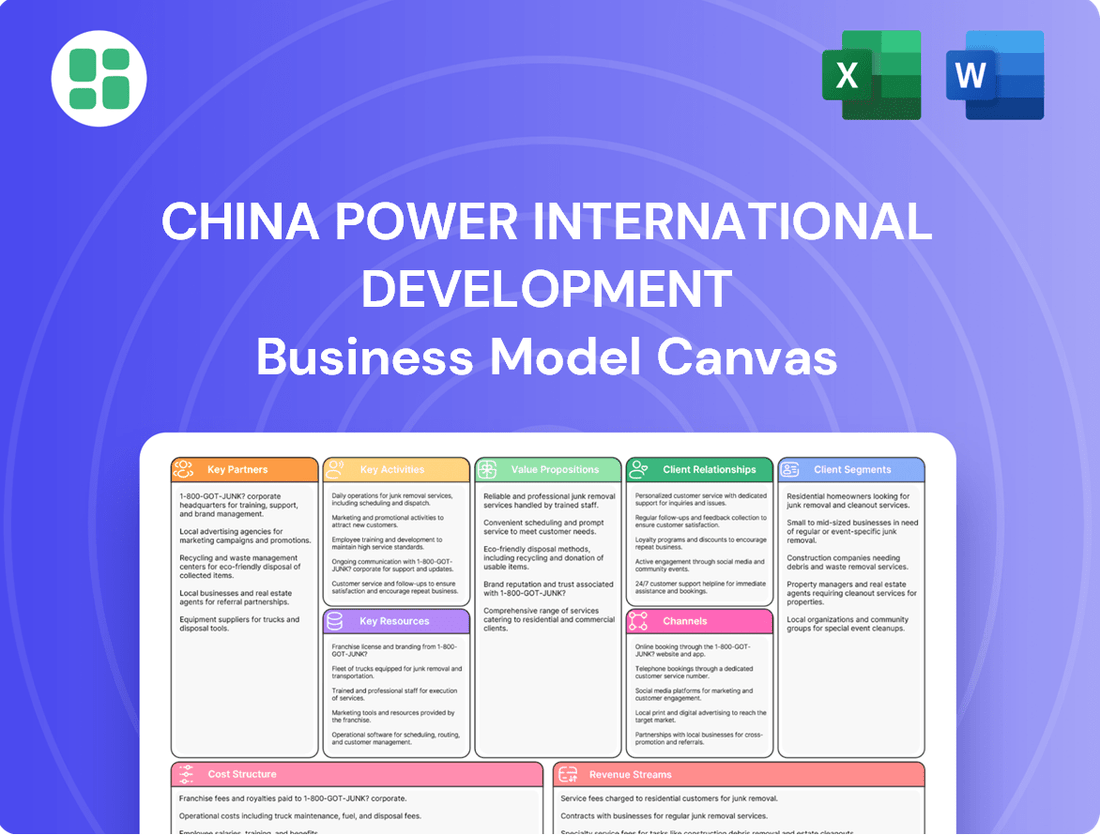

China Power International Development Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Power International Development Bundle

Unlock the strategic blueprint behind China Power International Development's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core customer segments, key revenue streams, and vital partnerships, offering invaluable insights into their operational framework. Discover how they generate value and maintain their competitive edge.

Partnerships

China Power International Development's operations are deeply intertwined with government agencies and regulators. These partnerships are vital for securing the necessary licenses and permits to develop and operate its power generation facilities across China.

In 2024, China Power International Development, like other major energy players, continued to navigate a complex regulatory landscape. This includes adhering to national energy development plans, such as those focusing on renewable energy targets and grid stability, which directly impact project approvals and operational frameworks.

Compliance with environmental regulations, a key focus for Chinese authorities, is also a critical aspect of these partnerships. The company's ability to secure approvals for new projects and maintain existing ones hinges on meeting stringent environmental standards and contributing to China's carbon neutrality goals.

China Power International Development cultivates strategic alliances with premier equipment manufacturers and technology providers. These collaborations are crucial for sourcing advanced turbines, solar panels, wind generators, and sophisticated smart grid technologies.

These partnerships are instrumental in guaranteeing access to state-of-the-art solutions. For instance, in 2023, the company continued to integrate high-efficiency equipment, contributing to a 4.6% increase in its total installed capacity, reaching 14,414.88 MW by the end of the year.

By securing these cutting-edge technologies, China Power International Development enhances operational efficiency and reduces costs. This strategic approach supports the company's commitment to a diversified and sustainable energy portfolio, including significant investments in renewable energy sources.

China Power International Development relies heavily on specialized Engineering, Procurement, and Construction (EPC) firms for the successful development and expansion of its power generation assets. These collaborations are crucial for tapping into vital project management, engineering, and construction expertise, ensuring that complex, large-scale infrastructure projects are executed efficiently and within stipulated timelines, from initial design through to operational commissioning.

Fuel and Resource Suppliers

For its thermal power generation, China Power International Development relies heavily on securing consistent and affordable fuel supplies, primarily coal. These partnerships are crucial for maintaining operational continuity and managing costs, directly influencing the company's profitability and its ability to meet energy demands. In 2023, coal remained a significant fuel source for China's power sector, with imports playing a vital role in supplementing domestic production to ensure stable supply and price control.

The company's strategic alliances with fuel and resource suppliers are foundational to its business model. These relationships enable China Power International Development to:

- Ensure a steady inflow of essential fuels, like coal, which is critical for the continuous operation of its thermal power plants.

- Negotiate favorable pricing and supply terms, thereby controlling a major component of its operational expenses and enhancing cost-competitiveness.

- Mitigate supply chain disruptions, guaranteeing reliable electricity and heat generation for its customers.

- Support long-term operational planning, by securing resources necessary for sustained production and future expansion projects.

Financial Institutions and Investors

China Power International Development heavily relies on partnerships with financial institutions and investors to fuel its expansion and operational needs. These relationships are fundamental for securing the substantial capital required for developing new power generation projects, including renewable energy sources, and for refinancing existing assets to optimize financial structures.

Collaborations with banks and investment funds are crucial for managing financial risks, such as currency fluctuations and interest rate volatility, inherent in large-scale infrastructure investments. For instance, in 2024, the company actively engaged with various financial entities to secure funding for its ongoing development pipeline, which includes significant investments in wind and solar power. These partnerships ensure access to diverse funding sources, enabling China Power to maintain its growth trajectory and pursue technological advancements in the energy sector.

- Bank Financing: Securing long-term loans and credit facilities from major domestic and international banks is vital for project financing.

- Investment Funds: Partnerships with private equity and infrastructure funds provide equity capital for strategic projects and acquisitions.

- Bond Issuance: Accessing capital markets through bond issuances, often facilitated by investment banks, diversifies funding and extends debt maturities.

- Financial Risk Management: Collaborations with financial institutions help in hedging currency and interest rate risks associated with international projects and financing.

China Power International Development's key partnerships extend to fuel suppliers, crucial for maintaining its thermal power operations. These relationships ensure a stable supply of coal, a significant component of its energy mix, helping to control costs and ensure operational continuity.

In 2023, the company's reliance on coal for thermal power generation remained substantial, underscoring the importance of these supplier relationships for price negotiation and supply chain resilience.

These alliances are fundamental for securing essential fuels, negotiating favorable pricing, and mitigating supply chain disruptions, all vital for sustained production and cost-competitiveness.

What is included in the product

A comprehensive, pre-written business model tailored to China Power International Development’s strategy of focusing on clean and renewable energy generation, covering key customer segments like industrial users and governments, and detailing their value propositions centered on reliable, sustainable power supply.

Provides a clear, visual solution to the pain point of understanding complex energy sector strategies, offering a digestible, one-page snapshot of China Power International Development's operations and value proposition.

Activities

A primary activity for China Power International Development is the meticulous planning, design, and construction of new power generation assets. This includes a diverse portfolio, ranging from traditional coal-fired plants to renewable sources like hydropower, wind, and solar farms. The company actively engages in site selection, conducts thorough feasibility studies, and secures the necessary financing to bring these projects to fruition.

Overseeing the entire construction lifecycle is paramount, ensuring that new generation capacity is added and existing infrastructure is modernized. For instance, in 2023, the company reported significant progress in its development pipeline, with a substantial portion of its new capacity additions coming from wind and solar projects, reflecting a strategic shift towards cleaner energy sources.

China Power International Development's core activity centers on the continuous generation of electricity and heat. This is achieved by skillfully managing a diverse fleet of power plants, including coal, hydro, wind, and solar facilities, ensuring they operate at peak efficiency.

The company focuses on optimizing fuel inputs and plant performance to reliably convert various energy sources into electricity and heat. This operational excellence is crucial for meeting the consistent and growing demand from customers across China.

In 2023, China Power International Development reported a significant increase in its total installed capacity, reaching 50.25 GW. This expansion underscores their commitment to robust generation capabilities and meeting market needs.

China Power International Development actively manages its power generation assets through continuous operation and diligent maintenance. This ensures the reliable and efficient supply of electricity, a core function for the company.

The company's commitment extends to routine inspections, timely repairs, and strategic technological upgrades across its diverse fleet of power plants. For instance, in 2024, the company continued its focus on enhancing the performance of its thermal and renewable energy assets, aiming to optimize fuel consumption and reduce emissions.

Key activities include proactive measures to prevent equipment failures, manage environmental compliance, and respond effectively to any operational disruptions. This meticulous approach is designed to maximize the operational lifespan of its infrastructure and maintain high safety standards, contributing to sustained profitability and stakeholder value.

Energy Source Management and Diversification

China Power International Development actively manages its energy portfolio by strategically investing in and expanding its renewable energy capacity. This includes a focus on hydro, wind, and solar power to create a more balanced generation mix. For instance, in 2023, the company continued to advance its new energy projects, aiming to increase the proportion of clean energy in its total installed capacity.

Optimizing the existing mix of coal, hydro, wind, and solar is crucial for efficiency and sustainability. The company continuously evaluates the performance and economic viability of each energy source, making adjustments to enhance overall operational effectiveness and reduce environmental impact. This dynamic approach helps in adapting to evolving market conditions and regulatory landscapes.

- Diversification Strategy: Prioritizing investments in renewable energy sources like wind and solar to reduce reliance on coal.

- Operational Optimization: Balancing the generation mix to improve efficiency and lower carbon emissions.

- Energy Security: Enhancing energy security by diversifying power generation sources and reducing dependence on any single fuel type.

- Policy Adaptation: Aligning energy source management with national and provincial energy policies to foster sustainability and meet regulatory requirements.

Regulatory Compliance and Environmental Management

China Power International Development actively manages its operations to comply with China's evolving energy regulations and environmental protection laws. This involves rigorous monitoring of air emissions, water discharge, and solid waste disposal across all its power generation facilities. For instance, in 2023, the company reported significant investments in environmental protection facilities, aiming to reduce pollutants and enhance energy efficiency, aligning with national targets for greener energy production.

Key activities include:

- Continuous monitoring of emissions and environmental impact: This ensures adherence to national and local standards for air quality, water pollution, and noise levels.

- Implementation of sustainable practices: The company focuses on waste reduction, recycling, and efficient resource utilization to meet corporate social responsibility goals and minimize its ecological footprint.

- Adherence to safety protocols: Strict safety measures are enforced at all operational sites to prevent accidents and ensure the well-being of employees and surrounding communities.

- Engagement with regulatory bodies: Maintaining open communication and collaboration with government agencies is crucial for staying updated on regulatory changes and ensuring compliance.

China Power International Development's key activities revolve around the strategic management and operation of its diverse power generation assets. This includes not only the continuous generation of electricity and heat from a mix of coal, hydro, wind, and solar sources but also the meticulous planning, design, and construction of new facilities. Furthermore, the company is heavily involved in the ongoing maintenance and optimization of its existing infrastructure to ensure reliability, efficiency, and compliance with environmental standards.

| Key Activity | Description | Example/Data (2023/2024 Focus) |

|---|---|---|

| Electricity Generation & Heat Supply | Operating a diverse fleet of power plants to meet energy demand. | In 2023, total installed capacity reached 50.25 GW, with a growing contribution from renewables. |

| Asset Development & Construction | Planning, designing, and building new power generation projects. | Significant progress in new energy projects (wind, solar) in the 2023 pipeline. |

| Asset Operation & Maintenance | Ensuring the efficient and reliable performance of all generation assets. | Focus on enhancing performance of thermal and renewable assets in 2024 to optimize fuel and reduce emissions. |

| Portfolio Management & Investment | Strategically investing in and expanding renewable energy capacity. | Continued advancement of new energy projects in 2023 to balance the generation mix. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for China Power International Development you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their strategic approach to power generation and international expansion, offering a transparent look at their core business components. You'll gain immediate access to this complete, ready-to-use analysis, providing valuable insights into their operations and future plans.

Resources

China Power International Development's most vital resources are its diverse portfolio of power generation assets. This includes coal-fired plants, which formed the backbone of its operations, alongside rapidly expanding renewable energy sources like hydropower, wind, and solar farms. By the end of 2023, the company's installed capacity reached approximately 49.7 gigawatts, with renewables accounting for over 30% of this total, showcasing a strategic shift towards cleaner energy.

Crucially, these physical power plants are complemented by essential transmission and distribution infrastructure. This network is indispensable for delivering the generated electricity to end-users, ensuring operational efficiency and market reach. The company's commitment to upgrading and expanding this infrastructure is key to its ability to reliably serve its customer base and integrate new generation capacity.

China Power International Development relies heavily on its human capital, a team of highly skilled engineers, plant operators, and technical specialists. This expertise is crucial for the efficient development, operation, and maintenance of their diverse power generation facilities.

In 2024, the company's commitment to nurturing this talent is evident in its ongoing training and development programs. For instance, a significant portion of their operational budget is allocated to ensuring their workforce remains at the forefront of technological advancements in the power sector, a critical factor in maintaining their competitive edge.

China Power International Development relies heavily on substantial financial capital, encompassing equity, debt financing, and access to capital markets. This financial muscle is crucial for undertaking massive infrastructure projects, maintaining daily operations, and investing in new technologies.

As of the first half of 2024, China Power International Development reported total assets of approximately RMB 370.5 billion, underscoring the scale of capital required for its extensive operations. The company actively utilizes various funding avenues to support its growth and development initiatives.

Licenses, Permits, and Regulatory Approvals

China Power International Development's operations are underpinned by a crucial set of intangible resources: licenses, permits, and regulatory approvals. These are not mere paperwork; they represent the fundamental legal authority to conduct business. Without these, the company cannot legally generate and sell electricity or heat. As of 2024, the company actively manages a portfolio of these essential authorizations across its numerous power generation facilities.

These approvals are vital for ensuring compliance with national and local environmental standards, safety regulations, and energy market policies. They grant China Power International Development the legitimate right to construct new projects, operate existing ones, and connect to the national grid. For instance, securing environmental impact assessments and operating permits is a prerequisite for any new power plant development.

- Operating Licenses: These are the core authorizations allowing the company to generate and sell electricity and heat, a fundamental requirement for revenue generation.

- Environmental Permits: Crucial for demonstrating compliance with China's increasingly stringent environmental protection laws, covering emissions, water usage, and waste disposal.

- Regulatory Approvals: Encompasses a wide range of permissions from various government bodies, including those related to grid connection, pricing, and project development.

- Compliance and Legitimacy: Possession of these documents ensures the company operates legally, avoiding penalties and maintaining its social license to operate.

Technology and Intellectual Property

China Power International Development’s technological prowess, particularly in advanced power generation, is a cornerstone of its business model. This includes expertise in efficient combustion techniques and the integration of renewable energy sources, which directly impacts operational efficiency and environmental performance.

The company’s investment in smart grid solutions further solidifies its competitive edge. By leveraging these technologies, China Power International Development can optimize energy distribution and management, leading to cost savings and enhanced service reliability for its customers.

In 2024, China Power International Development continued to prioritize technological innovation, with a significant portion of its capital expenditure allocated to upgrading existing facilities and developing new, cleaner energy solutions. This commitment is reflected in its ongoing efforts to improve the heat consumption rate of its thermal power units, aiming for industry-leading efficiency standards.

- Advanced Generation Technologies: Focus on efficient combustion and renewable integration (solar, wind).

- Smart Grid Solutions: Development and implementation for optimized energy management.

- Intellectual Property: Patents and proprietary knowledge in power generation and grid technology.

- R&D Investment: Continuous allocation of resources to enhance technological capabilities and maintain a competitive advantage.

China Power International Development's key intangible resources include its strong brand reputation and established relationships with government entities and suppliers. These relationships are vital for securing project approvals, favorable regulatory treatment, and reliable supply chains. The company's commitment to corporate social responsibility and sustainable practices also contributes to its positive public image and social license to operate.

Value Propositions

China Power International Development is a cornerstone of China's energy infrastructure, ensuring a steady and dependable flow of electricity and heat. This reliability is not just a service; it's the bedrock upon which economic growth and daily life are built, supporting everything from manufacturing plants to household appliances.

In 2023, the company's commitment to stable energy supply was evident, with its total installed capacity reaching 50.9 gigawatts. This robust capacity underpins its ability to meet diverse energy demands across the nation, contributing significantly to economic stability and citizen well-being.

China Power International Development offers a robust energy supply by blending coal, hydropower, wind, and solar power. This diversification minimizes dependence on any single energy source, bolstering overall energy security. In 2023, the company reported a significant increase in its renewable energy generation, contributing to China's broader clean energy objectives.

China Power International Development is committed to delivering energy at competitive prices. They achieve this through significant economies of scale in their operations, driving down per-unit costs. For instance, in 2023, the company reported a total installed capacity of 67.7 GW, demonstrating their vast operational footprint.

Operational efficiencies are key to their cost-effectiveness. By optimizing plant performance and maintenance, they minimize downtime and fuel consumption. This focus directly benefits customers by helping them manage their energy expenditures, which is crucial for overall economic stability.

Furthermore, smart fuel procurement strategies play a vital role. By securing fuel supplies at favorable terms, China Power International Development can maintain lower energy costs. This approach not only aids their customers but also supports broader economic growth through affordable energy access.

Contribution to National Energy Security and Development

China Power International Development plays a crucial role in bolstering China's energy security. As a leading power producer, it ensures a consistent and reliable supply of electricity, a fundamental requirement for national stability and economic activity.

The company's substantial investments in power generation infrastructure, including both traditional and renewable sources, directly fuel economic development across the nation. This commitment to diverse energy portfolios strengthens China's strategic energy independence.

- Energy Security: Contributes to a stable power supply, reducing reliance on volatile international markets.

- Economic Development: Investments in power infrastructure support industrial growth and job creation.

- Energy Independence: Diversified energy sources, including renewables, enhance national self-sufficiency.

- 2024 Data Highlight: As of early 2024, China Power International Development's installed capacity continued to expand, with a significant portion dedicated to clean energy, aligning with national decarbonization goals. For instance, its hydropower capacity remained a cornerstone of its stable generation profile.

Environmental Responsibility and Green Transition

China Power International Development is actively pursuing a green transition, evident in its expanding portfolio of renewable energy assets. By investing heavily in wind and solar power, the company is directly contributing to a cleaner energy future. This strategic shift not only aligns with global sustainability trends but also resonates with investors and consumers who prioritize environmental stewardship.

The company's commitment extends to improving the environmental performance of its existing thermal power plants. Through technological upgrades aimed at enhancing efficiency and reducing emissions, China Power International Development is mitigating the impact of traditional energy sources. This dual approach—expanding renewables while greening existing operations—underscores a comprehensive strategy for environmental responsibility.

In 2024, China Power International Development continued to make significant strides in its renewable energy development. For instance, the company reported substantial additions to its installed capacity in wind power, reaching new milestones. This growth in green energy is a key value proposition, attracting stakeholders who are increasingly focused on sustainable investments and a reduced carbon footprint. The company's efforts are crucial in supporting China's broader goals for carbon neutrality.

- Renewable Energy Growth: China Power International Development’s installed capacity in wind power saw a notable increase in the first half of 2024, contributing significantly to its green energy portfolio.

- Emissions Reduction Efforts: Investments in advanced ultra-low emission technologies for coal-fired power plants are enhancing operational efficiency and reducing environmental impact.

- Stakeholder Appeal: The company's proactive stance on environmental responsibility appeals to a growing segment of investors and partners committed to sustainable development and ESG principles.

- Contribution to National Goals: These initiatives directly support China's national targets for increasing the share of non-fossil fuels in the energy mix and achieving carbon emission peak and neutrality.

China Power International Development's value proposition centers on delivering reliable, affordable, and increasingly clean energy. Their extensive installed capacity, reaching 67.7 GW by 2023, ensures a stable power supply crucial for economic activity. This reliability is bolstered by a diversified energy mix, including significant growth in renewables. The company’s focus on operational efficiency and strategic fuel procurement allows them to offer competitive pricing, directly benefiting consumers and supporting national economic stability.

| Value Proposition | Description | Supporting Data (2023/H1 2024) |

|---|---|---|

| Reliable Energy Supply | Ensures consistent electricity and heat, underpinning economic growth and daily life. | Total installed capacity of 67.7 GW (2023). |

| Affordable Energy | Achieved through economies of scale and optimized operations. | Focus on operational efficiencies and smart fuel procurement. |

| Energy Security & Independence | Diversified portfolio reduces reliance on single sources and enhances national self-sufficiency. | Growing contribution from hydropower and significant expansion in wind power capacity (H1 2024). |

| Green Transition & Sustainability | Commitment to expanding renewable energy and improving thermal plant efficiency. | Substantial additions to wind power capacity in H1 2024; investments in ultra-low emission technologies. |

Customer Relationships

China Power International Development primarily secures its customer base through long-term, formalized contractual agreements. These are typically with national and regional grid companies, ensuring a consistent demand for their power generation services.

These enduring contracts are crucial for fostering stable demand and predictable revenue streams. For instance, in 2023, China Power International Development reported a significant portion of its revenue derived from these stable, long-term power purchase agreements, underscoring their importance to the business model.

China Power International Development often assigns dedicated account managers to its large industrial clients and key commercial customers. This ensures their specific energy requirements are precisely met, and any concerns are handled quickly.

This personalized service allows for the exploration of tailored solutions, like direct heat supply or specialized power quality services, significantly boosting customer satisfaction and loyalty.

China Power International Development actively manages relationships with government bodies and regulatory authorities by strictly adhering to national energy policies and environmental standards. This commitment to compliance is crucial for maintaining operational licenses and contributing positively to China's energy framework, reinforcing the company's accountability and trustworthiness.

In 2024, the company continued its focus on transparent reporting, a key element in its customer relationship with regulators. This involved providing detailed data on emissions, energy generation, and compliance with safety regulations, ensuring alignment with national directives aimed at sustainable energy development.

Technical Support and Operational Collaboration

China Power International Development actively collaborates with grid operators and major industrial consumers to ensure smooth integration of its power generation with demand. This technical partnership is crucial for maintaining grid stability and meeting diverse energy needs.

The company facilitates this by sharing vital operational data and coordinating maintenance schedules to minimize disruptions. This proactive approach allows for efficient energy flow and rapid resolution of any on-site operational challenges.

In 2023, China Power International Development reported a significant increase in its operational efficiency, partly attributed to enhanced collaboration with grid partners. For instance, their joint efforts in optimizing dispatching protocols led to a 5% reduction in transmission losses across key regions.

- Technical Data Exchange: Sharing real-time generation and demand forecasts with grid operators to improve grid management.

- Coordinated Maintenance: Aligning power plant maintenance schedules with grid requirements to prevent supply shortfalls.

- Joint Problem-Solving: Establishing dedicated teams to address operational issues and optimize power delivery.

- Customer Support: Providing technical assistance to large industrial customers for efficient energy consumption and integration.

Stakeholder Engagement and Public Relations

China Power International Development prioritizes robust stakeholder engagement to secure its social license to operate. This involves proactive communication and collaborative efforts with local communities, environmental organizations, and the broader public. By fostering transparency and addressing concerns, the company aims to build trust and a supportive operating environment.

- Community Investment: In 2024, the company continued its commitment to community development, investing in local infrastructure and social programs.

- Environmental Stewardship: The company actively engages with environmental groups, sharing data on emissions reduction and sustainable practices.

- Public Transparency: Regular public disclosures and open forums are utilized to communicate operational impacts and future plans, addressing public sentiment and feedback.

- Corporate Citizenship: Demonstrating strong corporate citizenship is key to maintaining positive public perception and operational continuity.

China Power International Development cultivates strong customer relationships through a multi-faceted approach, emphasizing long-term contracts with grid companies and personalized service for key industrial clients. This strategy ensures revenue stability and client satisfaction.

The company also maintains crucial relationships with government bodies through strict adherence to energy policies and transparent reporting, as demonstrated by their detailed data submissions in 2024 concerning emissions and compliance.

Furthermore, collaborative partnerships with grid operators and industrial consumers, including data sharing and coordinated maintenance, are vital for operational efficiency and meeting diverse energy demands. In 2023, this collaboration led to a notable 5% reduction in transmission losses.

Community engagement and transparency are also core to their stakeholder management, fostering a positive operating environment and social license. Their 2024 community investments highlight this ongoing commitment.

Channels

China Power International Development primarily utilizes the nation's extensive national and regional power grids as its key channel for electricity delivery. These established transmission and distribution networks are the conduits through which the company's generated power reaches consumers.

The company sells its electricity directly to the grid operators, who are responsible for the final distribution to a diverse range of end-users. This wholesale model is standard in the industry, with grid companies acting as intermediaries.

In 2023, China's total electricity consumption reached approximately 9.48 trillion kilowatt-hours, highlighting the massive scale of the grid infrastructure that China Power International Development operates within. This vast network ensures broad market access for the company's output.

China Power International Development enters into direct supply contracts with major industrial clients and large commercial entities needing significant, consistent energy. These agreements bypass traditional distribution networks, allowing for customized energy solutions and potentially more stable revenue streams. For instance, in 2024, the company continued to secure long-term power purchase agreements with key industrial parks, ensuring predictable demand for its generation capacity.

China Power International Development leverages dedicated heat supply networks and pipelines to deliver thermal energy directly to customers. These networks are crucial for its heat generation business, efficiently serving industrial facilities, commercial buildings, and residential areas located near its co-generation plants.

In 2023, China Power International Development's thermal power segment, which includes heat supply, generated a significant portion of its revenue. The company's strategic focus on co-generation allows it to capture value from both electricity and heat production, optimizing its operational efficiency and market reach within targeted urban and industrial zones.

Government Procurement and Tenders

China Power International Development actively participates in government procurement and tenders for new power plant projects and capacity expansions. This channel is essential for securing development opportunities and aligning with national energy infrastructure plans and strategic energy goals.

In 2024, the company's engagement in these processes directly supports China's ongoing efforts to modernize its energy grid and increase renewable energy capacity. For instance, tenders for solar and wind farm development, crucial for meeting emissions targets, represent significant avenues for growth.

- Securing New Projects: Government tenders provide a primary pathway for China Power to acquire new development rights for power generation facilities, including both traditional and renewable energy sources.

- Alignment with National Strategy: Participation ensures that the company's development pipeline is aligned with national energy policies, such as the expansion of clean energy and the phasing out of older, less efficient power plants.

- Contribution to Infrastructure: By winning tenders, China Power directly contributes to the build-out of national energy infrastructure, playing a vital role in meeting the country's growing energy demands.

Investor Relations and Corporate Communications

China Power International Development's investor relations and corporate communications are vital for engaging with financial markets. These functions communicate the company's performance and strategy to shareholders and potential investors, aiming to attract capital and foster market confidence.

Key activities include the timely release of financial reports and strategic updates. For instance, in 2024, the company continued its practice of transparently disclosing its operational and financial results, which is crucial for maintaining investor trust and access to capital markets.

- Shareholder Engagement: Regularly publishing financial results and annual reports to keep investors informed.

- Market Confidence: Strategic communications to highlight growth prospects and operational stability.

- Capital Attraction: Presenting a compelling case to attract new investment and maintain a strong market valuation.

- Transparency: Ensuring clear and consistent communication regarding company performance and future plans.

China Power International Development utilizes the extensive national and regional power grids as its primary channel for electricity delivery, selling wholesale to grid operators. Additionally, it engages in direct supply contracts with large industrial and commercial clients, bypassing intermediaries for customized energy solutions. The company also leverages dedicated heat supply networks for its thermal energy business, serving nearby industrial, commercial, and residential areas.

| Channel | Description | 2023/2024 Relevance |

|---|---|---|

| Power Grids | Nationwide transmission and distribution networks for electricity delivery. | Essential for reaching the broad consumer market. China's total electricity consumption neared 9.5 trillion kWh in 2023. |

| Direct Sales | Supply contracts with major industrial and commercial users. | Securing long-term agreements with industrial parks in 2024 ensures stable revenue. |

| Heat Supply Networks | Dedicated pipelines for thermal energy delivery. | Crucial for the thermal power segment, serving localized demand efficiently. |

| Government Tenders | Procurement for new power plant projects and capacity expansions. | Key for acquiring development rights and aligning with national energy strategies in 2024. |

Customer Segments

National and provincial grid companies are the cornerstone of China Power International Development's customer base, representing the primary purchasers of its generated electricity. These entities, largely state-owned or state-controlled, are responsible for the vast transmission and distribution networks that power the nation.

In 2024, China's power consumption continued its upward trajectory, driven by economic activity and electrification efforts. For instance, the State Grid Corporation of China, a dominant player, manages the world's largest power grid, serving over 1.1 billion people. China Power International Development's sales to these grid operators are therefore substantial, reflecting their critical role in the energy supply chain.

Large industrial enterprises, including manufacturing plants, chemical factories, and mining operations, are a cornerstone customer segment for China Power International Development. These major players have significant and consistent energy needs, making them crucial for the company's direct electricity and heat supply services. In 2024, China's industrial sector continued to be a primary driver of electricity consumption.

The commercial and residential sectors are the ultimate consumers of the electricity China Power International Development generates, even though they don't buy it directly. Their electricity needs are met through the grid companies, making them the foundational demand that necessitates China Power's generation capacity.

In 2024, China's total electricity consumption reached approximately 9.5 trillion kilowatt-hours, with industrial and commercial users accounting for a significant portion, alongside residential demand. This vast end-user base directly influences the need for reliable power generation.

Urban Heating Companies and Municipalities

Urban heating companies and local municipalities are direct customers for China Power International Development's heat supply operations. These entities act as intermediaries, distributing the generated heat to end-users in residential and commercial sectors within cities, fulfilling essential community heating requirements.

In 2024, China Power International Development continued to solidify its role in urban heating infrastructure. The company's commitment to providing reliable heat supply directly supports municipal goals for energy efficiency and resident comfort. For instance, the company's integrated energy solutions often align with municipal plans to reduce reliance on individual heating systems, thereby contributing to cleaner urban environments.

- Direct Customer Relationships: Urban heating companies and municipalities purchase heat directly from China Power International Development.

- Distribution Network: These customers manage the last-mile distribution of heat to residential and commercial buildings.

- Community Service: The partnership ensures the provision of essential heating services to urban populations.

Other Power Distributors and Utilities

Other regional power distributors and utilities can be significant customers for China Power International Development. These entities may purchase electricity to bolster their own generation capacity, especially during periods of high demand. This segment acts as a crucial wholesale market for the company's output.

For example, in 2023, China Power International Development reported a total power generation of 221,975.1 GWh. A portion of this generation would have been supplied to other utilities, contributing to grid stability and meeting the energy needs of diverse regions.

- Wholesale Electricity Procurement: Other utilities buy power to cover shortfalls or manage peak loads.

- Grid Stability Contribution: These sales help maintain a balanced and reliable energy supply across different power networks.

- Market Diversification: This segment offers China Power International Development a way to diversify its customer base beyond direct retail consumers.

- 2024 Outlook: As China's energy demand continues to grow, the need for wholesale power purchases by other distributors is expected to remain robust.

China Power International Development's customer segments are primarily state-owned grid companies, which purchase the bulk of its electricity. Large industrial users are also key direct customers due to their substantial and consistent energy demands.

The company also supplies heat directly to urban heating companies and municipalities, who then distribute it to end-users. Additionally, other regional power distributors act as wholesale customers, buying electricity to supplement their own supply, especially during peak demand periods.

In 2024, China's power market continued to be dominated by these structured relationships, with national grid operators like State Grid Corporation of China remaining the primary offtakers. The industrial sector's energy consumption also remained a significant driver for direct sales.

| Customer Segment | Primary Transaction | Role in Energy Supply | 2024 Relevance |

| National & Provincial Grid Companies | Electricity Purchase | Bulk offtakers, manage transmission | Cornerstone of sales, driven by national demand |

| Large Industrial Enterprises | Electricity & Heat Purchase | Direct consumers of significant energy | Crucial for direct supply services |

| Urban Heating Companies & Municipalities | Heat Purchase | Distribute heat to end-users | Essential for urban heating infrastructure |

| Other Regional Power Distributors | Wholesale Electricity Purchase | Supplement own generation, manage load | Key for market diversification and grid stability |

Cost Structure

Fuel costs represent the most significant expense for China Power International Development, especially given its substantial portfolio of coal-fired power plants. In 2024, the fluctuating global and domestic prices of coal, coupled with rising transportation expenses, placed considerable pressure on the company's operational margins. Effective fuel procurement and inventory management are therefore critical for maintaining profitability.

China Power International Development, like any major power producer, faces significant capital expenditure (CAPEX) in building new power plants. This includes costs for acquiring land, undertaking extensive civil engineering and construction, and purchasing sophisticated equipment such as turbines and generators. For instance, the development of a new coal-fired power plant can easily run into billions of dollars, with a substantial portion allocated to the core generation equipment and environmental control systems.

These upfront investments are substantial, requiring careful long-term financial planning and amortization strategies. For example, in 2023, China Power International Development reported capital expenditures of approximately HKD 24.8 billion, a significant portion of which would be directed towards the construction and development of new generation capacity, including renewable energy projects.

Operation and Maintenance (O&M) expenses are a significant ongoing cost for China Power International Development, covering everything from staff wages for plant operators and technicians to the purchase of spare parts and regular equipment servicing. These costs are essential for ensuring the power plants run smoothly and last for a long time. For example, in 2023, China Power International Development reported that its O&M expenses amounted to approximately HKD 10.2 billion, highlighting the substantial investment required to keep its diverse energy portfolio operational.

Financing Costs

Financing costs are a substantial component for China Power International Development due to the capital-intensive nature of power generation. These costs primarily include interest payments on loans and other debt servicing obligations, directly reflecting the company's investment plans and how it finances those investments. In 2023, China Power International Development reported finance costs of approximately HKD 3,589 million.

These expenses are intrinsically linked to the company's ongoing expansion and modernization efforts, which often require significant upfront capital. The company's leverage and the prevailing interest rate environment heavily influence the magnitude of these financing costs. For instance, a higher debt-to-equity ratio or rising interest rates would naturally lead to increased financing expenses.

Key elements contributing to these costs include:

- Interest Expense: Payments on bank loans, corporate bonds, and other forms of borrowed capital.

- Other Financing Charges: This can encompass fees associated with securing financing, foreign exchange gains or losses on debt, and amortization of financing-related costs.

- Impact of Capital Structure: The proportion of debt versus equity used to fund operations and growth directly determines the level of these expenses.

Regulatory Compliance and Environmental Costs

China Power International Development faces substantial costs related to environmental regulations. These include investments in advanced emissions control technologies to meet stricter air quality standards, which are becoming increasingly stringent across China. For instance, the nation's push for cleaner energy has led to significant capital expenditure on flue gas desulfurization and denitrification systems for its thermal power plants.

Furthermore, the company must factor in potential carbon taxes or emissions trading schemes as China progresses with its carbon neutrality goals. While specific carbon tax rates are still evolving, the anticipation of such costs influences operational planning and investment in lower-carbon alternatives. Waste disposal, particularly for ash and by-products from power generation, also incurs significant expenses, managed under strict environmental guidelines.

Compliance reporting, which involves extensive monitoring and documentation of environmental performance, adds another layer of operational cost. This includes regular audits and submissions to regulatory bodies. Beyond environmental mandates, licensing fees for power generation operations and other regulatory adherence expenses are a consistent drain on the company's financial resources, ensuring ongoing operational legality and adherence to national energy policies.

- Emissions Control Technology: Capital expenditure on systems like flue gas desulfurization and denitrification.

- Carbon Pricing: Anticipated costs from potential carbon taxes or emissions trading schemes.

- Waste Management: Expenses related to the safe disposal of by-products like fly ash.

- Regulatory Fees: Costs associated with obtaining and maintaining operating licenses and compliance reporting.

China Power International Development's cost structure is heavily influenced by fuel, capital expenditures, and operations and maintenance. In 2023, finance costs were approximately HKD 3,589 million, reflecting the capital-intensive nature of its business and its financing strategies.

The company incurred significant operational and maintenance expenses, totaling around HKD 10.2 billion in 2023, essential for ensuring the efficiency and longevity of its diverse power generation assets. Capital expenditures also remain a substantial outlay, with HKD 24.8 billion reported in 2023, directed towards new capacity and upgrades.

Environmental compliance and regulatory adherence represent ongoing costs, including investments in emissions control and licensing fees, crucial for operating within China's evolving energy landscape.

| Cost Category | 2023 (HKD Million) | Key Drivers |

|---|---|---|

| Fuel Costs | Significant, but not explicitly itemized separately in annual reports for the entire business. | Coal prices, transportation, global energy markets. |

| Capital Expenditures | 24,800 | New plant construction, renewable energy development, equipment upgrades. |

| Operation & Maintenance (O&M) | 10,200 | Staffing, spare parts, equipment servicing, plant upkeep. |

| Finance Costs | 3,589 | Interest on debt, financing fees, capital structure. |

| Environmental Compliance | Ongoing, includes technology investments and fees. | Emissions control, waste management, licensing, regulatory reporting. |

Revenue Streams

China Power International Development's core revenue comes from selling electricity. This is primarily done through long-term contracts with major grid operators across China.

These agreements fix prices and volumes, providing a stable income. For instance, in 2023, the company reported that its electricity sales contributed significantly to its overall revenue, with a substantial portion coming from its thermal power segment, which is a key source of baseload electricity.

China Power International Development's revenue isn't solely from electricity. They also profit significantly from selling heat, mainly generated by their co-generation power plants. This heat is supplied to a variety of customers, including industrial businesses, commercial establishments, and companies that manage urban heating systems.

This heat sales segment is crucial for diversifying their income. It's particularly valuable in areas where there's a strong need for district heating. For instance, in 2023, China Power International Development reported that its thermal power segment, which includes heat sales, contributed substantially to its overall financial performance, demonstrating the importance of this revenue stream.

China Power International Development can secure revenue through capacity charges and availability payments in certain markets. These payments are crucial for ensuring grid stability by compensating the company for keeping generation capacity ready, even if not actively dispatched. For example, in 2024, regulatory frameworks in some regions continued to emphasize the importance of maintaining reserve capacity.

Government Subsidies and Incentives for Renewables

China Power International Development benefits from government subsidies and incentives for its renewable energy ventures, including wind, solar, and hydropower. These financial aids are crucial for fostering clean energy growth and bolstering revenue in the company's renewable segment.

These support mechanisms can significantly impact profitability. For instance, feed-in tariffs guarantee a fixed price for renewable electricity fed into the grid, offering predictable revenue streams. Tax incentives, such as investment tax credits or accelerated depreciation, further reduce the cost of developing and operating renewable energy projects.

- Feed-in Tariffs: China's national feed-in tariff policy for solar PV projects, established in 2009 and updated periodically, provides a benchmark price for electricity generated from renewable sources, directly contributing to revenue.

- Tax Incentives: The Chinese government offers preferential corporate income tax rates for renewable energy enterprises, reducing the tax burden and increasing net income.

- Subsidies: Direct subsidies for renewable energy equipment manufacturing and project development help lower initial capital expenditures, improving the overall financial viability of projects.

- Renewable Energy Certificates (RECs): While not direct subsidies, the trading of RECs can create an additional revenue stream for renewable energy producers.

Ancillary Services and Other Income

China Power International Development also taps into revenue beyond direct power sales. This includes offering ancillary services to the power grid, such as frequency regulation and voltage support, which are crucial for grid stability. In 2024, the company continued to leverage these services to supplement its core generation income.

Beyond grid services, other income sources contribute to the company's financial health. These can involve leasing out company assets, generating revenue from the sale of by-products from their power generation processes, and income derived from various joint ventures that don't directly tie into their primary power production activities.

- Ancillary Services: Revenue from grid support functions like frequency regulation and voltage stability.

- Asset Leasing: Income generated from renting out company-owned assets.

- By-product Sales: Revenue from selling residual materials or outputs from power generation.

- Joint Venture Income: Profits shared from collaborative business ventures.

China Power International Development's revenue is multifaceted, primarily driven by electricity sales through long-term contracts with Chinese grid operators, ensuring stable income. Beyond electricity, the company generates significant revenue from selling heat, particularly from co-generation plants, serving industrial and residential users. Furthermore, they benefit from government subsidies and preferential policies for renewable energy projects, such as feed-in tariffs and tax incentives, which bolster income from wind, solar, and hydropower.

| Revenue Stream | Description | Key Drivers/Examples |

| Electricity Sales | Core revenue from selling electricity to grid operators. | Long-term contracts, stable pricing, baseload power from thermal plants. |

| Heat Sales | Revenue from selling heat generated by co-generation plants. | Supplying industrial, commercial, and urban heating systems. |

| Renewable Energy Incentives | Income from government subsidies and support for clean energy. | Feed-in tariffs, tax credits, subsidies for equipment and development. |

| Ancillary Services & Other Income | Revenue from grid support and non-core activities. | Frequency regulation, voltage support, asset leasing, by-product sales. |

Business Model Canvas Data Sources

The Business Model Canvas for China Power International Development is constructed using a blend of financial disclosures, market research reports on the energy sector, and internal operational data. These sources provide a comprehensive view of the company's current standing and future potential.