Charoen Pokphand Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charoen Pokphand Group Bundle

The Charoen Pokphand Group boasts impressive global reach and diversified business segments, but also faces intense competition and regulatory hurdles. Understanding these dynamics is crucial for anyone looking to invest or strategize within its vast ecosystem.

Want the full story behind CP Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Charoen Pokphand Group (CP Group) stands out due to its remarkably diversified business model, spanning critical sectors like agro-industry, food production, retail operations, telecommunications, and even the automotive industry. This broad reach significantly reduces the impact of downturns in any single market, providing a robust foundation for sustained growth. For instance, in 2024, CP Group's food segment continued to show resilience, contributing a substantial portion of its revenue, while its retail arm, particularly through the 7-Eleven franchise in Thailand, demonstrated consistent customer traffic and sales volume.

The group's strategic advantage is further amplified by its deep commitment to vertical integration, especially within its core agro-industry and food businesses. This approach provides CP Group with unparalleled control over its entire value chain, from farm to fork. By managing everything from animal feed production and livestock farming to food processing and distribution, the company can ensure high standards of quality and efficiency. This integration was evident in 2024 as the company navigated supply chain challenges, leveraging its internal resources to maintain product availability and cost-effectiveness, a key differentiator in a competitive global market.

Charoen Pokphand Foods (CP Foods), a vital part of the group, showed an impressive financial comeback in 2024, reporting a net profit of THB 19.5 billion. This marks a substantial 476% improvement from the prior year's loss, largely due to strong international performance and efficient cost controls.

The positive financial trend carried into the first quarter of 2025, with CP Foods experiencing another significant profit increase. This sustained growth highlights the resilience of its business strategies and the effectiveness of its operational adaptations.

CP Group's extensive global operational presence is a significant strength. CP Foods, a key subsidiary, reported that 63% of its 2024 revenue originated from international operations spanning 13 countries. This global reach, coupled with exports to over 50 nations, diversifies revenue streams and provides robust market access.

This broad international footprint significantly reduces the company's reliance on any single national economy, thereby bolstering overall business resilience. Furthermore, operating on a global scale enables CP Group to effectively leverage international best practices and gain valuable market insights, contributing to its competitive advantage.

Strong Commitment to Sustainability and Innovation

Charoen Pokphand Group (CP Group) demonstrates a robust dedication to sustainability and innovation, setting ambitious targets for environmental stewardship. The group aims for carbon neutrality by 2030 and net-zero emissions by 2050, reflecting a proactive approach to climate change mitigation.

This commitment is translated into tangible actions across its operations. CP Group is prioritizing sustainable sourcing practices, increasing its reliance on renewable energy sources, and significantly integrating artificial intelligence and digital technologies throughout its global supply chains. These advancements are designed to boost operational efficiency while simultaneously minimizing environmental footprints.

- Carbon Neutrality Target: 2030

- Net-Zero Emissions Target: 2050

- Key Initiatives: Sustainable sourcing, renewable energy adoption, AI and digital technology integration.

- Recognition: Positioned as a sustainability leader globally.

Dominant Market Leadership in Key Domestic Sectors

Charoen Pokphand Group's subsidiary, CP All, demonstrates formidable market leadership within Thailand's convenience store sector, operating the ubiquitous 7-Eleven brand. This dominant position translates into a robust and reliable revenue stream, bolstered by substantial brand equity.

The Thai retail market itself is a significant growth engine, with projections indicating considerable expansion. This optimism is fueled by rising consumer confidence and a resurgence in tourism, both key drivers for increased retail spending.

- Market Share: CP All's 7-Eleven stores command a leading share in Thailand's convenience retail market.

- Revenue Stability: The widespread store network ensures a consistent and predictable revenue base.

- Brand Recognition: Strong brand awareness fosters customer loyalty and drives sales.

- Market Growth: The expanding Thai retail landscape, supported by tourism and consumer confidence, offers further growth opportunities.

CP Group's diversified business portfolio, encompassing agro-industry, food, retail, and telecommunications, provides significant resilience against sector-specific downturns. This breadth ensures a stable revenue base, as seen in 2024 where its food and retail segments continued to perform strongly. The group's commitment to vertical integration, particularly in its core food operations, grants it exceptional control over quality and cost throughout the value chain, a critical advantage in managing supply chain complexities.

The financial performance of its subsidiaries highlights this strength. CP Foods reported a net profit of THB 19.5 billion in 2024, a remarkable 476% increase year-on-year, and this positive trend continued into Q1 2025. Furthermore, CP Group's extensive global footprint, with 63% of CP Foods' 2024 revenue generated internationally across 13 countries, diversifies risk and taps into varied market demands.

CP Group's proactive stance on sustainability and innovation is a key strength, with targets for carbon neutrality by 2030 and net-zero emissions by 2050. This commitment is backed by practical measures like sustainable sourcing and renewable energy adoption, enhanced by AI integration in supply chains. CP All's market dominance in Thailand's convenience retail sector, through its 7-Eleven operations, provides a consistent revenue stream, benefiting from Thailand's growing retail market driven by consumer confidence and tourism.

| Strength | Description | Supporting Data (2024/2025) |

| Diversified Business Model | Spans agro-industry, food, retail, telecom, automotive. | Resilience shown in 2024 food and retail segments. |

| Vertical Integration | Control over entire value chain (farm to fork). | Ensured product availability and cost-effectiveness in 2024 supply chain challenges. |

| Strong Financial Performance | Subsidiaries show robust profit growth. | CP Foods: THB 19.5 billion net profit in 2024 (+476% YoY); continued growth in Q1 2025. |

| Global Operational Presence | Operations in multiple countries, exports to over 50. | 63% of CP Foods' 2024 revenue from international operations (13 countries). |

| Sustainability & Innovation | Commitment to carbon neutrality and net-zero. | Targets: Carbon Neutrality by 2030, Net-Zero by 2050; AI integration in supply chains. |

| Retail Market Leadership | Dominant position in Thai convenience retail (7-Eleven). | Benefits from growing Thai retail market, tourism, and consumer confidence. |

What is included in the product

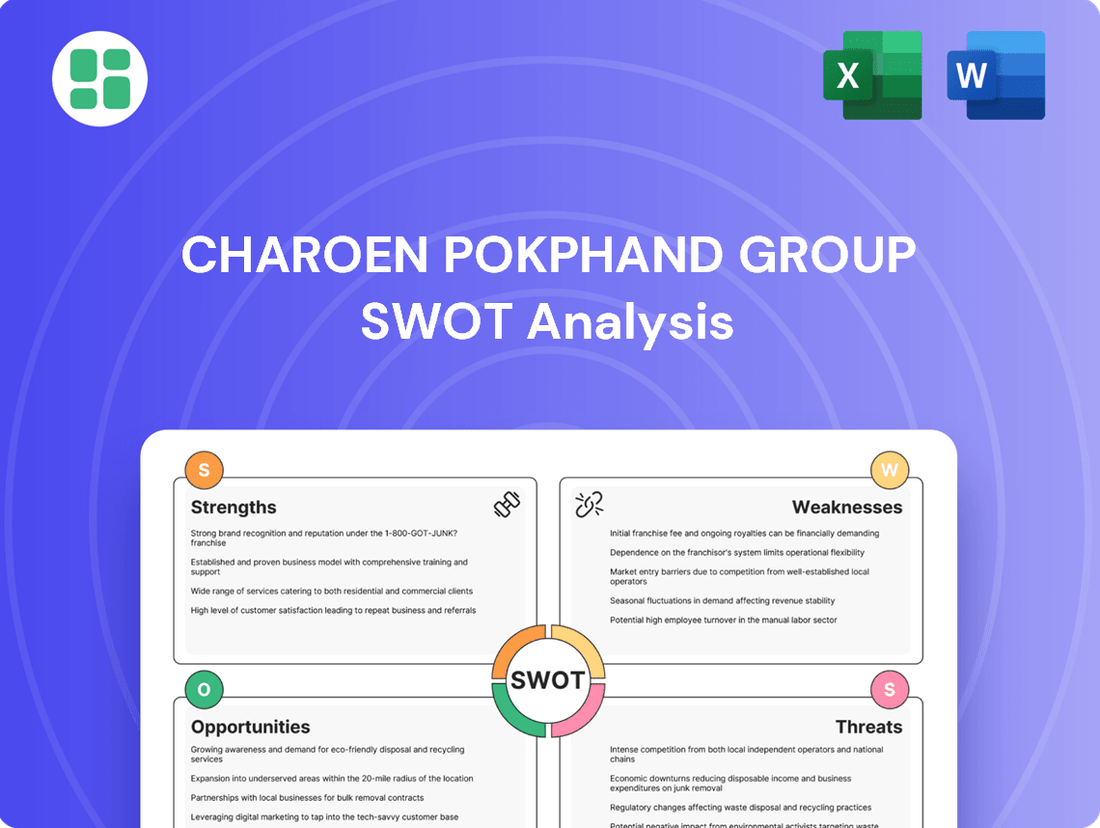

Analyzes Charoen Pokphand Group’s competitive position through key internal and external factors, highlighting its diversified business portfolio and global reach while also considering potential market saturation and regulatory challenges.

Offers a clear, actionable SWOT analysis of Charoen Pokphand Group, highlighting key strengths and opportunities to mitigate market challenges.

Weaknesses

The sheer breadth of Charoen Pokphand Group's operations, spanning agriculture, food, retail, and telecommunications, creates significant operational hurdles. Coordinating these diverse sectors, each with unique market dynamics and regulatory environments, demands sophisticated management. For instance, integrating supply chains across its agribusiness and retail arms, while aiming for efficiency, can be a complex undertaking.

This vastness can also lead to slower decision-making as information navigates through multiple layers of management. While CP Group aims for synergies, the sheer scale of its global footprint, operating in over 20 countries, can dilute focus and create inefficiencies. In 2024, managing this complexity is crucial as the group navigates evolving consumer demands and technological shifts across its varied business units.

Charoen Pokphand Group faces significant vulnerability to global economic and political shifts. For instance, True Corporation, a key subsidiary, has navigated a challenging Thai economic landscape marked by geopolitical tensions and elevated household debt in 2024. These external pressures directly influence consumer spending across CP Group's diverse retail and food businesses, potentially necessitating adjustments to financial forecasts.

Charoen Pokphand Group (CP Group) navigates a landscape of intense competition across its diverse business segments. In the ASEAN telecommunications sector, where its subsidiary True Corporation operates, the market is notably saturated with aggressive pricing strategies and rapid technological advancements, impacting revenue growth and profitability.

The Thai retail market, a core area for CP Group through entities like CP All (operating 7-Eleven), is also experiencing heightened competition. This includes the influx of new domestic and international players, alongside the continued growth of e-commerce, which collectively exert pressure on CP Group's market share and necessitate continuous innovation to maintain its competitive edge and protect margins.

Exposure to Commodity Price Volatility and Disease Risk in Agro-Industry

Despite a strong recovery in 2024, CP Foods remains vulnerable to the unpredictable swings in commodity prices, particularly for animal feed ingredients like corn and soybeans. For instance, in early 2024, global corn prices saw fluctuations driven by weather patterns and geopolitical events, directly impacting feed costs. This inherent volatility can significantly compress profit margins for the company's core agro-industrial operations.

Furthermore, the persistent threat of animal diseases, such as African Swine Fever (ASF), poses a substantial risk. Outbreaks can lead to widespread culling of herds, disrupting supply chains and causing sharp increases in livestock prices. The economic impact of ASF in regions where CP Foods operates, as seen in past years, highlights the potential for significant revenue loss and increased operational expenses due to biosecurity measures.

- Commodity Price Sensitivity: Fluctuations in feed raw material costs directly impact profitability.

- Disease Outbreak Risk: African Swine Fever (ASF) and other diseases can decimate livestock populations.

- Supply Chain Disruption: Disease outbreaks lead to production halts and price volatility.

- Cost Management Challenges: Volatile input costs necessitate agile cost management strategies.

High Capital Expenditure Requirements

Maintaining and expanding operations across Charoen Pokphand Group's diverse and large-scale businesses, particularly in telecommunications, requires significant capital expenditures. True Corporation, a key subsidiary, has projected capital expenditures (CAPEX) of THB 28-30 billion for 2025, which includes integration CAPEX. These substantial investment needs can strain financial resources, potentially limiting flexibility for other strategic initiatives or shareholder returns.

The high CAPEX requirements can impact the group's financial leverage and debt levels. For example, if market conditions shift or revenue growth slows, managing these large ongoing investments could become challenging, affecting profitability and cash flow generation.

- Substantial CAPEX: True Corporation's projected CAPEX of THB 28-30 billion for 2025 highlights the significant financial commitment needed for telecommunications infrastructure and integration.

- Financial Strain: These high investment demands can put pressure on the group's overall financial resources, potentially impacting its ability to pursue other growth opportunities or return capital to shareholders.

- Flexibility Constraint: Large, ongoing capital commitments can reduce financial flexibility, making it harder to respond to unexpected market changes or invest in new ventures outside of core operations.

The group's extensive diversification, while a strength, also presents a weakness through potential operational complexities and slower decision-making. Integrating diverse sectors like agriculture, food, retail, and telecommunications across over 20 countries demands sophisticated management to avoid inefficiencies and maintain focus amidst evolving consumer demands and technological shifts. This complexity can dilute strategic direction and hinder agile responses to market changes, a challenge amplified in 2024.

Same Document Delivered

Charoen Pokphand Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Charoen Pokphand Group's Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete document, showcasing the comprehensive nature of our Charoen Pokphand Group SWOT analysis. Once purchased, you’ll receive the full, editable version for your strategic planning needs.

Opportunities

CP Group's strategic acceleration of AI and digital technologies across its operations presents a significant opportunity to boost efficiency and optimize resource management. This focus, particularly in AgriTech and smart farming, is expected to drive innovation within CP Foods and True Corporation.

The adoption of AI-driven systems and predictive logistics is poised to streamline processes and unlock new business models. This aligns perfectly with the accelerating digital transformation trends observed throughout Southeast Asia in 2024 and projected into 2025.

The Southeast Asian food and beverage sector is a powerhouse, expected to hit US$900 billion by 2028. This surge is fueled by changing consumer habits and strong foreign investment, creating a fertile ground for expansion.

Thailand's retail market is also on an upward trajectory, with a notable increase in demand for convenient food options and a resurgence in tourism playing key roles in this growth.

Charoen Pokphand Group (CP Group) is strategically positioned to leverage these booming markets, thanks to its extensive and well-established food and retail infrastructure across the region.

Charoen Pokphand Group is actively pursuing international market expansion, with CP All slated to open new stores in Cambodia and Lao PDR in 2025. This move signals a clear strategy to tap into growing consumer bases in Southeast Asia.

Strategic partnerships are also a key avenue for growth. The MOU with Mitsubishi Electric for carbon neutrality and circular economy initiatives, for instance, not only aligns with global sustainability trends but also opens doors to new markets and technological capabilities in environmentally conscious sectors.

Capitalizing on Health, Wellness, and Sustainable Consumption Trends

The increasing global focus on health, wellness, and sustainable consumption presents a significant opportunity for Charoen Pokphand Group. Consumers are actively seeking out healthier, more nutritious, and ethically produced food options, with gut health emerging as a particularly strong driver for functional food purchases. For instance, the global functional foods market was valued at approximately $274 billion in 2023 and is projected to reach $454 billion by 2030, demonstrating robust growth.

CP Foods' 'Sustainovation' strategy, which emphasizes innovation in healthier product development, directly aligns with these evolving consumer preferences. This strategic focus allows the company to tap into a growing market segment, strengthening brand loyalty among health-conscious consumers who prioritize both personal well-being and environmental responsibility. By catering to these demands, CP Foods can enhance its market position and drive future growth.

- Growing Demand: Consumers are increasingly prioritizing health, nutrition, and sustainability in their food choices, with gut health being a key area of interest.

- Market Potential: The global functional foods market is expanding rapidly, offering substantial revenue opportunities for companies that can innovate in this space.

- Brand Loyalty: Aligning product development with consumer trends in health and sustainability can foster stronger brand loyalty and attract new customer segments.

- Innovation Avenue: This trend provides a clear pathway for CP Foods to innovate its product lines, introducing new offerings that meet the evolving needs of health-conscious consumers.

Synergy Realization and Operational Efficiency Post-Merger

True Corporation, now in its third year following its significant amalgamation, is actively pursuing the realization of identified synergies and the completion of its integration processes. This strategic focus is crucial for unlocking the full potential of the combined entities.

The company has already demonstrated tangible results from its efforts, achieving substantial cost reductions. These savings have been driven by key initiatives such as network modernization and a disciplined approach to financial management, which have collectively contributed to an improved EBITDA performance. For instance, by the end of 2023, True Corporation reported a notable increase in its operational efficiency metrics.

- Network Modernization: Continued investment in upgrading its infrastructure is expected to yield further cost efficiencies and service improvements.

- Financial Discipline: A sustained focus on prudent financial management is key to maintaining and enhancing profitability.

- Synergy Realization: Successfully integrating operations and capturing cross-selling opportunities across its diverse service offerings will be critical.

- EBITDA Improvement: The company aims to build upon its recent gains in EBITDA, targeting further growth through enhanced operational leverage.

The ongoing successful integration and the continued realization of these planned synergies have the potential to significantly bolster profitability and elevate operational efficiency throughout True Corporation's extensive telecommunications segment.

CP Group's strategic acceleration of AI and digital technologies across its operations presents a significant opportunity to boost efficiency and optimize resource management, particularly in AgriTech and smart farming, driving innovation within CP Foods and True Corporation.

The Southeast Asian food and beverage sector is a powerhouse, expected to hit US$900 billion by 2028, fueled by changing consumer habits and strong foreign investment, creating fertile ground for expansion.

The increasing global focus on health, wellness, and sustainable consumption presents a significant opportunity for Charoen Pokphand Group, with the global functional foods market valued at approximately $274 billion in 2023 and projected to reach $454 billion by 2030.

True Corporation's ongoing successful integration and the continued realization of planned synergies have the potential to significantly bolster profitability and elevate operational efficiency throughout its extensive telecommunications segment.

Threats

Charoen Pokphand Group operates in highly competitive environments across its diverse business segments. For instance, the Thai retail sector is seeing increased competition due to new market entrants, potentially impacting CP All's leading position.

In the telecommunications industry within ASEAN, competition remains intense, with factors like spectrum auctions and shifts in ownership among smaller operators creating challenges for entities such as True Corporation.

This broad-based competition across its various industries can lead to downward pressure on pricing strategies and a potential erosion of market share for the group's businesses.

Thailand's economic growth in 2024 fell short of projections, influenced by ongoing geopolitical tensions, elevated household debt levels, and increasing costs of living. This sluggish economic environment poses a significant threat to Charoen Pokphand Group.

A prolonged economic slowdown could further dampen consumer confidence and curb discretionary spending. This directly impacts CP Group's retail operations, such as its extensive 7-Eleven convenience store network, and its substantial food business segments, as consumers become more cautious with their expenditures.

Operating in diverse nations and heavily regulated sectors like telecommunications places Charoen Pokphand Group (CP Group) under various regulatory frameworks. Policy shifts in these markets, such as the impact of spectrum auctions in the ASEAN telecom sector, introduce significant uncertainty. For instance, Thailand's National Broadcasting and Telecommunications Commission (NBTC) has historically managed spectrum allocation, with auction outcomes directly influencing operator costs and competitive dynamics.

Climate Change and Disease Outbreaks

Charoen Pokphand Group's agro-industrial and food production businesses face significant threats from climate change and disease outbreaks. Extreme weather events, such as droughts and floods, directly impact crop yields and livestock health, creating volatility in raw material supply and increasing operational costs. For instance, the 2023 global weather patterns, marked by El Niño, led to agricultural disruptions in various regions, potentially affecting CP Foods' sourcing.

The food industry's contribution to greenhouse gas emissions also presents a reputational and regulatory risk. As global awareness of sustainability grows, companies like CP Foods are under increasing pressure to reduce their environmental footprint. This includes managing emissions from farming practices and transportation.

Disease outbreaks, particularly in animal agriculture, pose another critical threat. Avian influenza and African swine fever have historically caused widespread losses and supply chain disruptions globally. CP Foods actively implements robust biosecurity measures and risk-mitigation strategies to protect its operations and ensure business stability against these unpredictable health crises.

- Vulnerability to Extreme Weather: Climate-induced events like droughts and floods directly impact agricultural output, a core segment for CP Foods.

- Greenhouse Gas Emissions: The company's operations, like many in the food sector, contribute to GHG emissions, posing reputational and regulatory challenges.

- Disease Outbreak Risks: Animal disease epidemics, such as avian flu or swine fever, can severely disrupt supply chains and lead to significant financial losses.

- Mitigation Strategies: CP Foods invests in risk management, including biosecurity and sustainable practices, to buffer against these environmental and health threats.

Technological Disruption and Rapid Market Changes

The relentless pace of technological evolution, especially in digital services and artificial intelligence, poses a significant threat. CP Group's substantial investments in these domains are crucial, but agile new competitors leveraging breakthrough technologies could rapidly erode market share across its varied businesses. For instance, the acceleration of e-commerce and the emergence of novel telecommunication service models present ongoing challenges that demand constant vigilance and adaptation.

The retail sector, a core area for CP Group, is particularly vulnerable to technological disruption. The ongoing shift towards digital channels necessitates continuous investment and strategic pivots to maintain relevance and competitiveness. Failure to adapt quickly to evolving consumer preferences and new digital business models could lead to a decline in market position.

Consider these specific threats:

- E-commerce Acceleration: Online retail sales globally are projected to continue their strong growth trajectory, potentially exceeding $8.1 trillion by 2026, according to Statista projections. This rapid expansion by digital-native players challenges traditional brick-and-mortar models.

- AI-Driven Disruption: The integration of AI in customer service, logistics, and product development can create significant competitive advantages for early adopters, potentially leaving less prepared incumbents behind.

- New Service Models in Telecom: The telecommunications industry is constantly evolving with new connectivity solutions and service offerings, such as the expansion of 5G and the development of edge computing, which could render existing infrastructure and service packages less competitive.

Intensifying competition across its diverse business segments, from retail to telecommunications in ASEAN, presents a significant threat to Charoen Pokphand Group. This pressure can lead to price wars and market share erosion. The group also faces considerable risks from global economic slowdowns, with Thailand's growth in 2024 falling short of expectations, impacting consumer spending and consequently, CP Group's retail and food businesses.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to ensure a robust and insightful assessment of Charoen Pokphand Group.