China Power International Development Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Power International Development Bundle

China Power International Development operates within a dynamic energy sector, facing significant pressures from government regulation and the threat of new entrants in renewable energy. Understanding the intensity of these forces is crucial for strategic planning and investment decisions.

The complete report reveals the real forces shaping China Power International Development’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for China Power International Development (CPIH) is shaped by how concentrated the sources of its essential inputs are. While China's large economy suggests many potential suppliers for general goods, specialized equipment for power generation or specific grades of coal can originate from a more restricted set of providers. This concentration can grant these suppliers greater leverage in price negotiations and contract terms.

For instance, the availability and cost of high-quality thermal coal, a primary fuel for CPIH's thermal power plants, can be significantly influenced by a few major domestic mining companies. In 2024, fluctuations in coal prices, driven by domestic demand and supply dynamics, directly impacted CPIH's operating costs. Similarly, manufacturers of advanced turbines or specialized components for renewable energy projects, like wind or solar farms, might hold substantial power if their technology is proprietary or in high demand globally.

CPIH's increasing investment in renewable energy sources also introduces new supplier dynamics. The supply chain for rare earth materials, crucial for wind turbine magnets and solar panel components, can be concentrated in specific regions or among a limited number of producers. Any disruptions or price hikes in these critical raw materials can therefore amplify supplier bargaining power, affecting CPIH's project costs and expansion plans.

The bargaining power of suppliers for China Power International Development is significantly influenced by switching costs. For instance, retooling power plants or renegotiating long-term fuel supply contracts can be substantial undertakings, directly impacting the company's operational flexibility.

High switching costs empower suppliers. Consider the example of changing a major turbine supplier for a thermal or wind power plant; this necessitates considerable capital investment and intricate operational adjustments, making it difficult for China Power to easily shift to alternative providers.

The availability of alternative energy sources or equipment types significantly curtails supplier power. China Power International Development's diverse energy generation mix, encompassing coal, hydro, wind, and solar, offers a degree of insulation against price hikes for any single input. For instance, if coal prices were to spike, the company could potentially lean more on its hydro or wind assets, provided operational capacity allows.

However, this mitigation is not absolute. While the company diversifies its primary energy sources, specific critical components for each technology, such as advanced turbine blades for wind farms or specialized solar panels, might still face limited substitution options. This can leave China Power International Development vulnerable to price increases or supply disruptions for these particular inputs, thereby granting suppliers leverage in those specific instances.

Impact of Input on Output Quality/Cost

The criticality of supplier inputs directly impacts China Power International Development's operational efficiency and profitability. High-quality and competitively priced fuel, like coal, or advanced equipment, such as wind turbines and solar panels, are essential for generating electricity and heat effectively.

Suppliers of superior inputs wield significant influence due to their role in maintaining quality and cost-effectiveness. For example, fluctuations in fuel prices can dramatically alter a company's financial performance. In 2024, lower fuel costs were a key driver, contributing to a notable increase in the thermal power segment's profits for China Power.

- Dependence on Fuel Quality: The efficiency and emissions of thermal power plants are heavily reliant on the quality of coal supplied, affecting both operational costs and environmental compliance.

- Technological Advancements: Suppliers of cutting-edge renewable energy technologies, like more efficient solar panels or wind turbines, can command higher prices due to the performance benefits they offer.

- Cost Pass-Through: Suppliers with unique or essential components may have the ability to pass on increased costs to China Power, impacting the overall cost of electricity generation.

- Impact on Profitability: As seen in 2024, favorable fuel costs directly boosted the profitability of China Power's thermal power operations, highlighting the significant influence of input costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into power generation directly enhances their bargaining power over China Power International Development. While traditional raw material suppliers like coal producers might find this path less feasible, companies providing key technologies for renewable energy projects or specialized power plant equipment could potentially enter the generation market themselves. This capability gives them significant leverage, as they could become direct competitors rather than just suppliers.

For instance, a leading manufacturer of advanced solar photovoltaic modules or wind turbine components might possess the capital and technical expertise to establish its own power generation facilities. In 2024, the global renewable energy sector saw significant investment, with companies like Vestas Wind Systems and Jinko Solar continuing to expand their offerings beyond component supply. If such a company were to decide to build and operate its own solar farms or wind parks, it would directly compete with China Power, thereby increasing its negotiating position for supplying equipment to China Power's existing or future projects.

- Supplier Forward Integration Threat: Suppliers may enter the power generation market, increasing their leverage.

- Renewable Energy Sector Example: Technology providers for solar and wind power are potential forward integrators.

- Competitive Landscape Shift: Suppliers becoming competitors alters the power dynamic with China Power.

The bargaining power of suppliers for China Power International Development (CPIH) is moderately high, primarily due to the concentration in specialized equipment and critical raw materials. Switching costs for essential components like advanced turbines are substantial, and while CPIH diversifies its energy sources, specific input dependencies remain. The threat of forward integration by key technology suppliers also adds to their leverage.

| Factor | Impact on CPIH | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Moderate to High for specialized inputs | Key for advanced turbines and rare earth materials |

| Switching Costs | High for power generation equipment | Significant capital and operational hurdles to change suppliers |

| Availability of Substitutes | Moderate for energy sources, low for specific components | Diversification mitigates fuel risk, but component substitution is limited |

| Forward Integration Threat | Potential for technology providers | Renewable tech suppliers may enter generation market |

What is included in the product

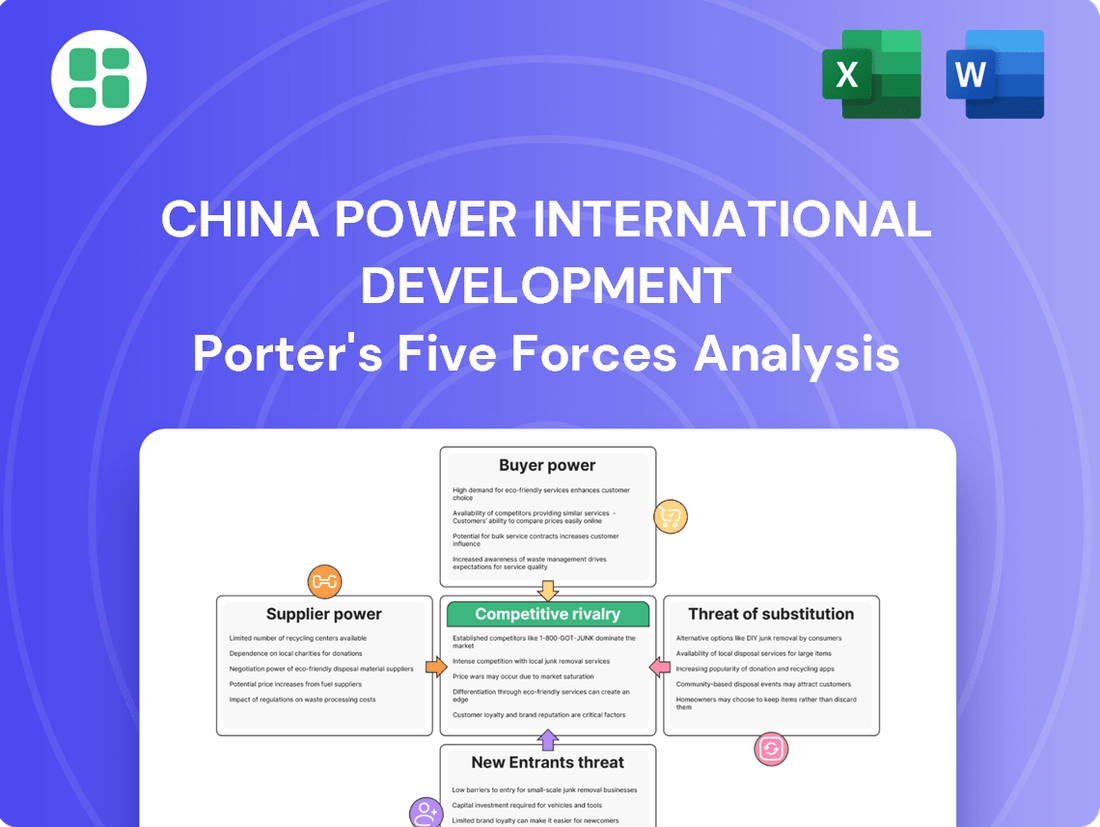

This analysis of China Power International Development examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within the context of the Chinese power generation industry.

Effortlessly identify and mitigate competitive threats in China's power sector with a streamlined Porter's Five Forces analysis, ensuring strategic agility.

Customers Bargaining Power

China Power International Development's customers are highly concentrated, with state-owned grid companies like State Grid Corporation of China and China Southern Power Grid being major buyers. These large entities purchase electricity and heat in substantial volumes, giving them considerable sway over pricing and contract terms.

The significant volume of purchases by these few, dominant customers means that China Power International Development is highly reliant on them. Losing even one of these key accounts could lead to a substantial drop in revenue, directly impacting the company's financial performance.

For end consumers of electricity and heat in China, switching costs are typically very high. This is because they are usually bound to the existing grid infrastructure or district heating networks, making it difficult and expensive to change providers.

However, the situation is different for China Power International Development's direct customers, which are primarily the large grid companies. These entities have a greater ability to negotiate with multiple power generators or to diversify their energy supply sources.

This enhanced flexibility for grid companies directly lowers their switching costs when dealing with China Power. Consequently, it strengthens their bargaining power, allowing them to potentially demand more favorable terms or pricing.

Customers, particularly major industrial consumers and grid operators in China, are well-informed about prevailing electricity prices, generation expenses, and the availability of competing energy providers. This high degree of market transparency, combined with the indispensable role of electricity in their operations, translates into significant price sensitivity.

This sensitivity directly impacts China Power International Development, compelling the company to maintain competitive pricing to win and retain crucial long-term supply agreements. For instance, in 2023, industrial electricity consumption accounted for a substantial portion of China's total power usage, highlighting the importance of these large customer segments.

Threat of Backward Integration by Customers

The threat of customers integrating backward into power generation, such as large industrial complexes building their own captive power plants or developing distributed renewable energy, can significantly increase customer bargaining power. This potential reduces their reliance on external suppliers like China Power International Development.

For instance, in 2024, China's industrial sector continued to explore energy self-sufficiency. Large manufacturing hubs, particularly those with high and consistent energy demands, were increasingly evaluating the economic viability of captive power generation. This trend is driven by the desire for greater cost control and supply chain resilience.

- Reduced Dependence: Customers building their own power sources lessen their dependence on China Power International Development, giving them more leverage in price negotiations.

- Cost Savings Potential: Captive power plants can offer cost savings for large energy consumers, especially if they can utilize waste heat or by-products.

- Energy Security: Industrial clients may pursue backward integration to ensure a stable and predictable energy supply, insulating them from market volatility.

Availability of Substitute Products for Customers

Customers generally have limited direct substitutes for grid-supplied electricity, fostering a degree of dependence on providers like China Power International Development. This inherent inelasticity in demand for essential power serves as a foundational strength for utility providers.

However, the landscape is evolving. Increased adoption of energy efficiency technologies, such as LED lighting and smart grid solutions, directly reduces the overall electricity consumption per user. For instance, in 2024, China continued its push for energy conservation, with industrial sectors reporting significant efficiency gains. This reduced demand inherently grants customers more bargaining power as their reliance on the grid diminishes.

Furthermore, the growth of distributed generation, particularly rooftop solar installations for industrial and commercial users, presents a more direct substitute. By generating their own power, these customers can offset a portion of their grid electricity needs. By the end of 2023, China's installed solar capacity had surpassed 600 GW, a substantial increase that indicates a growing capacity for self-generation among large consumers.

- Limited Direct Substitutes: Grid electricity is essential, creating initial customer dependence.

- Energy Efficiency: Measures reduce overall consumption, indirectly boosting customer leverage.

- Distributed Generation: Rooftop solar and other on-site generation offer a direct alternative for some users.

- Shifting Consumption Patterns: Alternative energy adoption can alter demand, increasing customer influence.

China Power International Development faces significant bargaining power from its customers, primarily large state-owned grid companies. These buyers, such as State Grid Corporation of China, purchase electricity in massive volumes, granting them considerable influence over pricing and contract terms. The company's reliance on these few major clients, coupled with customers' access to market information and potential for backward integration into power generation, further amplifies their leverage.

| Customer Type | Bargaining Power Factors | Impact on China Power | Key 2023/2024 Data Point |

| Major Grid Companies | High purchase volume, few suppliers, potential for diversification | Pressure on pricing, contract terms | Industrial electricity consumption in China was a significant portion of total usage in 2023. |

| Industrial Consumers | Price sensitivity, energy efficiency gains, potential for captive power | Need for competitive pricing, efficiency improvements | China's industrial sector explored energy self-sufficiency in 2024, evaluating captive power viability. |

| End Consumers (Indirect) | High switching costs (for grid infrastructure) | Limited direct power, but efficiency and distributed generation can shift balance | China's installed solar capacity exceeded 600 GW by end of 2023, indicating growing self-generation capacity. |

Preview the Actual Deliverable

China Power International Development Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces Analysis for China Power International Development, offering deep insights into the competitive landscape of the power generation industry. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, ensuring you get the complete, ready-to-use report without any alterations or placeholders.

Rivalry Among Competitors

China Power International Development faces a highly competitive landscape within the Chinese power generation sector. The market is dominated by several massive state-owned enterprises, including China Energy, China Huaneng Group, and State Power Investment Corporation, all of which possess substantial operational capacity and market influence.

This concentration of large players, particularly in the traditional coal-fired power segment, intensifies the rivalry for market share. For instance, as of early 2024, these major SOEs collectively control a vast majority of China's installed power generation capacity, creating a challenging environment for independent power producers like China Power International Development to expand their footprint.

China's power sector is booming, especially with renewables. In 2024 alone, the country added over 300 gigawatts of wind and solar capacity. This massive expansion means more electricity is available than ever before.

While electricity demand is climbing, this rapid capacity growth, particularly in wind and solar, can sometimes create an oversupply situation in specific areas or during certain periods. This excess capacity naturally heats up competition, leading to more aggressive pricing among power generation companies.

Electricity is largely a commodity, meaning there's little to distinguish one power producer from another, which naturally ramps up competition based on price. China Power International Development is making strides, aiming for over 80% clean energy capacity by the end of 2024, a significant move towards sustainability. However, for most customers, switching to a different power provider is relatively easy if a lower price is offered, keeping the rivalry intense.

Exit Barriers

China Power International Development, like many in the power generation sector, faces substantial exit barriers. The immense capital investment required for power plants, which are designed for decades of operation, creates significant sunk costs. For instance, a new large-scale coal-fired power plant can cost billions of dollars, and these assets have limited alternative uses, making divestment extremely challenging and often resulting in significant losses.

Regulatory obligations further complicate any potential exit. Companies are often bound by long-term power purchase agreements and environmental regulations that dictate operational standards and decommissioning processes. These commitments, coupled with the need to ensure a stable power supply, effectively lock companies into the market, even when profitability wanes. This rigidity contributes to persistent overcapacity within the Chinese power sector, intensifying competitive pressures as firms struggle to recoup their investments.

- High Capital Intensity: Power plants represent massive, long-term fixed asset investments, often running into billions of dollars, with limited resale value outside the power industry.

- Regulatory and Contractual Commitments: Companies are bound by power purchase agreements and environmental compliance requirements, making a swift exit legally and operationally difficult.

- Industry Overcapacity: The presence of numerous players with high exit barriers can lead to sustained oversupply, suppressing prices and profitability for all participants.

Strategic Stakes and Government Policy

China's power sector is a critical national asset, heavily influenced by government policy and strategic objectives. For instance, China aims for non-fossil fuel power capacity to reach 60% by 2025, a target that directly shapes investment and operational strategies for all power generators, including China Power. This strong governmental hand can alter the competitive landscape, potentially creating advantages for state-owned entities or particular energy sources, thereby intensifying rivalry for market share and resources.

The strategic importance of the power sector means government intervention is a constant factor. This can manifest through direct investments, subsidies, or regulatory frameworks that favor certain technologies or companies. For China Power, understanding these policy shifts is paramount, as they can significantly impact its competitive positioning. For example, policies promoting renewable energy development might create new growth avenues but also increase competition from specialized players in that segment.

- Government Influence: China's State Council sets ambitious energy targets, such as the 2025 goal of 60% non-fossil fuel power capacity.

- Policy Impact: Favorable policies for renewables or specific state-backed projects can reshape competitive dynamics for companies like China Power.

- Strategic Stakes: The sector's vital role in economic development means government policy will continue to be a primary driver of competitive intensity.

Competitive rivalry in China's power sector is fierce, driven by the presence of large state-owned enterprises and rapid growth in renewable energy capacity. By early 2024, major SOEs like China Energy and China Huaneng held a dominant share of installed capacity, intensifying competition for market share.

The addition of over 300 gigawatts of wind and solar capacity in 2024 alone has led to potential oversupply, further pressuring prices. As electricity is largely a commodity, differentiation is minimal, making price the primary competitive factor, especially with customers easily switching providers for lower rates.

China's strategic energy goals, such as increasing non-fossil fuel power capacity to 60% by 2025, significantly shape the competitive landscape, often favoring state-backed entities or specific technologies.

| Key Competitors (SOEs) | Approximate Share of Installed Capacity (Early 2024) | Key Focus Areas |

| China Energy | Significant Majority | Coal, Renewables, Hydro |

| China Huaneng Group | Significant Majority | Coal, Renewables, Nuclear |

| State Power Investment Corporation | Significant Majority | Coal, Renewables, Hydro |

SSubstitutes Threaten

The threat of substitutes for China Power's grid-supplied electricity and heat is significant, particularly due to distributed generation options offering a favorable price-performance trade-off. Rooftop solar installations, for example, can provide consumers with lower long-term electricity costs, thereby diminishing their dependence on centralized power providers like China Power.

In 2024, the cost of solar photovoltaic (PV) systems continued its downward trend, making distributed solar generation increasingly competitive. While specific figures for China Power's customer adoption of rooftop solar are not publicly detailed, the broader market trend indicates a growing consumer interest in self-generation due to both cost savings and environmental considerations.

Customer willingness to switch to alternative energy sources for China Power International Development is influenced by how easy it is to adopt these substitutes, the upfront costs involved, and how dependable they seem. For instance, if businesses see a clear financial advantage and favorable regulations, they may be more inclined to invest in their own power generation or energy-saving solutions.

The increasing affordability and accessibility of distributed energy solutions, like rooftop solar, represent a growing threat. As of 2024, the global installed capacity for solar PV continues its upward trajectory, with significant growth in distributed generation segments.

This trend allows end-users to generate a portion of their own electricity, directly diminishing reliance on traditional grid-supplied power. For companies like China Power International Development, this translates to a potential reduction in overall electricity demand from their customer base.

The declining cost of solar panels and associated technologies, coupled with supportive government policies in many regions, further accelerates the adoption of these distributed systems. This makes them an increasingly viable substitute for conventional power sources.

Energy Efficiency and Conservation

Improvements in energy efficiency and a growing focus on conservation are subtly but continuously threatening China Power International Development's market. By reducing the amount of electricity and heat needed per unit of economic activity, these trends shrink the overall demand for power generation. For instance, China's national energy efficiency targets aim to significantly lower energy intensity, which directly impacts the volume of electricity that needs to be produced.

This substitution threat is amplified by:

- Technological advancements in energy-saving equipment across industrial, commercial, and residential sectors.

- Government policies and incentives promoting conservation, such as subsidies for energy-efficient appliances and building codes.

- Shifting consumer behavior towards more mindful energy consumption, driven by environmental awareness and rising energy costs.

- The increasing adoption of distributed generation and smart grid technologies that optimize energy use and reduce reliance on large-scale power plants.

Technological Advancements in Energy Storage

Technological advancements in energy storage, particularly in battery technology, present a growing threat of substitution for traditional centralized power generation models. As energy storage solutions become more efficient and cost-effective, they enable distributed generation and microgrid setups to become increasingly viable alternatives. For instance, by mid-2024, the global average cost of lithium-ion battery packs had fallen significantly from previous years, making behind-the-meter storage more accessible for commercial and industrial users.

This trend could reduce reliance on large-scale power plants and extensive transmission infrastructure, indirectly impacting companies like China Power International Development. The increasing adoption of solar photovoltaic (PV) coupled with storage systems allows consumers to generate and store their own electricity, thereby bypassing the need for grid-supplied power. By the end of 2023, renewable energy sources, including solar and wind, accounted for a substantial portion of new capacity additions globally, often integrated with storage.

- Falling Battery Costs: Global average prices for lithium-ion battery packs continued their downward trend through early 2024, enhancing the economic feasibility of energy storage solutions.

- Rise of Distributed Generation: The combination of renewables and storage is making off-grid and semi-off-grid solutions more competitive, potentially reducing demand for centralized power.

- Grid Independence: Consumers and businesses are increasingly exploring ways to achieve greater energy independence, driven by cost savings and resilience concerns, directly challenging traditional utility models.

The threat of substitutes for China Power International Development primarily stems from distributed generation, particularly rooftop solar, which offers competitive pricing and greater control for consumers. As of early 2024, the cost of solar PV systems continued to decline, making self-generation increasingly attractive. This trend is further supported by advancements in energy storage, like falling battery costs, which enable greater energy independence and reduce reliance on grid-supplied power.

The increasing affordability and accessibility of distributed energy solutions, such as solar PV paired with battery storage, present a significant substitution threat. By mid-2024, the global average cost of lithium-ion battery packs had seen substantial reductions, making behind-the-meter storage more feasible for commercial and industrial users. This allows end-users to generate and store their own electricity, potentially decreasing demand for China Power's services.

| Substitute Type | Key Drivers | Impact on China Power |

|---|---|---|

| Distributed Solar PV | Falling PV costs, government incentives | Reduced demand for grid electricity |

| Energy Storage (Batteries) | Decreasing battery prices, improved efficiency | Enables greater grid independence, further reducing reliance on traditional utilities |

| Energy Efficiency Measures | Technological advancements, conservation focus | Shrinks overall electricity demand |

Entrants Threaten

The sheer scale of investment needed for power generation projects, from thermal plants to vast solar or wind farms, creates a formidable hurdle for newcomers. For instance, in 2024, the average cost to build a new utility-scale solar farm in China could range from $800,000 to $1.5 million per megawatt, and for a wind farm, it could be upwards of $1.2 million per megawatt.

These substantial upfront capital demands are a significant deterrent, effectively limiting the threat of new entrants for established players like China Power International Development. Without access to massive funding, aspiring competitors find it exceedingly difficult to enter the market and compete on a meaningful scale.

The Chinese power sector is characterized by stringent regulatory and licensing requirements. New entrants must navigate a complex web of permits, licenses, and adherence to evolving environmental standards. For instance, obtaining approvals for power plant construction, grid connection, and comprehensive environmental impact assessments can be a protracted and expensive process, acting as a significant barrier.

Access to China's national and regional power grids, largely controlled by state-owned giants like State Grid Corporation of China and China Southern Power Grid, presents a significant barrier for new entrants. These established entities manage the crucial transmission infrastructure, making it challenging for newcomers to secure favorable grid connection and transmission agreements. In 2023, China's total installed power generation capacity reached approximately 2,920 gigawatts, with the vast majority of this capacity already integrated into the existing grid system, leaving limited unallocated capacity for new players.

Economies of Scale and Experience Curve

Existing major players in China's power sector, including China Power International Development, leverage significant economies of scale. This scale translates into lower per-unit costs for electricity generation, fuel procurement, and operational management. For instance, in 2023, China Power International Development reported substantial operational capacity, enabling more efficient resource utilization compared to smaller, nascent operations.

New entrants would struggle to match these cost efficiencies. Without the established infrastructure and operational experience, they face a considerable cost disadvantage. This makes it challenging for them to compete effectively on price, impacting their ability to achieve profitability and market penetration.

- Economies of Scale: China Power International Development benefits from large-scale power generation facilities, reducing per-megawatt operating costs.

- Procurement Advantages: Bulk purchasing of fuel and equipment leads to lower input costs than what new entrants can secure.

- Experience Curve: Years of operational experience have optimized processes, further reducing costs and improving efficiency.

- Cost Disadvantage for Newcomers: Lacking scale and experience, new entrants face higher initial capital expenditure and ongoing operational expenses.

Government Policy and Support for Incumbents

Government policies in China's power sector can significantly deter new entrants by favoring established players. State-owned enterprises and strategically important companies often benefit from subsidies, preferential land allocation, and guaranteed long-term power purchase agreements, creating an uneven playing field. For instance, in 2023, the National Development and Reform Commission continued to implement policies aimed at supporting the stable operation of existing power generation facilities, which can indirectly limit opportunities for new, unsubsidized entrants.

While China actively encourages private investment and reform in its energy market, the deep-rooted support for incumbents remains a substantial barrier. This support can manifest as regulatory advantages or easier access to financing for state-backed entities. The inherent advantage enjoyed by established firms, particularly in securing crucial resources and market access, makes it challenging for newcomers to compete effectively.

- Government subsidies and tax breaks for state-owned power companies.

- Preferential access to land and grid connection for incumbent utilities.

- Long-term power purchase agreements that lock in demand for existing generators.

- Regulatory frameworks that may inadvertently favor established operational experience and scale.

The threat of new entrants into China's power generation sector is considerably low, largely due to massive capital requirements and stringent regulatory hurdles. For example, building a new utility-scale solar farm in China in 2024 could cost between $800,000 to $1.5 million per megawatt, a significant barrier for any aspiring competitor. Furthermore, securing grid access, a critical component for any power producer, is dominated by large state-owned entities like State Grid Corporation of China, which managed the vast majority of China's approximately 2,920 gigawatts of installed capacity by the end of 2023.

| Barrier Type | Description | Example Data (2023-2024) |

| Capital Requirements | High upfront investment for power plant construction. | Solar farm cost: $800k - $1.5M/MW (2024) |

| Regulatory Hurdles | Complex licensing, permits, and environmental standards. | Protracted and expensive approval processes. |

| Grid Access | Dominance of state-owned grid operators. | 2,920 GW total installed capacity (end 2023), largely integrated. |

| Economies of Scale | Established players benefit from lower per-unit costs. | China Power International Development's operational scale. |

| Government Support | Preferential treatment for incumbent state-owned enterprises. | Policies favoring stable operation of existing facilities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Power International Development is built upon a foundation of comprehensive data, including the company's annual reports, official regulatory filings with relevant Chinese authorities, and reputable industry research from organizations specializing in the energy sector.