Charoen Pokphand Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charoen Pokphand Group Bundle

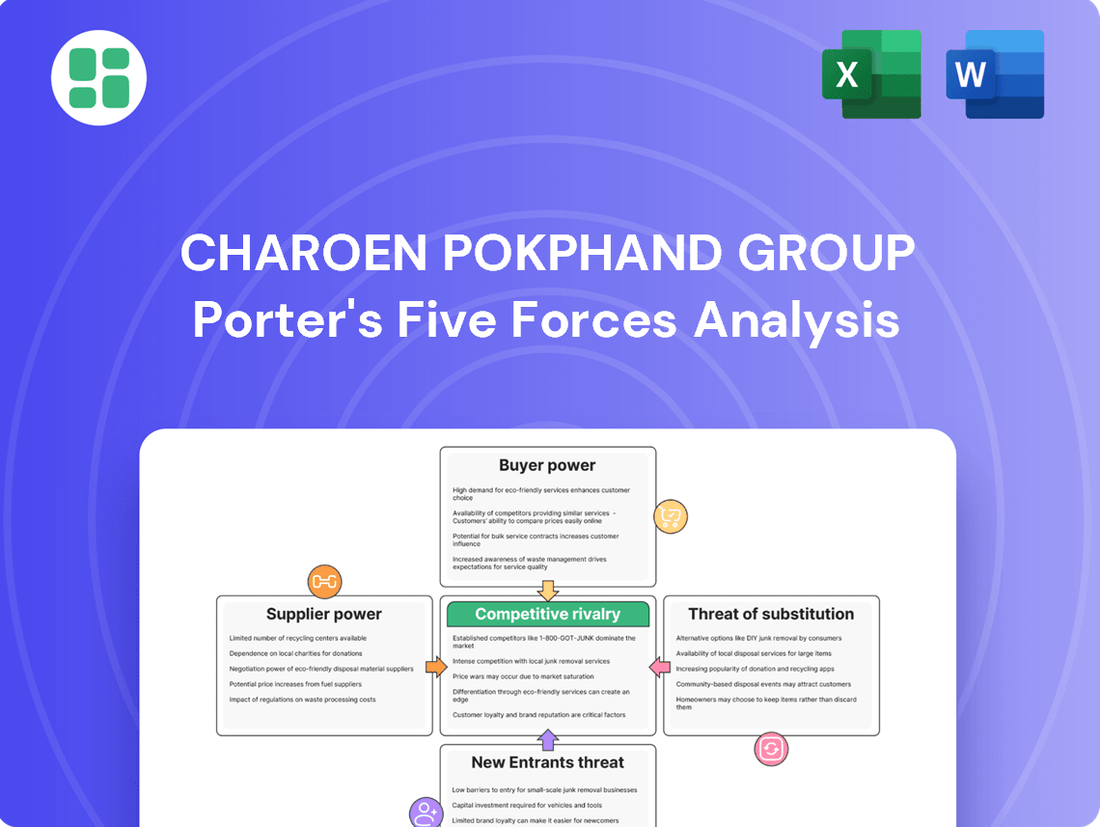

Charoen Pokphand Group navigates a complex landscape shaped by intense rivalry and significant buyer power within its diverse agribusiness and food sectors. Understanding the nuances of supplier relationships and the constant threat of substitutes is crucial for sustained growth. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Charoen Pokphand Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Charoen Pokphand Group's (CP Group) extensive and varied business interests, including agriculture, food production, retail operations, and telecommunications, necessitate the procurement of a broad spectrum of raw materials and services. This inherent diversification significantly dilutes the bargaining power of any individual supplier, as CP Group is not critically dependent on a singular input or supplier group. For instance, in 2024, CP Group's agro-industrial segment alone likely involved sourcing diverse inputs from numerous agricultural producers, preventing any single farm or cooperative from holding substantial sway.

Charoen Pokphand Group's extensive vertical integration, especially in its agro-industry, significantly curtails supplier power. By managing operations from animal feed production through to food processing, CP Group minimizes reliance on external suppliers for vital inputs such as feed ingredients and livestock.

This control over critical supply chain segments shields the company from price fluctuations and potential supply interruptions. For instance, CP Foods, a key subsidiary, operates integrated farms and processing plants, ensuring a stable supply of raw materials and reducing dependence on external feed producers.

Charoen Pokphand Group's extensive global sourcing capabilities significantly weaken supplier bargaining power. Operating in 13 countries, CP Group can tap into diverse geographical markets for raw materials, ensuring competitive pricing and supply stability. This broad reach allows them to bypass less competitive regional suppliers, effectively mitigating risks associated with localized supply disruptions.

Commodity Price Volatility

Commodity price volatility is a significant factor influencing the bargaining power of suppliers for Charoen Pokphand Group (CP Group). Fluctuations in global prices for key agricultural inputs like corn and soybean meal, driven by factors such as weather, geopolitical tensions, and market demand, can directly impact CP Group's raw material costs. For instance, in 2024, the price of corn experienced notable volatility due to drought conditions in major producing regions, putting upward pressure on feed costs for CP Group's livestock operations.

While CP Group's extensive vertical integration and sheer scale offer some buffer against these price swings, substantial shifts can still affect profitability. The company's historical performance has shown sensitivity to these commodity markets; for example, periods of high feed costs have previously impacted the profitability of its pork business. This ongoing price uncertainty means suppliers of these essential commodities retain a degree of leverage.

- Global Corn Prices: In early 2024, U.S. corn prices traded in a range influenced by planting intentions and early season weather forecasts, with significant price movements observed week-to-week.

- Soybean Meal Impact: The price of soybean meal, a crucial protein source, also saw fluctuations in 2024, directly affecting the cost structure for animal feed production within CP Group.

- Geopolitical Influence: Ongoing international conflicts and trade disputes continued to contribute to uncertainty and potential price spikes in agricultural commodity markets throughout 2024.

Technological and Specialized Suppliers

In sectors like telecommunications and automotive, Charoen Pokphand Group (CP Group) may encounter increased bargaining power from suppliers of highly specialized equipment, advanced technology, and proprietary intellectual property. These suppliers often possess unique products, patented innovations, or command significant switching costs, granting them considerable negotiation leverage, especially when contrasted with suppliers of more standardized goods found in CP Group's agro-industry operations.

For instance, the semiconductor industry, crucial for telecommunications, saw global chip shortages in 2021-2022, impacting production timelines and costs for many manufacturers. Suppliers in this space, holding critical patents and advanced manufacturing capabilities, demonstrated significant power. While CP Group's substantial scale provides a degree of negotiation strength, the specialized nature of these inputs means these suppliers can still exert considerable influence.

- Specialized Technology: Suppliers of cutting-edge telecommunications hardware or advanced automotive components often hold unique intellectual property and advanced manufacturing expertise.

- High Switching Costs: Integrating new, specialized technology can involve substantial retooling, training, and compatibility testing, making it costly for CP Group to switch suppliers.

- Patented Innovations: Suppliers with patented technologies in areas like 5G infrastructure or electric vehicle powertrains can command premium pricing and favorable terms.

- Scale as a Counterbalance: Despite supplier power, CP Group's vast operational scale and purchasing volume allow it to negotiate more effectively than smaller competitors.

While CP Group's vast scale and vertical integration generally limit supplier power, the impact of commodity price volatility remains a significant factor. For instance, in 2024, weather-related issues in key agricultural regions led to price surges for corn and soybean meal, directly increasing feed costs for CP Group's livestock operations and giving suppliers of these essential inputs a degree of leverage.

In specialized sectors like telecommunications, suppliers of advanced technology and proprietary intellectual property can wield considerable bargaining power. This is due to high switching costs and the unique nature of their offerings, as seen with semiconductor suppliers during global chip shortages impacting production timelines and costs in 2021-2022.

CP Group's extensive global sourcing capabilities, operating across 13 countries, help to mitigate supplier power by allowing access to diverse markets and competitive pricing, thereby reducing dependence on any single supplier or region.

The bargaining power of suppliers for Charoen Pokphand Group (CP Group) is generally moderate due to its immense scale and vertical integration, particularly in its agro-industrial and food businesses. This allows CP Group to absorb price fluctuations and maintain stable supply chains, limiting the leverage of individual suppliers.

What is included in the product

This analysis of Charoen Pokphand Group's competitive environment reveals the intensity of rivalry, the bargaining power of suppliers and buyers, and the threat of new entrants and substitutes.

Instantly identify and address competitive threats across the entire Charoen Pokphand Group value chain, from suppliers to new market entrants.

Gain a clear, actionable understanding of industry dynamics to proactively mitigate risks and capitalize on opportunities.

Customers Bargaining Power

In its vast retail operations, like 7-Eleven in Thailand, Charoen Pokphand Group (CP Group) serves a highly fragmented consumer base. This means millions of individual shoppers, none of whom can individually influence pricing or product terms. For instance, in 2023, 7-Eleven Thailand reported over 13,000 stores, serving a diverse demographic across the nation, further underscoring this fragmentation.

Similarly, CP Group's packaged food division, offering a wide array of products, also caters to a broad, unorganized consumer market. The sheer volume of individual buyers for items like instant noodles or snacks means no single customer possesses significant bargaining power. This widespread consumer demand, a key characteristic of the food industry, allows CP Group to effectively manage pricing strategies.

Charoen Pokphand Group's large B2B customers in the agro-industry, such as major food manufacturers and restaurant chains, wield significant bargaining power. These entities often place substantial orders, giving them leverage to negotiate for competitive pricing and tailored product specifications. For instance, a large fast-food chain might demand specific cuts of poultry or unique ingredient formulations, directly influencing CP Group's production processes and cost structures.

The ability of these key buyers to switch suppliers or even develop in-house capabilities further amplifies their bargaining strength. In 2024, the consolidation within the food service sector means fewer, larger buyers are dealing with suppliers. This concentration allows these major clients to dictate terms more effectively, pushing for lower costs and more stringent quality controls, which can impact CP Group's profit margins in its agro-business segments.

Charoen Pokphand Group (CP Group) actively invests in brand building and product innovation, especially within its robust food segment. Brands like CP and Authentic Asia are prime examples of this strategy, aiming to set their products apart in a competitive market. This focus on differentiation is crucial for mitigating customer bargaining power.

By cultivating strong brand loyalty and a reputation for quality, CP Group reduces the likelihood of customers switching to rivals. For instance, in 2023, CP Foods reported a revenue of over 230 billion Thai Baht, with a significant portion attributed to its well-established brands. This loyalty allows CP Group to maintain pricing power, effectively lowering the bargaining leverage customers hold.

Price Sensitivity in Mass Markets

While Charoen Pokphand Group (CP Group) benefits from brand recognition, a substantial segment of its mass-market food and retail customers exhibits significant price sensitivity. This is particularly evident in Thailand's competitive grocery and convenience store sectors, where consumers frequently compare prices. For instance, in 2024, the average Thai household's spending on food and non-alcoholic beverages constituted a notable portion of their income, making price a key decision factor.

Economic fluctuations and the aggressive pricing strategies of competitors can amplify this customer price sensitivity. CP Group must therefore maintain a delicate balance, strategically managing its pricing across its vast product portfolio to safeguard market share and sales volume. In 2023, the retail sector in Thailand saw intense promotional activity, with major players offering discounts that directly impacted consumer purchasing behavior, underscoring the need for CP Group's careful price management.

- Price Sensitivity in Mass Markets: A significant portion of CP Group's customer base, especially in food and retail, remains highly sensitive to price changes.

- Economic Impact: Economic conditions directly influence consumer willingness to pay, increasing price sensitivity and impacting purchasing decisions.

- Competitive Pressure: Competitors' pricing strategies, particularly in high-volume consumer goods, force CP Group to actively manage its own pricing to maintain market share.

- Market Share vs. Volume: CP Group faces the challenge of balancing competitive pricing to retain sales volume without eroding profitability.

Access to Information and Alternatives

Customers today, especially with the internet, have a wealth of information at their fingertips. They can easily compare prices, check product quality, and see what competitors are offering. This transparency really boosts their ability to negotiate, particularly for products that aren't all that different from each other across Charoen Pokphand Group's wide range of businesses.

For instance, in the retail sector, a consumer can quickly check prices for similar grocery items from different supermarkets or even compare electronics from various online stores. This ease of comparison means that if CP Group's offerings aren't competitively priced or perceived as superior, customers can easily switch to a rival. This increased awareness directly translates to greater bargaining power for the buyer.

- Increased Price Transparency: Online comparison tools and readily available reviews allow consumers to benchmark prices across numerous providers.

- Availability of Substitutes: The digital marketplace often reveals a broad spectrum of alternative products and services, diminishing the uniqueness of any single offering.

- Informed Purchasing Decisions: Customers can access detailed product specifications, user feedback, and expert reviews, enabling them to make more educated choices and demand better value.

- Shifting Power Dynamics: This heightened customer awareness and access to alternatives empower them to exert more pressure on pricing and product features, potentially impacting margins for companies like CP Group.

Charoen Pokphand Group's bargaining power with customers varies significantly. For its mass-market retail and food products, customer bargaining power is generally low due to a fragmented consumer base and strong brand loyalty, as evidenced by 7-Eleven Thailand's over 13,000 stores in 2023. However, larger business-to-business clients in the agro-industry, such as major restaurant chains, possess considerable leverage due to substantial order volumes and the ability to switch suppliers, a trend amplified by sector consolidation in 2024.

Price sensitivity is a key factor, particularly in Thailand's competitive food and retail sectors, where consumers actively compare prices, especially given that food and non-alcoholic beverages represent a significant portion of household spending in 2024. This necessitates strategic pricing management by CP Group to maintain market share amidst aggressive competitor promotions observed in 2023.

The digital age further empowers customers through increased price transparency and easy access to information, allowing them to compare offerings and exert more pressure on pricing and product features. This heightened awareness means CP Group must continually innovate and differentiate its products, as seen with brands like CP and Authentic Asia, to mitigate customer leverage and maintain its strong market position, supported by CP Foods' revenue of over 230 billion Thai Baht in 2023.

| Customer Segment | Bargaining Power Factor | CP Group Mitigation Strategy | 2023/2024 Data Point |

|---|---|---|---|

| Mass Consumers (Retail/Food) | Low (Fragmented base, Brand Loyalty) | Brand Building, Product Innovation | 7-Eleven Thailand: >13,000 stores (2023) |

| Large B2B Clients (Agro-industry) | High (Large orders, Supplier switching) | Competitive Pricing, Tailored Products | Sector Consolidation (2024) |

| Price-Sensitive Consumers | Moderate (Price sensitivity, Competition) | Strategic Pricing, Promotions | CP Foods Revenue: >230 Bn THB (2023) |

Same Document Delivered

Charoen Pokphand Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for the Charoen Pokphand Group, offering a detailed examination of competitive forces within its diverse industries. You are viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring transparency and no hidden content.

Rivalry Among Competitors

Charoen Pokphand Group (CP Group) navigates fiercely competitive landscapes, especially within its core agro-industry and food businesses. This intense rivalry stems from a multitude of both local Thai companies and significant international corporations vying for market share.

In the food sector, global giants and strong regional players constantly challenge CP Group's market position. Similarly, Thailand's convenience retail market, while led by CP Group's 7-Eleven, still experiences considerable competition from other retail formats and emerging players, as evidenced by the ongoing expansion of rivals like Family Mart and local independent stores.

Charoen Pokphand Group (CP Group) faces a dynamic competitive environment, characterized by a mix of large, diversified conglomerates and highly specialized firms across its various business units. This broad spectrum of rivals necessitates a nuanced understanding of market pressures within each sector.

In the telecommunications sector, True Corporation, a key CP Group subsidiary, operates within an oligopolistic market structure. Here, intense rivalry exists among a few major players vying for customer acquisition and retention. For instance, as of early 2024, the Thai mobile market sees intense competition for subscribers, with operators frequently engaging in price wars and aggressive promotional campaigns to gain market share.

Charoen Pokphand Group (CP Group) often commands substantial market share in its key sectors, exemplified by 7-Eleven's leading presence in Thailand's convenience store market. This dominance, a result of intense competition, translates into significant scale advantages.

This considerable scale grants CP Group considerable cost efficiencies, well-established distribution channels, and robust brand loyalty, presenting substantial hurdles for any new or existing competitors aiming to challenge their market position.

Geographic and Product Diversification

Charoen Pokphand Group's (CP Group) broad geographic reach and extensive product diversification mean it encounters a varied competitive landscape. This means the intensity of rivalry can differ significantly across its numerous business segments and operating regions, from food production in Thailand to telecommunications in other Asian markets.

This diversification acts as a strategic buffer against intense competition in any single area. For instance, while the agricultural sector might face robust competition, CP Group's presence in retail or energy can offset potential pressures. In 2024, CP Group continued to expand its global footprint, with operations spanning over 20 countries, demonstrating its strategy to spread risk and tap into diverse growth opportunities.

- Geographic Spread: CP Group operates in over 20 countries, facing localized competitors in each market.

- Industry Diversification: Competition varies from highly consolidated sectors like telecommunications to more fragmented markets like food processing.

- Risk Mitigation: Diversification reduces the impact of intense rivalry in any one sector, as seen in its balanced performance across different business units.

- Growth Avenues: New market entries and product expansions in 2024 provided alternative growth paths, lessening reliance on any single competitive arena.

Innovation and Technology as Differentiators

Competitive rivalry within Charoen Pokphand Group's diverse sectors is intensifying, with innovation and technology emerging as key differentiators. This is particularly evident in the food industry, where the demand for novel products like plant-based alternatives is reshaping market dynamics. For instance, by mid-2024, the global plant-based food market was projected to reach over $74 billion, underscoring the significant growth potential and competitive pressure in this segment.

CP Group's strategic advantage hinges on its capacity for continuous innovation, from developing new food formulations to integrating advanced technologies. The adoption of artificial intelligence (AI) across its operations, from optimizing agricultural yields to enhancing customer experiences in retail and telecom, is critical. By the end of 2023, CP All, CP Group's retail arm, was actively investing in digital transformation initiatives, aiming to leverage data analytics and AI to personalize offerings and streamline supply chains, thereby staying ahead of competitors like Seven & i Holdings.

- Innovation in Food: CP Group faces rivals launching innovative plant-based and premium food products, requiring rapid adaptation to evolving consumer tastes.

- Digital Transformation: Competitors in retail and telecom are heavily investing in digital services and AI, pushing CP Group to enhance its technological capabilities.

- AI Adoption: The effective integration of AI in areas like logistics, customer service, and product development is a significant factor in maintaining market share and profitability.

- 2024 Market Trends: Continued growth in the alternative protein sector and the increasing importance of personalized digital experiences are key drivers of rivalry.

Charoen Pokphand Group (CP Group) operates in highly competitive markets, with rivals ranging from global conglomerates to specialized local firms across its diverse portfolio. This rivalry is particularly fierce in its core agro-industry and food businesses, where international players and domestic companies constantly vie for market dominance. In telecommunications, CP Group's True Corporation faces intense competition within an oligopolistic structure, often leading to aggressive pricing strategies and promotional wars, as seen in the ongoing battle for subscribers in Thailand's mobile market throughout 2024.

CP Group's significant market share, notably in Thailand's convenience retail sector with 7-Eleven, provides scale advantages that create substantial barriers to entry for competitors. However, this dominance is constantly challenged by rivals like Family Mart and other retail formats. The group's extensive geographic spread across over 20 countries means it contends with a varied competitive landscape, with rivalry intensity differing significantly by region and industry segment. For example, while the food sector faces broad competition, CP Group's diversified interests in areas like energy can help mitigate pressures from any single market.

Innovation and technology are increasingly critical battlegrounds, especially in the food sector, with the plant-based market projected to exceed $74 billion by mid-2024. CP Group's retail arm, CP All, is actively investing in digital transformation and AI by the end of 2023 to enhance customer experiences and supply chain efficiency, aiming to stay ahead of competitors. This focus on AI adoption across logistics, customer service, and product development is crucial for maintaining market share and profitability in a rapidly evolving market.

| Key Competitors in CP Group's Sectors | Sector | 2024 Competitive Dynamics |

| Nestlé, Unilever, Thai Foods Group | Food & Agro-Industry | Intense competition driven by product innovation, particularly in plant-based alternatives; price sensitivity remains a factor. |

| Advanced Info Service (AIS), Total Access Communication (DTAC) | Telecommunications | Oligopolistic market with aggressive subscriber acquisition strategies and network infrastructure investments; 5G rollout competition is a key focus. |

| Family Mart, Lotus's, Tops Market | Retail (Convenience & Supermarkets) | High competition in store expansion, online delivery services, and personalized customer loyalty programs; focus on omnichannel strategies. |

| PTT Group, Gulf Energy | Energy | Competition in renewable energy projects and energy infrastructure development; government policies and global energy trends influence market dynamics. |

SSubstitutes Threaten

The growing consumer interest in plant-based diets and alternative proteins presents a significant threat of substitutes for Charoen Pokphand Group (CP Group) within the food sector. This trend, driven by health, environmental, and ethical concerns, could gradually erode demand for traditional meat products, CP Group's core offering.

For instance, the global plant-based meat market was valued at approximately USD 7.0 billion in 2023 and is projected to reach over USD 30 billion by 2030, indicating a substantial shift in consumer spending. CP Group, as a major player in protein production, faces the challenge of adapting to these evolving preferences, as consumers increasingly explore options like lab-grown meat and insect protein.

For Charoen Pokphand Group's extensive retail operations, particularly its 7-Eleven convenience stores, the threat of substitutes is significant. Consumers can easily turn to hypermarkets, supermarkets, traditional wet markets, and the increasingly dominant e-commerce platforms for their daily necessities. This broad availability of alternatives means CP Group must constantly innovate.

In 2024, the e-commerce sector in Thailand continued its robust growth, with online retail sales projected to reach over 500 billion Thai Baht. This surge directly challenges traditional brick-and-mortar retail, including convenience stores, by offering convenience, wider selection, and often competitive pricing. CP Group's ability to maintain customer loyalty hinges on its capacity to offer superior convenience, a curated product range, and seamless digital integration that rivals online offerings.

The threat of substitutes in communication technologies for Charoen Pokphand Group, particularly through its True Corporation subsidiary, is significant. Over-the-top (OTT) services like WhatsApp, Line, and Zoom offer compelling alternatives for voice and messaging, often at a fraction of the cost or even for free. This directly erodes traditional revenue streams from voice calls and SMS for telecom operators.

In 2024, the continued dominance of these OTT platforms means that while True Corporation generates substantial revenue from data services, the underlying value of basic communication is increasingly commoditized. For instance, global mobile messaging app usage continues to surge, with billions of active users worldwide, directly impacting the profitability of traditional telecom offerings.

Home Cooking and Food Service Alternatives

Home cooking presents a significant substitute threat to Charoen Pokphand Group's (CP Group) processed food products. During economic downturns, consumers often opt for preparing meals at home to manage expenses, directly impacting demand for convenience foods. For instance, in 2024, inflation rates in key CP Group markets like Thailand continued to influence household spending on groceries and dining out, potentially pushing more consumers towards home preparation.

The food service sector also poses a considerable threat. A vast array of dining options, including casual eateries, fast-food chains, and local street food vendors, provide consumers with readily available alternatives to CP Group's offerings. These alternatives often compete on price, convenience, and variety, making it challenging for CP Group to maintain market share, especially as the food service industry continues to innovate and cater to diverse consumer preferences.

- Home Cooking: A primary substitute, especially when economic uncertainty drives budget-conscious meal preparation.

- Food Service Alternatives: Diverse options from independent restaurants to street food vendors compete with CP's ready-to-eat meals and ingredients.

- Consumer Behavior Shift: In 2024, inflationary pressures in regions like Southeast Asia encouraged a greater propensity for home-cooked meals over convenience products.

Changing Agricultural Practices

The threat of substitutes for Charoen Pokphand Group (CP Group) in its animal feed and farming operations is influenced by evolving agricultural practices. New technologies and methods could lessen reliance on traditional feed formulations.

For example, advancements in precision agriculture allow for more targeted nutrient delivery, potentially reducing the overall volume of feed required per animal. This could impact the demand for CP Group's bulk feed products.

Furthermore, a shift towards localized, smaller-scale farming models, often driven by consumer demand for traceability and sustainability, presents an indirect substitution threat. These models might utilize different feed sources or even alternative protein production methods, bypassing large industrial agriculture supply chains.

- Precision agriculture adoption: While still growing, the adoption rate of precision agriculture technologies in livestock farming is increasing, with some estimates suggesting a global market growth of over 10% annually leading up to 2025.

- Alternative protein sources: Research and investment in alternative protein sources, such as insect farming or lab-grown meat, continue to grow, offering potential long-term substitutes for conventional animal protein production.

- Decentralized farming trends: Consumer interest in local food systems and shorter supply chains is a growing trend, potentially fragmenting the market for large-scale feed producers.

The threat of substitutes for Charoen Pokphand Group (CP Group) is multifaceted, impacting its diverse business segments. In food, plant-based alternatives and home cooking represent significant substitutes, driven by health consciousness and economic factors. For its retail arm, the convenience of e-commerce and hypermarkets challenges the traditional convenience store model, requiring continuous innovation in customer experience and product offerings.

The telecommunications sector, through True Corporation, faces substitution from Over-The-Top (OTT) services that offer communication at lower or no cost, commoditizing basic voice and messaging services. Even in agriculture, advancements in precision farming and alternative protein sources can reduce reliance on conventional feed, presenting a long-term substitution challenge.

| Substitute Category | CP Group Segment Impacted | Key Substitute Examples | 2024 Market Trend/Data Point |

| Dietary Shifts | Food Products, Animal Feed | Plant-based meats, lab-grown meat, insect protein | Global plant-based meat market projected to exceed USD 30 billion by 2030 (from approx. USD 7 billion in 2023). |

| Retail Channels | Retail (7-Eleven) | E-commerce platforms, hypermarkets, supermarkets | Thai e-commerce sales projected to exceed 500 billion Thai Baht in 2024. |

| Communication Methods | Telecommunications (True Corporation) | WhatsApp, Line, Zoom, other OTT services | Billions of active users globally on mobile messaging apps, impacting traditional telecom revenue. |

| Food Preparation | Processed Foods | Home cooking, street food vendors, other food service options | Inflationary pressures in Southeast Asia in 2024 increased propensity for home-cooked meals. |

| Agricultural Inputs | Animal Feed, Farming | Precision agriculture, alternative feed formulations, decentralized farming | Precision agriculture market growing at over 10% annually leading up to 2025. |

Entrants Threaten

The agro-industrial and telecommunications sectors, where Charoen Pokphand Group (CP Group) holds substantial interests, demand immense capital outlays. Establishing operations in these industries necessitates significant investment in infrastructure, land acquisition, advanced processing facilities, and extensive network development.

For instance, setting up a modern integrated agro-industrial complex can easily run into hundreds of millions of dollars, covering everything from farms to processing plants and distribution networks. Similarly, telecommunications infrastructure, including cell towers, fiber optic cables, and data centers, requires billions in investment for nationwide coverage and technological upgrades. These high capital requirements act as a powerful deterrent, effectively barring all but the most financially robust companies from entering the market, thus protecting CP Group's existing market position.

Charoen Pokphand Group's (CP Group) formidable vertical integration acts as a significant barrier to new entrants. Their control spans from upstream operations like animal feed production and aquaculture to midstream activities such as food processing and downstream distribution networks. This integrated model, as evidenced by CP Foods' extensive supply chain management, makes it incredibly difficult for newcomers to achieve comparable cost efficiencies and market reach.

Charoen Pokphand Group (CP Group) enjoys significant advantages due to its established brands like CP Foods and 7-Eleven, which boast strong consumer loyalty. These brands have cultivated trust and preference over many years, making it difficult for newcomers to gain traction. For instance, 7-Eleven's widespread presence across Thailand, with over 13,000 stores as of early 2024, represents a formidable distribution network that new convenience store operators would struggle to replicate.

Regulatory Hurdles and Compliance

The food production, agriculture, and telecommunications sectors, where Charoen Pokphand Group (CP Group) operates, are subject to stringent regulations. For instance, in 2024, Thailand's Department of Disease Control continued to emphasize strict food safety protocols for all food manufacturers, impacting new entrants' operational setup and compliance costs.

Navigating these complex regulatory landscapes, which include environmental standards and licensing requirements, presents a significant barrier. New companies must invest heavily in understanding and adhering to these rules, which can be a substantial deterrent.

Compliance with these regulations often translates to higher initial capital expenditure and ongoing operational costs for new market participants.

- Food Safety Standards: Strict adherence to national and international food safety regulations is mandatory, requiring significant investment in quality control and traceability systems.

- Environmental Regulations: Compliance with environmental protection laws, including waste management and emissions control, adds to operational costs and complexity for new entrants.

- Licensing and Permits: Obtaining necessary licenses and permits for agriculture, food processing, and telecommunications can be a time-consuming and costly process, creating a barrier to entry.

- Agricultural Subsidies and Support: Existing government subsidies and support programs for established agricultural players can create an uneven playing field for newcomers.

Economies of Scale and Experience Curve

CP Group's vast global operations create substantial economies of scale. For instance, in 2024, their agribusiness segment, a core area, likely saw significant cost advantages in sourcing raw materials like corn and soybeans due to sheer volume, making it difficult for smaller, new entrants to match these per-unit costs.

The experience curve also plays a crucial role. Having operated for decades, CP Group has refined its production processes and supply chains across various sectors, from food processing to retail. This accumulated knowledge allows for greater efficiency and lower operational costs, a barrier that new competitors would find challenging to overcome quickly.

- Economies of Scale: CP Group's global purchasing power for agricultural inputs and manufacturing components significantly lowers their cost of goods sold compared to nascent competitors.

- Experience Curve Advantages: Decades of operational refinement in areas like logistics and quality control translate into higher efficiency and reduced waste, further enhancing cost competitiveness.

- Capital Requirements: Establishing production facilities, distribution networks, and brand recognition at a scale comparable to CP Group requires immense capital investment, deterring many potential new entrants.

The threat of new entrants for Charoen Pokphand Group (CP Group) is generally low, primarily due to the substantial capital requirements across its core sectors like agro-industry and telecommunications. For example, establishing a modern integrated agro-industrial complex can cost hundreds of millions of dollars, while telecommunications infrastructure demands billions. Furthermore, CP Group's deep vertical integration, from feed production to retail, and its strong brand loyalty, exemplified by over 13,000 7-Eleven stores in Thailand as of early 2024, create formidable barriers.

Stringent regulatory environments, including food safety standards and licensing, also increase the cost and complexity for new players. CP Group's extensive global operations and decades of experience translate into significant economies of scale and experience curve advantages, making it difficult for newcomers to compete on cost efficiency. These combined factors significantly deter potential new entrants from challenging CP Group's market positions.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment needed for infrastructure, land, and technology in agro-industry and telecom. | Deters smaller or less capitalized firms. |

| Vertical Integration | CP Group controls supply chains from raw materials to retail. | Difficult for new entrants to match cost efficiencies and market reach. |

| Brand Loyalty & Distribution | Established brands like 7-Eleven have strong consumer trust and extensive networks. | Challenging for new brands to gain market share and replicate distribution. |

| Regulatory Environment | Strict food safety, environmental, and licensing regulations. | Increases compliance costs and complexity for new entrants. |

| Economies of Scale & Experience | Global purchasing power and refined operational processes. | New entrants struggle to match cost competitiveness. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Charoen Pokphand Group is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and public financial statements. We also incorporate insights from reputable industry research firms, market intelligence databases, and relevant trade publications to capture the dynamic competitive landscape.