Charoen Pokphand Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charoen Pokphand Group Bundle

Navigate the complex global landscape affecting Charoen Pokphand Group with our detailed PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping its vast operations. This comprehensive report provides the critical context you need to anticipate challenges and capitalize on opportunities.

Unlock actionable intelligence on the technological advancements and environmental regulations impacting Charoen Pokphand Group's diverse portfolio. Gain a strategic advantage by leveraging our expert insights into the legal frameworks and market dynamics that define its future. Download the full PESTLE analysis now to make informed decisions and strengthen your market position.

Political factors

Government policies directly shape Charoen Pokphand Group's (CP Group) agro-industry and food production segments. Initiatives focused on food security, agricultural subsidies, and import/export regulations significantly influence CP Group's operational costs and market access. For example, Thailand's National Food Policy Committee aims to ensure stable food supplies and competitive pricing, which can affect CP Group's input costs and sales strategies.

Trade policies, such as tariffs and quotas on agricultural products, can create both opportunities and challenges for CP Group. In 2024, many ASEAN nations continued to review trade agreements, impacting the flow of goods and raw materials critical to CP Group's integrated supply chains. These policy shifts necessitate agile adaptation in sourcing and distribution to maintain competitive pricing and market share.

Charoen Pokphand Group (CP Group), as a vast international conglomerate, is significantly influenced by international trade agreements and the ever-shifting landscape of geopolitical tensions. For instance, the potential for a 'Trump 2.0' administration in the United States, which could signal a return to more protectionist trade policies, is a key external risk the company actively monitors. Such shifts can directly impact global supply chains, potentially increasing costs for raw materials or finished goods, and can also alter market entry or expansion plans by imposing new tariffs or trade barriers.

Charoen Pokphand Group (CP Group) operates extensively across Asia, making political stability in these key markets a critical concern. Fluctuations in governance or policy can directly impact CP Group's substantial assets and ongoing business activities, influencing everything from supply chains to market access. For instance, Thailand, CP Group's home base, benefits from a stable monarchy, which historically contributes to a predictable and favorable investment climate.

Regulations on foreign direct investment (FDI)

Charoen Pokphand Group's global expansion hinges on navigating diverse foreign direct investment (FDI) regulations. Policies dictating ownership caps, profit repatriation, and available incentives directly influence their strategic entry into new territories. The company's ambitious goal to achieve 80% of total sales from outside Thailand and exports within five years underscores the critical importance of favorable FDI environments.

Key regulatory considerations for CP Group's international growth include:

- Ownership Limits: Restrictions on foreign equity stakes can impact control and integration of acquired businesses.

- Profit Repatriation: Regulations governing the transfer of profits back to Thailand affect financial planning and investment returns.

- Investment Incentives: Tax holidays, subsidies, and streamlined approval processes offered by host countries can significantly boost investment attractiveness.

- Local Content Requirements: Mandates for using locally sourced materials or labor can influence supply chain strategies and operational costs.

Labor laws and minimum wage policies

Charoen Pokphand Group (CP Group), with its extensive operations in Thailand and internationally, is significantly influenced by evolving labor laws. For instance, in Thailand, minimum wage adjustments directly affect the cost of labor across CP Group's vast agricultural, manufacturing, and retail sectors. As of early 2024, Thailand's government has been discussing potential minimum wage increases, which could add to operational expenses for businesses like CP Foods.

Changes in regulations concerning working conditions, overtime pay, and labor union rights also present a dynamic landscape for CP Group. These policies can impact employee morale and productivity, areas CP Foods actively seeks to enhance through its focus on an engaged and proud organizational culture. For example, stricter regulations on working hours could necessitate increased staffing or adjustments to operational schedules in their processing plants.

- Minimum Wage Impact: Potential increases in Thailand's minimum wage, a recurring topic in 2024, directly affect CP Group's labor costs in sectors like retail and agriculture.

- Working Conditions: Evolving standards for working hours and employee benefits can necessitate operational adjustments and investments in human resource management across CP Group's diverse businesses.

- Labor Relations: Regulations governing labor unions and collective bargaining influence CP Group's approach to employee relations and can affect negotiation outcomes in various segments.

Government policies significantly influence CP Group's operational landscape, particularly in agriculture and food. Thailand's commitment to food security and potential agricultural subsidies in 2024-2025 directly impact CP Foods' input costs and market strategies. Furthermore, trade policies, including tariffs and quotas, are actively monitored by CP Group, as seen in ongoing ASEAN trade agreement reviews that affect raw material flow.

Political stability in key operating regions is paramount for CP Group's extensive international presence. The company's strategic goal of deriving 80% of sales from outside Thailand highlights the critical need for favorable foreign direct investment (FDI) regulations, including ownership limits and profit repatriation policies, which are constantly being assessed.

Labor laws, such as minimum wage adjustments and working condition regulations, directly affect CP Group's operational expenses. Discussions around potential minimum wage increases in Thailand during 2024 are a key factor for CP Group's labor-intensive sectors like retail and agriculture.

CP Group's global operations are subject to diverse political risks, including geopolitical tensions and potential shifts in trade policies, such as those that might emerge from a US election cycle. These factors necessitate ongoing risk assessment and adaptation in their global supply chain management and market access strategies.

What is included in the product

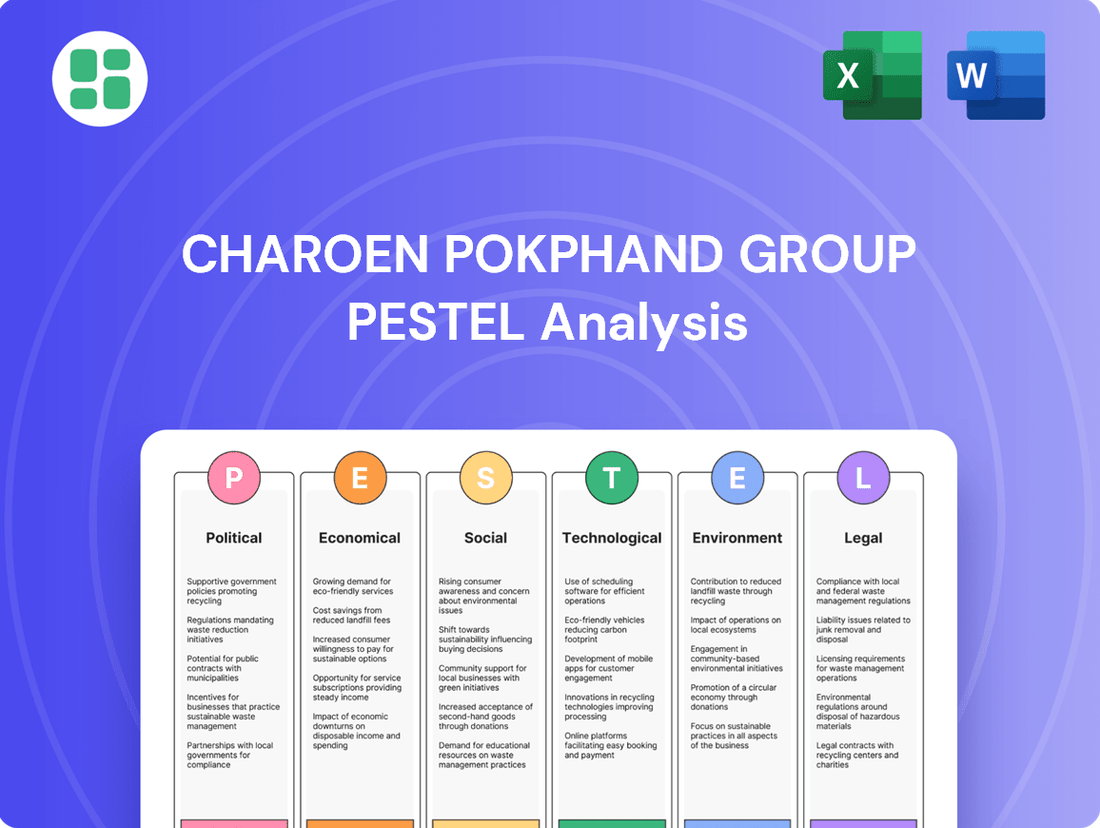

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Charoen Pokphand Group's diverse global operations.

It provides actionable insights into how these macro-environmental factors present both challenges and strategic opportunities for the conglomerate's future growth.

A PESTLE analysis for Charoen Pokphand Group offers a clear, summarized version of external factors, simplifying complex market dynamics for quick referencing during strategic planning.

It provides a visually segmented breakdown by PESTEL categories, enabling rapid interpretation of opportunities and threats for CP Group's diverse business lines.

Economic factors

Charoen Pokphand Group's extensive business interests, especially in retail through 7-Eleven and its food division, are directly tied to the health of the global economy and how much people have to spend. When economies are doing well, consumers tend to open their wallets more for everyday items and convenience foods.

The company's food segment, CP Foods, demonstrated this resilience in 2024, reporting a substantial increase in profits. This positive financial outcome was largely fueled by strong performance in its international markets and an overall improvement in market conditions, highlighting the impact of global economic trends on its profitability.

Commodity price fluctuations significantly impact Charoen Pokphand Group's (CP Group) agro-industrial operations. For instance, the cost of key animal feed ingredients like corn and soybeans can swing dramatically. In early 2024, global corn prices saw considerable volatility due to weather patterns in major producing regions, impacting feed costs for CP Foods. Similarly, soybean prices have been influenced by supply chain disruptions and geopolitical events, directly affecting CP Group's production expenses and profit margins.

Charoen Pokphand Group (CP Group), operating globally, faces significant risks from exchange rate volatility. Fluctuations in currency values directly affect the cost of imported raw materials and the repatriated value of export earnings. For instance, True Corporation, a key CP Group subsidiary, reported in 2024 that the Thai Baht's appreciation against the US Dollar negatively impacted its financial performance.

Inflation and interest rates

Rising inflation presents a significant challenge for Charoen Pokphand Group (CP Group), directly impacting its operational expenses. For instance, the global inflation rate averaged 5.9% in 2023, and while projections for 2024 suggest a slight moderation, persistent price pressures on raw materials, labor, and energy continue to elevate costs across CP Group's diverse business segments, from agriculture to retail.

Furthermore, elevated interest rates, a tool employed by central banks to combat inflation, directly affect CP Group's financial strategy. As of early 2024, many major economies, including the United States, maintain benchmark interest rates in the 5-5.5% range. This makes borrowing more expensive, potentially increasing the cost of capital for CP Group's large-scale, capital-intensive projects and expansion initiatives, thereby influencing their investment decisions and overall financial leverage.

- Increased Operational Costs: Global inflation in 2023 averaged 5.9%, directly increasing CP Group's expenses for raw materials, energy, and labor.

- Higher Borrowing Expenses: With US interest rates around 5.25-5.50% in early 2024, CP Group faces increased costs for financing capital-intensive projects and expansion.

- Navigating Capital Flows: CP Group must manage capital flows amidst global economic uncertainties and the impact of high interest rates in key markets like the US.

Disposable income trends in emerging markets

Charoen Pokphand Group (CP Group) strategically focuses on emerging markets for substantial growth. Rising disposable incomes in these regions directly fuel demand for CP's core offerings, including processed foods, convenience retail, and telecommunications. This trend translates into significant revenue streams and expansion potential for the conglomerate.

CP Foods, a key subsidiary, is actively developing products to meet these evolving consumer preferences. For instance, in Southeast Asia, a significant portion of CP Group's revenue comes from these growing economies. In 2024, projections indicated that disposable income in several key emerging markets, such as Vietnam and Indonesia, were expected to see continued upward trends, potentially growing by 5-7% annually.

- Rising Disposable Income: Emerging markets are experiencing a steady increase in disposable income, benefiting CP Group's consumer-facing businesses.

- Demand for Processed Foods: Higher incomes correlate with greater spending on convenient and processed food options offered by CP Foods.

- Retail and Telecom Growth: The expansion of CP Group's retail (e.g., 7-Eleven) and telecommunications (e.g., True Corporation) segments is directly supported by increasing consumer purchasing power.

- Product Innovation: CP Foods is investing in R&D to align its product portfolio with the changing tastes and needs of consumers in these dynamic markets.

Economic growth directly fuels Charoen Pokphand Group's (CP Group) retail and food businesses, as seen with CP Foods' profit increase in 2024 driven by international markets. However, the group faces challenges from volatile commodity prices, impacting feed costs for CP Foods, and currency fluctuations, as noted by True Corporation's 2024 report on the Thai Baht's impact. Persistent inflation, averaging 5.9% in 2023, raises operational costs, while higher interest rates, around 5.25-5.50% in early 2024, increase borrowing expenses for capital projects.

| Economic Factor | Impact on CP Group | 2023/2024 Data Point |

|---|---|---|

| Global Economic Growth | Boosts retail and food sales | CP Foods profit increase in 2024 |

| Commodity Prices | Affects feed costs (e.g., corn, soybeans) | Corn prices volatile in early 2024 due to weather |

| Exchange Rates | Impacts import costs and export earnings | True Corp noted negative impact of THB appreciation in 2024 |

| Inflation | Increases operational expenses | Global average inflation 5.9% in 2023 |

| Interest Rates | Raises cost of capital | US rates ~5.25-5.50% in early 2024 |

Same Document Delivered

Charoen Pokphand Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Charoen Pokphand Group. This detailed breakdown covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their diverse operations. You'll gain immediate access to actionable insights upon completing your purchase.

Sociological factors

Consumers are increasingly prioritizing health and wellness, driving demand for products perceived as beneficial. This shift is evident in the growing popularity of plant-based diets and organic foods. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, showcasing a significant growth trajectory.

Ethical sourcing and sustainability are also becoming paramount. Consumers are more aware of the environmental and social impact of their food choices, leading them to seek out brands with transparent and responsible supply chains. This influences purchasing decisions, with a notable percentage of consumers willing to pay a premium for sustainably produced goods.

CP Foods is actively responding to these evolving consumer preferences by investing in product innovation and sustainable sourcing. Their focus on developing healthier options, including plant-based and reduced-sugar products, aligns with market trends. In 2023, CP Foods reported a 7.4% increase in revenue, partly attributed to its ability to adapt its product portfolio to meet these changing demands.

Rapid urbanization, especially in Asia, is reshaping consumer habits. This trend fuels a growing demand for convenient food options, including ready-to-eat meals and easily accessible retail environments. For instance, Thailand, a key market for Charoen Pokphand Group (CP Group), saw its urban population reach approximately 52% in 2023, driving the need for solutions like CP Group's extensive 7-Eleven network.

These demographic shifts directly impact CP Group's strategic decisions, particularly in retail expansion and product development. The widespread presence of 7-Eleven stores across Thailand, numbering over 14,000 by early 2024, effectively serves both the evolving needs of urban dwellers and the transient demands of travelers, offering a diverse range of products tailored to modern lifestyles.

The availability of both skilled and unskilled labor is a critical sociological factor impacting Charoen Pokphand Group's operations across its agricultural, manufacturing, and retail businesses. As of early 2025, Thailand's labor force, particularly in agriculture, faces challenges with an aging population and migration to urban centers, potentially affecting the supply of essential workers.

Recognizing this, CP Group actively invests in human potential development and upskilling programs. For instance, their initiatives in 2024 focused on digital literacy and advanced farming techniques for agricultural workers, aiming to boost productivity and adapt to evolving market demands. This strategic approach ensures operational efficiency and a more resilient workforce.

Health and wellness trends

Growing consumer awareness regarding food safety, nutrition, and overall well-being directly influences Charoen Pokphand Group's (CP Group) food production and marketing strategies. Consumers are increasingly demanding transparency in labeling, healthier ingredients, and products tailored to specific dietary needs. For instance, CP Foods has been actively promoting its commitment to providing top-quality products emphasizing both nutrition and food safety, aligning with these evolving health consciousness trends.

This shift is evident in market data. By late 2024, the global health and wellness food market was projected to reach over $1 trillion, with a significant portion driven by demand for natural, organic, and functional foods. CP Group's investment in research and development for healthier product lines, such as low-sodium options and plant-based alternatives, directly addresses this burgeoning consumer preference.

- Increased demand for transparency: Consumers are scrutinizing ingredient lists and sourcing information more than ever.

- Focus on functional foods: Products offering specific health benefits, like immunity support or improved digestion, are gaining traction.

- Growth in plant-based alternatives: The market for meat and dairy substitutes continues to expand rapidly, driven by health and environmental concerns.

- Emphasis on food safety certifications: Consumers place a high value on products that meet stringent food safety standards and certifications.

Ethical consumerism and animal welfare concerns

Increasing public awareness around ethical consumerism and animal welfare is significantly shaping consumer choices in the food sector. This trend puts pressure on companies like Charoen Pokphand Foods (CPF) to demonstrate robust animal welfare standards and transparent, sustainable sourcing practices across their livestock farming and aquaculture operations. Failure to meet these expectations can directly impact brand reputation and market acceptance, potentially leading to reduced sales and investor confidence.

CPF has publicly committed to these principles, stating their aim to foster a society of equality and uphold human rights as foundational to sustainability. This commitment is crucial as consumers increasingly scrutinize supply chains. For instance, by 2024, a significant portion of consumers in key markets like Europe and North America are expected to actively seek out products with certified animal welfare labels, influencing purchasing decisions for protein products.

The group's efforts in this area are vital for maintaining consumer trust and market share.

- Growing consumer demand for ethically sourced food products.

- CPF's stated commitment to human rights and equality as sustainability pillars.

- Impact of animal welfare standards on brand reputation and market acceptance.

- The need for transparency in livestock farming and aquaculture supply chains.

Sociological factors significantly influence Charoen Pokphand Group's strategy, driven by evolving consumer values and demographics. A key trend is the increasing demand for transparency and ethical sourcing, with consumers actively seeking information about product origins and production methods. This is further amplified by a growing emphasis on health and wellness, leading to a surge in demand for functional foods and plant-based alternatives.

Rapid urbanization, particularly in Asian markets, is reshaping consumer habits, fostering a greater need for convenience and accessible retail. Simultaneously, concerns regarding animal welfare and ethical consumerism are pressuring companies to adopt and showcase higher standards in their supply chains, directly impacting brand perception and market acceptance.

| Sociological Factor | Impact on CP Group | Supporting Data/Trend |

|---|---|---|

| Health & Wellness Consciousness | Increased demand for healthier product lines, plant-based options. | Global plant-based food market projected to reach $162 billion by 2030 (from $29.7 billion in 2023). |

| Urbanization | Growth in demand for convenience foods and accessible retail. | Thailand's urban population reached ~52% in 2023; CP Group operates over 14,000 7-Eleven stores in Thailand. |

| Ethical Consumerism & Animal Welfare | Pressure for transparent, sustainable sourcing and higher animal welfare standards. | Consumers in key markets increasingly seek certified animal welfare labels. |

| Labor Market Dynamics | Challenges with aging populations and rural-to-urban migration impacting labor supply. | Aging population and urban migration in Thailand affect agricultural labor availability. |

Technological factors

Charoen Pokphand Group (CP Group) is actively integrating advanced agricultural technologies, often termed agri-tech, across its vast agro-industrial businesses. This strategic adoption aims to significantly boost operational efficiency and output. For instance, CP Group is implementing smart farming techniques and precision agriculture, which utilize real-time data to optimize resource allocation, such as water and fertilizer, leading to more sustainable farming practices.

The group is also investing in cutting-edge genetic breeding programs to develop more resilient and higher-yielding crop varieties. Artificial intelligence (AI) plays a crucial role, providing data-driven insights that help CP Group enhance crop yields and manage resources more effectively. This technological push is crucial for meeting growing global food demand while minimizing environmental impact, a key challenge in the agricultural sector.

Innovation in food processing and preservation is a major technological driver for Charoen Pokphand Group (CP Group). Advances in areas like aseptic processing, modified atmosphere packaging, and advanced freezing techniques allow CP Foods to enhance product quality and significantly extend shelf life. For instance, in 2024, CP Foods continued to invest in technologies that reduce spoilage, aiming to cut food waste by a targeted percentage across its operations.

The integration of digital technologies and robotics throughout CP Foods' production chain is revolutionizing efficiency and safety. By implementing AI-powered quality control systems and automated sorting, the company is not only boosting output but also ensuring higher standards of food safety. This digital transformation is key to maintaining competitiveness in the rapidly evolving global food market, with significant capital allocated in 2024 towards these upgrades.

Charoen Pokphand Group's retail operations, especially 7-Eleven, are heavily investing in digital transformation. This involves leveraging AI and big data to personalize customer experiences and streamline operations. For instance, in 2024, CP All, the operator of 7-Eleven Thailand, continued to bolster its e-commerce presence, aiming to reach a wider customer base beyond physical stores.

The integration of mobile payment solutions is a key component of this strategy, making transactions faster and more convenient for consumers. This digital push is crucial for expanding e-commerce capabilities and creating a seamless omnichannel experience, blurring the lines between online and offline shopping. By 2025, the group anticipates further growth in its digital channels, reflecting the evolving consumer preferences.

Telecommunications infrastructure development

Telecommunications infrastructure development is a key technological factor for Charoen Pokphand Group (CP Group). As a major player in the telecom sector through True Corporation, advancements in network technology, particularly 5G and the Internet of Things (IoT), directly impact CP Group's competitive advantage, the range of services it can offer, and its potential for digital innovation across all its diverse business segments.

True Corporation's strategic focus on automation highlights the importance of this infrastructure. The company has set an ambitious goal to achieve 100% automation of its repetitive processes by 2027. This makes artificial intelligence (AI) a critical success factor, enabling greater efficiency and new service development.

- 5G Rollout: True Corporation is actively expanding its 5G network coverage, aiming to reach a significant portion of the population, thereby enabling faster data speeds and new applications for consumers and businesses.

- IoT Integration: The development of robust telecommunications infrastructure is crucial for the successful integration of IoT devices, which can streamline operations in CP Group's agribusiness, food, and retail sectors.

- Digital Transformation: Enhanced connectivity empowers CP Group to accelerate its digital transformation initiatives, from smart farming solutions to data-driven retail experiences, leveraging real-time data from connected devices.

- AI Adoption: By 2027, True aims for 100% automation of repetitive tasks, underscoring the reliance on advanced telecommunications infrastructure to support widespread AI implementation and operational efficiency.

Biotechnology and sustainable farming innovations

Charoen Pokphand Group (CP Group) is heavily investing in biotechnology and sustainable farming, recognizing their critical role in future food security. Their research and development efforts span alternative proteins and cellular agriculture, alongside eco-friendly farming techniques. For instance, CP Foods has been actively integrating green technology throughout its operations, aiming to reduce environmental impact.

These advancements are not just about innovation; they are fundamental to meeting global food demand sustainably. By 2050, the world population is projected to reach nearly 10 billion, requiring significant boosts in food production efficiency and reduced resource consumption. CP Group’s commitment to these areas positions them to address these escalating challenges.

- Biotechnology Investment: CP Group's R&D focuses on alternative proteins and cellular agriculture to meet evolving consumer preferences and sustainability demands.

- Sustainable Farming: The group is pioneering environmentally friendly farming methods to enhance resource efficiency and minimize ecological footprints.

- Green Technology Integration: CP Foods is actively embedding green technologies across its entire supply chain, from production to distribution.

- Addressing Food Security: These innovations are crucial for ensuring a stable and sustainable food supply for a growing global population.

Charoen Pokphand Group (CP Group) is aggressively adopting advanced agri-tech, including smart farming and precision agriculture, to boost efficiency and sustainability. Investments in genetic breeding and AI are enhancing crop yields and resource management, crucial for meeting global food demand. For example, CP Foods is integrating green technologies to reduce its environmental footprint, a key strategy for 2024 and beyond.

Digital transformation is reshaping CP Group's retail arm, with 7-Eleven leveraging AI and big data for personalized customer experiences and enhanced e-commerce capabilities. By 2025, CP Group anticipates significant growth in its digital channels, reflecting evolving consumer preferences for seamless online and offline shopping.

True Corporation's telecommunications infrastructure, particularly its 5G rollout and IoT integration, is a vital technological enabler for CP Group. The company aims for 100% automation of repetitive processes by 2027, underscoring the critical role of AI and advanced connectivity in driving operational efficiency across all business segments.

| Technology Area | CP Group Initiative/Focus | Key Data/Target |

| Agri-tech | Smart farming, Precision agriculture, Genetic breeding, AI for crop management | Enhanced efficiency and output; Data-driven resource optimization |

| Food Processing | Aseptic processing, Modified atmosphere packaging, Advanced freezing | Extended shelf life, Reduced food waste (targeted reduction in 2024) |

| Digital Retail | AI, Big data for personalization, E-commerce expansion | Personalized customer experiences, Growing digital channel presence (anticipated by 2025) |

| Telecommunications | 5G network expansion, IoT integration, AI for automation | 100% automation of repetitive processes targeted by 2027 |

Legal factors

Charoen Pokphand Group's extensive food and agro-industry operations are governed by a complex web of national and international food safety regulations. These include strict hygiene standards, quality control measures, and detailed labeling requirements that dictate everything from ingredient sourcing to final product presentation. For instance, in 2024, the European Union continued to enforce its rigorous Food Safety Authority (EFSA) guidelines, impacting imports and export standards for companies like CP Foods.

Compliance with these regulations is not merely a legal obligation but a cornerstone of maintaining consumer trust and brand reputation. Failure to adhere to these standards can result in significant legal penalties, product recalls, and substantial damage to the company's image. CP Foods has actively communicated its commitment to these standards, notably positioning its chicken products as meeting the highest, often referred to as space-grade, food safety benchmarks, a claim supported by various certifications and audits throughout 2024 and into early 2025.

Antitrust and competition laws are crucial for Charoen Pokphand Group (CP Group) given its vast operations across numerous sectors. These regulations aim to prevent monopolistic behavior and ensure a level playing field, directly impacting CP Group's strategic decisions regarding mergers, acquisitions, and market expansion. For instance, in 2024, regulatory bodies globally continued to scrutinize large conglomerates for potential anti-competitive practices, a trend that will likely persist into 2025, requiring CP Group to maintain rigorous compliance.

Charoen Pokphand Group's vast agricultural and manufacturing activities are subject to rigorous environmental protection laws. These regulations cover critical areas like water consumption, air emissions, and the responsible disposal of waste, all vital for sustainable resource management and maintaining operational permits. The group's commitment to environmental stewardship is underscored by achievements such as CP Foods receiving the CSR-DIW Continuous Award in 2024, highlighting their proactive approach to compliance and corporate responsibility.

Data privacy and cybersecurity laws

Charoen Pokphand Group (CP Group), with its extensive operations in retail, finance, and telecommunications, manages a significant volume of sensitive customer data. Adhering to stringent data privacy laws, such as Thailand's Personal Data Protection Act (PDPA), is paramount. The group's commitment to protecting this information necessitates continuous investment in advanced cybersecurity infrastructure to mitigate the risk of data breaches.

CP Group's proactive approach to cybersecurity is demonstrated by its ongoing investments. For instance, in 2024, the group continued to allocate substantial resources to enhance its digital defenses, aiming to safeguard customer trust and operational integrity across its diverse business units. This focus is critical given the increasing sophistication of cyber threats.

- Data Volume: CP Group handles petabytes of customer data across its retail, financial, and telecom sectors.

- Regulatory Landscape: Compliance with PDPA in Thailand and similar global data protection laws is a key legal consideration.

- Cybersecurity Investment: The group prioritizes significant capital expenditure on cybersecurity systems to prevent breaches and protect sensitive information.

Intellectual property rights

Intellectual property rights are crucial for Charoen Pokphand Group (CP Group) to maintain its edge in diverse sectors. Protecting its patents, trademarks, and proprietary technologies in areas such as animal breeding, advanced food processing techniques, and telecommunications is vital for its competitive advantage.

The legal frameworks governing intellectual property provide CP Group with the necessary tools to safeguard its innovations and actively prevent any infringement by competitors. This legal protection is fundamental to their business model, allowing them to invest in research and development with confidence.

As of recent reports, CP Group has demonstrated a strong commitment to innovation, evidenced by its registration of approximately 7,500 patents and petty patents for its various technological advancements and product developments.

- Patent Protection: Safeguarding innovations in breeding and food processing technologies.

- Trademark Enforcement: Protecting brand identity across its vast product and service portfolio.

- Proprietary Technology: Securing exclusive rights to unique processes in sectors like telecommunications.

- Innovation Investment: CP Group's 7,500+ patent registrations underscore its focus on R&D.

Charoen Pokphand Group (CP Group) navigates a complex legal landscape, particularly concerning food safety and environmental regulations. In 2024, CP Foods continued to adhere to stringent EU EFSA guidelines, impacting its import and export activities, while also earning the CSR-DIW Continuous Award for its environmental compliance efforts.

Antitrust and data privacy laws are also critical. CP Group faces ongoing scrutiny from global regulatory bodies regarding anti-competitive practices, necessitating vigilance in mergers and acquisitions. Simultaneously, compliance with Thailand's PDPA and similar international data protection laws requires significant investment in cybersecurity, a focus that intensified in 2024 with substantial capital allocation towards digital defenses.

Intellectual property protection is paramount, with CP Group holding over 7,500 patents and petty patents as of recent data, safeguarding its innovations in areas like animal breeding and telecommunications technology.

Environmental factors

Climate change presents a substantial threat to Charoen Pokphand Group's agricultural ventures. Unpredictable weather, including prolonged droughts and severe floods, directly impacts crop yields and the health of livestock, potentially disrupting the entire supply chain. For instance, in 2024, Thailand experienced significant rainfall anomalies, affecting harvests across key agricultural regions where CP Foods operates.

CP Foods is actively deploying advanced risk mitigation strategies to build resilience. These measures are crucial for maintaining business stability and ensuring food security amidst the growing challenges posed by climate change. The company is investing in climate-resilient farming techniques and diversifying sourcing locations to buffer against localized weather disruptions.

Charoen Pokphand Group's extensive agricultural and aquaculture operations are inherently water-intensive, making water scarcity a significant environmental factor. As global water stress increases, particularly in regions where CP Group has a substantial presence, the company must prioritize robust water management strategies. This includes investing in advanced water-saving technologies and ensuring strict adherence to evolving water usage regulations.

CP Foods, a key subsidiary, actively champions water stewardship initiatives, aiming to mitigate the environmental impact of its operations. For instance, in 2024, the company reported a 5% reduction in water consumption across its key processing plants through improved recycling and efficiency measures, demonstrating a commitment to responsible resource management in the face of growing scarcity.

Charoen Pokphand Group faces significant environmental scrutiny regarding deforestation and land use change, particularly concerning its vast agricultural and livestock operations. Concerns over unsustainable practices directly impact the company's reputation and operational license, especially as global demand for commodities like palm oil and soy continues to grow. For instance, the ongoing pressure to ensure deforestation-free sourcing for raw materials is a key focus, with many supply chains still grappling with traceability challenges.

Greenhouse gas emissions and carbon footprint

Charoen Pokphand Group (CP Group) faces increasing global scrutiny regarding its greenhouse gas emissions and overall carbon footprint. This pressure necessitates significant investment in cleaner energy sources and operational efficiencies throughout its diverse business segments. The company is actively working towards ambitious sustainability targets, aiming for carbon neutrality and zero waste by 2030, and a net-zero emissions goal by 2050.

To achieve these objectives, CP Group is implementing several key strategies:

- Investing in Renewable Energy: CP Group is expanding its use of solar power and other renewable energy sources across its facilities, aiming to reduce reliance on fossil fuels. For instance, CP Foods has installed solar panels on over 40 of its factories and farms.

- Improving Energy Efficiency: The group is focused on optimizing energy consumption in its production processes, logistics, and buildings through technological upgrades and operational improvements.

- Sustainable Practices: This includes adopting sustainable agricultural methods, reducing waste in packaging and operations, and promoting circular economy principles within its value chain.

- Carbon Footprint Measurement: CP Group is enhancing its systems for accurately measuring and reporting its carbon emissions across all scopes, enabling more targeted reduction efforts.

Waste management and plastic pollution

Charoen Pokphand Group (CP Group) faces substantial environmental hurdles in managing waste from its extensive food processing, packaging, and retail activities, with plastic pollution being a critical concern. The company is actively pursuing circular economy models to mitigate these impacts.

CP Group's commitment to sustainability includes ambitious targets for waste reduction. For instance, in 2023, their retail businesses in Thailand, such as 7-Eleven, continued initiatives to reduce single-use plastics, aiming for a significant decrease in plastic bag usage by implementing fee-based systems and promoting reusable alternatives. This aligns with their broader goal of achieving zero waste across operations.

- Circular Economy Initiatives: CP Group is investing in technologies and partnerships to enable the recycling and repurposing of materials used in their supply chains, particularly plastics from packaging.

- Plastic Reduction Targets: The group has set specific goals for reducing virgin plastic consumption in its packaging by 2025, aiming to incorporate higher percentages of recycled content.

- Waste-to-Value Programs: CP Foods is exploring and implementing programs that convert food processing by-products into valuable resources, such as animal feed or biogas, minimizing landfill waste.

- Supply Chain Collaboration: CP Group works with suppliers and logistics partners to optimize packaging and transportation, thereby reducing overall waste generation and carbon footprint.

Climate change poses a direct threat to Charoen Pokphand Group's agricultural operations, with unpredictable weather patterns impacting crop yields and livestock health. In 2024, Thailand's weather anomalies highlighted these risks, affecting harvests for CP Foods. The company is proactively implementing climate-resilient farming techniques and diversifying sourcing locations to mitigate these disruptions and ensure supply chain stability.

Water scarcity is a growing concern for CP Group's water-intensive businesses, necessitating robust management strategies. CP Foods, a key subsidiary, reported a 5% reduction in water consumption across its processing plants in 2024 through efficiency improvements, demonstrating a commitment to responsible water stewardship amidst increasing global water stress.

The group faces scrutiny over deforestation and land use, particularly for commodities like palm oil and soy, impacting its reputation and operational licenses. Ensuring deforestation-free sourcing remains a critical focus, with ongoing efforts to improve supply chain traceability.

CP Group is actively addressing its carbon footprint by investing in renewable energy, such as solar power installations across over 40 CP Foods facilities, and enhancing energy efficiency. The company has set ambitious targets, aiming for carbon neutrality by 2030 and net-zero emissions by 2050, underscoring a strong commitment to environmental sustainability.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Charoen Pokphand Group is built on a robust foundation of data from reputable sources including the World Bank, International Monetary Fund, and various national government economic reports. We also incorporate insights from leading industry publications and market research firms to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.