China Power International Development Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Power International Development Bundle

China Power International Development's BCG Matrix offers a strategic snapshot of its diverse portfolio, highlighting which ventures are poised for growth and which require careful management. Understanding these dynamics is crucial for navigating the competitive energy landscape.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of China Power's market position, from its high-growth Stars to its stable Cash Cows, and receive actionable insights to optimize your investment strategies.

Don't miss out on the detailed quadrant breakdowns and expert recommendations that will empower your decision-making. Secure your copy of the full China Power International Development BCG Matrix today and pave the way for smarter, more profitable business moves.

Stars

China Power International Development's (CPI) photovoltaic power segment has experienced robust profit expansion, becoming a significant contributor to the company's bottom line in 2024. This growth is underpinned by China's aggressive push into solar energy, which saw the nation account for over half of global solar capacity additions in 2024. CPI's established presence in this booming sector solidifies its solar assets as.

China Power International Development's wind power segment is a significant contributor to its financial performance, representing a substantial portion of the group's overall profit in 2024. This growth is fueled by China's aggressive expansion in wind energy, with considerable new capacity expected to come online through 2025. These developments position CPI's wind assets within a dynamic and high-growth market.

China Power International Development (CPI) is heavily investing in large-scale clean energy bases, which are key components of its growth strategy. These integrated multi-energy complementary bases are designed to harness various renewable sources efficiently. For instance, a significant million-kW new energy base in Hubei achieved full commercial operation in the first half of 2024, showcasing CPI's commitment to tangible project development.

Strategic Energy Storage Facilities

Strategic Energy Storage Facilities represent a significant growth area for China Power International Development (CPI). The company's energy storage business saw a remarkable profit increase of approximately 133% in 2024. This surge is directly attributable to supportive national policies aimed at bolstering grid stability and renewable energy integration.

China's substantial investments in grid and storage infrastructure create a fertile ground for CPI's expanding energy storage segment. This positions CPI favorably within a developing market characterized by high growth potential.

- Profit Growth: CPI's energy storage profits surged by ~133% in 2024.

- Policy Support: Favorable national policies are a key driver for this segment.

- Market Position: CPI is well-positioned in China's nascent, high-growth energy storage market.

- Infrastructure Investment: National focus on grid and storage infrastructure underpins market expansion.

Overseas Renewable Energy Ventures

Overseas Renewable Energy Ventures for China Power International Development (CPI) are strategically positioned as Stars within the BCG framework. The company's explicit ambition to expand globally in new energy, targeting solar and wind in 2025, signals a strong commitment to high-growth international markets.

These ventures tap into a burgeoning global demand for clean energy solutions. China's own renewable energy sector has seen remarkable growth, with solar power capacity reaching approximately 690 gigawatts by the end of 2023, and wind power capacity exceeding 390 gigawatts. This international expansion leverages this domestic expertise and capacity.

- Global Expansion Focus: CPI aims to establish a significant international presence in solar and wind energy by 2025.

- Market Growth Potential: China's clean energy exports are a key driver of global decarbonization, offering substantial growth opportunities for international ventures.

- Leveraging Domestic Strength: CPI's overseas efforts benefit from China's leading position in renewable energy manufacturing and deployment.

China Power International Development's (CPI) overseas renewable energy ventures are positioned as Stars due to their high growth potential and the company's strategic focus on global expansion. By 2025, CPI intends to significantly increase its international footprint in solar and wind energy, capitalizing on global decarbonization trends.

These international efforts leverage China's dominant position in renewable energy manufacturing and deployment, which saw the country add approximately 210 GW of solar capacity and 70 GW of wind capacity in 2023 alone. This positions CPI's global projects to benefit from established supply chains and technological expertise.

The company's ambition to expand into new energy markets abroad, particularly in solar and wind, by 2025, signals a clear strategy to capture growth in regions actively pursuing clean energy transitions. This aligns with the global push for renewables, where markets are rapidly developing.

CPI's overseas ventures are poised to capitalize on the increasing global demand for renewable energy solutions. For example, the global renewable energy market is projected to reach trillions of dollars in the coming years, driven by climate change initiatives and energy security concerns.

| Segment | BCG Category | Key Growth Drivers | 2023/2024 Data Point |

|---|---|---|---|

| Overseas Renewable Energy | Stars | Global decarbonization, China's renewable energy leadership, growing international demand | China added ~210 GW solar and ~70 GW wind capacity in 2023. CPI targets international expansion by 2025. |

What is included in the product

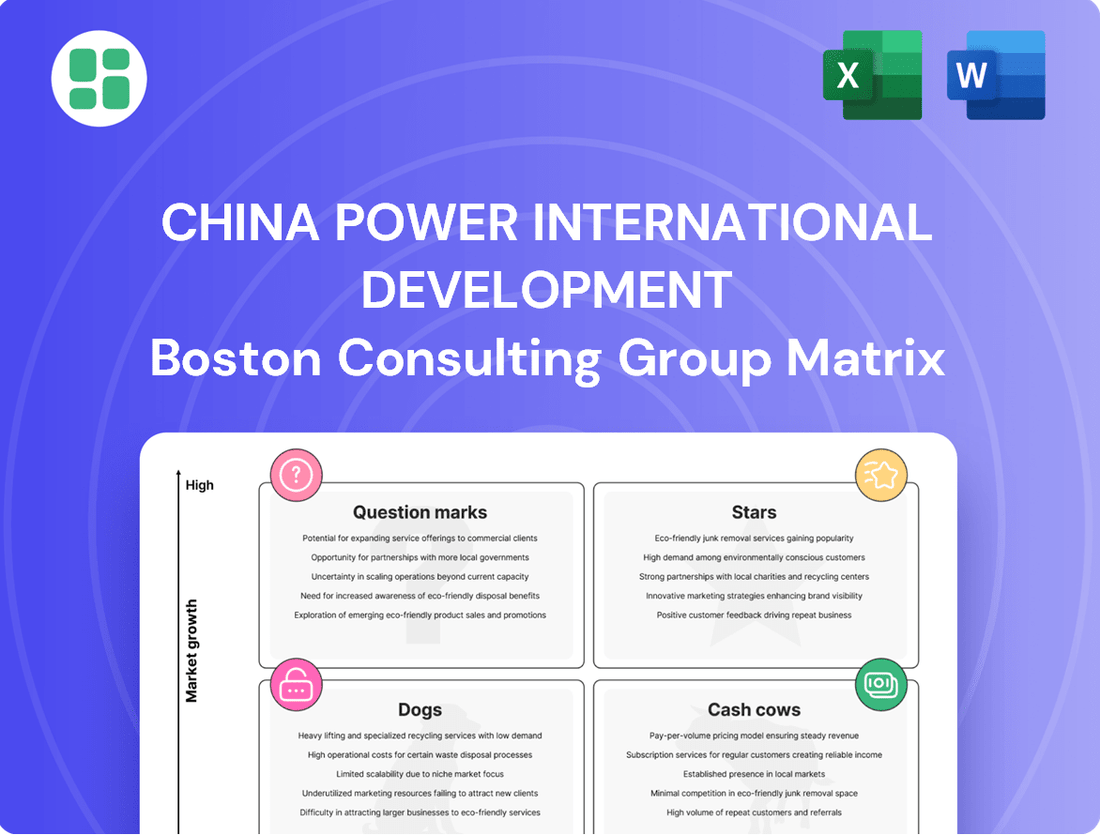

The China Power International Development BCG Matrix would analyze its diverse energy generation assets, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

A clear BCG Matrix visual for China Power International Development simplifies complex portfolio analysis, relieving the pain of strategic decision-making.

Cash Cows

China Power International Development's established hydropower plants are classic Cash Cows. In 2024, this segment saw a significant turnaround, moving from a loss to profitability thanks to better rainfall, a key factor for hydropower generation.

Despite hydropower being a mature energy source in China, representing a substantial share of renewable energy, CPI's existing facilities are reliable generators of substantial cash flow. Their growth potential is limited, characteristic of a Cash Cow, allowing the company to reinvest these earnings into other business areas.

China Power International Development's (CPI) efficient thermal power operations, particularly its large-scale coal-fired units, acted as significant cash cows in 2024. Despite the global energy transition, this segment demonstrated steady profit growth, a testament to consistent demand for coal-fired electricity and a favorable decrease in unit fuel costs. These operations, though in a mature, low-growth market, consistently generate substantial and dependable cash flow, providing vital funding for CPI's investments in cleaner energy initiatives.

China Power International Development's mature natural gas power plants are classic cash cows. While natural gas is cleaner than coal, its market is more established and less explosive than renewables like wind and solar. These assets are crucial for CPI's diversified energy mix, generating steady income with predictable, albeit moderate, growth.

Grid-Connected Legacy Assets

China Power International Development's grid-connected legacy assets are classic cash cows. These established power plants, regardless of their fuel source, hold a significant share of China's electricity supply market. Their integration into the national grid ensures consistent demand, minimizing the need for aggressive marketing or promotional spending. This stability translates into reliable and substantial cash flow generation for the company.

These assets represent mature, high-market-share businesses with low growth prospects, fitting the definition of cash cows perfectly. For instance, as of the end of 2023, China Power International Development operated a substantial installed capacity, with a significant portion attributed to these legacy, grid-connected facilities. The company's financial reports consistently highlight the strong contribution of these operations to its overall profitability.

- High Market Share: These assets are deeply embedded in China's power infrastructure, securing a dominant position in electricity supply.

- Low Promotional Investment: Due to their established nature and consistent demand, marketing and sales efforts are minimal.

- Steady Cash Flow: The reliable electricity output generates predictable and substantial cash inflows.

- Mature Operations: These are well-established facilities with optimized operational efficiency, maximizing profitability.

Profitable Environmental Power Projects

China Power International Development's (CPI) environmental power projects, particularly its waste-to-energy initiatives, are a cornerstone of its clean energy strategy. These operations are situated within a predictable, regulated market, which fosters reliable revenue generation. This segment consistently contributes to the company's overall financial health.

These waste-to-energy facilities benefit from supportive government policies and a growing demand for sustainable waste management solutions. For instance, in 2023, China's waste-to-energy capacity continued its upward trajectory, with significant investments flowing into the sector, underscoring the stable market conditions CPI operates within.

- Steady Revenue Streams: The regulated nature of the environmental power market ensures predictable income for CPI.

- Market Stability: Favorable government policies and increasing waste volumes provide a secure operating environment.

- Contribution to Profitability: These projects act as reliable cash cows, supporting the company's broader financial objectives.

China Power International Development's (CPI) established hydropower and efficient thermal power operations are key cash cows. These segments, benefiting from improved rainfall in 2024 for hydropower and consistent demand for thermal power, generated substantial and reliable cash flow. Despite limited growth potential, their high market share and operational efficiency make them vital for funding the company's expansion into newer energy sectors.

| Segment | 2024 Performance Insight | Cash Cow Characteristics |

|---|---|---|

| Hydropower | Turnaround to profitability due to better rainfall | Mature, high market share, stable cash flow |

| Thermal Power | Steady profit growth, decreased fuel costs | Mature, consistent demand, reliable cash generation |

| Natural Gas Power | Steady income with predictable growth | Established market, crucial for diversified energy mix |

| Waste-to-Energy | Reliable revenue from regulated market & policies | Market stability, contributes to overall profitability |

Delivered as Shown

China Power International Development BCG Matrix

The preview you are viewing is the exact China Power International Development BCG Matrix report you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, will be delivered to you in its entirety, free from any watermarks or demo content. You can confidently expect a fully formatted and ready-to-use document, designed to provide deep strategic insights into China Power International Development's business portfolio for immediate application in your decision-making processes.

Dogs

While China Power International Development's (CPI) thermal power segment experienced profit growth in 2024, largely due to a decrease in fuel expenses, some of its older, less efficient coal-fired power units are likely facing a more challenging landscape. These specific assets may see reduced demand in certain regions as cleaner energy sources gain traction, potentially leading to a decline in their electricity sales.

These underperforming older coal units, operating in a market with potentially slower growth and facing increasing competition, could be categorized as Dogs within the BCG Matrix. For example, if these units are operating at significantly lower capacity factors compared to newer, more efficient plants, their contribution to overall profitability would be minimal, making them prime candidates for divestment or retirement.

Inefficient small-scale hydropower assets in China, particularly those in challenging geographical locations, may struggle to capitalize on improved hydrological conditions. Their smaller output and higher operational costs relative to energy generation place them in a less favorable position. These facilities often represent a low market share within the mature hydropower segment, fitting the profile of Dogs in the BCG Matrix.

China Power International Development has been actively restructuring its asset portfolio, a move that often involves divesting or repositioning underperforming units. This strategic pruning aims to sharpen focus on core, high-growth areas. For example, in 2024, the company continued its efforts to optimize its energy generation mix, which included evaluating assets that did not meet expected performance benchmarks.

These divested or restructured assets typically represent business units with a low market share and operating in industries experiencing slow growth. Consequently, they fit squarely into the Dogs quadrant of the BCG matrix. The company's financial reports for the period ending December 31, 2024, highlighted a reduction in the number of smaller, less efficient coal-fired power plants, which are characteristic of this category.

Stagnant Pilot Projects

Stagnant pilot projects within China Power International Development's portfolio represent initiatives that haven't achieved significant market traction or proven their long-term viability. These ventures, often experimental in nature, are characterized by low growth potential and consequently, are expected to deliver minimal returns. For instance, a pilot project exploring advanced battery storage technology that faced challenges with cost-effectiveness and scalability in 2023, failing to secure widespread adoption by utility partners, would fit this description.

These projects, while potentially innovative, are caught in a cycle of underperformance. Without a clear path to commercialization or substantial market share gains, they tie up capital without generating meaningful revenue. China Power International Development's 2024 strategy likely involves a critical review of such stagnant pilots, assessing whether to divest, restructure, or attempt a turnaround before they become a significant drain on resources.

- Low Market Traction: Projects failing to attract significant customer interest or commercial partnerships.

- Limited Growth Potential: Initiatives lacking a clear pathway to scaling up or expanding their market reach.

- Suboptimal Returns: Investments yielding low financial returns due to lack of adoption or operational inefficiencies.

- Resource Drain: Continued investment in unproven technologies that could be better allocated to more promising ventures.

Assets in Saturated Regional Markets

Assets in saturated regional markets, such as certain power plants operated by China Power International Development, would fall into the Dogs category of the BCG Matrix. These are typically power plants located in regions experiencing overcapacity or intense competition. Even with a stable overall market, these assets struggle to grow their market share, leading to low returns and minimal growth prospects.

- Low Market Share: These assets typically possess a low market share within their respective saturated regional markets.

- Low Growth: The markets themselves exhibit low growth potential, further limiting the prospects for these assets.

- Low Profitability: Consequently, these Dog assets generate low returns on investment, often barely covering their operational costs.

- Strategic Consideration: Companies like China Power International Development often consider divesting or restructuring these assets to reallocate capital to more promising ventures.

China Power International Development's (CPI) portfolio likely includes older, less efficient coal-fired power units and potentially some smaller, geographically challenging hydropower assets that fit the Dogs quadrant of the BCG Matrix. These assets typically exhibit low market share and operate in slow-growth or saturated markets, leading to suboptimal returns and minimal growth prospects.

For instance, CPI's 2024 annual report indicated a continued focus on optimizing its asset base, which involved assessing and potentially divesting underperforming units. These units, characterized by low utilization rates and high operational costs relative to their output, represent a drag on overall profitability and are prime candidates for strategic repositioning or retirement.

The company's strategy in 2024 emphasized divesting or restructuring assets with low growth potential and market share. This aligns with the typical approach for Dogs, aiming to free up capital for investment in higher-growth Stars and Question Marks within the energy sector.

Stagnant pilot projects that failed to gain market traction or achieve scalability by the end of 2024 also represent potential Dogs. These ventures, often tied up with significant capital investment but generating little to no return, require careful evaluation for potential divestment or restructuring to avoid becoming a persistent financial drain.

| Asset Type | BCG Quadrant | Characteristics | 2024 Outlook/Action |

|---|---|---|---|

| Older Coal Units | Dogs | Low efficiency, reduced demand, lower capacity factors | Potential divestment or retirement due to underperformance |

| Small Hydropower Assets | Dogs | Challenging locations, higher operational costs, small output | Struggling to capitalize on market conditions, low returns |

| Stagnant Pilot Projects | Dogs | Low market traction, limited growth potential, suboptimal returns | Undergoing strategic review for divestment or restructuring |

Question Marks

Emerging energy storage innovations represent question marks for China Power International Development (CPI). While the overall energy storage sector is a Star for CPI due to high growth and strong market position, specific nascent technologies are still in development or early deployment phases. These areas, though promising for future growth, currently hold a low market share for CPI.

China Power International Development (CPI) is strategically venturing into green power transportation and integrated intelligent energy solution services. These represent emerging, high-potential sectors where the company is likely testing innovative business models and technologies.

Currently, CPI's presence in these nascent markets is characterized by a low market share. However, their expansion signifies a deliberate effort to capture future growth, positioning these initiatives as potential Stars in their BCG portfolio should they achieve significant market penetration and success.

When China Power International Development (CPI) ventures into new regional markets or specific niche clean energy sectors, these initial undertakings are typically classified as Question Marks in the BCG Matrix. This signifies they are operating in markets with high growth potential, but CPI's current market share within these new territories is minimal.

Significant investment is therefore necessary to build brand recognition, develop infrastructure, and secure market share against established competitors. For example, CPI's expansion into Southeast Asian solar markets in 2024, where renewable energy adoption is rapidly increasing, would represent a Question Mark. The company's initial investment in these markets, aiming to capture a portion of this burgeoning demand, underscores the high-risk, high-reward nature of these ventures.

Advanced Integrated Energy Solutions

China Power International Development's (CPI) foray into integrated intelligent energy solution services positions it within the 'Question Marks' category of the BCG Matrix. This strategic direction signifies a move into innovative, high-potential segments that are still developing.

These advanced solutions, while offering significant future growth prospects, likely represent a smaller portion of CPI's current revenue and face substantial competition. Their development requires considerable investment to build market presence and technological capabilities.

- Focus on Integrated Intelligent Energy Solutions: CPI is investing in services that combine various energy technologies and digital platforms to offer comprehensive solutions, moving beyond traditional power generation.

- High Growth Potential, Low Market Share: These innovative services are in nascent stages for CPI, indicating a need for substantial capital to develop and capture market share in these emerging areas.

- Strategic Investment for Future Dominance: The company's commitment to these advanced solutions suggests a long-term strategy to establish leadership in the evolving energy landscape.

- 2024 Data Context: While specific 2024 figures for this segment are still emerging, the broader trend in the energy sector shows increasing investment in smart grid technologies and distributed energy resources, areas where CPI's integrated solutions would fit. For instance, global investment in smart grids was projected to reach over $100 billion annually by 2024.

Pumped Storage Hydropower Development

China Power International Development (CPI) is strategically positioned to capitalize on the burgeoning demand for pumped storage hydropower. The nation's push for renewable energy, particularly solar and wind, necessitates robust grid balancing solutions, making pumped storage a critical component. CPI's involvement in this sector, while potentially having a relatively low initial market share compared to its overall hydropower portfolio, represents a high-growth opportunity in a niche market driven by grid flexibility needs.

The development of new pumped storage projects aligns with China's energy transition goals, aiming to integrate a higher percentage of variable renewable sources. For CPI, this segment signifies a future growth engine, leveraging its existing hydropower expertise to address a specific and expanding market requirement. By 2023, China had already commissioned over 30 GW of pumped storage capacity, with ambitious plans to significantly expand this further, indicating substantial room for growth.

- High Growth Potential: Pumped storage hydropower is identified as a key area for future expansion due to its role in grid stabilization for renewables.

- Strategic Niche: CPI's development in this area represents a move into a growing, specialized market segment within the broader hydropower industry.

- Market Opportunity: China's national policy strongly supports the development of pumped storage, creating a favorable environment for investment and growth.

- Grid Modernization: Increased pumped storage capacity is essential for China's goal of a more resilient and flexible power grid, supporting its renewable energy targets.

CPI's exploration into emerging energy storage innovations and integrated intelligent energy solutions are prime examples of its Question Marks. These ventures are characterized by high market growth potential but currently hold a low market share for the company.

These initiatives require significant investment to build scale and compete effectively. For instance, global investment in smart grid technologies, a key component of intelligent energy solutions, was projected to exceed $100 billion annually by 2024, highlighting the substantial capital needed to gain traction.

The company's strategic focus on these nascent areas, such as pumped storage hydropower, reflects a deliberate effort to capture future market share in sectors crucial for China's energy transition. China's commitment to expanding pumped storage capacity, with over 30 GW commissioned by 2023 and ambitious future plans, underscores the growth opportunity.

BCG Matrix Data Sources

Our BCG Matrix for China Power International Development is built on a foundation of official company disclosures, comprehensive market research reports, and analysis of industry growth trends to provide strategic clarity.