Charoen Pokphand Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charoen Pokphand Group Bundle

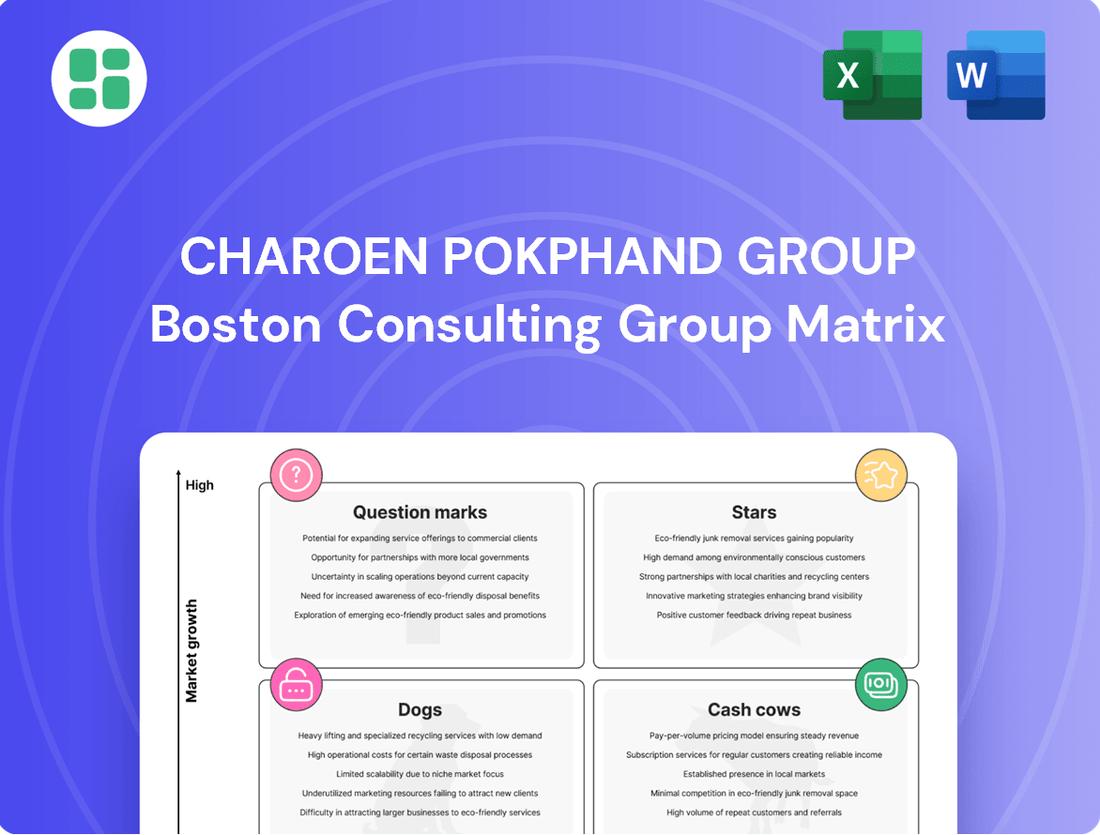

Unlock the strategic potential of the Charoen Pokphand Group with a comprehensive BCG Matrix analysis, revealing which of their diverse business units are market leaders and which require careful consideration. This essential tool will help you understand their current portfolio health and identify future growth opportunities.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Overseas Agro-Industrial and Food Operations, primarily driven by CP Foods' international segments, are a key component of the Charoen Pokphand Group's strategy. In 2024, these operations, especially in Vietnam, demonstrated remarkable growth, accounting for a substantial 63% of total sales. This success is attributed to a robust recovery in the livestock sector and highly efficient operational management.

These international ventures are situated in high-growth markets where CP Foods commands a strong competitive advantage. The company's commitment to investing in and optimizing these overseas assets underscores its focus on achieving sustained growth through 2025 and beyond, solidifying their position as a star performer.

CP Foods is significantly boosting investment in smart chicken farms, integrating AI and IoT to boost efficiency and sustainability. This focus on technological advancement in agriculture, exemplified by projects like 'Forest in Farm' and advanced pellet mills, places these solutions in a high-growth sector. The company aims to optimize resource management and biosecurity, positioning these tech-driven farming methods for future leadership.

Plant-based and sustainable food products represent a significant growth area for Charoen Pokphand Group (CP Group). The global and Thai food markets are increasingly prioritizing healthier, organic, and environmentally conscious options. CP Foods, a key subsidiary, is actively developing new product lines to meet this demand. By 2025, CP Foods aims for 100% sustainable plastic packaging in Thailand, demonstrating a commitment to this trend.

This strategic focus taps into a high-growth consumer segment that values both personal well-being and environmental responsibility. CP Foods' 'Sustainovation' strategy, which includes developing net-zero food products, directly addresses this burgeoning market. Consumer demand for ethical and eco-friendly food choices continues to rise, positioning these products as a strong contender within the BCG matrix.

True Corporation's 5G and Data Services

True Corporation is a standout performer within Thailand's telecommunications landscape, particularly in its 5G and data services. The company is capitalizing on the nation's increasing reliance on digital connectivity, with the Thai telecom market itself expected to see continued expansion. This positions True's 5G and data offerings firmly within a high-growth technology sector, driven by ongoing digital transformation efforts across the country.

True's strategic emphasis on 5G network development and the escalating demand for data services are key drivers of its success. The company holds a significant share of the mobile revenue market, and projections for FY2025 anticipate robust profit growth. These factors strongly support its classification as a Star in the BCG Matrix.

- Market Leadership: True Corporation is a dominant force in Thailand's telecom sector, with its 5G and data services experiencing significant growth.

- Growth Trajectory: The overall Thai telecom market is poised for continued expansion, benefiting True's high-growth technology segments.

- Financial Outlook: Anticipated profit growth for FY2025, coupled with a strong mobile revenue market share, reinforces True's Star status.

- Digitalization Push: Increased data consumption and digital transformation initiatives are fueling the demand for True's advanced services.

Expansion of E-commerce and Digital Retail Offerings

While 7-Eleven Thailand is a strong cash cow for Charoen Pokphand Group (CP Group), its broader digital commerce and omnichannel retail strategies are positioned as a star, particularly in Southeast Asia's booming e-commerce landscape.

CP Group is actively expanding its online product assortments and integrating digital innovations across its retail network. Initiatives like the 7App application and the 7Delivery service are directly addressing the growing consumer demand for convenience and digital shopping experiences. This segment is poised for substantial growth, fueled by the accelerating digital transformation throughout the region.

- Southeast Asia's E-commerce Growth: The region's e-commerce market is projected to reach $200 billion by 2025, with digital retail becoming increasingly central to consumer purchasing habits.

- 7-Eleven's Digital Integration: In 2023, 7-Eleven Thailand reported a significant increase in mobile app usage and online orders, demonstrating the success of its digital strategy.

- Omnichannel Strategy: CP Group's investment in seamless online-to-offline experiences, such as click-and-collect services through its extensive store network, further solidifies its star potential.

Overseas agro-industrial and food operations, particularly CP Foods' international segments, are a significant growth driver. In 2024, these operations, especially in Vietnam, showed strong performance, contributing substantially to total sales due to livestock sector recovery and efficient management.

CP Foods is also investing heavily in smart chicken farms, integrating AI and IoT for enhanced efficiency and sustainability. This focus on technological advancement in agriculture, with projects like 'Forest in Farm,' positions these tech-driven farming methods for leadership in a high-growth sector.

Plant-based and sustainable food products are another key growth area for CP Group, tapping into a high-growth consumer segment. CP Foods' 'Sustainovation' strategy, including net-zero food products and a 2025 goal for 100% sustainable plastic packaging in Thailand, directly addresses this burgeoning market.

True Corporation's 5G and data services are a standout performer in Thailand's telecommunications market. The company is benefiting from the nation's increasing reliance on digital connectivity, with projections for FY2025 anticipating robust profit growth and a strong mobile revenue market share.

7-Eleven Thailand's digital commerce and omnichannel retail strategies, including the 7App and 7Delivery services, are poised for substantial growth in Southeast Asia's booming e-commerce landscape. The region's e-commerce market is projected to reach $200 billion by 2025, with digital retail becoming increasingly central to consumer purchasing habits.

| Business Unit | BCG Category | Key Growth Drivers | 2024/2025 Data/Projections |

|---|---|---|---|

| Overseas Agro-Industrial & Food (CP Foods) | Star | Livestock sector recovery, operational efficiency, high-growth markets | Vietnam operations: substantial sales contribution in 2024 |

| Smart Chicken Farms (CP Foods) | Star | AI/IoT integration, sustainability focus, resource optimization | Investment in technological advancement for future leadership |

| Plant-based & Sustainable Foods (CP Foods) | Star | Growing consumer demand for healthy/eco-friendly options, 'Sustainovation' strategy | 2025 target: 100% sustainable plastic packaging in Thailand |

| True Corporation (5G & Data Services) | Star | Digital transformation, increasing data consumption, 5G network development | FY2025: anticipated robust profit growth, strong mobile revenue market share |

| 7-Eleven Thailand (Digital Commerce/Omnichannel) | Star | Booming Southeast Asian e-commerce, digital integration, convenience demand | Region's e-commerce market: projected $200 billion by 2025 |

What is included in the product

The Charoen Pokphand Group BCG Matrix highlights which business units to invest in, hold, or divest for optimal growth.

The Charoen Pokphand Group BCG Matrix offers a clear, actionable overview of business unit performance, simplifying complex portfolios for strategic decision-making.

This visual tool acts as a pain point reliever by highlighting areas needing attention or divestment, enabling focused resource allocation.

Cash Cows

7-Eleven, managed by CP ALL, stands as a titan in Thailand's convenience retail landscape. By the close of 2024, its network had surpassed an impressive 15,000 outlets, solidifying its position as a market leader in a mature sector.

This extensive reach and deeply ingrained consumer loyalty translate into a consistent and robust cash flow. The brand's ubiquity and the predictable purchasing habits of its customer base create a stable revenue stream, making it a true cash cow for the Charoen Pokphand Group.

While the market itself is mature, 7-Eleven's formidable brand equity and unparalleled accessibility mean it continues to deliver strong, reliable profits. The need for significant new investment to drive growth is minimal, allowing the business to largely self-fund its operations and contribute substantially to the group's overall financial health.

Charoen Pokphand Group's traditional animal feed production is a cornerstone of its agro-industrial operations, representing a significant 23% of its total revenue in 2024. This established market, characterized by steady demand and moderate growth, is bolstered by CP Group's robust, integrated supply chain and substantial economies of scale.

The substantial market share and predictable demand for animal feed position this segment as a consistent and reliable source of cash flow for the conglomerate. This financial stability allows CP Group to invest in other, potentially higher-growth areas of its diverse business portfolio.

Charoen Pokphand Group's core processed food products in Thailand represent a significant cash cow. This segment, encompassing ready-to-eat meals and packaged snacks, thrives in a large, mature domestic market where CP Foods enjoys a dominant position. Established distribution networks and strong consumer loyalty underpin its consistent performance.

Domestic sales accounted for 31% of CP Group's total sales in 2024, highlighting the importance of this segment. The high market share and predictable demand within Thailand translate into stable profits and robust cash generation, making these products a reliable source of funding for other ventures within the group.

Fixed Broadband Services (True Corporation)

True Corporation's fixed broadband services operate as a cash cow within the Charoen Pokphand Group's portfolio. This segment consistently delivers stable revenue, bolstered by a growing average revenue per user (ARPU). Despite a maturing Thai telecom market, the demand for fixed broadband, especially Fiber to the Home/Building (FTTH/B) connections, remains a dependable income source.

True's extensive network infrastructure and substantial existing subscriber base provide a solid foundation for predictable cash flow generation. While growth in this area might be slower compared to newer technologies, its reliability solidifies its cash cow status.

- Consistent Revenue Stability: True Corporation's fixed broadband segment has demonstrated a steady upward trend in revenue, contributing significantly to the company's overall financial health and ARPU improvement.

- Mature Market Resilience: Even as the Thai telecom market reaches maturity, fixed broadband, particularly FTTH/B, continues to be a robust and stable revenue generator for True.

- Established Infrastructure Advantage: True's well-developed infrastructure and loyal subscriber base ensure a reliable and predictable cash flow, characteristic of a cash cow, despite lower growth potential.

Traditional Livestock and Aquaculture Operations (Established Markets)

Traditional livestock and aquaculture operations, particularly within established markets, represent the bedrock of CP Foods' financial performance. In 2024, these core farming activities contributed a substantial 55% to the company's overall revenue, underscoring their importance in a mature, albeit competitive, industry landscape.

These segments, while susceptible to the inherent volatility of agricultural markets, derive significant strength from Charoen Pokphand Group's immense scale and deeply entrenched vertical integration. This allows for cost efficiencies and a robust supply chain, ensuring consistent production and market presence.

The consistent and substantial cash flow generated by these traditional operations is a critical asset. This financial stability provides the necessary capital to fuel investments in new growth ventures and research and development, aligning with the group's broader strategic objectives.

- Revenue Contribution: 55% of CP Foods' revenue in 2024 stemmed from traditional livestock and aquaculture.

- Market Position: Operates within mature, established markets, leveraging the group's scale.

- Financial Strength: Generates significant and consistent cash flow for reinvestment.

- Strategic Advantage: Benefits from vertical integration and vast operational scale.

Charoen Pokphand Group's established animal feed production is a significant cash cow, contributing 23% of its total revenue in 2024. This segment benefits from steady demand and CP Group's integrated supply chain, ensuring consistent cash flow. The group's core processed food products in Thailand also act as a cash cow, holding a dominant position in a mature domestic market with strong consumer loyalty.

Domestic sales, at 31% of total sales in 2024, highlight the reliability of these processed foods. True Corporation's fixed broadband services are another cash cow, providing stable revenue and benefiting from a growing ARPU. Despite market maturity, the demand for FTTH/B connections remains a dependable income source for True.

Traditional livestock and aquaculture operations are the bedrock of CP Foods, generating 55% of its 2024 revenue. These segments, despite market volatility, leverage CP Group's scale and vertical integration for cost efficiencies and consistent market presence, providing substantial cash flow for reinvestment.

| Business Segment | 2024 Revenue Contribution | Market Status | Cash Flow Generation |

|---|---|---|---|

| Animal Feed Production | 23% | Mature, Steady Demand | Consistent & Reliable |

| Processed Foods (Thailand) | 31% (Domestic Sales) | Mature, Dominant Position | Stable & Robust |

| True Fixed Broadband | Significant ARPU Growth | Mature, Growing Demand (FTTH/B) | Predictable & Stable |

| Livestock & Aquaculture | 55% (CP Foods Revenue) | Mature, Established | Substantial & Consistent |

What You See Is What You Get

Charoen Pokphand Group BCG Matrix

The preview you see of the Charoen Pokphand Group BCG Matrix is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be immediately downloadable, allowing you to leverage its professional formatting and market-backed data without delay. You are not looking at a sample, but the final, ready-to-use report designed to empower your business planning and competitive analysis.

Dogs

Within Charoen Pokphand Group's (CP Group) broad diversification, "Legacy Automotive Ventures" would represent any automotive-related businesses that haven't gained substantial market traction or operate in mature, low-growth segments. These ventures might be characterized by low profitability or even losses, consuming capital without delivering significant returns. While CP Group's automotive interests are not extensively detailed publicly, this categorization reflects a common outcome for conglomerates that explore various industries.

Within Charoen Pokphand Group's extensive retail holdings, certain legacy formats or physical locations may be lagging behind the rapid evolution of modern retail and the pervasive influence of e-commerce. These older stores, perhaps situated in less dynamic areas or lacking contemporary upgrades, are likely facing diminished customer engagement and sales performance.

Consequently, these specific retail units could exhibit a low market share within their respective, potentially stagnant, local markets. This situation presents a clear case for strategic review, potentially leading to initiatives such as revitalization, rebranding efforts, or even divestment to enhance the overall efficiency and profitability of CP Group's retail portfolio.

Within Charoen Pokphand Group's extensive agricultural operations, certain niche products may be classified as 'Dogs' in a BCG matrix. These are typically products with low market share and low market growth, often struggling with declining consumer interest or facing strong competition in mature markets. For instance, a specific type of heritage grain or a less common vegetable variety might fall into this category, requiring careful management to avoid significant losses.

Certain Fixed-Line Voice Services (True Corporation)

Within the Charoen Pokphand Group's BCG Matrix, True Corporation's certain fixed-line voice services are positioned as a potential 'Dog'. This classification stems from the broader telecommunications industry trend where traditional voice services are experiencing a decline. The widespread adoption of mobile technology and internet-based communication platforms has significantly reduced the reliance on fixed-line telephony.

While True Corporation is actively investing in and expanding its data and 5G services, its legacy fixed-line voice offerings are likely characterized by low market share and minimal growth prospects. These services, though maintained for a base of existing customers, do not represent a significant area for future revenue generation or strategic expansion. Consequently, they may consume resources without yielding substantial returns.

- Market Trend: Global fixed-line voice revenue has been in steady decline, with many markets seeing single-digit or negative annual growth rates in recent years. For instance, some reports indicated a decline of over 5% year-over-year in traditional voice services in mature markets leading up to 2024.

- Resource Allocation: Maintaining legacy infrastructure for fixed-line voice can divert capital and operational focus away from more promising growth areas like 5G and digital services.

- Customer Base: While a loyal customer base may exist, the long-term viability and profitability of these services are questionable in the face of evolving communication preferences.

- Strategic Fit: In a portfolio focused on high-growth digital and mobile services, fixed-line voice often represents a mature or declining segment that offers limited strategic advantage.

Non-Core, Non-Performing Investments

As a vast conglomerate, Charoen Pokphand Group (CP Group) likely holds investments that are not central to its core operations or are underperforming. These might be smaller ventures or experimental projects that haven't captured significant market share or are in slow-growing sectors. For example, a small stake in a niche technology startup that hasn't scaled could fall into this category.

These non-core, non-performing assets could be candidates for divestment if they don't align with CP Group's evolving strategic direction or show no clear path to profitability. The group's diverse holdings mean some ventures might naturally fall into this quadrant as market dynamics shift.

- Underperforming Ventures: Investments in sectors with limited growth potential or those that have failed to gain market traction.

- Non-Strategic Holdings: Minor stakes in businesses that do not complement CP Group's primary strategic objectives.

- Divestment Considerations: Such assets are typically evaluated for sale if they drain resources without contributing to overall growth or strategic alignment.

- Resource Reallocation: Divesting these assets allows CP Group to redirect capital towards more promising Stars or Cash Cows in its portfolio.

Within Charoen Pokphand Group's diverse portfolio, certain ventures can be categorized as 'Dogs' in the BCG matrix. These are typically businesses with low market share in slow-growing or declining industries. For example, some of CP Group's legacy investments in traditional media or specific types of agricultural inputs that face intense competition and shifting consumer preferences might fit this description. These operations often require significant management attention but yield minimal returns, potentially draining resources that could be better allocated to growth areas.

These 'Dog' segments within CP Group's holdings are characterized by their inability to generate substantial profits or market growth. They might be in mature industries where innovation is slow or consumer demand is waning. For instance, older retail formats or specific agricultural product lines that haven't adapted to market changes could be considered 'Dogs'. Such businesses often have low profitability and may even incur losses, necessitating careful strategic evaluation for potential restructuring or divestment to optimize the group's overall financial health.

The presence of 'Dog' businesses within a conglomerate like CP Group is not uncommon. These can include niche manufacturing operations with limited demand, outdated technology platforms, or specific service offerings that have been superseded by newer alternatives. For example, a particular segment of their food processing business that caters to a declining consumer trend or a legacy logistics operation that hasn't modernized could represent 'Dogs'. These segments often have low market share and are in industries with little to no growth prospects, making them candidates for divestment.

For Charoen Pokphand Group, identifying and managing these 'Dog' assets is crucial for maintaining a competitive edge. These businesses, while perhaps historically significant, now represent a drag on resources and profitability. For example, if a particular line of animal feed, due to changing farming practices or the rise of alternative nutrition sources, has seen its market share shrink significantly and operates in a stagnant market, it would be a 'Dog'. The group's strategy would likely involve either a turnaround effort, if feasible, or a strategic exit to reallocate capital towards more promising 'Star' or 'Cash Cow' businesses.

Question Marks

CP Group's Ascend Group, encompassing fintech innovations like TrueMoney, is strategically positioned within Southeast Asia's rapidly expanding digital economy. This sector is characterized by high growth potential, with the digital payments market in Southeast Asia projected to reach over $1 trillion by 2025, according to various market analyses.

However, Ascend faces intense competition from both global giants and local fintech startups vying for dominance. Despite TrueMoney's strong presence, achieving a truly commanding market share necessitates continued, significant investment in user acquisition and the development of a broader suite of financial services.

Charoen Pokphand Group's (CP Group) retail division is actively pursuing international expansion, targeting new markets outside its core Asian territories. This strategy aligns with the group's growth objectives, aiming to tap into potentially high-growth emerging consumer bases. For instance, CP Group's retail operations in China, a significant market, have seen substantial investment and development over the years, demonstrating their commitment to international retail presence.

Venturing into these new retail markets, particularly in regions where CP Group's brand recognition is nascent, represents a classic 'Question Mark' in the BCG matrix. These markets offer considerable upside potential due to unmet consumer needs or evolving retail landscapes. However, they also demand significant capital outlay for establishing supply chains, marketing campaigns, and store networks, leading to a low initial market share and substantial cash consumption to build momentum and compete effectively.

Beyond core smart farming, Charoen Pokphand Group is likely investing in cutting-edge sustainable technologies like cellular agriculture and advanced bio-fermentation. These represent high-risk, high-reward frontiers with substantial R&D demands and currently minimal market penetration.

These nascent technologies, such as lab-grown meat or precision fermentation for alternative proteins, require significant capital to demonstrate feasibility and achieve scalability. For instance, the global cellular agriculture market, though small, is projected for substantial growth, with some estimates suggesting it could reach tens of billions of dollars by the late 2020s, underscoring the long-term potential CP Group might be targeting.

New Energy and Renewable Projects

Charoen Pokphand Group (CP Group) is actively pursuing new energy and renewable projects as part of its broader commitment to sustainability and a circular economy. This strategic focus aligns with global trends and government support for green initiatives, positioning these ventures in a high-growth sector.

Investments in areas like large-scale solar farms and biomass power plants represent CP Group's push into renewable energy. For instance, in 2024, the group continued its expansion in renewable energy capacity, aiming to significantly increase its contribution to Thailand's energy mix. These projects, while promising, often require substantial upfront capital to achieve economies of scale and establish a significant market presence.

- High Growth Potential: The global renewable energy market is projected to continue its upward trajectory, driven by climate change concerns and supportive policies.

- Capital Intensive: Developing new energy infrastructure, such as solar or biomass facilities, demands significant financial investment for land acquisition, technology, and construction.

- Market Share Development: While CP Group is a major conglomerate, its specific market share in the rapidly evolving new energy sector may still be developing, necessitating strategic growth to become a dominant player.

- Sustainability Alignment: These projects directly support CP Group's stated sustainability goals, contributing to a lower carbon footprint and promoting energy independence.

AI and Data Analytics Solutions (Internal and External Application)

Charoen Pokphand Group (CP Group) is actively embedding AI and data analytics across its diverse business units, aiming to boost efficiency and innovation. This internal focus spans areas like optimizing smart farming practices and streamlining retail operations. For instance, CP Foods has been leveraging data analytics to improve feed conversion ratios in its aquaculture, with reports indicating potential yield improvements of up to 5% through precise feeding strategies.

While CP Group's internal adoption of AI and data analytics is significant, the external commercialization of these specific solutions and their market share in the broader AI solutions sector might still be developing. The global AI market, however, is projected for substantial growth, with some estimates placing its value at over $200 billion by 2024, indicating a vast potential market for advanced analytics.

These AI and data analytics initiatives represent high-potential growth areas for CP Group, requiring ongoing investment. The company's commitment to digital transformation, including significant investments in technology infrastructure, underscores its strategy to harness these capabilities. For example, CP Group has announced plans to invest billions of dollars in digital transformation initiatives through 2025, with a substantial portion allocated to AI and data analytics.

- Internal Integration: CP Group utilizes AI for smart farming and retail efficiency.

- Market Position: External commercialization of CP's AI solutions may be in early stages with low market share.

- Market Growth: The global AI market is expanding rapidly, exceeding $200 billion in 2024.

- Investment Focus: Continuous investment is crucial for developing and adopting these technologies within CP Group.

CP Group's ventures into new international retail markets and emerging sustainable technologies like cellular agriculture are prime examples of Question Marks. These areas offer significant future growth but currently require substantial investment with uncertain returns and low market share.

The group's expansion into new international retail territories, while promising for tapping into new consumer bases, demands considerable capital for infrastructure and marketing. Similarly, cutting-edge sustainable technologies, though positioned for future growth, are capital-intensive with minimal current market penetration, necessitating ongoing R&D and scaling efforts.

These initiatives, including renewable energy projects and the commercialization of AI solutions, represent strategic bets on high-growth sectors. While CP Group is investing heavily, their market share in these nascent fields is still developing, making them classic Question Marks requiring careful management and continued investment to potentially become Stars.

| Venture Area | BCG Category | Key Characteristics | Market Potential | Investment Needs |

|---|---|---|---|---|

| New International Retail Markets | Question Mark | Low market share, high investment for expansion | Untapped consumer bases | High (supply chain, marketing) |

| Cellular Agriculture & Bio-fermentation | Question Mark | Nascent technology, high R&D costs | Projected billions by late 2020s | Very High (feasibility, scalability) |

| New Energy & Renewable Projects | Question Mark | Developing market share, significant upfront capital | Strong global growth drivers | High (infrastructure, technology) |

| AI & Data Analytics (External Commercialization) | Question Mark | Early-stage market share, ongoing tech investment | >$200 billion market in 2024 | High (digital transformation) |

BCG Matrix Data Sources

Our Charoen Pokphand Group BCG Matrix is built on robust data, integrating financial disclosures, market research reports, and industry growth forecasts to provide strategic clarity.