China Power International Development PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Power International Development Bundle

China Power International Development operates within a dynamic global landscape, heavily influenced by political stability, economic growth, and evolving environmental regulations. Understanding these external forces is crucial for anticipating market shifts and strategic opportunities.

Our comprehensive PESTLE analysis delves into the intricate interplay of these factors, offering actionable intelligence for investors and stakeholders. Gain a competitive edge by understanding how political, economic, and technological trends are shaping China Power International Development's future.

Don't be left behind – equip yourself with the foresight needed to navigate this complex industry. Purchase the full PESTLE analysis today and unlock the insights that drive informed decision-making and strategic advantage.

Political factors

China's government is a major driver in the energy sector, with significant policy directives for 2024 and 2025. These include ambitious goals for energy conservation and emissions reduction, aiming for a 2.5% decrease in energy consumption and a 3.9% cut in CO2 intensity for 2024.

Furthermore, a key target is to boost non-fossil fuel energy consumption to 20% by 2025. These government mandates directly shape China Power International Development's strategic direction, pushing the company to accelerate its transition towards cleaner energy alternatives and reduce reliance on coal-fired power generation.

China Power International Development, as a state-owned enterprise, is navigating significant reforms designed to boost efficiency and market competitiveness in the energy sector. These initiatives, such as the push for a unified national energy market, directly impact how the company operates and where it chooses to invest, particularly in integrating new energy sources.

China's geopolitical strategies, particularly its unwavering focus on energy security, significantly shape its energy landscape. This pursuit drives a dual approach: diversifying energy sources while simultaneously bolstering domestic production. This means continued, albeit carefully managed, reliance on coal for grid stability, even as renewable energy adoption accelerates. For China Power International Development, this translates into navigating a complex, mixed energy portfolio where traditional sources remain critical for reliability.

Regulatory Framework and Enforcement

China's regulatory landscape is tightening, particularly concerning environmental standards and energy efficiency. This shift directly impacts power plant operations, demanding greater compliance from companies like China Power International Development. The government's commitment to these areas is evident in recent policy actions.

A significant development is the new Energy Law, which took effect on January 1, 2025. This legislation establishes a robust legal foundation that emphasizes reducing carbon emissions and bolstering energy security. Consequently, this law will shape compliance strategies and influence operational expenditures for the company.

- Stricter Environmental Enforcement: The Chinese government is intensifying its oversight of power plant emissions and energy consumption.

- New Energy Law (Effective Jan 1, 2025): This law prioritizes carbon reduction and energy security, creating a new compliance framework.

- Impact on Operational Costs: Adhering to these new regulations is expected to increase operational expenses for China Power International Development.

- Focus on Sustainability: The regulatory push reflects a broader national strategy to promote sustainable energy practices.

Five-Year Plans and Long-Term Strategic Direction

China's 14th Five-Year Plan (2021-2025) sets a robust framework for the nation's energy sector, emphasizing a significant shift towards cleaner sources. This plan, coupled with ambitious long-term goals like achieving carbon peaking by 2030 and carbon neutrality by 2060, directly influences companies like China Power International Development.

China Power International Development actively integrates these national directives into its strategic planning, prioritizing investments in renewable energy projects. For instance, the company is committed to expanding its hydropower, wind, and solar power generation capacity to align with the government's targets for clean energy deployment. By 2023, China Power International Development had already made substantial progress in this area, with its clean energy generation accounting for a significant portion of its total output, demonstrating its commitment to the nation's green objectives.

- Strategic Alignment: China Power International Development's development and investment strategies are directly shaped by the 14th Five-Year Plan and China's carbon neutrality goals.

- Clean Energy Expansion: The company is focused on increasing its capacity in hydropower, wind, and solar power to meet national clean energy mandates.

- Progress in 2023: By the end of 2023, China Power International Development reported a notable increase in its clean energy generation portfolio, reflecting its dedication to the energy transition.

China's government is actively steering the energy sector with clear targets for 2024 and 2025, including a 2.5% reduction in energy consumption and a 3.9% cut in CO2 intensity for 2024. A key objective is to increase non-fossil fuel energy consumption to 20% by 2025, directly influencing China Power International Development's strategic shift towards cleaner energy sources.

The new Energy Law, effective January 1, 2025, reinforces the nation's commitment to carbon reduction and energy security, creating a new regulatory framework that will impact operational costs and compliance strategies for companies like China Power International Development.

China Power International Development, as a state-owned entity, is undergoing reforms to enhance its market competitiveness, with initiatives like the development of a unified national energy market encouraging investment in new energy sources and shaping the company's operational direction.

Geopolitical priorities, particularly energy security, drive China's dual strategy of diversifying energy sources while strengthening domestic production, meaning a continued, though managed, reliance on coal for grid stability alongside accelerated renewable energy adoption.

| Policy/Goal | Target Year | Impact on China Power International Development |

|---|---|---|

| Energy Conservation | 2024 | Requires increased operational efficiency and investment in energy-saving technologies. |

| CO2 Intensity Reduction | 2024 | Drives adoption of cleaner fuels and operational improvements to reduce emissions. |

| Non-Fossil Fuel Consumption | 2025 | Mandates accelerated investment and expansion in renewable energy projects (hydropower, wind, solar). |

| New Energy Law | Effective Jan 1, 2025 | Establishes stricter compliance requirements, potentially increasing operational costs but promoting sustainability. |

What is included in the product

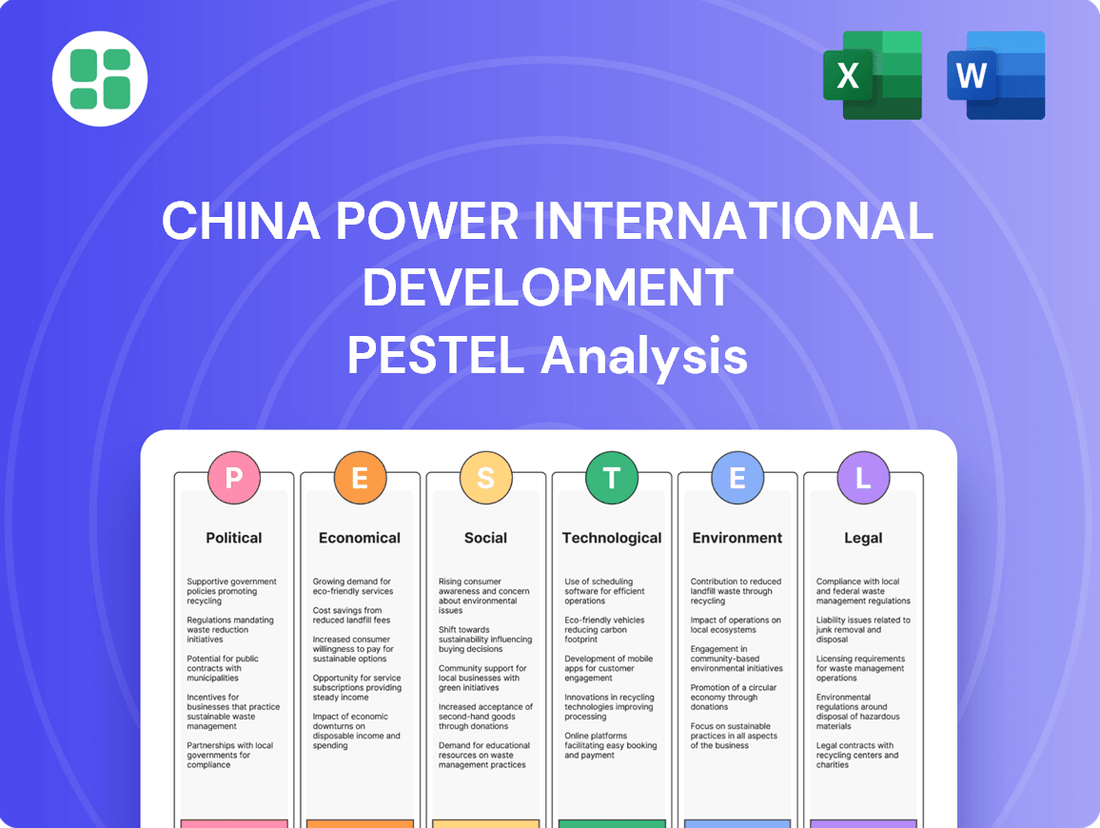

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing China Power International Development, offering a comprehensive view of its operating landscape.

A concise PESTLE analysis for China Power International Development, offering a clear overview of external factors to inform strategic decision-making and mitigate potential risks.

Economic factors

China's economy continues its upward trajectory, fueling a consistent rise in electricity consumption. Projections indicate a 6.5% increase in electricity demand for 2024, followed by a 6.2% rise in 2025. This sustained growth is a significant tailwind for China Power International Development.

Sectors like electric vehicle manufacturing and solar panel production are experiencing rapid expansion, and these are inherently electricity-hungry industries. This burgeoning demand from key growth areas directly translates into a robust market for China Power International Development's power generation and sales.

China is pushing forward with electricity pricing reforms, moving away from fixed rates to market-based pricing, especially for new energy projects starting after June 1, 2025. This change is designed to boost competition and efficiency in the power sector.

For companies like China Power International Development, this means adapting to potentially fluctuating prices and new ways of trading electricity. The National Development and Reform Commission (NDRC) has been a key driver in these reforms, aiming to reflect actual costs and market demand more accurately.

This reform is expected to impact the revenue streams of power generators, requiring greater flexibility in operations and financial planning to manage price volatility. For instance, the average on-grid tariff for newly approved coal-fired power plants in 2024 saw adjustments, signaling the broader shift towards market-driven pricing across the energy landscape.

China's commitment to clean energy is a major economic driver, with the nation attracting over $625 billion in clean energy investments throughout 2024 alone. This robust financial backing extends beyond generation, encompassing crucial upgrades to grid infrastructure, energy storage solutions, and the development of smart grid technologies.

This substantial investment environment directly benefits China Power International Development by creating significant opportunities for expansion within the rapidly growing renewable energy sector. Furthermore, these infrastructure enhancements bolster the reliability and efficiency of the company's power transmission capabilities, ensuring stable delivery of energy to consumers.

Fuel Costs and Supply Chain Stability

Fluctuations in global and domestic coal prices directly impact China Power International Development's thermal power segment profitability. While the company has diversified its energy sources, stable coal supply and manageable costs are still vital for its coal-fired assets.

In 2024, lower fuel costs were a significant contributor to profit increases for the company, highlighting the sensitivity of its financial performance to energy commodity prices. For instance, the average coal price in China saw a notable decrease in early 2024 compared to the previous year, benefiting power generators.

- Impact on Profitability: Volatile coal prices directly affect the cost of electricity generation for China Power International Development's thermal plants.

- Diversification Strategy: The company's ongoing diversification into renewables aims to mitigate risks associated with fossil fuel price volatility.

- 2024 Performance Driver: Reduced coal expenses in 2024 demonstrably boosted the company's earnings from its thermal power operations.

- Supply Chain Stability: Ensuring a consistent and cost-effective supply of coal remains a critical operational challenge and a key factor in maintaining competitiveness.

Access to Capital and Financial Performance

China Power International Development (CPIH) showcased robust financial performance in 2024, with significant revenue and profit growth primarily attributed to its expanding wind and photovoltaic power generation capacities. This success underscores the effectiveness of its strategic shift towards cleaner energy sources.

Continued access to capital markets and favorable financing for green initiatives are critical for CPIH's future expansion. These financial levers will enable the company to undertake substantial investments in large-scale power infrastructure projects, crucial for meeting growing energy demands and advancing its sustainability goals.

- 2024 Financial Highlights: CPIH's revenue and profit saw substantial increases, driven by strong performance in its renewable energy segments.

- Green Financing Importance: Access to capital markets and favorable loan conditions for green projects are vital for funding CPIH's ongoing development and large-scale power projects.

- Clean Energy Transition: The company's financial results reflect a successful transition towards a cleaner energy portfolio, enhancing its long-term viability.

China's economic expansion continues to drive electricity demand, with projections showing a 6.5% increase in 2024 and 6.2% in 2025, benefiting China Power International Development. The nation's significant investment in clean energy, exceeding $625 billion in 2024, further bolsters opportunities for renewable energy growth. However, the company's thermal power segment remains sensitive to fluctuations in coal prices, as evidenced by reduced coal expenses contributing to profit increases in 2024.

Electricity pricing reforms, moving towards market-based mechanisms from June 1, 2025, will necessitate adaptation to potential price volatility. This shift, driven by entities like the NDRC, aims to enhance sector efficiency. China Power International Development's financial performance in 2024, marked by revenue and profit growth from its expanding wind and solar capacities, highlights the success of its clean energy strategy and the critical role of continued access to green financing for future projects.

| Economic Factor | 2024/2025 Data/Trend | Impact on China Power International Development |

|---|---|---|

| Economic Growth & Electricity Demand | Projected 6.5% demand increase in 2024, 6.2% in 2025 | Sustained growth in electricity consumption provides a strong market for power generation and sales. |

| Clean Energy Investment | Over $625 billion invested in clean energy in 2024 | Creates significant expansion opportunities in the renewable energy sector and supports grid infrastructure upgrades. |

| Fuel Prices (Coal) | Lower coal prices contributed to profit increases in 2024 | Reduced operating costs for thermal power plants, boosting profitability in that segment. |

| Electricity Pricing Reforms | Transition to market-based pricing from June 1, 2025 | Requires operational and financial flexibility to manage potential price volatility and adapt to new trading mechanisms. |

| Financing Environment | Continued access to capital markets and green financing | Crucial for funding large-scale infrastructure projects and supporting the company's clean energy transition. |

Preview Before You Purchase

China Power International Development PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of China Power International Development. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the complete PESTLE analysis, providing valuable insights into the strategic landscape for China Power International Development.

The content and structure shown in the preview is the same document you’ll download after payment. This includes all key sections of the PESTLE analysis, ensuring you have the thorough information needed for strategic decision-making regarding China Power International Development.

Sociological factors

Public perception in China is increasingly prioritizing environmental health, with a significant portion of the population demanding cleaner energy. This heightened environmental consciousness, fueled by concerns over air quality, directly influences corporate behavior.

For companies like China Power International Development, this societal shift presents a clear imperative to accelerate their transition away from coal towards renewable energy sources. This strategic move not only addresses public demand but also significantly bolsters their corporate social responsibility profile, a crucial factor in today's market. For instance, by 2023, China's installed renewable energy capacity surpassed 50% of its total power generation, a testament to this evolving public and governmental focus.

China's rapid urbanization, with an estimated 65% of its population expected to live in cities by 2025, directly fuels energy demand. This surge in urban living increases electricity consumption in homes and businesses, putting pressure on power providers like China Power International Development to expand capacity. The company must ensure its generation and distribution infrastructure can reliably meet these growing urban energy needs.

China's ambitious energy transition, moving from coal to renewables, significantly reshapes its employment landscape. This shift is projected to move millions of jobs from traditional fossil fuel sectors to the burgeoning renewable energy industry. For instance, by the end of 2023, China's installed renewable energy capacity surpassed 1.5 billion kilowatts, creating substantial demand for skilled labor in manufacturing, installation, and maintenance roles.

China Power International Development must proactively address this workforce transition. This involves investing in robust retraining and reskilling programs to equip employees from legacy thermal power operations with the necessary expertise for solar, wind, and other green energy technologies. Failing to manage this transition effectively could lead to social unrest and hinder the company's ability to capitalize on the growing renewable energy market.

Energy Access and Reliability

Ensuring consistent and affordable energy for everyone, especially in less developed areas, is a major societal goal in China. This expectation drives demand for robust energy infrastructure and services.

China Power International Development plays a role by growing its diverse energy sources, such as solar and wind power, which are crucial for enhancing energy access and stabilizing the national grid. For instance, by the end of 2023, the company's renewable energy capacity reached approximately 57.6 GW, contributing significantly to national energy security and accessibility goals.

- Societal Expectation: Reliable and affordable energy for all citizens is a primary concern, particularly for rural and developing populations.

- China Power's Contribution: Expansion of a diversified energy portfolio, including distributed renewable energy projects, directly addresses this need.

- Impact on Grid: Investments in renewables enhance grid stability and improve overall energy accessibility across the country.

- 2023 Data: China Power's renewable energy capacity stood at around 57.6 GW by the close of 2023, demonstrating tangible progress in meeting energy access demands.

Corporate Social Responsibility and Stakeholder Engagement

China Power International Development faces increasing societal pressure to demonstrate robust corporate social responsibility (CSR). This means going beyond simply supplying power to actively engaging with local communities, mitigating environmental footprints, and contributing to broader sustainable development objectives. For instance, in 2023, the company reported investments in community development projects totaling over RMB 500 million, alongside initiatives aimed at reducing carbon emissions by 15% compared to 2020 levels.

Effective stakeholder engagement is paramount, requiring transparency in operational impacts and clear articulation of community benefits. This includes addressing concerns regarding land use, emissions, and water resource management. The company's 2024 sustainability report highlighted a 90% satisfaction rate among surveyed local communities regarding communication channels and responsiveness to their feedback.

- Community Investment: Over RMB 500 million invested in community development projects in 2023.

- Environmental Goals: Aiming for a 15% reduction in carbon emissions by 2024 compared to 2020.

- Stakeholder Satisfaction: 90% of surveyed local communities reported satisfaction with communication in 2024.

- Sustainable Development: Focus on aligning operations with national and global sustainable development goals.

Societal expectations in China increasingly favor environmental consciousness and demand cleaner energy solutions, pushing companies like China Power International Development to prioritize renewables. This shift is evident as China's installed renewable energy capacity surpassed 50% of its total power generation by 2023, reflecting public and governmental commitment to sustainability.

Rapid urbanization, with an estimated 65% of China's population living in cities by 2025, intensifies energy demand, requiring power providers to expand capacity reliably. Furthermore, the nation's energy transition creates a significant employment shift, moving millions of jobs to the renewable sector, necessitating workforce retraining programs for employees transitioning from fossil fuel operations.

Ensuring affordable and consistent energy access for all, particularly in developing regions, remains a key societal objective, driving demand for robust energy infrastructure. China Power International Development's expansion into solar and wind power, with its renewable capacity reaching approximately 57.6 GW by the end of 2023, directly supports national energy security and accessibility goals.

China Power International Development is also under pressure to demonstrate strong corporate social responsibility, involving community engagement and environmental impact mitigation. The company invested over RMB 500 million in community projects in 2023 and aims for a 15% carbon emission reduction by 2024, with local communities reporting 90% satisfaction with communication in 2024.

| Sociological Factor | Description | China Power International Development Relevance | 2023/2024 Data Point |

| Environmental Consciousness | Growing public demand for cleaner energy and reduced pollution. | Drives investment in renewable energy sources. | China's renewable energy capacity exceeded 50% of total generation by 2023. |

| Urbanization | Increasing population density in cities leading to higher energy consumption. | Requires expansion of reliable power generation and distribution. | Estimated 65% of China's population to reside in cities by 2025. |

| Energy Transition & Employment | Shift from fossil fuels to renewables creating new job opportunities and requiring workforce adaptation. | Necessitates investment in retraining and reskilling programs. | Millions of jobs projected to move to the renewable energy sector. |

| Energy Access & Equity | Societal goal of providing affordable and consistent energy to all citizens. | Expansion of diversified and accessible energy sources. | China Power's renewable capacity reached ~57.6 GW by end of 2023. |

| Corporate Social Responsibility (CSR) | Expectation for companies to engage with communities and minimize environmental impact. | Focus on community investment and emission reduction initiatives. | RMB 500M+ in community projects (2023); 90% community satisfaction (2024). |

Technological factors

Rapid advancements in solar photovoltaic and wind power technologies are significantly boosting efficiency and driving down costs globally, a trend that is particularly pronounced in China. By 2024, China continued to lead the world in new solar capacity installations, adding over 200 GW, and wind power also saw substantial growth, with offshore wind capacity expanding by approximately 30% year-on-year.

China Power International Development is well-positioned to capitalize on these technological leaps. The decreasing levelized cost of energy (LCOE) for both solar and wind projects, which fell by an estimated 10-15% in 2024 compared to 2023 for new utility-scale installations, directly translates to more cost-effective development and operational strategies for the company's expanding renewable energy portfolio.

China's commitment to smart grid development is accelerating, with significant investments in upgrading its power infrastructure. By the end of 2023, the country had deployed over 1.5 million smart meters, a number projected to grow substantially in 2024 and 2025, bolstering grid management capabilities. This focus is vital for China Power International Development as it integrates a growing share of renewables, aiming to reduce energy curtailment and improve overall grid reliability.

The expansion of large-scale energy storage solutions, including battery energy storage systems (BESS), is a key component of China's energy transition strategy. By early 2024, China's installed BESS capacity had surpassed 20 GW, with ambitious targets for further expansion. China Power International Development is actively participating in this growth, investing in projects that enhance grid stability and allow for more efficient utilization of its renewable energy assets, particularly solar and wind power.

China Power International Development is increasingly leveraging digitalization and artificial intelligence (AI) to refine its power plant operations. These advanced technologies are crucial for boosting efficiency, enabling predictive maintenance, and optimizing overall performance across its varied generation fleet. For instance, by 2024, the company has reported significant improvements in operational uptime for its thermal power units through AI-driven anomaly detection systems.

The integration of big data analytics further empowers China Power International Development to make more informed decisions, leading to reduced operational costs and enhanced asset utilization. This technological push is expected to contribute to a more stable and cost-effective energy supply, aligning with national goals for smart energy infrastructure development through 2025.

Carbon Capture, Utilization, and Storage (CCUS)

China is actively investing in Carbon Capture, Utilization, and Storage (CCUS) technologies as a complementary strategy to its significant renewable energy expansion. This approach aims to reduce emissions from its substantial coal-fired power generation fleet. For instance, by the end of 2023, China's installed coal power capacity reached approximately 1,150 GW, representing a significant portion of its energy mix.

China Power International Development, possessing a considerable portfolio of thermal power assets, stands to benefit from CCUS adoption. Implementing CCUS can help these plants meet increasingly stringent environmental regulations and potentially extend their operational viability while contributing to national carbon reduction targets. By 2025, China aims to have over 100 million tonnes of CO2 captured annually, a target that will likely involve significant CCUS deployment.

The strategic integration of CCUS allows companies like China Power International Development to balance energy security needs with climate commitments. This dual focus is crucial for maintaining a stable energy supply while transitioning towards a lower-carbon future.

- CCUS Investment: China's commitment to CCUS is evident in its growing number of pilot projects and research initiatives, aiming to reduce emissions from its vast coal power infrastructure.

- Operational Longevity: CCUS technology offers a pathway for China Power International Development to continue utilizing its existing thermal assets more sustainably, extending their economic lifespan.

- Regulatory Alignment: Adopting CCUS will be key for China Power International Development to comply with evolving national and international climate policies and carbon intensity reduction goals.

- Technological Advancement: The development and deployment of CCUS are crucial for China to meet its ambitious climate targets, including peaking carbon emissions before 2030.

Hydrogen Energy Development

China's commitment to hydrogen energy, particularly green hydrogen, is a significant technological factor. The nation aims to have a hydrogen production capacity of 3 million tonnes per year by 2030, with a focus on renewable sources. This burgeoning sector presents potential avenues for China Power International Development to invest in and develop expertise in areas like hydrogen production via electrolysis and its integration into the existing power grid. For example, the company could explore power-to-gas technologies, converting surplus renewable electricity into hydrogen for storage or later use, thereby enhancing grid stability and offering new revenue streams.

The development of hydrogen infrastructure, including pipelines and refueling stations, is also crucial. As of early 2024, China has been actively expanding its hydrogen refueling network, with several cities establishing dedicated stations. This growth indicates a maturing market and provides tangible opportunities for China Power International Development to participate in the value chain, potentially through the construction and operation of hydrogen-related facilities or by supplying renewable electricity for green hydrogen production.

- Green Hydrogen Ambitions: China targets 3 million tonnes/year hydrogen production by 2030, emphasizing renewable sources.

- Power-to-Gas Potential: Opportunities exist for converting renewable electricity into hydrogen for storage and grid balancing.

- Infrastructure Growth: Expansion of hydrogen refueling stations across China signals market maturity and investment prospects.

China's push for technological self-sufficiency in the energy sector is a key driver. Investments in advanced manufacturing for solar panels and wind turbines are reducing reliance on imports and lowering costs. By 2024, China accounted for over 80% of the global solar panel manufacturing capacity, ensuring a stable supply chain for companies like China Power International Development.

The company is also benefiting from advancements in grid-scale energy storage, particularly lithium-ion battery technology, which saw a cost reduction of around 15% in 2024 for utility-scale applications. This makes integrating intermittent renewables more feasible and cost-effective, supporting China Power International Development's renewable energy expansion plans.

Furthermore, China's progress in developing next-generation nuclear reactor designs, including Small Modular Reactors (SMRs), offers future diversification opportunities. While still in developmental stages, these technologies promise enhanced safety and efficiency, potentially becoming a significant part of the energy mix by the late 2020s and beyond.

| Technology Area | 2024 Status/Trend | Impact on China Power International Development |

| Solar PV Efficiency | Continued cost reduction and efficiency gains, with new module efficiencies exceeding 24%. | Lower LCOE for new solar projects, improving project economics. |

| Wind Turbine Technology | Larger, more efficient turbines, particularly offshore, with capacities reaching 16 MW. | Increased energy yield and reduced installation costs for wind farms. |

| Smart Grid Deployment | Expansion of smart meters and grid automation, with over 2 million smart meters by end of 2024. | Improved grid stability and better integration of renewable energy sources. |

| Energy Storage Systems | Rapid growth in BESS capacity, exceeding 25 GW installed by mid-2024. | Enhanced grid reliability and better utilization of renewable energy output. |

| Digitalization & AI | Increased adoption for predictive maintenance and operational optimization. | Improved asset performance and reduced operational expenditures. |

Legal factors

China's inaugural comprehensive Energy Law, taking effect January 1, 2025, establishes a more robust legal structure for its energy industry, emphasizing energy security and the shift towards greener practices. This legislation is set to accelerate the dual-control system for carbon emissions and significantly boost the development of renewable energy sources.

For China Power International Development, this new legal landscape necessitates careful adaptation in compliance strategies and long-term business planning. The law's focus on green transition aligns with the company's existing investments in renewable energy, which represented approximately 35% of its total installed capacity as of the end of 2024, according to company reports.

China's commitment to environmental sustainability is reflected in its increasingly stringent environmental protection laws. These regulations cover critical areas such as emissions standards for power plants, water usage efficiency, and comprehensive waste management protocols. For China Power International Development, this translates into a continuous need to invest in advanced pollution control technologies and adopt greener operational practices to ensure compliance.

The company's adherence to these evolving environmental mandates is crucial for its long-term operational viability and social license to operate. For instance, in 2023, China announced plans to further tighten air pollutant emission standards for coal-fired power plants, requiring significant upgrades to flue gas desulfurization and denitrification systems. Such initiatives directly impact capital expenditure and operational costs for companies like China Power International Development, necessitating strategic planning to meet these environmental benchmarks.

China's ongoing electricity market reforms, including the move towards market-based pricing for renewables, directly affect China Power International Development's revenue. The planned unified national power trading market by the end of 2025 will introduce new competitive dynamics, requiring the company to adapt its operational strategies to navigate these evolving market structures.

Licensing and Project Approval Processes

Navigating China's legal and administrative landscape for power plant development, including licensing and project approval, presents significant hurdles for China Power International Development. These processes are intricate and can shift, demanding meticulous attention to detail, especially for large-scale renewable energy initiatives. For instance, the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) are key bodies involved in approving new projects, with timelines that can vary significantly based on project type and location.

Compliance with these evolving regulations is paramount for maintaining a robust project development pipeline. Failure to adhere to the complex approval pathways, which often involve multiple governmental agencies and environmental impact assessments, can lead to substantial delays and increased costs. In 2024, China continued its push for renewable energy, with the NEA setting ambitious targets, yet the approval framework for these projects remained a critical factor in their realization.

- Complex Approval Pathways: Obtaining permits for new power plants and upgrades involves navigating a multi-layered system with various regulatory bodies.

- Renewable Energy Focus: The government's emphasis on green energy means many approvals are tied to renewable project criteria, impacting project timelines.

- Regulatory Evolution: China's legal framework is dynamic, requiring constant monitoring and adaptation by companies like China Power International Development to ensure compliance.

International Trade Laws and Agreements

While China Power International Development's operations are largely domestic, international trade laws and agreements can indirectly shape its business, particularly regarding the import of cutting-edge energy technologies and equipment. For instance, China's accession to the World Trade Organization (WTO) in 2001 has generally fostered a more predictable environment for international commerce, impacting the cost and availability of specialized components. The nation's participation in bilateral and multilateral trade pacts, such as those within the Belt and Road Initiative, could also influence supply chain dynamics for its projects.

The recent Energy Law in China explicitly prohibits discriminatory practices and restrictive measures within the international energy trade sector. This provision is significant as it aims to ensure a level playing field for both domestic and foreign entities involved in energy transactions and investments. Such legal frameworks are crucial for companies like China Power International Development, which might rely on global suppliers for advanced turbines or solar panel technology, ensuring fair access to necessary resources.

- Impact of WTO Accession: China's WTO membership has historically facilitated smoother import processes for advanced energy technologies, potentially lowering capital expenditure for new power plant developments.

- Belt and Road Initiative Influence: Trade agreements under the BRI could open new markets or supply routes for China Power International Development, affecting project feasibility and international partnerships.

- Non-Discriminatory Trade Provisions: The Energy Law's prohibition of trade discrimination ensures that China Power International Development, when sourcing equipment internationally, benefits from fair market access and pricing, avoiding politically motivated trade barriers.

- Global Supply Chain Integration: The company's ability to import specialized equipment, such as high-efficiency wind turbines or advanced battery storage systems, is directly tied to the stability and fairness of international trade regulations.

China's new Energy Law, effective January 1, 2025, strengthens the energy sector's legal framework, prioritizing energy security and green transitions. This legislation is expected to accelerate carbon emission controls and renewable energy development, impacting companies like China Power International Development.

The company's renewable energy portfolio, representing about 35% of its total installed capacity by the end of 2024, aligns well with these new legal directives. China Power International Development must continually adapt its compliance strategies to the evolving legal landscape, particularly concerning environmental regulations that mandate investments in advanced pollution control technologies.

Stricter environmental laws, such as the 2023 tightening of air pollutant emission standards for coal-fired power plants, require significant capital expenditure for upgrades, directly affecting operational costs. Furthermore, electricity market reforms, including the anticipated unified national power trading market by the end of 2025, will introduce new competitive dynamics that necessitate strategic adjustments.

Navigating China's intricate project approval processes, overseen by bodies like the NDRC and NEA, remains a critical challenge for power plant development, especially for large-scale renewable projects. Compliance with these evolving regulations and complex approval pathways is vital for maintaining a healthy project pipeline and avoiding delays.

Environmental factors

China's ambitious goal to reach peak carbon emissions before 2030 and achieve carbon neutrality by 2060 significantly shapes the energy sector. This commitment is further underscored by a robust 2024-2025 action plan focused on energy saving and carbon reduction, directly influencing companies like China Power International Development.

The implementation of a dual-control system for carbon emissions mandates that China Power International Development align its operational strategies with these national environmental objectives. This means actively contributing to the reduction of energy consumption and carbon intensity across its power generation portfolio.

China's commitment to renewable energy is substantial, with a goal to have non-fossil fuels represent 20% of its total energy consumption by 2025. This policy directly fuels massive capacity expansion across wind, solar, and hydropower sectors.

China Power International Development is strategically positioned to benefit from these mandates, actively growing its clean energy assets. By the end of 2023, the company had already achieved a significant clean energy proportion in its installed capacity, demonstrating its alignment with national objectives.

China Power International Development's operations are deeply tied to water availability. Hydropower generation, a key component of their portfolio, directly relies on sufficient water levels. Furthermore, their thermal power plants require substantial amounts of water for cooling systems, making efficient water resource management a critical environmental consideration for the company.

Climate change poses a significant challenge, with potential shifts in precipitation patterns impacting hydropower output. For instance, the Yangtze River basin, crucial for many of China's power plants, experienced a severe drought in 2022, affecting electricity generation. Additionally, increasingly stringent water usage regulations across China could constrain operational capacity and necessitate costly upgrades to water-saving technologies, impacting future planning and financial performance.

Land Use and Biodiversity Conservation

The expansion of renewable energy projects, such as the significant investments China Power International Development (CPID) makes in wind and solar farms, necessitates substantial land acquisition. This can lead to considerable impacts on local ecosystems and the biodiversity they support. For instance, the development of large solar farms can alter habitats, while wind turbine installations can pose risks to avian populations.

CPID is increasingly focused on environmental stewardship. The company is mandated to conduct thorough environmental impact assessments (EIAs) for all new projects. These assessments are crucial for identifying potential ecological risks and developing strategies to mitigate them, ensuring that development aligns with national conservation goals.

- Land Use Demands: CPID's renewable energy portfolio, particularly its wind and solar capacity, requires extensive land. As of the end of 2023, China's installed solar power capacity surpassed 600 GW, with wind power exceeding 400 GW, illustrating the scale of land commitment for these technologies.

- Biodiversity Impact Mitigation: CPID is implementing measures like habitat restoration and wildlife monitoring around its operational sites. This includes careful site selection to avoid sensitive ecological areas and the use of bird-friendly turbine designs where applicable.

- Regulatory Compliance: The company adheres to China's stringent environmental protection laws, which increasingly emphasize biodiversity conservation. This includes requirements for ecological compensation and the protection of endangered species during project development and operation.

Pollution Control and Waste Management

China Power International Development, despite its growing renewable portfolio, still operates significant thermal power assets that face increasingly strict environmental regulations. These regulations focus on controlling emissions of sulfur dioxide (SOx), nitrogen oxides (NOx), and particulate matter. For instance, in 2023, China continued to enforce its ultra-low emission standards for coal-fired power plants, requiring advanced pollution control technologies.

The management of waste products from thermal power generation, particularly coal ash, presents another key environmental challenge. Proper disposal and utilization of this ash are crucial to prevent soil and water contamination. China's National Development and Reform Commission (NDRC) has been promoting the comprehensive utilization of solid waste, including coal ash, encouraging its use in construction materials and other industrial applications.

- Stringent Emission Standards: Adherence to ultra-low emission standards for SOx, NOx, and particulate matter remains a key operational requirement for China Power International Development's thermal power plants.

- Coal Ash Management: Effective and environmentally sound management of coal ash, a significant by-product, is critical for preventing pollution and complying with waste disposal regulations.

- Circular Economy Initiatives: Government policies encouraging the utilization of industrial by-products, such as coal ash in construction, offer both compliance and potential economic opportunities.

- Environmental Compliance Costs: Investment in advanced pollution control equipment and waste management systems represents a significant operational cost that impacts profitability.

China's aggressive environmental targets, including carbon neutrality by 2060, mandate significant shifts in its energy landscape. This policy environment directly impacts China Power International Development (CPID) by driving investment in renewables and imposing stricter controls on thermal power operations.

The company's reliance on hydropower makes it vulnerable to climate change impacts like droughts, as seen in the 2022 Yangtze River basin drought which affected generation. Furthermore, evolving water usage regulations could necessitate costly technological upgrades for CPID's thermal plants.

CPID's expansion into wind and solar power, with China's installed solar capacity exceeding 600 GW and wind over 400 GW by late 2023, requires substantial land. This necessitates careful management of land use and biodiversity impacts, including habitat restoration and bird-friendly turbine designs.

CPID's thermal assets must comply with increasingly stringent emission standards, such as the ultra-low emission standards enforced in 2023 for coal-fired plants. Managing coal ash, a by-product, is also critical, with government initiatives promoting its use in construction to prevent pollution.

| Environmental Factor | Impact on CPID | Data/Trend (2023/2024-2025) |

|---|---|---|

| Carbon Neutrality Goals | Drives shift to renewables, pressure on thermal assets | Peak carbon before 2030, neutrality by 2060 |

| Water Availability & Climate Change | Affects hydropower output, potential constraints on thermal cooling | 2022 Yangtze drought impacted generation; stricter water regulations expected |

| Land Use for Renewables | Requires significant land acquisition, potential biodiversity impact | China's solar >600 GW, wind >400 GW installed capacity (end 2023) |

| Emissions & Waste Management | Mandates advanced pollution control for thermal plants, strict waste disposal | Ultra-low emission standards for coal plants enforced; coal ash utilization promoted |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Power International Development draws upon data from official Chinese government publications, reports from international financial institutions like the World Bank and IMF, and reputable industry analysis firms specializing in the energy sector. This comprehensive approach ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.