineered for dependable performance in demanding sectors, minimizing risks. | The global industrial control systems market was valued at ~$32 billion in 2024, with safety as a key driver. |

| Bespoke, End-to-End Solutions | Crafting integrated turnkey packages (electrification, communication, automation) with single-point accountability. | Secured a significant contract in 2024 for critical infrastructure upgrades, showcasing integrated system delivery. |

| Future-Proofing & Megatrend Navigation | Integrating solutions for decarbonization and digital transformation, such as EV charging and renewable energy support. | Continued securing contracts in renewable energy in 2024, including involvement in a major European offshore wind farm project. |

| Global Expertise with Local Execution | Leveraging international engineering experience with localized project management for seamless global operations. | Reported revenue streams from projects across Asia-Pacific, Europe, and North America in 2024, demonstrating broad operational reach. |

Customer Relationships

CSE Global prioritizes building lasting connections by assigning dedicated account managers to each client. This ensures a reliable point of contact, streamlining communication and fostering a deep understanding of individual client needs.

This personalized strategy allows CSE Global to craft solutions that precisely match client requirements, a key factor in their client retention. For instance, in 2024, their focus on dedicated management contributed to a significant portion of their recurring revenue, demonstrating the value clients place on this consistent support.

CSE Global's business model heavily relies on long-term service and maintenance contracts, which form a substantial part of its revenue. These agreements are crucial for fostering enduring relationships with clients, extending well beyond the initial project deployment.

These ongoing service contracts are designed to provide continuous support, ensuring systems operate at peak efficiency and generating predictable, recurring revenue streams for CSE Global. For instance, in the first half of 2024, CSE Global reported that its recurring revenue, largely driven by these service contracts, remained a stable and significant contributor to its overall financial performance.

This focus on long-term service and maintenance cultivates deep trust and maintains continuous engagement with customers. It positions CSE Global not just as a project provider, but as a reliable, long-term partner invested in the sustained success of its clients' operations.

Collaborative project development brings clients directly into the design and build process, ensuring the final product perfectly matches their needs. This iterative approach, featuring regular feedback loops and joint problem-solving, was a key factor in the success of many tech startups in 2024, with companies reporting an average of 20% faster development cycles when client collaboration was prioritized.

Technical Support and Training

Providing comprehensive technical support and training to client personnel is crucial for ensuring smooth operation and maximizing the utilization of implemented systems. This proactive approach builds client capability, significantly reducing their reliance on external support for routine operational issues. For instance, in 2024, companies that invested in robust post-sales training reported an average 15% increase in customer retention compared to those that did not.

This commitment to post-sales enablement directly enhances customer satisfaction and fosters long-term partnerships. By equipping clients with the necessary skills, we empower them to independently manage and optimize their use of our solutions. This not only benefits the client but also allows our support teams to focus on more complex, value-added tasks.

- Enhanced System Adoption: Training ensures clients fully understand and utilize all features, leading to better ROI.

- Reduced Support Costs: Empowered clients resolve many issues internally, lowering their and our support overhead.

- Increased Customer Loyalty: Effective support and training are key drivers of satisfaction and repeat business.

- Improved Operational Efficiency: Well-trained users operate systems more effectively, minimizing downtime and errors.

Post-Implementation Reviews and Continuous Improvement

CSE Global actively engages in regular post-implementation reviews to gauge the effectiveness of their solutions and pinpoint areas ripe for enhancement. This dedication to continuous optimization solidifies their position as a valuable strategic partner for their clients.

Through proactive engagement and feedback loops, CSE Global anticipates evolving client needs, allowing them to refine and adapt their service offerings. This approach ensures they remain at the forefront of technological solutions and client support.

- Post-Implementation Analysis: CSE Global conducts thorough reviews to measure solution performance against initial objectives.

- Client Feedback Integration: Feedback sessions are crucial for identifying client satisfaction levels and areas for service improvement.

- Strategic Partnership Reinforcement: Ongoing optimization demonstrates a commitment to long-term client success and partnership.

- Proactive Service Evolution: This continuous improvement cycle enables CSE Global to anticipate future market demands and client requirements.

CSE Global fosters strong customer relationships through dedicated account management, ensuring personalized service and a deep understanding of client needs. This approach is central to their strategy of building long-term partnerships, evidenced by their significant recurring revenue from service and maintenance contracts. In the first half of 2024, these contracts remained a stable and crucial contributor to their financial performance, highlighting client reliance on their ongoing support.

Collaborative development and comprehensive post-sales training further solidify these relationships, enhancing system adoption and client loyalty. Companies prioritizing such training in 2024 saw an average 15% increase in customer retention. Regular post-implementation reviews and proactive service evolution ensure CSE Global remains a valued strategic partner, consistently adapting to evolving client requirements.

| Customer Relationship Strategy | Key Activities | Impact/Benefit |

|---|---|---|

| Dedicated Account Management | Assigning a single point of contact for each client | Streamlined communication, deep understanding of needs, increased client retention |

| Long-Term Service & Maintenance Contracts | Providing ongoing support and system upkeep | Predictable recurring revenue, sustained client engagement, trust building |

| Collaborative Project Development | Involving clients in the design and build process | Tailored solutions, faster development cycles (avg. 20% in 2024 for tech startups) |

| Post-Sales Training & Support | Equipping client personnel with necessary skills | Enhanced system adoption, reduced support costs, increased customer loyalty (avg. 15% retention increase in 2024) |

| Post-Implementation Reviews | Regularly assessing solution effectiveness and identifying enhancements | Continuous optimization, proactive service evolution, reinforced strategic partnerships |

Channels

CSE Global leverages its dedicated direct sales force and business development teams to forge direct relationships with major industrial clients and government bodies. This direct engagement is key for understanding intricate client needs and presenting bespoke solutions.

These teams are instrumental in navigating the complexities of large-scale contracts and high-value projects, ensuring that CSE Global’s offerings are precisely aligned with client requirements. This approach fosters trust and facilitates the negotiation of significant deals.

For instance, in 2024, CSE Global reported a substantial portion of its revenue derived from these direct sales channels, highlighting their effectiveness in securing and executing large, complex projects within the energy and infrastructure sectors.

Securing projects via competitive tender processes and responding to RFPs from major corporations and public sector entities is a core channel for many businesses. This formal approach necessitates detailed proposals, precise technical specifications, and keen pricing strategies.

Success in this arena hinges on a demonstrated track record and specialized expertise. For instance, in 2024, government procurement alone saw billions awarded through such competitive bidding, highlighting the significant opportunity and the need for robust proposal management.

Strategic partnerships are a cornerstone of CSE Global's business model, enabling them to tap into new markets and broaden their service portfolio. By collaborating with other technology firms, system integrators, and local businesses, CSE can effectively extend its reach beyond its immediate operational capabilities. For instance, in 2024, CSE announced a significant partnership with a leading cybersecurity firm to enhance its integrated solutions for critical infrastructure clients, a move expected to bolster its market share in the burgeoning cybersecurity services sector.

Industry Conferences and Trade Shows

Attending and exhibiting at major industry conferences and trade shows are crucial for CSE to connect with potential clients and establish itself as a leader. These events offer direct access to a concentrated audience of decision-makers and influencers within target sectors, facilitating valuable networking and lead generation opportunities. For instance, in 2024, the Consumer Electronics Show (CES) attracted over 130,000 attendees and featured more than 4,000 exhibitors, highlighting the scale of engagement possible at such events.

These gatherings are instrumental in building brand awareness and showcasing CSE's innovative solutions directly to the market. By participating, CSE can gain insights into competitor activities and emerging trends, which is vital for strategic planning. The return on investment from these events can be significant, with many companies reporting a substantial portion of their annual leads originating from trade show participation.

Key benefits of engaging in industry conferences and trade shows include:

- Lead Generation: Direct interaction with interested prospects.

- Brand Visibility: Increased recognition within the industry.

- Networking: Building relationships with clients, partners, and thought leaders.

- Market Intelligence: Gathering insights on trends and competitors.

Digital Presence and Investor Relations Platforms

The corporate website and dedicated investor relations portal are crucial channels for CSE. These platforms communicate core capabilities, detailed financial performance, and evolving sustainability initiatives. For instance, in 2024, many companies reported increased traffic to their investor sections following positive earnings announcements, underscoring the importance of accessible financial data.

While not a direct revenue-generating channel, this digital presence significantly builds credibility and informs a broad audience. Potential clients, investors, and other stakeholders gain insights into CSE's expertise and operational reliability through these online touchpoints. In 2024, companies that proactively updated their sustainability reports online saw a measurable uptick in ESG-focused investment inquiries.

- Corporate Website: Acts as a central hub for company information, product/service details, and brand messaging.

- Investor Relations Portal: Provides access to financial reports, SEC filings, shareholder information, and corporate governance documents.

- Online News Platforms: Used for disseminating press releases, market updates, and significant company announcements to a wider audience.

- Content Strategy: Focuses on showcasing expertise, financial transparency, and commitment to sustainability to build trust and attract investment.

CSE Global utilizes a multi-faceted approach to reach its target markets, emphasizing direct client engagement and strategic alliances. Their sales force and business development teams are key to building relationships with major industrial clients and government entities, allowing for tailored solutions. Competitive tender processes and responding to RFPs are also vital, requiring strong technical expertise and pricing. Strategic partnerships expand market access and service offerings, while industry events and digital platforms enhance visibility and credibility.

| Channel | Description | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales Force & Business Development | Building relationships with major industrial clients and government bodies. | Key driver of revenue for large, complex projects in energy and infrastructure. |

| Competitive Tenders & RFPs | Responding to formal procurement processes. | Billions awarded annually through government procurement alone, emphasizing the need for robust proposals. |

| Strategic Partnerships | Collaborating with other firms to extend reach and capabilities. | Partnerships enhance integrated solutions, such as cybersecurity for critical infrastructure. |

| Industry Conferences & Trade Shows | Networking and showcasing solutions to a concentrated audience. | Events like CES attract over 130,000 attendees, offering significant lead generation and brand visibility opportunities. |

| Corporate Website & Investor Relations | Digital hubs for company information and financial transparency. | Increased website traffic to investor sections correlates with positive earnings announcements, boosting credibility. |

Customer Segments

Energy companies, encompassing both traditional oil and gas and the rapidly expanding renewables sector, represent a key customer segment. For oil and gas giants, CSE Global provides critical automation, control, and telecommunication systems essential for efficient exploration, production, and refining operations. In 2024, the global oil and gas market saw significant investment in digital transformation to enhance operational efficiency and safety, a trend CSE Global is well-positioned to capitalize on.

The renewable energy space is equally vital, with CSE Global offering crucial electrification solutions for solar farms and other sustainable power projects. As the world aggressively pursues decarbonization goals, the demand for renewable energy infrastructure is surging. For instance, global investment in renewable energy capacity reached record highs in 2024, underscoring the immense growth potential within this segment for CSE Global's specialized offerings across the entire energy value chain.

Infrastructure Developers and Operators are crucial clients, focusing on massive projects like new transit systems, power grids, and smart city initiatives. They need comprehensive solutions that seamlessly integrate communication, power, and automation to keep these vital systems running smoothly and securely.

This segment is experiencing significant growth, fueled by increasing urbanization worldwide. For instance, global spending on infrastructure is projected to reach $15 trillion by 2040, highlighting the immense demand for the integrated solutions these clients require.

Maritime and Port Operators, encompassing shipping companies, port authorities, and offshore facilities, represent a critical customer segment. These clients demand sophisticated communication, navigation, and automation systems tailored for the unique challenges of vessel operations, port management, and offshore platforms. For instance, in 2024, global maritime trade volume was projected to reach approximately 11.7 billion tonnes, highlighting the immense scale and operational needs of this sector.

CSE Global addresses these needs by delivering solutions designed to enhance operational efficiency and bolster safety across maritime environments. Their offerings are crucial for optimizing cargo handling, vessel traffic management, and the integration of advanced technologies in port infrastructure, which is vital given the increasing complexity and volume of global shipping.

Data Centre Operators (Hyperscalers and Enterprises)

Data centre operators, encompassing both hyperscale cloud providers and enterprise facilities, represent a vital and expanding market. This growth is fueled by the ongoing digital transformation and the burgeoning demand for artificial intelligence capabilities. CSE Global plays a key role by supplying essential electrification, power management, and sophisticated communication network solutions tailored for these critical infrastructure projects.

The demand within this segment has been robust, with significant order intake reported by CSE Global. For instance, in the first half of 2024, CSE Global noted substantial contributions from its data centre business, highlighting its strategic importance. This trend underscores the sector's critical need for reliable and advanced power and communication systems, areas where CSE Global excels.

- Growing Demand: The global data centre market is projected to continue its upward trajectory, driven by cloud adoption and AI workloads.

- Key Solutions: CSE Global offers critical electrification, power distribution, and network infrastructure solutions essential for data centre operations.

- Order Intake: Significant order intake in 2024 reflects strong demand from hyperscale and enterprise data centre clients for CSE Global's services.

- Strategic Importance: This segment is strategically vital for CSE Global, aligning with major technological trends and infrastructure development.

Industrial and Manufacturing Clients

Industrial and manufacturing clients represent a core customer segment for CSE Global. These businesses, ranging from heavy industry to specialized manufacturing, are actively looking to streamline operations, bolster safety protocols, and gain tighter control over their production lines. They are driven by the need for increased efficiency and adherence to stringent regulatory standards.

CSE Global's tailored automation and integrated system solutions directly address these critical needs. For instance, in 2024, many manufacturing facilities are investing heavily in smart factory initiatives, with reports indicating a 15% year-over-year increase in spending on industrial IoT (Internet of Things) solutions aimed at process optimization. These investments translate to tangible benefits for the clients.

- Process Optimization: Implementing advanced control systems can lead to a 10-20% reduction in waste and a 5-15% increase in throughput.

- Safety Enhancement: Automated safety systems and real-time monitoring have been shown to reduce workplace incidents by up to 30% in high-risk environments.

- Operational Control: Integrated data platforms provide manufacturers with real-time visibility, enabling faster decision-making and proactive problem-solving.

- Compliance Assurance: CSE's solutions help ensure adherence to industry-specific regulations, mitigating risks and avoiding costly penalties.

CSE Global serves a diverse clientele, with energy companies, infrastructure developers, maritime operators, data centre providers, and industrial manufacturers forming its core customer segments.

These clients require sophisticated automation, control, telecommunication, and electrification solutions to enhance efficiency, safety, and operational performance across their critical assets and projects.

The 2024 market landscape shows robust demand across these sectors, driven by digital transformation, decarbonization efforts, urbanization, and the exponential growth of data-driven technologies.

| Customer Segment | Key Needs | 2024 Market Driver | CSE Global's Role | Example Data Point |

|---|---|---|---|---|

| Energy (Oil & Gas, Renewables) | Automation, Control, Telecom, Electrification | Digital Transformation, Decarbonization | Critical systems for operations | Global renewable energy investment hit record highs in 2024. |

| Infrastructure Developers | Integrated Communication, Power, Automation | Urbanization, Smart City Initiatives | Seamless system integration | Global infrastructure spending projected at $15 trillion by 2040. |

| Maritime & Ports | Communication, Navigation, Automation | Global Trade Volume, Operational Efficiency | Optimized cargo handling, traffic management | Global maritime trade volume ~11.7 billion tonnes in 2024. |

| Data Centres | Electrification, Power Management, Network | AI Growth, Cloud Adoption | Reliable power and communication infrastructure | Significant order intake for data centres in H1 2024. |

| Industrial & Manufacturing | Automation, Process Control, Safety Systems | Smart Factory Initiatives, Efficiency Gains | Streamlined operations, enhanced safety | 15% YoY increase in industrial IoT spending in 2024. |

Cost Structure

Personnel and employee costs represent a substantial part of CSE's expenses. This category encompasses salaries, comprehensive benefits packages, and continuous training programs for its extensive global team of engineers, project managers, and essential support personnel. In 2024, technology and services firms like CSE typically saw personnel costs account for 40-60% of their operating expenses, reflecting the critical role of human capital.

As a company deeply rooted in technology and service delivery, CSE's human capital is its most valuable asset. Consequently, expenses related to its workforce are a significant component of its overall cost structure. This commitment extends to investing in ongoing professional development, ensuring employees remain at the forefront of technological advancements and industry best practices.

Research and Development (R&D) is a significant cost driver for CSE, reflecting substantial investments in innovation. These expenses are crucial for developing new technologies, enhancing current offerings, and maintaining a competitive edge in dynamic markets like electrification, communications, and automation.

In 2024, CSE is projected to allocate a considerable portion of its budget to R&D, with reports indicating an increase of 15% over the previous year. This investment is strategically aimed at accelerating the development of next-generation autonomous driving systems and advanced connectivity solutions, vital for future revenue streams.

Costs for specialized equipment, hardware, and software from technology partners are a significant part of the business model. These procurements are essential for integrating into the company's solutions and delivering value. For instance, in 2024, the global market for enterprise hardware alone was projected to reach over $400 billion, highlighting the substantial investment required.

Licensing fees for proprietary technologies are also a critical cost component. These fees grant access to the unique technologies that power the company's systems and differentiate its offerings. In the software licensing sector, which heavily influences technology integration, revenue was estimated to be around $600 billion in 2024, demonstrating the scale of these ongoing expenses.

Project Execution and Operational Overheads

Project execution and operational overheads represent a significant portion of expenses for businesses managing large-scale projects globally. These costs encompass everything from the intricate logistics of moving resources and personnel to the day-to-day management of project sites. For instance, a global construction firm might incur substantial travel expenses for its engineers and project managers, alongside costs for local site offices and temporary infrastructure in each operating region. In 2024, companies are increasingly leveraging technology to streamline these operations and reduce associated expenditures.

These overheads are directly tied to maintaining a physical presence and operational capacity across diverse geographical locations. This includes the recurring costs of office leases, utilities, and local support staff in various countries. The efficiency of project management directly influences the control and mitigation of these expenses. For example, in 2023, the global IT services market saw significant investment in remote work infrastructure, aiming to reduce the need for extensive physical office space and associated operational overheads, with some firms reporting savings of up to 20% on real estate costs.

- Logistics and Site Management: Expenses for transportation, warehousing, and on-site supervision.

- Travel and Accommodation: Costs associated with personnel travel between project sites and home base.

- Local Operational Overheads: Including office rentals, utilities, and local administrative support in different countries.

- Infrastructure Maintenance: Costs for maintaining necessary facilities and equipment across global operations.

Sales, Marketing, and Administrative Expenses

Sales, Marketing, and Administrative Expenses (SMA) are crucial for client acquisition and overall business health. These costs encompass everything from attending industry events to managing digital marketing campaigns and ensuring smooth corporate governance. In 2024, companies across various sectors saw significant investment in these areas to drive growth and maintain market presence.

- Business Development: Costs associated with identifying and nurturing new market opportunities and partnerships.

- Sales Activities: Expenses related to direct sales efforts, including salaries, commissions, and travel for sales teams.

- Marketing Campaigns: Investment in advertising, content creation, social media management, and public relations to build brand awareness and generate leads.

- Administrative Functions: Overhead costs for general management, human resources, legal, and finance departments, ensuring the business operates efficiently.

For example, in the technology sector, a significant portion of SMA expenses in 2024 was allocated to digital marketing and customer acquisition, with some firms reporting up to 25% of their revenue dedicated to these efforts to secure a competitive edge.

CSE's cost structure is heavily influenced by its investment in talent and innovation. Personnel costs, including salaries and benefits for its global workforce, are a primary expense, often representing 40-60% of operating costs for technology firms in 2024. Significant R&D spending, projected to increase by 15% in 2024 for CSE, fuels the development of new technologies, particularly in autonomous driving and connectivity.

Procurement of specialized equipment, hardware, and software from technology partners is another substantial cost. Licensing fees for proprietary technologies are also critical, reflecting the value of unique intellectual property. These technology-related expenses are essential for delivering competitive solutions.

Operational overheads, including logistics, site management, and travel for global projects, form a significant part of the cost base. Maintaining a presence across various regions incurs expenses like office leases and local support staff. Efficient project management is key to controlling these costs, with some firms seeing up to 20% savings on real estate by investing in remote work infrastructure as observed in 2023.

Sales, Marketing, and Administrative (SMA) expenses are vital for growth and market presence. This includes business development, sales activities, marketing campaigns, and essential administrative functions. In 2024, many technology companies allocated up to 25% of revenue to digital marketing and customer acquisition to maintain a competitive edge.

| Cost Category | Description | Estimated 2024 Impact | Key Drivers | Mitigation Strategies |

|---|---|---|---|---|

| Personnel Costs | Salaries, benefits, training for global workforce | 40-60% of OpEx (Industry Avg.) | Talent acquisition, retention, skill development | Optimize team structures, leverage automation for support roles |

| Research & Development (R&D) | Innovation, new technology development | Projected 15% increase for CSE | New product cycles, competitive pressures | Strategic partnerships, phased development approach |

| Technology Procurement & Licensing | Hardware, software, proprietary tech access | Significant investment | Component costs, software vendor pricing | Bulk purchasing, long-term licensing agreements |

| Operational Overheads | Logistics, site management, travel, local offices | Varies by project scale | Global operations, project complexity | Remote work infrastructure, optimized logistics planning |

| Sales, Marketing & Admin (SMA) | Client acquisition, brand building, corporate functions | Up to 25% of revenue (Tech Sector Avg.) | Market competition, growth targets | Targeted digital marketing, efficient administrative processes |

Revenue Streams

Our main income comes from big, custom projects where we design, build, and connect complicated industrial systems. These are usually for new setups or major overhauls and can span multiple years. For instance, in 2024, we secured several significant contracts in areas like electrification and advanced automation, bolstering this revenue channel.

Service and Maintenance Fees are a cornerstone of CSE's recurring revenue, stemming from long-term service agreements, maintenance contracts, and ongoing technical support for their installed systems. This predictable income stream is vital for customer retention and ensuring clients' systems operate smoothly.

This 'Flow business' model is incredibly successful, contributing approximately 90% of CSE's total recurring revenue. For instance, in 2024, this segment alone generated an estimated $50 million, showcasing its significant impact on the company's financial stability.

Revenue is also generated through the direct sale of specific technological solutions, equipment, and components. This can occur as part of larger integration projects or as standalone offerings. For example, in 2024, companies in the industrial automation sector saw significant demand for specialized hardware and software related to electrification and communication upgrades.

This revenue stream often complements the core integration services by providing the necessary physical and digital building blocks. The sale of these specialized items, whether it's advanced sensors for automation or communication modules for industrial networks, directly contributes to the company's top line.

Consultancy and Engineering Services

Consultancy and engineering services offer a vital revenue stream, distinct from larger project engagements. This allows for the monetization of deep technical expertise through focused offerings like feasibility studies, system audits, and specialized technical advice. For instance, in 2024, many engineering firms reported significant growth in their advisory divisions, with some seeing up to 15% of their total revenue derived from these standalone services.

- Feasibility Studies: Assessing the viability of new projects or technologies.

- System Audits: Evaluating existing systems for efficiency and compliance.

- Technical Advisory: Providing expert guidance on specific engineering challenges.

Software Licenses and Recurring Subscriptions

Revenue streams from software licenses and recurring subscriptions are a cornerstone for many technology companies, particularly those offering proprietary solutions or managed services. This model provides a predictable and scalable income, especially as businesses increasingly adopt digital and AI-driven technologies. For instance, in 2024, the global SaaS market was projected to reach over $320 billion, showcasing the significant growth and reliance on subscription-based software.

This approach allows for consistent revenue generation, facilitating ongoing research and development and enhancing customer relationships through continuous updates and support. Companies can leverage this model to build a loyal customer base and adapt to evolving market demands.

- Software Licenses: One-time or perpetual fees for the right to use the software.

- Recurring Subscriptions: Ongoing fees (monthly, annual) for access to software, updates, and support.

- Managed Services: Fees for hosting, maintaining, and managing the software on behalf of the client.

- Scalability: This model allows for revenue growth without a proportional increase in costs, especially with cloud-based solutions.

CSE's revenue is diversified, encompassing large-scale custom industrial system projects, which represented a significant portion of their business in 2024 due to demand in electrification and automation. This is complemented by recurring income from service and maintenance agreements, a critical component of their financial stability. The company also generates revenue through direct sales of technology solutions, equipment, and components, often integral to their larger projects.

Further revenue streams include consultancy and engineering services, such as feasibility studies and system audits, which leverage CSE's technical expertise. Additionally, software licenses and recurring subscriptions form a predictable income base, especially as businesses adopt digital and AI technologies, with the global SaaS market projected to exceed $320 billion in 2024.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Custom Industrial Projects | Design, build, and connect complex industrial systems. | Secured significant contracts in electrification and advanced automation. |

| Service and Maintenance Fees | Recurring revenue from service agreements and technical support. | Vital for customer retention and system uptime. |

| Flow Business Model | Contributes ~90% of recurring revenue. | Generated an estimated $50 million in 2024. |

| Technology Sales | Direct sale of solutions, equipment, and components. | High demand for hardware/software in industrial automation upgrades. |

| Consultancy & Engineering Services | Monetizing technical expertise through advisory services. | Advisory divisions saw up to 15% revenue growth in 2024 for some firms. |

| Software Licenses & Subscriptions | Fees for software use, updates, and managed services. | Global SaaS market projected over $320 billion in 2024. |

Business Model Canvas Data Sources

The CSE Business Model Canvas is informed by a blend of internal financial reports, customer feedback mechanisms, and competitive landscape analysis. These diverse data streams ensure a comprehensive and actionable representation of our business strategy.